Drip Irrigation System Market Synopsis:

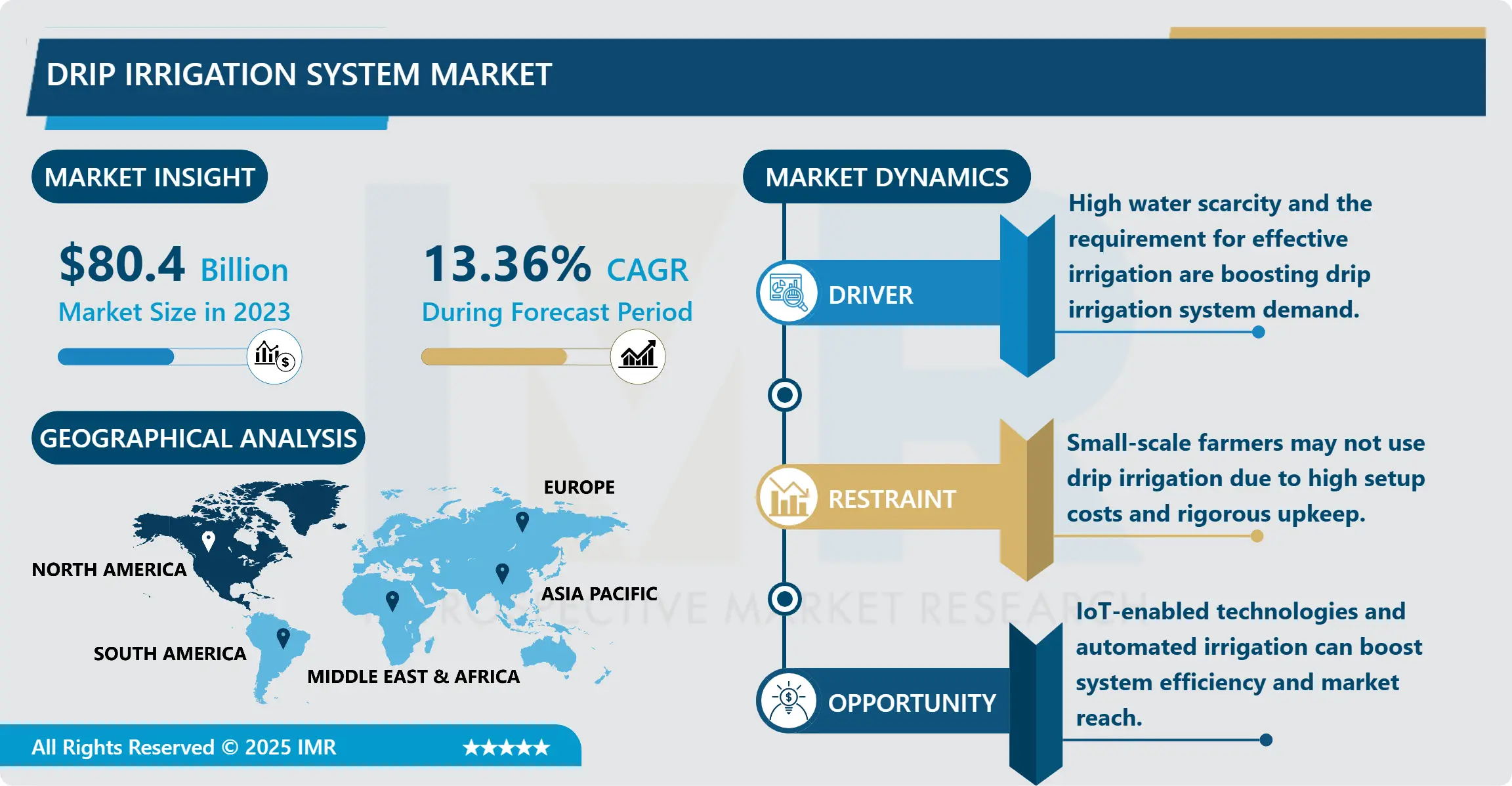

Drip Irrigation System Market Size Was Valued at USD 5.5 Billion in 2023, and is Projected to Reach USD 15.09 Billion by 2032, Growing at a CAGR of 8.85% from 2024-2032.

The drip irrigation system market entails the utilization of an accurate watering procedure that have water supplied directly to the root zone by channels of pipes and tubes and emitters. This method does not allow the water to evaporate or run off and therefore is useful in agricultural of horticultural uses of water. Because water is a precious resource in the world today, farmers opted for it because it helped conserve water and increase productivity. This method is commonly applicable to water scarce areas or those areas where water is required to be conserved fully.

