Key Market Highlights

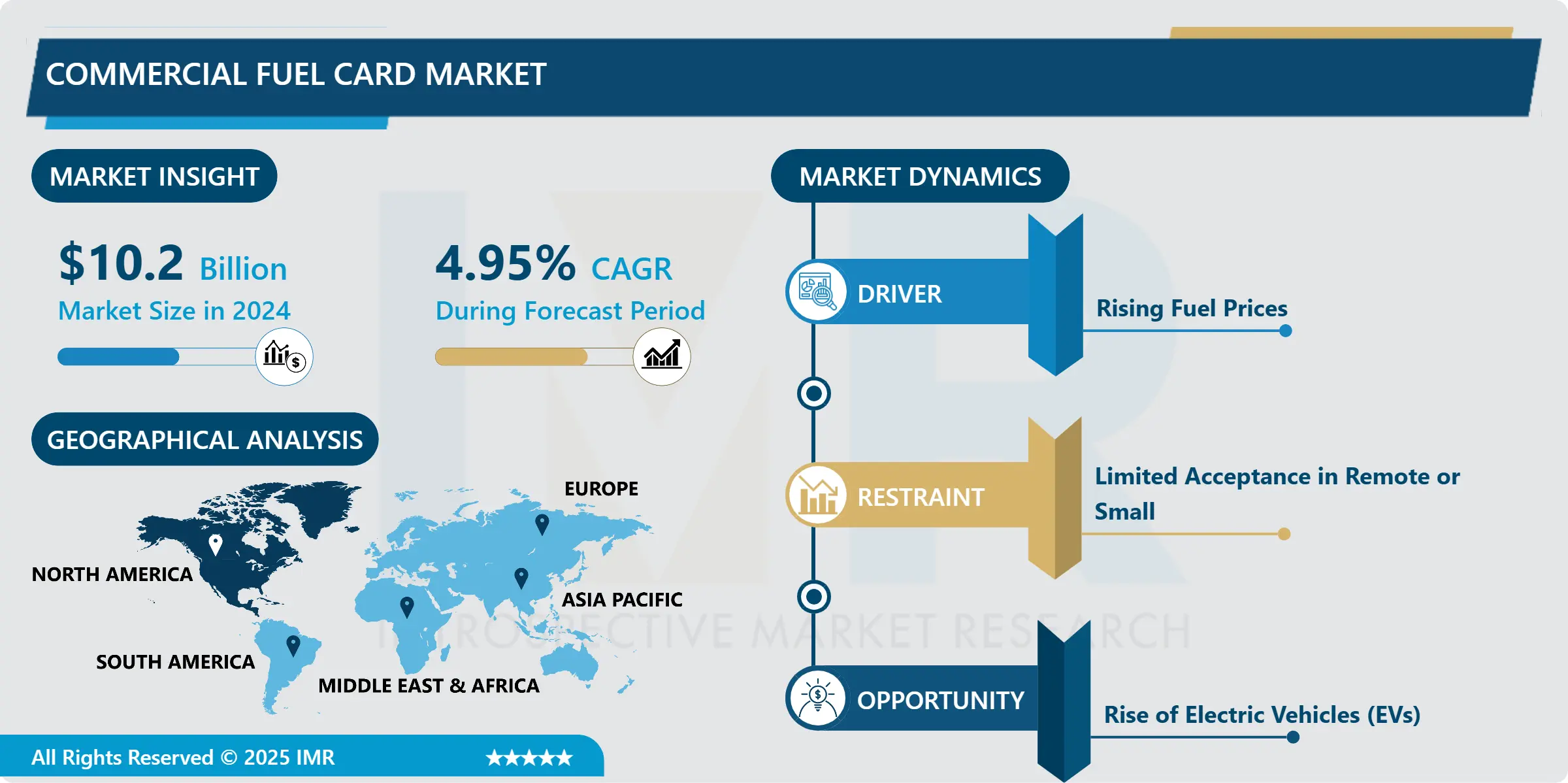

Commercial Fuel Card Market Size Was Valued at USD 10.2 Billion in 2024, and is Projected to Reach USD 17.35 Billion by 2035, Growing at a CAGR of 4.95 % from 2025-2035.

