Snowmobile Market Synopsis

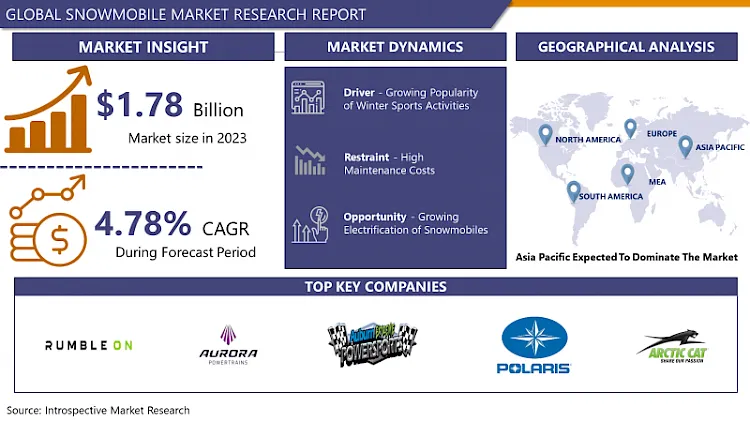

Snowmobile Market Size Was Valued at USD 1.87 Billion in 2024 and is Projected to Reach USD 2.72 Billion by 2032, Growing at a CAGR of 4.78 % From 2025-2032.

A snowmobile is a motorized vehicle designed for travel over snow and ice. It typically features skis in the front for steering and a track system in the rear for propulsion. Snowmobiles are popular for recreational use in snowy regions, as well as for transportation in remote areas with harsh winter conditions. They come in various sizes and designs, offering versatility for different terrain and purposes, including sport, utility, and touring.

The snowmobile market encompasses the manufacturing, distribution, and sale of recreational vehicles designed for traversing snow-covered terrain. These vehicles typically feature caterpillar tracks at the rear and skis at the front, providing stability and traction on snow and ice. Initially developed for utilitarian purposes such as transportation in remote areas, snowmobiles have evolved into popular recreational vehicles enjoyed by enthusiasts worldwide.

Key players in the snowmobile market include manufacturers such as Arctic Cat, Ski-Doo, and Polaris Industries, among others. These companies continually innovate to enhance the performance, safety, and environmental sustainability of their products, incorporating advanced technologies like fuel injection, electronic stability control, and lightweight materials.

The market is influenced by factors such as weather conditions, economic trends, and consumer preferences for outdoor recreational activities. Demand for snowmobiles fluctuates seasonally, peaking during winter months in regions where snowfall is abundant and recreational opportunities are plentiful.

The snowmobile market is impacted by regulations governing emissions and noise levels, driving manufacturers to develop cleaner and quieter propulsion systems. The snowmobile market remains a dynamic sector, driven by technological advancements, changing consumer demographics, and evolving preferences for outdoor recreational pursuits.

.webp)

Snowmobile Market Trend Analysis

Growing Popularity of Winter Sports Activities

- The growing popularity of winter sports activities serves as a significant driving force behind the expansion of the snowmobile market. As more individuals engage in activities like snowboarding, skiing, and ice fishing, the demand for convenient and efficient modes of transportation across snow-covered terrain increases. Snowmobiles offer enthusiasts a versatile and thrilling way to navigate through snowy landscapes, enhancing their overall experience in winter sports.

- The rise in adventure tourism and recreational activities in snow-clad regions amplifies the need for snowmobiles among tourists and outdoor enthusiasts. Tour operators and rental businesses capitalize on this trend by providing snowmobiles for guided tours and recreational purposes, further fueling market growth.

- Additionally, advancements in snowmobile technology, such as improved engine efficiency, enhanced safety features, and eco-friendly designs, have attracted a broader demographic of consumers, including families and eco-conscious individuals.

- The growing appeal of winter sports activities coupled with technological advancements and increasing tourism in snow-covered regions are key factors propelling the snowmobile market forward, driving manufacturers to innovate and meet the rising demand for these exhilarating winter vehicles.

Growing Electrification of Snowmobiles

- Electric snowmobiles produce zero tailpipe emissions, making them an attractive option for environmentally-conscious consumers and government regulators alike, especially in regions where air quality and environmental conservation are prioritized.

- The electric snowmobiles offer quieter operation compared to traditional gasoline-powered models. This makes them more appealing to recreational users and those living in areas where noise pollution is a concern, potentially expanding the market to new demographics and locations.

