Global Surgical Site Infection Market Overview

The Surgical Site Infection Market size is expected to grow from USD 4.59 Billion in 2022 to USD 6.38 Billion by 2030, at a CAGR of 4.2% during the forecast period.

When an infection develops in the area of the body where surgery was performed, it is called a surgical site infection. Sometimes infections at surgical sites are only skin deep. Infections at other surgical sites can be much more dangerous because they can spread to deeper layers of tissue, organs, or implanted materials. The Centers for Disease Control and Prevention (CDC) publishes guidelines and tools for the medical community to help eliminate surgical site infections, and it also provides resources for the general public to learn more about these infections and take preventative measures. Patients who have recently undergone surgery are at increased risk for developing an infection at the incision site, which can lead to a number of complications and even a second hospitalization. One of the primary causes of surgical site infections is pathogenic wound contamination during surgical procedures, while another primary cause is a compromised immune system's inability to fight off bacterial invaders.

Surgery-related infections are just one source of surgical site infections; factors like patient obesity, smoking, cancer, diabetes, and a compromised immune system also play a role. Infections at surgical sites can be classified as either superficial (in the skin), deep (in the muscle), or space (in the surrounding tissue) by the CDC.

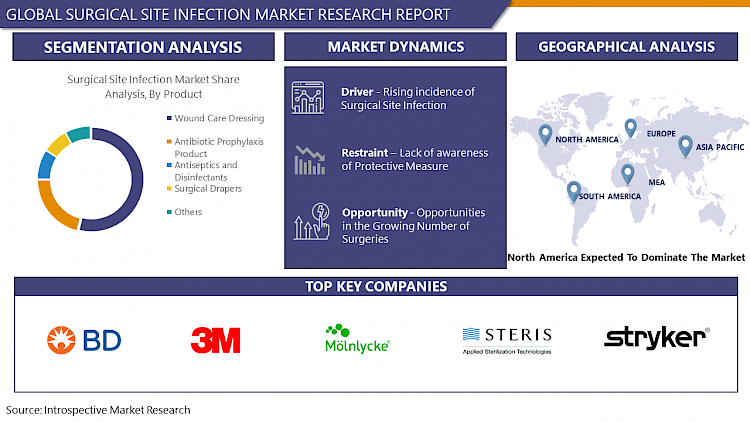

Market Dynamics and Factors for Surgical Site Infection Market

Drivers:

- Rising Incidence of Surgical Site Infection.

Restraints:

- Lack of Awareness of Protective Measures

Opportunity:

- Opportunities in the Growing Number of Surgeries

Challenges:

- The Implementation of New Standards of Care

Regional Analysis in Surgical Site Infection Market

The market for medicines to prevent and treat infections at surgical sites can be broken down into regional subsets. APAC, LATA, and MEA are the regions in question. The developed healthcare infrastructure in North America and Europe, as well as rising investments in research activities by many key players in developing innovative treatments of surgical site infection, are expected to keep these regions at the forefront of the global surgical site infections treatment market over the forecast period. North America's surgical site infections treatment market is expected to grow at a significant rate due to the region's large patient pool, growing awareness from government organizations, and rising prevalence of surgical site infections. The markets in Latin America and the Middle East and Africa are also expected to expand, but for different reasons.

Covid-19 Impact Analysis on Surgical Site Infection Market

As a result of hospitals and clinics postponing surgical procedures to avoid the spread of the COVID-19 virus, the global COVID-19 outbreak and the lockdown scenario in certain countries have caused hurdles for the surgical equipment business. Surgical procedures were affected by the spread of COVID-19. The number of surgeries performed during the pandemic dropped dramatically as a result of the regulatory authorities' strict guidance against performing any non-emergency surgeries. For instance, worldwide admissions for general surgery fell by 42.8% in the study published in October 2021 by the National Library of Medicine. As a result, the COVID-19 pandemic had a major effect on the market for preventing infections at surgical sites. The wide spread of COVID-19, however, drove home the importance of practicing good hand hygiene and employing other traditional forms of infection control. In addition, the market quickly recovered to pre-pandemic levels as elective surgeries resumed and COVID-19 cases leveled off. Sani-24 Germicidal Disposable Wipe, Sani-HyPerCide Germicidal Disposable Wipe, and Sani-HyPerCide Germicidal Spray were all introduced by PDI in March 2022 to aid infection preventionists in their fight against the spread of HAIs and COVID-19.

