Global Synthetic Monitoring Market Overview

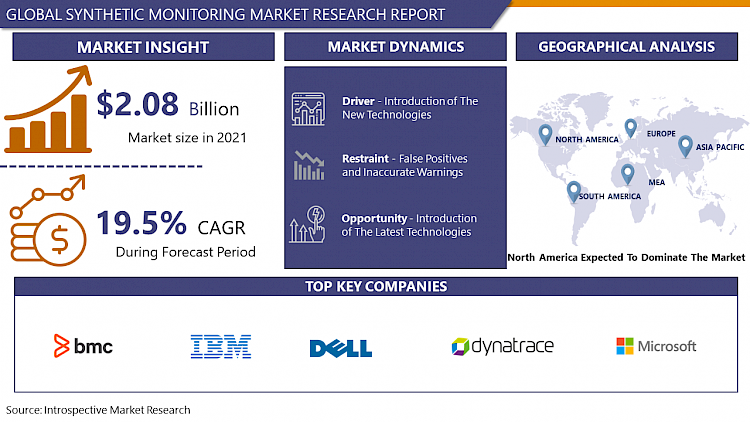

The Global Synthetic Monitoring Market size is expected to grow from USD 2.49 billion in 2022 to USD 10.34 billion by 2030, at a CAGR of 19.5% during the forecast period (2023-2030).

Synthetic or directional monitoring is a method of monitoring an application by simulating a user which tells the path through the application. This targeted monitoring provides information about the uptime and performance of critical business transactions and the most common paths for your application. The simple reality is that there is no easy way to combine the accessibility, consistency, and manageability of a centralized system with the benefits of sharing, growing, cost, and autonomy of a distributed system. With this interface, companies seek advice from their IT development and operations teams. APM tools can be used to fill these gaps. Synthetic monitoring works by sending an automated simulated transaction from a robot client to an application to mimic what a typical user is doing. Synthetic monitoring can be used to ensure that all machines are running correctly inside the firewall, inside the data center, or to provide availability and performance information from a global perspective outside the firewall increase. These server calls and test scripts are "monitoring tools" in that they run at set periodic intervals (for example, every 15 minutes), a single synthetic monitoring client browser specified, or different. It can be published by multiple browsers at the server location. Monitor site availability around the world to improve your judgment and responsiveness. Due to such versatility, the Synthetic Monitoring Market presents a massive opportunity in various business verticals.

Market Dynamics and Factors for the Synthetic Monitoring Market:

Drivers:

New businesses are adopting new generation monitoring applications into their daily business operations. The essential driving factor for the synthetic monitoring market includes the management and proactive monitoring required for complex applications, the variety of microservices that enable better application development, the evaluation of SLA parameters, and the importance of DevOps. Key opportunities to drive Synthetic Monitoring shortly include predictive analytics, data-driven decision making, customer experience management, the era of software definition, and advances in application delivery. The synthetic monitoring market is growing rapidly and is used to monitor static back-end systems for next-generation solutions to validate dynamic customer applications and improve application performance and availability. These next-generation monitoring solutions derive meaningful information directly from the applications they are monitoring, demonstrating that enterprises can better serve their customers and translate them into actionable results that improve performance and operations.

Constant development in software-based solutions and introduction of the latest technologies, such as software as a service and other technologies used to monitor static back-end systems. Synthetic monitoring is used in various phases of application development, including when launching a new application or updating a component from a third-party website. In addition, with the growing demand for rich user experiences, organizations are using synthetic monitoring to provide rich user experiences for third-party components such as analytics, social networking, and search engine optimization. This progression drives the Synthetic Monitoring Market at a global level.

Restraints:

Synthetic Monitoring presents some restraining factors which can hinder the growth of the market such as detected issues that require external support. Alerts presented by synthetic monitoring cannot determine the business impact of an incident and also lack in the identification of root cause can be a major restraining factor in Synthetic Monitoring which slows down the growth of the overall market.

