Distribution Software Market Synopsis

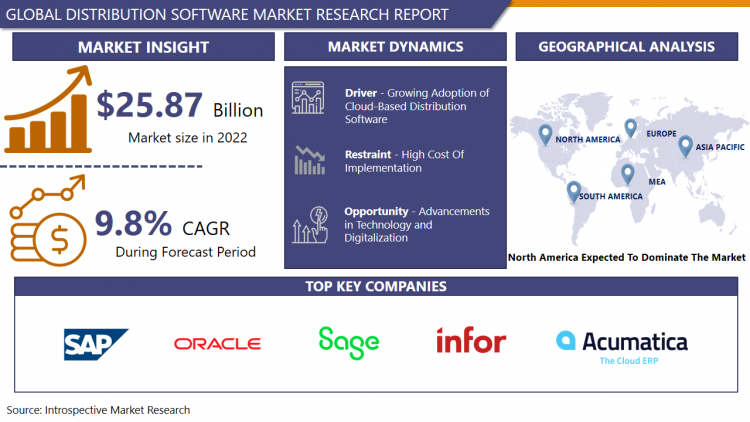

Global Distribution Software Market Size Was Valued at USD 25.87 Billion in 2022 and is Projected To Reach USD 54.65 Billion by 2030, Growing at a CAGR of 9.8% From 2022 To 2030.

Distribution software refers to software that manages everything from order processing and inventory control to accounting, purchasing and customer service, supply chain management, sales, customer relationship management, and finance management.

- The distribution software market is gaining traction due to the growing need for efficient inventory management and the development of advanced technologies such as artificial intelligence and machine learning.

- The global software market for distribution is highly competitive, driven by the rising need for products that streamline processes as a result of the expansion of e-commerce and online sales. The demand for distribution software solutions is also being driven by the supply chain's growing complexity. The need to lower labor costs and boost operational efficiency also drives the market. The demand for more precise inventory management is another factor driving the market.

The Distribution Software Market Trend Analysis

Growing Adoption of Cloud-Based Distribution Software

- The growing adoption of cloud-based distribution software is primarily driven by the remarkable benefits it offers to organizations across various industries. Cloud-based distribution software enhances operational efficiency and agility. It enables businesses to streamline their distribution processes, optimize inventory management, and respond swiftly to changing market demands. With real-time data accessibility and analytics capabilities, companies can make data-driven decisions, leading to improved supply chain performance. Cost savings play a significant role in the adoption of cloud distribution solutions. By eliminating the need for on-premises infrastructure, businesses can reduce capital expenditures and IT maintenance costs. The cloud's pay-as-you-go pricing model allows companies to scale their distribution operations seamlessly without large upfront investments.

- Furthermore, cloud-based distribution software enhances collaboration and visibility throughout the supply chain. It facilitates communication and data sharing among suppliers, distributors, and customers, leading to better coordination and faster order fulfilment. This heightened transparency also reduces the risk of errors and delays.

- Security is another critical driver. Cloud providers invest heavily in robust security measures, often surpassing what many organizations can achieve on their own. This helps alleviate concerns about data breaches and cyber threats, making the cloud a secure option for managing sensitive distribution data. The scalability and accessibility of cloud solutions cater to businesses of all sizes, from small and medium enterprises to large corporations. This inclusivity fosters widespread adoption, allowing organizations to compete effectively in today's dynamic markets.

Advancements in Technology and Digitalization

- The rapid advancements in technology and the ongoing process of digitalization present a significant and transformative opportunity for the Distribution Software Market. First and foremost, the integration of cutting-edge technologies such as Artificial Intelligence (AI), Internet of Things (IoT), and Big Data analytics into distribution software enables companies to gain deeper insights into their supply chains. This data-driven approach allows for more precise demand forecasting, efficient inventory management, and optimized routing and logistics, ultimately resulting in cost savings and enhanced customer satisfaction.

