Dietary Supplements Market Synopsis:

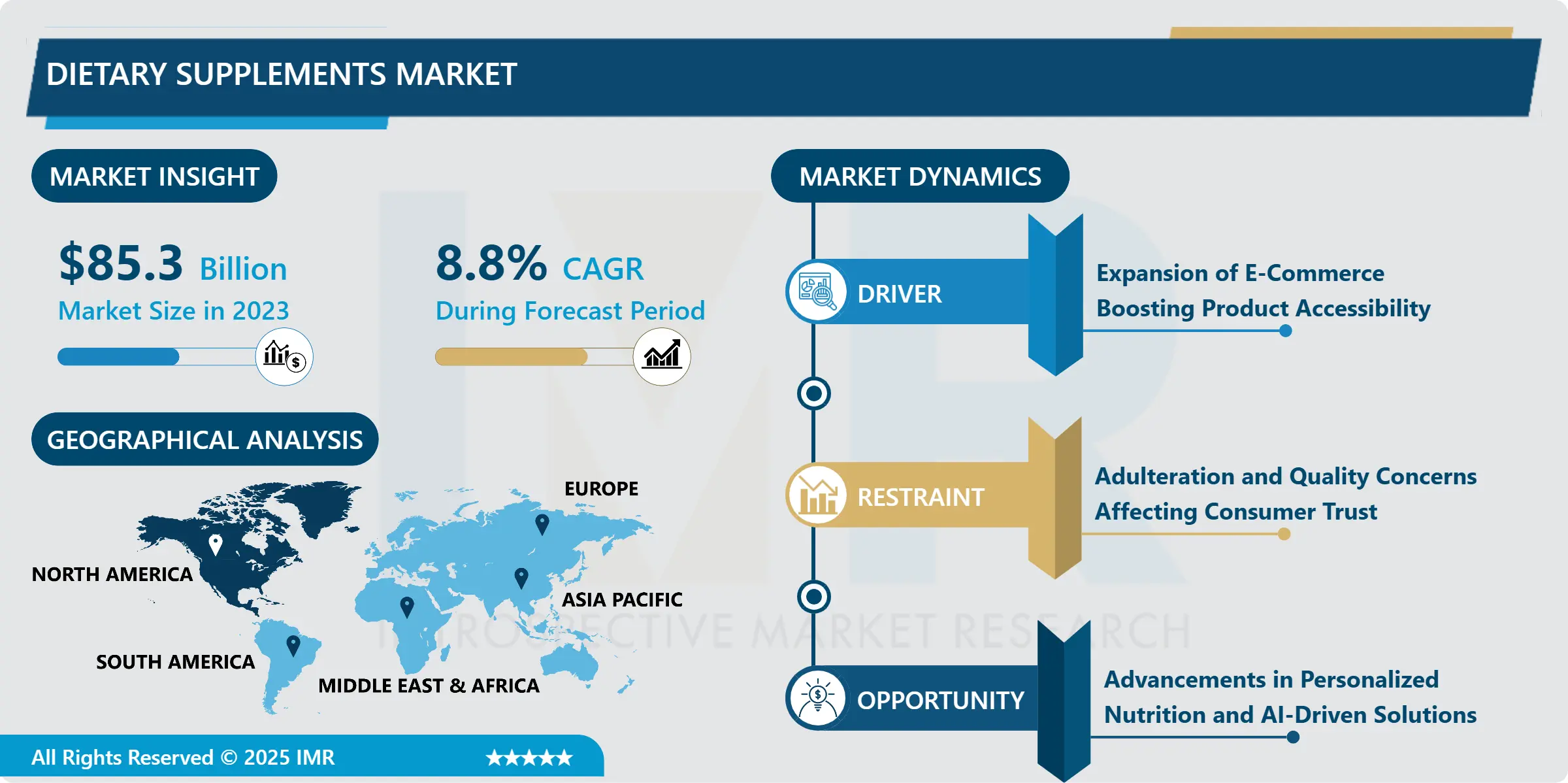

Dietary Supplements Market Size Was Valued at USD 85.30 Billion in 2023, and is Projected to Reach USD 182.22 Billion by 2032, Growing at a CAGR of 8.80% From 2024-2032.

Thus, the global dietary supplements market comprises products and preparations containing nutritive substances include vitamins, minerals, amino acids and other biologically active compounds derived from natural ingredients or by chemical synthesis. These supplements are meant to be taken alongside normal meals, in that they fill in the nutritional requirements that are missing or support a certain health issue.

