Global Data Integration Market Overview

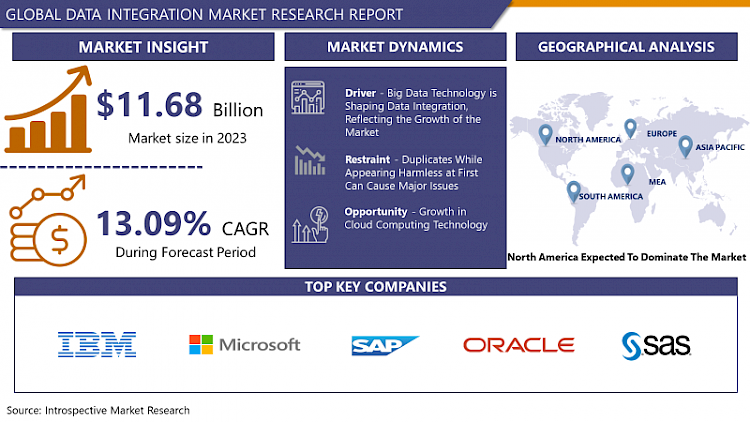

The Global Data Integration Market size is expected to grow from USD 11.68 billion in 2023 to USD 35.34 billion by 2032, at a CAGR of 13.09% during the forecast period (2024-2032).

Data integration software combines data from several sources to provide users with a unified picture of the information. The need for diverse applications that can access, link, utilize and integrate several heterogeneous information repositories and sources has increased dramatically in recent years (including knowledge bases, databases, file systems, information retrievals systems, digital libraries, and electronic mail systems). In the search for an ultimate information integration system for data integration and integrity software, a variety of strategies have been proposed and accepted. Data integration and integrity software sharing must take place inside a well-defined governance procedure and legal framework, using suitable technology. This assures data security as well as the data integration and management staff's capacity.

Because of the increase in new start-ups, expansion of established firms, and the changing nature of enterprises, the adoption rate is increasing. Cloud-based services are becoming more popular among new start-ups as a sophisticated deployment methodology. Due to significant improvements in AI, learning algorithms, and software development, the industry is expected to evolve in the future. However, the market's growth is hampered by a lack of standards, competence, and management strategy in the business, and the process of combining data spread across several systems, sources, and silos are difficult.

Market Dynamics and Factors For Data Integration:

Drivers

Big data technology is shaping data integration, reflecting the growth of the market.

Data Integration is a growing need for companies with massive customer and client bases. Organizations are encountering several issues in dealing with fast-rising data sources as their client base grows and they expand into new regions and industries. Organizations have begun to see the benefits of fully utilizing big data and are investing in big data technologies, including data integration, as a result of the introduction of big data technology. Internal data sources such as Enterprise Resource Planning (ERP), Customer Relationship Management (CRM), financial transactions from various departments, and external data sources such as online and cloud data sources, which are establishing many information silos, are among the rising data sources. Traditional technologies are increasingly insufficient to gather and integrate data and combine these information silos, requiring enhanced data integration solutions to enable organizations to combine these information silos and gain useful business insights. Modern data integration systems, including sophisticated transformation tools supplied by various vendors, come with advanced capabilities like data capture, data profiling, data quality, data governance, and metadata management to handle data post-integration, resulting in seamless and reliable data extraction.

Restraints

Over 92 percent of firms are aware that their systems contain duplicate data. Duplicates, while appearing harmless at first, can cause major issues in the long run. The bigger the danger to a firm, the more duplicate data it has. In the system, true data identification becomes a time-consuming and manpower-intensive operation. The majority of the time, these duplicates are caused by a 'silo mindset' issue. Duplicates and inexplicable variances become the norm in data integration pipelines if teams don't exchange data and communicate properly, which is a limiting constraint in the Data Integration Market.