Opportunities:

Rapid growth in the IT and telecommunication sector and reliance on cloud infrastructure from numerous business verticals present a significant growth opportunity. Effective monitoring is a key component of on-premises, cloud, or hybrid infrastructure. It is becoming increasingly difficult for IT managers to rely on traditional IT monitoring tools that are not designed for complex infrastructure landscapes. These are actively moving to comprehensive monitoring solutions. Active monitoring is critical in complex infrastructures managed by many IT teams and where multiple networks, providers, and applications can consume all IT time and resources. Therefore, synthetic monitoring helps troubleshoot these cases by continuously showing the IT team what the user is seeing. Updating services for the IT and telecommunications sectors is an advanced API management approach to bridging the gap between traditional on-premises and cloud-based IT systems. This improves operational efficiency and effectiveness, integrates how data is collected, analyzed, and communicated to the enterprise, improving the experience. Thus advancement and demand from such industries pushed the growth of the Synthetic Monitoring Market.

Challenges

The main challenge with synthetic monitoring is the use of predefined actions. The actual user action is unpredictable and may not follow the most common paths. As a result, synthetic monitoring may not detect performance issues while real users encounter availability issues in their business applications. In comparison to Real User monitoring, this collects data from real user transactions to detect issues such as slowdowns and website errors. This technique is typically performed using a few lines of code in a web page that collects and distributes relevant data. It is typically agentless and asynchronous, so it does not degrade application performance. Hence, a superior alternative is a major challenge for Synthetic Monitoring Market.

Market Segmentation For Synthetic Monitoring

By Type, Transaction Monitoring is the dominating in the type segment of the Synthetic Monitoring Market. Transaction Monitoring allows for the monitoring of a customer's transactions, including assessing past / current customer information and interactions to gain a complete picture of the customer's activities. This may include wire transfers, deposits, and withdrawals. Most financial companies use software to analyze this data automatically. The potentially most effective approach to transaction monitoring in AML is for employees to manually stop and query all transactions completed by the customer. Only after this validation is the transaction allowed ending. Transaction Monitoring offers far better functioning compared to other types of synthetic monitoring which help to elevate the growth of the overall market.

By Application, website monitoring is the dominating segment in the Synthetic Monitoring Market. The usage of synthetic monitoring in website monitoring offers a solid baseline for the monitoring of website server and application performance with low user interaction. Synthetic Monitoring consists of test scripts that simulate end-user clickstreams through simple navigation, form submission, shopping cart transactions, and even online games, so before offering new features or regular offline maintenance. Users also can perform synthetic monitoring in a private test environment. To identify potential failures before real users encounter them. Activities can simulate the browser or control the actual browser.

By End User, Retail and E-commerce is the dominating in the end-user segment of Synthetic Monitoring Market. Retail and E-commerce companies are majorly relying on consumer analytics and data gathered from the website traffic and transaction. Synthetic monitoring allows you to emulate business processes and user transactions such as logging in; searching, filling out forms, adding items to your shopping cart, and checking out from different regions, and monitoring their performance. You can then compare performance statistics between regions and transaction steps to plan for better performance. Massive growth in the use of eCommerce platforms helped to propel the Synthetic Monitoring Market globally.

Players Covered in Synthetic Monitoring market are :

- CA Technologies

- BMC Software

- IBM

- Dell

- Dynatrace

- Microsoft

- Splunkbase

- Appdynamics

- New Relic

- Riverbed and other major players.

Regional Analysis for the Synthetic Monitoring Market:

The North American market is growing due to the significant need for proactive monitoring of increasingly complex applications and the increasing adoption of cloud-based and DevOps applications. In North America, consumers are increasingly favoring online platforms for a variety of services, including traditional markets. As a result, enterprises are focused on improving application management services. In addition, with the increase in DevOps, there is also significant demand for SaaS-based applications in the region. By 2021, North America is projected to account for 48% of all large public cloud data centers known as hyper-scale data centers, according to the Cisco Global Cloud Index Report. IBM recently partnered with Bank of America. Under the agreement, Bank of America will be a dedicated partner to leverage the platform, host critical applications on IBM's public cloud, and serve 66 million banking customers.

The Asia Pacific is expected to be one of the fastest-growing regions in the synthetic monitoring market. Massive development in IT sector and growing online business platform across Asia pacific with growing IT infrastructure in India, China, Japan, and South Korea boosting the Synthetic Monitoring Market.

