Global Thermal Imaging Market Overview

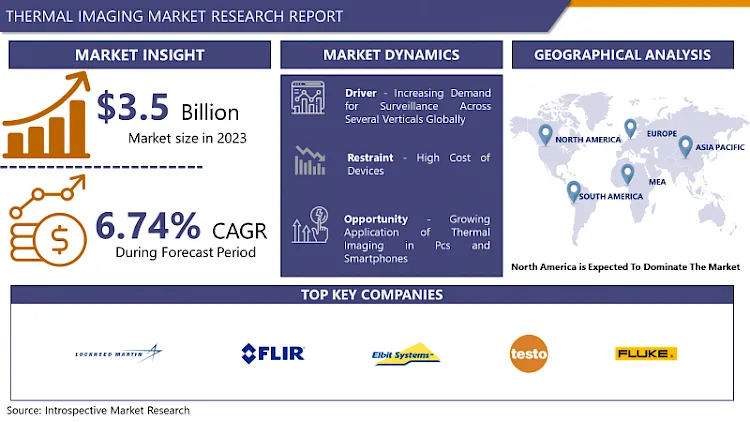

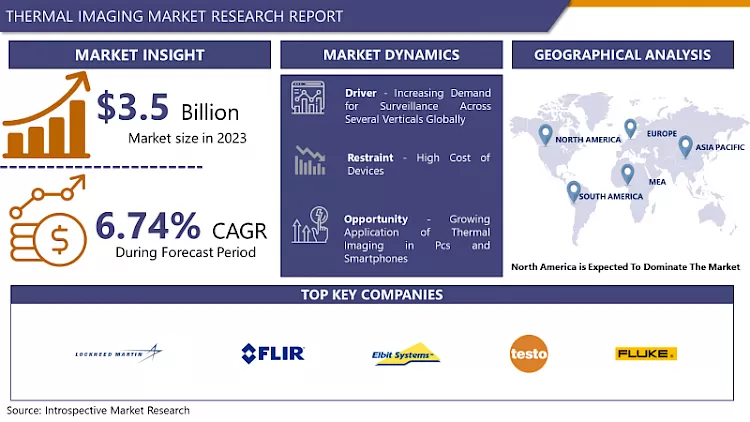

The Global Thermal Imaging market was valued at USD 3.5 billion in 2023 and is expected to reach USD 6.3 billion by the year 2032, at a CAGR of 6.74%.

Thermal Imaging is a method of using infrared radiation and thermal energy to collect information regarding the objects, aiming to develop images of them, even in low visibility environments. It's a type of technology that has conglomerated a broad range of uses across the years. In particular, it's an effective form of night-vision technology, with the capacity to work in the total absence of any light (since it doesn't rely on visible light), and can even work in fog, smog, smoke, and haze. Moreover, thermal imaging is based upon the science of infrared energy (otherwise known as "heat"), which is discharged from all objects. This energy from an object is also known as the "heat signature", and the quantity of radiation emitted tends to be proportional to the overall heat of the object. Thermal cameras or thermal imagers are advanced devices that incorporated a sensitive heat sensor with the capacity to pick up minute differences in temperature. As they gather the infrared radiation from objects in a special environment, they can begin to map out an image based on the differences and inflections of the temperature measurements.

Furthermore, thermal images are grayscale: with white representing heat, black constituting colder regions, and various shades of grey indicating gradients of temperatures between the two. Nevertheless, newer models of thermal imaging cameras even add color to the images they produce, aiming to support users better identify distinct objects more clearly – using colors such as yellow, purple, orange, blue, and red.

Market Dynamics And Factors For The Thermal Imaging Market

Drivers:

Thermal imaging technology is being utilized for the different sectors apart such as Aerospace & Defense, Automotive, Commercial, Law Enforcement, Industrial, Food & Beverages, Residential, Healthcare & Life Sciences, Oil & Gas and other applications. Furthermore, the energy audit sector has created new opportunities for thermal imaging technology, especially in preventative maintenance. The automobile industry is including thermal imaging cameras in cars to overcome the potential dangers of accidents at night. For example, major brands such as BMW and Audi have utilized thermal imaging cameras in cars that support in identifying living objects such as pedestrians and animals, which are difficult to spot in the dark. Furthermore, thermal imaging technology is utilized in the healthcare sector to protect animals and humans from disease. hence, these factors are anticipated to trigger the thermal imaging market development throughout the forecast period.

Furthermore, the advancement of low-priced or low-cost systems is one of the key challenges of the thermal imaging market. These systems creep easily into the market, which in turn increases the demand for new apps owing to their exceptional features such as technological evolutions, outsourcing of work, and increased knowledge. The market is also turned by raised demand for low-price infrared and thermal imaging systems which lay the path for new applications. With an increased target on the size of the system and also its price, manufactures are more concerned about designing, integrating, and developing the system which increases sales of the thermal cameras. This demand is anticipated to be a major factor for continual reduction in the cost of thermal imaging systems, along with the rise in the adoption of thermal imaging systems over various commercial markets.

