Software Quality Assurance Market Synopsis

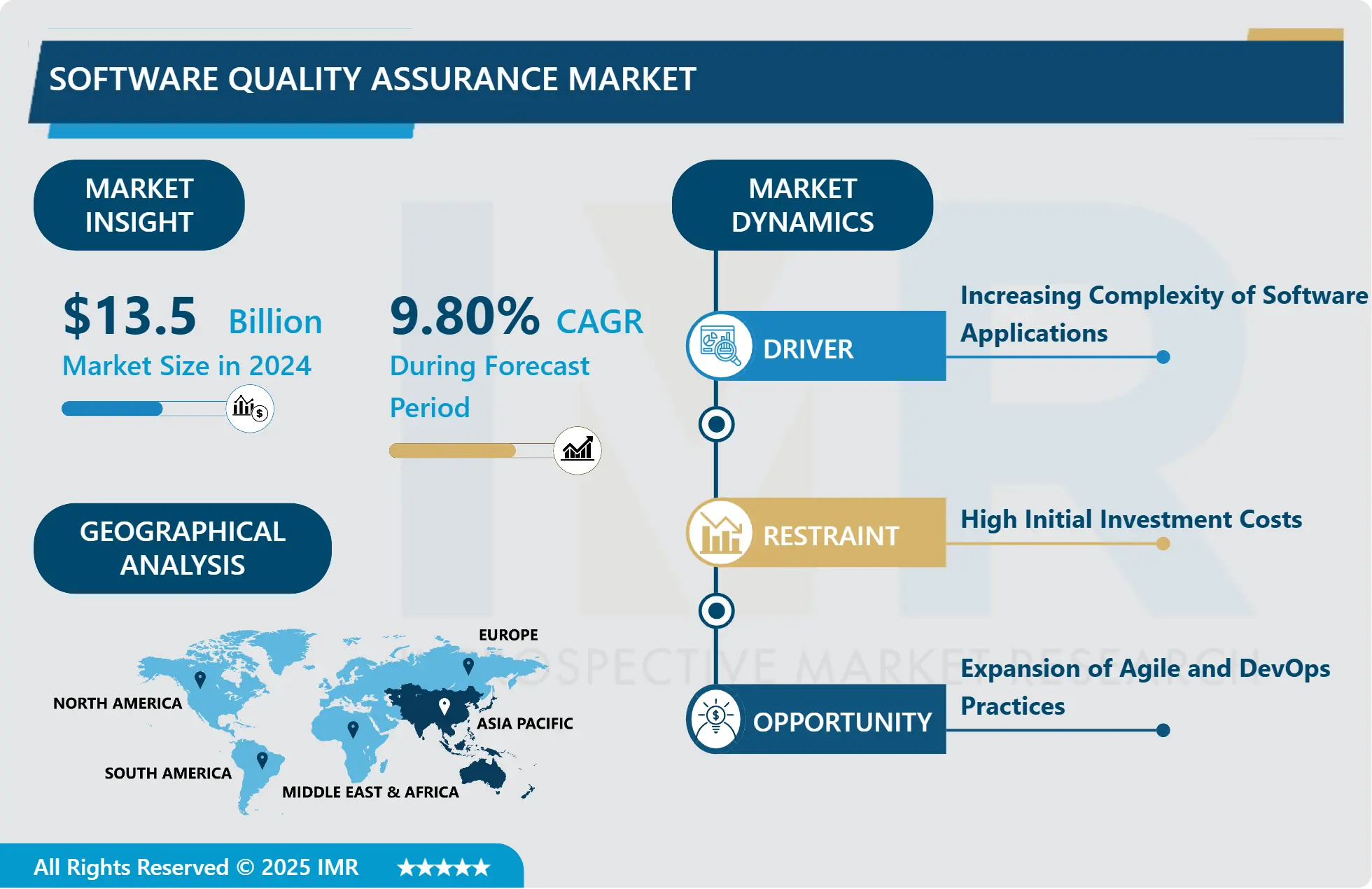

Software Quality Assurance Market Size Was Valued at USD 13.5 Billion in 2024, and is Projected to Reach USD 28.52 Billion by 2032, Growing at a CAGR of 9.80% From 2025-2032.

