Wine Packaging Boxes Market Synopsis:

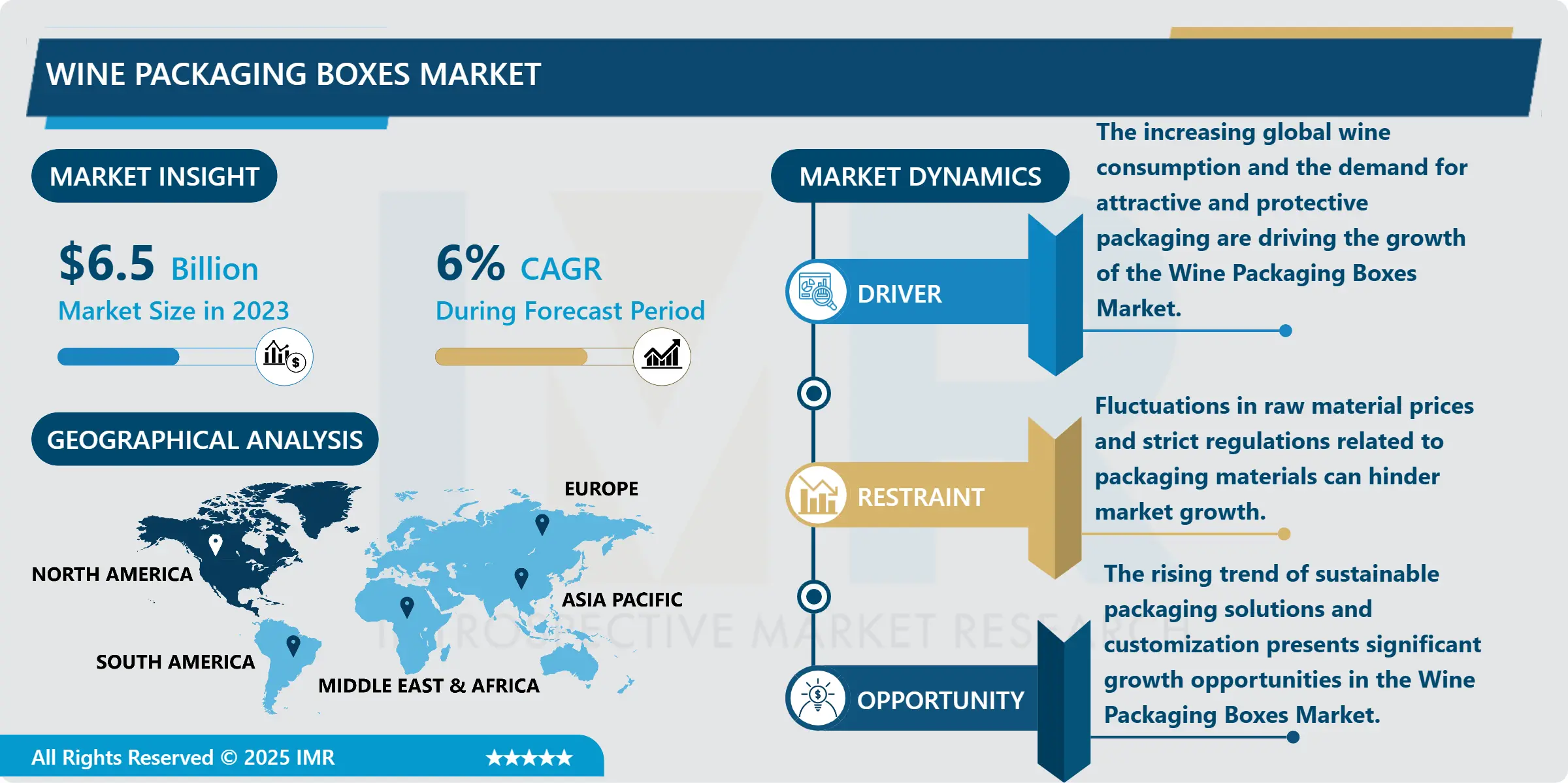

Wine Packaging Boxes Market Size Was Valued at USD 6.5 Billion in 2023, and is Projected to Reach USD 10 Billion by 2032, Growing at a CAGR of 6% From 2024-2032.

The Wine Packaging Boxes Market has seen a significant amount of growth in the recent past, this growth is attributed to the improved perceived quality and budding luxury wines market. With an increase in wine consumption across the world and in areas such as North America and Europe, wineries and wine distributors realize the need for fancy and often safe packaging for wine to not only give a pleasing image but also to ensure that the wines are well protected during transportation. Viniculture containers are not only produced to protect wines from breaking but also to give a chance to create a brand and a message; thus, wine boxes are one of the most important components of the wine positioning and marketing efforts.

