Hazmat Suits Market Synopsis:

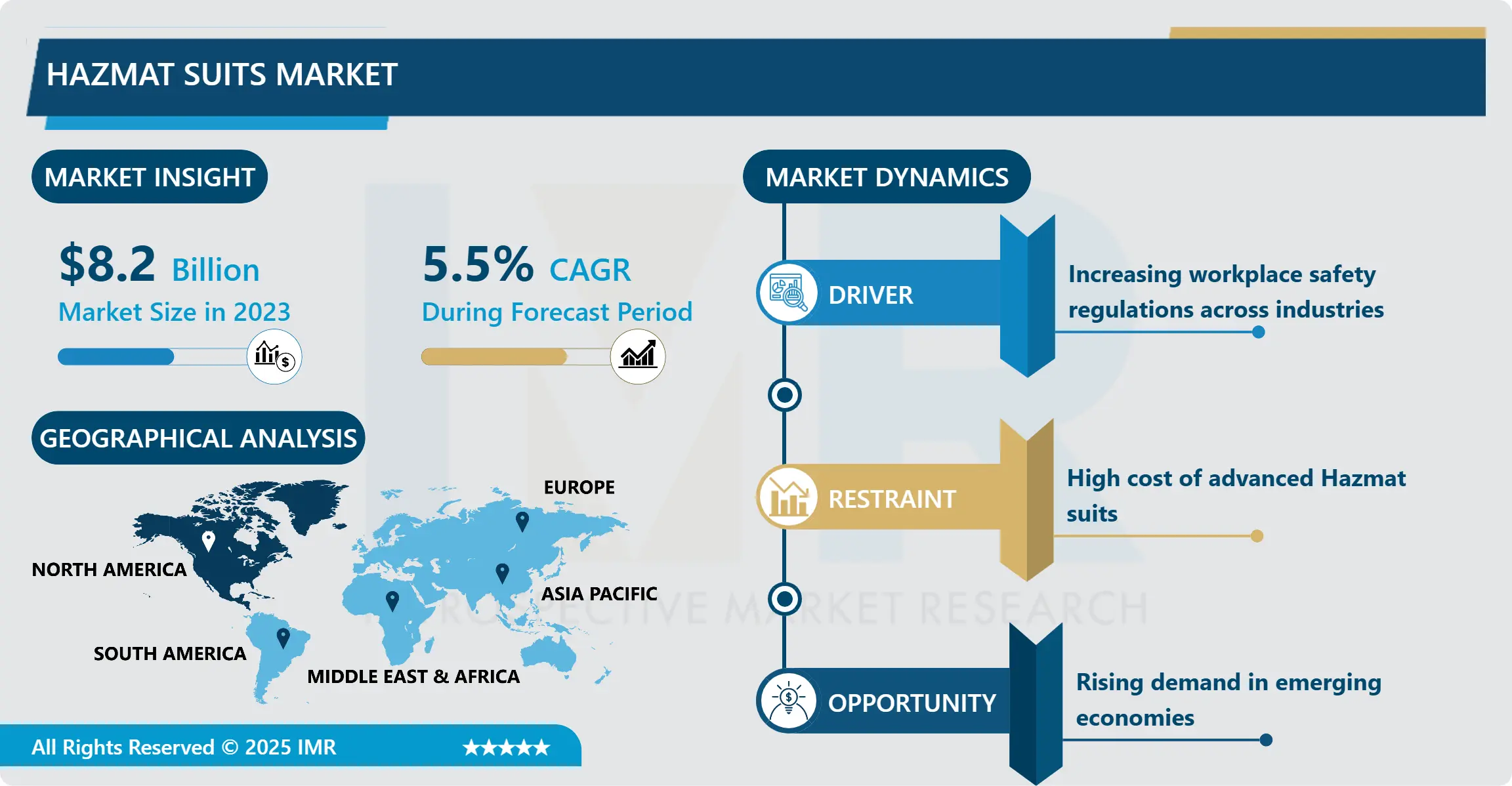

Hazmat Suits Market Size Was Valued at USD 8.2 Billion in 2023, and is Projected to Reach USD 13.28 Billion by 2032, Growing at a CAGR of 5.5% From 2024-2032.

