Analytics as a Service Market Synopsis

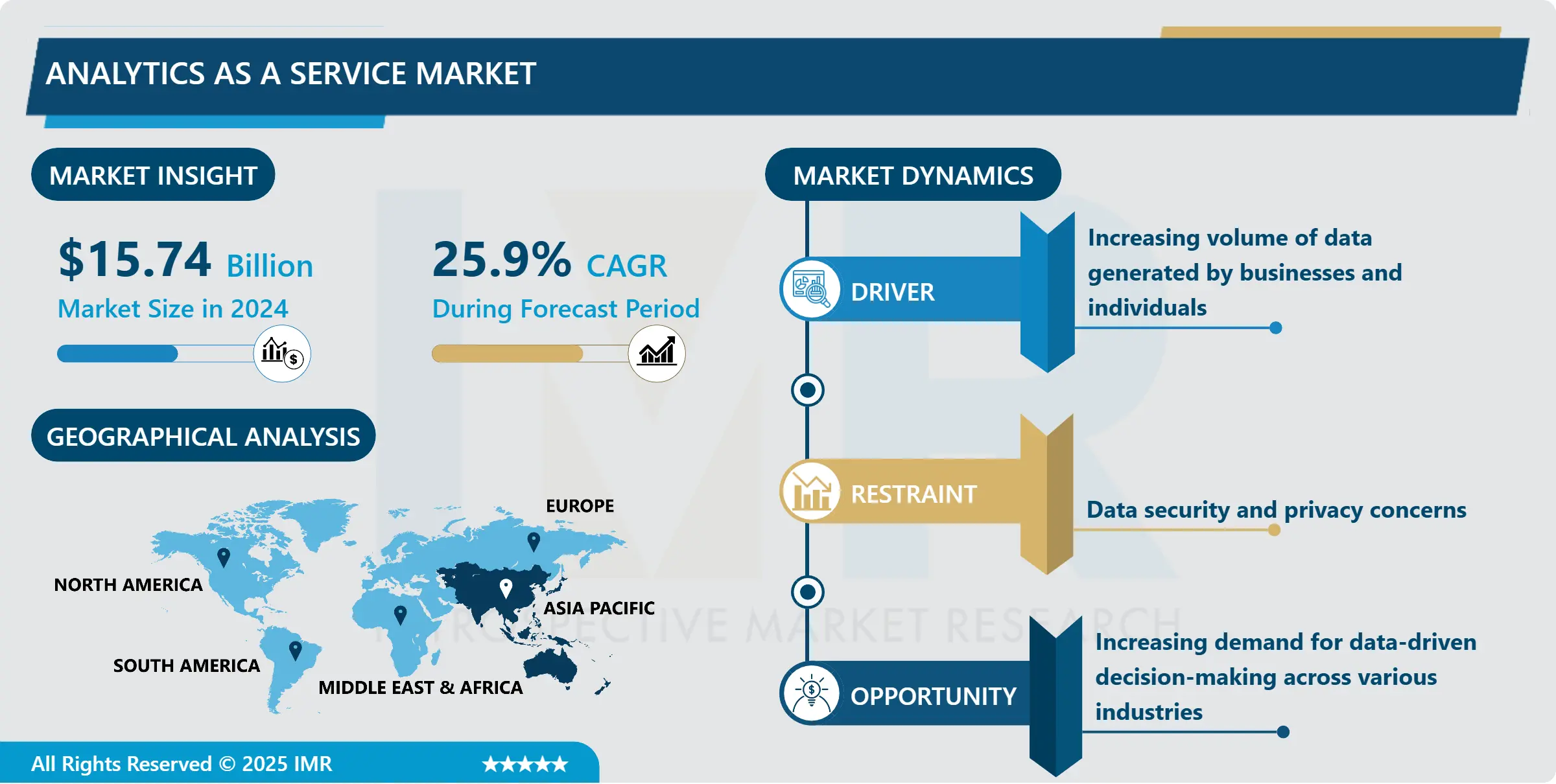

Analytics as a Service Market Size Was Valued at USD 12.5 Billion in 2023, and is Projected to Reach USD 99.4 Billion by 2032, Growing at a CAGR of 25.9% From 2024-2032.

