Tissue and Organ Transplantation Market Synopsis

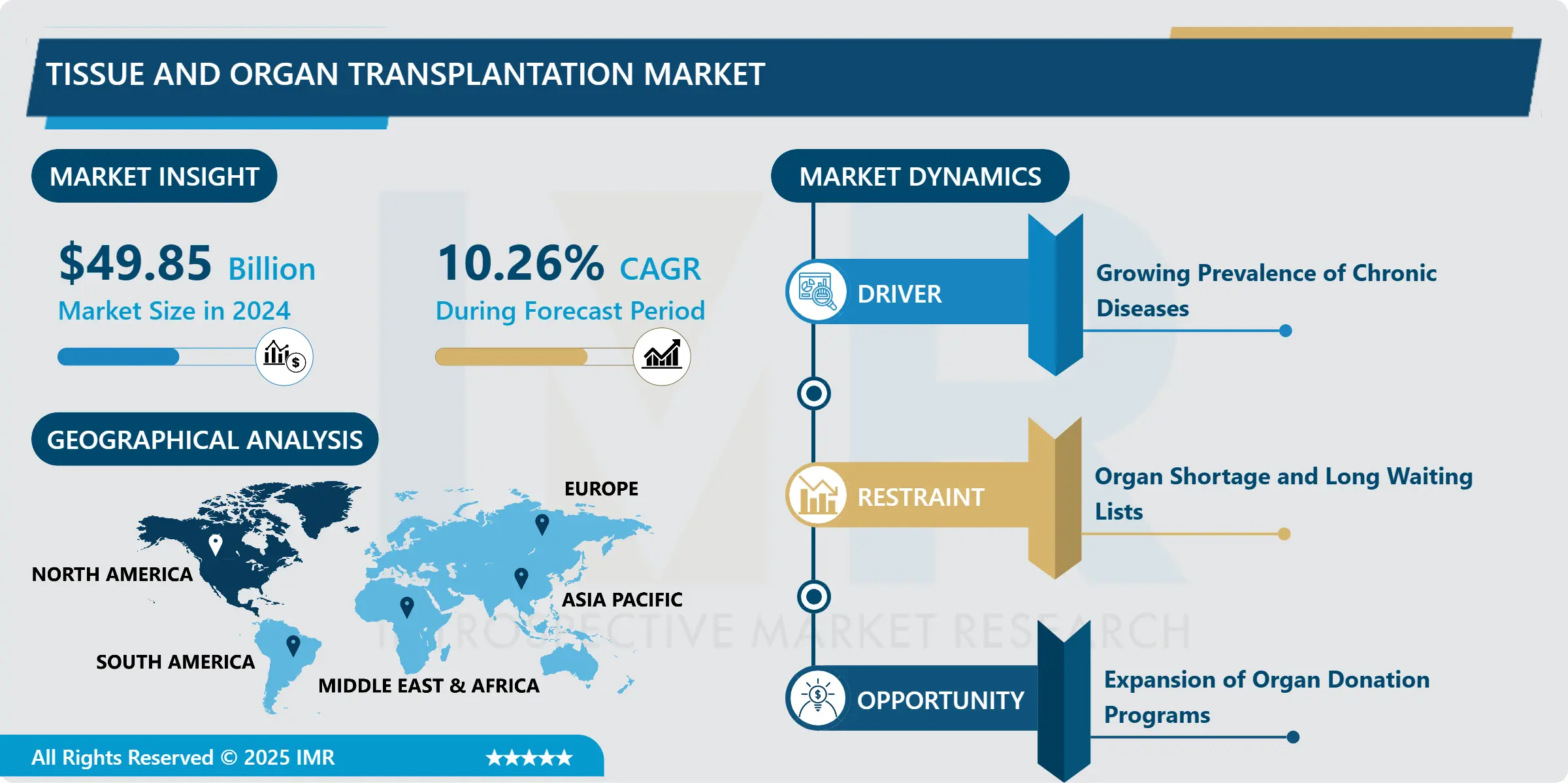

Tissue and Organ Transplantation Market Size Was Valued at USD 49.85 Billion in 2024 and is Projected to Reach USD 145.97 Billion by 2035, Growing at a CAGR of 10.26% From 2025-2035.