- Furthermore, digitalization fosters real-time connectivity across the entire distribution ecosystem. From suppliers and manufacturers to distributors and end customers, stakeholders can seamlessly exchange information and collaborate. This enhanced visibility and communication led to faster response times, reduced lead times, and better coordination throughout the supply chain.

- E-commerce and online marketplaces are booming, and distribution software plays a pivotal role in supporting these channels. The ability to integrate with various e-commerce platforms and automate order processing, inventory updates, and shipment tracking is essential for businesses aiming to thrive in the digital marketplace.

Distribution Software Market Segmentation Analysis:

Distribution Software market segments cover the Type, Enterprise Size, and End-users. By Type, the Cloud-based segment is anticipated to dominate the Market over the Forecast period.

- Enterprises are primarily focusing on reducing their IT infrastructure costs and also working on improving the flexibility, agility, and efficiency of business operations. The emergence of cloud-based distribution software is growing among end-users because it does not require the client to set up their servers and eliminates the need to purchase additional hardware.

- Applications on the cloud are simpler to use and more widely available. Instead of making a sizable upfront investment in cloud-based distribution software, the end user only needs a web browser and an Internet connection and can make regular payments. The recurring costs are for the software's upkeep and upgrades. The widespread use of the Internet can be blamed for the growing adoption of cloud-based solutions. During the forecast period, these factors are anticipated to support the cloud-based market segment's growth.

By End-User, the IT and Telecommunication segment is projected to witness faster growth.

- In the rapidly evolving landscape of the Distribution Software Market, the IT and Telecommunication segment is poised to experience accelerated growth. This surge can be attributed to several key factors. The IT and telecommunications industry relies heavily on efficient distribution networks to deliver hardware, software, and communication equipment to a global customer base. As technology continues to advance, the demand for streamlined distribution processes intensifies, driving the adoption of cutting-edge distribution software solutions.

- The IT and Telecommunication sector often deals with intricate supply chain operations, necessitating robust inventory management, order fulfillment, and real-time tracking capabilities. Distribution software plays a pivotal role in optimizing these functions, enhancing operational efficiency, and reducing costs.

- The sector's rapid expansion and the growing need for flexible, scalable, and customizable distribution solutions create a favorable environment for software providers. Consequently, companies in IT and telecommunications are increasingly investing in distribution software to gain a competitive edge, making it one of the fastest-growing segments within the Distribution Software Market. This trend is expected to persist as technology continues to shape the industry's landscape.

Distribution Software Market Regional Analysis

North America is expected to dominate the Market over the Forecast Period.

- The North American Distribution Software Market is experiencing strong growth. This is due to the increasing demand for efficient and cost-effective solutions to manage the distribution of goods and services. The market is driven by the need for improved customer service, increased operational efficiency, and improved inventory management. The market is also being driven by the increasing adoption of cloud-based solutions, which provide scalability and flexibility to businesses. Additionally, the increasing demand for IT and Telecommunication solutions is also driving the market growth.

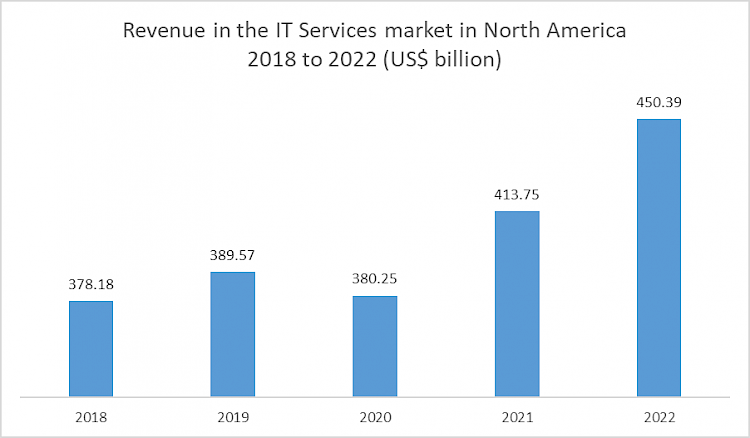

- According to Statista, the IT Services market in North America is poised for robust revenue growth in 2022, largely driven by the thriving Distribution Software Market. IT Outsourcing leads the charge with a projected market volume of US$164.10 billion, offering companies cost-effective solutions for their technology needs.