Opportunities

The need for cloud computing technology is increasing every day because it enables enterprises to collect data from a variety of sources, including linked distant sensors, dispersed servers, and the web, and derive important business insights from it. Organizations require powerful big data integration solutions to gather and integrate this huge volume of data acquired from diverse internal and external sources, as well as to unite information silos. These technologies may quickly adapt to the needs of enterprises, allowing them to fully use their data pool by merging cloud data with on-premise data transported to the cloud. Organizations are favoring cloud deployments over on-premises installations following the COVID-19 epidemic and worldwide lockdown. As a result, enterprises have been forced to change their data management methods and embrace data integration techniques, creating a huge potential for the data integration industry to develop and thrive.

Challenges

To deliver projects efficiently, an organization's data integration and management methods must be aligned with its business strategy. However, because there are various departments in a business, and separate departments have distinct data integration requirements based on their information silos, enterprises frequently fail in their enterprise-level planning. For efficient enterprise-level planning, a business needs a consistent data integration approach. Data integration channels are frequently duplicated in organizations. They employ several versions of the same items or apply multiple tools and techniques for the same task. As a result, comprehensive enterprise-level planning and deployment of standards in data integration and management strategies are critical for enterprises to enhance productivity at all levels and departments.

Market Segmentation

By Component, the Services segment is dominating the Data Integration Market. This is because of the growing need to combine several heterogeneous data sources along with the rise of cloud computing, thereby creating demand for effective data integration tools and services. The service segment has seen significant demand from small and medium-sized businesses due to expansion and a growing customer base. However, Large enterprise dominates the demand for data integration services. Also, data integration services for government agencies are pushing the market further. Government agencies have enormous public data which required to be filtered, managed, sorted, and integrate. Such demand from government bodies creates long-term demand in the market. For instance, FedRAMP from Informatica is designed for Government agencies to data-driven integrated solutions for better data handling. Therefore, the service segment is expected to be dominating in the Data Integration Market.

By Deployment Model, on-premises is dominating in the deployment segment of the Data Integration Market. On premises, deployment is the most used method of opting for data integration service. On-premises solutions are the software that is installed and maintained by the customer or enterprise itself instead of relying on service-providing companies to operate on behalf of them. One of the advantages of on-premises deployment is the operations and data maintenance is controlled by the enterprise itself. Therefore, impromptu changes and requirement can be sought out within the organization which saves time and improve productivity. On premises, deployment is expected to gain more momentum in the coming years.

By Enterprise Size, Large Enterprises dominate the segment in Data Integration Market. Large enterprises are in the need of sophisticated data integration solutions. Companies with massive customer and client information that need to secure on their platform in a well-segregated manner opt for the data integration tools such as Oracle GoldenGate, AWS Glue, SQL Server Integration Services (SSIS) by Microsoft and Informatica PowerCenter. These tools are highly capable to provide seamless data integration and warehouse solutions for large enterprises. Currently, E-commerce companies are in major need of data management and integration due to multi-domain integration such as customer data, payment gateway process, and information as well as product-related data which is required to be up to data and integrated. Hence, large enterprises are expected to generate more demand in Data Integration Market.

By Industry Vertical, BFSI is dominating the Data Integration Market and projected to be the fastest-growing segment by industry vertical. At present, financial firms face certain issues in manual processing systems related to costs and time management. Also, customers take a lot of time to gather relevant documents in many cases. In recent years banking and finance sectors have become more focused on online presence related to customer data as well as market-sensitive data. Data Integration tools allow BFSI companies to store, manage and transfer their sensitive data on a cloud-based platform which provides bomber security to data. Also, to improve customer experience and streamline the process, the adoption rate of data integration and integrity in the BFSI Sector is attributed to the growth of the market.

Players Covered in Data Integration market are :

- IBM(US)

- Microsoft (US)

- SAP(Germany)

- Oracle (US)

- SAS Institute (US)

- Talend (US)

- Informatica (US)

- Precisely (US)

- Software AG(Germany)

- Salesforce (US)

- Qlik (US)

- Tibco (US) and other major players.