They attributed growth in the dietary supplements market mainly to increasing consciousness regarding preventive healthcare. Customers are getting quite fancy in picking supplements to be taken as food supplements or remedial for their damaged diets due to lifestyle challenges like obesity, stress, and fatigue among others. This is also boosted by the increased geriatric population, who also need to be fed in order to improve on their health state.

Due to the increased popularity of e-business, accessibility of dietary supplements has been boosted around the world. From the comfort of your home and more so today with social media, manufacturers are now reaching a rich tapestry of customers including the young people. However, the discovery of individualized supplement solutions resulting from high innovation in technology and use of analytics propels the uptake.

Dietary Supplements Market Trend Analysis:

Magical Integration and Personalized Meal Plan

-

The consumers today are pursuing natural and organic supplementary sources rather than synthetic ones. This shift is due emphasis on possible adverse health effects of synthetic additives and preservatives. This has resulted in new product development in plant-derived products, herbal remedies, and clean-label supplements and achieving a wide acceptance across the ages.

- The market for dietary supplements is increasingly adopting technology solutions as well as artificial intelligence-based tailored nutrition plans, and wearable wellness trackers. Such innovations help the manufacturers to offer solutions based on health-related information such as DNA information and life cycle systems. This trend accords with the emerging market requirement of novelty, efficacy, keen consumer interest, and specificity with regards to health products.

Product innovation and niche categories can also be envisaged and specified throughout a product-division matrix.

-

Growth is evident most, especially in the Asia-Pacific, Latin America and Middle Eastern developing economies. Due to the upgrades in standards of living in these regions, shifting towards urban areas and a growing consciousness in the subject of healthcare, demand has been pushed up in these areas. Governments are also putting into action plans to increase nutritional consciousness and consequently, increasing the market.

- The new subgroup of supplements including nootropics, beauty products and sports nutrition is opening up significant opportunities. The special cases are these products are targeted towards small groups and personal choices, making manufacturers to work on better formulations for their products. Also, an effective use of green or reusable packing to gain the trust of the buyers focusing on sustainable or eco-friendly packaging can give a boost to brand loyalty.

Dietary Supplements Market Segment Analysis:

Dietary Supplements Market Segmented on the basis of type, Form, Application, End User, and Region.

By Type, Vitamins segment is expected to dominate the market during the forecast period

-

Global market for dietary supplements is categorized by product type as Vitamins, Minerals, Proteins & Amino Acids, Omega-3 Fatty Acids, Probiotics, Herbal and Others. The two most popular supplement types remain vitamins and minerals because these micronutrients are important for maintenance of good health. Bodybuilding and exercise supplements utilize proteins and amino acids; consumers of omega-3 fatty acids target their heart health; probiotics are consumed to improve gut health. Herbal supplements are known to be taken by customers who are in search of natural remedies for different illness.

By Application, Energy & Weight Management segment expected to held the largest share

-

Energy & Weight Management leads the list of key application areas for dietary supplements, closely followed by General Health, Bone & Joint Health, Immunity, Digestive Health and Others. These includes; The most common type is general health supplements that supply the bodies nutrient and vitamins to meet the daily nutritional requirement. vitamin and minerals supplements considered to enhance body immunity became popular during the COVID-19 period, and supplements related to digestive and bone health also remain on the growth trajectory due to enhance consumer awareness of such health niches.

Dietary Supplements Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

The global market for dietary supplements mainly centers on North America, which on average contributes to 35- 40% of the whole market value. These factors include; an increased incidence of lifestyle diseases, a fully developed health care system and a population that is informed about the advantages of supplement intake. Moreover, the regional e-commerce index makes it easy to obtain a vast range of products for consumers.

- USA is the leading country in the market share of North America because of the increasing demand for sports nutrition and customized supplements. More appropriate regulatory frameworks and research endeavours towards advance understanding of the mechanisms underlying supplements’ efficacy sustain the region’s market leadership internationally.

Active Key Players in the Dietary Supplements Market:

-

Abbott Laboratories (USA)

- Amway (USA)

- Bayer AG (Germany)

- Blackmores (Australia)

- DSM (Netherlands)

- Glanbia (Ireland)

- Herbalife Nutrition (USA)

- Nature's Bounty (USA)

- Nestlé Health Science (Switzerland)

- Pfizer (USA)

- Other Active Players

|

Global Dietary Supplements Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 85.30 Billion |

|

Forecast Period 2024-32 CAGR: |

8.80% |

Market Size in 2032: |

USD 182.55 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Dietary Supplements Market by Type

4.1 Dietary Supplements Market Snapshot and Growth Engine

4.2 Dietary Supplements Market Overview

4.3 Vitamins

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Vitamins: Geographic Segmentation Analysis

4.4 Minerals

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Minerals: Geographic Segmentation Analysis