Furthermore, the environment friendly and sustainable packaging is a concept that is slowly catching up in the Wine Packaging Boxes Market. As more consumers think about the environment, many wineries have started seeking environmentally friendly material for packaging. This change not only contributes positively to making a better environment but also respond effectively to new ethic of green buyers who are concerned with the sustainability of products. Therefore, the market is advancing with the use of sustainable materials and designs from manufacturers, and they outweigh the competition of wine packaging boxes.

The technological developments also have a great influence on the Wine Packaging Boxes Market. That is why the introduction of modern technologies and opportunities to customize the outcomes of the printing process as requiring specific skills do not cause any issues for wineries and can be used as an opportunity to design exclusive packages that would attract consumers’ attention on the shelves. Further, in protective packaging, some new enhancements to the padded insert containers and useful material can cover the wines highly and protect it from getting damaged during transit. It is therefore believed that these trends are further likely to propel growth in the Wine Packaging Boxes Market as it remains a key sub-segment under the overall packaging market.

Wine Packaging Boxes Market Trend Analysis:

Shift Toward Sustainable Packaging

-

A key factor emerging in the Wine Packaging Boxes Market is that more companies are prioritizing the use of environmentally friendly packaging material. Recently, consumers gain awareness about their harm to the environment, and therefore, the wineries are actively searching for environmentally friendly packaging of wines.

- These come in the form of using environmentally friendly packaging materials such as the reusing and recycling bottles and incorporating biodegradable and reusable packaging on wine boxes and employing the extended functional unit longevity and remanufacturing methods in packaging.

- This way, besides satisfying the consumer demand for eco-friendly products, wineries also improve the appeal of sustainable packaging and attract consumers. Such a tendency makes manufacturers strive to create new faces and materials for wines and other alcoholic products and affects the further evolution of wine packaging.

Customization and Premium Packaging

-

The second major trend that could be associated with the Wine Packaging Boxes Market development is the continuously growing focus on customization and premiumization of packaging. The contemporary trends in the wine market reveal ever greater attention paid to the aesthetics of wrappers which also should correspond to the company’s brand strategy. More and more people specifically for gift purposes and occasions require extra work and cosmetic designs on wine containers where wine boxes with engravings and special labels are drawn on with great finesse and elegant finishes on the body of the wine boxes.

- With the help of this trend, it becomes possible to stand out from the competition and target clients that are ready to pay attention not only to the contents of the glass, but also to its appearance. From the perspective of emphasis placed on the use of premium packaging, the current market offers a more extensive variety of various wine packaging solutions concerning their design or material.

Wine Packaging Boxes Market Segment Analysis:

Wine Packaging Boxes Market Segmented on the basis of Container, Bulk Packaging, Closure Accessories, and Region.

By Container, Glass Bottles segment is expected to dominate the market during the forecast period

-

The segmentation by geography along with the type of container used in packaging wines, is likely to have a profound impact on the global Wine Packaging Boxes Market. Glass bottles are still the most conventional and preferred type of wine bottles since they help retain wine quality and extend its shelf life, though giving it an elite look. Nonetheless, more and more wine is being bottled in plastic due to their convenience – they do not weigh as much nor are they as fragile as glass.

- Current and novel consumers prefer lower-price wines and those marketed to them—including wine in plastic bottles. Another emerging packaging trend is the bag-in-box packaging style, which are already more recognizable for the large-volume or easy-drinking wines due to portability and more environmentally friendly solution compared to other conventional packaging types. The characteristics of each type of container creates a different range of benefits and as such, different packaging practices can be observed in the wine industry, and different solutions adjusted to the needs of individual consumers and the market.

By Accessories, Labels segment expected to held the largest share

-

In the Wine Packaging Boxes Market, accessories including boxes and carriers and labels are very important to increase the aesthetics and the utility of the wine packaging. Carriers and boxes are intended to offer security and convenience when moving the bottles of wine together with the purpose of serving as a substrate for branding and narration. This includes the rigid box, folding carton as well as corrugated carrier which targets lower class markets as well as higher end markets including the wine buyer.