Tissue and Organ Transplantation refers to the medical procedures through which tissues or organs harvested from one body are relocating to another body (recipient) in order to replace damaged or non-functioning tissues and organs. It consists of range of products like tissue grafts, immunosuppressives and preservation solutions without which such surgeries become almost impossible.

The Tissue and Organ Transplantation Market has deemed significant progress since the last few years due to the higher incidences of chronic diseases, organ failure, and an enhancement in the number of patients on transplantation waiting lists. Advances in equipment used in surgeries, and treatment of patients after the operation have also boosted this growth as transplants become safer and more effective than before. Organ transplantation and tissue transplantation are the segments found in this market and it has a vast network of products like tissue products, immunosuppressive drugs and preservation solutions that facilitates organ transplantation. The leading contributors to this market are those countries that already have functional healthcare sectors or policies regarding organ donation.

The ever increasing need of organs and tissues also resulted in technology investment towards better availability and better preservation from the donor’s side. Nevertheless, one of the tremendous problem is an overall scarcity of organs and tissues in the entire world there are long-time waiting lists for patients. There are efforts by governments and organizations to intensify the sensitization of the population and its provisions, introduce new legislation, as well as actively work on hard and soft technologies such as tissue engineering and regenerative medicine as possible future initiatives. The growth of the market is also supported by the following factors: Demographic changes; people in the market area are aging; incidence of end organ dysfunction; many people are experiencing organ failure; the market area experiences frequent cases of cardiovascular diseases, liver diseases, and kidney diseases thus translating to frequent cases of transplantation.

Tissue and Organ Transplantation Market Trend Analysis

Rise of Bioprinting in Tissue Transplantation

- Bioprinting can be regarded as the key trend in the tissue transplantation market, which is undergoing a revolution. This technology involves building of tissues based on printing of a biological material that includes cells and bio-inks. The idea of bioprinting is useful to produce tissues in the exact need of the patients hence no reliance on donor tissue and the likelihood of their rejection. Many modern universities and some of the best-known biotech companies are working to make ordered functional tissue constructs, with the ultimate goal of printing entire organs.

- Bioprinting is a great technological advancement not only in the field of tissue engineering but also in removing one of the challenges to the tissue transplantation market that is, availability of tissue. Bioprinting is useful through the development of laboratory constructed human tissues so that it helps to minimize the time taken to look for tissue grafts for the patients. Furthermore, bioprinting has potential to enhance the patients quality since they can get their required tissues be it natives, without having to bear the ramifications of immune rejection. What is more, the changes in the present days indicate that in future bioprinting will be a regular tool in the field of tissue and organ transplantation.

Expansion of Organ Donation Programs

- Development of organ donation services represent a valuable opportunity for the Tissue and Organ Transplantation Market. Primarily all the governments, non-profit organization and healthcare institutions are trying to spread awareness about organ donation and are trying to frame policies that can encourage organ donation. States have probably carried out awareness creation crusades in several countries to demystify the entire issue of organ donation and so, political application endeavors to simplify the entire process of organ donations. For instance, some countries have asked societies to presume that the public is willing to donate hence implementing unconscious systems which have greatly expanded donor base.

- This opportunity is valid for both developed and evolving markets due to increasing demand in the need for organ transplantation. Higher organ awareness means more people are signing up for a donor card and thus, more organ availability. Together with the emergence of new preservation solutions and transportations, it is possible to observe the increase in the number of successful organ transplants and, therefore, to predict the further growth of the market. The future development of such programs will have great importance in solving the problem of shortage of organs and the need to increase the availability of transplants worldwide.

Tissue and Organ Transplantation Market Segment Analysis:

Tissue and Organ Transplantation Market Segmented based on Type, Product Type , and End User.

By Type, Tissue and Organ Transplantation segment is expected to dominate the market during the forecast period

- The Tissue and Organ Transplantation Market can be broadly categorized into two main segments: They include Organ transplantation and Tissue transplantation. Organ transplantation means the surgical relocation of the organ such as heart, lung, kidney, liver and pancreas from one human being to another. This segment is regarded as one of the most significant segments into the market since these operations are relatively complex and carried out for the overall purpose of saving people’s lives. Of the above, kidney transplantation in particular has accounted for many of the transplantation surgical procedures due to the rising incidences of chronic kidney disease all over the world.

