Supply Chain Management Market Synopsis

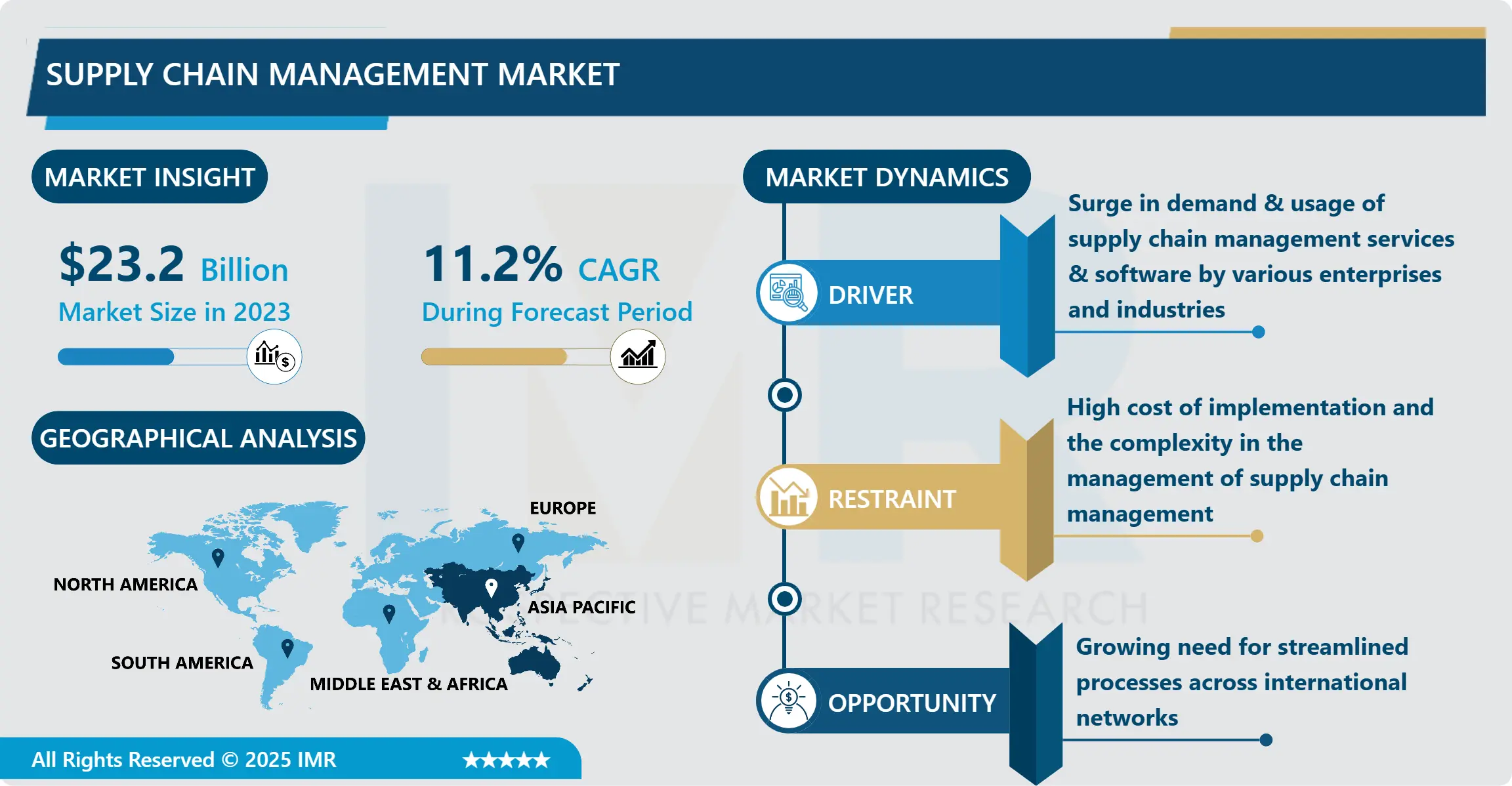

Supply Chain Management Market Size Was Valued at USD 23.2 Billion in 2023, and is Projected to Reach USD 60.3 Billion by 2032, Growing at a CAGR of 11.2% From 2024-2032.