- The increasing demand for Distribution Software, a critical component of supply chain management, is enhancing the efficiency of businesses across various industries. This, in turn, fuels the need for IT Services, as companies seek expert assistance in implementing and maintaining these software solutions. Consequently, the IT Services sector in North America is experiencing a surge in revenue, set to reach US$450.39 billion in 2022.

COVID-19 Impact Analysis on the Distribution Software Market

COVID-19 has had a significant impact on all industrial sectors, but especially on SMEs. Due to businesses temporarily ceasing operations to comply with government regulations, the food service distribution software market is expanding slowly. Despite the outbreak, some large businesses and government organizations continue to distribute food services to the public to supply them with essential goods. For instance, in 2020 Sysco and U.S. Foods, the two biggest restaurants and food service distributors in the U.S., will be supplying groceries to retail establishments, which will increase the demand for food service distribution software to track inventory management, supply chain, and performance.

Top Key Players Covered in the Distribution Software Market

- SAP (Germany)

- Oracle (United States)

- Sage Group (United Kingdom)

- Infor (United States)

- Jda Software Group (United States)

- Acumatica (United States)

- Ads Solutions (United States)

- Agnitech (United States)

- Cadre Software (United States)

- Cloud 9 Erp Solutions (United States)

- Data-Basics (United States)

- DDI System (United States)

- Distribution One (United States)

- Epicor (United States)

- Fishbowl (United States)

- Flowtrac (United States)

- Syncron (United States)

- Vormittag Associates (United States)

- Accsoft Business Solutions (Canada)

- Blue Link Associates (Canada)

- Inflow Inventory Software (Canada)

- Exact (Netherlands)

- Ecount (South Korea)

- Fasttrack Solutions (Australia)

- Jcurve Solutions (Australia)

- Syspro (South Africa), and Other Major Players.

Key Industry Developments in the Distribution Software Market

In April 2023, Oracle, a global leader in database technology, announced the launch of Oracle Database 23c Free—Developer Release, catering to the surging demand from developers and organizations for access to the latest features in Oracle Database 23c "App Simple." This release empowers developers with innovative capabilities, streamlining the development of contemporary data-driven applications, in preparation for the upcoming Oracle Database 23c Long-Term Support Release.

In March 2023, SYSPRO, a global provider of industry-built ERP software for manufacturers and distributors, today announced new capabilities to their latest ERP release with enriched functionality for improved internal and organizational controls, a connected supply chain, deeper business intelligence, and digital dexterity.

|

Global Distribution Software Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2016 to 2021 |

Market Size in 2022: |

USD 12257.47 Mn. |

|

Forecast Period 2023-30 CAGR: |

2.30 % |

Market Size in 2030: |

USD 14703 Mn. |

|

Segments Covered: |

By Deployment |

|

|

|

By Enterprise Size |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- ANALYSIS OF THE IMPACT OF COVID-19

- Impact On The Overall Market

- Impact On The Supply Chain

- Impact On The Key Manufacturers

- Impact On The Pricing

- Post COVID Situation

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- DISTRIBUTION SOFTWARE MARKET BY TYPE (2017-2030)

- DISTRIBUTION SOFTWARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CLOUD-BASED

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ON-PREMISES

- DISTRIBUTION SOFTWARE MARKET BY ENTERPRISE SIZE (2017-2030)

- DISTRIBUTION SOFTWARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SMALL AND MEDIUM ENTERPRISE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LARGE ENTERPRISE