- Market Size in 2024: USD 10.2 Billion

- Projected Market Size by 2035: USD 17.35 Billion

- CAGR (2025–2035): 4.95 %

- Leading Market in 2024: North American

- Fastest-Growing Market: East Asia

- By Vehicle Type: The Light fleet vehicles segment is anticipated to lead the market by accounting for 40.03% of the market share throughout the forecast period.

- By Application: The Fuel Refill segment is expected to capture 55.6%.of the market share, thereby maintaining its dominance over the forecast period.

- By Region: North America region is projected to hold 40.1% of the market share during the forecast period.

- Active Players: Allstar Business Solutions (UK), Barclays (UK), BP p.l.c. (UK), Chevron Corporation (USA), Circle K Stores, Inc. (USA), and Other Active Players.

Commercial Fuel Card Market Synopsis:

A fuel card lets businesses pay for fuel and vehicle services while tracking expenses in real time. Unlike regular cards, it offers spending limits, PIN security, and usage controls. The market is growing fast due to rising fuel costs and digital tech like GPS, AI, and mobile apps that improve fleet efficiency and prevent fraud.

Commercial Fuel Card Market Dynamics and Trend Analysis:

Commercial Fuel Card Market Growth Driver- Rising Fuel Prices

-

Fuel prices are going up in many parts of the world. This increase makes it harder for businesses that rely on vehicles like delivery companies, transport services, and construction firms to keep their costs under control. Every extra dollar spent on fuel can impact profits, especially for companies with large fleets. To manage these rising fuel costs, many businesses are now using fuel cards. A fuel card is a special type of payment card that drivers can use to buy fuel. It works like a credit card but is made just for fuel and vehicle-related expenses.

- Fuel cards help companies track every fuel purchase in real time. Business owners or fleet managers can see how much fuel each driver is buying, where they are buying it, and when. This helps them spot unusual activity, like fuel theft or unnecessary refuelling. With this information, businesses can reduce waste and make better decisions about routes, vehicle use, and driver behaviour. Fuel cards also allow businesses to set spending limits, control fuel types (like diesel or petrol), and avoid personal purchases. By managing fuel use more closely, companies can reduce their overall fuel expenses even when prices are high.

- In short, as fuel prices continue to rise, businesses are turning to fuel cards as a smart and simple way to save money and run their operations more efficiently. This is one of the main reasons the fuel card market is growing. ?

Commercial Fuel Card Market Limiting Factor - Limited Acceptance in Remote or Small

-

One of the biggest limiting factors in the growth of the commercial fuel card market is limited acceptance in small towns and remote areas. While fuel cards are widely accepted at major fuel station chains, they are not always accepted at smaller or independently owned fuel stations. These stations are often found in rural regions or along less-travelled routes.

- The main reason is that these smaller stations may not have the proper technology or systems to process fuel cards. Many of them still use older payment machines that are not compatible with digital or commercial card systems. Because of this, fleet drivers who are traveling in remote areas may not be able to use their fuel cards. This causes inconvenience and forces businesses to carry extra cash or allow other forms of payment, which reduces the control and benefits that fuel cards usually offer.

- For companies that operate in the logistics, transport, or delivery sectors especially those covering long distances this becomes a serious challenge. If drivers cannot use fuel cards everywhere, businesses lose real-time tracking, spending limits, and fraud protection.

- Until fuel card providers expand their network or more stations upgrade their systems, limited acceptance in these areas will continue to slow down full adoption. This remains a key obstacle to market growth, especially in developing countries or less connected regions.

Commercial Fuel Card Market Expansion Opportunity - Rise of Electric Vehicles (EVs)

-

The growing shift toward electric vehicles (EVs) presents a major expansion opportunity for the commercial fuel card market. As more companies look to reduce fuel costs and cut down on emissions, many are adding electric vehicles to their fleets. This includes delivery vans, service vehicles, and company cars.

