AI in Agriculture Market Synopsis

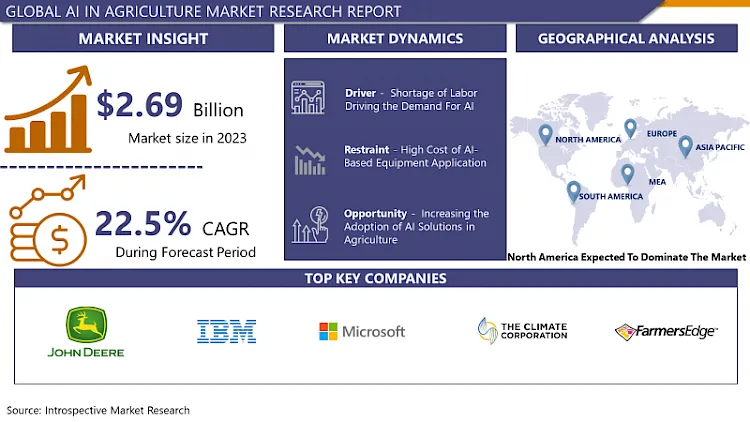

The Global Market for Artificial Intelligence (AI) In Agriculture Was Estimated at USD 2.69 Billion In the Year 2023 and is Projected to Reach A Revised Size of USD 16.71 Billion By 2032, Growing at A CAGR of 22.5% Over the Forecast Period 2024- 2032.

Artificial Intelligence has become one of the most important technologies in every sector, including education, banking, robotics, agriculture, etc. In the agriculture sector, it is playing a very crucial role, and it is transforming the agriculture industry. Artificial Intelligence has improved crop production and real-time monitoring, harvesting, processing, and marketing.

AI is widely used in this sector. For agriculture, Artificial Intelligence has become a revolutionary technology. It helps the farmers by yielding healthier crops, controlling pests, soil monitoring, and many more ways. The industry is turning to Artificial Intelligence technologies to help yield healthier crops, control pests, monitor soil, and growing conditions, organize data for farmers, help with the workload, and improve a wide range of agriculture-related tasks in the entire food supply chain.

Different hi-tech computer-based systems are designed to determine various important parameters such as weed detection, yield detection, crop quality, and many more. AI has come up with a new application called Plantix. It was developed by PEAT to identify deficiencies in soil, including plant pests and diseases. With the help of this application, farmers can get an idea to use better fertilizer which can improve the harvest quality.

With AI sensors, weed can be detected easily, and it also detects weed-affected areas. On finding such areas, herbicides can be precisely sprayed to reduce the use of herbicides and also saves time and crop. Different AI companies are building robots with AI and computer vision, which can precisely spray on weeds. The use of AI sprayers can widely reduce the number of chemicals to be used on fields, hence improving the quality of crops and also saving money. With help of Artificial Intelligence farmers can analyze weather conditions by using weather forecasting.

Robotics is being widely used in different sectors, mainly in manufacturing, to perform complex tasks. Nowadays, different AI companies are developing robots to be employed in the Agriculture sector. These AI robots are developed in such a way that they can perform multiple tasks in farming.

AI In Agriculture Market Trend Analysis

Shortage of Labor Driving the Demand For AI

- There has always been an issue of labor shortage in the agriculture industry. AI can solve this issue with automation in farming. With AI and automation, farmers can get work done without having more people, and some examples are Driverless tractors.

- Smart irrigation and fertilizing systems, smart spraying, vertical farming software, and AI-based robots for harvesting. AI-driven machines and equipment are much faster and more accurate compared to human farmhands.

- The downturn is fueling trends toward automated farming operations because of a lack of qualified workers, aging farmers, and younger generations who don't find farming appealing.

- The developed world is not immune to this downward trend. The agricultural sector in Asia and the Pacific is experiencing a severe labor shortage due to an aging population. The market for artificial intelligence in agriculture is projected to flourish in the following years. ?

Increasing the Adoption of AI Solutions in Agriculture

- Climate change has made it difficult for farmers to determine the right time for sowing seeds, and that’s where AI comes into the picture. With the help of artificial intelligence, it is easy to gain insight into how weather, seasonal sunlight, wind speed, and rain will affect crop planting cycles.

- Technologies such as AI have the potential to anonymize data while helping to uncover insight that creates new opportunities. Farmers will no longer have to be worried about relinquishing their IP, which will encourage greater collaboration and ultimately growth.