Analytics as a Service or AaaS in short is a cloud-based solution that offers the framework and resources required for data analytics without the need for system and equipment investments in the local environment. AaaS utilizes the characteristics and features of cloud computing to provide a broad spectrum of analytics solutions that start with data-driven insights and extend to using predictive analytics and data mining algorithms. This service model allows organizations to engage in complex data analytics as a subscription service where organizations afford themselves the licenses to well-developed analytics platforms whereby they can feed large sets of data in real-time while generating meaningful insights that aid in the making of rapid decisions in organizations. Thus, the implementation of AaaS can bring value to companies by improving their analytics-driven decisions, optimizing cost, and providing better performances.

The current market of Analytics as a Service (PaaS) is rapidly expanding due to the rise in the demand of organizations aiming at using considerable amounts of analytics in their decisions. As the amount of data increases, fueled by the use of digital technology, organizations opt for AaaS service solutions as a way of enhancing their competitiveness through the obtaining of more meaningful information from the raw data. The characteristics of Typical AaaS are shown that AaaS vendors deliver scalability, flexibility, and cost-savvy because they use a pure Cloud-Infrastructure; they offer up-to-date high-level analytic tools for business applications without high investments in hardware and software.

Challenges within the AaaS market include the steps being towards the increasing use of cloud services, the development of artificial intelligence and machine learning technologies, and the importance of real-time data analysis that is constantly gaining value. Further, the incorporation of the AaaS in new technologies like IoT and big data analytics enhances its applicability in various ways since it enables organizations to gain meaningful insights from a variety of data sources. With the focus on delivering flexibility and innovation to solution portfolios by creating analytical capabilities for businesses, AaaS market is projected to evolve even further, catering to the diverse demands of industries and businesses.

Analytics as a Service Market Trend Analysis

Analytics as a Service Market Drivers- Increasing adoption of cloud computing and the growing need for businesses

- Analytics as a Service (AaaS) market is in high-growth phase and this growth has been triggered by the growth of cloud computing and need for businesses to generate insights from massive data analytics. The adoption of AaaS solutions in organizations has grown considerably by providing effective organizational decision-making support, effective customer experience management, and competitive gain. Several industry verticals have now adopted digital magazines, and technologies like artificial intelligence and machine learning are pushing the uptake of analytics platforms that promise scalability and affordable options.

- Furthermore, AaaS extended with IoT or big data technologies promises new possibilities to enhance the meaning of analysts’ services based on real-time analytics or other deep methodologies. With business decision-makers increasingly turning to intelligent processes to drive their organization’s performance forward, there are outstanding growth and development opportunities for the AaaS services market.

Analytics as a Service Market Opportunity- Increasing demand for data-driven decision-making across various industries

- It has players such as Amazon Web Services, Inc, Google LLC, Microsoft Corporation and SAP SE located in United States, Germany respectively, making the market more elastic for development. With less reliance on fixed physical infrastructure, many organizations have turned to AaaS solutions in order to improve their ability to derive decision-supporting information. The next major trend is caused by prompt development of cloud solutions, artificial intelligence, and management of big data to increase business productivity and customer satisfaction. By investing more and more in their data-driven approaches, the AaaS market is expected to grow significantly in the coming years, opening up new opportunities and prospects for business implementing such services as well as for their providers.

Analytics as a Service Market Segment Analysis:

Analytics as a Service Market is segmented on the basis of type, enterprise size, and end-use.

