Global Food Grade & Pharma Grade Calcium Phosphate Market Overview

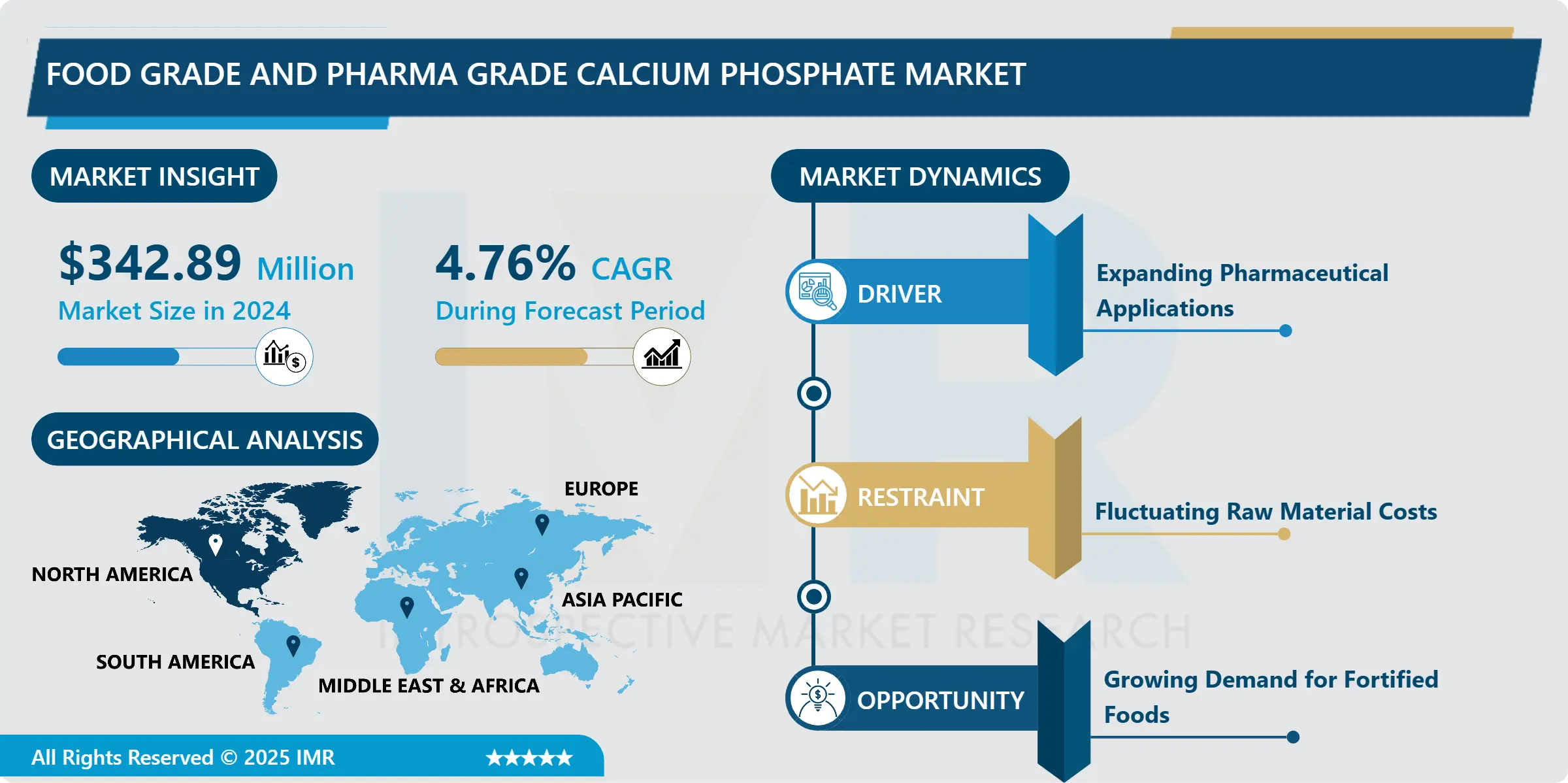

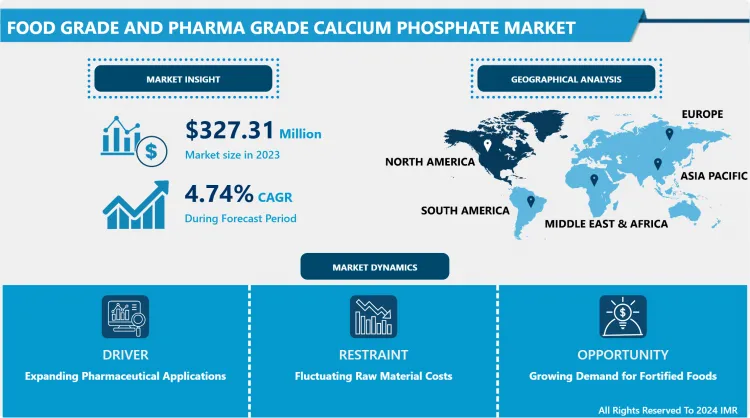

Food Grade & Pharma Grade Calcium Phosphate Market size was valued at USD 342.89 million In 2024 and Is projected to reach USD 571.88 million by 2035, growing at a CAGR of 4.76% from 2025-2035.

Food- and Pharma-Grade Calcium Phosphate represents a meticulously refined calcium phosphate variant meeting exacting standards for application in food and pharmaceutical spheres. Sourced from natural reservoirs such as minerals or bones, it undergoes stringent processing to comply with purity and safety criteria mandated by regulatory authorities.

This form of calcium phosphate offers notable advantages, chiefly its high bioavailability, facilitating easy absorption within the body. It serves as an exceptional source of both calcium and phosphorus, fundamental minerals crucial for bone health, dental strength, and diverse metabolic functions. Additionally, its lack of taste or odour and recognition as generally safe render it suitable for integration into a broad spectrum of food and pharmaceutical products.

Within the food industry, it serves as a nutrient booster in various items including baked goods, beverages, dairy alternatives, and dietary supplements. It augments calcium content without compromising taste or consistency. In pharmaceuticals, it functions as a supplement for calcium and phosphorus in medications and features in dental products including toothpaste. Its applications extend to supporting bone health, averting osteoporosis, and aiding in remedying calcium deficiencies. The regulated purity and bioavailability of Food- and Pharma-Grade Calcium Phosphate make it a pivotal component, ensuring nutritional fortification and health benefits in numerous consumable and medicinal items.

Food Grade & Pharma Grade Calcium Phosphate Market Trend Analysis:

Expanding pharmaceutical applications