- Whereas, for identification purpose, labels are crucial in order to display certain information about the wine; the brand, variety of the wine and its origin, this apart from information it conveys, a label also affords an area for artistic presentation. In combination, such accessories not only safeguard the goodness of the wine during the transportation process, but also play an augmented role in consumer decision making, making them part of the packaging of the product.

Wine Packaging Boxes Market Regional Insights:

Asia-Pacific Wine Packaging Market is expected to grow at the fastest CAGR from 2024 to 2034.

-

The Asia-Pacific Wine Packaging Market is stipulated for robust growth, which is likely to see the highest compounded annual growth rate for the period 2024 to 2034 in Asia-Pacific region due to increasing intake of wine in Asia-Pacific countries including China and India. With wine culture becoming more popular in the region due to growing disposable income, and changing trends whereby customers are willing to pay more for better quality brands, there is the corresponding demand for uniqueness and aesthetics in packaging.

- Winemakers are slowly appreciating that packaging is not only a protective barrier and a marketing tool but a strategic way through which discerning consumers differentiate between similar products in a highly competitive world. Moreover, the focus on change in packaging material and moving to sustainable packaging is gradually emerging given the increasing demand for eco-friendly packaging material by the target customers. This growing demand for wine coupled with users demand and shifting trends makes the Asia-Pacific Wine Packaging Market a promising submarket under the Wine Packaging Boxes Market.

Active Key Players in the Wine Packaging Boxes Market

-

Amcor Limited (Australia)

- Ardagh Group SA (Ireland)

- Avery Dennison Corporation (U.S.)

- Ball Corporation (U.S.)

- CCL Industries Incorporated (Canada)

- Encore Glass Incorporated (U.S.)

- Exal Group (U.S.)

- G3 Enterprises Incorporated (U.S.)

- Hoover Container Solutions Incorporated (U.S.),

- Other Active Players

|

Global Wine Packaging Boxes Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.5 Billion |

|

Forecast Period 2024-32 CAGR: |

6% |

Market Size in 2032: |

USD 10 Billion |

|

Segments Covered: |

By Container |

|

|

|

By Bulk Packaging |

|

||

|

By Closure |

|

||

|

By Accessories |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Wine Packaging Boxes Market by Container

4.1 Wine Packaging Boxes Market Snapshot and Growth Engine

4.2 Wine Packaging Boxes Market Overview

4.3 Glass Bottles

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Glass Bottles: Geographic Segmentation Analysis

4.4 Plastic Bottles

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Plastic Bottles: Geographic Segmentation Analysis

4.5 Bag In Box Container

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Bag In Box Container: Geographic Segmentation Analysis

4.6 and Others

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 and Others: Geographic Segmentation Analysis

Chapter 5: Wine Packaging Boxes Market by Bulk Packaging

5.1 Wine Packaging Boxes Market Snapshot and Growth Engine

5.2 Wine Packaging Boxes Market Overview

5.3 IBCs

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 IBCs: Geographic Segmentation Analysis

5.4 Flexitanks

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Flexitanks: Geographic Segmentation Analysis

5.5 and Drums

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 and Drums: Geographic Segmentation Analysis

Chapter 6: Wine Packaging Boxes Market by Closure

6.1 Wine Packaging Boxes Market Snapshot and Growth Engine

6.2 Wine Packaging Boxes Market Overview

6.3 Natural Corks

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Natural Corks: Geographic Segmentation Analysis

6.4 Aluminum Screw Caps

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Aluminum Screw Caps: Geographic Segmentation Analysis

6.5 and Synthetic Corks

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 and Synthetic Corks: Geographic Segmentation Analysis

Chapter 7: Wine Packaging Boxes Market by Accessories

7.1 Wine Packaging Boxes Market Snapshot and Growth Engine

7.2 Wine Packaging Boxes Market Overview

7.3 Boxes & Carriers and Labels)

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Boxes & Carriers and Labels) : Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Wine Packaging Boxes Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 AMCOR LIMITED (AUSTRALIA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 ARDAGH GROUP SA (IRELAND)

