Sachet Packaging Market Synopsis:

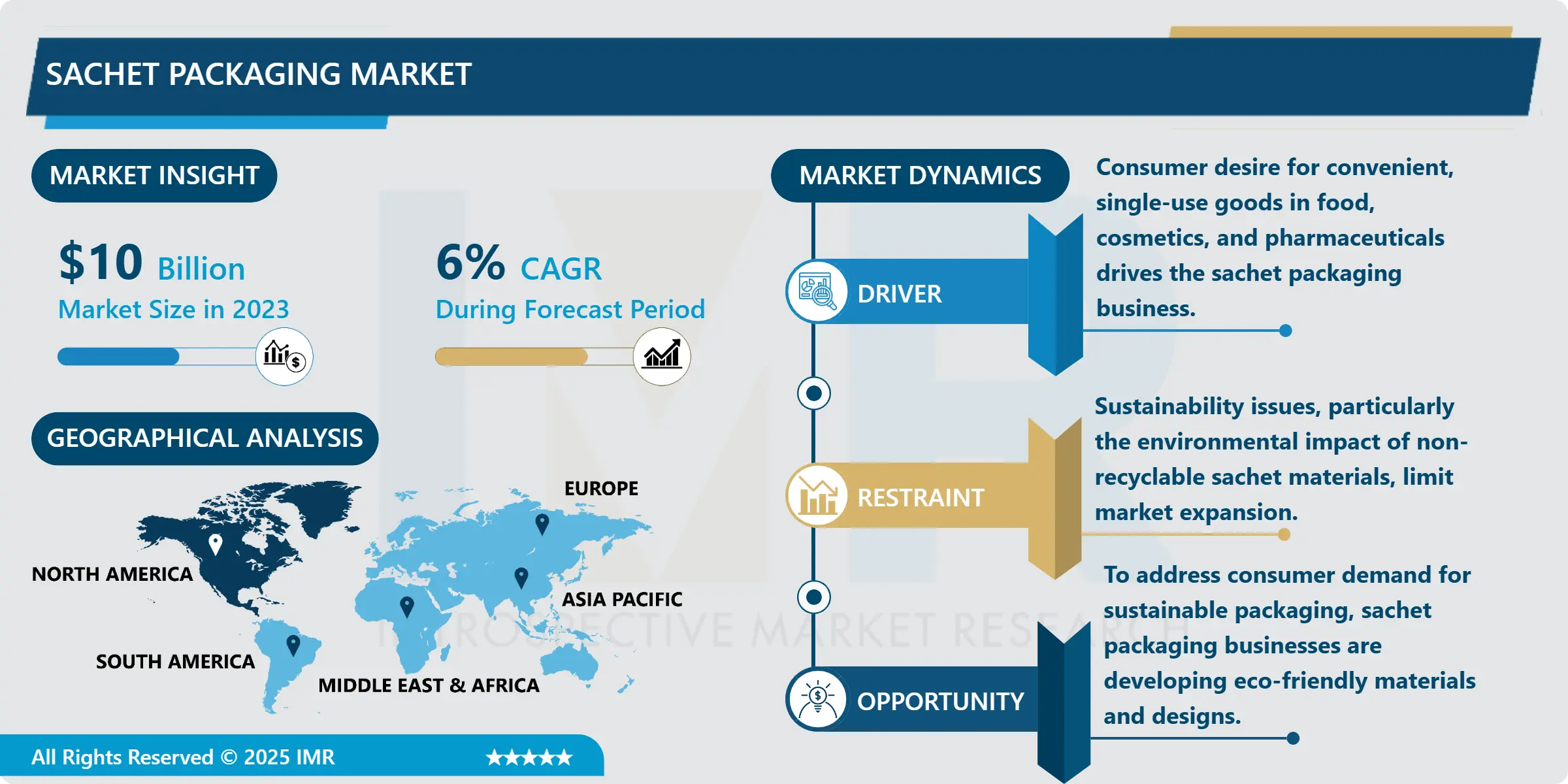

Sachet Packaging Market Size Was Valued at USD 10 Billion in 2023, and is Projected to Reach USD 15 Billion by 2032, Growing at a CAGR of 6% From 2024-2032.