- The Food- and Pharma-Grade Calcium Phosphate market experiences substantial growth driven by expanding pharmaceutical applications. Its pivotal role in diverse medicinal formulations and treatments significantly contributes to this trend. Calcium phosphate stands as a crucial element in pharmaceuticals, particularly in crafting tablets, capsules, and oral medications. Its direct provision of calcium and phosphorus in drug formulations enhances their effectiveness, stability, and absorption. Additionally, its biocompatibility and ability to break down naturally make it a favoured option in drug delivery systems, dental applications, and bone grafts. The surge in chronic diseases, especially those impacting bone health and causing mineral deficiencies, amplifies the need for medicines containing calcium phosphate. Ailments including osteoporosis, osteocalcin, and hypocalcaemia require treatments fortified with calcium and phosphorus, thus fueling the demand for Food- and Pharma-Grade Calcium Phosphate.

- Moreover, ongoing research and development ventures exploring fresh therapeutic uses, inventive drug delivery mechanisms, and advanced formulations utilizing calcium phosphate further drive its demand in the pharmaceutical realm. As pharmaceutical firms continuously innovate and diversify their product arrays, the versatility and efficacy of calcium phosphate significantly contribute to its increased adoption across various pharmaceutical applications, steering the market's growth trajectory.

Growing Demand for Fortified Foods

- The burgeoning demand for fortified foods presents a substantial market opportunity for Food- and Pharma-Grade Calcium Phosphate. With consumers placing greater emphasis on health and wellness, there's a noticeable shift towards fortified foods and beverages containing essential nutrients. Calcium phosphate, renowned for its ability to fortify products without compromising taste or texture, perfectly aligns with this trend.

- Contemporary consumers seek functional foods that offer more than just basic nutrition; they crave products that deliver added health benefits, particularly those addressing bone health and overall well-being. Calcium phosphate emerges as an ideal fortifier, enriching the calcium content in a wide array of food and beverage items such as juices, dairy alternatives, baked goods, and nutritional supplements. This demand mirrors the overarching trend of preventive health, where consumers actively seek dietary choices to address potential health concerns.