4.5 Proteins & Amino Acids

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Proteins & Amino Acids: Geographic Segmentation Analysis

4.6 Omega-3 Fatty Acids

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Omega-3 Fatty Acids: Geographic Segmentation Analysis

4.7 Probiotics

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Probiotics: Geographic Segmentation Analysis

4.8 Herbal Supplements

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Herbal Supplements: Geographic Segmentation Analysis

4.9 Others

4.9.1 Introduction and Market Overview

4.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.9.3 Key Market Trends, Growth Factors and Opportunities

4.9.4 Others: Geographic Segmentation Analysis

Chapter 5: Dietary Supplements Market by Form

5.1 Dietary Supplements Market Snapshot and Growth Engine

5.2 Dietary Supplements Market Overview

5.3 Tablets

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Tablets: Geographic Segmentation Analysis

5.4 Capsules

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Capsules: Geographic Segmentation Analysis

5.5 Powders

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Powders: Geographic Segmentation Analysis

5.6 Liquids

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Liquids: Geographic Segmentation Analysis

5.7 Gummies

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Gummies: Geographic Segmentation Analysis

5.8 Softgels

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Softgels: Geographic Segmentation Analysis

Chapter 6: Dietary Supplements Market by Application

6.1 Dietary Supplements Market Snapshot and Growth Engine

6.2 Dietary Supplements Market Overview

6.3 Energy & Weight Management

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Energy & Weight Management: Geographic Segmentation Analysis

6.4 General Health

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 General Health: Geographic Segmentation Analysis

6.5 Bone & Joint Health

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Bone & Joint Health: Geographic Segmentation Analysis

6.6 Immunity

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Immunity: Geographic Segmentation Analysis

6.7 Digestive Health

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Digestive Health: Geographic Segmentation Analysis

6.8 Others

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Others: Geographic Segmentation Analysis

Chapter 7: Dietary Supplements Market by End User

7.1 Dietary Supplements Market Snapshot and Growth Engine

7.2 Dietary Supplements Market Overview

7.3 Adults

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Adults: Geographic Segmentation Analysis

7.4 Children

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Children: Geographic Segmentation Analysis

7.5 Pregnant Women

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Pregnant Women: Geographic Segmentation Analysis

7.6 Geriatric

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Geriatric: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Dietary Supplements Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 AMWAY (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 HERBALIFE NUTRITION (USA)

8.4 ABBOTT LABORATORIES (USA)

8.5 GLANBIA (IRELAND)

8.6 NESTLÉ HEALTH SCIENCE (SWITZERLAND)

8.7 BAYER AG (GERMANY)

8.8 NATURE'S BOUNTY (USA)

8.9 DSM (NETHERLANDS)

8.10 PFIZER (USA)

8.11 BLACKMORES (AUSTRALIA)

8.12 OTHER ACTIVE PLAYERS

Chapter 9: Global Dietary Supplements Market By Region

9.1 Overview

9.2. North America Dietary Supplements Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Type

9.2.4.1 Vitamins

9.2.4.2 Minerals

9.2.4.3 Proteins & Amino Acids

9.2.4.4 Omega-3 Fatty Acids

9.2.4.5 Probiotics

9.2.4.6 Herbal Supplements

9.2.4.7 Others

9.2.5 Historic and Forecasted Market Size By Form

9.2.5.1 Tablets

9.2.5.2 Capsules

9.2.5.3 Powders

9.2.5.4 Liquids

9.2.5.5 Gummies

9.2.5.6 Softgels

9.2.6 Historic and Forecasted Market Size By Application

9.2.6.1 Energy & Weight Management

9.2.6.2 General Health

9.2.6.3 Bone & Joint Health

9.2.6.4 Immunity

9.2.6.5 Digestive Health

9.2.6.6 Others

9.2.7 Historic and Forecasted Market Size By End User

9.2.7.1 Adults

9.2.7.2 Children

9.2.7.3 Pregnant Women

9.2.7.4 Geriatric

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Dietary Supplements Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Type

9.3.4.1 Vitamins

9.3.4.2 Minerals

9.3.4.3 Proteins & Amino Acids

9.3.4.4 Omega-3 Fatty Acids

9.3.4.5 Probiotics

9.3.4.6 Herbal Supplements

9.3.4.7 Others

9.3.5 Historic and Forecasted Market Size By Form

9.3.5.1 Tablets

9.3.5.2 Capsules

9.3.5.3 Powders

9.3.5.4 Liquids

9.3.5.5 Gummies

9.3.5.6 Softgels

9.3.6 Historic and Forecasted Market Size By Application

9.3.6.1 Energy & Weight Management

9.3.6.2 General Health

9.3.6.3 Bone & Joint Health

9.3.6.4 Immunity

9.3.6.5 Digestive Health

9.3.6.6 Others

9.3.7 Historic and Forecasted Market Size By End User

9.3.7.1 Adults

9.3.7.2 Children

9.3.7.3 Pregnant Women

9.3.7.4 Geriatric

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Dietary Supplements Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Type

