Logistics Market Synopsis:

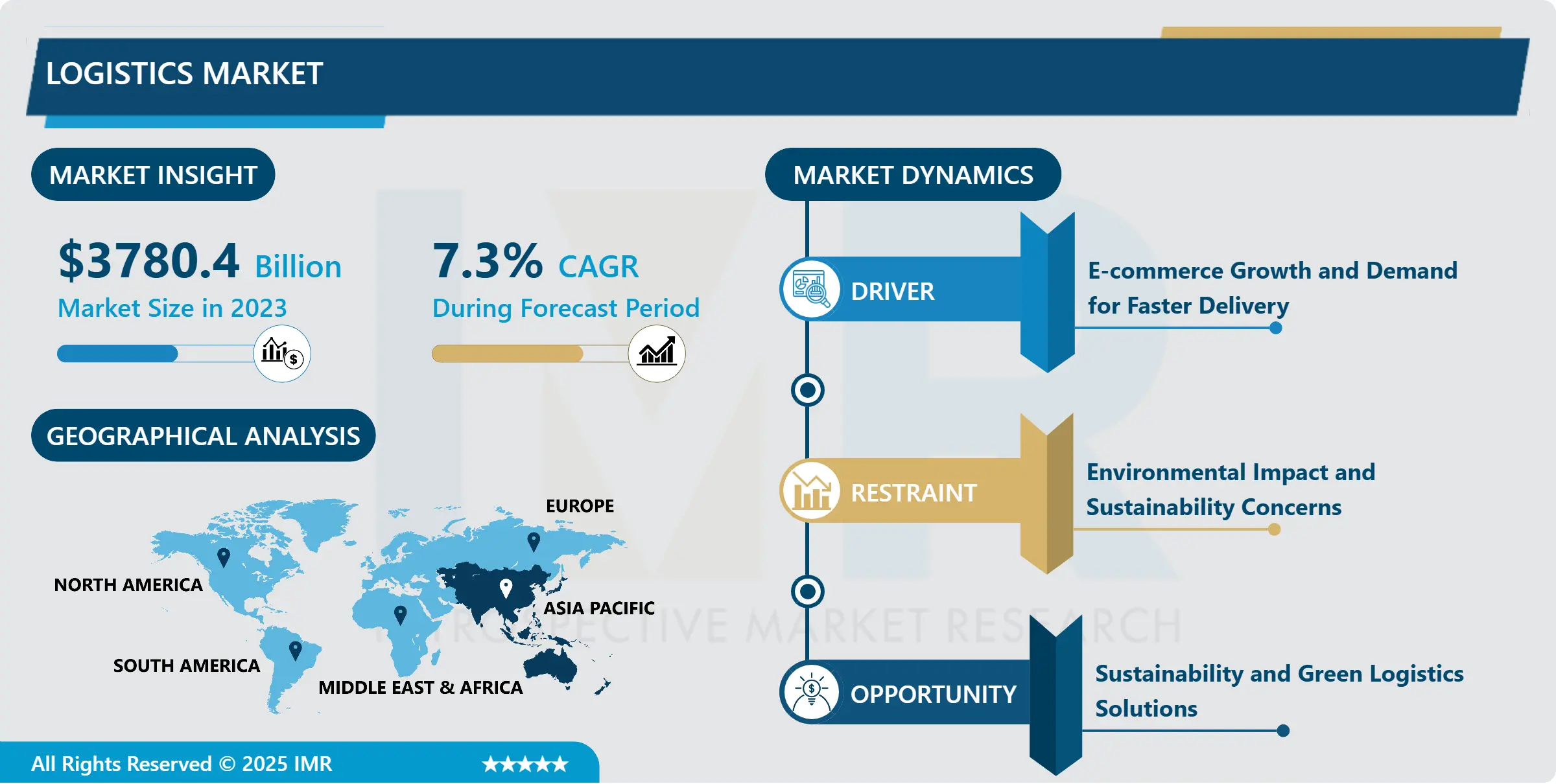

Logistics Market Size Was Valued at USD 3780.40 Billion in 2023, and is Projected to Reach USD 7126.70 Billion by 2032, Growing at a CAGR of 7.30 % From 2024-2032.