The sachet packaging type is becoming popular in different industries to serve its purpose of packaging smaller portions in a convenient, cheap and effective manner. Sachets are small, flexible packets that can be made from plastic, paper, aluminum or a mix of all three and are effective for packaging a number of products – mainly food and beverages, cosmetics, pharmaceuticals and personal products. Owing to their small size and uniform shape, they are suitable for single as well as travel portions, which is today’s consumer trend for convenient and controlled portioning. Due to the desire of many organizations to save on material costs and space on the shelves, sachet packaging is becoming more common.

A major factor that influences growth of sachet packaging market is the growing demand for small packaging which is preferred in many developing countries given their price sensitivity to products and services. Sachet packaging also provides companies the opportunity to introduce products into the market at cheaper prices but not as cheap as to degrade their quality so that many people can afford them. Moreover, extension of facility of online selling along with rising use samples and small handy products has expanded the use of sachet packaging since it is lightweight, robust, and assists in cutting down the expenses of shipping.

However, the sachet packaging market has been experiencing the following challenges concerning sustainability Sachet packaging is usually made of a multi-layered material, and their recyclability is a significant concern. Yet, advances in other biodegradable and recyclable materials are the new opportunities for the growth of the market. To tackle envione issues and to counter the increasing trend of conscious consumption of packaging products, companies are shifting to green solutions. When these innovations are in effect, the sachet packaging market is likely to grow steadily because it is profitable and adaptable, and because of shifting consciousness toward environmental sustainability.

Sachet Packaging Market Trend Analysis

Rising Demand for Single-Use and Travel-Sized Products

- Another emerging segment in sachet packaging market today is convenience packaging, particularly in the fields of personal care, foods, and medicines. The younger generation of consumers along with consumer in the urban cities and developing world are interested in convenient portable products. Sachets are particularly suitable for these products because they enable firms to package smaller quantities which are cheaper than bigger packs. This trend is perhaps most notable in industries such as cosmetics, where sample constructions of products entice customers to experiment with new brands and consequently push the use of sachet packaging.

Shift Toward Sustainable Packaging Solutions

- Sustainability is emerging as a significant factor for sachet packaging market as concerns over the environment compelled the firms to look for greener solutions. The obsolete sachets can come in multiple layers of different materials that cannot easily be recycled, thus a problem in terms of plastics. However, currently, there are innovations in using eco-friendly and biodegradable, compostable, and recyclable materials meant to replace sachet packaging. The shift in the usage of environment friendly materials has open new opportunities for growth in the market as more and more brands have aligned with newer and stricter regulatory compliances as well as the general customer preference for eco friendly products.

Sachet Packaging Market Segment Analysis:

Sachet Packaging Market is Segmented on the basis of Pack Size, Material, Application, and Region.

By Pack Size, 11 ml - 20 ml segment is expected to dominate the market during the forecast period

- The sachet packaging market, by pack size, consists of categories such as 1 ml – 10 ml, 11 ml – 20 ml, 21 ml – 30 ml and others based on the types of product and the consumers’ needs. The 1- 10 ml measuring segment can be useful while handling samples, single applications personal care products such as shampoos and lotion and small proportions of medicine. The size range of 11 ml - 20 ml contains food condiments, sauces and skincare solutions since they allow dispensing slightly more volume for added convenience. Items such as beverages, supplements and large personal items are found in this segment where consumers are able to obtain relatively larger quantities of products. It is noticeable that these variegated pack sizes enables flexibility in packaging, which can be of strategic value in responding to market requirements in cosmetics, food and the healthcare sector among others.