Key Industry Developments in the Synthetic Monitoring Market:

- In August 2019, SmartBear announced the acquisition of Bitbar, a provider of global advanced test automation platforms for mobile applications and device clouds. This transaction helps SmartBear use technically advanced test solutions in its existing product portfolio. With this acquisition, SmartBear will be able to take full advantage of automation to deliver higher quality software faster.

- February 2020, Dynatrace announced a partnership with the U.S. Department of Veterans Affairs (VA) to introduce the Dynatrace software intelligence platform to significantly improve enterprise cloud visibility and support VA's cloud migration efforts.

COVID-19 Impact on the Synthetic Monitoring Market:

The Covid19 pandemic epidemic has dramatically disrupted every aspect of human life, including the IT sector. In many IT companies around the world, offices are closed and work is done from home and Internationalization has slowed significantly. The majority of companies that are adopting a culture of remote work and implementing blockades in various countries can be beneficial for Synthetic Monitoring Market. Remote work involves multiple applications running on remote endpoints that require monitoring and troubleshooting of performance issues. As a result, the demand for comprehensive enterprise monitoring solutions is growing rapidly. Companies like IMB, Oracle, and Dell Technologies have seen massive growth in the demand and excess revenue during pandemic which certainly seems to be a fruitful period for Synthetic Monitoring Market.

|

Global Synthetic Monitoring Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2021 |

Market Size in 2022: |

USD 2.49 Bn. |

|

Forecast Period 2023-30 CAGR: |

19.5% |

Market Size in 2030: |

USD 10.34 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Application

3.3 By End User

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Synthetic Monitoring Market by Type

5.1 Synthetic Monitoring Market Overview Snapshot and Growth Engine

5.2 Synthetic Monitoring Market Overview

5.3 Uptime Monitoring

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Uptime Monitoring: Grographic Segmentation

5.4 Page Speed Monitoring

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Page Speed Monitoring: Grographic Segmentation

5.5 Transaction Monitoring

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Transaction Monitoring: Grographic Segmentation

Chapter 6: Synthetic Monitoring Market by Application

6.1 Synthetic Monitoring Market Overview Snapshot and Growth Engine

6.2 Synthetic Monitoring Market Overview

6.3 API Monitoring

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 API Monitoring: Grographic Segmentation

6.4 Website Monitoring

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Website Monitoring: Grographic Segmentation

6.5 Mobile Application Monitoring

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Mobile Application Monitoring: Grographic Segmentation

Chapter 7: Synthetic Monitoring Market by End User

7.1 Synthetic Monitoring Market Overview Snapshot and Growth Engine

7.2 Synthetic Monitoring Market Overview

7.3 BFSI

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 BFSI: Grographic Segmentation

7.4 IT & Telecommunication

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 IT & Telecommunication: Grographic Segmentation

7.5 Retail & E-commerce

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Retail & E-commerce: Grographic Segmentation

7.6 Media & Entertainment

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2016-2028F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Media & Entertainment: Grographic Segmentation

7.7 Travel & Hospitality

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size (2016-2028F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Travel & Hospitality: Grographic Segmentation

7.8 Others

7.8.1 Introduction and Market Overview

7.8.2 Historic and Forecasted Market Size (2016-2028F)

7.8.3 Key Market Trends, Growth Factors and Opportunities

7.8.4 Others: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Synthetic Monitoring Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Synthetic Monitoring Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Synthetic Monitoring Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 CA TECHNOLOGIES

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 BMC SOFTWARE

8.4 IBM

8.5 DELL

8.6 DYNATRACE

8.7 MICROSOFT

8.8 SPLUNKBASE

8.9 APPDYNAMICS

8.10 NEW RELIC

8.11 RIVERBED

8.12 OTHER MAJOR PLAYERS

Chapter 9: Global Synthetic Monitoring Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Type

