Key Market Highlights:

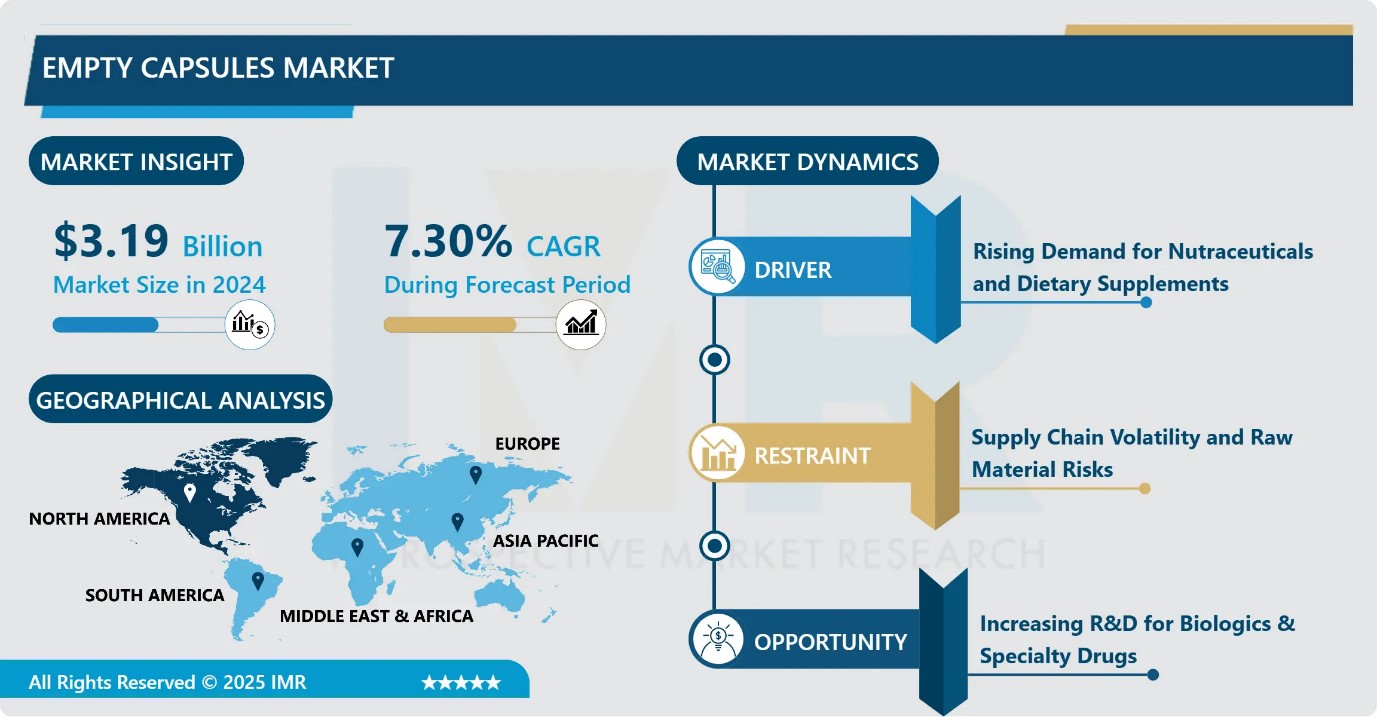

Empty Capsules Market Size Was Valued at USD 3.19 Billion in 2024, and is Projected to Reach USD 6.45 Billion by 2035, Growing at a CAGR of 7.30% from 2025-2035.

- Market Size in 2024: USD 3.19 Billion

- Projected Market Size by 2035: USD 6.45 Billion

- CAGR (2025–2035): 7.30%

- Leading Market in 2024: North America

- Fastest-Growing Market: Asia Pacific

- By Product Types: The Gelatine Capsule segment is anticipated to lead the market by accounting for 29.22% of the market share throughout the forecast period.