Regional Analysis of Data Integration Market

North America is dominating the Data Integration Market. One of the primary driving drivers for the big data industry in the United States is the increase in data collecting from unstructured sources. The high-demand sectors, such as public utilities, are responsible for the market's growth. As more government agencies use mobile, social media, and weblogs to do business, these apps and websites are responsible for creating massive amounts of data daily. This information is used to provide business insights and projections. As a result, data integration technologies assist the US market in gaining a competitive advantage by gathering, translating, and analyzing raw data from a variety of sources into useful business information. The Canadian Big Data and Analytics market is predicted to develop at a CAGR of 9.4%, according to market analysis. Big data technologies are one of the top software investment goals for Canadian firms to draw useful insights and automate processes. Big data subsequently reflected on the structured data integration methods in various verticals. Experts feel that the introduction of big data and analytics is laying the groundwork for the future acceptance of AI-related technology.

The Asia Pacific is the fastest-growing region in Data Integration Market. Countries like China, Japan, India are considered to be IT enabling countries in Asia Pacific Region. The large population in the region generates the demand for sophisticated data integration and data warehouse solutions. The key factors of this market are – a sudden rise in the application of social media to study the customer behavior pattern by the businesses to make their strategies more effective. The growth in the amount of transitional information also acts as a driver for accelerating the data integration market in Japan. The big data sector in China will continue to depict steady expansion by 2028. Policy support and technology integration are major factors driving this growth. Due to the growing adoption of big data technology, data integration became more effective and safer which led to demand generating factors for Data Integration Market. Observing the up-surging graph of big data, the report predicts that AI platforms will become the third-largest sub-market of the overall big data industry by 2028 while replacing commercial services.

Key Developments of Data Integration Market

- In January 2024, Microsoft introduced new AI and data solutions for retailers, enabling personalized shopping experiences, empowering store associates, and unifying retail data. These solutions include copilot templates on Azure OpenAI Service, retail data solutions in Microsoft Fabric, copilot features in Microsoft Dynamics 365 Customer Insights, and the launch of Retail Media Creative Studio in the Microsoft Retail Media Platform. These new capabilities provide retailers with more options to enhance copilot experiences throughout the shopper journey.

- In November 2023, IBM announced that it has been working with Amazon Web Services (AWS) on the general availability of Amazon Relational Database Service (Amazon RDS) for Db2, a fully managed cloud offering designed to make it easier for database customers to manage data for artificial intelligence (AI) workloads across hybrid cloud environments.

|

Global Data Integration Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 11.68 Bn. |

|

Forecast Period 2024-32 CAGR: |

13.09% |

Market Size in 2032: |

USD 35.34 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Deployment Model |

|

||

|

By Enterprise Size |

|

||

|

By Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Component

3.2 By Deployment Model

3.3 By Enterprise Size

3.4 By Industry

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Data Integration Market by Component

5.1 Data Integration Market Overview Snapshot and Growth Engine

5.2 Data Integration Market Overview

5.3 Solutions

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Solutions: Grographic Segmentation

5.4 Services

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Services: Grographic Segmentation

Chapter 6: Data Integration Market by Deployment Model

6.1 Data Integration Market Overview Snapshot and Growth Engine

6.2 Data Integration Market Overview

6.3 On-Premises

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 On-Premises: Grographic Segmentation

6.4 On-Demand

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 On-Demand: Grographic Segmentation

Chapter 7: Data Integration Market by Enterprise Size

7.1 Data Integration Market Overview Snapshot and Growth Engine

7.2 Data Integration Market Overview

7.3 Large Enterprises

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Large Enterprises: Grographic Segmentation

7.4 SMEs

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 SMEs: Grographic Segmentation

Chapter 8: Data Integration Market by Industry

8.1 Data Integration Market Overview Snapshot and Growth Engine

8.2 Data Integration Market Overview

8.3 BFSI

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size (2016-2028F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 BFSI: Grographic Segmentation

