Farm Tractors Market Synopsis:

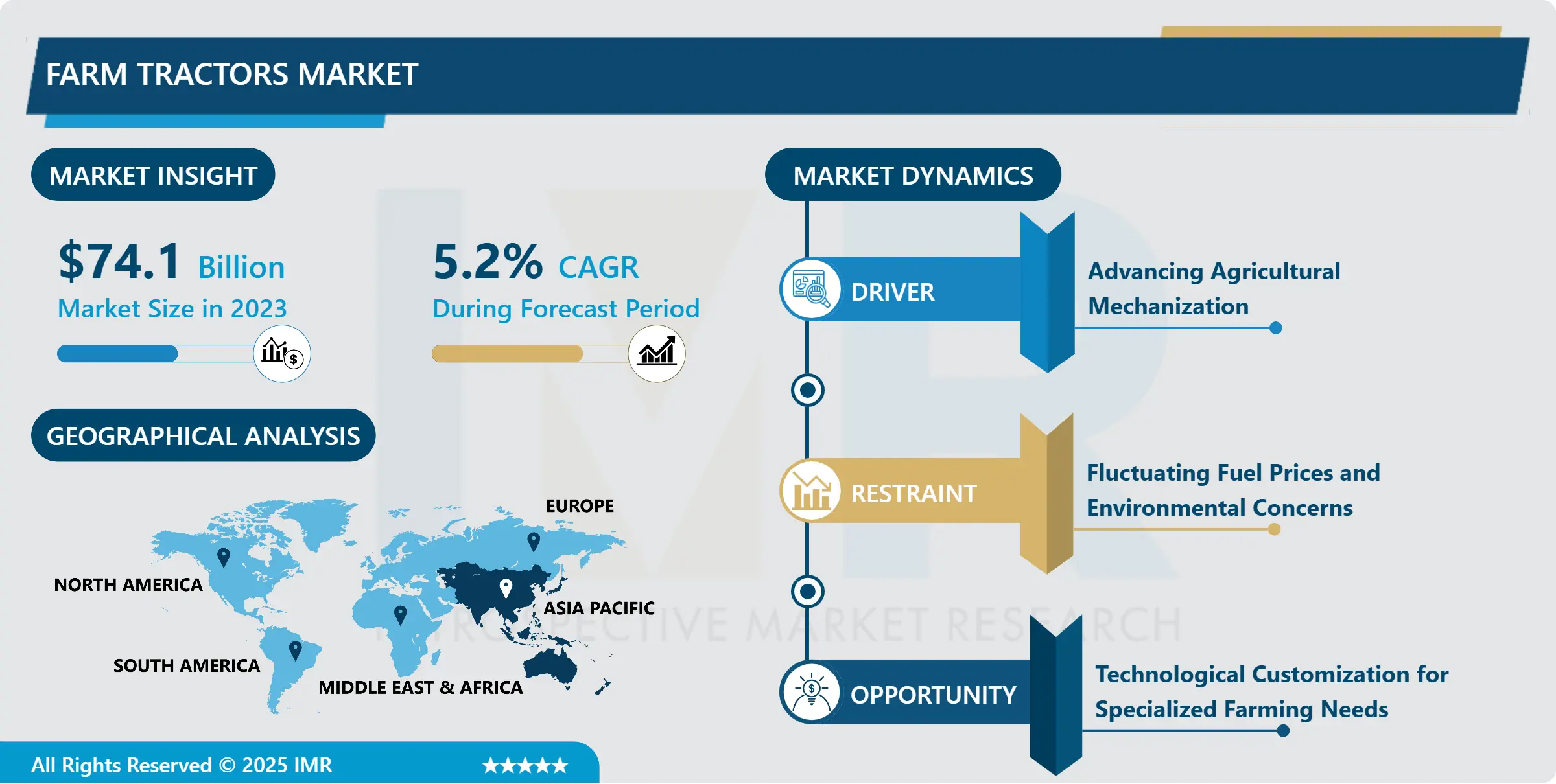

Farm Tractors Market Size Was Valued at USD 74.10 Billion in 2023, and is Projected to Reach USD 116.94 Billion by 2032, Growing at a CAGR of 5.20% From 2024-2032.