The market under consideration is an umbrella term for protective clothing and equipment used to protect individuals from CBRN risks, including chemical, biological, radiological and nuclear risks. These suits are most commonly worn in chemical production plants, hospitals, firefighting services and emergency service sectors to provide essential protection in hazardous conditions are examples of personalized protective clothing. Made with an enhanced material, Hazmat suits come with attributes including being worn-through, fire retardant and abrasion resistance accompanied protection against toxic and flammable materials. Due to growing importance for safety at the workplace, the market has expanded constantly, meeting the requirements of industrial and public segments.

In general, the Hazmat Suits Market has registered a constant rate of growth over the past few years and it is expected to grow this way in the near future due to growing safety standards and raising concern of workplace accidents and diseases. Manufacturing companies especially chemicals, pharmaceuticals and healthcare have been leading the markets for personal protective equipment since they call for high quality protective equipment due to risks associated with the industries involved. Moreover, the growth of emergency response units and the military as a particular special consumer also contributed to the development of the market. The already increasing rate of the occurrence of pandemics, as was evident with COVID-19, also increases the demand for more enhanced Hazmat suits in health and public health facilities.

Regionally, the market is extensively growing in North America and Europe due to strong safety regulation and industrial development. Asia-Pacific region is almost close behind, as the constant development of industry and governmental funds for disaster preparedness lead to the constant usage of Hazmat suits. The existence of technologically advanced suits with features like light weight and comfort are dramatically changing the market environment and therefore leading to constant growth during the forecast period.

Hazmat Suits Market Trend Analysis:

Technological Innovations Boosting Hazmat Suit Efficiency

-

Innovations have emerged as the key drivers that are improving performance of the Hazmat Suits Market through the development of new technologies in the market. Some of the add-ons that are slowly finding their way into garments include advanced air circulation systems, materials that are considerably lighter and smart sensors that may help to monitor the health of the person wearing the garment. The latest development of nanotechnology and antimicrobial coatings is gradually enhancing the effectiveness of the suit to shield against tiny malicious forces. More so, the world is shifting towards sustainable and reusable Hazmat;, suits due to global sustainability goals. These innovations address sectors that value safety over output, which is a principal change in supply and demand.

Expanding Applications Across Emerging Economies

-

The growth prospects of the Hazmat Suits Market are promising in the emerging economies due to increasing industrialization and urb(Group: izection in these countries. It takes protective gear to work on the infrastructure, healthcare, and disaster management sectors, particularly governments and private sectors in developing countries such as India, Brazil, and Indonesia. In addition better understanding of risks in connection with the work place safety and in compliance with ever rising labor safety standards are prompting various sectors to include Hazmat suits into their usage. They also have a great potential for manufacturers to increase its coverage since customer requirements for these regions are still rising and it is rich with inexpensive workforce and technologies.

Hazmat Suits Market Segment Analysis:

Hazmat Suits Market is Segmented on the basis of Type, Application, End User, and Region

By Type, Chemical Resistant Suits segment is expected to dominate the market during the forecast period

-

Out of all the end-users in the Hazmat Suits Market, chemical-resistant suits are expected to dominate during the course of the forecast period due to their market relevance in industries including chemicals, oil and gas, and pharmaceuticals. Being articulated to offer the highest level of safety against corrosive as well as toxic products, these suits are essential to locations that pose big hazards. This is due to there experience and the factor that they can withstand very hard conditions and this make them to be used in industrial purposes.

- This segment can also be viewed as dominant due to the rising importance of chemical safety standards all over the world. Welfare and legal organizations across the global are now recommending or making protective suits compulsory in workplaces and this propel the demand for chemical-resistant suits. New materials innovations including multilayer laminate and flexible composites are also being incorporated in these suits to improve their usability thus cementing their stand in the market.

