Global Predictive Maintenance Market Overview

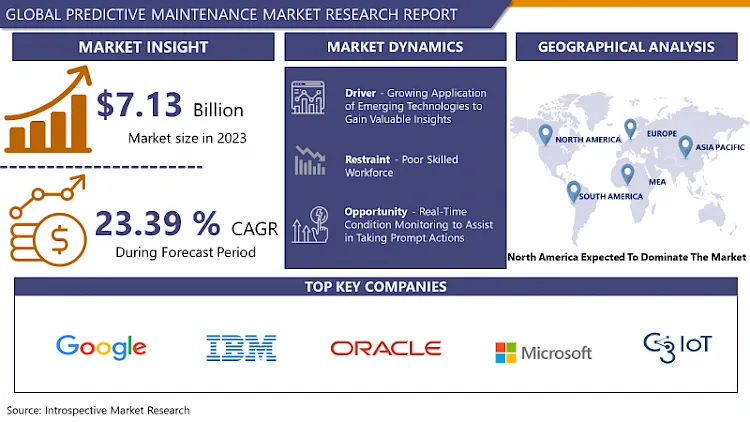

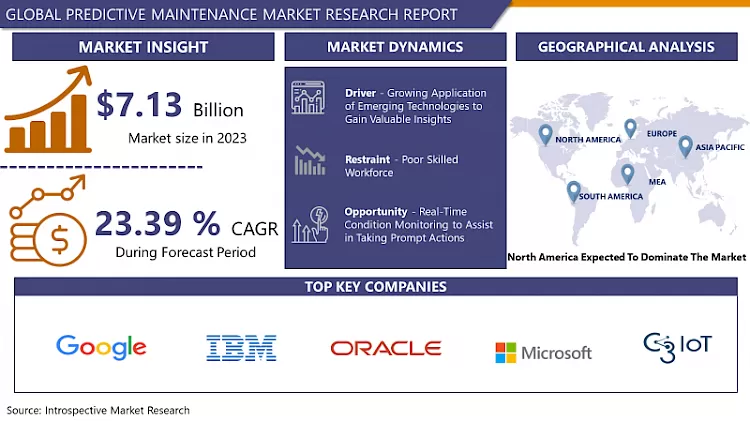

Predictive Maintenance Market Size Was Valued at USD 7.13 Billion in 2023 and is Projected to Reach USD 47.27 Billion by 2032, Growing at a CAGR of 23.39% From 2024-2032

Predictive maintenance is a technology that applies for the data analysis tools and techniques to determine inconsistency in the operation and possible defects in equipment and processes so we can fix them before they fail. Preferably, predictive maintenance enables the maintenance frequency to be as low as possible to prevent unplanned reactive maintenance, without suffering costs related to doing too much-preventing maintenance. Furthermore, predictive maintenance uses historical and real-time data from different parts of the operation to expect problems before they happen. The major areas of the company that factor into predictive maintenance such as the real-time monitoring of asset condition and performance, the analysis of work order data, benchmarking MRO inventory usage. There is a various key component to predictive maintenance with technology and software being one of these critical pieces such as the artificial intelligence, Internet of Things (IoT), and integrated system allow for various assets and systems to connect, work together and analyze, share, and action data. These tools record information utilizing industrial controls, predictive maintenance sensors, and businesses systems (such as EAM software and ERP software). They then make sense of it and utilize it to identify any areas that require focus.

Moreover, for instance, using predictive maintenance and predictive maintenance sensors include vibration analysis, thermal imaging, oil analysis, and equipment observation which leads the growth of the market during the forecast period. Moreover, the importance of predictive maintenance such as if predictive maintenance is working successfully as a maintenance strategy, maintenance is only performed on machines when it is needed. Therefore, just before failure is probably to occur. This brings different cost savings, reducing the time the equipment is being maintained, decreasing the production hours lost to maintenance, overcome the cost of spare parts and supplies which helps to growth of the market in the course of the forecast period. Predictive maintenance programs have been shown to support the tenfold increase in ROI, a 25%-30% decrease in maintenance costs, a 70%-75% reduction of breakdowns, and a 35%-45% minimize in downtime. Some condition monitoring techniques are costly and need specialist and experienced personnel for data analysis to be effective.

