Energy Trading & Risk Management (ETRM) Market Overview

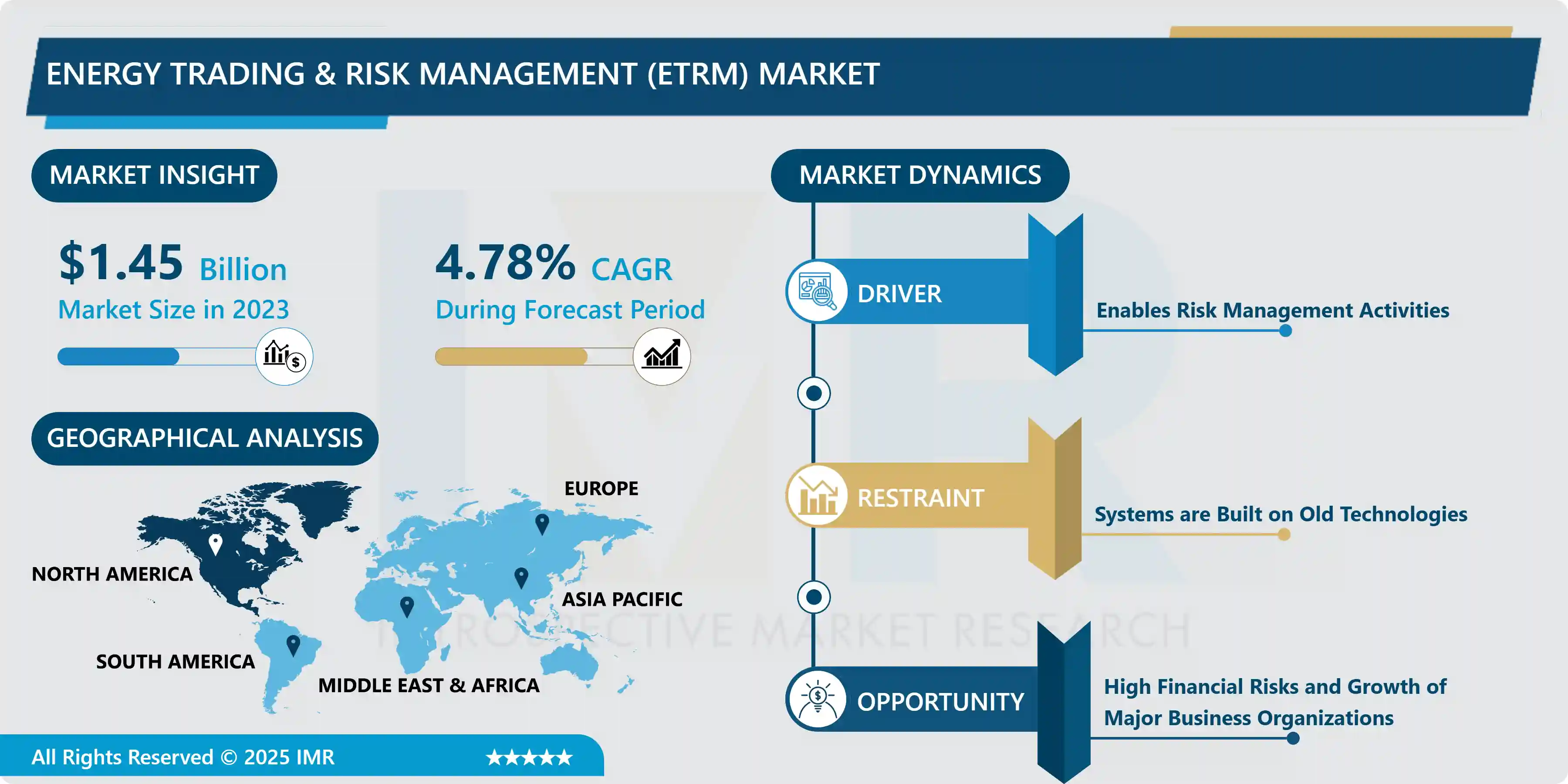

The Global Energy Trading and Risk Management (ETRM) Market size is expected to grow from USD 1.45 billion in 2023 to USD 2.21 billion by 2032, at a CAGR of 4.78% during the forecast period (2024-2032).

