Artificial Intelligence Things Market Synopsis

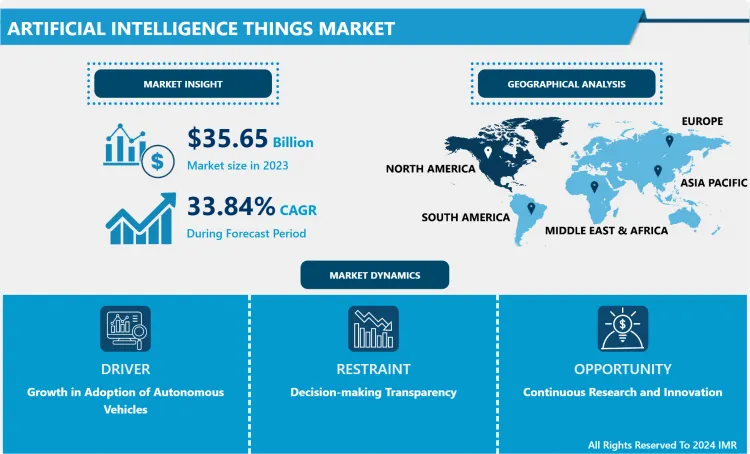

The Artificial Intelligence Things Market was valued at USD 35.65 billion in 2023 and is projected to reach USD 491.28 billion by 2032, registering a CAGR of 33.84 % from 2024 to 2032.

Artificial intelligence is the simulation of human intelligence processes by machines, especially computer systems. Specific applications of AI include expert systems, natural language processing, speech recognition, and machine vision.

Artificial intelligence (AI) makes it possible for machines to learn from experience, adjust to new inputs, and perform human-like tasks.

The rapidly expanding Internet of Things extends connectivity and data exchange across a vast network of portable devices, home appliances, vehicles, manufacturing equipment, and other things embedded with electronics, software, sensors, actuators, and connectivity

In the fast-growing world of IoT, which connects and shares data across a vast network of devices organizations win with analytics. For its ability to make rapid decisions and uncover deep insights as it learns from massive volumes of IoT data, AI is an essential form of analytics for any organization that wants to expand the value of IoT.

North America leads the IoT market with the highest market share, driven by widespread IoT adoption across industries and the implementation of IoT platforms for efficient data management and predictive analytics. IoT is gaining traction in the healthcare industry. For instance, smartwatches and fitness trackers, are increasingly being used to monitor and track a patient's health issue.

Artificial Intelligence Things Market Trend Analysis

Growth in Adoption of Autonomous Vehicles

- Autonomous Vehicles are gaining increasing importance due to the current needs of modern society for better mobility and societal impact. Autonomous development and adoption will be driven by Artificial Intelligence (AI) and 5G/6G technologies which will offer increased speed, reduced latency, and ubiquity. Autonomous AI optimizes operations, leading the cost savings and enhancing productivity.

- However, the public is concerned with the concept of handing total control of driving to vehicles. These concerns will inhibit the adoption of CAVs to become available to the public. It conducts a statistical analysis and applies machine learning techniques to predict user adoption for CAVs. Several machine-learning approaches were effective in forecasting user adoption for CAVs. The increasing adoption of autonomous vehicles of artificial intelligence is driving the growth of the Artificial Intelligence Market.

Continuous Research and Innovation

- Advanced technologies in industry verticals, such as automotive, healthcare, retail, finance, and manufacturing. For instance, in 2023, Apple acquired a Mountain View-based startup, Wave One, that was developing AI algorithms for compressing video.

- In 2023, Oracle announced its plans to develop powerful, generative AI services for organizations worldwide. Oracle provides native generative AI services to help organizations automate end-to-end business processes, improve decision-making, and enhance customer experiences, in collaboration with Cohere, a leading AI platform for enterprise.

- In 2020, Intel Corporation acquired Cnvrg.io, an Israeli company that develops and operates a platform for data scientists to build and run machine learning models, to boost its artificial intelligence business.

Decision-making Transparency

Decision-making transparency is the restraining factor of the Artificial intelligence market. The complexation models make it difficult to understand the process of decision-making. Artificial intelligence-based solutions often generate outcomes that come with black-box nature, this can lead to a lack of trust and accountability. This is particularly concerning in critical areas such as finance and healthcare. These industries or end users have a delicate need for transparency to protect the proprietary. Thus, transparency issues in decision-making hamper the growth of the market.