- There is an opportunity for solution providers to concentrate on farms with less than 5 hectares of land because governments all over the world support the use of AI for agricultural applications and help farmers with small farms. For instance, the US Department of Agriculture offers small and mid-size producers’ programs that make easy loans available to farmers and enhance their technological know-how so they can use the best farming technology. Thus, the increasing adoption of AI solutions in agriculture is creating opportunities for AI in Agriculture Market.

Segmentation Analysis of The AI in Agriculture Market

AI in the Agriculture Market segments covers the Type, Technology, Deployment, Application, and end-users. By Application, the Precision Farming segment is Anticipated to Dominate the Market Over the Forecast period.

- Today, mobile apps, smart sensors, drones, and cloud computing make precision agriculture possible for farming cooperatives and even small family farms.

- Precision farming enables farmers to reduce costs and maximize available resources. For precision farming, digital data is gathered, interpreted, and analyzed by automated intelligence. Precision farming applications focus on increasing farm output because of the growing population and the need for better food quality which drives precision farming.

- Precision Agriculture leverages advanced digital technologies and will play a significant role in the third modern farming revolution. It effectively minimizes inputs, labor, and time sustainably, maximizes productivity and profitability, ensures sustainability, and reduces environmental impact. The Netherlands is a country known for advanced initiatives in precision farming

- Both big and small farmers and organizations working with growers benefit by adopting precision and digital farming technologies, which help to optimize agri-input resources without adding costs or workload.

Regional Analysis of The AI In Agriculture Market

North America is Expected to Dominate the Market Over the Forecast period.

- The North American economy is characterized by rising disposable income, ongoing funding for automation, significant investments in the Internet of Things, and an increasing focus on domestic AI equipment development by governments.

- The region has a thriving artificial intelligence market and a leading industrial automation sector. The population's increased purchasing power, ongoing increases in automation, large investments in the IoT, and growing government attention on domestic AI equipment production are all characteristics of North America.

- The presence of various agricultural technology companies looking into AI-based solutions, such as IBM Corporation, Deere & Company, Microsoft, Granular, Inc., and The Climate Corporation, is also advantageous to the market.

Top Key Players Covered in The AI In Agriculture Market

- Deere & Company(US)

- IBM Corporation (US)

- Microsoft Corporation (US)

- The Climate Corporation (US)

- Farmers Edge Inc. (Canada)

- Hewlett Packard Enterprise Development LP (US)

- Cisco Systems Inc. (US)

- Google LLC (US)

- Amazon Web Services Inc (US)

- Corteva Inc (US)

- AgEagle Aerial Systems Inc. (US)

- Descartes Labs Inc. (US) and Other Major Players.

Key Industry Developments in the AI in Agriculture Market

- In June 2024, Cisco Investments, the venture arm of Cisco (NASDAQ: CSCO), launched a $1B AI investment fund to enhance the startup ecosystem and develop secure AI solutions. Initial investments include Cohere, Mistral AI, and Scale AI, aiming to boost customers’ AI readiness and support Cisco's AI innovation strategy. Nearly $200M of the fund has already been committed. This initiative underscores Cisco’s dedication to driving AI advancements and ensuring robust, reliable AI technologies for the future.

- In December 2023, John Deere is investing in AI for completely autonomous farms by the year 2030. John Deere is dedicating resources to AI technology, particularly in computer vision and machine learning, to transform the agricultural industry. CTO Jahmy Hindman believes that their See & Spray technology is a prime example of this innovation. The system accurately identifies and eliminates weeds using herbicide, minimizing excess and supporting healthier crop growth. By constantly analyzing field data, the system adjusts to different conditions and stages of plant growth, aiding farmers in addressing issues such as population growth and climate change. Deere's objective is to accomplish completely autonomous agriculture by 2030, improving both productivity and environmental friendliness.

|

Global AI in Agriculture Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.69 Billion. |

|

Forecast Period 2024-32 CAGR: |

22.5% |

Market Size in 2032: |

USD 16.71 Billion. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Deployment |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: AI in Agriculture Market by Type (2018-2032)

4.1 AI in Agriculture Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Solution

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Service

Chapter 5: AI in Agriculture Market by Technology (2018-2032)

5.1 AI in Agriculture Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Machine Learning

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Computer Vision

5.5 Predictive Analytics

Chapter 6: AI in Agriculture Market by Deployment (2018-2032)

6.1 AI in Agriculture Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Cloud

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 On-premise

6.5 Hybrid

Chapter 7: AI in Agriculture Market by Application (2018-2032)

7.1 AI in Agriculture Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Weather Tracking

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Precision Farming

7.5 Drone Analytics

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 AI in Agriculture Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 DOTERRA(U.S.)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 YOUNG LIVING ESSENTIAL OILS (U.S.)