Software Quality Assurance (SQA) is a procedure that defines and maintains the standard of the software products and processes that are involved as well as the documentation throughout the various phases of the development cycle. It includes the managerial activity of planning, controlling, and enhancing the software processes with the aim of achieving the predefined quality targets. To this end, SQA strives to minimize the occurrence of defects within the software and the inadequacies that are bound to emerge as a result through proper testing and implementation of quality control measures and standards, thus facilitating improvement of the reliability, functionality, and usability of the software product.

The Software Quality Assurance (SQA) market has a significant function in providing the software applications reliability, functionality, and performance to the enterprises of various kinds of industry. The role of software is dramatically growing within organizations as the means of managing their processes and delivering customer experiences Subsequently, the need for stable SQA processes and tools is also highly relevant.

SQA includes a wide variety of activities to which the goal is to avoid defects and check that software meets the specified requirements. This means codes testing while coding the program or unit testing, integration testing where modules are tested as they are integrated and user acceptance testing where users test the program before it is deployed. SQA service and tool market comprises organizations of various sizes, including large companies as well as mid-sized and small SDT teams.

The following factors are potential growth motors within the market containing SQA: Specifically, the growing use of the Agile and DevOps methods where the integration and delivery of QAs are continuous. These approaches demand very short testing cycles, and testing automation so that the quality doesn’t suffer even if the rate of development is increased. Hence, there is now a new trend in the market, which is demand for test automation tools, test management systems and plug-ins that can easily fit the CI/CD systems.

Also, the continuing enhancement of various software applications compounded by cloud computing applications, IoT implementation, and AI make it essential to go for higher level testing strategies. Several SQA providers are already coming up with new testing frameworks that integrate Artificial Intelligence technologies to emulate users’ actions, trace and analyze defects and enhance on coverage. This transition to intelligent testing not only increases the productivity but also increases the effectiveness of identifying possible threats and areas of poor performance.

Similarly, legal stipulations and industrial best practices introduce strict SQA procedures, mainly in the industries like finance, health, and automotive since software latency is critical. Implementing standards of the sort of ISO 9001 or certain rules like GDPR or HIPAA requires strict adherence to quality assurance to guarantee the protection of data.

This is also true in the SQA market where outsourcing, which is driven by cost and distinct skill set, is growing with the quest for geographical diversification. Offshore and nearshore SQA service providers come with type of specialization starting from functional and regression testing, through security and performance testing and up to security and performance testing and everything in between, satisfying the need of the international clients who want to supplement their internal capacity or to meet various regulations in various countries.

As for the future, it is possible to speak about the further development of SQA with reference to such technologies as machine learning and natural language processing, which will continue the work on test case generation and defect prediction and contribute to the increase in the quality of developed software products. Given the fact that organizations are becoming increasingly focused on providing perfect user experience, and keeping all the processes smooth, it is going to be vital to develop strong SQA solutions to avoid potential risks, while delivering high-quality software solutions.

Software Quality Assurance Market Trend Analysis

Software Quality Assurance Market Growth Driver- Shift Towards AI-Driven Testing Software Quality

- The Market for Software Quality Assurance (QA) services has been gradually moving towards utilizing artificial intelligence and machine learning alike for testing services. Some of the benefits of using AI in QA tools are as follows; the tools help in automating the tests, identifying the faulty areas that might lead to defects, and the ability of simulating the real environment in the best way possible. These tools work with complex algorithms to format large volumes of information, extract trends, and estimate future problems that might affect the functionality of the software.

- This change is induction by such factors such as the necessity for faster cycles of development, reliability of the software and cost implications. The QA of applications is becoming automated as companies seek ways to decrease manual efforts while increasing test coverage by using AI-driven QA solutions. Day by day, the AI technologies’ advancements are expected to grow in the significance in terms of enhancing the software quality and more importantly, the period with which the competing businesses can bring in a new product or service to the market.

Software Quality Assurance Market Opportunity- Expansion of Agile and DevOps Practices

- Growing demand for Agile & DevOps across enterprises worldwide is the major factor that would fuel the growth of Agile and DevOps Practices Assurance market. With their approach of frequent and regularly repeated cycles, flexibility is attributed to the agile methodologies that as a result make it possible to deliver software products and services at high speeds in the current pursuing world. DevOps, in contrast, is a concept that covers cooperation between the development and operations teams with the principal goal to integrate, automate all stages of software development. The assurance market related to these practices focuses on the key Agile and DevOps enablers and services aiming at guaranteeing the efficiency, security, and adaptability of their executions.