Top Key Players Covered in Surgical Site Infection Market

- 3M Company (U.S)

- STERIS plc (U.K)

- Stryker Corporation (U.S)

- Medtronic plc (Ireland)

- Prescient Surgical Inc. (U.S)

- Covalon Technologies Ltd. (Canada)

- Surgical Site Infection Prevention LLC (U.S)

- HARTMANN GROUP (Germany)

- Mölnlycke Health Care AB (Sweden)

- Becton (U.S)

- Dickinson and Company (U.S), and Other Major Players

Key Industry Development in The Surgical Site Infection Market

In May 2019, KCI Licensing, Inc. received FDA approval to use PREVENA negative pressure incision system to reduce superficial surgical site infections in patients at high risk of post-op infections.

In October 2018, 3M Company launched SoluPrep Film-Forming Sterile Surgical Solution. The company stated that that the new surgical infection control product is a 2% chlorhexidine gluconate and 7055 isopropyl alc surgical skin preparation solution.

|

Global Surgical Site Infection Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 4.59 Bn. |

|

Forecast Period 2022-30 CAGR: |

4.2% |

Market Size in 2030: |

USD 6.38 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Type |

|

||

|

By Phase |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Product

3.2 By Type

3.3 By Phase

3.4 By End-Users

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Surgical Site Infection Market by Product

5.1 Surgical Site Infection Market Overview Snapshot and Growth Engine

5.2 Surgical Site Infection Market Overview

5.3 Wound Care Dressing

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Wound Care Dressing: Geographic Segmentation

5.4 Antibiotic Prophylaxis Products

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Antibiotic Prophylaxis Products: Geographic Segmentation

5.5 Antiseptics and Disinfectants

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Antiseptics and Disinfectants: Geographic Segmentation

5.6 Surgical Drapers

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Surgical Drapers: Geographic Segmentation

5.7 Others

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size (2016-2028F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Others: Geographic Segmentation

Chapter 6: Surgical Site Infection Market by Type

6.1 Surgical Site Infection Market Overview Snapshot and Growth Engine

6.2 Surgical Site Infection Market Overview

6.3 Superficial Incisional Infection

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Superficial Incisional Infection: Geographic Segmentation

6.4 Deep Incisional Infection

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Deep Incisional Infection: Geographic Segmentation

6.5 Space Infection

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Space Infection: Geographic Segmentation

Chapter 7: Surgical Site Infection Market by Phase

7.1 Surgical Site Infection Market Overview Snapshot and Growth Engine

7.2 Surgical Site Infection Market Overview

7.3 Preoperative Phase

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Preoperative Phase: Geographic Segmentation

7.4 Intraoperative Phase

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Intraoperative Phase: Geographic Segmentation

7.5 Postoperative Phase

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Postoperative Phase: Geographic Segmentation

Chapter 8: Surgical Site Infection Market by End-Users

8.1 Surgical Site Infection Market Overview Snapshot and Growth Engine

8.2 Surgical Site Infection Market Overview

8.3 Hospitals

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size (2016-2028F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Hospitals: Geographic Segmentation

8.4 Clinics

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size (2016-2028F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Clinics: Geographic Segmentation

8.5 Ambulatory Surgery Centers

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size (2016-2028F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Ambulatory Surgery Centers: Geographic Segmentation

8.6 Others

8.6.1 Introduction and Market Overview

8.6.2 Historic and Forecasted Market Size (2016-2028F)

8.6.3 Key Market Trends, Growth Factors and Opportunities

8.6.4 Others: Geographic Segmentation

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Positioning

9.1.2 Surgical Site Infection Sales and Market Share By Players

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Surgical Site Infection Industry Concentration Ratio (CR5 and HHI)

9.1.6 Top 5 Surgical Site Infection Players Market Share

9.1.7 Mergers and Acquisitions

9.1.8 Business Strategies By Top Players

9.2 3M COMPANY

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Operating Business Segments

9.2.5 Product Portfolio

9.2.6 Business Performance

9.2.7 Key Strategic Moves and Recent Developments

9.2.8 SWOT Analysis

9.3 STERIS PLC

9.4 STRYKER CORPORATION

9.5 MEDTRONIC PLC

9.6 PRESCIENT SURGICAL INC.

9.7 COVALON TECHNOLOGIES LTD.

9.8 SURGICAL SITE INFECTION PREVENTION LLC

9.9 HARTMANN GROUP

9.10 MÖLNLYCKE HEALTH CARE AB

9.11 BECTON

9.12 DICKINSON AND COMPANY

9.13 OTHER MAJOR PLAYERS

Chapter 10: Global Surgical Site Infection Market Analysis, Insights and Forecast, 2016-2028