The logistics market pertains on the flow of having the products when they start from the manufacturer and up to the moment that they reach the consumer. They comprise the coordination, execution and monitoring of the transportation and storage of products, services and associated information throughout the supply network. Logistics market is essential to guarantee smooth and seamless transfer of goods and materials and is closely related with such industries as production, commerce, car manufacturing, and online sales.

The overall development of the given market is therefore stimulated by the preconditioned global trade and the emerging need for proper supply chain solutions. As various companies began penetrating borders of different countries, logistics plays a significant role in ensuring efficient flow of goods and services and information. Thirdly, there has been growing demand in faster and cheap means of transporting goods that has spurred the growth of the logistics market by many companies aiming at efficient strategies in elimination of long deivery periods.

The second force is the increasing trend in online shopping. E commerce is becoming popular with consumers as they shop online hence there is the need to have proper supply chain management so that goods can be delivered at the right time. Technological advancement in automation and artificial intelligence in the management of supply chain has equally contributed to increase efficiency, cutting down of operation cost as well as enhancement of service delivery in the logistics industry.

Logistics Market Trend Analysis:

Automation and the use of artificial intelligence

- The current trends identified in the logistics market include; automation and the use of artificial intelligence. Robotic automation operating with smart controls or auto vehicles & drones are already being used in logistics for operational effectiveness. These inventions assist in enhancement of efficiency of storing, sorting, and transporting leading to lower expenditures and shorter cycle time. It was also noted that the increase of artificial intelligence presence in logistics is aimed at increasing the effectiveness and reliability of the deliveries by offering predictive analysis, route planning and real time tracking of deliveries.

- Another trend is sustainability in the field of logistics services and products delivery. As the impact on the environment continues to cause significant concern, logistics firms are moving to going green through adoption of electric cars, efficient packing for the warehouses and environmentally friendly packaging materials to name but a few. The transition from using conventional supply chain and logistics management systems to green solutions has been influenced by legal and voluntary initiatives, customers and social conscious on emissions.

Increasing demand for last one-mile delivery solutions

- The logistics market also holds much promise since the market continues to experience increasing demand for last one-mile delivery solutions. As the e-commerce sector expands, there is increased pressure to have rapid, adaptable, and cheap last-mile delivery. Organizations are now structuring capital on innovations and collaborations to show quick delivery in not even a day or within a day. Further, urban logistics brings prospects for the establishment of new delivery centers and efficient distributions in great cities.

- This is another area of opportunity because the market is extending its demands for an integrated logistics service. This is because as companies search for integrated solutions regarding transportation, warehousing, and value-added solutions, firm specialised in delivery of comprehensive logistics solutions will prove to have an added advantage. This trend is most apparent in industries related to automobiles, healthcare, and retailing: industries that strongly depend on logistics.

Logistics Market Segment Analysis:

Logistics Market is Segmented on the basis of Mode of Transportation, Service Type, End-User Industry, and Region.

By Mode of Transportation, Road, Rail segment is expected to dominate the market during the forecast period

- By transportation mode the global logistics market is divided into road, rail, air and sea logistics. Road transport still holds the largest share of the total transport because it provides more flexibility and is cheaper than other modes of transport, especially in short and medium distance haulage.

- Because of the infrastructure of the railways, heavy and bulk carriage is preferred in railway transport than in road transport as it is more efficient as well as friendly to the environment than the road transport. Air freight is the most preferred method when there is need for urgency, that is more costly than other modes of transport. Sea freight is particularly suitable for large consignments of goods and over long distances and provides an economical means of transport since it is used for international transport of goods.

By Service Type, Transportation segment expected to held the largest share

- Transportation & warehousing; value added services; and inventory management and control are distinguished as the four classifications of logistics. Transportation is a process through which goods are moved from one place to another through various means; road, rail, air and sea transport.

- It also offers the way and means of accommodating the inventory that may flow in and out of the business to enable proper functioning of the business. Added services are services such as packaging, labeling and assembling which go along with the basic logistics functions. Inventory control is a business of receiving, storing and issuing inventory with the aim of minimizing on possible stock-outs or overly stocking on spare parts.