- They include usage of Artificial Intelligence and Machine Learning to enhance DevOps, Cloud first and containers/Kubernetes, continuous testing and monitoring. Another factor that fuels the implementation of assurance services is compliance and security that Agile and DevOps solutions should meet, including regulation requirements. As the idea of being more nimble and effective in generating or delivering software applications has become a core concern for numerous organizations, the opportunities for growth in the Agile and DevOps Practices Assurance market remain vast, as the practice aims at improving productivity, creativity, and customers’ satisfaction within digital environments.

Software Quality Assurance Market Analysis:

Software Quality Assurance Market Segmented based on Solution , Deployment , Organization and Vertical.

By Solution , Supplier Quality Management segment is expected to dominate the market during the forecast period

- The Assurance Market refers to a vast spectrum of services that are essential for guaranteeing organization’s standards and conformity all-inclusive. This entails Supplier Quality Management that aims at maintaining proper standards throughout suppliers; Non-Conformances/Corrective and Preventive Actions which are critical in ensuring treatment of non-conformities; Change Management to address change issues, ensuring the various changes do not affect organizational processes; Document Control is also a critical solution that concerns itself with proper management of documents; supplier Audit is another solution that deals with matters of audits, and compliance is important in ensuring that there

- Altogether, these solutions strengthen organizational productivity, manage operational threats, and ensure compliance with the legislation’s requirements while satisfying the needs of various sectors, including healthcare and manufacturing. This growth is due to rising regulatory standards and the market’s unrelenting attaining greater heights of operational efficiency; aids from the deployment of technology such as AI and cloud solutions that improve solution efficacy and versatility in global markets.

By Deployment , Cloud segment held the largest share in 2024

- The Deployment Analysis Assurance Market refers to the solutions and services relating to the guarantee of optimal, effective, and secure deployment approaches such as Cloud and On-premise. Cloud helps to be scalable, versatile and economical, to the enterprises who do not have deep pockets to make large investments in hardware systems. He noted that the Cloud segment focus its assurance services on data accuracy, compliance with the GDPR and HIPAA, as well as virtualization risks.

- On the other hand, there is the On-premise deployment which is more of the control since industries with strong data policies and regulations, or those with operations that require close physical handling of structures will go for it. The assurance solutions of services here involve emphasis on hardware reliability, network protection, and compatibility with existing IT systems. Both deployment models promote the need of holistic assurance solutions, including vulnerability assessments, constant monitoring, and incident response strategies from the specifics of both deployment models’ prospects and risks.

Software Quality Assurance Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Looking at the factors fairly and square; the Asia Pacific region is anticipated to takeover the assurance market over the forecast period. Among the major factors, the economic development of countries such as China, India, Japan, and nations of the South East Asia Pacific involves rigorous investments into infrastructures and the financial sectors. Such growth creates the need to have proper assurance services to act as a compliance tool, manage risks and quality of financial statements. In addition, the middle class population is increasing in the region hence the need for consumption and investment where assurance solutions provide necessary protection as well as enhance the stability of the market. Laws which act to bring transparency and standardization to corporate management also have great significance; they force organizations to implemenent strict assurance measures.

- AI, Blockchain, and Data analytics being the game-changers in the year 2021 brings new tools for new forms of perspectives of assurance especially in APAC markets such as; Fraud detection, Automation of Audit, and Real-time monitoring and Reporting. Moreover, boosting the understanding of sustainable methods and enhancing their use create demand for assurance of the corresponding environmental, social, and governance activities of companies. In general, realization of market assurance fundamentals in Asia Pacific presents a stimulatory matrix of economic progress, emergent rules and ordinances, technologies, and developing corporate governance that places the region well on track to becoming the global center of assurance services.