Supply chain management is the achievement of purchasing materials and the management of the delivery of finished goods and services and SCM controls all the activities leading to the production of the finished goods. Supply chain management entails the ongoing revitalization of a firm’s supply-side processes with a view of enhancing the value delivered to customers and achieving competitive superiority in a market. Also, SCM means the endeavors of suppliers to create and effectively manage supply chains that could be as effective and cost-efficient as possible. Supply chains comprise production, product development, and the information systems required to manage these activities.

Supply chain management emphasizes on Creating and delivering value with efficiency and velocity . There are digital SCM systems that business associates have developed to enhance performance in aspects like material transportation. This paper explores the effectiveness of supply chain software utilised by suppliers, manufacturers, logistics providers and retailers involved in the creation of products, order management/fulfilment and information tracking. Increased technology adoption & spending together with increased usage & adoption of supply chain management solutions by different organizations and firms positively impact the global supply chain management market.

The global SCM market also shows a good growth trend since the needs and awareness of SCM solutions like transportation management, planning & analytics, accuracy of forecast, warehouse & inventory, supply chain improvement, procurement & sourcing, utilization of waste, manufacturing execution and synthesis of relevant business information are also increasing. Nevertheless, a fast pace of utilization of information technology and technical advancements enhances and strengthens the total supply chain and aids in increasing the market. An increase in demand of supply chain management has influenced formation of alliances among various companies to boost on its capacities.

The factors such as rise in demand for TMS software and that of integration of blockchain technology in SCM software will have a positive impact on the growth of the SCM market in the coming years. Other new technologies like the Internet of Things, Artificial Intelligence, robotics, and 5G, SCM solutions are developed to solve future requirements.

Supply Chain Management Market Trend Analysis

Increase in adoption of SCM software in healthcare and pharmaceutical companies

- Healthcare supply chain is therefore a complex system constituted by many systems, parts and processes that are involved in production, distribution and provision of medicine and other healthcare supplies for use by patient. The processes in the Supply Chain can be described as if there is a back end program running to co-ordinate all the processes. The supply chain implemented guarantees availability of medicine/product at the right time, reduces costs on expired medicine/products, enhances patient care resulting to increase in patients’ compliance to medicines/products, increases coordination in all departments and reduces on human error/ medication errors.

- This can be achieved through some of the probable characteristics such as synergistic integration of the subsystems, work flow management, application of (RFID) RADIO FREQUENCY IDENTIFICATION TECHNOLOGIES, STANDARD PRODUCT CODES & GLOBAL IDENTIFICATION NUMBER. Increase in the pressure that is placed on healthcare practitioners, organizations, hospitals, and facilities to present sustainable working efficiency and profitability, encourages SCM software use in the healthcare sector. In the present context, the patterns of the global healthcare market involve the rising trends related to the healthcare costs and national healthcare spending.

Rise in technological advancement and investments

- The rise of technology and the investment facilitate the management of operation efficiency and contribute to enhancing the business income. Also, these technologies are applied to enhancing the transparency, supply chain visibility, connection and utilization of supply chain management. In addition, the application of automation has served as a way through which many organisations have achieved multiple objectives in their supply chains for a long time now. Such a pace of change has been experienced because of technological enhancements like Cloud based SCM and Intelligent automation (IA) which integrates with Artificial Intelligence (AI) along with Robotics to automate the complex machine processes. Furthermore, key players in this market are implementing and adopting various software technologies like cloud computing, AI, ML and others in SCM.

- For instance, Gartner survey revealed that among 211 supply chain professionals, 34% of the respondent said that to adapt new technology is the most significant strategic shift in supply chain organizations; the increase in the adoption and integration of AI-based and cloud-based SCM software by leading global players fuels the growth of the market.

Supply Chain Management Market Segment Analysis:

- Supply Chain Management Market Segmented based on Component, Deployment, Enterprise Size, and Vertical.