Energy trading and risk management (ETRM) systems comprise commercial decision making and market execution using an integrated system that allows data exchanges among trade floor, credit, operations, contract, and accounting functions. Integral to the process are event and trade identification/capture, scheduling/nomination/transportation and settlement execution, comprehensive risk management strategies/policies. The process also offers price transparency, controlled access, market monitoring, and regulatory compliance. Furthermore, Energy trading and risk management software is used by financial trading companies, banks, and physical energy companies from upstream, midstream to downstream. Core software functionality includes trade capture, trade valuations, counterparty creditworthiness, and limit monitoring, trade compliance, risk factors reporting and monitoring, and financial derivative accounting (Mark-to-Market), and hedge accounting.

Additionally, an Energy trading and risk management system is a software application that would be typically utilized by oil traders, distributors, suppliers, and wholesalers to automate business processes related to the supply and trading of crude oil, refined products, alternative fuels, renewable products, and financial derivatives, the movement, and delivery of those energy commodities and related risk management activities. Moreover, owing to the recent development in technology, so many organizations are in search of new ways to help streamline tasks, overcome operation costs, manage risk, and optimize processes. One of such technologies that have been utilized by oil and gas firms to assist manage risk and raising productivity is the use of Energy trading and risk management systems.

Market Dynamics And Factors For The Energy Trading And Risk Management (ETRM) Market

Drivers:

- Energy Trading and Risk Management is of great benefit for energy businesses, particularly. It comes with applications and tools that especially deal with processes and potential problems. Whether it is about making on-time energy supplies, collecting data, or optimization of resources, Energy trading and risk management does a great deal which helps to growth of the Energy trading and risk management market during the forecast period.

- Energy trading and risk management helps to maintain a record of all day-to-day transactions. As energy enterprises buy and sell energy commodities on a large scale, it is manually impractical to keep all transactions in one place. That's where Energy trading and risk management comes as a significant solution. It ensures that the data is always authentic and updated.

- With Energy trading and risk management, risks and potential problems are estimated beforehand. This way, business processes are streamlined. Energy trading and risk management enables coming up with the solutions beforehand. This way, it provides a controlled business environment.

- With most day-to-day operations managed by CTRM, the cost of manual operations decreases largely. It further helps in the increase of productivity, and therefore, businesses enjoy higher profits and ROI.

- CTRM provides automated operations and helps in adopting efficient practices. This does not only ease day-to-day task management but proves to be very beneficial in the long run. This allows companies to follow new energy trends and make the most out of Energy trading and risk management market opportunities.

- Energy trading and risk management supports risk management activities greatly. It helps in making a solid strategy to remove risk and perform important risk scans on time. Also, it helps deal with the risks by diversifying the supply portfolio. Again, energy companies can make sure lesser risk by following market trends and opportunities which, Energy trading and risk management plays as an important asset.

- Authentic data entry and updating transactions and records regularly help in providing audit trails on time. This allows for efficient decision-making as the energy sector is mostly about making rapid decisions. Maintaining in view the supply and demand for energy commodities, the audit trail is also important to deal with legal business aspects.

Challenges:

- Many current Energy trading and risk management systems are built on older technologies, which haven't adapted well to changing business conditions, nor have they facilitated accelerated deployment methodologies like Agile.

- While most of the major Energy trading and risk management systems were originally custom solutions, their technical architectures are based on technologies common at the time of their initial development. Current Energy trading and risk management systems that have older technology architectures are difficult and expensive to integrate into other systems, such as ERP, owing to their monolithic architecture.

- Current Energy trading and risk management system transaction processing capabilities result in structured business datasets that are often "trapped" within the Energy trading and risk management data model, unable to be easily consumed by the enterprise for advanced analytics or other solutions. Recent trends of consolidation among Energy trading and risk management solution providers have reduced the number of vendors, but not the number of product options. Technology updates continue, but they're often years behind schedule and even further behind market relevancy in a rapidly changing environment.

Opportunities:

- Growing financial risks and the growth of major business organizations will create growth opportunities for this market. Furthermore, utilizing digital transformation capabilities facilitates transformative business operations, improves efficiencies, differentiates from the competition, enables better manage risk, and will create new legalized opportunities during the forecast period. Furthermore, Energy trading and risk management system for the future solutions for the new sectors will create lucrative opportunities such as harden and boosted Energy trading and risk management system architecture like operating systems, databases, and runtime software to overcome the risk of a cyber incident., integrating AI and blockchain solutions to ensure security, transparency and AI to drive profitable decisions, connecting sensor technology enables companies to measure asset performance to drive operational excellence, imitating human activities with software like RPA to automate high-volume, repetitive tasks across applications, effectively and efficiently translating the wealth of available data into actionable insight to inform and drive intelligent decisions, finding and exploit hidden value from data using machine learning and AI-enabled analytics and capabilities.

