Key Market Highlights

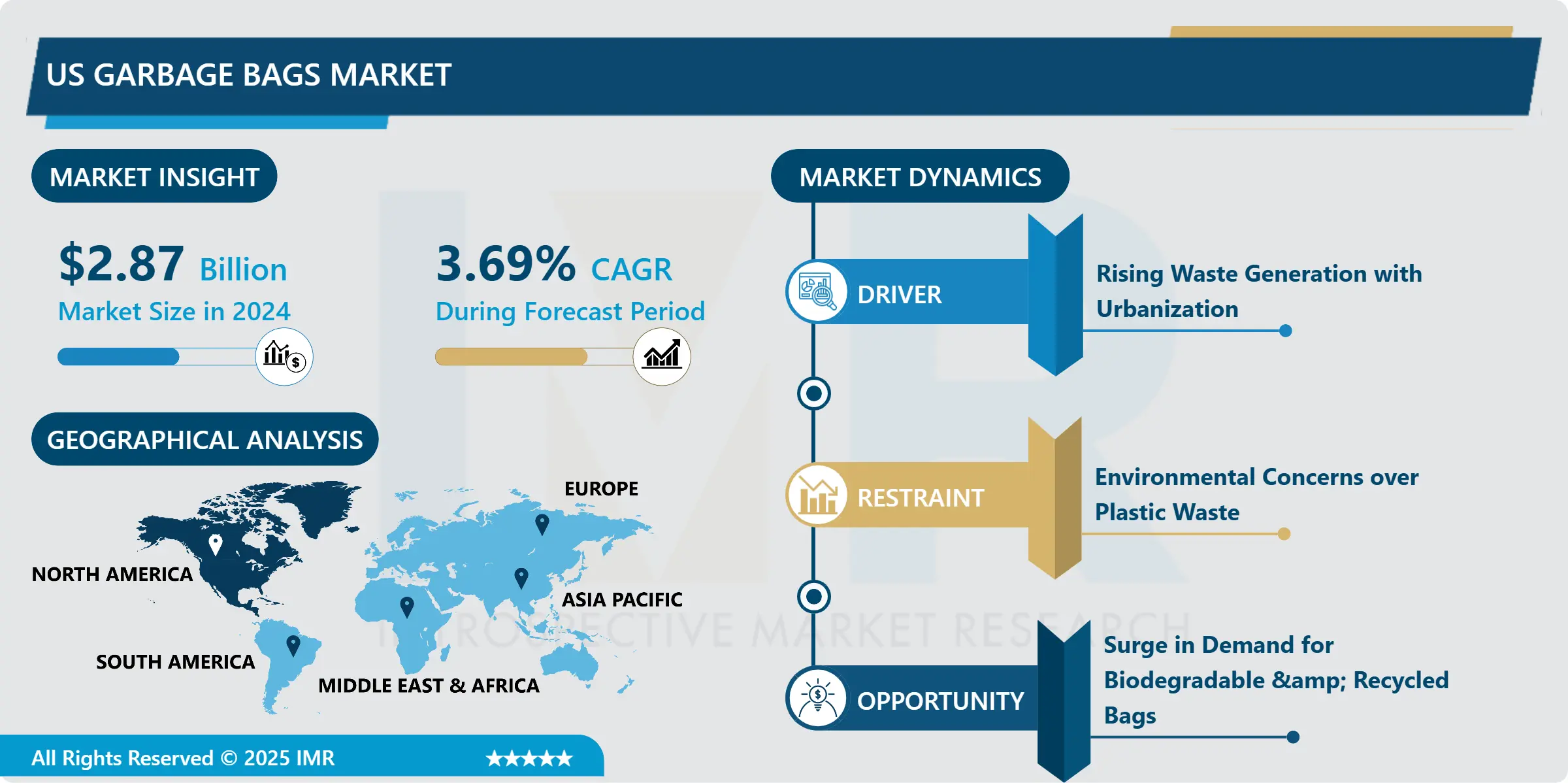

US Garbage Bags Market Size Was Valued at USD 2.87 billion in 2024, and is Projected to Reach USD 4.28 billion by 2035, Growing at a CAGR of 3.69% from 2025-2035.