9.2.1 Uptime Monitoring

9.2.2 Page Speed Monitoring

9.2.3 Transaction Monitoring

9.3 Historic and Forecasted Market Size By Application

9.3.1 API Monitoring

9.3.2 Website Monitoring

9.3.3 Mobile Application Monitoring

9.4 Historic and Forecasted Market Size By End User

9.4.1 BFSI

9.4.2 IT & Telecommunication

9.4.3 Retail & E-commerce

9.4.4 Media & Entertainment

9.4.5 Travel & Hospitality

9.4.6 Others

Chapter 10: North America Synthetic Monitoring Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Uptime Monitoring

10.4.2 Page Speed Monitoring

10.4.3 Transaction Monitoring

10.5 Historic and Forecasted Market Size By Application

10.5.1 API Monitoring

10.5.2 Website Monitoring

10.5.3 Mobile Application Monitoring

10.6 Historic and Forecasted Market Size By End User

10.6.1 BFSI

10.6.2 IT & Telecommunication

10.6.3 Retail & E-commerce

10.6.4 Media & Entertainment

10.6.5 Travel & Hospitality

10.6.6 Others

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Synthetic Monitoring Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Uptime Monitoring

11.4.2 Page Speed Monitoring

11.4.3 Transaction Monitoring

11.5 Historic and Forecasted Market Size By Application

11.5.1 API Monitoring

11.5.2 Website Monitoring

11.5.3 Mobile Application Monitoring

11.6 Historic and Forecasted Market Size By End User

11.6.1 BFSI

11.6.2 IT & Telecommunication

11.6.3 Retail & E-commerce

11.6.4 Media & Entertainment

11.6.5 Travel & Hospitality

11.6.6 Others

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific Synthetic Monitoring Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Uptime Monitoring

12.4.2 Page Speed Monitoring

12.4.3 Transaction Monitoring

12.5 Historic and Forecasted Market Size By Application

12.5.1 API Monitoring

12.5.2 Website Monitoring

12.5.3 Mobile Application Monitoring

12.6 Historic and Forecasted Market Size By End User

12.6.1 BFSI

12.6.2 IT & Telecommunication

12.6.3 Retail & E-commerce

12.6.4 Media & Entertainment

12.6.5 Travel & Hospitality

12.6.6 Others

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa Synthetic Monitoring Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Uptime Monitoring

13.4.2 Page Speed Monitoring

13.4.3 Transaction Monitoring

13.5 Historic and Forecasted Market Size By Application

13.5.1 API Monitoring

13.5.2 Website Monitoring

13.5.3 Mobile Application Monitoring

13.6 Historic and Forecasted Market Size By End User

13.6.1 BFSI

13.6.2 IT & Telecommunication

13.6.3 Retail & E-commerce

13.6.4 Media & Entertainment

13.6.5 Travel & Hospitality

13.6.6 Others

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America Synthetic Monitoring Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Uptime Monitoring

14.4.2 Page Speed Monitoring

14.4.3 Transaction Monitoring

14.5 Historic and Forecasted Market Size By Application

14.5.1 API Monitoring

14.5.2 Website Monitoring

14.5.3 Mobile Application Monitoring

14.6 Historic and Forecasted Market Size By End User

14.6.1 BFSI

14.6.2 IT & Telecommunication

14.6.3 Retail & E-commerce

14.6.4 Media & Entertainment

14.6.5 Travel & Hospitality

14.6.6 Others

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Synthetic Monitoring Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2021 |

Market Size in 2022: |

USD 2.49 Bn. |

|

Forecast Period 2023-30 CAGR: |

19.5% |

Market Size in 2030: |

USD 10.34 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. SYNTHETIC MONITORING MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. SYNTHETIC MONITORING MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. SYNTHETIC MONITORING MARKET COMPETITIVE RIVALRY

TABLE 005. SYNTHETIC MONITORING MARKET THREAT OF NEW ENTRANTS

TABLE 006. SYNTHETIC MONITORING MARKET THREAT OF SUBSTITUTES

TABLE 007. SYNTHETIC MONITORING MARKET BY TYPE

TABLE 008. UPTIME MONITORING MARKET OVERVIEW (2016-2028)

TABLE 009. PAGE SPEED MONITORING MARKET OVERVIEW (2016-2028)

TABLE 010. TRANSACTION MONITORING MARKET OVERVIEW (2016-2028)