8.4 Healthcare

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size (2016-2028F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Healthcare: Grographic Segmentation

8.5 IT & Telecom

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size (2016-2028F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 IT & Telecom: Grographic Segmentation

8.6 Others

8.6.1 Introduction and Market Overview

8.6.2 Historic and Forecasted Market Size (2016-2028F)

8.6.3 Key Market Trends, Growth Factors and Opportunities

8.6.4 Others: Grographic Segmentation

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Positioning

9.1.2 Data Integration Sales and Market Share By Players

9.1.3 Industry BCG Matrix

9.1.4 Ansoff Matrix

9.1.5 Data Integration Industry Concentration Ratio (CR5 and HHI)

9.1.6 Top 5 Data Integration Players Market Share

9.1.7 Mergers and Acquisitions

9.1.8 Business Strategies By Top Players

9.2 IBM

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Operating Business Segments

9.2.5 Product Portfolio

9.2.6 Business Performance

9.2.7 Key Strategic Moves and Recent Developments

9.2.8 SWOT Analysis

9.3 MICROSOFT

9.4 SAP

9.5 ORACLE

9.6 SAS INSTITUTE

9.7 TALEND

9.8 INFORMATICA

9.9 PRECISELY

9.10 SOFTWARE AG

9.11 SALESFORCE

9.12 QLIK

9.13 OTHER MAJOR PLAYERS

Chapter 10: Global Data Integration Market Analysis, Insights and Forecast, 2016-2028

10.1 Market Overview

10.2 Historic and Forecasted Market Size By Component

10.2.1 Solutions

10.2.2 Services

10.3 Historic and Forecasted Market Size By Deployment Model

10.3.1 On-Premises

10.3.2 On-Demand

10.4 Historic and Forecasted Market Size By Enterprise Size

10.4.1 Large Enterprises

10.4.2 SMEs

10.5 Historic and Forecasted Market Size By Industry

10.5.1 BFSI

10.5.2 Healthcare

10.5.3 IT & Telecom

10.5.4 Others

Chapter 11: North America Data Integration Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Component

11.4.1 Solutions

11.4.2 Services

11.5 Historic and Forecasted Market Size By Deployment Model

11.5.1 On-Premises

11.5.2 On-Demand

11.6 Historic and Forecasted Market Size By Enterprise Size

11.6.1 Large Enterprises

11.6.2 SMEs

11.7 Historic and Forecasted Market Size By Industry

11.7.1 BFSI

11.7.2 Healthcare

11.7.3 IT & Telecom

11.7.4 Others

11.8 Historic and Forecast Market Size by Country

11.8.1 U.S.

11.8.2 Canada

11.8.3 Mexico

Chapter 12: Europe Data Integration Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Component

12.4.1 Solutions

12.4.2 Services

12.5 Historic and Forecasted Market Size By Deployment Model

12.5.1 On-Premises

12.5.2 On-Demand

12.6 Historic and Forecasted Market Size By Enterprise Size

12.6.1 Large Enterprises

12.6.2 SMEs

12.7 Historic and Forecasted Market Size By Industry

12.7.1 BFSI

12.7.2 Healthcare

12.7.3 IT & Telecom

12.7.4 Others

12.8 Historic and Forecast Market Size by Country

12.8.1 Germany

12.8.2 U.K.

12.8.3 France

12.8.4 Italy

12.8.5 Russia

12.8.6 Spain

12.8.7 Rest of Europe

Chapter 13: Asia-Pacific Data Integration Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Component