Market Dynamics and Factors of Predictive Maintenance Market

Drivers:

Evaluating the aggressive time constraints for different industrial products and services, it is important to recognize the causes of failures or potential faults before they have a chance to occur. Developing technologies such as Internet of Things (IoT) cloud storage, and big data analytics are qualified more industrial equipment and assembly robots to provide condition-based data, making fault detection easier and practical. Information received from this equipment can be turned into actionable and meaningful insights by using these solutions. This is anticipated to stimulate the demand for these solutions over the globe.

Companies are deploying their maintenance services more effectively and are boosting equipment up-time by proactively determining potential issues by using the available data within the plant. The faults or failures of the equipment or plant can be determined easily by effectively using the available structural data. The structural data pointers include working hours, year of production, model, make, warranty details along with unstructured data mainly repair logs and maintenance history. This information allows organizations to predict if or when the equipment will fail so that the repair works can be carried out before the failure occurs.

Predictive maintenance can be applied to all industry verticals where machines create significant amounts of data and require maintenance. Industries such as healthcare, aerospace, manufacturing, automotive, and process industries such as chemicals, food, and beverage, oil, and gas can be transformed with the help of these solutions. In addition, apart from the advantages such as reducing downtime, removing the causes of failure, and managing repair costs, these solutions also employ non-intrusive testing techniques for evaluating and computing asset performance trends.

Restraints:

Insufficient accessibility of skilled workforce with suitable knowledge of operating the predictive maintenance solution is a major challenge experienced by the organizations. Trained workers are required to handle the new software systems to deploy AI-based IoT technologies and skillsets. Therefore, the existing workers are required to be trained on how to operate the latest and upgraded systems. Furthermore, industries are dynamic toward approving new technologies, however, they are experiencing a scarcity of highly skilled workforce and proficient workers.

Opportunities:

Real-time condition monitoring to support in taking prompt actions. Upgraded asset management is growingly needed across almost every vertical. Solution providers equipped with AI and ML can collect and turn the vast amount of customer-related data into significant insights, as IoT generates a huge amount of data from connected devices. AI can also be non-segregated with the IoT devices to improve various aspects of service delivery, such as predictive maintenance and quality assessment, without the need for any human interference. The real-time inputs from sensors, actuators, and other control parameters would not only predict embryonic asset failures but also support companies monitor in real-time and take quick actions.

Market Segmentation

Segmentation Analysis of Predictive Maintenance Market:

Based on the Components, the solution component accounted for the largest market share during the forecast period. Owing to the rising concern of organizations towards cutting down the cost and advancement in the uptime of equipment.

Based on Deployment Type, the on-premise segment is expected to dominate the overall predictive maintenance market and is anticipated to maintain its dominance over the forecast period. This is imputed to its modular sensors and easier deployments in pre-existing equipment. Nevertheless, cloud-based predictive maintenance solutions are anticipated to exhibit the highest growth rate over the projected period, due to remote accessibility, direct IT control, efficient resource internal data delivery & handling, faster data processing using advance predictive analytics, utilization, and cost-effectiveness.

Based on the Organization Size, the large enterprise segment dominates the market over the forecast period. These enterprises are developing and automating their operational maintenance process by using these solutions. Furthermore, the cost related to downtime and assets in large enterprises is very high. To reduce these challenges predictive maintenance solutions are progressively being deployed in large enterprises over the world.

Based on the Industry Vertical, the manufacturing segment is expected to dominate the global market during the forecast period. The increasing requirement for maintenance of producing equipment such as machinery, industrial robots, elevators, and pumps for decreasing the overall downtime is turning the adoption of predictive maintenance solutions and services in the manufacturing segment. Furthermore, the growing automation in the manufacturing sector coupled with Industry 4.0 is also expected to drive the demand for these solutions to protect the high-end equipment from losses.

Regional Analysis of Predictive Maintenance Market:

North America is expected to hold a maximum market share over the forecast period. The region is the market commander in the advancement and acquisition of advanced predictive maintenance solutions. This can be assigned to the presence of a large number of leading solutions and service providers. Furthermore, higher investments made in developing technologies such as IoT, artificial intelligence, and machine learning are expected to support the region to maintain its dominant position shortly. Moreover, higher awareness related to predictive maintenance measures and their importance is also producing significant demand for these solutions.

The Asia Pacific is expected to observe significant market share during the forecast period. The higher growth of the market in the region is especially attributed to huge investments done by public and private sectors for the improvement of asset maintenance solutions. Hence, increasing the demand for predictive maintenance solutions deployed for automating the maintenance process of the plant. Furthermore, the higher availability of cheap labor in the region has led to the establishment of a massive number of producing units in the region. Furthermore, growing concerns for decreasing overall downtime and operation costs in producing plants are compelling the plant owners to deploy these solutions.