Active Key Players in the Software Quality Assurance Market

- A1QA (Russia)

- Sparta Systems (USA)

- Digital Dream Forge (USA)

- Performance Lab (USA)

- Lighthouse Technologies (USA)

- QA Consultants (Canada)

- Cognizant (USA)

- Oracle Corporation (USA)

- Microsoft (USA)

- Siemens (Germany)

- Verse Solutions (USA) and Other Active Players

|

Global Software Quality Assurance Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 13.5 Bn. |

|

Forecast Period 2025-32 CAGR: |

9.80% |

Market Size in 2032: |

USD 28.52 Bn. |

|

Segments Covered: |

By Solution |

|

|

|

By Deployment |

|

||

|

By Organization Size |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Software Quality Assurance Market by Solution (2018-2032)

4.1 Software Quality Assurance Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Supplier Quality Management

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Non-Conformances/Corrective & Preventative

4.5 Change Management

4.6 Document Control

4.7 Audit Management

4.8 Complaint Handling

4.9 Calibration Management

4.10 Employee Training

4.11 Others

Chapter 5: Software Quality Assurance Market by Deployment (2018-2032)

5.1 Software Quality Assurance Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Cloud

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 On-premise

Chapter 6: Software Quality Assurance Market by Organization Size (2018-2032)

6.1 Software Quality Assurance Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Large Enterprise

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Small & Medium-Sized Enterprise

Chapter 7: Software Quality Assurance Market by Vertical (2018-2032)

7.1 Software Quality Assurance Market Snapshot and Growth Engine

7.2 Market Overview

7.3 IT

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Telecom

7.5 Consumer goods

7.6 Defense

7.7 Aerospace

7.8 Manufacturing

7.9 Consumer goods

7.10 Retail

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Software Quality Assurance Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 A1QA (RUSSIA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 SPARTA SYSTEMS (USA)

8.4 DIGITAL DREAM FORGE (USA)

8.5 PERFORMANCE LAB (USA)

8.6 LIGHTHOUSE TECHNOLOGIES (USA)

8.7 QA CONSULTANTS (CANADA)

8.8 COGNIZANT (USA)

8.9 ORACLE CORPORATION (USA)

8.10 MICROSOFT (USA)

8.11 SIEMENS (GERMANY)

8.12 VERSE SOLUTIONS (USA) OTHER KEY PLAYERS

Chapter 9: Global Software Quality Assurance Market By Region

9.1 Overview

9.2. North America Software Quality Assurance Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Solution

9.2.4.1 Supplier Quality Management

9.2.4.2 Non-Conformances/Corrective & Preventative

9.2.4.3 Change Management

9.2.4.4 Document Control

9.2.4.5 Audit Management

9.2.4.6 Complaint Handling

9.2.4.7 Calibration Management

9.2.4.8 Employee Training

9.2.4.9 Others

9.2.5 Historic and Forecasted Market Size by Deployment

9.2.5.1 Cloud

9.2.5.2 On-premise

9.2.6 Historic and Forecasted Market Size by Organization Size

9.2.6.1 Large Enterprise

9.2.6.2 Small & Medium-Sized Enterprise

9.2.7 Historic and Forecasted Market Size by Vertical

9.2.7.1 IT

9.2.7.2 Telecom

9.2.7.3 Consumer goods

9.2.7.4 Defense

9.2.7.5 Aerospace

9.2.7.6 Manufacturing

9.2.7.7 Consumer goods

9.2.7.8 Retail

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Software Quality Assurance Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Solution

9.3.4.1 Supplier Quality Management

9.3.4.2 Non-Conformances/Corrective & Preventative

9.3.4.3 Change Management

9.3.4.4 Document Control

9.3.4.5 Audit Management

9.3.4.6 Complaint Handling

9.3.4.7 Calibration Management

9.3.4.8 Employee Training

9.3.4.9 Others

9.3.5 Historic and Forecasted Market Size by Deployment

9.3.5.1 Cloud

9.3.5.2 On-premise

9.3.6 Historic and Forecasted Market Size by Organization Size

9.3.6.1 Large Enterprise

9.3.6.2 Small & Medium-Sized Enterprise

9.3.7 Historic and Forecasted Market Size by Vertical

9.3.7.1 IT

9.3.7.2 Telecom

9.3.7.3 Consumer goods

9.3.7.4 Defense

9.3.7.5 Aerospace

9.3.7.6 Manufacturing

9.3.7.7 Consumer goods

9.3.7.8 Retail

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Software Quality Assurance Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Solution