Restraints:

Export restrictions imposed on thermal imaging products are anticipated to restraint the thermal imaging market expansion during the forecast period. Several economies have foisted strict restrictions on the export of certain thermal imaging products. As per the U.S. Department of State Office of Defense Trade Controls, the export of U.S.-produced night vision equipment is strictly prohibited without a valid export license. The limitations are by the International Traffic in Arms (ITAR), Title 22, Code of Federal Regulation Part 120-130. hence, these factors are anticipated to hamper the thermal imaging market development during the forecast period.

Opportunities:

The growing application of thermal imaging in PCs and smartphones can create lucrative opportunities owing to the massive scope for thermal imaging technology in PCs and smartphone applications. Thermal imaging devices need cooling technology, which in turn raises the cost. Key players such as FLIR Systems have launched innovative devices namely the lepton sensor, which is lighter, smaller, and therefore, can be added to a smartphone. Additionally, it does not use an external cooler to run, which decreases the cost of thermal devices. FLIR Systems has also launched a thermal imaging camera named FLIR ONE, which can be easily assimilated in smartphones such as iPhone 5s.

Market Segmentation

Segmentation Analysis of Thermal Imaging Market:

Based on the Product Type, handheld thermal cameras are projected to register the maximum thermal imaging market over the forecast period due to the massive demand for handheld thermal scanners amidst COVID 19 outbreak for temperature measurement over different places such as factories, metro stations, airports, commercial buildings, and others. The growing popularity of handheld thermal imaging devices owing to their portability, ease of utilization, and widespread application in maintenance, quality control, diagnostics, and spot measurements is anticipated to provide market growth.

Based on the Type, The thermal cameras segment is expected to capture the maximum share of the thermal imaging market throughout the forecast period. This growth is due to the rising adoption of thermal cameras in the residential and commercial sectors. In the residential and commercial sectors, thermal imagers are mainly utilized to provide details for leakage, home insulation, cracks, and insufficient insulation. In addition, thermal cameras are competent in operating in the day, fog, night, and cluttered environment.

Based on the Technology, the cooled segment is anticipated to hold the largest share of the thermal imaging market over the projected period. The cooled segment has a maximum market share in 2020 as they can determine even the smallest changes in the temperature. Uncooled thermal imaging is that which has an opportunity to increase during the forecast period owing to cheap-cost devices used in monitoring.

Based on Applications, the security and surveillance segment is expected to dominate the thermal imaging market over the forecast period. Rapid urbanization increases the requirements for developed thermal imaging solutions for security and surveillance applications. The growing conflicts and terrorist activities among economies also increase the demand for well-equipped systems to monitor the country's borders from the illegal intrusion of enemies and defend the country from them.

Based on the Industry Vertical, the oil & gas segment is expected to dominate the thermal imaging market over the forecast period. Oil and gas refineries are forever at risk from terrorist attacks and need security solutions to determine threats before the breach of the perimeter. Thermal imaging systems are efficient in determining any invader and allow threat assessment in darkness, fog, haze, dust, or smoke. Monitoring different kilometers of gas pipeline networks is a monotonous task, but technology has made it easier by taking over labor-intensive tasks. These systems are generally utilized as a preventive maintenance tool that supports in finding leaks in tanks and pipelines. It helps in taking a precautionary measure by finding and declining the surprise of leakage in regulatory agencies.

Regional Analysis of Thermal Imaging Market:

North America is expected to dominate the Thermal Imaging market over the forecast period. This is primarily owing to growing applications of thermal imaging for monitoring and inspection of historical monuments, process and manufacturing industries, commercial and residential buildings. Huge investment of the government in the defense sector and the raised prominence on screening of people in airports, hospitals, railway stations, and other public spaces are turning the demand for thermal scanners in the region. Furthermore, the growth of the thermal imaging market in this region is owing to the presence of major key players such as Lockheed Martin Corporation (US), FLIR Systems (US), Thermoteknix Systems (UK), L-3 Communications Holdings, Inc. (the US), Leonardo DRS (US), and others, and distributors, the low cost of thermal imaging components, and the growing government expenditure in the aerospace & defense sector. This is anticipated to further help the expansion of the thermal imaging market in North America over the forecast period.

In Europe, the United Kingdom, Germany, and France are growingly adopting high-cost cool thermal imaging solutions. The demand for a cooled camera is increasing market demand over healthcare facilities, manufacturing plants, and automobiles.