By Type, predictive analytics segment is expected to dominate the market during the forecast period

- The AaaS market by type is expected to grow at a higher rate and be dominated by the predictive analytics type during the forecast period. Thanks to predictive analysis, an organization can assess scenarios and possibilities of their future behavior or performance with the help of earlier observations and tests based on mathematical models. Many organizations, irrespective of the industry type, are embedding the advanced technique of predictive analytics in their systems to predict consumer behavior, manage processes, control risks, and determine important strategies.

- A number of aspects can be identified that have contributed to predictive analytics of being dominant within the AaaS market. They include the increased adoption of the use of big data in organizations, abundance of data that can be analyzed, and emergence of new related technologies in fields such as machine learning and AI. Furthermore, there are realizations that PA solutions can bring about complete tangible advantages such as the improved accuracy in forecasting, the increased marketing effectiveness, and the improved operational efficiency, which has led to the increasing demand of the product.

By End Use, BFSI segment is expected to held the largest share

- The AaaS market share of various end use industries reveals that Banking, Financial Service and Insurance industry has the largest proportion of market share among all the industries. The following factors within the business, financial services and industrial sector may account for this dominance. Firstly, the financial institutions have to handle massive transactions and customers’ information, market trends, and other risk factors. AaaS solutions have provided these organizations with this data to manage, analyzed, use for decision making purposes, fraud detection, minimize risks as well as to improve customers’ experience.

- Furthermore, the market for BFSI is characterized by high regulatory pressure and rising competition, making it essential for organizations to adopt robust analytical solutions to meet the complicated regulatory norms and sustain their presence in the marketplace. Factors such as change and growth in regulatory requirements and the state of the market for AaaS highlight why AaaS platforms offer the flexibility needed while at the same time offering actionable intelligence that lead to the enhancement of operations and profitability.

Analytics as a Service Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Concerning the global Analytics as a Service (AaaS) market, the Asia Pacific region will seize the market in the upcoming years due to the following aspects: There is one particularly crucial influence and it has to do with the fast-paced advancement of digitalization in various industries within the region. Therefore, growth in the number of organizations that use data and analytics to support their management and gain a competitive edge in the market is forecasted to lead to growth in the popularity of different AaaS solutions.

- Also, the rate at which Cloud Computing and Advanced Analytics technologies are being adopted in countries such as China, India, Japan, and South Korea has increase demanding for these products. Characterized by their well-developed IT systems, an availability of skilled human capital, and the increased rate of start-ups, these countries present the right environment for the uptake of AaaS solutions.

Active Key Players in the Analytics as a Service Market

- Amazon Web Services, Inc. (United States)

- GoodData Corporation (United States)

- Google LLC (United States)

- Hewlett Packard Enterprise Development LP (United States)

- IBM (United States)

- Microsoft Corporation (United States)

- Oracle Corporation (United States)

- SAP SE (Germany)

- SAS Institute Inc. (United States), Other Active Players

|

Global Analytics as a Service Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 15.74 Bn. |

|

Forecast Period 2024-32 CAGR: |

25.9 % |

Market Size in 2032: |

USD 99.4 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Enterprise Size |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Analytics as a Service Market by Type (2018-2032)

4.1 Analytics as a Service Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Predictive Analytics

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Prescriptive Analytics

4.5 Diagnostic Analytics

4.6 Descriptive Analytics

Chapter 5: Analytics as a Service Market by Enterprise Size (2018-2032)

5.1 Analytics as a Service Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Large Enterprise

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Small & Medium Enterprise (SME)

Chapter 6: Analytics as a Service Market by End User (2018-2032)

6.1 Analytics as a Service Market Snapshot and Growth Engine

6.2 Market Overview

6.3 BFSI

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Retail

6.5 Government

6.6 IT & Telecom

6.7 Healthcare

6.8 Manufacturing

6.9 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Analytics as a Service Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CAPGEMINI