Market Segmentation

Global Energy Trading & Risk Management (ETRM) Market Research report comprises of Porter's five forces analysis to do the detail study about its every segmentation like Product segmentation, End-user/application segment analysis and Major key players analysis mentioned as below:

Segmentation Analysis of Energy Trading and Risk Management (ETRM) Market:

- Based on Type, the market is classified into Software, Service, and Other. Service segment by type is anticipated to significantly turn the market and dominate the market in terms of volume.

- Based on Operation, the market is classified into the front office, back office, and middle office. The back-office segment is expected to dominate the Energy trading and risk management market over the forecast period. The back office transmits out accounting operations and derivative accounting tasks and conducts the inventory.

- Based on Application, the Energy trading and risk management market is segmented into Oil industries, Refineries, Gas industries, electric power industries. The electric power industries application segment is expected to significantly drive the Energy trading and risk management market and dominate the Energy trading and risk management market in terms of volume during the forecast period. We know that electric cars are impeding the transport business. China wants a fifth of its 35 million annual vehicle sales to be electric cars by 2025. India is considering dramatic plans to electrify all vehicles by 2032i. The UK has guaranteed to ban the sales of new petrol and diesel vehicles by 2040ii and Scotland by 2032. This means people won't be driving down to the local gas station to fill up their tanks. Rather, they will be plugging into power outlets wherever they can – at home, in office parking lots, at shopping malls, game parks, and curbsides.

Regional Analysis of Energy Trading and Risk Management (ETRM) Market:

- Based on geography, the energy trading and risk management market is divided into North America, Asia Pacific, Europe, the Middle East, and Africa, and Latin America. North America and Europe Energy trading and risk management markets are anticipated to further expand led by significant investments from trading firms that are present in these regions. The shale gas boom in the U.S. and volatility of energy markets are also accelerating the growth of the energy trading and risk management market in these regions. The Asia Pacific is a relatively new market for the energy trading business. Thus, the region is anticipated to display a demand for Energy trading and risk management solutions over the forecast period.

Players Covered in Energy Trading & Risk Management (ETRM) Market are :

- Accenture

- Generation 10 Ltd.

- Allegro Development Corporation

- Amphora Inc.

- Brady Technologies

- Triple Point Technology Inc.

- Openlink LLC.

- ComFin Software

- Eka Software Solutions

- SAP SE

- Sapient

- Enuit LLC

- Contigo Software Ltd.

- Ventyx

- Trayport

- Calvus

- FIS

- Previse Systems GmbH and Others major players.

Key Industry Developments In The Energy Trading And Risk Management (ETRM) Market

- In April 2024, Symphony Technology Group, a US-based private equity firm, announced the acquisition of Eka Software Solutions, a leading provider of commodity management solutions. This strategic acquisition aimed to strengthen Symphony's portfolio and enhance Eka’s capabilities in delivering innovative solutions to clients in the commodity and supply chain management sectors. The deal represents a significant step forward in Symphony’s commitment to expanding its technology-driven investments.

- In February 2024, Allegro Development Corporation has successfully acquired a smaller competitor specializing in AI-powered risk management solutions. This strategic acquisition strengthens Allegro's capabilities in AI integration, enhancing its position in the market. By combining innovative AI technologies with its existing offerings, Allegro aims to provide advanced risk management solutions and deliver greater value to clients across industries. This move underscores Allegro's commitment to growth and technological advancement.

|

Global Energy Trading & Risk Management (ETRM) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.45 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.78% |

Market Size in 2032: |

USD 2.21 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Functionality |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Energy Trading & Risk Management (ETRM) Market by Type (2018-2032)

4.1 Energy Trading & Risk Management (ETRM) Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Software

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Service

4.5 Others

Chapter 5: Energy Trading & Risk Management (ETRM) Market by Application (2018-2032)

5.1 Energy Trading & Risk Management (ETRM) Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Oil Industries

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Refineries

5.5 Gas Industries

5.6 Electric Power Industries

Chapter 6: Energy Trading & Risk Management (ETRM) Market by Functionality (2018-2032)

6.1 Energy Trading & Risk Management (ETRM) Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Trade & Operations

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Hedging & Risk

6.5 Inventory Management & Reconciliation

6.6 Financial Accounting

6.7 Reporting

6.8 Integration

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Energy Trading & Risk Management (ETRM) Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 MICROSOFT (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ZOOM VIDEO COMMUNICATIONS (US)