- DISTRIBUTION SOFTWARE MARKET BY END USERS (2017-2030)

- DISTRIBUTION SOFTWARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- IT AND TELECOMMUNICATION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- HEALTHCARE

- GOVERNMENT

- MANUFACTURING

- RETAIL AND E-COMMERCE

- TRANSPORTATION AND LOGISTICS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Distribution Software Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- SAP (GERMANY)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ORACLE (UNITED STATES)

- SAGE GROUP (UNITED KINGDOM)

- INFOR (UNITED STATES)

- JDA SOFTWARE GROUP (UNITED STATES)

- ACUMATICA (UNITED STATES)

- ADS SOLUTIONS (UNITED STATES)

- AGNITECH (UNITED STATES)

- CADRE SOFTWARE (UNITED STATES)

- CLOUD 9 ERP SOLUTIONS (UNITED STATES)

- DATA-BASICS (UNITED STATES)

- DDI SYSTEM (UNITED STATES)

- DISTRIBUTION ONE (UNITED STATES)

- EPICOR (UNITED STATES)

- FISHBOWL (UNITED STATES)

- FLOWTRAC (UNITED STATES)

- SYNCRON (UNITED STATES)

- VORMITTAG ASSOCIATES (UNITED STATES)

- ACCSOFT BUSINESS SOLUTIONS (CANADA)

- BLUE LINK ASSOCIATES (CANADA)

- INFLOW INVENTORY SOFTWARE (CANADA)

- EXACT (NETHERLANDS)

- ECOUNT (SOUTH KOREA)

- FASTTRACK SOLUTIONS (AUSTRALIA)

- JCURVE SOLUTIONS (AUSTRALIA)

- SYSPRO (SOUTH AFRICA), AND OTHER MAJOR PLAYERS.

- COMPETITIVE LANDSCAPE

- GLOBAL DISTRIBUTION SOFTWARE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Enterprise Size

- Historic And Forecasted Market Size By End-Users

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Distribution Software Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2016 to 2021 |

Market Size in 2022: |

USD 12257.47 Mn. |

|

Forecast Period 2023-30 CAGR: |

2.30 % |

Market Size in 2030: |

USD 14703 Mn. |

|

Segments Covered: |

By Deployment |

|

|

|

By Enterprise Size |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. DISTRIBUTION SOFTWARE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. DISTRIBUTION SOFTWARE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. DISTRIBUTION SOFTWARE MARKET COMPETITIVE RIVALRY

TABLE 005. DISTRIBUTION SOFTWARE MARKET THREAT OF NEW ENTRANTS

TABLE 006. DISTRIBUTION SOFTWARE MARKET THREAT OF SUBSTITUTES

TABLE 007. DISTRIBUTION SOFTWARE MARKET BY TYPE

TABLE 008. CLOUD-BASED MARKET OVERVIEW (2016-2030)

TABLE 009. ON-PREMISES MARKET OVERVIEW (2016-2030)

TABLE 010. DISTRIBUTION SOFTWARE MARKET BY ENTERPRISE SIZE

TABLE 011. SMALL AND MEDIUM ENTERPRISE MARKET OVERVIEW (2016-2030)

TABLE 012. LARGE ENTERPRISE MARKET OVERVIEW (2016-2030)

TABLE 013. DISTRIBUTION SOFTWARE MARKET BY END-USER

TABLE 014. IT AND TELECOMMUNICATION MARKET OVERVIEW (2016-2030)

TABLE 015. HEALTHCARE MARKET OVERVIEW (2016-2030)

TABLE 016. GOVERNMENT MARKET OVERVIEW (2016-2030)

TABLE 017. MANUFACTURING MARKET OVERVIEW (2016-2030)

TABLE 018. RETAIL AND E-COMMERCE MARKET OVERVIEW (2016-2030)

TABLE 019. TRANSPORTATION AND LOGISTICS MARKET OVERVIEW (2016-2030)