- Market Size in 2024: USD 2.87 billion

- Projected Market Size by 2035: USD 4.28 billion

- CAGR (2025–2035): 3.69%

- Leading Market in 2024: North America

- Fastest-Growing Market: Canada

- By Type: The Plastic bags segment is anticipated to lead the market by accounting for 71.7% of the market share throughout the forecast period.

- By Application: The Trash bags segment is expected to capture 36.1% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: North America region is projected to hold 40% of the market share during the forecast period.

- Active Players: AEP Industries Inc. (USA), All American Poly (USA), Alpha Poly (Canada), American Plastics Company (USA), Basura Bags (USA), Other Active Players

US Garbage Bags Market Synopsis:

The U.S. garbage bags market pertains to the manufacture, distribution, and consumption of disposable bags used for waste collection and disposal in residential, commercial, and industrial/municipal sectors. Common materials include HDPE, LDPE, LLDPE, along with growing categories like bioplastics, compostable, and recycled-content bags

US Garbage Bags Market Dynamics and Trend Analysis:

US Garbage Bags Market Growth Driver - Rising Waste Generation with Urbanization

- As more people move to cities and urban areas in the United States, the amount of waste being produced is increasing quickly. This trend is mainly due to population growth, higher living standards, and changing lifestyles that come with urban development. When people live in more densely populated areas, they tend to consume more packaged goods, food items, and disposable products, which leads to more garbage being generated every day.

- Currently, the U.S. produces more than 292 million tons of municipal solid waste each year. This includes everything from household trash to commercial and industrial waste. Managing this large amount of waste requires strong, reliable waste collection and disposal systems. Garbage bags are one of the most basic and essential tools in this process. They help in safely collecting, storing, and transporting waste without mess or odor.

- Residential areas, office buildings, restaurants, hospitals, and schools all rely on trash bags to handle their daily waste. As cities continue to grow, the demand for garbage bags is also expected to rise steadily. This growth presents a strong opportunity for manufacturers and retailers of garbage bags. The more waste that is created, the more important it becomes to have durable, cost-effective, and easy-to-use garbage bags available for consumers and businesses alike.

US Garbage Bags Market Limiting Factor - Environmental Concerns over Plastic Waste

- In recent years, people have become more aware of how plastic waste harms the environment. Single-use plastics, like many types of garbage bags, often end up in landfills, oceans, and natural habitats, where they can take hundreds of years to break down. This causes serious problems for wildlife, pollutes water and soil, and contributes to climate change.

- Because of these concerns, both consumers and governments in the U.S. are taking action. Many people are now trying to reduce their use of plastic products, including traditional garbage bags made from polyethylene. They are looking for more sustainable options, such as biodegradable or compostable bags. At the same time, lawmakers in several states have introduced bans, taxes, or strict regulations on single-use plastic bags to help protect the environment.

- These environmental pressures are making it harder for companies that produce and sell plastic garbage bags to operate in the same way they used to. They are being forced to find greener alternatives or improve recycling processes. While these changes are good for the planet, they can also increase production costs and limit the use of certain types of bags. As a result, environmental concerns over plastic waste are becoming a major challenge for the traditional garbage bag market in the U.S.

US Garbage Bags Market Expansion Opportunity - Surge in Demand for Biodegradable & Recycled Bags

- As concerns about plastic pollution grow, both consumers and businesses in the U.S. are starting to prefer more eco-friendly waste disposal options. Instead of using traditional plastic garbage bags, many are switching to alternatives like biodegradable, compostable, and recycled (PCR) plastic bags. These types of bags are designed to break down more quickly or reuse existing plastic materials, making them better for the environment.

- This shift in demand is creating new opportunities in the garbage bag market. Companies now have the chance to innovate by developing greener products that not only meet environmental standards but also attract eco-conscious customers. Biodegradable and recycled bags allow businesses to stand out in a competitive market by offering more sustainable choices.