TABLE 011. SYNTHETIC MONITORING MARKET BY APPLICATION

TABLE 012. API MONITORING MARKET OVERVIEW (2016-2028)

TABLE 013. WEBSITE MONITORING MARKET OVERVIEW (2016-2028)

TABLE 014. MOBILE APPLICATION MONITORING MARKET OVERVIEW (2016-2028)

TABLE 015. SYNTHETIC MONITORING MARKET BY END USER

TABLE 016. BFSI MARKET OVERVIEW (2016-2028)

TABLE 017. IT & TELECOMMUNICATION MARKET OVERVIEW (2016-2028)

TABLE 018. RETAIL & E-COMMERCE MARKET OVERVIEW (2016-2028)

TABLE 019. MEDIA & ENTERTAINMENT MARKET OVERVIEW (2016-2028)

TABLE 020. TRAVEL & HOSPITALITY MARKET OVERVIEW (2016-2028)

TABLE 021. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 022. NORTH AMERICA SYNTHETIC MONITORING MARKET, BY TYPE (2016-2028)

TABLE 023. NORTH AMERICA SYNTHETIC MONITORING MARKET, BY APPLICATION (2016-2028)

TABLE 024. NORTH AMERICA SYNTHETIC MONITORING MARKET, BY END USER (2016-2028)

TABLE 025. N SYNTHETIC MONITORING MARKET, BY COUNTRY (2016-2028)

TABLE 026. EUROPE SYNTHETIC MONITORING MARKET, BY TYPE (2016-2028)

TABLE 027. EUROPE SYNTHETIC MONITORING MARKET, BY APPLICATION (2016-2028)

TABLE 028. EUROPE SYNTHETIC MONITORING MARKET, BY END USER (2016-2028)

TABLE 029. SYNTHETIC MONITORING MARKET, BY COUNTRY (2016-2028)

TABLE 030. ASIA PACIFIC SYNTHETIC MONITORING MARKET, BY TYPE (2016-2028)

TABLE 031. ASIA PACIFIC SYNTHETIC MONITORING MARKET, BY APPLICATION (2016-2028)

TABLE 032. ASIA PACIFIC SYNTHETIC MONITORING MARKET, BY END USER (2016-2028)

TABLE 033. SYNTHETIC MONITORING MARKET, BY COUNTRY (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA SYNTHETIC MONITORING MARKET, BY TYPE (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA SYNTHETIC MONITORING MARKET, BY APPLICATION (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA SYNTHETIC MONITORING MARKET, BY END USER (2016-2028)

TABLE 037. SYNTHETIC MONITORING MARKET, BY COUNTRY (2016-2028)

TABLE 038. SOUTH AMERICA SYNTHETIC MONITORING MARKET, BY TYPE (2016-2028)

TABLE 039. SOUTH AMERICA SYNTHETIC MONITORING MARKET, BY APPLICATION (2016-2028)

TABLE 040. SOUTH AMERICA SYNTHETIC MONITORING MARKET, BY END USER (2016-2028)

TABLE 041. SYNTHETIC MONITORING MARKET, BY COUNTRY (2016-2028)

TABLE 042. CA TECHNOLOGIES: SNAPSHOT

TABLE 043. CA TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 044. CA TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 045. CA TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. BMC SOFTWARE: SNAPSHOT

TABLE 046. BMC SOFTWARE: BUSINESS PERFORMANCE

TABLE 047. BMC SOFTWARE: PRODUCT PORTFOLIO

TABLE 048. BMC SOFTWARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. IBM: SNAPSHOT

TABLE 049. IBM: BUSINESS PERFORMANCE

TABLE 050. IBM: PRODUCT PORTFOLIO

TABLE 051. IBM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. DELL: SNAPSHOT

TABLE 052. DELL: BUSINESS PERFORMANCE

TABLE 053. DELL: PRODUCT PORTFOLIO

TABLE 054. DELL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. DYNATRACE: SNAPSHOT

TABLE 055. DYNATRACE: BUSINESS PERFORMANCE

TABLE 056. DYNATRACE: PRODUCT PORTFOLIO

TABLE 057. DYNATRACE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. MICROSOFT: SNAPSHOT