- It is thus different from a surgery where practices such as the skin grafts, corneal transplant as well as bone transplant fall under. This segment is projected to soar in growth as the test tube development in tissue engineering gains momentum and the trend towards reconstruction surgeries becomes more popular. Transplantation of tissue is less traumatic than transplantation of organs and therefore recommended for many patients. Advanced inkjet bioprinting and more efficient means to preserve tissue have potential to increase demand in this segment in the near future.

By Product Type, Tissue Products segment held the largest share in 2024

- According of the product type the market is also categorized into tissue products, immunosuppressive drugs and preservation solutions. Effectiveness of various techniques as well as use of tissue products as bone grafts, skin grafts, and corneal transplants in reconstructive non reconstructive, anti aging surgeries and orthopedic surgeries has also been on rise. These products are particularly useful in reconstructive surgery either to repair a deficient tissue or to reconstruct form and function.

- The under mentioned are among the uses of immunosuppressive drugs; Control of organ transplant rejection because the immune system of the recipient identifies the transplanted organ as an alien body. These drugs are being consumed more since more patients are being transplanted. Another segments are preservation solutions which are employed to ensure the organ’s functionality during transportation. As the demand for long distance transportation of the organ increases, preservation technologies will play a crucial role in determination of low organ wastage and increased success rates.

Tissue and Organ Transplantation Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- In the Tissue and Organ Transplantation Market, North America has the largest share, favourable healthcare structures, a higher level of awareness regarding organ donation, and support from the governments in the region to transplants. The USA set the pace in the number of organ transplantation conducted annually, due to sound networks of organ donation and efficient research on transplantation technology. To it, the region also enjoys high usage of the better immunosuppressive drugs and preservation solutions.

- Thus, constant growth of the number of chronic diseases and cases of organ failures among people in North America contributes to the market growth. With the help of such measures as OPTN in USA, the question of the organ allocation is solved, and waiting lists are to be reduced. The constant increase in demand for tissues and organs transplants should ensure that this North American region remains dominant in the market especially with advances in bioprinting, tissue engineering and transplant solutions.

Active Key Players in the Tissue and Organ Transplantation Market

- Medtronic (Ireland)

- Stryker Corporation (USA)

- Zimmer Biomet (USA)

- Acelity (USA)

- Arthrex, Inc. (USA)

- Novartis AG (Switzerland)

- AbbVie (USA)

- Baxter International Inc. (USA)

- Organogenesis (USA)

- CryoLife, Inc. (USA)

- Teva Pharmaceuticals (Israel)

- Biolife Solutions (USA)

- 3D Bioprinting Solutions (Russia)

- BioTime, Inc. (USA)

- BioLife Solutions, Inc. (USA) Others Key Player

Key Industry Developments in the Tissue and Organ Transplantation Market

- In November 2023, Vericel Corporation, a US-based company specializing in bioengineered skin substitutes, completed the acquisition of MatriCell, Inc., a regenerative medicine company, for approximately $288 million. This strategic move expands Vericel’s product portfolio to include cartilage and meniscus repair tissues, reinforcing its position in the regenerative medicine market.

- In October 2023, Miromatrix Medical Inc., based in the US, introduced MiroPure Xtracellular Matrix (ECM) Implant for the treatment of osteoarthritis in knees. Derived from porcine small intestine submucosa, this collagen-based implant serves as a natural scaffold for cartilage regeneration in osteoarthritic knees, offering a potentially less invasive alternative to traditional joint replacement surgery.