The Asia Pacific is also anticipated to observe crucial growth due to the growing defense budget. Major economies such as India, South Korea, and China are investing massively to develop their military weapons to protect their borders. Manufactures in the market are emerging several solutions for military operations, depending on the specifications and operations of these defense sectors.

Players Covered in Thermal Imaging market are :

- Lockheed Martin Corporation (US)

- FLIR Systems (US)

- Elbit Systems Ltd. (Israel)

- Testo (Germany)

- Fluke Corporation (US)

- Opgal (Israel)

- Leonardo (Italy)

- L3HARRIS TECHNOLOGIES (US)

- United Technologies (US)

- Axis Communications (Sweden)

- Raytheon Company (US)

- Sofradir Group (US)

- BAE Systems PLC (UK)

- Xenics (Belgium)

- Thermoteknix Systems (UK)

- L-3 Communications Holdings

- Inc. (the US)

- Leonardo DRS (US)

- and others Major Players.

Key Industry Developments In The Thermal Imaging Market

- In February 2024, Seek Thermal announced the launch of the Reveal XR, a professional-grade thermal imaging camera designed for building inspections, search and rescue, and other demanding applications. The Reveal XR features a 1280x960 resolution sensor, a 30Hz frame rate, and a 45-degree field of view. It also includes a number of new features, such as laser sighting, image stitching, and the ability to record video and images.

- In January 2024, Seek Thermal partnered with FLIR Systems to integrate Seek's thermal imaging technology into FLIR's security and surveillance cameras. This partnership will allow FLIR to offer its customers a wider range of thermal imaging solutions.

|

Global Thermal Imaging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.5 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.74% |

Market Size in 2032: |

USD 6.3 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Thermal Imaging Market by Product Type (2018-2032)

4.1 Thermal Imaging Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Thermal Cameras

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Thermal Modules

4.5 Thermal Scopes

Chapter 5: Thermal Imaging Market by Technology (2018-2032)

5.1 Thermal Imaging Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Cooled

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Uncooled

Chapter 6: Thermal Imaging Market by Application (2018-2032)

6.1 Thermal Imaging Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Security & Surveillance

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Monitoring & Inspection

6.5 Detection & Measurement

6.6 Others

Chapter 7: Thermal Imaging Market by End Users (2018-2032)

7.1 Thermal Imaging Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Automotive

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Commercial

7.5 Government & defense

7.6 Healthcare & life sciences

7.7 Oil & Gas

7.8 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Thermal Imaging Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 CURTISS-WRIGHT CORPORATION (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 IPG PHOTONICS CORPORATION (US)

8.4 LUMENTUM OPERATIONS LLC (US)

8.5 COHERENT INC (US)

8.6 HAYDEN CORPORATION (US)

8.7 ALABAMA SPECIALTY PRODUCTS INC. (US)

8.8 EFESTO (US)

8.9 FRAUNHOFER USA'S CENTER MIDWEST (US)

8.10 KONDEX CORPORATION (US)

8.11 LASERSTAR (US)

8.12 PRECO (US)

8.13 LINCOLN LASER SOLUTIONS (CANADA)

8.14 JENOPTIK (GERMANY)

8.15 LASERLINE (GERMANY)

8.16 TRUMPF (GERMANY)

8.17 LUMIBIRD (FRANCE)

8.18 GRAVOTECH (FRANCE)

8.19 TECHNOGENIA (FRANCE)

8.20 OC OERLIKON MANAGEMENT AG (SWITZERLAND)

8.21 HOGANAS AB (SWEDEN)

8.22 OPTOMEC (MEXICO)

8.23 TLM LASER (UK)

8.24 LASER CLADDING TECHNOLOGIES (SINGAPORE)

8.25 LASERBOND (AUSTRALIA)

8.26 HAN'S LASER TECHNOLOGY INDUSTRY GROUP CO.LTD. (CHINA)

8.27

Chapter 9: Global Thermal Imaging Market By Region

9.1 Overview

9.2. North America Thermal Imaging Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Product Type

9.2.4.1 Thermal Cameras

9.2.4.2 Thermal Modules

9.2.4.3 Thermal Scopes

9.2.5 Historic and Forecasted Market Size by Technology

9.2.5.1 Cooled

9.2.5.2 Uncooled

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Security & Surveillance

9.2.6.2 Monitoring & Inspection

9.2.6.3 Detection & Measurement

9.2.6.4 Others

9.2.7 Historic and Forecasted Market Size by End Users

9.2.7.1 Automotive

9.2.7.2 Commercial

9.2.7.3 Government & defense

9.2.7.4 Healthcare & life sciences

9.2.7.5 Oil & Gas

9.2.7.6 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Thermal Imaging Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Product Type