The farm tractor market encompasses the global demand for tractors used in agricultural activities like plowing, planting, and harvesting. These tractors are essential for various farm operations, including tilling, cultivating, and transporting crops. The market is characterized by diverse tractor types, power output, and drive systems, catering to different farm sizes and needs.

The farm tractors market is experiencing tremendous growth because mechanized farming techniques are adopted at a very fast pace. Most emerging economy governments are supporting farm modernization through offering subsidies and financial incentives for tractor procurement. These developments have gotten rid of most of manual work and have in one way or the other assisted in the enhancement of agricultural productivity. In addition, due to the reduction in arable land and increase in the demand for food tractors and other related equipment must be used to improve efficiency.

The modern tractors are being popular due to the adoption of efficiency enhancing precision farming strategies and methodologies like GPS and IoT enabled devices. These are imposing tractors that would enable precise operations on the farm hence doing away with wastage while at the same time registering high yields. There is also increased concern in adopting sustainable farming techniques hence increased production of tractors that facilitate precision farming and hence minimizing on the use of Recourses.

Farm Tractors Market Trend Analysis:

Integration of Smart Technology

-

The independent and electric farming vehicles are changing the farm tractors market. Small and intelligent tractors with the use of AI and sensors can allow farmers to complete a task with little assistance since there are few people living in rural areas. Also, electrified tractors are slowly entering the market given their efficiency in environmental conservation and cost of operations as considered by sustainable development objectives worldwide.

- Self-driving tractors with telematics, real time to field monitoring, and big data analytic features are no longer futuristic dreams. That kind of tractors facilitates farmers vital signs of efficacy, situations on the fields and timely service, enhancing productivity. It is anticipated that as connectivity increases in rural areas more of these smart tractors will be embraced.

Customization and Niche Applications

-

The farm tractors market in Asia-Pacific and Africa is expected to create handsome growth prospects as these represents the emerging economies. Rising adoption of technological tools in agriculture and bettering rural infrastructure are the factors that are expecting to lead higher tractor usage in this area. Also, the population pressure coupled with demand pressure for food also contribute to the right environment for market growth.

- Customization has therefore emerged as a major trend among manufacturers in order to target various specific requirements within farming including the unique requirements of vineyard operations or compact models suitable for small farming operations. This trend offers possibilities to extend to specific niches for which the demand for customized services is increasing. Customisations increases adaptability of tractors for use across different tasks and other geographical conditions.

Farm Tractors Market Segment Analysis:

Farm Tractors Market Segmented on the basis of engine Power, Driver Type, Operation Type, Application, and Region

By Driver Type, Four-Wheel Drive (4WD) segment is expected to dominate the market during the forecast period

-

The Four-Wheel Drive (4WD) segment is expected to maintain a leading position in the global farm tractors market throughout the forecast period. This trend reflects growing operational demands across large-scale farms, particularly in regions adopting mechanized agriculture practices. 4WD tractors offer enhanced traction and better load-pulling capabilities on varied terrains, making them more suitable for challenging field conditions compared to two-wheel drive models. Their adaptability to diverse agricultural applications increases their utility in modern farming operations, especially in geographies with expanding commercial agriculture.

- Growth across the farm tractors market is supported by rising demand for high-efficiency machinery and the need for improved productivity in cultivation and harvesting activities. Farmers are allocating budgets toward machinery upgrades to improve field performance and reduce manual labor dependency. Equipment leasing models and agricultural financing programs are making these tractors accessible to a broader user base. OEMs are also expanding their product lines with models tailored for different land sizes and crop types, influencing purchase decisions.

By Application, Agriculture segment expected to held the largest share

-

The agriculture segment is projected to maintain the largest share in the global farm tractors market due to the ongoing expansion of mechanized farming practices. With increasing pressure on land productivity and labor shortages in rural areas, farmers across developing and developed regions are steadily transitioning to tractor-based operations. Government-backed initiatives promoting modern agricultural techniques and easy financing options for equipment purchases have also encouraged wider adoption of tractors across various farming communities.

- The market is experiencing healthy demand growth as manufacturers focus on improving product offerings tailored to regional farming requirements. Compact and mid-range tractors are gaining more attention, particularly in Asia-Pacific and Latin America, where smallholder farming is predominant. Technological integration, such as GPS tracking and automation features, continues to enhance operational efficiency, influencing buyer preferences. The adoption rate is further supported by after-sales service networks and product availability across rural and semi-urban distribution channels.