TABLE 020. NORTH AMERICA DISTRIBUTION SOFTWARE MARKET, BY TYPE (2016-2030)

TABLE 021. NORTH AMERICA DISTRIBUTION SOFTWARE MARKET, BY ENTERPRISE SIZE (2016-2030)

TABLE 022. NORTH AMERICA DISTRIBUTION SOFTWARE MARKET, BY END-USER (2016-2030)

TABLE 023. N DISTRIBUTION SOFTWARE MARKET, BY COUNTRY (2016-2030)

TABLE 024. EASTERN EUROPE DISTRIBUTION SOFTWARE MARKET, BY TYPE (2016-2030)

TABLE 025. EASTERN EUROPE DISTRIBUTION SOFTWARE MARKET, BY ENTERPRISE SIZE (2016-2030)

TABLE 026. EASTERN EUROPE DISTRIBUTION SOFTWARE MARKET, BY END-USER (2016-2030)

TABLE 027. DISTRIBUTION SOFTWARE MARKET, BY COUNTRY (2016-2030)

TABLE 028. WESTERN EUROPE DISTRIBUTION SOFTWARE MARKET, BY TYPE (2016-2030)

TABLE 029. WESTERN EUROPE DISTRIBUTION SOFTWARE MARKET, BY ENTERPRISE SIZE (2016-2030)

TABLE 030. WESTERN EUROPE DISTRIBUTION SOFTWARE MARKET, BY END-USER (2016-2030)

TABLE 031. DISTRIBUTION SOFTWARE MARKET, BY COUNTRY (2016-2030)

TABLE 032. ASIA PACIFIC DISTRIBUTION SOFTWARE MARKET, BY TYPE (2016-2030)

TABLE 033. ASIA PACIFIC DISTRIBUTION SOFTWARE MARKET, BY ENTERPRISE SIZE (2016-2030)

TABLE 034. ASIA PACIFIC DISTRIBUTION SOFTWARE MARKET, BY END-USER (2016-2030)

TABLE 035. DISTRIBUTION SOFTWARE MARKET, BY COUNTRY (2016-2030)

TABLE 036. MIDDLE EAST & AFRICA DISTRIBUTION SOFTWARE MARKET, BY TYPE (2016-2030)

TABLE 037. MIDDLE EAST & AFRICA DISTRIBUTION SOFTWARE MARKET, BY ENTERPRISE SIZE (2016-2030)

TABLE 038. MIDDLE EAST & AFRICA DISTRIBUTION SOFTWARE MARKET, BY END-USER (2016-2030)

TABLE 039. DISTRIBUTION SOFTWARE MARKET, BY COUNTRY (2016-2030)

TABLE 040. SOUTH AMERICA DISTRIBUTION SOFTWARE MARKET, BY TYPE (2016-2030)

TABLE 041. SOUTH AMERICA DISTRIBUTION SOFTWARE MARKET, BY ENTERPRISE SIZE (2016-2030)

TABLE 042. SOUTH AMERICA DISTRIBUTION SOFTWARE MARKET, BY END-USER (2016-2030)

TABLE 043. DISTRIBUTION SOFTWARE MARKET, BY COUNTRY (2016-2030)

TABLE 044. SAP (GERMANY): SNAPSHOT

TABLE 045. SAP (GERMANY): BUSINESS PERFORMANCE

TABLE 046. SAP (GERMANY): PRODUCT PORTFOLIO

TABLE 047. SAP (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. ORACLE (UNITED STATES): SNAPSHOT

TABLE 048. ORACLE (UNITED STATES): BUSINESS PERFORMANCE

TABLE 049. ORACLE (UNITED STATES): PRODUCT PORTFOLIO

TABLE 050. ORACLE (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. SAGE GROUP (UNITED KINGDOM): SNAPSHOT

TABLE 051. SAGE GROUP (UNITED KINGDOM): BUSINESS PERFORMANCE

TABLE 052. SAGE GROUP (UNITED KINGDOM): PRODUCT PORTFOLIO

TABLE 053. SAGE GROUP (UNITED KINGDOM): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. INFOR (UNITED STATES): SNAPSHOT