13.4.1 Solutions

13.4.2 Services

13.5 Historic and Forecasted Market Size By Deployment Model

13.5.1 On-Premises

13.5.2 On-Demand

13.6 Historic and Forecasted Market Size By Enterprise Size

13.6.1 Large Enterprises

13.6.2 SMEs

13.7 Historic and Forecasted Market Size By Industry

13.7.1 BFSI

13.7.2 Healthcare

13.7.3 IT & Telecom

13.7.4 Others

13.8 Historic and Forecast Market Size by Country

13.8.1 China

13.8.2 India

13.8.3 Japan

13.8.4 Singapore

13.8.5 Australia

13.8.6 New Zealand

13.8.7 Rest of APAC

Chapter 14: Middle East & Africa Data Integration Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Component

14.4.1 Solutions

14.4.2 Services

14.5 Historic and Forecasted Market Size By Deployment Model

14.5.1 On-Premises

14.5.2 On-Demand

14.6 Historic and Forecasted Market Size By Enterprise Size

14.6.1 Large Enterprises

14.6.2 SMEs

14.7 Historic and Forecasted Market Size By Industry

14.7.1 BFSI

14.7.2 Healthcare

14.7.3 IT & Telecom

14.7.4 Others

14.8 Historic and Forecast Market Size by Country

14.8.1 Turkey

14.8.2 Saudi Arabia

14.8.3 Iran

14.8.4 UAE

14.8.5 Africa

14.8.6 Rest of MEA

Chapter 15: South America Data Integration Market Analysis, Insights and Forecast, 2016-2028

15.1 Key Market Trends, Growth Factors and Opportunities

15.2 Impact of Covid-19

15.3 Key Players

15.4 Key Market Trends, Growth Factors and Opportunities

15.4 Historic and Forecasted Market Size By Component

15.4.1 Solutions

15.4.2 Services

15.5 Historic and Forecasted Market Size By Deployment Model

15.5.1 On-Premises

15.5.2 On-Demand

15.6 Historic and Forecasted Market Size By Enterprise Size

15.6.1 Large Enterprises

15.6.2 SMEs

15.7 Historic and Forecasted Market Size By Industry

15.7.1 BFSI

15.7.2 Healthcare

15.7.3 IT & Telecom

15.7.4 Others

15.8 Historic and Forecast Market Size by Country

15.8.1 Brazil

15.8.2 Argentina

15.8.3 Rest of SA

Chapter 16 Investment Analysis

Chapter 17 Analyst Viewpoint and Conclusion

|

Global Data Integration Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 11.68 Bn. |

|

Forecast Period 2024-32 CAGR: |

13.09% |

Market Size in 2032: |

USD 35.34 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Deployment Model |

|

||

|

By Enterprise Size |

|

||

|

By Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. DATA INTEGRATION MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. DATA INTEGRATION MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. DATA INTEGRATION MARKET COMPETITIVE RIVALRY

TABLE 005. DATA INTEGRATION MARKET THREAT OF NEW ENTRANTS

TABLE 006. DATA INTEGRATION MARKET THREAT OF SUBSTITUTES

TABLE 007. DATA INTEGRATION MARKET BY COMPONENT

TABLE 008. SOLUTIONS MARKET OVERVIEW (2016-2028)

TABLE 009. SERVICES MARKET OVERVIEW (2016-2028)

TABLE 010. DATA INTEGRATION MARKET BY DEPLOYMENT MODEL

TABLE 011. ON-PREMISES MARKET OVERVIEW (2016-2028)

TABLE 012. ON-DEMAND MARKET OVERVIEW (2016-2028)

TABLE 013. DATA INTEGRATION MARKET BY ENTERPRISE SIZE

TABLE 014. LARGE ENTERPRISES MARKET OVERVIEW (2016-2028)

TABLE 015. SMES MARKET OVERVIEW (2016-2028)

TABLE 016. DATA INTEGRATION MARKET BY INDUSTRY

TABLE 017. BFSI MARKET OVERVIEW (2016-2028)

TABLE 018. HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 019. IT & TELECOM MARKET OVERVIEW (2016-2028)

TABLE 020. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 021. NORTH AMERICA DATA INTEGRATION MARKET, BY COMPONENT (2016-2028)