9.4.4.1 Supplier Quality Management

9.4.4.2 Non-Conformances/Corrective & Preventative

9.4.4.3 Change Management

9.4.4.4 Document Control

9.4.4.5 Audit Management

9.4.4.6 Complaint Handling

9.4.4.7 Calibration Management

9.4.4.8 Employee Training

9.4.4.9 Others

9.4.5 Historic and Forecasted Market Size by Deployment

9.4.5.1 Cloud

9.4.5.2 On-premise

9.4.6 Historic and Forecasted Market Size by Organization Size

9.4.6.1 Large Enterprise

9.4.6.2 Small & Medium-Sized Enterprise

9.4.7 Historic and Forecasted Market Size by Vertical

9.4.7.1 IT

9.4.7.2 Telecom

9.4.7.3 Consumer goods

9.4.7.4 Defense

9.4.7.5 Aerospace

9.4.7.6 Manufacturing

9.4.7.7 Consumer goods

9.4.7.8 Retail

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Software Quality Assurance Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Solution

9.5.4.1 Supplier Quality Management

9.5.4.2 Non-Conformances/Corrective & Preventative

9.5.4.3 Change Management

9.5.4.4 Document Control

9.5.4.5 Audit Management

9.5.4.6 Complaint Handling

9.5.4.7 Calibration Management

9.5.4.8 Employee Training

9.5.4.9 Others

9.5.5 Historic and Forecasted Market Size by Deployment

9.5.5.1 Cloud

9.5.5.2 On-premise

9.5.6 Historic and Forecasted Market Size by Organization Size

9.5.6.1 Large Enterprise

9.5.6.2 Small & Medium-Sized Enterprise

9.5.7 Historic and Forecasted Market Size by Vertical

9.5.7.1 IT

9.5.7.2 Telecom

9.5.7.3 Consumer goods

9.5.7.4 Defense

9.5.7.5 Aerospace

9.5.7.6 Manufacturing

9.5.7.7 Consumer goods

9.5.7.8 Retail

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Software Quality Assurance Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Solution

9.6.4.1 Supplier Quality Management

9.6.4.2 Non-Conformances/Corrective & Preventative

9.6.4.3 Change Management

9.6.4.4 Document Control

9.6.4.5 Audit Management

9.6.4.6 Complaint Handling

9.6.4.7 Calibration Management

9.6.4.8 Employee Training

9.6.4.9 Others

9.6.5 Historic and Forecasted Market Size by Deployment

9.6.5.1 Cloud

9.6.5.2 On-premise

9.6.6 Historic and Forecasted Market Size by Organization Size

9.6.6.1 Large Enterprise

9.6.6.2 Small & Medium-Sized Enterprise

9.6.7 Historic and Forecasted Market Size by Vertical

9.6.7.1 IT

9.6.7.2 Telecom

9.6.7.3 Consumer goods

9.6.7.4 Defense

9.6.7.5 Aerospace

9.6.7.6 Manufacturing

9.6.7.7 Consumer goods

9.6.7.8 Retail

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Software Quality Assurance Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Solution

9.7.4.1 Supplier Quality Management

9.7.4.2 Non-Conformances/Corrective & Preventative

9.7.4.3 Change Management

9.7.4.4 Document Control

9.7.4.5 Audit Management

9.7.4.6 Complaint Handling

9.7.4.7 Calibration Management

9.7.4.8 Employee Training

9.7.4.9 Others

9.7.5 Historic and Forecasted Market Size by Deployment

9.7.5.1 Cloud

9.7.5.2 On-premise

9.7.6 Historic and Forecasted Market Size by Organization Size

9.7.6.1 Large Enterprise

9.7.6.2 Small & Medium-Sized Enterprise

9.7.7 Historic and Forecasted Market Size by Vertical

9.7.7.1 IT

9.7.7.2 Telecom

9.7.7.3 Consumer goods

9.7.7.4 Defense

9.7.7.5 Aerospace

9.7.7.6 Manufacturing

9.7.7.7 Consumer goods

9.7.7.8 Retail

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Software Quality Assurance Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 13.5 Bn. |

|

Forecast Period 2025-32 CAGR: |

9.80% |

Market Size in 2032: |

USD 28.52 Bn. |

|

Segments Covered: |

By Solution |

|

|

|

By Deployment |

|

||

|

By Organization Size |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||