Artificial Intelligence Things Market Segment Analysis

Artificial Intelligence Things Market segments cover the Technology, Application, Component, and End User. By Technology, the Deep Learning segment is anticipated to dominate the Market Over the Forecast period.

- The deep Learning segment is dominated to drive the demand of the Global Artificial Intelligence Things Market over the forecast period. Its complex applications are driven by the data such as audio, video, and text recognition. The rising technological advancements in the field of deep learning are expected to overcome the challenges associated with the high volumes of data. Furthermore, the rising adoption of deep learning technology in the medical field is expected to grow the growth of the segment over the forecast period.

- The BFSI segment is dominated to drive the demand for the Global Artificial Intelligence Things Market over the forecast period. Artificial intelligence (AI) solutions are widely being adopted in the banking and finance sectors for multiple purposes, including account inquiries, loan applications, fraud detection, and credit score monitoring. The BFSI sector becomes an ideal candidate for AI application owing to the massive amount of data the sector generates daily.

Artificial Intelligence Things Market Regional Insights

North America is expected to Dominate the Market over the Forecast Period

- North America capture the market share of revenue in 2022. The higher demand for advanced technological hardware and software products across various end-use raise and the favorable government policies that inspire industries in North America to adopt artificial intelligence AI have appreciably contributed to the growth of the artificial intelligence market.

- American president launched an American enterprise to promote the US as a leader in artificial intelligence technology in 2019. This enterprise focused on the assumption of AI-based systems by providing guidelines for the real-life application of artificial intelligence technology in various industries and sectors. North America is the place of residence to the leading tech monsters for instance: Facebook, Amazon, Google, IBM, Microsoft, and Apple, which have outstanding contributions to the development of the AI market in North America.

- Moreover, the United States has been working to organize the National Artificial Intelligence Enterprise, which focuses on six strategic pillars: advancing reliable AI, increasing AI innovation, increasing current infrastructure through new technologies, developing new opportunities, easing private and federal sector utilization of AI to improve current systems, and encourage an international environment that supports further growing Artificial Intelligence things market in North America region.

COVID-19 Impact on Artificial Intelligence Things Market

- During the spread of Coronavirus, the ability of organizations to access scalable, and highly secure computing power, whether for vital healthcare work or to keep unprecedented numbers of employees online and productive from home are some of the critical factors owing to the growth of the market in this situation.

- Hospital networks, pharmaceutical companies, and research labs are using AI-enabled IoT devices to care for patients, explore treatments, and mitigate the impacts of COVID-19 in many other ways COVID-19 pandemic positively impacted the overall economy of the AI in the IoT market.

- Moreover, virtual desktop utilities played a crucial role in facilitating remote working during the period, as these tools provided cost-effective management and working solutions for employees. Such factors further supported the growth of the AI in IoT market during the period.

Top Key Players of the Artificial Intelligence Things Market

- NVIDIA (U.S)

- IBM (U.S)

- MICROSOFT (U.S)

- AMAZON (U.S)

- GOOGLE (U.S)

- ALPHABET (U.S)

- DATA ROBOT, INC. (U.S)

- DEEPMIND (UK)

- APPLE (U.S)

- SIEMENS (GERMANY)

- ORACLE (U.S)

- SALESFORCE (U.S)

- APPIER (TAIWAN)

- GENERAL ELECTRIC COMPANY (U.S)

- PONY.AI (U.S)

- ALIBABA CLOUD (CHINA)

- ROCKWELL AUTOMATION (U.S)

- FRACTAL ANALYTICS (U.S)

- ELEMENT AI (CANADA)

- SAP (GERMANY)

- PEOPLE.AI (U.S)

- H2O.AI (U.S)

- CLARIFAI (CANADA)

- OPENAI (U.S)

Key Industry Development of Artificial Intelligence Things Market

- In March 2023, Apple acquired a Mountain View-based startup, Wave One, that was developing AI algorithms for compressing video. But Wave One’s website was shut down around January, and several former employees, including one of Wave One’s co-founders, now work within Apple’s various machine learning groups.

- In June 2023, Oracle announced its plans to develop powerful, generative AI services for organizations worldwide. Oracle provides native generative AI services to help organizations automate end-to-end business processes, improve decision-making, and enhance customer experiences, in collaboration with Cohere, a leading AI platform for enterprise. Built on Oracle Cloud Infrastructure (OCI) and leveraging Oracle's unique Supercluster capabilities, Oracle is generative.