By Enterprise Size, large enterprise segment is expected to dominate the market during the forecast period

- The large enterprise segment grabbed the largest market share in 2023 and this segment holds the largest share in the target market in the coming years as well. On the basis of the above factors, new growth factors include demand for constant monitoring systems and automation features including advanced shipment notification management, notifications for various forms, current shipment status, customizable user interface dashboards, and visual representations of supply chain in several large size industries. SCM also gives an accurate freight real-time and discrete features of reporting that allows large enterprises to make sound business decisions such as supply planning, inventory planning, and distribution planning among others. Market growth is because there is a vast increase in the need for software in large enterprises to capture critical business information like the quantities of the stock, anticipated sales quantities, suppliers’ information, among others.

- For instance, Microsoft in November 2022 announced the Microsoft supply chain platform launch and provided a live review of the platform through Supply Chain Microsoft Center. In other words, the SCC is meant as to operate in synchronization with the concrete supply chain applications and IDs of an organization. It follows that supply chain flexibility or the ability to adapt and steadiness of enterprises is a reflection of the extent of integration and management of key platforms and their pertinent data. Microsoft’s supply chain solution provides the foundations where large enterprises can begin constructing or can implement point solutions for individual supply chain requirements across Azure, Microsoft Teams, Power Platform as well as Dynamics 365.

By vertical, manufacturing segment held the largest share in 2023

- According to the vertical, the Market has been divided into retail & e-commerce, healthcare, automotive, transportation & Logistics, foods & beverages, manufacturing and others. The manufacturing segment was the largest market share in 2023 and will continue to be dominate the target market during the forecast period due to the rising demand for automation of supply chain process within the manufacturing sector. Reducing operating costs: A reliable SCM system helps manufacturers in making their product manufacturing processes better so that they need less work to manage when activities are not taking place.

- For example, in March 2022, the American Software, Inc failed to complete the planning involving all aspects of the software as they revealed updates to improve planning in the product development cycle. Clients of the digital platform of the company in the manufacturing domain require to understand the global connections of integrated supply chain through supply chain network map.

Supply Chain Management Market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is predicted to be the most significant supply chain management market in the year to come. This dominance can be attributed to the following factors, the swift industrialization and economic advancement that has been realized particularly in the far-eastern countries such as China, India, and Japan. An established manufacturing industry, growth in the electronic commerce market as well as the rising implementation of the internet of things and artificial intelligence in the logistical and supply chain segments are key drivers. Also, crucial supply chain service suppliers and continuing efforts in the infrastructure expansion also support the region’s supremacy in the global supply chain management market.

- Besides, Asia-Pacific controls the maximum supply chain management market and is anticipated to maintain the same position throughout the forecast period. This is due to the factors such as high and rapidly growing ecommerce sales in Asia-Pacific which is creating demand for efficient and effective supply chain solutions.

Active Key Players in the Supply Chain Management Market

- SAP SE

- Oracle

- Blue Yonder, Inc.

- Infor

- Manhattan Associates

- Coupa Software, Inc.

- IBM

- American Software, Inc.

- Korber AG

- Epicor Software Corporation, and Other Key Players.

Key Industry Developments in the Supply Chain Management Market:

- In May 2023, Accenture and Blue Yonder, Inc. , a leading provider of digital operations and catalogs, prolonged their cooperation to improve supply chain performance. Blue Yonder’s supply chain planners and Accenture’s cloud-native platform engineers and industry specialists will design new solutions on the Blue Yonder Luminate Platform, supplying end-to-end supply chain orchestration. The partnership was to assist the clients in transforming towards the future vision of a more digitized and a modular, agile supply chain by co-developing and adopting the Vertical of advanced technologies that includes generative AI and RPA.