- In December 2023, United Therapeutics Corporation (US) and Lung Biotechnology PBC (UK) announced a partnership to collaborate on the development and commercialization of LBT-101, a potential treatment for pulmonary fibrosis. This collaboration leverages United Therapeutics’ expertise in rare respiratory diseases and Lung Biotechnology’s innovative gene therapy platform, accelerating the progress of this promising therapy for organ transplantation patients.

|

Tissue and Organ Transplantation Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 49.85 Bn. |

|

Forecast Period 2025-35 CAGR: |

10.26% |

Market Size in 2035: |

USD 145.97 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Product Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Tissue and Organ Transplantation Market by Type (2018-2035)

4.1 Tissue and Organ Transplantation Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Organ Transplantation

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Tissue Transplantation

Chapter 5: Tissue and Organ Transplantation Market by Product Type (2018-2035)

5.1 Tissue and Organ Transplantation Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Tissue Products

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Immunosuppressive Drugs

5.5 Preservation Solutions

Chapter 6: Tissue and Organ Transplantation Market by End User (2018-2035)

6.1 Tissue and Organ Transplantation Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospital

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Transplant Centers

6.5 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Tissue and Organ Transplantation Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 MEDTRONIC (IRELAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 STRYKER CORPORATION (USA)

7.4 ZIMMER BIOMET (USA)

7.5 ACELITY (USA)

7.6 ARTHREX INC. (USA)

7.7 NOVARTIS AG (SWITZERLAND)

7.8 ABBVIE (USA)

7.9 BAXTER INTERNATIONAL INC. (USA)

7.10 ORGANOGENESIS (USA)

7.11 CRYOLIFE INC. (USA)

7.12 TEVA PHARMACEUTICALS (ISRAEL)

7.13 BIOLIFE SOLUTIONS (USA)

7.14 3D BIOPRINTING SOLUTIONS (RUSSIA)

7.15 BIOTIME INC. (USA)

7.16 BIOLIFE SOLUTIONS INC. (USA)

7.17 OTHERS KEY PLAYER

Chapter 8: Global Tissue and Organ Transplantation Market By Region

8.1 Overview

8.2. North America Tissue and Organ Transplantation Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Organ Transplantation

8.2.4.2 Tissue Transplantation

8.2.5 Historic and Forecasted Market Size by Product Type

8.2.5.1 Tissue Products

8.2.5.2 Immunosuppressive Drugs

8.2.5.3 Preservation Solutions

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Hospital

8.2.6.2 Transplant Centers

8.2.6.3 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Tissue and Organ Transplantation Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Organ Transplantation

8.3.4.2 Tissue Transplantation

8.3.5 Historic and Forecasted Market Size by Product Type

8.3.5.1 Tissue Products

8.3.5.2 Immunosuppressive Drugs

8.3.5.3 Preservation Solutions

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Hospital

8.3.6.2 Transplant Centers

8.3.6.3 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Tissue and Organ Transplantation Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Organ Transplantation

8.4.4.2 Tissue Transplantation

8.4.5 Historic and Forecasted Market Size by Product Type

8.4.5.1 Tissue Products

8.4.5.2 Immunosuppressive Drugs

8.4.5.3 Preservation Solutions

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Hospital

8.4.6.2 Transplant Centers

8.4.6.3 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Tissue and Organ Transplantation Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Organ Transplantation

8.5.4.2 Tissue Transplantation

8.5.5 Historic and Forecasted Market Size by Product Type

8.5.5.1 Tissue Products

8.5.5.2 Immunosuppressive Drugs

8.5.5.3 Preservation Solutions

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Hospital

8.5.6.2 Transplant Centers

8.5.6.3 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Tissue and Organ Transplantation Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Organ Transplantation

8.6.4.2 Tissue Transplantation

8.6.5 Historic and Forecasted Market Size by Product Type

8.6.5.1 Tissue Products

8.6.5.2 Immunosuppressive Drugs

8.6.5.3 Preservation Solutions

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Hospital

8.6.6.2 Transplant Centers

8.6.6.3 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Tissue and Organ Transplantation Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Organ Transplantation

8.7.4.2 Tissue Transplantation

8.7.5 Historic and Forecasted Market Size by Product Type

8.7.5.1 Tissue Products

8.7.5.2 Immunosuppressive Drugs

8.7.5.3 Preservation Solutions

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Hospital

8.7.6.2 Transplant Centers

8.7.6.3 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Tissue and Organ Transplantation Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 49.85 Bn. |

|

Forecast Period 2025-35 CAGR: |

10.26% |

Market Size in 2035: |

USD 145.97 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Product Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||