10.1 Market Overview

10.2 Historic and Forecasted Market Size By Product

10.2.1 Wound Care Dressing

10.2.2 Antibiotic Prophylaxis Products

10.2.3 Antiseptics and Disinfectants

10.2.4 Surgical Drapers

10.2.5 Others

10.3 Historic and Forecasted Market Size By Type

10.3.1 Superficial Incisional Infection

10.3.2 Deep Incisional Infection

10.3.3 Space Infection

10.4 Historic and Forecasted Market Size By Phase

10.4.1 Preoperative Phase

10.4.2 Intraoperative Phase

10.4.3 Postoperative Phase

10.5 Historic and Forecasted Market Size By End-Users

10.5.1 Hospitals

10.5.2 Clinics

10.5.3 Ambulatory Surgery Centers

10.5.4 Others

Chapter 11: North America Surgical Site Infection Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Product

11.4.1 Wound Care Dressing

11.4.2 Antibiotic Prophylaxis Products

11.4.3 Antiseptics and Disinfectants

11.4.4 Surgical Drapers

11.4.5 Others

11.5 Historic and Forecasted Market Size By Type

11.5.1 Superficial Incisional Infection

11.5.2 Deep Incisional Infection

11.5.3 Space Infection

11.6 Historic and Forecasted Market Size By Phase

11.6.1 Preoperative Phase

11.6.2 Intraoperative Phase

11.6.3 Postoperative Phase

11.7 Historic and Forecasted Market Size By End-Users

11.7.1 Hospitals

11.7.2 Clinics

11.7.3 Ambulatory Surgery Centers

11.7.4 Others

11.8 Historic and Forecast Market Size by Country

11.8.1 U.S.

11.8.2 Canada

11.8.3 Mexico

Chapter 12: Europe Surgical Site Infection Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Product

12.4.1 Wound Care Dressing

12.4.2 Antibiotic Prophylaxis Products

12.4.3 Antiseptics and Disinfectants

12.4.4 Surgical Drapers

12.4.5 Others

12.5 Historic and Forecasted Market Size By Type

12.5.1 Superficial Incisional Infection

12.5.2 Deep Incisional Infection

12.5.3 Space Infection

12.6 Historic and Forecasted Market Size By Phase

12.6.1 Preoperative Phase

12.6.2 Intraoperative Phase

12.6.3 Postoperative Phase

12.7 Historic and Forecasted Market Size By End-Users

12.7.1 Hospitals

12.7.2 Clinics

12.7.3 Ambulatory Surgery Centers

12.7.4 Others

12.8 Historic and Forecast Market Size by Country

12.8.1 Germany

12.8.2 U.K.

12.8.3 France

12.8.4 Italy

12.8.5 Russia

12.8.6 Spain

12.8.7 Rest of Europe

Chapter 13: Asia-Pacific Surgical Site Infection Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Product

13.4.1 Wound Care Dressing

13.4.2 Antibiotic Prophylaxis Products

13.4.3 Antiseptics and Disinfectants

13.4.4 Surgical Drapers

13.4.5 Others

13.5 Historic and Forecasted Market Size By Type

13.5.1 Superficial Incisional Infection

13.5.2 Deep Incisional Infection

13.5.3 Space Infection

13.6 Historic and Forecasted Market Size By Phase

13.6.1 Preoperative Phase

13.6.2 Intraoperative Phase

13.6.3 Postoperative Phase

13.7 Historic and Forecasted Market Size By End-Users

13.7.1 Hospitals

13.7.2 Clinics

13.7.3 Ambulatory Surgery Centers

13.7.4 Others

13.8 Historic and Forecast Market Size by Country

13.8.1 China

13.8.2 India

13.8.3 Japan

13.8.4 Singapore

13.8.5 Australia

13.8.6 New Zealand

13.8.7 Rest of APAC

Chapter 14: Middle East & Africa Surgical Site Infection Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Product

14.4.1 Wound Care Dressing

14.4.2 Antibiotic Prophylaxis Products

14.4.3 Antiseptics and Disinfectants

14.4.4 Surgical Drapers

14.4.5 Others

14.5 Historic and Forecasted Market Size By Type

14.5.1 Superficial Incisional Infection

14.5.2 Deep Incisional Infection

14.5.3 Space Infection

14.6 Historic and Forecasted Market Size By Phase

14.6.1 Preoperative Phase

14.6.2 Intraoperative Phase

14.6.3 Postoperative Phase

14.7 Historic and Forecasted Market Size By End-Users

14.7.1 Hospitals

14.7.2 Clinics

14.7.3 Ambulatory Surgery Centers

14.7.4 Others

14.8 Historic and Forecast Market Size by Country

14.8.1 Turkey

14.8.2 Saudi Arabia

14.8.3 Iran

14.8.4 UAE

14.8.5 Africa

14.8.6 Rest of MEA

Chapter 15: South America Surgical Site Infection Market Analysis, Insights and Forecast, 2016-2028