TABLE 058. MICROSOFT: BUSINESS PERFORMANCE

TABLE 059. MICROSOFT: PRODUCT PORTFOLIO

TABLE 060. MICROSOFT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. SPLUNKBASE: SNAPSHOT

TABLE 061. SPLUNKBASE: BUSINESS PERFORMANCE

TABLE 062. SPLUNKBASE: PRODUCT PORTFOLIO

TABLE 063. SPLUNKBASE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. APPDYNAMICS: SNAPSHOT

TABLE 064. APPDYNAMICS: BUSINESS PERFORMANCE

TABLE 065. APPDYNAMICS: PRODUCT PORTFOLIO

TABLE 066. APPDYNAMICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. NEW RELIC: SNAPSHOT

TABLE 067. NEW RELIC: BUSINESS PERFORMANCE

TABLE 068. NEW RELIC: PRODUCT PORTFOLIO

TABLE 069. NEW RELIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. RIVERBED: SNAPSHOT

TABLE 070. RIVERBED: BUSINESS PERFORMANCE

TABLE 071. RIVERBED: PRODUCT PORTFOLIO

TABLE 072. RIVERBED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 073. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 074. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 075. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. SYNTHETIC MONITORING MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. SYNTHETIC MONITORING MARKET OVERVIEW BY TYPE

FIGURE 012. UPTIME MONITORING MARKET OVERVIEW (2016-2028)

FIGURE 013. PAGE SPEED MONITORING MARKET OVERVIEW (2016-2028)

FIGURE 014. TRANSACTION MONITORING MARKET OVERVIEW (2016-2028)

FIGURE 015. SYNTHETIC MONITORING MARKET OVERVIEW BY APPLICATION

FIGURE 016. API MONITORING MARKET OVERVIEW (2016-2028)

FIGURE 017. WEBSITE MONITORING MARKET OVERVIEW (2016-2028)

FIGURE 018. MOBILE APPLICATION MONITORING MARKET OVERVIEW (2016-2028)

FIGURE 019. SYNTHETIC MONITORING MARKET OVERVIEW BY END USER

FIGURE 020. BFSI MARKET OVERVIEW (2016-2028)

FIGURE 021. IT & TELECOMMUNICATION MARKET OVERVIEW (2016-2028)

FIGURE 022. RETAIL & E-COMMERCE MARKET OVERVIEW (2016-2028)

FIGURE 023. MEDIA & ENTERTAINMENT MARKET OVERVIEW (2016-2028)

FIGURE 024. TRAVEL & HOSPITALITY MARKET OVERVIEW (2016-2028)

FIGURE 025. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 026. NORTH AMERICA SYNTHETIC MONITORING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. EUROPE SYNTHETIC MONITORING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. ASIA PACIFIC SYNTHETIC MONITORING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. MIDDLE EAST & AFRICA SYNTHETIC MONITORING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. SOUTH AMERICA SYNTHETIC MONITORING MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Synthetic Monitoring Market research report is 2023-2030.

CA Technologies, BMC Software, IBM, Dell, Dynatrace, Microsoft, Splunkbase, Appdynamics, New Relic, Riverbed, and other major players.

The Synthetic Monitoring Market is segmented into Type, Application, Application, and region. By Type, the market is categorized into Uptime Monitoring, Page Speed Monitoring, and Transaction Monitoring. By Application, the market is categorized into API Monitoring, Website Monitoring, and Mobile Application Monitoring. By End User, the market is categorized into BFSI, IT & Telecommunication, Retail & E-commerce, Media & Entertainment, Travel & Hospitality, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Synthetic or directional monitoring is a method of monitoring an application by simulating a user which tells the path through the application. This targeted monitoring provides information about the uptime and performance of critical business transactions and the most common paths for your application. The simple reality is that there is no easy way to combine the accessibility, consistency, and manageability of a centralized system with the benefits of sharing, growing, cost, and autonomy of a distributed system.

The Global Synthetic Monitoring Market size is expected to grow from USD 2.49 billion in 2022 to USD 10.34 billion by 2030, at a CAGR of 19.5% during the forecast period (2023-2030).