7.4 CISCO (US)

7.5 ADOBE (US)

7.6 HUAWEI (CHINA)

7.7 AVAYA INC. (US)

7.8 AWS (US)

7.9 GOOGLE

7.10 LLC (US)

7.11 HP (US)

7.12 GOTO (US)

7.13 ENGHOUSE SYSTEMS (CANADA)

7.14 PEXIP (NORWAY)

7.15 QUMU CORPORATION (US)

7.16 SONIC FOUNDRY INC. (US)

7.17 LIFESIZE INC. (US)

7.18 KALTURA INC. (US)

7.19 BLUEJEANS NETWORK (US)

7.20 KOLLECTIVE TECHNOLOGY INC. (US)

7.21 OTHER KEY PLAYERS

Chapter 8: Global Energy Trading & Risk Management (ETRM) Market By Region

8.1 Overview

8.2. North America Energy Trading & Risk Management (ETRM) Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Software

8.2.4.2 Service

8.2.4.3 Others

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Oil Industries

8.2.5.2 Refineries

8.2.5.3 Gas Industries

8.2.5.4 Electric Power Industries

8.2.6 Historic and Forecasted Market Size by Functionality

8.2.6.1 Trade & Operations

8.2.6.2 Hedging & Risk

8.2.6.3 Inventory Management & Reconciliation

8.2.6.4 Financial Accounting

8.2.6.5 Reporting

8.2.6.6 Integration

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Energy Trading & Risk Management (ETRM) Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Software

8.3.4.2 Service

8.3.4.3 Others

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Oil Industries

8.3.5.2 Refineries

8.3.5.3 Gas Industries

8.3.5.4 Electric Power Industries

8.3.6 Historic and Forecasted Market Size by Functionality

8.3.6.1 Trade & Operations

8.3.6.2 Hedging & Risk

8.3.6.3 Inventory Management & Reconciliation

8.3.6.4 Financial Accounting

8.3.6.5 Reporting

8.3.6.6 Integration

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Energy Trading & Risk Management (ETRM) Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Software

8.4.4.2 Service

8.4.4.3 Others

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Oil Industries

8.4.5.2 Refineries

8.4.5.3 Gas Industries

8.4.5.4 Electric Power Industries

8.4.6 Historic and Forecasted Market Size by Functionality

8.4.6.1 Trade & Operations

8.4.6.2 Hedging & Risk

8.4.6.3 Inventory Management & Reconciliation

8.4.6.4 Financial Accounting

8.4.6.5 Reporting

8.4.6.6 Integration

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Energy Trading & Risk Management (ETRM) Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Software

8.5.4.2 Service

8.5.4.3 Others

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Oil Industries

8.5.5.2 Refineries

8.5.5.3 Gas Industries

8.5.5.4 Electric Power Industries

8.5.6 Historic and Forecasted Market Size by Functionality

8.5.6.1 Trade & Operations

8.5.6.2 Hedging & Risk

8.5.6.3 Inventory Management & Reconciliation

8.5.6.4 Financial Accounting

8.5.6.5 Reporting

8.5.6.6 Integration

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Energy Trading & Risk Management (ETRM) Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Software

8.6.4.2 Service

8.6.4.3 Others

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Oil Industries

8.6.5.2 Refineries

8.6.5.3 Gas Industries

8.6.5.4 Electric Power Industries

8.6.6 Historic and Forecasted Market Size by Functionality

8.6.6.1 Trade & Operations

8.6.6.2 Hedging & Risk

8.6.6.3 Inventory Management & Reconciliation

8.6.6.4 Financial Accounting

8.6.6.5 Reporting

8.6.6.6 Integration

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Energy Trading & Risk Management (ETRM) Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Software

8.7.4.2 Service

8.7.4.3 Others

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Oil Industries

8.7.5.2 Refineries

8.7.5.3 Gas Industries

8.7.5.4 Electric Power Industries

8.7.6 Historic and Forecasted Market Size by Functionality

8.7.6.1 Trade & Operations

8.7.6.2 Hedging & Risk

8.7.6.3 Inventory Management & Reconciliation

8.7.6.4 Financial Accounting

8.7.6.5 Reporting

8.7.6.6 Integration

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Energy Trading & Risk Management (ETRM) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.45 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.78% |

Market Size in 2032: |

USD 2.21 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Functionality |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||