- In March 2022, Microsoft announced the completion of its acquisition of Nuance Communications Inc. (Nasdaq: NUAN), a leader in conversational AI and ambient intelligence across industries including healthcare, financial services, retail, and telecommunications.

|

Artificial Intelligence Things Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 35.65 Bn. |

|

Forecast Period 2024-32 CAGR: |

33.84% |

Market Size in 2032: |

USD 491.28 Bn. |

|

Segments Covered: |

By Technology |

|

|

|

By Application |

|

||

|

By Component |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Artificial Intelligence Things Market by Technology (2018-2032)

4.1 Artificial Intelligence Things Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Machine Learning

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Deep Learning

4.5 Ambient Intelligence

4.6 Smart Objects

4.7 Big Data

Chapter 5: Artificial Intelligence Things Market by Application (2018-2032)

5.1 Artificial Intelligence Things Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Smart Retail

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Smart Office Buildings

5.5 Video-Based Traffic Management

5.6 Autonomous Vehicle

5.7 Health Care

Chapter 6: Artificial Intelligence Things Market by Component (2018-2032)

6.1 Artificial Intelligence Things Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Platform

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Software

6.5 Service

Chapter 7: Artificial Intelligence Things Market by End User (2018-2032)

7.1 Artificial Intelligence Things Market Snapshot and Growth Engine

7.2 Market Overview

7.3 BFSI

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 IT & Telecom

7.5 Insurance

7.6 Autonomous Vehicles

7.7 Personalized Fitness

7.8 Other

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Artificial Intelligence Things Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 GE POWER(U.S)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 SIEMENS ENERGY (GERMANY)

8.4 MITSUBISHI POWER (JAPAN)

8.5 ANSALDO ENERGIA S.P.A (UAE)

8.6 MITSUBISHI HEAVY INDUSTRIES LTD. (JAPAN)

8.7 SOLAR TURBINES INC. (U.S)

8.8 TECHNO STRENGTH PRIVATE LIMITED (INDIA)

8.9 BAKER HUGHES (U.S)

8.10 NANJING TURBINE & ELECTRIC MACHINERY (CHINA)

8.11 BHARAT HEAVY ELECTRICALS LIMITED (INDIA)

8.12 KAWASAKI HEAVY INDUSTRIES LTD. (JAPAN)

8.13 JOHN F WELCH TECHNOLOGY CENTER (INDIA)

8.14 OPRA TURBINES (NETHERLANDS)

8.15 MAN

8.16 ENERGY SOLUTIONS SE (GERMANY)

8.17 SHANGHAI ELECTRIC GROUP COMPANY LIMITED (CHINA)

8.18 DONGFANG ELECTRIC CORPORATION (CHINA)

8.19 DOOSAN ENERGY COLTD. (SOUTH KOREA)

8.20 CAPSTONE TURBINE CORPORATION (U.S)

8.21 CENTRAX GAS TURBINE (U.K)

8.22 SOLAR TURBINE INTERNATIONAL COMPANY (CALIFORNIA)

Chapter 9: Global Artificial Intelligence Things Market By Region

9.1 Overview

9.2. North America Artificial Intelligence Things Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Technology

9.2.4.1 Machine Learning

9.2.4.2 Deep Learning

9.2.4.3 Ambient Intelligence

9.2.4.4 Smart Objects

9.2.4.5 Big Data

9.2.5 Historic and Forecasted Market Size by Application

9.2.5.1 Smart Retail

9.2.5.2 Smart Office Buildings

9.2.5.3 Video-Based Traffic Management

9.2.5.4 Autonomous Vehicle

9.2.5.5 Health Care

9.2.6 Historic and Forecasted Market Size by Component

9.2.6.1 Platform

9.2.6.2 Software

9.2.6.3 Service

9.2.7 Historic and Forecasted Market Size by End User

9.2.7.1 BFSI

9.2.7.2 IT & Telecom

9.2.7.3 Insurance

9.2.7.4 Autonomous Vehicles

9.2.7.5 Personalized Fitness

9.2.7.6 Other

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Artificial Intelligence Things Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Technology