The drip irrigation system market across the world is gradually growing because of certain factors such as; enhanced use of water conservation devices, improved awareness of environmentally friendly farming, and government policies that support the use of technologies that conserve water. Many farmers are now adopting drip irrigation to reduce water usage since in the arid and semi-arid regions, the irrigation may be very inefficient. In addition, the availability and increased population around the world and global food demand has raised the need to enhance agricultural methods, which has also contributed to the market growth. Landscape applications both commercial and residential are also using the system and this is a contributing factor to the increased usage.

Nevertheless, similar to any other technology, the drip irrigation market has some problems, such as high initial investments, which might keep small farmers from using the technique. Moreover, the practice of drip irrigation has to be accompanied by frequent check-ups in order to avoid clogging of the pipes or improper water distribution. However, the market is widely progressing with new advances in automation and sensor-based solutions where further improvements in system efficiency and decreased operational expenses are possible. Since agriculture is going forward with less resource use, the products like drip irrigation are bound to have a bigger market in coming years.

Drip Irrigation System Market Trend Analysis:

Technological Advancements in Drip Irrigation Systems

-

The emerging trend that has been experienced in the drip irrigation system market today is the adoption of IoT sensors, automation systems and data analysis. Such innovation helps farmers to monitor and manage irrigation systems from their offices or homes enhancing water and crops management. Smart systems give information on how the soil, weather and the system is as opposed to other IOT systems assist in accurate scheduling of irrigation. The shift towards smart irrigation systems is not only increasing production efficiency, but it is also efficiently cutting water wastage, making it suitable for climate smart agriculture around the region.

Adoption in Non-Agricultural Applications

-

Another growing trend is the degree to which drip irrigation systems are being adopted in non- agricultural applications: landscaping and gardening. Drip irrigation is thus gradually gaining popularity in the reestablishment of ‘turf’ and open space, gardens, and public parks as urbanization advances and the need for landscapes increases. Furthermore, the business producers in the floriculture and horticulture crops and fields are turning into drip systems for more appropriate and efficient water use. It is opening up the market from traditional agriculture and providing new prospects for growth in urban and landscape uses.

Drip Irrigation System Market Segment Analysis:

Drip Irrigation System Market Segmented on the basis of Component, Method, Crop, and Region.

By Component, Valves segment is expected to dominate the market during the forecast period

-

In the drip irrigation system market, the opportunities tend to be centered on the specific components such as valves, pump and filters because of these critical functions that they have within the drip irrigation system. Water control is the main function of valves to ensure that water can be controlled and turned off to a certain area of the filed or garden. Irrigation pumps are key when it comes to creating the right water pressure especially when it comes to water delivery through the drip lines especially in areas where pressure is usually low. There are several reasons why filters are important with regard to clogging in the emitters and drip lines; the filters sieve the water and eliminate of any impurities that may block the system. These components are parts of the drip irrigation systems performance and durability; innovative improvements and trends in its type contribute to market development in regions with fluctuating water quality and supply concerns.

By Crop, Field Crops segment expected to held the largest share

-

The uptake of drip irrigation system in the market is seen in the field crop segment and fruits and nuts largely due to water rationing and increased yields. For the crops grown in field like cereals, grains, vegetables, the most appropriate type of irrigation is drip irrigation because it delivers water to the root zone only thus avoiding wastage of water in large scale farming for uniform growth. For fruits and nuts, water management is highly important, so drip irrigation is used for citrus fruits, grapes, and almonds, for example. Since both segments are concerned by issues of water deficit and climatic change, the need for drip irrigation systems to support crop production in different climates is likely to grow rapidly and more efficiently.

Drip Irrigation System Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America is expected to dominate the drip irrigation system market over the forecast period, driven by increasing adoption of water-efficient technologies in agriculture, particularly in the U.S. and Mexico. With concerns about water scarcity and the need for sustainable farming practices, farmers in the region are increasingly turning to drip irrigation to optimize water usage and improve crop yields. Additionally, government initiatives and incentives supporting water conservation practices are contributing to market growth. The presence of leading agricultural technology companies, along with a growing focus on precision farming, is also propelling the demand for advanced drip irrigation systems in North America, positioning it as a key market leader.

Active Key Players in the Drip Irrigation System Market

- NETAFIM (Israel)

- Jain Irrigation Systems Ltd. (India)

- Lindsay Corporation (U.S.)

- The Toro Company (U.S.)

- Rivulis (Israel)

- Rain Bird Corporation (U.S.)

- HUNTER INDUSTRIES INC. (U.S.)

- T-L Irrigation (U.S.)