Europe is expected to hold a significant market share during the forecast period. The high demand for predictive maintenance solutions, due to the rising organizational investments and consciousness about the benefits of predictive maintenance technology to reach competitive advantages.

The Middle East and Africa are expected to observe a stable growth rate in the predictive maintenance market. Growing demand for more cost-efficient predictive maintenance solutions and a tendency towards minimizing machine breakdowns will create the growth of the predictive maintenance market over the region.

Players Covered in Predictive Maintenance Market are:

- Google (US)

- IBM (US)

- Oracle(US)

- Microsoft (US)

- Sigma Industrial Precision (Spain)

- C3 IoT (US)

- Hitachi (Japan)

- RapidMiner (US)

- PTC (US)

- GE (US)

- Schneider Electric (France)

- SAS (US)

- TIBCO (US)

- Softweb Solutions (US)

- A system (France)

- Ecolibrium Energy (India)

- Fiix Software (Canada)

- OPEX Group (UK)

- Seebo (Israel)

- Dingo (Australia)

- Software AG (Germany)

- HPE (US)

- Uptake (US)

- AWS (US)

- Micro Focus (UK)

- SAP (Germany)

- Splunk (US)

- Altair (US)

- ReliaSol (Netherlands)

Key Industry Developments of Predictive Maintenance Market

- In February 2024, Siemens is releasing a new generative artificial intelligence (AI) functionality into its predictive maintenance solution Senseye Predictive Maintenance. This advance makes predictive maintenance more conversational and intuitive. Through this new release of Senseye Predictive Maintenance with generative AI functionality, Siemens will make human-machine interactions and predictive maintenance faster and more efficient by enhancing proven machine learning capabilities with generative AI.

- In March 2024, Oracle introduced Oracle Smart Operations, a new supply chain execution feature in its Fusion Cloud Supply Chain & Manufacturing (SCM). This feature, powered by AI, can enhance productivity, and quality, reduce unplanned downtime, and improve operational visibility. The new capabilities, which are part of Oracle Fusion Cloud Manufacturing and Oracle Fusion Cloud Maintenance, aim to help organizations stay competitive by enhancing factory efficiency, reducing unplanned downtime risks, and expanding visibility across operations. Oracle Smart Operations offers connected, intelligent, and automated capabilities, enabling customers to make better business decisions with agile execution.

|

Global Predictive Maintenance Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.13 Bn. |

|

Forecast Period 2024-32 CAGR: |

23.39 % |

Market Size in 2032: |

USD 47.27 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Deployment |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Predictive Maintenance Market by Component (2018-2032)

4.1 Predictive Maintenance Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Solutions

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Services

Chapter 5: Predictive Maintenance Market by Deployment (2018-2032)

5.1 Predictive Maintenance Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Cloud

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 On-Premise

Chapter 6: Predictive Maintenance Market by Vertical (2018-2032)

6.1 Predictive Maintenance Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Government & Defense

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Energy & Utilities

6.5 Manufacturing

6.6 Healthcare

6.7 Transportation & Logistics

6.8 Other Vertical

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Predictive Maintenance Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 RENTOKIL INITIAL PLC (UK)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 SOLVAY S.A. (BELGIUM)

7.4 DETIA DEGESCH GMBH (GERMANY)

7.5 INDUSTRIAL FUMIGANT COMPANY LLC (USA)

7.6 ROYAL AGRO ORGANIC PVT. LTD. (INDIA)

7.7 UPI-USA (USA)

7.8 NATIONAL FUMIGANTS (USA)

7.9 CORTEVA AGRISCIENCE (USA)

7.10 JAFFER GROUP OF COMPANIES (PAKISTAN)

7.11 AMVAC CHEMICAL CORPORATION (USA)

7.12 BASF SE (GERMANY)

7.13 DOW AGROSCIENCES LLC (USA)

7.14 SYNGENTA AG (SWITZERLAND)

7.15 FMC CORPORATION (USA)

7.16 ADAMA AGRICULTURAL SOLUTIONS LTD. (ISRAEL)

7.17 AND

Chapter 8: Global Predictive Maintenance Market By Region

8.1 Overview

8.2. North America Predictive Maintenance Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Component

8.2.4.1 Solutions

8.2.4.2 Services

8.2.5 Historic and Forecasted Market Size by Deployment

8.2.5.1 Cloud

8.2.5.2 On-Premise

8.2.6 Historic and Forecasted Market Size by Vertical

8.2.6.1 Government & Defense

8.2.6.2 Energy & Utilities

8.2.6.3 Manufacturing

8.2.6.4 Healthcare

8.2.6.5 Transportation & Logistics

8.2.6.6 Other Vertical

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Predictive Maintenance Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Component