Farm Tractors Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

-

The Asia Pacific region is projected to lead the global farm tractors market throughout the forecast period due to a steady rise in agricultural mechanization and an expanding rural economy. Increasing government investments in modern farming technologies and favorable credit support for smallholder farmers are supporting the adoption of tractors across key economies such as India, China, and ASEAN nations. The region benefits from a large agricultural workforce and growing demand for efficient cultivation practices, which continue to support market expansion.

- Growing food demand, urbanization pressures, and changing climatic conditions are reshaping agricultural priorities across Asia Pacific. Market participants are responding by introducing compact and mid-range tractor models that align with region-specific needs, such as small land holdings and varied crop patterns. As OEMs invest in product localization and distribution networks, market accessibility improves, supporting consistent year-on-year growth. The Asia Pacific market is also seeing gradual adoption of smart farming solutions, further enhancing operational efficiency for end users.

Active Key Players in the Farm Tractors Market

- AGCO Corporation (USA)

- CLAAS KGaA (Germany)

- CNH Industrial (UK)

- Deere & Company (USA)

- Escorts Limited (India)

- Kubota Corporation (Japan)

- Mahindra & Mahindra (India)

- Same Deutz-Fahr Group (Italy)

- Tractors and Farm Equipment Limited (India)

- Yanmar Holdings (Japan)

- Other Active Players

|

Global Farm Tractors Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 74.10 Billion |

|

Forecast Period 2024-32 CAGR: |

5.20% |

Market Size in 2032: |

USD 116.94 Billion |

|

Segments Covered: |

By Engine Power |

|

|

|

Driver Type |

|

||

|

Operation Mode |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Farm Tractors Market by Engine power

4.1 Farm Tractors Market Snapshot and Growth Engine

4.2 Farm Tractors Market Overview

4.3 Less than 40 HP

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Less than 40 HP: Geographic Segmentation Analysis

4.4 40–100 HP

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 40–100 HP: Geographic Segmentation Analysis

4.5 101–200 HP

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 101–200 HP: Geographic Segmentation Analysis

4.6 201–300 HP

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 201–300 HP: Geographic Segmentation Analysis

4.7 above 300 HP

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 above 300 HP: Geographic Segmentation Analysis

Chapter 5: Farm Tractors Market by Drive Type

5.1 Farm Tractors Market Snapshot and Growth Engine

5.2 Farm Tractors Market Overview

5.3 Two-Wheel Drive (2WD)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Two-Wheel Drive (2WD): Geographic Segmentation Analysis

5.4 Four-Wheel Drive (4WD)

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Four-Wheel Drive (4WD): Geographic Segmentation Analysis

Chapter 6: Farm Tractors Market by Operation

6.1 Farm Tractors Market Snapshot and Growth Engine

6.2 Farm Tractors Market Overview

6.3 Manual

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Manual: Geographic Segmentation Analysis

6.4 Autonomous

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Autonomous: Geographic Segmentation Analysis

Chapter 7: Farm Tractors Market by Application

7.1 Farm Tractors Market Snapshot and Growth Engine

7.2 Farm Tractors Market Overview

7.3 Agriculture

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Agriculture: Geographic Segmentation Analysis

7.4 Landscaping

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Landscaping: Geographic Segmentation Analysis

7.5 Industrial

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Industrial: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Farm Tractors Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 DEERE & COMPANY (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 CNH INDUSTRIAL (UK)

8.4 MAHINDRA & MAHINDRA (INDIA)

8.5 KUBOTA CORPORATION (JAPAN)

8.6 AGCO CORPORATION (USA)

8.7 CLAAS KGAA (GERMANY)

8.8 ESCORTS LIMITED (INDIA)

8.9 YANMAR HOLDINGS (JAPAN)

8.10 SAME DEUTZ-FAHR GROUP (ITALY)

8.11 TRACTORS AND FARM EQUIPMENT LIMITED (INDIA)

8.12 OTHER ACTIVE PLAYERS

Chapter 9: Global Farm Tractors Market By Region

9.1 Overview

9.2. North America Farm Tractors Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Engine power

9.2.4.1 Less than 40 HP

9.2.4.2 40–100 HP

9.2.4.3 101–200 HP

9.2.4.4 201–300 HP

9.2.4.5 above 300 HP

9.2.5 Historic and Forecasted Market Size By Drive Type

9.2.5.1 Two-Wheel Drive (2WD)

9.2.5.2 Four-Wheel Drive (4WD)

9.2.6 Historic and Forecasted Market Size By Operation

9.2.6.1 Manual

9.2.6.2 Autonomous

9.2.7 Historic and Forecasted Market Size By Application

9.2.7.1 Agriculture

9.2.7.2 Landscaping

9.2.7.3 Industrial

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Farm Tractors Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Engine power