- Governments are also playing a big role in this change. Many states are encouraging or requiring the use of eco-friendly materials through new laws and regulations. This support makes it easier for green products to enter the market and be accepted by a larger group of consumers.

- Overall, the rising demand for biodegradable and recycled garbage bags is opening the door for growth and innovation in the U.S. waste management industry. It reflects a major move toward sustainability and responsible consumption that is likely to continue in the coming years.

US Garbage Bags Market Challenge and Risk - Regulatory Compliance & Transition Costs

- As environmental concerns increase, the U.S. government is introducing stricter regulations on plastic use and waste management. These new rules are pushing garbage bag manufacturers to make changes such as using eco-friendly materials, upgrading their production processes, and meeting new safety and sustainability standards. While these efforts support a cleaner environment, they come with significant costs.

- Switching from traditional plastic bags to biodegradable or recycled alternatives is not easy or cheap. Manufacturers may need to invest in new machinery, retrain workers, and source more expensive materials. In addition, companies must often go through complicated and costly certification processes to prove their products meet environmental guidelines.

- These challenges are especially hard on small and mid-sized companies, which may not have the resources to make these changes quickly. Many face the risk of falling behind larger competitors, losing market share, or even being forced to shut down if they cannot comply with the new regulations in time.

- Overall, while regulatory compliance is essential for environmental protection, it also presents a serious challenge for businesses in the garbage bags market. Balancing eco-friendly goals with affordability and operational stability is a growing concern that manufacturers must carefully manage.

US Garbage Bags Market Segment Analysis:

US Garbage Bags Market is segmented based on Type, Application, End-Users, and Region

By Type, US Garbage Bags Segment is Expected to Dominate the Market During the Forecast Period

- Plastic bags made from HDPE (High-Density Polyethylene) and LDPE (Low-Density Polyethylene) are still the most commonly used waste bags around the world. This is mainly because they are cheap to make, easy to find, and strong enough to carry all kinds of garbage.

- HDPE bags are thin but very strong. They are often used in kitchen bins, grocery stores, and for packaging. LDPE bags are thicker and more flexible. They are good for carrying heavy or sharp waste, like yard debris or industrial trash.

- One big reason people still prefer plastic bags is their low cost. Whether it's a household, a business, or a city, plastic bags offer an affordable way to manage large amounts of waste. They’re also lightweight, water-resistant, and can be made in different sizes and styles to suit different needs.

- Even though there’s growing concern about plastic pollution, especially from single-use plastics, these bags are still widely used because alternatives like biodegradable or compostable bags cost more and are not available everywhere.

- Until better and cheaper eco-friendly options become common, HDPE and LDPE plastic bags will likely continue to lead the market in both residential and commercial waste management.

By Application, US Garbage Bags Segment Held the Largest Share in 2024

- Trash bags are the most commonly used type of waste bags. They are a broad category designed to collect and hold general waste from homes, offices, and public places like parks, schools, and restaurants.

- People use trash bags every day to throw away household waste such as food scraps, packaging, and cleaning materials. In offices, they are used for paper waste, food wrappers, and other non-hazardous garbage. Public spaces also rely on trash bags in bins to keep areas clean and organized.

- These bags come in many sizes and thicknesses to suit different needs. For example, small bags are used in bathrooms and offices, while large, heavy-duty trash bags are used for outdoor bins or in commercial buildings.

- Trash bags are usually made of plastic, especially HDPE or LDPE, because plastic is strong, flexible, and affordable. Some newer options are made from biodegradable materials, which are better for the environment, but they are still less common due to higher costs.

- Overall, trash bags are essential for daily waste management. Their wide use across residential, commercial, and public settings makes them the most in-demand type of waste bag on the market today. As long as people produce waste, trash bags will continue to play a key role in keeping spaces clean and hygienic.

US Garbage Bags Market Regional Insights:

Western United is Expected to Dominate the Market Over the Forecast Period

- The Western United States, especially states like California, Washington, and Oregon, is the top-performing region in the U.S. garbage bags market. This region stands out due to its strong environmental regulations, progressive waste management policies, and consumer awareness around sustainability.