9.3.4.1 Thermal Cameras

9.3.4.2 Thermal Modules

9.3.4.3 Thermal Scopes

9.3.5 Historic and Forecasted Market Size by Technology

9.3.5.1 Cooled

9.3.5.2 Uncooled

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Security & Surveillance

9.3.6.2 Monitoring & Inspection

9.3.6.3 Detection & Measurement

9.3.6.4 Others

9.3.7 Historic and Forecasted Market Size by End Users

9.3.7.1 Automotive

9.3.7.2 Commercial

9.3.7.3 Government & defense

9.3.7.4 Healthcare & life sciences

9.3.7.5 Oil & Gas

9.3.7.6 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Thermal Imaging Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Product Type

9.4.4.1 Thermal Cameras

9.4.4.2 Thermal Modules

9.4.4.3 Thermal Scopes

9.4.5 Historic and Forecasted Market Size by Technology

9.4.5.1 Cooled

9.4.5.2 Uncooled

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Security & Surveillance

9.4.6.2 Monitoring & Inspection

9.4.6.3 Detection & Measurement

9.4.6.4 Others

9.4.7 Historic and Forecasted Market Size by End Users

9.4.7.1 Automotive

9.4.7.2 Commercial

9.4.7.3 Government & defense

9.4.7.4 Healthcare & life sciences

9.4.7.5 Oil & Gas

9.4.7.6 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Thermal Imaging Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Product Type

9.5.4.1 Thermal Cameras

9.5.4.2 Thermal Modules

9.5.4.3 Thermal Scopes

9.5.5 Historic and Forecasted Market Size by Technology

9.5.5.1 Cooled

9.5.5.2 Uncooled

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Security & Surveillance

9.5.6.2 Monitoring & Inspection

9.5.6.3 Detection & Measurement

9.5.6.4 Others

9.5.7 Historic and Forecasted Market Size by End Users

9.5.7.1 Automotive

9.5.7.2 Commercial

9.5.7.3 Government & defense

9.5.7.4 Healthcare & life sciences

9.5.7.5 Oil & Gas

9.5.7.6 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Thermal Imaging Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Product Type

9.6.4.1 Thermal Cameras

9.6.4.2 Thermal Modules

9.6.4.3 Thermal Scopes

9.6.5 Historic and Forecasted Market Size by Technology

9.6.5.1 Cooled

9.6.5.2 Uncooled

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Security & Surveillance

9.6.6.2 Monitoring & Inspection

9.6.6.3 Detection & Measurement

9.6.6.4 Others

9.6.7 Historic and Forecasted Market Size by End Users

9.6.7.1 Automotive

9.6.7.2 Commercial

9.6.7.3 Government & defense

9.6.7.4 Healthcare & life sciences

9.6.7.5 Oil & Gas

9.6.7.6 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Thermal Imaging Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Product Type

9.7.4.1 Thermal Cameras

9.7.4.2 Thermal Modules

9.7.4.3 Thermal Scopes

9.7.5 Historic and Forecasted Market Size by Technology

9.7.5.1 Cooled

9.7.5.2 Uncooled

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Security & Surveillance

9.7.6.2 Monitoring & Inspection

9.7.6.3 Detection & Measurement

9.7.6.4 Others

9.7.7 Historic and Forecasted Market Size by End Users

9.7.7.1 Automotive

9.7.7.2 Commercial

9.7.7.3 Government & defense

9.7.7.4 Healthcare & life sciences

9.7.7.5 Oil & Gas

9.7.7.6 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Thermal Imaging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.5 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.74% |

Market Size in 2032: |

USD 6.3 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Thermal Imaging Market research report is 2024-2032.

Lockheed Martin Corporation (US), FLIR Systems (US), Elbit Systems Ltd. (Israel), Testo (Germany), Fluke Corporation (US), Opgal (Israel), Leonardo (Italy), L3HARRIS TECHNOLOGIES (US), United Technologies (US), Axis Communications (Sweden), Raytheon Company (US), Sofradir Group (US), BAE Systems PLC (UK), Xenics (Belgium), Thermoteknix Systems (UK), L-3 Communications Holdings, Inc. (the US), Leonardo DRS (US), and other major players.

The Thermal Imaging Market is segmented into Product Type, Technology, Application, End Users, and region. By Product Type, the market is categorized into Thermal Cameras, Thermal Modules, and Thermal Scopes. By Technology, the market is categorized into Cooled, Uncooled. By Application, the market is categorized into Security & Surveillance, Monitoring & Inspection, Detection & Measurement, and Others. By End-User the market is categorized into Automotive, Commercial, Government & Defense, Healthcare & life sciences, Oil & Gas, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Thermal Imaging is a method of using infrared radiation and thermal energy to collect information regarding the objects, aiming to develop images of them, even in low visibility environments. It's a type of technology that has conglomerated a broad range of uses across the years.

The Global Thermal Imaging market was valued at USD 3.5 billion in 2023 and is expected to reach USD 6.3 billion by the year 2032, at a CAGR of 6.74%.