- Fuel card providers have a chance to grow by adapting their services to support these changes. Traditionally, fuel cards are used to purchase petrol or diesel, but with the rise of EVs, there is a need for EV-compatible payment solutions. By offering cards that can be used at EV charging stations, providers can remain relevant and useful to modern businesses.

- In addition to payments, these cards can also help businesses track electricity usage, monitor charging costs, and manage EV-related data, just like they do for fuel-powered vehicles. This helps companies control expenses, plan better, and make smarter decisions for their electric fleets.

- As governments push for cleaner transportation and offer incentives for using EVs, more businesses will likely follow this trend. Fuel card companies that quickly adjust to this new demand can attract new customers, retain existing ones, and play a key role in the green transportation movement. The rise of EVs is not a threat but a valuable opportunity for growth and innovation in the fuel card industry.

Commercial Fuel Card Market Challenge and Risk - Data Security and Fraud

-

One of the most serious challenges in the commercial fuel card market is the issue of data security and fraud. Fuel cards are widely used by businesses to manage fuel expenses, but they also carry sensitive financial and driver information. If this data is not properly protected, it becomes a target for hackers and fraudsters. Weak security systems can lead to card misuse, unauthorized transactions, or even large-scale cyberattacks. For example, someone might steal a card number and use it to make fake purchases, costing the business money. In some cases, entire systems can be hacked, exposing the data of many customers at once.

- Such incidents can result in financial loss, disruption to operations, and a loss of trust between the customer and the fuel card provider. This is especially risky for companies with large fleets, where one security breach can affect many vehicles and employees. To reduce these risks, fuel card providers must invest in strong cybersecurity measures, such as encrypted transactions, real-time fraud alerts, PIN protection, and regular system updates. They must also educate customers and drivers about safe card use.

- As fuel card systems become more digital and connected, the need for robust security becomes even more important. Without it, the market could face serious trust and safety issues that slow down its growth.

Commercial Fuel Card Market Segment Analysis:

Commercial Fuel Card Market is segmented based on Type, Application, End-Users, and Region

By Type, Commercial Fuel Card Segment is Expected to Dominate the Market During the Forecast Period

-

The light fleet segment in the commercial fuel card market includes smaller vehicles such as vans, cars, SUVs, and pickup trucks, all typically weighing under 10,000 pounds. These vehicles are often used by small to medium-sized businesses, service providers, repair companies, and delivery services. This segment is growing quickly because more businesses are using light vehicles for daily operations, customer visits, and local deliveries. Unlike heavy trucks, light fleets are easier to manage, cheaper to maintain, and more fuel-efficient. As the demand for fast delivery and mobile services increases, the number of light fleet vehicles is also rising.

- Fuel cards are becoming very useful for companies that operate light fleets. They allow business owners to track fuel spending, set spending limits, and monitor vehicle use. Cards also help prevent misuse, such as drivers using fuel money for personal reasons. By using fuel cards, companies gain better control over their expenses and improve their fleet management.

- Light fleet operators also benefit from digital tools like mobile apps, GPS tracking, and real-time reporting. These features make it easier to plan routes, reduce fuel waste, and improve driver efficiency. Because of these advantages, the light fleet segment is expected to play a key role in the future growth of the fuel card market. It is becoming one of the most important areas for fuel card providers.

By Application, Commercial Fuel Card Segment Held the Largest Share of 55.6%.in 2024

-

One important application of commercial fuel cards is vehicle service. This includes paying for regular maintenance tasks such as oil changes, engine checks, brake repairs, tire replacements, and other scheduled services. Keeping vehicles in good condition is essential for fleet operations, as it helps avoid breakdowns and reduces long-term costs.

- Fuel cards that support vehicle service allow businesses to easily pay for repairs and maintenance at authorized service centres. Instead of using cash or personal cards, drivers can use the company-issued fuel card to cover these expenses. This makes the process more organized and easier to track. Using fuel cards for vehicle servicing also gives fleet managers better control over how money is spent. They can monitor maintenance costs for each vehicle, set spending limits, and receive real-time reports. This helps spot issues early, plan future services, and ensure that all vehicles are maintained on schedule.