9.4.4.1 Vitamins

9.4.4.2 Minerals

9.4.4.3 Proteins & Amino Acids

9.4.4.4 Omega-3 Fatty Acids

9.4.4.5 Probiotics

9.4.4.6 Herbal Supplements

9.4.4.7 Others

9.4.5 Historic and Forecasted Market Size By Form

9.4.5.1 Tablets

9.4.5.2 Capsules

9.4.5.3 Powders

9.4.5.4 Liquids

9.4.5.5 Gummies

9.4.5.6 Softgels

9.4.6 Historic and Forecasted Market Size By Application

9.4.6.1 Energy & Weight Management

9.4.6.2 General Health

9.4.6.3 Bone & Joint Health

9.4.6.4 Immunity

9.4.6.5 Digestive Health

9.4.6.6 Others

9.4.7 Historic and Forecasted Market Size By End User

9.4.7.1 Adults

9.4.7.2 Children

9.4.7.3 Pregnant Women

9.4.7.4 Geriatric

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Dietary Supplements Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Type

9.5.4.1 Vitamins

9.5.4.2 Minerals

9.5.4.3 Proteins & Amino Acids

9.5.4.4 Omega-3 Fatty Acids

9.5.4.5 Probiotics

9.5.4.6 Herbal Supplements

9.5.4.7 Others

9.5.5 Historic and Forecasted Market Size By Form

9.5.5.1 Tablets

9.5.5.2 Capsules

9.5.5.3 Powders

9.5.5.4 Liquids

9.5.5.5 Gummies

9.5.5.6 Softgels

9.5.6 Historic and Forecasted Market Size By Application

9.5.6.1 Energy & Weight Management

9.5.6.2 General Health

9.5.6.3 Bone & Joint Health

9.5.6.4 Immunity

9.5.6.5 Digestive Health

9.5.6.6 Others

9.5.7 Historic and Forecasted Market Size By End User

9.5.7.1 Adults

9.5.7.2 Children

9.5.7.3 Pregnant Women

9.5.7.4 Geriatric

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Dietary Supplements Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Type

9.6.4.1 Vitamins

9.6.4.2 Minerals

9.6.4.3 Proteins & Amino Acids

9.6.4.4 Omega-3 Fatty Acids

9.6.4.5 Probiotics

9.6.4.6 Herbal Supplements

9.6.4.7 Others

9.6.5 Historic and Forecasted Market Size By Form

9.6.5.1 Tablets

9.6.5.2 Capsules

9.6.5.3 Powders

9.6.5.4 Liquids

9.6.5.5 Gummies

9.6.5.6 Softgels

9.6.6 Historic and Forecasted Market Size By Application

9.6.6.1 Energy & Weight Management

9.6.6.2 General Health

9.6.6.3 Bone & Joint Health

9.6.6.4 Immunity

9.6.6.5 Digestive Health

9.6.6.6 Others

9.6.7 Historic and Forecasted Market Size By End User

9.6.7.1 Adults

9.6.7.2 Children

9.6.7.3 Pregnant Women

9.6.7.4 Geriatric

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Dietary Supplements Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Type

9.7.4.1 Vitamins

9.7.4.2 Minerals

9.7.4.3 Proteins & Amino Acids

9.7.4.4 Omega-3 Fatty Acids

9.7.4.5 Probiotics

9.7.4.6 Herbal Supplements

9.7.4.7 Others

9.7.5 Historic and Forecasted Market Size By Form

9.7.5.1 Tablets

9.7.5.2 Capsules

9.7.5.3 Powders

9.7.5.4 Liquids

9.7.5.5 Gummies

9.7.5.6 Softgels

9.7.6 Historic and Forecasted Market Size By Application

9.7.6.1 Energy & Weight Management

9.7.6.2 General Health

9.7.6.3 Bone & Joint Health

9.7.6.4 Immunity

9.7.6.5 Digestive Health

9.7.6.6 Others

9.7.7 Historic and Forecasted Market Size By End User

9.7.7.1 Adults

9.7.7.2 Children

9.7.7.3 Pregnant Women

9.7.7.4 Geriatric

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Dietary Supplements Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 85.30 Billion |

|

Forecast Period 2024-32 CAGR: |

8.80% |

Market Size in 2032: |

USD 182.55 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||