- By Application: The Vitamin and dietary supplement segment is expected to capture 31.38% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: North America region is projected to hold 30.71% of the market share during the forecast period.

- Active Players: Capsugel (USA), Qualicaps (Japan), Suheung (South Korea), Medi-Caps (India), Capscanada (Canada), Roxlor (USA), Bright Pharma Caps (India), Sunil Healthcare (India), Snail Pharma (India), ACG Worldwide (India), Erawat Group (India), Nectar Lifesciences Ltd (India), Shaoxing Kangke (China), Anhui Huangshan Capsule (China), and Other Active Players.

Empty Capsules Market Synopsis:

Empty capsules are widely utilized in the pharmaceutical and nutraceutical industries due to their customizable and practical dosage format. Empty capsules, which are composed of Gelatine or vegetarian alternatives such as cellulose, are available in a range of sizes, colors, and forms to accommodate various requirements. These encapsulating devices furnish a noxious and malodorous exterior to powders, granules, or liquids, thereby guaranteeing precise dosing and effortless administration. In addition to encapsulating herbal extracts, vitamins, minerals, and other dietary supplements, empty capsules are a versatile and dependable solution for encapsulation requirements.

The pharmaceutical industry is experiencing growth due to the prevalence of chronic diseases and the escalating global healthcare demands. As a result, there is an increased demand for empty capsules. Pharmaceutical substances, supplements, and other items are frequently encapsulated within these capsules. The demand for nutraceuticals and dietary supplements is on the rise, and these products are frequently delivered in the form of empty capsules. Increasing consciousness regarding wellness and preventive healthcare trends is additionally driving this demand.

Empty Capsules Market Dynamics and Trend Analysis:

Empty Capsules Market Growth Driver- Rising Demand for Nutraceuticals and Dietary Supplements

- The global empty capsules market is witnessing significant growth driven by the surging consumer interest in nutraceuticals and dietary supplements. As health-conscious lifestyles become increasingly prevalent, individuals are seeking convenient, safe, and effective ways to meet their daily nutritional requirements. Empty capsules serve as a versatile medium for encapsulating vitamins, minerals, herbal extracts, and other dietary supplements, ensuring precise dosing and enhanced bioavailability. Additionally, the pharmaceutical sector’s growing focus on patient compliance and personalized medicine further amplifies the demand for capsules as an ideal delivery system.

- The trend is reinforced by the rising popularity of preventive healthcare, where consumers prefer supplements over traditional medications to maintain wellness. Coupled with advancements in capsule manufacturing technologies that improve stability, shelf-life, and encapsulation of sensitive ingredients, these factors collectively position empty capsules as a critical component in the expanding health and wellness market. This sustained demand is expected to continue fuelling market expansion over the coming decade.

Empty Capsules Market Limiting Factor- Stringent Regulatory Standards and Compliance Challenges

- One of the primary limiting factors for the global empty capsules market is the increasingly stringent regulatory environment governing pharmaceutical and nutraceutical products. Empty capsules, being a critical drug and supplement delivery medium, must adhere to rigorous quality, safety, and hygiene standards imposed by agencies such as the FDA, EMA, and other national authorities. Compliance with Good Manufacturing Practices (GMP), testing for contamination, and verification of raw material sources (animal- or plant-based) can increase production costs and extend lead times.

- Additionally, variations in regulations across regions create challenges for manufacturers seeking to operate globally, as capsules must meet diverse labelling, composition, and quality specifications. These regulatory complexities may limit smaller manufacturers from entering the market and slow the launch of innovative capsule products. Consequently, while market demand continues to grow, compliance requirements remain a significant barrier, influencing production scalability, pricing, and overall market expansion.

Empty Capsules Market Expansion Opportunity- Growing Preference for Non-Gelatine and Plant-Based Capsules

- The global empty capsules market presents a significant expansion opportunity through the rising consumer shift toward non-Gelatine and plant-based alternatives. Increasing awareness about vegetarian, vegan, and halal-friendly products has fueled demand for hydroxypropyl methylcellulose (HPMC) and other plant-derived capsules, which offer the same functional benefits as traditional Gelatine capsules without animal-derived ingredients.