8.4 AVERY DENNISON CORPORATION (U.S.)

8.5 BALL CORPORATION (U.S.)

8.6 CCL INDUSTRIES INCORPORATED (CANADA)

8.7 ENCORE GLASS INCORPORATED (U.S.)

8.8 EXAL GROUP (U.S.)

8.9 G3 ENTERPRISES INCORPORATED (U.S.)

8.10 HOOVER CONTAINER SOLUTIONS INCORPORATED (U.S.)

8.11 OTHER ACTIVE PLAYERS

Chapter 9: Global Wine Packaging Boxes Market By Region

9.1 Overview

9.2. North America Wine Packaging Boxes Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Container

9.2.4.1 Glass Bottles

9.2.4.2 Plastic Bottles

9.2.4.3 Bag In Box Container

9.2.4.4 and Others

9.2.5 Historic and Forecasted Market Size By Bulk Packaging

9.2.5.1 IBCs

9.2.5.2 Flexitanks

9.2.5.3 and Drums

9.2.6 Historic and Forecasted Market Size By Closure

9.2.6.1 Natural Corks

9.2.6.2 Aluminum Screw Caps

9.2.6.3 and Synthetic Corks

9.2.7 Historic and Forecasted Market Size By Accessories

9.2.7.1 Boxes & Carriers and Labels)

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Wine Packaging Boxes Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Container

9.3.4.1 Glass Bottles

9.3.4.2 Plastic Bottles

9.3.4.3 Bag In Box Container

9.3.4.4 and Others

9.3.5 Historic and Forecasted Market Size By Bulk Packaging

9.3.5.1 IBCs

9.3.5.2 Flexitanks

9.3.5.3 and Drums

9.3.6 Historic and Forecasted Market Size By Closure

9.3.6.1 Natural Corks

9.3.6.2 Aluminum Screw Caps

9.3.6.3 and Synthetic Corks

9.3.7 Historic and Forecasted Market Size By Accessories

9.3.7.1 Boxes & Carriers and Labels)

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Wine Packaging Boxes Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Container

9.4.4.1 Glass Bottles

9.4.4.2 Plastic Bottles

9.4.4.3 Bag In Box Container

9.4.4.4 and Others

9.4.5 Historic and Forecasted Market Size By Bulk Packaging

9.4.5.1 IBCs

9.4.5.2 Flexitanks

9.4.5.3 and Drums

9.4.6 Historic and Forecasted Market Size By Closure

9.4.6.1 Natural Corks

9.4.6.2 Aluminum Screw Caps

9.4.6.3 and Synthetic Corks

9.4.7 Historic and Forecasted Market Size By Accessories

9.4.7.1 Boxes & Carriers and Labels)

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Wine Packaging Boxes Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Container

9.5.4.1 Glass Bottles

9.5.4.2 Plastic Bottles

9.5.4.3 Bag In Box Container

9.5.4.4 and Others

9.5.5 Historic and Forecasted Market Size By Bulk Packaging

9.5.5.1 IBCs

9.5.5.2 Flexitanks

9.5.5.3 and Drums

9.5.6 Historic and Forecasted Market Size By Closure

9.5.6.1 Natural Corks

9.5.6.2 Aluminum Screw Caps

9.5.6.3 and Synthetic Corks

9.5.7 Historic and Forecasted Market Size By Accessories

9.5.7.1 Boxes & Carriers and Labels)

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Wine Packaging Boxes Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Container

9.6.4.1 Glass Bottles

9.6.4.2 Plastic Bottles

9.6.4.3 Bag In Box Container

9.6.4.4 and Others

9.6.5 Historic and Forecasted Market Size By Bulk Packaging

9.6.5.1 IBCs

9.6.5.2 Flexitanks

9.6.5.3 and Drums

9.6.6 Historic and Forecasted Market Size By Closure

9.6.6.1 Natural Corks

9.6.6.2 Aluminum Screw Caps

9.6.6.3 and Synthetic Corks

9.6.7 Historic and Forecasted Market Size By Accessories

9.6.7.1 Boxes & Carriers and Labels)

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Wine Packaging Boxes Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Container

9.7.4.1 Glass Bottles

9.7.4.2 Plastic Bottles

9.7.4.3 Bag In Box Container

9.7.4.4 and Others

9.7.5 Historic and Forecasted Market Size By Bulk Packaging

9.7.5.1 IBCs

9.7.5.2 Flexitanks

9.7.5.3 and Drums

9.7.6 Historic and Forecasted Market Size By Closure

9.7.6.1 Natural Corks

9.7.6.2 Aluminum Screw Caps

9.7.6.3 and Synthetic Corks

9.7.7 Historic and Forecasted Market Size By Accessories

9.7.7.1 Boxes & Carriers and Labels)

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Wine Packaging Boxes Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.5 Billion |

|

Forecast Period 2024-32 CAGR: |

6% |

Market Size in 2032: |

USD 10 Billion |

|

Segments Covered: |

By Container |

|

|

|

By Bulk Packaging |

|

||

|

By Closure |

|

||

|

By Accessories |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||