TABLE 054. INFOR (UNITED STATES): BUSINESS PERFORMANCE

TABLE 055. INFOR (UNITED STATES): PRODUCT PORTFOLIO

TABLE 056. INFOR (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. JDA SOFTWARE GROUP (UNITED STATES): SNAPSHOT

TABLE 057. JDA SOFTWARE GROUP (UNITED STATES): BUSINESS PERFORMANCE

TABLE 058. JDA SOFTWARE GROUP (UNITED STATES): PRODUCT PORTFOLIO

TABLE 059. JDA SOFTWARE GROUP (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. ACUMATICA (UNITED STATES): SNAPSHOT

TABLE 060. ACUMATICA (UNITED STATES): BUSINESS PERFORMANCE

TABLE 061. ACUMATICA (UNITED STATES): PRODUCT PORTFOLIO

TABLE 062. ACUMATICA (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. ADS SOLUTIONS (UNITED STATES): SNAPSHOT

TABLE 063. ADS SOLUTIONS (UNITED STATES): BUSINESS PERFORMANCE

TABLE 064. ADS SOLUTIONS (UNITED STATES): PRODUCT PORTFOLIO

TABLE 065. ADS SOLUTIONS (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. AGNITECH (UNITED STATES): SNAPSHOT

TABLE 066. AGNITECH (UNITED STATES): BUSINESS PERFORMANCE

TABLE 067. AGNITECH (UNITED STATES): PRODUCT PORTFOLIO

TABLE 068. AGNITECH (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. CADRE SOFTWARE (UNITED STATES): SNAPSHOT

TABLE 069. CADRE SOFTWARE (UNITED STATES): BUSINESS PERFORMANCE

TABLE 070. CADRE SOFTWARE (UNITED STATES): PRODUCT PORTFOLIO

TABLE 071. CADRE SOFTWARE (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. CLOUD 9 ERP SOLUTIONS (UNITED STATES): SNAPSHOT

TABLE 072. CLOUD 9 ERP SOLUTIONS (UNITED STATES): BUSINESS PERFORMANCE

TABLE 073. CLOUD 9 ERP SOLUTIONS (UNITED STATES): PRODUCT PORTFOLIO

TABLE 074. CLOUD 9 ERP SOLUTIONS (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. DATA-BASICS (UNITED STATES): SNAPSHOT