- The shift towards electrification opens doors for innovation and technological advancements within the industry. Manufacturers have the opportunity to develop cutting-edge electric propulsion systems, battery technologies, and smart features that enhance performance, efficiency, and user experience.

- Furthermore, as electric vehicle infrastructure continues to expand, including charging stations in popular snowmobiling areas, the practicality and convenience of electric snowmobiles are further bolstered, encouraging more widespread adoption. The growing electrification of snowmobiles presents a compelling opportunity for the market by addressing environmental concerns, improving user experience, fostering innovation, and leveraging the expanding electric vehicle infrastructure.

Snowmobile Market Segment Analysis:

Snowmobile Market is segmented based on Displacement Type, Engine Type, and Distribution Channel.

By Displacement Type, 500 CC to 800 CC segment is expected to dominate the market during the forecast period

- The 500 CC to 800 CC segment dominates the snowmobile market primarily due to its versatility, performance, and affordability. Snowmobiles within this displacement range strike a balance between power and maneuverability, making them suitable for various terrains and riding styles.

- Moreover, snowmobiles in this segment often come with advanced features and technologies typically found in higher-end models, enhancing the overall riding experience. Additionally, their relatively lower price point compared to larger displacement models makes them more accessible to a broader range of riders, driving their popularity in the market.

- Furthermore, manufacturers continually innovate within this segment, introducing new models with improved performance, fuel efficiency, and comfort features, further solidifying its dominance in the snowmobile market. Overall, the 500 CC to 800 CC segment offers a convincing combination of performance, affordability, and innovation, attracting a significant portion of snowmobile enthusiasts.

By Engine Type, Four-Stroke Engine segment held the largest share in 2024

- Four-stroke engines dominate the snowmobile market due to several key advantages. They offer better fuel efficiency compared to two-stroke engines, making them more cost-effective to operate over time. Additionally, four-stroke engines produce lower emissions, meeting increasingly stringent environmental regulations and appealing to eco-conscious consumers.

- They also tend to have a smoother power delivery, providing a more comfortable and controlled riding experience, crucial for navigating diverse snow conditions. Moreover, four-stroke engines typically require less maintenance and have longer service intervals, reducing downtime and ownership costs. Their durability and reliability make them preferred by rental companies and recreational riders alike, seeking dependable performance in demanding winter environments. Overall, the combination of efficiency, environmental friendliness, performance, and reliability solidifies the dominance of four-stroke engines in the snowmobile market.

Snowmobile Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The growing popularity of winter sports and recreational activities in countries like Japan, South Korea, and China has fueled the demand for snowmobiles. As disposable incomes rise and leisure time increases, more people are seeking exhilarating experiences in snowy landscapes, driving up the need for snowmobiles.

- The advancements in technology and design have made snowmobiles more accessible and appealing to a wider audience in the Asia Pacific region. Manufacturers have been quick to adapt their products to suit the preferences and requirements of Asian consumers, resulting in sleeker, more efficient, and user-friendly snowmobiles.

- Additionally, government initiatives and investments in winter tourism infrastructure have further boosted the growth of the snowmobile market in Asia Pacific. Improved access to snow-covered regions and the development of dedicated trails and parks have created ideal environments for snowmobiling enthusiasts.

- Furthermore, collaborations between international and local snowmobile manufacturers have facilitated the exchange of expertise and resources, contributing to the expansion of the market. Overall, with its combination of increasing demand, technological innovation, supportive policies, and strategic collaborations, the Asia Pacific region has firmly established itself as a powerhouse in the global snowmobile market.

Snowmobile Market Top Key Players:

- Tracks USA (United States)

- Auburn Extreme Powersports (United States)

- Arctic Cat (United States)

- Polaris (United States)

- Aurora Powertrains (Canada)

- RumbleOn (United States)

- BRP (Canada)

- Alpina Snowmobiles (Italy)

- Taiga Motors Inc. (Canada)

- Yamaha (Japan), and other Major Players.