By Application, Consumer Goods segment expected to held the largest share

- The sachet packaging market has versatile uses across food and beverages; pharmaceuticals; cosmetics and personal care; industrial; consumer goods; adhesive and sealants; lubricants and solutions; tobacco and others industries. In the food and beverage industry, sachets are employed for holding food condiments, sauces, spices, and single serving bottled drinks to capture convenience and portion Sizes. Pharmaceutical industry uses sachet packaging for single or individual dosing of drugs and supplements where measures things like measure, cleanliness and hygiene are very crucial. Sachets are common among cosmetics and personal care products especially for small volumes of products such as shampoos, creams and lotions where portability and unit trials are important indicators. Sachets commonly employ in the industrial uses for packing adhesive, lubricants, sealants, and in moisture retaining packaging in the tobacco industry. Such flexible application in numerous industries has thus seen sachet packaging foster to be a growing solution towards providing convenience, reduced cost and efficiency in the supply of products in the market.

Sachet Packaging Market Regional Insights:

Asia-Pacific is expected to dominate in the sachet packaging market.

- The Asia-Pacific region still remains the largest market for sachet packaging due to large population, increased disposable income, and various industries needs small packaging for single use products. Schnitzer notes that sachet packaging is common in nations like India, Indonesia, and Philippines because it is affordable, and people buy small, cheap amounts of items such as washing soap, seasonings, and medicines. The growth of urban population and the constantly rising middle class in area also fuels sachet packaging market as current trends show people prefer convenience and portability. On the same note, the region boasts of well-developed manufacturing industry and emergence of environmental-friendly packaging materials for sachet packaging.

Active Key Players in the Sachet Packaging Market:

- Amcor plc (Australia)

- ProAmpac (U.S.)

- Huhtamäki Oyj (Finland)

- Constantia Flexibles (Austria)

- CLONDALKIN GROUP (Ireland)

- Adcraft Products Co., Inc. (U.S.)

- Ultra Seal Corporation (U.S.)

- Unico I.T.C. dba (Italy)

- American Towelette, Inc. (U.S.)

- Giles & Kendall, Inc. (U.S.)

- Cedar & Hardwood (U.S.)

- DEVE-PACK (Italy)

- Daila srl (Italy)

- RCP Ranstadt GmbH (Germany)

- bagobag (Italy)

- BERNHARDT Packaging & Process (Germany)

- A E Adams (Henfield) Ltd (U.K.)

- Bemis Manufacturing Company (U.S.)

- Coveris (U.K.)

- EPOCA Products s.a. (France)

- Other Active Players

|

Sachet Packaging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10 Billion |

|

Forecast Period 2024-32 CAGR: |

6% |

Market Size in 2032: |

USD 15 Billion |

|

Segments Covered: |

By Pack Size |

|

|

|

By Material |

|

||

|

By Packaging Machinery |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Sachet Packaging Market by Pack Size

4.1 Sachet Packaging Market Snapshot and Growth Engine

4.2 Sachet Packaging Market Overview

4.3 1 ml - 10 ml

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 1 ml - 10 ml: Geographic Segmentation Analysis

4.4 11 ml - 20 ml

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 11 ml - 20 ml: Geographic Segmentation Analysis

4.5 21 - 30 ml and Others

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 21 - 30 ml and Others: Geographic Segmentation Analysis

Chapter 5: Sachet Packaging Market by Material

5.1 Sachet Packaging Market Snapshot and Growth Engine

5.2 Sachet Packaging Market Overview

5.3 Plastic

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Plastic: Geographic Segmentation Analysis

5.4 Paper

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Paper: Geographic Segmentation Analysis

5.5 Aluminium Foil and Others

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Aluminium Foil and Others: Geographic Segmentation Analysis

Chapter 6: Sachet Packaging Market by Packaging Machinery

6.1 Sachet Packaging Market Snapshot and Growth Engine

6.2 Sachet Packaging Market Overview

6.3 Vertical Form-Fill-Seal(VFFS) and Horizontal Form-Fill-Seal (HFFS))

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Vertical Form-Fill-Seal(VFFS) and Horizontal Form-Fill-Seal (HFFS)): Geographic Segmentation Analysis

6.4

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 : Geographic Segmentation Analysis

Chapter 7: Sachet Packaging Market by Application

7.1 Sachet Packaging Market Snapshot and Growth Engine

7.2 Sachet Packaging Market Overview

7.3 Food and Beverage

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Food and Beverage: Geographic Segmentation Analysis