- Moreover, the pharmaceutical industry is exploring non-Gelatine capsules to enhance patient inclusivity and cater to a broader demographic. Technological advancements in capsule formulation improving stability, solubility, and taste masking further support this transition. Manufacturers that invest in expanding their non-Gelatine product lines can tap into new consumer segments, enter emerging markets, and differentiate themselves in an increasingly competitive landscape, positioning the market for sustained long-term growth.

Empty Capsules Market Challenge and Risk- Supply Chain Volatility and Raw Material Risks

- A key challenge and risk in the global empty capsules market stems from the volatility of raw material supply. Traditional Gelatine capsules rely on animal-based ingredients such as pig and bovine sources, while non-Gelatine alternatives depend on plant-derived materials like HPMC. Fluctuations in livestock availability, disease outbreaks, or agricultural shortages can disrupt production, leading to higher costs and delays. Additionally, quality inconsistencies in raw materials may compromise capsule integrity, stability, and safety, posing risks for pharmaceutical and nutraceutical applications.

- The global nature of the supply chain further exposes manufacturers to geopolitical tensions, trade restrictions, and import/export regulations, which can impact sourcing and distribution. These challenges require companies to invest in robust supplier networks, inventory management, and quality assurance protocols to mitigate risks. Failure to address these factors could affect market reliability, increase operational costs, and limit the ability to meet growing consumer and industry demand.

Empty Capsules Market Trend- Rising Adoption of Personalized and Functional Medicine

- A prominent trend shaping the global empty capsules market is the increasing adoption of personalized and functional medicine. Consumers and healthcare providers are moving toward tailored solutions that meet individual nutritional and therapeutic needs, driving demand for capsules capable of delivering precise dosages of vitamins, minerals, probiotics, and other active compounds. This trend is further fueled by advances in capsule formulation technology, including modified-release, taste-masked, and multi-compartment capsules, which enhance efficacy and patient compliance.

- The wellness and nutraceutical sectors are witnessing growth in functional supplements targeting immunity, gut health, and cognitive support, encouraging manufacturers to innovate with versatile encapsulation methods. The convergence of digital health monitoring, personalized nutrition, and on-demand supplement production is expected to reinforce this trend, positioning empty capsules as a critical enabler of customized healthcare solutions in both pharmaceutical and consumer wellness markets.

Empty Capsules Market Segment Analysis:

Empty Capsules Market is Segmented based on Product type, Raw material, therapeutic Application, End-users, and Region

By Product Type, Gelatine Capsule segment is expected to dominate the market with around 29.22% share during the forecast period.

- The empty capsules market is broadly segmented by product type, with Gelatine capsules and non-Gelatine capsules being the primary categories. Gelatine capsules can be further divided into soft Gelatine capsules (SGC) and hard Gelatine capsules (HGC). Soft Gelatine capsules (SGC) are a popular choice for encapsulating liquid and oil-based substances. They are known for their flexibility and ease of swallowing, making them ideal for a wide range of pharmaceutical and nutraceutical applications. Hard Gelatine capsules (HGC), on the other hand, are preferred for encapsulating dry ingredients, such as powders and granules. They are known for their durability and ability to retain their shape even under extreme conditions, making them suitable for a variety of formulations. Hard Gelatine capsules are often used for pharmaceutical drugs, vitamins, and dietary supplements.

By Therapeutic Application, Vitamin and Dietary is expected to dominate with close to 31.38% market share during the forecast period.

- The therapeutic application-based segmentation of the empty capsules market reflects the wide variety of pharmaceutical and nutraceutical products that employ capsules as their preferable dosage form. Dietary and vitamin supplements are among the most common uses for unused capsules. The capsule format provides consumers with a convenient and readily digestible means of ingesting vitamins, minerals, and other nutritional supplements.