9.3.4.1 Less than 40 HP

9.3.4.2 40–100 HP

9.3.4.3 101–200 HP

9.3.4.4 201–300 HP

9.3.4.5 above 300 HP

9.3.5 Historic and Forecasted Market Size By Drive Type

9.3.5.1 Two-Wheel Drive (2WD)

9.3.5.2 Four-Wheel Drive (4WD)

9.3.6 Historic and Forecasted Market Size By Operation

9.3.6.1 Manual

9.3.6.2 Autonomous

9.3.7 Historic and Forecasted Market Size By Application

9.3.7.1 Agriculture

9.3.7.2 Landscaping

9.3.7.3 Industrial

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Farm Tractors Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Engine power

9.4.4.1 Less than 40 HP

9.4.4.2 40–100 HP

9.4.4.3 101–200 HP

9.4.4.4 201–300 HP

9.4.4.5 above 300 HP

9.4.5 Historic and Forecasted Market Size By Drive Type

9.4.5.1 Two-Wheel Drive (2WD)

9.4.5.2 Four-Wheel Drive (4WD)

9.4.6 Historic and Forecasted Market Size By Operation

9.4.6.1 Manual

9.4.6.2 Autonomous

9.4.7 Historic and Forecasted Market Size By Application

9.4.7.1 Agriculture

9.4.7.2 Landscaping

9.4.7.3 Industrial

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Farm Tractors Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Engine power

9.5.4.1 Less than 40 HP

9.5.4.2 40–100 HP

9.5.4.3 101–200 HP

9.5.4.4 201–300 HP

9.5.4.5 above 300 HP

9.5.5 Historic and Forecasted Market Size By Drive Type

9.5.5.1 Two-Wheel Drive (2WD)

9.5.5.2 Four-Wheel Drive (4WD)

9.5.6 Historic and Forecasted Market Size By Operation

9.5.6.1 Manual

9.5.6.2 Autonomous

9.5.7 Historic and Forecasted Market Size By Application

9.5.7.1 Agriculture

9.5.7.2 Landscaping

9.5.7.3 Industrial

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Farm Tractors Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Engine power

9.6.4.1 Less than 40 HP

9.6.4.2 40–100 HP

9.6.4.3 101–200 HP

9.6.4.4 201–300 HP

9.6.4.5 above 300 HP

9.6.5 Historic and Forecasted Market Size By Drive Type

9.6.5.1 Two-Wheel Drive (2WD)

9.6.5.2 Four-Wheel Drive (4WD)

9.6.6 Historic and Forecasted Market Size By Operation

9.6.6.1 Manual

9.6.6.2 Autonomous

9.6.7 Historic and Forecasted Market Size By Application

9.6.7.1 Agriculture

9.6.7.2 Landscaping

9.6.7.3 Industrial

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Farm Tractors Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Engine power

9.7.4.1 Less than 40 HP

9.7.4.2 40–100 HP

9.7.4.3 101–200 HP

9.7.4.4 201–300 HP

9.7.4.5 above 300 HP

9.7.5 Historic and Forecasted Market Size By Drive Type

9.7.5.1 Two-Wheel Drive (2WD)

9.7.5.2 Four-Wheel Drive (4WD)

9.7.6 Historic and Forecasted Market Size By Operation

9.7.6.1 Manual

9.7.6.2 Autonomous

9.7.7 Historic and Forecasted Market Size By Application

9.7.7.1 Agriculture

9.7.7.2 Landscaping

9.7.7.3 Industrial

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Farm Tractors Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 74.10 Billion |

|

Forecast Period 2024-32 CAGR: |

5.20% |

Market Size in 2032: |

USD 116.94 Billion |

|

Segments Covered: |

By Engine Power |

|

|

|

Driver Type |

|

||

|

Operation Mode |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||