7.4 Pharmaceuticals

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Pharmaceuticals: Geographic Segmentation Analysis

7.5 Cosmetic and Personal Care

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Cosmetic and Personal Care: Geographic Segmentation Analysis

7.6 Industrial

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Industrial: Geographic Segmentation Analysis

7.7 Consumer Goods

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Consumer Goods: Geographic Segmentation Analysis

7.8 Adhesives and Sealants Lubricant and Solution

7.8.1 Introduction and Market Overview

7.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.8.3 Key Market Trends, Growth Factors and Opportunities

7.8.4 Adhesives and Sealants Lubricant and Solution: Geographic Segmentation Analysis

7.9 Tobacco and Others

7.9.1 Introduction and Market Overview

7.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.9.3 Key Market Trends, Growth Factors and Opportunities

7.9.4 Tobacco and Others: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Sachet Packaging Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 AMCOR PLC (AUSTRALIA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 PROAMPAC (U.S.)

8.4 HUHTAMÄKI OYJ (FINLAND)

8.5 CONSTANTIA FLEXIBLES (AUSTRIA)

8.6 CLONDALKIN GROUP (IRELAND)

8.7 ADCRAFT PRODUCTS CO. INC. (U.S.)

8.8 ULTRA SEAL CORPORATION (U.S.)

8.9 UNICO I.T.C. DBA (ITALY)

8.10 AMERICAN TOWELETTE INC. (U.S.)

8.11 GILES & KENDALL INC. (U.S.)

8.12 CEDAR & HARDWOOD (U.S.)

8.13 DEVE-PACK (ITALY)

8.14 DAILA SRL (ITALY)

8.15 RCP RANSTADT GMBH (GERMANY)

8.16 BAGOBAG (ITALY)

8.17 BERNHARDT PACKAGING & PROCESS (GERMANY)

8.18 A E ADAMS (HENFIELD) LTD (U.K.)

8.19 BEMIS MANUFACTURING COMPANY (U.S.)

8.20 COVERIS (U.K.)

8.21 EPOCA PRODUCTS S.A. (FRANCE)

8.22 OTHER ACTIVE PLAYERS

Chapter 9: Global Sachet Packaging Market By Region

9.1 Overview

9.2. North America Sachet Packaging Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Pack Size

9.2.4.1 1 ml - 10 ml

9.2.4.2 11 ml - 20 ml

9.2.4.3 21 - 30 ml and Others

9.2.5 Historic and Forecasted Market Size By Material

9.2.5.1 Plastic

9.2.5.2 Paper

9.2.5.3 Aluminium Foil and Others

9.2.6 Historic and Forecasted Market Size By Packaging Machinery

9.2.6.1 Vertical Form-Fill-Seal(VFFS) and Horizontal Form-Fill-Seal (HFFS))

9.2.6.2

9.2.7 Historic and Forecasted Market Size By Application

9.2.7.1 Food and Beverage

9.2.7.2 Pharmaceuticals

9.2.7.3 Cosmetic and Personal Care

9.2.7.4 Industrial

9.2.7.5 Consumer Goods

9.2.7.6 Adhesives and Sealants Lubricant and Solution

9.2.7.7 Tobacco and Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Sachet Packaging Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Pack Size

9.3.4.1 1 ml - 10 ml

9.3.4.2 11 ml - 20 ml

9.3.4.3 21 - 30 ml and Others

9.3.5 Historic and Forecasted Market Size By Material

9.3.5.1 Plastic

9.3.5.2 Paper

9.3.5.3 Aluminium Foil and Others

9.3.6 Historic and Forecasted Market Size By Packaging Machinery

9.3.6.1 Vertical Form-Fill-Seal(VFFS) and Horizontal Form-Fill-Seal (HFFS))

9.3.6.2

9.3.7 Historic and Forecasted Market Size By Application

9.3.7.1 Food and Beverage

9.3.7.2 Pharmaceuticals

9.3.7.3 Cosmetic and Personal Care

9.3.7.4 Industrial

9.3.7.5 Consumer Goods

9.3.7.6 Adhesives and Sealants Lubricant and Solution

9.3.7.7 Tobacco and Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Sachet Packaging Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Pack Size