- California, in particular, has some of the strictest plastic bag laws in the country. Many cities and counties across the West have banned single-use plastic bags or imposed fees and restrictions. These rules have pushed businesses and households to switch from traditional plastic garbage bags to eco-friendly options, such as biodegradable, compostable, or recycled plastic bags.

- Consumers in the West are more likely to care about the environmental impact of their purchases. As a result, there is high demand for plant-based, non-toxic, and certified compostable trash bags in both residential and commercial sectors. Grocery stores, offices, and even government buildings are adopting sustainable bag alternatives as part of their green policies.

- This shift has opened up new opportunities for manufacturers and brands that offer environmentally safe and innovative garbage bag solutions. The region also benefits from strong support from local governments and sustainability-focused organizations.

- Overall, the Western U.S. is leading the way in the garbage bags market by combining strict regulations, eco-conscious consumers, and a growing demand for green products.

US Garbage Bags Market Active Players:

- AEP Industries Inc. (USA)

- All American Poly (USA)

- Alpha Poly (Canada)

- American Plastics Company (USA)

- Basura Bags (USA)

- Berry Global Inc. (USA)

- BioBag Americas, Inc. (USA/Norway)

- Colonial Bag Corporation (USA)

- Complete Packaging & Shipping Supplies, Inc. (USA)

- C-P Flexible Packaging (USA)

- Duro Bag Manufacturing (Novolex brand) (USA)

- EcoSafe Zero Waste (Canada)

- Elkay Plastics Co., Inc. (USA)

- FlexSol Packaging Corp. (USA)

- Four Star Plastics (USA)

- GreenPolly (Denmark)

- Heritage Bag (a Novolex brand) (USA)

- Hippo Sak (Crown Poly, Inc.) (USA)

- Inteplast Group (USA)

- International Plastics (USA)

- Novolex (Hilex Poly, Heritage Bag) (USA)

- Plastilite Corporation (USA)

- Poly-America, L.P. (USA)

- Reynolds Consumer Products (Hefty) (USA)

- Riverside Paper Co., Inc. (USA)

- Seventh Generation (USA)

- Simplehuman (USA)

- Stout by Envision (USA)

- The Glad Products Company (Clorox) (USA)

- UNNI (biodegradable trash bags) (USA)

- Other Active Players

|

US Garbage Bags Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.87 billion |

|

Forecast Period 2025-35 CAGR: |

3.69 % |

Market Size in 2035: |

USD 4.28 billion |

|

Segments Covered: |

By Type |

|

|

|

By Product Type

|

|

||

|

By Thickness |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: US Garbage Bags Market by Material Type (2018-2035)

4.1 US Garbage Bags Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Plastic

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Biodegradable

4.5 Recyclable

4.6 Paper

Chapter 5: US Garbage Bags Market by Product Type (2018-2035)

5.1 US Garbage Bags Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Kitchen Bags

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Trash Bags

5.5 Lawn and Leaf Bags

5.6 Pet Waste Bags

Chapter 6: US Garbage Bags Market by End-use (2018-2035)

6.1 US Garbage Bags Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Residential

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Commercial

6.5 Industrial

Chapter 7: US Garbage Bags Market by Thickness (2018-2035)

7.1 US Garbage Bags Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Light Duty

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Medium Duty

7.5 Heavy Duty

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 US Garbage Bags Market Share by Manufacturer/Service Provider(2024)