By Application, Chemical Industry segment expected to held the largest share

-

Therefore, the chemical industry is expected to be the largest application segment in the Hazmat Suits Market, as it is most vulnerable to the need for protective gear. The chemical companies adopt the hazmat suits while processing, manufacturing, and storing dangerous materials to protect staff from dangerous chemicals and flammable products. It is thus clear that due to the safety measures in the various industries and the danger that comes along with handling chemical, Hazmat suits are important part of safety measures at places.

- Furthermore, the demand for chemicals has also risen worldwide and this is attributed to growth of other sectors including construction, automotive and consumers products where the Hazmat suits are used. Chemical industry firms are spending highly on protective uniforms to meet the varied legal specifications and to safeguard their employees and this has boosted this segment.

Hazmat Suits Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America held the largest market share in the Hazmat Suits Market in the year 2023, and it was estimated that it will account for a maximum 35-40% of the total market. This leadership could be because most facilities in the region are industrial in nature, states have strict Workplace Safety Laws, hazards and risks are well managed, and investments in Disaster Management are higher in these regions. This together with the concentration of major equipment manufacturing companies and the high end consumer pull from industry verticals like chemicals, healthcare and defense substantiate North America’s domination in the smart car mirror market. Among the leading markets, the United States has the most developed safety industrial base and a tendency to purchase technologically complex protective clothing.

Active Key Players in the Hazmat Suits Market:

- 3M (United States)

- Alpha Pro Tech (Canada)

- Ansell Limited (Australia)

- Asatex AG (Germany)

- Cardinal Health (United States)

- Drägerwerk AG (Germany)

- DuPont (United States)

- Honeywell International (United States)

- Kimberly-Clark Corporation (United States)

- Lakeland Industries (United States)

- Microgard Limited (United Kingdom)

- Respirex International Ltd. (United Kingdom)

- Sioen Industries (Belgium)

- Uvex Safety Group (Germany)

- W.L. Gore & Associates (United States)

- Other Active Players

|

Hazmat Suits Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.2 Billion |

|

Forecast Period 2024-32 CAGR: |

5.5% |

Market Size in 2032: |

USD 13.28 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Hazmat Suits Market by Type

4.1 Hazmat Suits Market Snapshot and Growth Engine

4.2 Hazmat Suits Market Overview

4.3 Chemical Resistant Suits

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Chemical Resistant Suits: Geographic Segmentation Analysis

4.4 Biological Resistant Suits

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Biological Resistant Suits: Geographic Segmentation Analysis

4.5 Radiation Protection Suits

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Radiation Protection Suits: Geographic Segmentation Analysis

4.6 Fire Resistant Suits

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Fire Resistant Suits: Geographic Segmentation Analysis

4.7 Combination Suits

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Combination Suits: Geographic Segmentation Analysis

Chapter 5: Hazmat Suits Market by Application

5.1 Hazmat Suits Market Snapshot and Growth Engine

5.2 Hazmat Suits Market Overview

5.3 Chemical Industry

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Chemical Industry: Geographic Segmentation Analysis

5.4 Healthcare

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Healthcare: Geographic Segmentation Analysis

5.5 Emergency Response

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Emergency Response: Geographic Segmentation Analysis

5.6 Military and Defense

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Military and Defense: Geographic Segmentation Analysis

5.7 Environmental Cleanup

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Environmental Cleanup: Geographic Segmentation Analysis

Chapter 6: Hazmat Suits Market by End User

6.1 Hazmat Suits Market Snapshot and Growth Engine

6.2 Hazmat Suits Market Overview

6.3 First Responders

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 First Responders: Geographic Segmentation Analysis

6.4 Healthcare Workers

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Healthcare Workers: Geographic Segmentation Analysis

6.5 Industrial Workers

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Industrial Workers: Geographic Segmentation Analysis

6.6 Military Personnel

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Military Personnel: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Hazmat Suits Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 3M (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ALPHA PRO TECH (CANADA)