9.3.4.1 Machine Learning

9.3.4.2 Deep Learning

9.3.4.3 Ambient Intelligence

9.3.4.4 Smart Objects

9.3.4.5 Big Data

9.3.5 Historic and Forecasted Market Size by Application

9.3.5.1 Smart Retail

9.3.5.2 Smart Office Buildings

9.3.5.3 Video-Based Traffic Management

9.3.5.4 Autonomous Vehicle

9.3.5.5 Health Care

9.3.6 Historic and Forecasted Market Size by Component

9.3.6.1 Platform

9.3.6.2 Software

9.3.6.3 Service

9.3.7 Historic and Forecasted Market Size by End User

9.3.7.1 BFSI

9.3.7.2 IT & Telecom

9.3.7.3 Insurance

9.3.7.4 Autonomous Vehicles

9.3.7.5 Personalized Fitness

9.3.7.6 Other

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Artificial Intelligence Things Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Technology

9.4.4.1 Machine Learning

9.4.4.2 Deep Learning

9.4.4.3 Ambient Intelligence

9.4.4.4 Smart Objects

9.4.4.5 Big Data

9.4.5 Historic and Forecasted Market Size by Application

9.4.5.1 Smart Retail

9.4.5.2 Smart Office Buildings

9.4.5.3 Video-Based Traffic Management

9.4.5.4 Autonomous Vehicle

9.4.5.5 Health Care

9.4.6 Historic and Forecasted Market Size by Component

9.4.6.1 Platform

9.4.6.2 Software

9.4.6.3 Service

9.4.7 Historic and Forecasted Market Size by End User

9.4.7.1 BFSI

9.4.7.2 IT & Telecom

9.4.7.3 Insurance

9.4.7.4 Autonomous Vehicles

9.4.7.5 Personalized Fitness

9.4.7.6 Other

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Artificial Intelligence Things Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Technology

9.5.4.1 Machine Learning

9.5.4.2 Deep Learning

9.5.4.3 Ambient Intelligence

9.5.4.4 Smart Objects

9.5.4.5 Big Data

9.5.5 Historic and Forecasted Market Size by Application

9.5.5.1 Smart Retail

9.5.5.2 Smart Office Buildings

9.5.5.3 Video-Based Traffic Management

9.5.5.4 Autonomous Vehicle

9.5.5.5 Health Care

9.5.6 Historic and Forecasted Market Size by Component

9.5.6.1 Platform

9.5.6.2 Software

9.5.6.3 Service

9.5.7 Historic and Forecasted Market Size by End User

9.5.7.1 BFSI

9.5.7.2 IT & Telecom

9.5.7.3 Insurance

9.5.7.4 Autonomous Vehicles

9.5.7.5 Personalized Fitness

9.5.7.6 Other

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Artificial Intelligence Things Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Technology

9.6.4.1 Machine Learning

9.6.4.2 Deep Learning

9.6.4.3 Ambient Intelligence

9.6.4.4 Smart Objects

9.6.4.5 Big Data

9.6.5 Historic and Forecasted Market Size by Application

9.6.5.1 Smart Retail

9.6.5.2 Smart Office Buildings

9.6.5.3 Video-Based Traffic Management

9.6.5.4 Autonomous Vehicle

9.6.5.5 Health Care

9.6.6 Historic and Forecasted Market Size by Component

9.6.6.1 Platform

9.6.6.2 Software

9.6.6.3 Service

9.6.7 Historic and Forecasted Market Size by End User

9.6.7.1 BFSI

9.6.7.2 IT & Telecom

9.6.7.3 Insurance

9.6.7.4 Autonomous Vehicles

9.6.7.5 Personalized Fitness

9.6.7.6 Other

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Artificial Intelligence Things Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Technology

9.7.4.1 Machine Learning

9.7.4.2 Deep Learning

9.7.4.3 Ambient Intelligence

9.7.4.4 Smart Objects

9.7.4.5 Big Data

9.7.5 Historic and Forecasted Market Size by Application

9.7.5.1 Smart Retail

9.7.5.2 Smart Office Buildings

9.7.5.3 Video-Based Traffic Management

9.7.5.4 Autonomous Vehicle

9.7.5.5 Health Care

9.7.6 Historic and Forecasted Market Size by Component

9.7.6.1 Platform

9.7.6.2 Software

9.7.6.3 Service

9.7.7 Historic and Forecasted Market Size by End User

9.7.7.1 BFSI

9.7.7.2 IT & Telecom

9.7.7.3 Insurance

9.7.7.4 Autonomous Vehicles

9.7.7.5 Personalized Fitness

9.7.7.6 Other

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Artificial Intelligence Things Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 35.65 Bn. |

|

Forecast Period 2024-32 CAGR: |

33.84% |

Market Size in 2032: |

USD 491.28 Bn. |

|

Segments Covered: |

By Technology |

|

|

|

By Application |

|

||

|

By Component |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||