8.4 ISAGENIX WORLDWIDE INC. (U.S.)

8.5 EDEN GARDENS (INDIA)

8.6 FLORIHANA (FRANCE)

8.7 CARGILL INCORPORATED (U.S.)

8.8 SENSIENT TECHNOLOGIES CORPORATION (U.S.)

8.9 MOUNTAIN ROSE HERBS (U.S.)

8.10 PLANT THERAPY ESSENTIAL OILS (U.S.)

8.11 ROCKY MOUNTAIN OILS LLC. (U.S.)

8.12 BIOLANDES (FRANCE)

8.13 STADLER FORM (SWITZERLAND)

8.14 HUBMAR (U.S)

8.15 SYMRISE (GERMANY)

Chapter 9: Global AI in Agriculture Market By Region

9.1 Overview

9.2. North America AI in Agriculture Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Solution

9.2.4.2 Service

9.2.5 Historic and Forecasted Market Size by Technology

9.2.5.1 Machine Learning

9.2.5.2 Computer Vision

9.2.5.3 Predictive Analytics

9.2.6 Historic and Forecasted Market Size by Deployment

9.2.6.1 Cloud

9.2.6.2 On-premise

9.2.6.3 Hybrid

9.2.7 Historic and Forecasted Market Size by Application

9.2.7.1 Weather Tracking

9.2.7.2 Precision Farming

9.2.7.3 Drone Analytics

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe AI in Agriculture Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Solution

9.3.4.2 Service

9.3.5 Historic and Forecasted Market Size by Technology

9.3.5.1 Machine Learning

9.3.5.2 Computer Vision

9.3.5.3 Predictive Analytics

9.3.6 Historic and Forecasted Market Size by Deployment

9.3.6.1 Cloud

9.3.6.2 On-premise

9.3.6.3 Hybrid

9.3.7 Historic and Forecasted Market Size by Application

9.3.7.1 Weather Tracking

9.3.7.2 Precision Farming

9.3.7.3 Drone Analytics

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe AI in Agriculture Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Solution

9.4.4.2 Service

9.4.5 Historic and Forecasted Market Size by Technology

9.4.5.1 Machine Learning

9.4.5.2 Computer Vision

9.4.5.3 Predictive Analytics

9.4.6 Historic and Forecasted Market Size by Deployment

9.4.6.1 Cloud

9.4.6.2 On-premise

9.4.6.3 Hybrid

9.4.7 Historic and Forecasted Market Size by Application

9.4.7.1 Weather Tracking

9.4.7.2 Precision Farming

9.4.7.3 Drone Analytics

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific AI in Agriculture Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Solution

9.5.4.2 Service

9.5.5 Historic and Forecasted Market Size by Technology

9.5.5.1 Machine Learning

9.5.5.2 Computer Vision

9.5.5.3 Predictive Analytics

9.5.6 Historic and Forecasted Market Size by Deployment

9.5.6.1 Cloud

9.5.6.2 On-premise

9.5.6.3 Hybrid

9.5.7 Historic and Forecasted Market Size by Application

9.5.7.1 Weather Tracking

9.5.7.2 Precision Farming

9.5.7.3 Drone Analytics

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa AI in Agriculture Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Solution

9.6.4.2 Service

9.6.5 Historic and Forecasted Market Size by Technology

9.6.5.1 Machine Learning

9.6.5.2 Computer Vision

9.6.5.3 Predictive Analytics

9.6.6 Historic and Forecasted Market Size by Deployment

9.6.6.1 Cloud

9.6.6.2 On-premise

9.6.6.3 Hybrid

9.6.7 Historic and Forecasted Market Size by Application

9.6.7.1 Weather Tracking

9.6.7.2 Precision Farming

9.6.7.3 Drone Analytics

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America AI in Agriculture Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Solution

9.7.4.2 Service

9.7.5 Historic and Forecasted Market Size by Technology

9.7.5.1 Machine Learning

9.7.5.2 Computer Vision

9.7.5.3 Predictive Analytics

9.7.6 Historic and Forecasted Market Size by Deployment

9.7.6.1 Cloud

9.7.6.2 On-premise

9.7.6.3 Hybrid

9.7.7 Historic and Forecasted Market Size by Application

9.7.7.1 Weather Tracking

9.7.7.2 Precision Farming

9.7.7.3 Drone Analytics

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global AI in Agriculture Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.69 Billion. |

|

Forecast Period 2024-32 CAGR: |

22.5% |

Market Size in 2032: |

USD 16.71 Billion. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Deployment |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||