- In April 2023, Oracle added new AI and automation functions that are intended to help clients automate end-to-end supply chain management. These new features were built on AI automation and with its help were improving the effectiveness of the supply chain management for the customers of the company. These updates were incorporated changes in Quote-to-cash procedures in Oracle Fusion Vertical s and new planning, usage based price, and rebates management functionalities in Oracle Fusion Cloud Supply Chain & Manufacturing (SCM).

|

Supply Chain Management Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 23.2 Bn. |

|

Forecast Period 2024-32 CAGR: |

11.2% |

Market Size in 2032: |

USD 60.3 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Deployment |

|

||

|

By Enterprise Size |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Supply Chain Management Market by Component (2018-2032)

4.1 Supply Chain Management Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Solution

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Transportation Management System

4.5 Planning & Analytics

4.6 Warehouse & Inventory Management System

4.7 Procurement & Sourcing

4.8 Manufacturing Execution System

4.9 Services

4.10 Professional Services

4.11 Managed Services

Chapter 5: Supply Chain Management Market by Deployment (2018-2032)

5.1 Supply Chain Management Market Snapshot and Growth Engine

5.2 Market Overview

5.3 On-premise

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Cloud-based

Chapter 6: Supply Chain Management Market by Enterprise Size (2018-2032)

6.1 Supply Chain Management Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Small & Medium-Sized Enterprises

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Large Enterprises

Chapter 7: Supply Chain Management Market by Vertical (2018-2032)

7.1 Supply Chain Management Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Retail & e-Commerce

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Healthcare

7.5 Automotive

7.6 Transportation & Logistics

7.7 Food & Beverages

7.8 Manufacturing

7.9 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Supply Chain Management Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 SAP SE

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 ORACLE

8.4 BLUE YONDER INCINFOR

8.5 MANHATTAN ASSOCIATES

8.6 COUPA SOFTWARE INCIBM

8.7 AMERICAN SOFTWARE INCKORBER AG

8.8 EPICOR SOFTWARE CORPORATION

8.9 AND OTHER KEY PLAYERS.

Chapter 9: Global Supply Chain Management Market By Region

9.1 Overview

9.2. North America Supply Chain Management Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Component

9.2.4.1 Solution

9.2.4.2 Transportation Management System

9.2.4.3 Planning & Analytics

9.2.4.4 Warehouse & Inventory Management System

9.2.4.5 Procurement & Sourcing

9.2.4.6 Manufacturing Execution System

9.2.4.7 Services

9.2.4.8 Professional Services

9.2.4.9 Managed Services

9.2.5 Historic and Forecasted Market Size by Deployment

9.2.5.1 On-premise

9.2.5.2 Cloud-based

9.2.6 Historic and Forecasted Market Size by Enterprise Size

9.2.6.1 Small & Medium-Sized Enterprises

9.2.6.2 Large Enterprises

9.2.7 Historic and Forecasted Market Size by Vertical

9.2.7.1 Retail & e-Commerce

9.2.7.2 Healthcare

9.2.7.3 Automotive

9.2.7.4 Transportation & Logistics

9.2.7.5 Food & Beverages

9.2.7.6 Manufacturing

9.2.7.7 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Supply Chain Management Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Component

9.3.4.1 Solution

9.3.4.2 Transportation Management System

9.3.4.3 Planning & Analytics

9.3.4.4 Warehouse & Inventory Management System

9.3.4.5 Procurement & Sourcing

9.3.4.6 Manufacturing Execution System

9.3.4.7 Services

9.3.4.8 Professional Services

9.3.4.9 Managed Services

9.3.5 Historic and Forecasted Market Size by Deployment

9.3.5.1 On-premise

9.3.5.2 Cloud-based

9.3.6 Historic and Forecasted Market Size by Enterprise Size

9.3.6.1 Small & Medium-Sized Enterprises

9.3.6.2 Large Enterprises

9.3.7 Historic and Forecasted Market Size by Vertical

9.3.7.1 Retail & e-Commerce

9.3.7.2 Healthcare

9.3.7.3 Automotive

9.3.7.4 Transportation & Logistics

9.3.7.5 Food & Beverages

9.3.7.6 Manufacturing

9.3.7.7 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Supply Chain Management Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Component