9.4.4.1 1 ml - 10 ml

9.4.4.2 11 ml - 20 ml

9.4.4.3 21 - 30 ml and Others

9.4.5 Historic and Forecasted Market Size By Material

9.4.5.1 Plastic

9.4.5.2 Paper

9.4.5.3 Aluminium Foil and Others

9.4.6 Historic and Forecasted Market Size By Packaging Machinery

9.4.6.1 Vertical Form-Fill-Seal(VFFS) and Horizontal Form-Fill-Seal (HFFS))

9.4.6.2

9.4.7 Historic and Forecasted Market Size By Application

9.4.7.1 Food and Beverage

9.4.7.2 Pharmaceuticals

9.4.7.3 Cosmetic and Personal Care

9.4.7.4 Industrial

9.4.7.5 Consumer Goods

9.4.7.6 Adhesives and Sealants Lubricant and Solution

9.4.7.7 Tobacco and Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Sachet Packaging Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Pack Size

9.5.4.1 1 ml - 10 ml

9.5.4.2 11 ml - 20 ml

9.5.4.3 21 - 30 ml and Others

9.5.5 Historic and Forecasted Market Size By Material

9.5.5.1 Plastic

9.5.5.2 Paper

9.5.5.3 Aluminium Foil and Others

9.5.6 Historic and Forecasted Market Size By Packaging Machinery

9.5.6.1 Vertical Form-Fill-Seal(VFFS) and Horizontal Form-Fill-Seal (HFFS))

9.5.6.2

9.5.7 Historic and Forecasted Market Size By Application

9.5.7.1 Food and Beverage

9.5.7.2 Pharmaceuticals

9.5.7.3 Cosmetic and Personal Care

9.5.7.4 Industrial

9.5.7.5 Consumer Goods

9.5.7.6 Adhesives and Sealants Lubricant and Solution

9.5.7.7 Tobacco and Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Sachet Packaging Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Pack Size

9.6.4.1 1 ml - 10 ml

9.6.4.2 11 ml - 20 ml

9.6.4.3 21 - 30 ml and Others

9.6.5 Historic and Forecasted Market Size By Material

9.6.5.1 Plastic

9.6.5.2 Paper

9.6.5.3 Aluminium Foil and Others

9.6.6 Historic and Forecasted Market Size By Packaging Machinery

9.6.6.1 Vertical Form-Fill-Seal(VFFS) and Horizontal Form-Fill-Seal (HFFS))

9.6.6.2

9.6.7 Historic and Forecasted Market Size By Application

9.6.7.1 Food and Beverage

9.6.7.2 Pharmaceuticals

9.6.7.3 Cosmetic and Personal Care

9.6.7.4 Industrial

9.6.7.5 Consumer Goods

9.6.7.6 Adhesives and Sealants Lubricant and Solution

9.6.7.7 Tobacco and Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Sachet Packaging Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Pack Size

9.7.4.1 1 ml - 10 ml

9.7.4.2 11 ml - 20 ml

9.7.4.3 21 - 30 ml and Others

9.7.5 Historic and Forecasted Market Size By Material

9.7.5.1 Plastic

9.7.5.2 Paper

9.7.5.3 Aluminium Foil and Others

9.7.6 Historic and Forecasted Market Size By Packaging Machinery

9.7.6.1 Vertical Form-Fill-Seal(VFFS) and Horizontal Form-Fill-Seal (HFFS))

9.7.6.2

9.7.7 Historic and Forecasted Market Size By Application

9.7.7.1 Food and Beverage

9.7.7.2 Pharmaceuticals

9.7.7.3 Cosmetic and Personal Care

9.7.7.4 Industrial

9.7.7.5 Consumer Goods

9.7.7.6 Adhesives and Sealants Lubricant and Solution

9.7.7.7 Tobacco and Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Sachet Packaging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10 Billion |

|

Forecast Period 2024-32 CAGR: |

6% |

Market Size in 2032: |

USD 15 Billion |

|

Segments Covered: |

By Pack Size |

|

|

|

By Material |

|

||

|

By Packaging Machinery |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||