- Antibiotics and antibacterial medications represent an additional critical application of empty capsules. These medications are effectively delivered in capsule form, enabling precise dosing and targeted delivery to the site of infection. Anti-flatulent and antacid formulations are frequently encapsulated to facilitate patient adherence and facilitate administration. Capsules ensure that the active ingredients reach the intestines, where they can be most effective, by protecting them from gastric acid.

Empty Capsules Market Regional Insights:

North America region is estimated to lead the market with around 30.71% share during the forecast period.

- The North American market for empty capsules is a dynamic and growing segment within the pharmaceutical and nutraceutical industries. Empty capsules serve as crucial vehicles for the delivery of various drugs, supplements, and herbal products. They offer advantages such as precise dosage, taste masking, and ease of swallowing, making them a preferred choice for many pharmaceutical and nutraceutical manufacturers.

- The North American empty capsules market has witnessed steady growth, driven by several factors. One of the key drivers is the increasing demand for pharmaceuticals and dietary supplements. As the population ages and consumers become more health-conscious, there is a growing need for medications and supplements, which in turn fuels the demand for empty capsules. Moreover, technological advancements in capsule manufacturing have led to the development of capsules with improved performance and stability, further boosting their demand. The market is also influenced by regulatory trends, with stringent quality standards and regulations driving the adoption of high-quality capsules.

Empty Capsules Market Active Players:

- Capsugel (USA)

- Qualicaps (Japan)

- Suheung (South Korea)

- Medi-Caps (India)

- Capscanada (Canada)

- Roxlor (USA)

- Bright Pharma Caps (India)

- Sunil Healthcare (India)

- Snail Pharma (India)

- ACG Worldwide (India)

- Erawat Group (India)

- Nectar Lifesciences Ltd (India)

- Shaoxing Kangke (China)

- Anhui Huangshan Capsule (China), and Other Active players

Empty Capsules: A Key Pillar of Modern Drug and Supplement Delivery

- Empty capsules are a cornerstone of modern pharmaceutical and nutraceutical delivery Systems, providing a versatile, safe, and convenient way to administer active ingredients.

- Their importance lies in precise dosage control, improved patient compliance, and the ability to encapsulate powders, granules, or even sensitive herbal extracts without altering their properties. They also support targeted release profiles, such as delayed or sustained release, which enhances therapeutic effectiveness.

- The manufacturing of empty capsules involves meticulous processes to ensure quality and uniformity. Gelatine capsules are produced by dipping metal pins into heated Gelatine or Gelatine-based solutions, followed by drying, trimming, and polishing.

- Non-Gelatine alternatives, such as HPMC (hydroxypropyl methylcellulose), are formed through similar moulding processes. Stringent quality checks for thickness, moisture content, and microbiological safety are applied to meet global regulatory standards.

- Looking ahead, the empty capsule market is poised for robust growth, driven by rising demand for nutraceuticals, personalized medicine, and plant-based alternatives. Innovations in capsule technology such as multi-compartment, delayed-release, and taste-masking designs alongside increased adoption of vegetarian and vegan capsules, are set to redefine patient-centric delivery.

- With global health awareness on the rise and pharmaceutical innovation accelerating, empty capsules will remain a pivotal medium for safe, efficient, and customizable therapeutic solutions

|

Empty Capsules Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 3.19 Bn. |

|

Forecast Period 2025-35 CAGR: |

7.30% |

Market Size in 2035: |

USD 6.45 Bn. |

|

Segments Covered: |

By Product Type

|

|

|

|

By Raw Material

|

|

||

|

By Therapeutic Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Empty Capsules Market by Product Type (2018-2035)

4.1 Empty Capsules Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Gelatine Capsule

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Soft Gelatine Capsule (SGC)

4.5 Hard Gelatine Capsule (HGC)

4.6 Non-Gelatine Capsule

Chapter 5: Empty Capsules Market by Raw Material (2018-2035)