- The fortification of foods with calcium phosphate enables manufacturers to cater to this demand, meeting consumer preferences for products that bolster bone strength, dental health, and overall vitality. Additionally, as awareness regarding osteoporosis and calcium deficiencies increases, there's an opportunity for the market to respond by offering a diverse range of fortified products. By leveraging this growing consumer demand for fortified foods, companies can not only fulfill evolving dietary needs but also propel the market growth for Food- and Pharma-Grade Calcium Phosphate.

Food Grade & Pharma Grade Calcium Phosphate Market Segment Analysis:

Food Grade & Pharma Grade Calcium Phosphate Market Segmented on the basis of type, application.

By Type, TCP segment is expected to dominate the market during the forecast period

- Tricalcium Phosphate (TCP) commands a dominant position among service types in the Food- and Pharma-Grade Calcium Phosphate market owing to its versatile applications and high calcium content. TCP finds wide utilization in numerous food products, supplements, and pharmaceuticals primarily for its role in enhancing bone health. Its prevalence arises from the growing emphasis on calcium fortification in foods and supplements. TCP's effectiveness in providing a substantial calcium boost without altering taste or texture makes it the preferred choice for fortification purposes. Its usage spans a broad spectrum of products, from dairy alternatives and baked goods to nutritional supplements, meeting the increasing consumer demand for bone-strengthening and health-promoting items.

- Furthermore, TCP's GRAS (Generally Recognized as Safe) status and compatibility with different formulations further bolster its dominance in the market, positioning it as a crucial ingredient for addressing concerns regarding calcium deficiency in various consumer products and pharmaceutical formulations.

By Application, Food segment is expected to dominate the market during the forecast period.

- The food industry has witnessed a surge in demand for Food- and Pharma-Grade Calcium Phosphate, primarily driven by consumer preferences. Heightened health consciousness among consumers has led to a prioritization of nutritional value in their diets, fueling the need for fortified foods offering added health benefits. Calcium phosphate plays a crucial role in fortifying various food items such as dairy alternatives, baked goods, cereals, and snacks. Its capacity to boost calcium and phosphorus levels without altering taste or texture has made it a highly coveted ingredient among food manufacturers striving to produce healthier choices.

- Additionally, regulatory efforts advocating for essential mineral fortification in staple foods have contributed significantly to calcium phosphate's prominence in the food segment. Its widespread application in addressing calcium deficiencies and promoting bone health aligns perfectly with consumer preferences for functional foods, solidifying its pivotal role in fortified food products and cementing its dominance in this market segment.

Food Grade & Pharma Grade Calcium Phosphate Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America stands out as a powerhouse in the Food- and Pharma-Grade Calcium Phosphate market due to its well-established pharmaceutical and food sectors adhering to strict quality standards. The region benefits from a health-conscious population driving the demand for fortified foods and medicines enriched with calcium phosphate, focusing on bone health and overall wellness.

- Additionally, its advanced healthcare infrastructure and ongoing research efforts propel the use of calcium phosphate in medications targeting bone-related conditions. Technological advancements in manufacturing ensure top-notch quality, meeting industry demands. The region's penchant for innovation in functional foods and fortified beverages further amplifies the need for calcium phosphate, solidifying North America's dominance in this market segment.

Key Players Covered in Food Grade & Pharma Grade Calcium Phosphate Market:

- Innophos (US)

- Budenheim (Germany)

- Hens (Germany)

- Biesterfeld (Germany)

- Alfacal (Spain)

- Prayon (Belgium)

- Icl Pp (Israel)

- Haifa Group (Israel)

- Gadot Biochemical (Israel)

- Chengxing Industrial (China)

- Tianjia Chem (China)

- Kede Food Ingredients (China)

- Jiangsu Kolod Food Ingredients Co., Ltd. (China)

- Kede Food Ingredients (China)

- Guangdong Xingfa Chemical Group (China)

- Sudeep Pharma (India)

- Hindustan Phosphates (India)

- Global Calcium Phosphate Limited (India), and other major players

Key Industry Developments in the Food Grade & Pharma Grade Calcium Phosphate Market:

- In January 2023, Prayon, a major player in phosphorus chemistry on a global scale, has confirmed the successful acquisition of Arkema's shares in Febex, a leading entity in the European electronics industry's phosphoric acid sector. Securing 97% ownership of Febex, based in Bex, Switzerland, positions Prayon as the majority stakeholder in this company, boasting around 60 employees and achieving a turnover of €32 million in 2021. Febex stands as the premier producer and distributor of electronic-grade phosphoric acid within Europe.