Logistics Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is anticipated to dominate the logistics market during the forecast period, driven by rapid economic growth, robust trade activities, and increasing demand for efficient supply chain solutions. The region's strategic location, housing major global economies like China, India, Japan, and Southeast Asian countries, makes it a hub for manufacturing, exports, and imports.

- Technological advancements, such as automation, artificial intelligence, and blockchain, are enhancing logistics operations, contributing to faster and more cost-effective services. the rise of e-commerce, coupled with evolving consumer preferences for fast deliveries, is further fueling the demand for logistics services. Governments in the region are also investing heavily in infrastructure development, such as smart ports, railways, and highways, which will further boost the logistics sector's growth. These factors collectively position Asia Pacific as the leader in the logistics market.

Active Key Players in the Logistics Market:

- C.H. Robinson Worldwide (USA)

- DB Schenker (Germany)

- DHL (Germany)

- DSV Panalpina (Denmark)

- FedEx Corporation (USA)

- Kuehne + Nagel (Switzerland)

- Maersk (Denmark)

- Nippon Express (Japan)

- UPS (USA)

- XPO Logistics (USA), and Other Active Players

|

Logistics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3780.40 Billion |

|

Forecast Period 2024-32 CAGR: |

7.30 % |

Market Size in 2032: |

USD 7126.70 Billion |

|

Segments Covered: |

By Mode of Transportation |

|

|

|

By Service Type |

|

||

|

By End-user Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Logistics Market by Mode of Transportation

4.1 Logistics Market Snapshot and Growth Engine

4.2 Logistics Market Overview

4.3 Road

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Road: Geographic Segmentation Analysis

4.4 Rail

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Rail: Geographic Segmentation Analysis

4.5 Air

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Air: Geographic Segmentation Analysis

4.6 Sea

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Sea: Geographic Segmentation Analysis

Chapter 5: Logistics Market by Service Type

5.1 Logistics Market Snapshot and Growth Engine

5.2 Logistics Market Overview

5.3 Transportation

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Transportation: Geographic Segmentation Analysis

5.4 Warehousing

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Warehousing: Geographic Segmentation Analysis

5.5 Value-added Services

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Value-added Services: Geographic Segmentation Analysis

5.6 Inventory Management

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Inventory Management: Geographic Segmentation Analysis

Chapter 6: Logistics Market by End-User Industry

6.1 Logistics Market Snapshot and Growth Engine

6.2 Logistics Market Overview

6.3 Automotive

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Automotive: Geographic Segmentation Analysis

6.4 Consumer Goods

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Consumer Goods: Geographic Segmentation Analysis

6.5 Healthcare

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Healthcare: Geographic Segmentation Analysis

6.6 Retail

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Retail: Geographic Segmentation Analysis

6.7 Food & Beverages

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Food & Beverages: Geographic Segmentation Analysis

6.8 Manufacturing

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Manufacturing: Geographic Segmentation Analysis

6.9 E-commerce

6.9.1 Introduction and Market Overview

6.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.9.3 Key Market Trends, Growth Factors and Opportunities

6.9.4 E-commerce: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Logistics Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 DHL (GERMANY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 FEDEX CORPORATION (USA)

7.4 KUEHNE + NAGEL (SWITZERLAND)

7.5 XPO LOGISTICS (USA)

7.6 DB SCHENKER (GERMANY)

7.7 UPS (USA)

7.8 MAERSK (DENMARK)

7.9 C.H. ROBINSON WORLDWIDE (USA)

7.10 NIPPON EXPRESS (JAPAN)

7.11 DSV PANALPINA (DENMARK)

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global Logistics Market By Region