TABLE 075. DATA-BASICS (UNITED STATES): BUSINESS PERFORMANCE

TABLE 076. DATA-BASICS (UNITED STATES): PRODUCT PORTFOLIO

TABLE 077. DATA-BASICS (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. DDI SYSTEM (UNITED STATES): SNAPSHOT

TABLE 078. DDI SYSTEM (UNITED STATES): BUSINESS PERFORMANCE

TABLE 079. DDI SYSTEM (UNITED STATES): PRODUCT PORTFOLIO

TABLE 080. DDI SYSTEM (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. DISTRIBUTION ONE (UNITED STATES): SNAPSHOT

TABLE 081. DISTRIBUTION ONE (UNITED STATES): BUSINESS PERFORMANCE

TABLE 082. DISTRIBUTION ONE (UNITED STATES): PRODUCT PORTFOLIO

TABLE 083. DISTRIBUTION ONE (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. EPICOR (UNITED STATES): SNAPSHOT

TABLE 084. EPICOR (UNITED STATES): BUSINESS PERFORMANCE

TABLE 085. EPICOR (UNITED STATES): PRODUCT PORTFOLIO

TABLE 086. EPICOR (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. FISHBOWL (UNITED STATES): SNAPSHOT

TABLE 087. FISHBOWL (UNITED STATES): BUSINESS PERFORMANCE

TABLE 088. FISHBOWL (UNITED STATES): PRODUCT PORTFOLIO

TABLE 089. FISHBOWL (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. FLOWTRAC (UNITED STATES): SNAPSHOT

TABLE 090. FLOWTRAC (UNITED STATES): BUSINESS PERFORMANCE

TABLE 091. FLOWTRAC (UNITED STATES): PRODUCT PORTFOLIO

TABLE 092. FLOWTRAC (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. SYNCRON (UNITED STATES): SNAPSHOT

TABLE 093. SYNCRON (UNITED STATES): BUSINESS PERFORMANCE

TABLE 094. SYNCRON (UNITED STATES): PRODUCT PORTFOLIO

TABLE 095. SYNCRON (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 095. VORMITTAG ASSOCIATES (UNITED STATES): SNAPSHOT

TABLE 096. VORMITTAG ASSOCIATES (UNITED STATES): BUSINESS PERFORMANCE

TABLE 097. VORMITTAG ASSOCIATES (UNITED STATES): PRODUCT PORTFOLIO

TABLE 098. VORMITTAG ASSOCIATES (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 098. ACCSOFT BUSINESS SOLUTIONS (CANADA): SNAPSHOT

TABLE 099. ACCSOFT BUSINESS SOLUTIONS (CANADA): BUSINESS PERFORMANCE

TABLE 100. ACCSOFT BUSINESS SOLUTIONS (CANADA): PRODUCT PORTFOLIO

TABLE 101. ACCSOFT BUSINESS SOLUTIONS (CANADA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 101. BLUE LINK ASSOCIATES (CANADA): SNAPSHOT

TABLE 102. BLUE LINK ASSOCIATES (CANADA): BUSINESS PERFORMANCE

TABLE 103. BLUE LINK ASSOCIATES (CANADA): PRODUCT PORTFOLIO

TABLE 104. BLUE LINK ASSOCIATES (CANADA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 104. INFLOW INVENTORY SOFTWARE (CANADA): SNAPSHOT

TABLE 105. INFLOW INVENTORY SOFTWARE (CANADA): BUSINESS PERFORMANCE

TABLE 106. INFLOW INVENTORY SOFTWARE (CANADA): PRODUCT PORTFOLIO

TABLE 107. INFLOW INVENTORY SOFTWARE (CANADA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 107. EXACT (NETHERLANDS): SNAPSHOT

TABLE 108. EXACT (NETHERLANDS): BUSINESS PERFORMANCE

TABLE 109. EXACT (NETHERLANDS): PRODUCT PORTFOLIO

TABLE 110. EXACT (NETHERLANDS): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 110. ECOUNT (SOUTH KOREA): SNAPSHOT

TABLE 111. ECOUNT (SOUTH KOREA): BUSINESS PERFORMANCE

TABLE 112. ECOUNT (SOUTH KOREA): PRODUCT PORTFOLIO

TABLE 113. ECOUNT (SOUTH KOREA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 113. FASTTRACK SOLUTIONS (AUSTRALIA): SNAPSHOT

TABLE 114. FASTTRACK SOLUTIONS (AUSTRALIA): BUSINESS PERFORMANCE

TABLE 115. FASTTRACK SOLUTIONS (AUSTRALIA): PRODUCT PORTFOLIO

TABLE 116. FASTTRACK SOLUTIONS (AUSTRALIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 116. JCURVE SOLUTIONS (AUSTRALIA): SNAPSHOT

TABLE 117. JCURVE SOLUTIONS (AUSTRALIA): BUSINESS PERFORMANCE

TABLE 118. JCURVE SOLUTIONS (AUSTRALIA): PRODUCT PORTFOLIO

TABLE 119. JCURVE SOLUTIONS (AUSTRALIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 119. SYSPRO (SOUTH AFRICA): SNAPSHOT