|

Global Food Grade & Pharma Grade Calcium Phosphate Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 342.89 Mn. |

|

Forecast Period 2025-35 CAGR: |

4.76% |

Market Size in 2035: |

USD 571.88 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Food Grade & Pharma Grade Calcium Phosphate Market by Type (2018-2032)

4.1 Food Grade & Pharma Grade Calcium Phosphate Market Snapshot and Growth Engine

4.2 Market Overview

4.3 TCP

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 DCP

4.5 MCP

Chapter 5: Food Grade & Pharma Grade Calcium Phosphate Market by Application (2018-2032)

5.1 Food Grade & Pharma Grade Calcium Phosphate Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Food

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Beverage

5.5 Pharma

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Food Grade & Pharma Grade Calcium Phosphate Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 CAPOT CHEMICAL CO. LTD. (CHINA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 TOKYO CHEMICAL INDUSTRY CO. LTD. (JAPAN)

6.4 SHANGHAI WORLDYANG CHEMICAL CO. LIMITED (CHINA)

6.5 PARCHEM FINE & SPECIALTY CHEMICALS (US)

6.6 ANHUI HERMAN IMPEX CO. LTD. (CHINA)

6.7 HAIHANG INDUSTRY CO. LTD. (CHINA)

6.8 SIGMA-ALDRICH (US)

6.9 EMERALD PERFORMANCE MATERIALS (US)

6.10 MYRIANT CORPORATION (US)

6.11 SIMAGCHEM CORPORATION (CHINA)

6.12 GODAVARI BIOREFINERIES LTD (INDIA)

6.13 BIOFINE INTERNATIONAL INC. (US)

6.14 SEGETIS INC. (US)

6.15 IOGEN CORPORATION (CANADA)

6.16 HANGZHOU DAYANGCHEM CO. LTD. (CHINA)

6.17 ANHUI SUNHERE PHARMACEUTICAL EXCIPIENTS CO. LTD. (CHINA)

6.18 HEBEI LANGFANG TRIPLE WELL CHEMICALS CO. LTD. (CHINA)

6.19 ANHUI JIN'AO CHEMICAL CO. LTD. (CHINA)

6.20 ANHUI SUNHERE PHARMACEUTICAL EXCIPIENTS CO. LTD. (CHINA)

6.21 TRACTUS (CANADA)

6.22 MUBY CHEMICALS (INDIA)

6.23 GF BIOCHEMICALS LTD. (ITALY)

6.24 BIOFINE TECHNOLOGY LLC (US)

6.25 AVANTIUM (NETHERLANDS)

6.26 HEROY CHEMICAL INDUSTRY CO. LTD. (CHINA)

6.27

Chapter 7: Global Food Grade & Pharma Grade Calcium Phosphate Market By Region

7.1 Overview

7.2. North America Food Grade & Pharma Grade Calcium Phosphate Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 TCP

7.2.4.2 DCP

7.2.4.3 MCP

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Food

7.2.5.2 Beverage

7.2.5.3 Pharma

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Food Grade & Pharma Grade Calcium Phosphate Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 TCP

7.3.4.2 DCP

7.3.4.3 MCP

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Food

7.3.5.2 Beverage

7.3.5.3 Pharma

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Food Grade & Pharma Grade Calcium Phosphate Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 TCP

7.4.4.2 DCP

7.4.4.3 MCP

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Food

7.4.5.2 Beverage

7.4.5.3 Pharma

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Food Grade & Pharma Grade Calcium Phosphate Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 TCP

7.5.4.2 DCP

7.5.4.3 MCP

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Food

7.5.5.2 Beverage

7.5.5.3 Pharma

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Food Grade & Pharma Grade Calcium Phosphate Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 TCP

7.6.4.2 DCP

7.6.4.3 MCP

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Food

7.6.5.2 Beverage

7.6.5.3 Pharma

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Food Grade & Pharma Grade Calcium Phosphate Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 TCP

7.7.4.2 DCP

7.7.4.3 MCP

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Food

7.7.5.2 Beverage

7.7.5.3 Pharma

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Food Grade & Pharma Grade Calcium Phosphate Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 342.89 Mn. |

|

Forecast Period 2025-35 CAGR: |

4.76% |

Market Size in 2035: |

USD 571.88 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||