- In many cases, fuel card providers partner with service networks, giving businesses access to discounts and preferred pricing at selected garages and workshops. This helps companies save money and time, while also keeping their vehicles in safe and roadworthy condition. As fleets grow and vehicles log more miles, the need for efficient, trackable maintenance spending becomes even more important making vehicle service a valuable and growing part of the fuel card market.

Commercial Fuel Card Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

-

North America is the leading region in the commercial fuel card market. This means more businesses in the U.S. and Canada are using fuel cards to manage their fleet operations compared to other regions. One big reason is that North America has a large number of commercial vehicles, including trucks, vans, and service cars. These vehicles are used by companies in transport, delivery, construction, and repair services.

- Businesses in this region are also early adopters of modern technology. They use advanced fleet management systems to track vehicles, manage fuel costs, and reduce waste. Fuel cards play a key role in this system by allowing companies to monitor where, when, and how much fuel is purchased. This helps reduce misuse and saves money.

- Leading companies like WEX and FleetCor offer strong fuel card services in North America. Their cards support not just fuel payments, but also vehicle services like maintenance and tolls. Many businesses now use mobile apps, GPS tracking (telematics), and contactless payments with their fuel cards, making the process faster and safer.

Commercial Fuel Card Market Active Players:

- Allstar Business Solutions (UK)

- Barclays (UK)

- BP p.l.c. (UK)

- Chevron Corporation (USA)

- Circle K Stores, Inc. (USA)

- Citibank (USA)

- Comdata Inc. (USA)

- Corpay, Inc. (USA)

- DKV Euro Service GmbH (Germany)

- Edenred SA (France)

- ExxonMobil Corporation (USA)

- FleetCor Technologies (USA)

- Fuelman Inc. (USA)

- HSBC (UK)

- Petro Canada Fleet Card (Canada)

- P Fleet (USA)

- Phillips 66 (USA)

- Radius Payment Solutions (UK)

- Royal Bank of Scotland (UK)

- Royal Dutch Shell (Netherlands/UK)

- RTS Financial Service, Inc. (USA)

- Suncor Energy (Canada)

- TCS Fuel (USA)

- TotalEnergies SE (France)

- TravelCenters of America (Voyager) (USA)

- U.S. Bank Voyager Fleet Systems (USA)

- Valero Energy Corporation (USA)

- Verifone (USA)

- WEX Inc. (USA)

- World Kinect Corporation (USA)

- Other Active Players

Key Industry Developments in the Commercial Fuel Card Market:

- In 2025 ExxonMobil released a new fuel card integrated with its mobile app, offering personalized rewards and increasing customer engagement by 12%. ExxonMobil launched a fuel card with app-based rewards, increasing user engagement.

- IN 2025 Shell launched a fleet-focused fuel card, providing real-time analytics and tracking to help companies reduce fuel expenses by 15%. Shell introduced a fleet-focused card offering real-time analytics, helping companies cut fuel costs by 15% through better tracking and smarter

|

Commercial Fuel Card Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 10.2 Billion |

|

Forecast Period 2025-35 CAGR: |

4.95 % |

Market Size in 2035: |

USD 17.35 Billion

|

|

Segments Covered: |

By Card Type |

|

|

|

By Vehicle Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Commercial Fuel Card Market by Card Type (2018-2035)

4.1 Commercial Fuel Card Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Branded Fuel Cards

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Universal Fuel Cards

4.5 Merchant Fuel Cards

Chapter 5: Commercial Fuel Card Market by Vehicle Type (2018-2035)

5.1 Commercial Fuel Card Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Heavy Fleet

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Light Fleet

Chapter 6: Commercial Fuel Card Market by Application (2018-2035)

6.1 Commercial Fuel Card Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Fuel Refill

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Parking

6.5 Vehicle Service

6.6 Toll Charge

6.7 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Commercial Fuel Card Market Share by Manufacturer/Service Provider(2024)