TABLE 022. NORTH AMERICA DATA INTEGRATION MARKET, BY DEPLOYMENT MODEL (2016-2028)

TABLE 023. NORTH AMERICA DATA INTEGRATION MARKET, BY ENTERPRISE SIZE (2016-2028)

TABLE 024. NORTH AMERICA DATA INTEGRATION MARKET, BY INDUSTRY (2016-2028)

TABLE 025. N DATA INTEGRATION MARKET, BY COUNTRY (2016-2028)

TABLE 026. EUROPE DATA INTEGRATION MARKET, BY COMPONENT (2016-2028)

TABLE 027. EUROPE DATA INTEGRATION MARKET, BY DEPLOYMENT MODEL (2016-2028)

TABLE 028. EUROPE DATA INTEGRATION MARKET, BY ENTERPRISE SIZE (2016-2028)

TABLE 029. EUROPE DATA INTEGRATION MARKET, BY INDUSTRY (2016-2028)

TABLE 030. DATA INTEGRATION MARKET, BY COUNTRY (2016-2028)

TABLE 031. ASIA PACIFIC DATA INTEGRATION MARKET, BY COMPONENT (2016-2028)

TABLE 032. ASIA PACIFIC DATA INTEGRATION MARKET, BY DEPLOYMENT MODEL (2016-2028)

TABLE 033. ASIA PACIFIC DATA INTEGRATION MARKET, BY ENTERPRISE SIZE (2016-2028)

TABLE 034. ASIA PACIFIC DATA INTEGRATION MARKET, BY INDUSTRY (2016-2028)

TABLE 035. DATA INTEGRATION MARKET, BY COUNTRY (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA DATA INTEGRATION MARKET, BY COMPONENT (2016-2028)

TABLE 037. MIDDLE EAST & AFRICA DATA INTEGRATION MARKET, BY DEPLOYMENT MODEL (2016-2028)

TABLE 038. MIDDLE EAST & AFRICA DATA INTEGRATION MARKET, BY ENTERPRISE SIZE (2016-2028)

TABLE 039. MIDDLE EAST & AFRICA DATA INTEGRATION MARKET, BY INDUSTRY (2016-2028)

TABLE 040. DATA INTEGRATION MARKET, BY COUNTRY (2016-2028)

TABLE 041. SOUTH AMERICA DATA INTEGRATION MARKET, BY COMPONENT (2016-2028)

TABLE 042. SOUTH AMERICA DATA INTEGRATION MARKET, BY DEPLOYMENT MODEL (2016-2028)

TABLE 043. SOUTH AMERICA DATA INTEGRATION MARKET, BY ENTERPRISE SIZE (2016-2028)

TABLE 044. SOUTH AMERICA DATA INTEGRATION MARKET, BY INDUSTRY (2016-2028)

TABLE 045. DATA INTEGRATION MARKET, BY COUNTRY (2016-2028)

TABLE 046. IBM: SNAPSHOT

TABLE 047. IBM: BUSINESS PERFORMANCE

TABLE 048. IBM: PRODUCT PORTFOLIO

TABLE 049. IBM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. MICROSOFT: SNAPSHOT

TABLE 050. MICROSOFT: BUSINESS PERFORMANCE

TABLE 051. MICROSOFT: PRODUCT PORTFOLIO

TABLE 052. MICROSOFT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. SAP: SNAPSHOT

TABLE 053. SAP: BUSINESS PERFORMANCE

TABLE 054. SAP: PRODUCT PORTFOLIO

TABLE 055. SAP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. ORACLE: SNAPSHOT

TABLE 056. ORACLE: BUSINESS PERFORMANCE

TABLE 057. ORACLE: PRODUCT PORTFOLIO

TABLE 058. ORACLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. SAS INSTITUTE: SNAPSHOT