- Chinadrip Irrigation Equipment Co., Ltd. (China)

- Antelco (Australia)

- AZUD (Spain)

- Other Active Players

|

Drip Irrigation System Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 80.4 Billion |

|

Forecast Period 2024-32 CAGR: |

13.36 % |

Market Size in 2032: |

USD 278.6 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Drip Irrigation System Market by Component

4.1 Drip Irrigation System Market Snapshot and Growth Engine

4.2 Drip Irrigation System Market Overview

4.3 Valves

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Valves: Geographic Segmentation Analysis

4.4 Pumps

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Pumps: Geographic Segmentation Analysis

4.5 Filters

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Filters: Geographic Segmentation Analysis

Chapter 5: Drip Irrigation System Market by Method

5.1 Drip Irrigation System Market Snapshot and Growth Engine

5.2 Drip Irrigation System Market Overview

5.3 Surface

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Surface: Geographic Segmentation Analysis

5.4 Subsurface

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Subsurface: Geographic Segmentation Analysis

Chapter 6: Drip Irrigation System Market by Crop

6.1 Drip Irrigation System Market Snapshot and Growth Engine

6.2 Drip Irrigation System Market Overview

6.3 Field Crops

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Field Crops: Geographic Segmentation Analysis

6.4 Fruits & Nuts

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Fruits & Nuts: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Drip Irrigation System Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 NETAFIM (ISRAEL)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 JAIN IRRIGATION SYSTEMS LTD. (INDIA)

7.4 LINDSAY CORPORATION (U.S.)

7.5 THE TORO COMPANY (U.S.)

7.6 RIVULIS (ISRAEL)

7.7 RAIN BIRD CORPORATION (U.S.)

7.8 HUNTER INDUSTRIES INC. (U.S.)

7.9 T-L IRRIGATION (U.S.)

7.10 CHINADRIP IRRIGATION EQUIPMENT (XIAMEN) CO. LTD. (CHINA)

7.11 ANTELCO (AUSTRALIA)

7.12 AZUD (SPAIN)

7.13 OTHER ACTIVE PLAYERS

Chapter 8: Global Drip Irrigation System Market By Region

8.1 Overview

8.2. North America Drip Irrigation System Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Component

8.2.4.1 Valves

8.2.4.2 Pumps

8.2.4.3 Filters

8.2.5 Historic and Forecasted Market Size By Method

8.2.5.1 Surface

8.2.5.2 Subsurface

8.2.6 Historic and Forecasted Market Size By Crop

8.2.6.1 Field Crops

8.2.6.2 Fruits & Nuts

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Drip Irrigation System Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Component

8.3.4.1 Valves

8.3.4.2 Pumps

8.3.4.3 Filters

8.3.5 Historic and Forecasted Market Size By Method

8.3.5.1 Surface

8.3.5.2 Subsurface

8.3.6 Historic and Forecasted Market Size By Crop

8.3.6.1 Field Crops

8.3.6.2 Fruits & Nuts

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Drip Irrigation System Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Component

8.4.4.1 Valves

8.4.4.2 Pumps

8.4.4.3 Filters

8.4.5 Historic and Forecasted Market Size By Method

8.4.5.1 Surface

8.4.5.2 Subsurface

8.4.6 Historic and Forecasted Market Size By Crop

8.4.6.1 Field Crops

8.4.6.2 Fruits & Nuts

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Drip Irrigation System Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Component

8.5.4.1 Valves

8.5.4.2 Pumps

8.5.4.3 Filters

8.5.5 Historic and Forecasted Market Size By Method

8.5.5.1 Surface

8.5.5.2 Subsurface

8.5.6 Historic and Forecasted Market Size By Crop

8.5.6.1 Field Crops

8.5.6.2 Fruits & Nuts

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Drip Irrigation System Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Component

8.6.4.1 Valves

8.6.4.2 Pumps

8.6.4.3 Filters

8.6.5 Historic and Forecasted Market Size By Method

8.6.5.1 Surface

8.6.5.2 Subsurface

8.6.6 Historic and Forecasted Market Size By Crop

8.6.6.1 Field Crops

8.6.6.2 Fruits & Nuts

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Drip Irrigation System Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Component

8.7.4.1 Valves

8.7.4.2 Pumps

8.7.4.3 Filters

8.7.5 Historic and Forecasted Market Size By Method

8.7.5.1 Surface

8.7.5.2 Subsurface

8.7.6 Historic and Forecasted Market Size By Crop

8.7.6.1 Field Crops

8.7.6.2 Fruits & Nuts

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Drip Irrigation System Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 80.4 Billion |

|

Forecast Period 2024-32 CAGR: |

13.36 % |

Market Size in 2032: |

USD 278.6 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||