7.1.3 Industry BCG Matrix

7.1.4 PArtnerships, Mergers & Acquisitions

7.2 ALLSTAR BUSINESS SOLUTIONS (UK)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Recent News & Developments

7.2.10 SWOT Analysis

7.3 BARCLAYS (UK)

7.4 BP P.L.C. (UK)

7.5 CHEVRON CORPORATION (USA)

7.6 CIRCLE K STORES

7.7 INC. (USA)

7.8 CITIBANK (USA)

7.9 COMDATA INC. (USA)

7.10 CORPAY

7.11 INC. (USA)

7.12 DKV EURO SERVICE GMBH (GERMANY)

7.13 EDENRED SA (FRANCE)

7.14 EXXONMOBIL CORPORATION (USA)

7.15 FLEETCOR TECHNOLOGIES (USA)

7.16 FUELMAN INC. (USA)

7.17 HSBC (UK)

7.18 PETRO CANADA FLEET CARD (CANADA)

7.19 P FLEET (USA)

7.20 PHILLIPS 66 (USA)

7.21 RADIUS PAYMENT SOLUTIONS (UK)

7.22 ROYAL BANK OF SCOTLAND (UK)

7.23 ROYAL DUTCH SHELL (NETHERLANDS/UK)

7.24 RTS FINANCIAL SERVICE

7.25 INC. (USA)

7.26 SUNCOR ENERGY (CANADA)

7.27 TCS FUEL (USA)

7.28 TOTALENERGIES SE (FRANCE)

7.29 TRAVELCENTERS OF AMERICA (VOYAGER) (USA)

7.30 U.S. BANK VOYAGER FLEET SYSTEMS (USA)

7.31 VALERO ENERGY CORPORATION (USA)

7.32 VERIFONE (USA)

7.33 WEX INC. (USA)

7.34 WORLD KINECT CORPORATION (USA)

7.35 AND OTHER ACTIVE PLAYERS.

Chapter 8: Global Commercial Fuel Card Market By Region

8.1 Overview

8.2. North America Commercial Fuel Card Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecast Market Size by Country

8.2.4.1 US

8.2.4.2 Canada

8.2.4.3 Mexico

8.3. Eastern Europe Commercial Fuel Card Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecast Market Size by Country

8.3.4.1 Russia

8.3.4.2 Bulgaria

8.3.4.3 The Czech Republic

8.3.4.4 Hungary

8.3.4.5 Poland

8.3.4.6 Romania

8.3.4.7 Rest of Eastern Europe

8.4. Western Europe Commercial Fuel Card Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecast Market Size by Country

8.4.4.1 Germany

8.4.4.2 UK

8.4.4.3 France

8.4.4.4 The Netherlands

8.4.4.5 Italy

8.4.4.6 Spain

8.4.4.7 Rest of Western Europe

8.5. Asia Pacific Commercial Fuel Card Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecast Market Size by Country

8.5.4.1 China

8.5.4.2 India

8.5.4.3 Japan

8.5.4.4 South Korea

8.5.4.5 Malaysia

8.5.4.6 Thailand

8.5.4.7 Vietnam

8.5.4.8 The Philippines

8.5.4.9 Australia

8.5.4.10 New Zealand

8.5.4.11 Rest of APAC

8.6. Middle East & Africa Commercial Fuel Card Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecast Market Size by Country

8.6.4.1 Turkiye

8.6.4.2 Bahrain

8.6.4.3 Kuwait

8.6.4.4 Saudi Arabia

8.6.4.5 Qatar

8.6.4.6 UAE

8.6.4.7 Israel

8.6.4.8 South Africa

8.7. South America Commercial Fuel Card Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecast Market Size by Country

8.7.4.1 Brazil

8.7.4.2 Argentina

8.7.4.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

Chapter 10 Our Thematic Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Chapter 11 Case Study

Chapter 12 Appendix

10.1 Sources

10.2 List of Tables and figures

10.3 Short Forms and Citations

10.4 Assumption and Conversion

10.5 Disclaimer

|

Commercial Fuel Card Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 10.2 Billion |

|

Forecast Period 2025-35 CAGR: |

4.95 % |

Market Size in 2035: |

USD 17.35 Billion

|

|

Segments Covered: |

By Card Type |

|

|

|

By Vehicle Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||