TABLE 059. SAS INSTITUTE: BUSINESS PERFORMANCE

TABLE 060. SAS INSTITUTE: PRODUCT PORTFOLIO

TABLE 061. SAS INSTITUTE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. TALEND: SNAPSHOT

TABLE 062. TALEND: BUSINESS PERFORMANCE

TABLE 063. TALEND: PRODUCT PORTFOLIO

TABLE 064. TALEND: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. INFORMATICA: SNAPSHOT

TABLE 065. INFORMATICA: BUSINESS PERFORMANCE

TABLE 066. INFORMATICA: PRODUCT PORTFOLIO

TABLE 067. INFORMATICA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. PRECISELY: SNAPSHOT

TABLE 068. PRECISELY: BUSINESS PERFORMANCE

TABLE 069. PRECISELY: PRODUCT PORTFOLIO

TABLE 070. PRECISELY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. SOFTWARE AG: SNAPSHOT

TABLE 071. SOFTWARE AG: BUSINESS PERFORMANCE

TABLE 072. SOFTWARE AG: PRODUCT PORTFOLIO

TABLE 073. SOFTWARE AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. SALESFORCE: SNAPSHOT

TABLE 074. SALESFORCE: BUSINESS PERFORMANCE

TABLE 075. SALESFORCE: PRODUCT PORTFOLIO

TABLE 076. SALESFORCE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. QLIK: SNAPSHOT

TABLE 077. QLIK: BUSINESS PERFORMANCE

TABLE 078. QLIK: PRODUCT PORTFOLIO

TABLE 079. QLIK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 080. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 081. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 082. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. DATA INTEGRATION MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. DATA INTEGRATION MARKET OVERVIEW BY COMPONENT

FIGURE 012. SOLUTIONS MARKET OVERVIEW (2016-2028)

FIGURE 013. SERVICES MARKET OVERVIEW (2016-2028)

FIGURE 014. DATA INTEGRATION MARKET OVERVIEW BY DEPLOYMENT MODEL

FIGURE 015. ON-PREMISES MARKET OVERVIEW (2016-2028)

FIGURE 016. ON-DEMAND MARKET OVERVIEW (2016-2028)

FIGURE 017. DATA INTEGRATION MARKET OVERVIEW BY ENTERPRISE SIZE

FIGURE 018. LARGE ENTERPRISES MARKET OVERVIEW (2016-2028)

FIGURE 019. SMES MARKET OVERVIEW (2016-2028)

FIGURE 020. DATA INTEGRATION MARKET OVERVIEW BY INDUSTRY

FIGURE 021. BFSI MARKET OVERVIEW (2016-2028)

FIGURE 022. HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 023. IT & TELECOM MARKET OVERVIEW (2016-2028)

FIGURE 024. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 025. NORTH AMERICA DATA INTEGRATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. EUROPE DATA INTEGRATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. ASIA PACIFIC DATA INTEGRATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. MIDDLE EAST & AFRICA DATA INTEGRATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. SOUTH AMERICA DATA INTEGRATION MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Data Integration Market research report is 2024-2032.

IBM(US), Microsoft (US), SAP(Germany), Oracle (US), SAS Institute (US), Talend (US), Informatica (US), Precisely (US), Software AG(Germany), Salesforce (US), Qlik (US), Tibco (US), and other major players.

The Data Integration Market is segmented into Component, Deployment Model, Enterprise Size, Industry, and region. By Component, the market is categorized into Tools (Solutions), Services. By Deployment Model, the market is categorized into On-Premises, On-Demand. By Enterprise Size, the market is categorized into Large Enterprises, SMEs. By Industry, the market is categorized into BFSI, Healthcare, IT & Telecom, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Data integration software combines data from several sources to provide users with a unified picture of the information.

The Global Data Integration Market size is expected to grow from USD 11.68 billion in 2023 to USD 35.34 billion by 2032, at a CAGR of 13.09% during the forecast period (2024-2032).