Key Industry Developments in the Snowmobile Market:

- In March 2023, Polaris Inc. unveiled its latest lineup of snowmobiles and snow bikes, boasting enhanced rider-centric innovations and features. The release emphasized heightened performance, control, and agility, showcasing the debut of the Series 9 325 track and Timbersled's cutting-edge RIOT Gen 2 system. These advancements mark Polaris' commitment to pushing the boundaries of winter recreational vehicles, providing enthusiasts with unparalleled experiences on snow.

|

Global Snowmobile Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.87 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.78 % |

Market Size in 2032: |

USD 2.72 Bn. |

|

Segments Covered: |

By Displacement Type |

|

|

|

By Engine Type |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Snowmobile Market by Displacement Type (2018-2032)

4.1 Snowmobile Market Snapshot and Growth Engine

4.2 Market Overview

4.3 <500 CC

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 500 CC to 800 CC

4.5 800 CC & above

Chapter 5: Snowmobile Market by Engine Type (2018-2032)

5.1 Snowmobile Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Two-Stroke Engine

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Four-Stroke Engine

Chapter 6: Snowmobile Market by Distribution Channel (2018-2032)

6.1 Snowmobile Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Specialty Stores

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Online Retail

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Snowmobile Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 VOLLERS CORSETS (UNITED KINGDOM)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ADOREME (UNITED STATES)

7.4 EASTO GARMENTS (INDIA)

7.5 DARKLURE (UNITED STATES)

7.6 DARK GARDEN CORSETRY (UNITED STATES)

7.7 ISABELLA CORSETRY (UNITED STATES)

7.8 VERSATILE CORSETS (UNITED STATES)

7.9 ALLURE LINGERIE (UNITED STATES)

7.10 ORGANIC CORSET CO. (UNITED STATES)

7.11 AXFORDS (UNITED KINGDOM)

7.12 TRUE CORSET (UNITED KINGDOM)

7.13 ORCHARD CORSET (UNITED STATES)

7.14 LACE EMBRACE ATELIER (CANADA)

7.15 BEAUTIFUL CONNECTION GROUP (UNITED STATES)

7.16

Chapter 8: Global Snowmobile Market By Region

8.1 Overview

8.2. North America Snowmobile Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Displacement Type

8.2.4.1 <500 CC

8.2.4.2 500 CC to 800 CC

8.2.4.3 800 CC & above

8.2.5 Historic and Forecasted Market Size by Engine Type

8.2.5.1 Two-Stroke Engine

8.2.5.2 Four-Stroke Engine

8.2.6 Historic and Forecasted Market Size by Distribution Channel

8.2.6.1 Specialty Stores

8.2.6.2 Online Retail

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Snowmobile Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Displacement Type

8.3.4.1 <500 CC

8.3.4.2 500 CC to 800 CC

8.3.4.3 800 CC & above

8.3.5 Historic and Forecasted Market Size by Engine Type

8.3.5.1 Two-Stroke Engine

8.3.5.2 Four-Stroke Engine

8.3.6 Historic and Forecasted Market Size by Distribution Channel

8.3.6.1 Specialty Stores

8.3.6.2 Online Retail

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Snowmobile Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Displacement Type

8.4.4.1 <500 CC

8.4.4.2 500 CC to 800 CC

8.4.4.3 800 CC & above

8.4.5 Historic and Forecasted Market Size by Engine Type

8.4.5.1 Two-Stroke Engine

8.4.5.2 Four-Stroke Engine

8.4.6 Historic and Forecasted Market Size by Distribution Channel

8.4.6.1 Specialty Stores

8.4.6.2 Online Retail

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Snowmobile Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Displacement Type

8.5.4.1 <500 CC

8.5.4.2 500 CC to 800 CC

8.5.4.3 800 CC & above

8.5.5 Historic and Forecasted Market Size by Engine Type

8.5.5.1 Two-Stroke Engine

8.5.5.2 Four-Stroke Engine

8.5.6 Historic and Forecasted Market Size by Distribution Channel

8.5.6.1 Specialty Stores

8.5.6.2 Online Retail

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Snowmobile Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Displacement Type

8.6.4.1 <500 CC

8.6.4.2 500 CC to 800 CC

8.6.4.3 800 CC & above

8.6.5 Historic and Forecasted Market Size by Engine Type

8.6.5.1 Two-Stroke Engine

8.6.5.2 Four-Stroke Engine

8.6.6 Historic and Forecasted Market Size by Distribution Channel

8.6.6.1 Specialty Stores

8.6.6.2 Online Retail

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Snowmobile Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Displacement Type

8.7.4.1 <500 CC

8.7.4.2 500 CC to 800 CC

8.7.4.3 800 CC & above

8.7.5 Historic and Forecasted Market Size by Engine Type

8.7.5.1 Two-Stroke Engine

8.7.5.2 Four-Stroke Engine

8.7.6 Historic and Forecasted Market Size by Distribution Channel

8.7.6.1 Specialty Stores

8.7.6.2 Online Retail

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Snowmobile Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.87 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.78 % |

Market Size in 2032: |

USD 2.72 Bn. |

|

Segments Covered: |

By Displacement Type |

|

|

|

By Engine Type |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||