5.1 Empty Capsules Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Pig Meat

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Bovine Meat

5.5 HPMC

5.6 Bone

5.7 Others

Chapter 6: Empty Capsules Market by Therapeutic Application (2018-2035)

6.1 Empty Capsules Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Vitamin and Dietary Supplements

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Antibiotic and Antibacterial Drug

6.5 Cardiac Therapy Drug

6.6 Other

Chapter 7: Empty Capsules Market by End-User (2018-2035)

7.1 Empty Capsules Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Pharmaceutical Companies

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Cosmetics Companies

7.5 Nutraceutical

7.6 Other

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Empty Capsules Market Share by Manufacturer/Service Provider(2024)

8.1.3 Industry BCG Matrix

8.1.4 PArtnerships, Mergers & Acquisitions

8.2 CAPSUGEL (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Recent News & Developments

8.2.10 SWOT Analysis

8.3 QUALICAPS (JAPAN)

8.4 SUHEUNG (SOUTH KOREA)

8.5 MEDI-CAPS (INDIA)

8.6 CAPSCANADA (CANADA)

8.7 ROXLOR (USA)

8.8 BRIGHT PHARMA CAPS (INDIA)

8.9 SUNIL HEALTHCARE (INDIA)

8.10 SNAIL PHARMA (INDIA)

8.11 ACG WORLDWIDE (INDIA)

8.12 ERAWAT GROUP (INDIA)

8.13 NECTAR LIFESCIENCES LTD (INDIA)

8.14 SHAOXING KANGKE (CHINA)

8.15 ANHUI HUANGSHAN CAPSULE (CHINA)

8.16 OTHER ACTIVE PLAYERS

Chapter 9: Global Empty Capsules Market By Region

9.1 Overview

9.2. North America Empty Capsules Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecast Market Size by Country

9.2.4.1 US

9.2.4.2 Canada

9.2.4.3 Mexico

9.3. Eastern Europe Empty Capsules Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecast Market Size by Country

9.3.4.1 Russia

9.3.4.2 Bulgaria

9.3.4.3 The Czech Republic

9.3.4.4 Hungary

9.3.4.5 Poland

9.3.4.6 Romania

9.3.4.7 Rest of Eastern Europe

9.4. Western Europe Empty Capsules Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecast Market Size by Country

9.4.4.1 Germany

9.4.4.2 UK

9.4.4.3 France

9.4.4.4 The Netherlands

9.4.4.5 Italy

9.4.4.6 Spain

9.4.4.7 Rest of Western Europe

9.5. Asia Pacific Empty Capsules Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecast Market Size by Country

9.5.4.1 China

9.5.4.2 India

9.5.4.3 Japan

9.5.4.4 South Korea

9.5.4.5 Malaysia

9.5.4.6 Thailand

9.5.4.7 Vietnam

9.5.4.8 The Philippines

9.5.4.9 Australia

9.5.4.10 New Zealand

9.5.4.11 Rest of APAC

9.6. Middle East & Africa Empty Capsules Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecast Market Size by Country

9.6.4.1 Turkiye

9.6.4.2 Bahrain

9.6.4.3 Kuwait

9.6.4.4 Saudi Arabia

9.6.4.5 Qatar

9.6.4.6 UAE

9.6.4.7 Israel

9.6.4.8 South Africa

9.7. South America Empty Capsules Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecast Market Size by Country

9.7.4.1 Brazil

9.7.4.2 Argentina

9.7.4.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

Chapter 11 Our Thematic Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Chapter 12 Case Study

Chapter 13 Appendix

13 .1 Sources

13 .2 List of Tables and figures

13 .3 Short Forms and Citations

13 .4 Assumption and Conversion

13 .5 Disclaimer

|

Empty Capsules Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 3.19 Bn. |

|

Forecast Period 2025-35 CAGR: |

7.30% |

Market Size in 2035: |

USD 6.45 Bn. |

|

Segments Covered: |

By Product Type

|

|

|

|

By Raw Material

|

|

||

|

By Therapeutic Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||