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 GOODDATA

7.4 GAVS TECHNOLOGIES

7.5 ORACLE CORPORATION

7.6 IBM CORPORATION

7.7 ACCENTURE

7.8 CREDIWATCH

7.9 CIVICA

7.10 ANALYTICS WISE

7.11 DELOITTE

7.12 THINKBRIDGE SOFTWARE

7.13 TOTANGO

7.14 9LENSES

7.15 JBARA

7.16 ACTICO GMBH

7.17 AND OTHER KEY PLAYERS

Chapter 8: Global Analytics as a Service Market By Region

8.1 Overview

8.2. North America Analytics as a Service Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Predictive Analytics

8.2.4.2 Prescriptive Analytics

8.2.4.3 Diagnostic Analytics

8.2.4.4 Descriptive Analytics

8.2.5 Historic and Forecasted Market Size by Enterprise Size

8.2.5.1 Large Enterprise

8.2.5.2 Small & Medium Enterprise (SME)

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 BFSI

8.2.6.2 Retail

8.2.6.3 Government

8.2.6.4 IT & Telecom

8.2.6.5 Healthcare

8.2.6.6 Manufacturing

8.2.6.7 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Analytics as a Service Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Predictive Analytics

8.3.4.2 Prescriptive Analytics

8.3.4.3 Diagnostic Analytics

8.3.4.4 Descriptive Analytics

8.3.5 Historic and Forecasted Market Size by Enterprise Size

8.3.5.1 Large Enterprise

8.3.5.2 Small & Medium Enterprise (SME)

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 BFSI

8.3.6.2 Retail

8.3.6.3 Government

8.3.6.4 IT & Telecom

8.3.6.5 Healthcare

8.3.6.6 Manufacturing

8.3.6.7 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Analytics as a Service Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Predictive Analytics

8.4.4.2 Prescriptive Analytics

8.4.4.3 Diagnostic Analytics

8.4.4.4 Descriptive Analytics

8.4.5 Historic and Forecasted Market Size by Enterprise Size

8.4.5.1 Large Enterprise

8.4.5.2 Small & Medium Enterprise (SME)

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 BFSI

8.4.6.2 Retail

8.4.6.3 Government

8.4.6.4 IT & Telecom

8.4.6.5 Healthcare

8.4.6.6 Manufacturing

8.4.6.7 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Analytics as a Service Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Predictive Analytics

8.5.4.2 Prescriptive Analytics

8.5.4.3 Diagnostic Analytics

8.5.4.4 Descriptive Analytics

8.5.5 Historic and Forecasted Market Size by Enterprise Size

8.5.5.1 Large Enterprise

8.5.5.2 Small & Medium Enterprise (SME)

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 BFSI

8.5.6.2 Retail

8.5.6.3 Government

8.5.6.4 IT & Telecom

8.5.6.5 Healthcare

8.5.6.6 Manufacturing

8.5.6.7 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Analytics as a Service Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Predictive Analytics

8.6.4.2 Prescriptive Analytics

8.6.4.3 Diagnostic Analytics

8.6.4.4 Descriptive Analytics

8.6.5 Historic and Forecasted Market Size by Enterprise Size

8.6.5.1 Large Enterprise

8.6.5.2 Small & Medium Enterprise (SME)

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 BFSI

8.6.6.2 Retail

8.6.6.3 Government

8.6.6.4 IT & Telecom

8.6.6.5 Healthcare

8.6.6.6 Manufacturing

8.6.6.7 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Analytics as a Service Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Predictive Analytics

8.7.4.2 Prescriptive Analytics

8.7.4.3 Diagnostic Analytics

8.7.4.4 Descriptive Analytics

8.7.5 Historic and Forecasted Market Size by Enterprise Size

8.7.5.1 Large Enterprise

8.7.5.2 Small & Medium Enterprise (SME)

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 BFSI

8.7.6.2 Retail

8.7.6.3 Government

8.7.6.4 IT & Telecom

8.7.6.5 Healthcare

8.7.6.6 Manufacturing

8.7.6.7 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Analytics as a Service Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 15.74 Bn. |

|

Forecast Period 2024-32 CAGR: |

25.9 % |

Market Size in 2032: |

USD 99.4 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Enterprise Size |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||