8.1 Overview

8.2. North America Logistics Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Mode of Transportation

8.2.4.1 Road

8.2.4.2 Rail

8.2.4.3 Air

8.2.4.4 Sea

8.2.5 Historic and Forecasted Market Size By Service Type

8.2.5.1 Transportation

8.2.5.2 Warehousing

8.2.5.3 Value-added Services

8.2.5.4 Inventory Management

8.2.6 Historic and Forecasted Market Size By End-User Industry

8.2.6.1 Automotive

8.2.6.2 Consumer Goods

8.2.6.3 Healthcare

8.2.6.4 Retail

8.2.6.5 Food & Beverages

8.2.6.6 Manufacturing

8.2.6.7 E-commerce

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Logistics Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Mode of Transportation

8.3.4.1 Road

8.3.4.2 Rail

8.3.4.3 Air

8.3.4.4 Sea

8.3.5 Historic and Forecasted Market Size By Service Type

8.3.5.1 Transportation

8.3.5.2 Warehousing

8.3.5.3 Value-added Services

8.3.5.4 Inventory Management

8.3.6 Historic and Forecasted Market Size By End-User Industry

8.3.6.1 Automotive

8.3.6.2 Consumer Goods

8.3.6.3 Healthcare

8.3.6.4 Retail

8.3.6.5 Food & Beverages

8.3.6.6 Manufacturing

8.3.6.7 E-commerce

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Logistics Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Mode of Transportation

8.4.4.1 Road

8.4.4.2 Rail

8.4.4.3 Air

8.4.4.4 Sea

8.4.5 Historic and Forecasted Market Size By Service Type

8.4.5.1 Transportation

8.4.5.2 Warehousing

8.4.5.3 Value-added Services

8.4.5.4 Inventory Management

8.4.6 Historic and Forecasted Market Size By End-User Industry

8.4.6.1 Automotive

8.4.6.2 Consumer Goods

8.4.6.3 Healthcare

8.4.6.4 Retail

8.4.6.5 Food & Beverages

8.4.6.6 Manufacturing

8.4.6.7 E-commerce

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Logistics Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Mode of Transportation

8.5.4.1 Road

8.5.4.2 Rail

8.5.4.3 Air

8.5.4.4 Sea

8.5.5 Historic and Forecasted Market Size By Service Type

8.5.5.1 Transportation

8.5.5.2 Warehousing

8.5.5.3 Value-added Services

8.5.5.4 Inventory Management

8.5.6 Historic and Forecasted Market Size By End-User Industry

8.5.6.1 Automotive

8.5.6.2 Consumer Goods

8.5.6.3 Healthcare

8.5.6.4 Retail

8.5.6.5 Food & Beverages

8.5.6.6 Manufacturing

8.5.6.7 E-commerce

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Logistics Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Mode of Transportation

8.6.4.1 Road

8.6.4.2 Rail

8.6.4.3 Air

8.6.4.4 Sea

8.6.5 Historic and Forecasted Market Size By Service Type

8.6.5.1 Transportation

8.6.5.2 Warehousing

8.6.5.3 Value-added Services

8.6.5.4 Inventory Management

8.6.6 Historic and Forecasted Market Size By End-User Industry

8.6.6.1 Automotive

8.6.6.2 Consumer Goods

8.6.6.3 Healthcare

8.6.6.4 Retail

8.6.6.5 Food & Beverages

8.6.6.6 Manufacturing

8.6.6.7 E-commerce

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Logistics Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Mode of Transportation

8.7.4.1 Road

8.7.4.2 Rail

8.7.4.3 Air

8.7.4.4 Sea

8.7.5 Historic and Forecasted Market Size By Service Type

8.7.5.1 Transportation

8.7.5.2 Warehousing

8.7.5.3 Value-added Services

8.7.5.4 Inventory Management

8.7.6 Historic and Forecasted Market Size By End-User Industry

8.7.6.1 Automotive

8.7.6.2 Consumer Goods

8.7.6.3 Healthcare

8.7.6.4 Retail

8.7.6.5 Food & Beverages

8.7.6.6 Manufacturing

8.7.6.7 E-commerce

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Logistics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3780.40 Billion |

|

Forecast Period 2024-32 CAGR: |

7.30 % |

Market Size in 2032: |

USD 7126.70 Billion |

|

Segments Covered: |

By Mode of Transportation |

|

|

|

By Service Type |

|

||

|

By End-user Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||