9.4.4.1 Solution

9.4.4.2 Transportation Management System

9.4.4.3 Planning & Analytics

9.4.4.4 Warehouse & Inventory Management System

9.4.4.5 Procurement & Sourcing

9.4.4.6 Manufacturing Execution System

9.4.4.7 Services

9.4.4.8 Professional Services

9.4.4.9 Managed Services

9.4.5 Historic and Forecasted Market Size by Deployment

9.4.5.1 On-premise

9.4.5.2 Cloud-based

9.4.6 Historic and Forecasted Market Size by Enterprise Size

9.4.6.1 Small & Medium-Sized Enterprises

9.4.6.2 Large Enterprises

9.4.7 Historic and Forecasted Market Size by Vertical

9.4.7.1 Retail & e-Commerce

9.4.7.2 Healthcare

9.4.7.3 Automotive

9.4.7.4 Transportation & Logistics

9.4.7.5 Food & Beverages

9.4.7.6 Manufacturing

9.4.7.7 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Supply Chain Management Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Component

9.5.4.1 Solution

9.5.4.2 Transportation Management System

9.5.4.3 Planning & Analytics

9.5.4.4 Warehouse & Inventory Management System

9.5.4.5 Procurement & Sourcing

9.5.4.6 Manufacturing Execution System

9.5.4.7 Services

9.5.4.8 Professional Services

9.5.4.9 Managed Services

9.5.5 Historic and Forecasted Market Size by Deployment

9.5.5.1 On-premise

9.5.5.2 Cloud-based

9.5.6 Historic and Forecasted Market Size by Enterprise Size

9.5.6.1 Small & Medium-Sized Enterprises

9.5.6.2 Large Enterprises

9.5.7 Historic and Forecasted Market Size by Vertical

9.5.7.1 Retail & e-Commerce

9.5.7.2 Healthcare

9.5.7.3 Automotive

9.5.7.4 Transportation & Logistics

9.5.7.5 Food & Beverages

9.5.7.6 Manufacturing

9.5.7.7 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Supply Chain Management Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Component

9.6.4.1 Solution

9.6.4.2 Transportation Management System

9.6.4.3 Planning & Analytics

9.6.4.4 Warehouse & Inventory Management System

9.6.4.5 Procurement & Sourcing

9.6.4.6 Manufacturing Execution System

9.6.4.7 Services

9.6.4.8 Professional Services

9.6.4.9 Managed Services

9.6.5 Historic and Forecasted Market Size by Deployment

9.6.5.1 On-premise

9.6.5.2 Cloud-based

9.6.6 Historic and Forecasted Market Size by Enterprise Size

9.6.6.1 Small & Medium-Sized Enterprises

9.6.6.2 Large Enterprises

9.6.7 Historic and Forecasted Market Size by Vertical

9.6.7.1 Retail & e-Commerce

9.6.7.2 Healthcare

9.6.7.3 Automotive

9.6.7.4 Transportation & Logistics

9.6.7.5 Food & Beverages

9.6.7.6 Manufacturing

9.6.7.7 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Supply Chain Management Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Component

9.7.4.1 Solution

9.7.4.2 Transportation Management System

9.7.4.3 Planning & Analytics

9.7.4.4 Warehouse & Inventory Management System

9.7.4.5 Procurement & Sourcing

9.7.4.6 Manufacturing Execution System

9.7.4.7 Services

9.7.4.8 Professional Services

9.7.4.9 Managed Services

9.7.5 Historic and Forecasted Market Size by Deployment

9.7.5.1 On-premise

9.7.5.2 Cloud-based

9.7.6 Historic and Forecasted Market Size by Enterprise Size

9.7.6.1 Small & Medium-Sized Enterprises

9.7.6.2 Large Enterprises

9.7.7 Historic and Forecasted Market Size by Vertical

9.7.7.1 Retail & e-Commerce

9.7.7.2 Healthcare

9.7.7.3 Automotive

9.7.7.4 Transportation & Logistics

9.7.7.5 Food & Beverages

9.7.7.6 Manufacturing

9.7.7.7 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Supply Chain Management Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 23.2 Bn. |

|

Forecast Period 2024-32 CAGR: |

11.2% |

Market Size in 2032: |

USD 60.3 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Deployment |

|

||

|

By Enterprise Size |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||