8.1.3 Industry BCG Matrix

8.1.4 PArtnerships, Mergers & Acquisitions

8.2 AEP INDUSTRIES INC. (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Recent News & Developments

8.2.10 SWOT Analysis

8.3 ALL AMERICAN POLY (USA)

8.4 ALPHA POLY (CANADA)

8.5 AMERICAN PLASTICS COMPANY (USA)

8.6 BASURA BAGS (USA)

8.7 BERRY GLOBAL INC. (USA)

8.8 BIOBAG AMERICAS

8.9 INC. (USA/NORWAY)

8.10 COLONIAL BAG CORPORATION (USA)

8.11 COMPLETE PACKAGING & SHIPPING SUPPLIES

8.12 INC. (USA)

8.13 C-P FLEXIBLE PACKAGING (USA)

8.14 DURO BAG MANUFACTURING (NOVOLEX BRAND) (USA)

8.15 ECOSAFE ZERO WASTE (CANADA)

8.16 ELKAY PLASTICS CO.

8.17 INC. (USA)

8.18 FLEXSOL PACKAGING CORP. (USA)

8.19 FOUR STAR PLASTICS (USA)

8.20 GREENPOLLY (DENMARK)

8.21 HERITAGE BAG (A NOVOLEX BRAND) (USA)

8.22 HIPPO SAK (CROWN POLY

8.23 INC.) (USA)

8.24 INTEPLAST GROUP (USA)

8.25 INTERNATIONAL PLASTICS (USA)

8.26 NOVOLEX (HILEX POLY

8.27 HERITAGE BAG) (USA)

8.28 PLASTILITE CORPORATION (USA)

8.29 POLY-AMERICA

8.30 L.P. (USA)

8.31 REYNOLDS CONSUMER PRODUCTS (HEFTY) (USA)

8.32 RIVERSIDE PAPER CO.

8.33 INC. (USA)

8.34 SEVENTH GENERATION (USA)

8.35 SIMPLEHUMAN (USA)

8.36 STOUT BY ENVISION (USA)

8.37 THE GLAD PRODUCTS COMPANY (CLOROX) (USA)

8.38 UNNI (BIODEGRADABLE TRASH BAGS) (USA)

8.39 AND OTHER ACTIVE PLAYERS.

Chapter 9: Global US Garbage Bags Market By Region

9.1 Overview

9.2. North America US Garbage Bags Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecast Market Size by Country

9.2.4.1 US

9.2.4.2 Canada

9.2.4.3 Mexico

9.3. Eastern Europe US Garbage Bags Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecast Market Size by Country

9.3.4.1 Russia

9.3.4.2 Bulgaria

9.3.4.3 The Czech Republic

9.3.4.4 Hungary

9.3.4.5 Poland

9.3.4.6 Romania

9.3.4.7 Rest of Eastern Europe

9.4. Western Europe US Garbage Bags Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecast Market Size by Country

9.4.4.1 Germany

9.4.4.2 UK

9.4.4.3 France

9.4.4.4 The Netherlands

9.4.4.5 Italy

9.4.4.6 Spain

9.4.4.7 Rest of Western Europe

9.5. Asia Pacific US Garbage Bags Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecast Market Size by Country

9.5.4.1 China

9.5.4.2 India

9.5.4.3 Japan

9.5.4.4 South Korea

9.5.4.5 Malaysia

9.5.4.6 Thailand

9.5.4.7 Vietnam

9.5.4.8 The Philippines

9.5.4.9 Australia

9.5.4.10 New Zealand

9.5.4.11 Rest of APAC

9.6. Middle East & Africa US Garbage Bags Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecast Market Size by Country

9.6.4.1 Turkiye

9.6.4.2 Bahrain

9.6.4.3 Kuwait

9.6.4.4 Saudi Arabia

9.6.4.5 Qatar

9.6.4.6 UAE

9.6.4.7 Israel

9.6.4.8 South Africa

9.7. South America US Garbage Bags Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecast Market Size by Country

9.7.4.1 Brazil

9.7.4.2 Argentina

9.7.4.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

Chapter 11 Our Thematic Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Chapter 12 Case Study

Chapter 13 Appendix

13.1 Sources

13.2 List of Tables and figures

13.3 Short Forms and Citations

13.4 Assumption and Conversion

13.5 Disclaimer

|

US Garbage Bags Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.87 billion |

|

Forecast Period 2025-35 CAGR: |

3.69 % |

Market Size in 2035: |

USD 4.28 billion |

|

Segments Covered: |

By Type |

|

|

|

By Product Type

|

|

||

|

By Thickness |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||