7.4 ANSELL LIMITED (AUSTRALIA)

7.5 ASATEX AG (GERMANY)

7.6 CARDINAL HEALTH (UNITED STATES)

7.7 DRÄGERWERK AG (GERMANY)

7.8 DUPONT (UNITED STATES)

7.9 HONEYWELL INTERNATIONAL (UNITED STATES)

7.10 KIMBERLY-CLARK CORPORATION (UNITED STATES)

7.11 LAKELAND INDUSTRIES (UNITED STATES)

7.12 MICROGARD LIMITED (UNITED KINGDOM)

7.13 RESPIREX INTERNATIONAL LTD. (UNITED KINGDOM)

7.14 SIOEN INDUSTRIES (BELGIUM)

7.15 UVEX SAFETY GROUP (GERMANY)

7.16 W.L. GORE & ASSOCIATES (UNITED STATES)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Hazmat Suits Market By Region

8.1 Overview

8.2. North America Hazmat Suits Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Chemical Resistant Suits

8.2.4.2 Biological Resistant Suits

8.2.4.3 Radiation Protection Suits

8.2.4.4 Fire Resistant Suits

8.2.4.5 Combination Suits

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Chemical Industry

8.2.5.2 Healthcare

8.2.5.3 Emergency Response

8.2.5.4 Military and Defense

8.2.5.5 Environmental Cleanup

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 First Responders

8.2.6.2 Healthcare Workers

8.2.6.3 Industrial Workers

8.2.6.4 Military Personnel

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Hazmat Suits Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Chemical Resistant Suits

8.3.4.2 Biological Resistant Suits

8.3.4.3 Radiation Protection Suits

8.3.4.4 Fire Resistant Suits

8.3.4.5 Combination Suits

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Chemical Industry

8.3.5.2 Healthcare

8.3.5.3 Emergency Response

8.3.5.4 Military and Defense

8.3.5.5 Environmental Cleanup

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 First Responders

8.3.6.2 Healthcare Workers

8.3.6.3 Industrial Workers

8.3.6.4 Military Personnel

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Hazmat Suits Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Chemical Resistant Suits

8.4.4.2 Biological Resistant Suits

8.4.4.3 Radiation Protection Suits

8.4.4.4 Fire Resistant Suits

8.4.4.5 Combination Suits

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Chemical Industry

8.4.5.2 Healthcare

8.4.5.3 Emergency Response

8.4.5.4 Military and Defense

8.4.5.5 Environmental Cleanup

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 First Responders

8.4.6.2 Healthcare Workers

8.4.6.3 Industrial Workers

8.4.6.4 Military Personnel

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Hazmat Suits Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Chemical Resistant Suits

8.5.4.2 Biological Resistant Suits

8.5.4.3 Radiation Protection Suits

8.5.4.4 Fire Resistant Suits

8.5.4.5 Combination Suits

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Chemical Industry

8.5.5.2 Healthcare

8.5.5.3 Emergency Response

8.5.5.4 Military and Defense

8.5.5.5 Environmental Cleanup

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 First Responders

8.5.6.2 Healthcare Workers

8.5.6.3 Industrial Workers

8.5.6.4 Military Personnel

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Hazmat Suits Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Chemical Resistant Suits

8.6.4.2 Biological Resistant Suits

8.6.4.3 Radiation Protection Suits

8.6.4.4 Fire Resistant Suits

8.6.4.5 Combination Suits

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Chemical Industry

8.6.5.2 Healthcare

8.6.5.3 Emergency Response

8.6.5.4 Military and Defense

8.6.5.5 Environmental Cleanup

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 First Responders

8.6.6.2 Healthcare Workers

8.6.6.3 Industrial Workers

8.6.6.4 Military Personnel

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Hazmat Suits Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Chemical Resistant Suits

8.7.4.2 Biological Resistant Suits

8.7.4.3 Radiation Protection Suits

8.7.4.4 Fire Resistant Suits

8.7.4.5 Combination Suits

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Chemical Industry

8.7.5.2 Healthcare

8.7.5.3 Emergency Response

8.7.5.4 Military and Defense

8.7.5.5 Environmental Cleanup

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 First Responders

8.7.6.2 Healthcare Workers

8.7.6.3 Industrial Workers

8.7.6.4 Military Personnel

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Hazmat Suits Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.2 Billion |

|

Forecast Period 2024-32 CAGR: |

5.5% |

Market Size in 2032: |

USD 13.28 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||