8.3.4.1 Solutions

8.3.4.2 Services

8.3.5 Historic and Forecasted Market Size by Deployment

8.3.5.1 Cloud

8.3.5.2 On-Premise

8.3.6 Historic and Forecasted Market Size by Vertical

8.3.6.1 Government & Defense

8.3.6.2 Energy & Utilities

8.3.6.3 Manufacturing

8.3.6.4 Healthcare

8.3.6.5 Transportation & Logistics

8.3.6.6 Other Vertical

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Predictive Maintenance Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Component

8.4.4.1 Solutions

8.4.4.2 Services

8.4.5 Historic and Forecasted Market Size by Deployment

8.4.5.1 Cloud

8.4.5.2 On-Premise

8.4.6 Historic and Forecasted Market Size by Vertical

8.4.6.1 Government & Defense

8.4.6.2 Energy & Utilities

8.4.6.3 Manufacturing

8.4.6.4 Healthcare

8.4.6.5 Transportation & Logistics

8.4.6.6 Other Vertical

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Predictive Maintenance Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Component

8.5.4.1 Solutions

8.5.4.2 Services

8.5.5 Historic and Forecasted Market Size by Deployment

8.5.5.1 Cloud

8.5.5.2 On-Premise

8.5.6 Historic and Forecasted Market Size by Vertical

8.5.6.1 Government & Defense

8.5.6.2 Energy & Utilities

8.5.6.3 Manufacturing

8.5.6.4 Healthcare

8.5.6.5 Transportation & Logistics

8.5.6.6 Other Vertical

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Predictive Maintenance Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Component

8.6.4.1 Solutions

8.6.4.2 Services

8.6.5 Historic and Forecasted Market Size by Deployment

8.6.5.1 Cloud

8.6.5.2 On-Premise

8.6.6 Historic and Forecasted Market Size by Vertical

8.6.6.1 Government & Defense

8.6.6.2 Energy & Utilities

8.6.6.3 Manufacturing

8.6.6.4 Healthcare

8.6.6.5 Transportation & Logistics

8.6.6.6 Other Vertical

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Predictive Maintenance Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Component

8.7.4.1 Solutions

8.7.4.2 Services

8.7.5 Historic and Forecasted Market Size by Deployment

8.7.5.1 Cloud

8.7.5.2 On-Premise

8.7.6 Historic and Forecasted Market Size by Vertical

8.7.6.1 Government & Defense

8.7.6.2 Energy & Utilities

8.7.6.3 Manufacturing

8.7.6.4 Healthcare

8.7.6.5 Transportation & Logistics

8.7.6.6 Other Vertical

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Predictive Maintenance Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.13 Bn. |

|

Forecast Period 2024-32 CAGR: |

23.39 % |

Market Size in 2032: |

USD 47.27 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Deployment |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Predictive Maintenance Market research report is 2024-2032.

Google (US), IBM (US),Oracle(US), Microsoft (US), Sigma Industrial Precision (Spain), C3 IoT (US), Hitachi (Japan), RapidMiner (US), PTC (US),GE (US), Schneider Electric (France), SAS (US), TIBCO (US), Softweb Solutions (US), A system (France), Ecolibrium Energy (India), Fiix Software (Canada), OPEX Group (UK), Seebo (Israel), Dingo (Australia), Software AG (Germany), HPE (US), Uptake (US),AWS (US), Micro Focus (UK), SAP (Germany), Splunk (US), Altair (US), ReliaSol (Netherlands) and other major players.

The Predictive Maintenance Market is segmented into Component, Deployment, Vertical, and region. By Component, the market is categorized into Solutions, Services. By Deployment, the market is categorized into Cloud, On-Premise. By Vertical, the market is categorized into Government & Defense, Energy & Utilities, Manufacturing, Healthcare, Transportation & Logistics, Other Verticals. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Predictive maintenance is a technology that applies for the data analysis tools and techniques to determine inconsistency in the operation and possible defects in equipment and processes so we can fix them before they fail.

Predictive Maintenance Market Size Was Valued at USD 7.13 Billion in 2023 and is Projected to Reach USD 47.27 Billion by 2032, Growing at a CAGR of 23.39% From 2024-2032