TABLE 120. SYSPRO (SOUTH AFRICA): BUSINESS PERFORMANCE

TABLE 121. SYSPRO (SOUTH AFRICA): PRODUCT PORTFOLIO

TABLE 122. SYSPRO (SOUTH AFRICA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 122. AND OTHER MAJOR PLAYERS.: SNAPSHOT

TABLE 123. AND OTHER MAJOR PLAYERS.: BUSINESS PERFORMANCE

TABLE 124. AND OTHER MAJOR PLAYERS.: PRODUCT PORTFOLIO

TABLE 125. AND OTHER MAJOR PLAYERS.: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. DISTRIBUTION SOFTWARE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. DISTRIBUTION SOFTWARE MARKET OVERVIEW BY TYPE

FIGURE 012. CLOUD-BASED MARKET OVERVIEW (2016-2030)

FIGURE 013. ON-PREMISES MARKET OVERVIEW (2016-2030)

FIGURE 014. DISTRIBUTION SOFTWARE MARKET OVERVIEW BY ENTERPRISE SIZE

FIGURE 015. SMALL AND MEDIUM ENTERPRISE MARKET OVERVIEW (2016-2030)

FIGURE 016. LARGE ENTERPRISE MARKET OVERVIEW (2016-2030)

FIGURE 017. DISTRIBUTION SOFTWARE MARKET OVERVIEW BY END-USER

FIGURE 018. IT AND TELECOMMUNICATION MARKET OVERVIEW (2016-2030)

FIGURE 019. HEALTHCARE MARKET OVERVIEW (2016-2030)

FIGURE 020. GOVERNMENT MARKET OVERVIEW (2016-2030)

FIGURE 021. MANUFACTURING MARKET OVERVIEW (2016-2030)

FIGURE 022. RETAIL AND E-COMMERCE MARKET OVERVIEW (2016-2030)

FIGURE 023. TRANSPORTATION AND LOGISTICS MARKET OVERVIEW (2016-2030)

FIGURE 024. NORTH AMERICA DISTRIBUTION SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 025. EASTERN EUROPE DISTRIBUTION SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 026. WESTERN EUROPE DISTRIBUTION SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 027. ASIA PACIFIC DISTRIBUTION SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 028. MIDDLE EAST & AFRICA DISTRIBUTION SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 029. SOUTH AMERICA DISTRIBUTION SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Distribution Software Market research report is 2023-2030.

SAP (Germany), Oracle (United States), Sage Group (United Kingdom), Infor (United States), JDA Software Group (United States), Acumatica (United States), ADS Solutions (United States), Agnitech (United States), Cadre Software (United States), Cloud 9 ERP Solutions (United States), Data-Basics (United States), DDI System (United States), Distribution One (United States), Epicor (United States), Fishbowl (United States), FlowTrac (United States), Syncron (United States), Vormittag Associates (United States), AccSoft Business Solutions (Canada), Blue Link Associates (Canada), inFlow Inventory Software (Canada), Exact (Netherlands), ECOUNT (South Korea), Fasttrack Solutions (Australia), JCurve Solutions (Australia), SYSPRO (South Africa), and Other Major Players.

The Distribution Software Market is segmented into Type, Enterprise Size, End-User, and region. By Type, the market is categorized into Cloud-based and on-premises. By Enterprise Size, the market is categorized into Small and Medium Enterprise, Large Enterprise. By End-user, the market is categorized into IT and Telecommunication, Healthcare, Government, Manufacturing, Retail and e-commerce, Transportation and Logistics. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Distribution software refers to software that manages everything from order processing and inventory control to accounting, purchasing and customer service, supply chain management, sales, customer relationship management, and finance management. The distribution software market is gaining traction due to the growing need for efficient inventory management and the development of advanced technologies such as artificial intelligence and machine learning.

Global Distribution Software Market Size Was Valued At USD 25.87 Billion In 2022 And Is Projected To Reach USD 54.65 Billion By 2030, Growing At A CAGR Of 9.8% From 2022 To 2030.