15.1 Key Market Trends, Growth Factors and Opportunities

15.2 Impact of Covid-19

15.3 Key Players

15.4 Key Market Trends, Growth Factors and Opportunities

15.4 Historic and Forecasted Market Size By Product

15.4.1 Wound Care Dressing

15.4.2 Antibiotic Prophylaxis Products

15.4.3 Antiseptics and Disinfectants

15.4.4 Surgical Drapers

15.4.5 Others

15.5 Historic and Forecasted Market Size By Type

15.5.1 Superficial Incisional Infection

15.5.2 Deep Incisional Infection

15.5.3 Space Infection

15.6 Historic and Forecasted Market Size By Phase

15.6.1 Preoperative Phase

15.6.2 Intraoperative Phase

15.6.3 Postoperative Phase

15.7 Historic and Forecasted Market Size By End-Users

15.7.1 Hospitals

15.7.2 Clinics

15.7.3 Ambulatory Surgery Centers

15.7.4 Others

15.8 Historic and Forecast Market Size by Country

15.8.1 Brazil

15.8.2 Argentina

15.8.3 Rest of SA

Chapter 16 Investment Analysis

Chapter 17 Analyst Viewpoint and Conclusion

|

Global Surgical Site Infection Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 4.59 Bn. |

|

Forecast Period 2022-30 CAGR: |

4.2% |

Market Size in 2030: |

USD 6.38 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Type |

|

||

|

By Phase |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. SURGICAL SITE INFECTION MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. SURGICAL SITE INFECTION MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. SURGICAL SITE INFECTION MARKET COMPETITIVE RIVALRY

TABLE 005. SURGICAL SITE INFECTION MARKET THREAT OF NEW ENTRANTS

TABLE 006. SURGICAL SITE INFECTION MARKET THREAT OF SUBSTITUTES

TABLE 007. SURGICAL SITE INFECTION MARKET BY PRODUCT

TABLE 008. WOUND CARE DRESSING MARKET OVERVIEW (2016-2028)

TABLE 009. ANTIBIOTIC PROPHYLAXIS PRODUCTS MARKET OVERVIEW (2016-2028)

TABLE 010. ANTISEPTICS AND DISINFECTANTS MARKET OVERVIEW (2016-2028)

TABLE 011. SURGICAL DRAPERS MARKET OVERVIEW (2016-2028)

TABLE 012. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 013. SURGICAL SITE INFECTION MARKET BY TYPE

TABLE 014. SUPERFICIAL INCISIONAL INFECTION MARKET OVERVIEW (2016-2028)

TABLE 015. DEEP INCISIONAL INFECTION MARKET OVERVIEW (2016-2028)

TABLE 016. SPACE INFECTION MARKET OVERVIEW (2016-2028)

TABLE 017. SURGICAL SITE INFECTION MARKET BY PHASE

TABLE 018. PREOPERATIVE PHASE MARKET OVERVIEW (2016-2028)

TABLE 019. INTRAOPERATIVE PHASE MARKET OVERVIEW (2016-2028)

TABLE 020. POSTOPERATIVE PHASE MARKET OVERVIEW (2016-2028)

TABLE 021. SURGICAL SITE INFECTION MARKET BY END-USERS

TABLE 022. HOSPITALS MARKET OVERVIEW (2016-2028)

TABLE 023. CLINICS MARKET OVERVIEW (2016-2028)

TABLE 024. AMBULATORY SURGERY CENTERS MARKET OVERVIEW (2016-2028)

TABLE 025. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 026. NORTH AMERICA SURGICAL SITE INFECTION MARKET, BY PRODUCT (2016-2028)

TABLE 027. NORTH AMERICA SURGICAL SITE INFECTION MARKET, BY TYPE (2016-2028)

TABLE 028. NORTH AMERICA SURGICAL SITE INFECTION MARKET, BY PHASE (2016-2028)

TABLE 029. NORTH AMERICA SURGICAL SITE INFECTION MARKET, BY END-USERS (2016-2028)

TABLE 030. N SURGICAL SITE INFECTION MARKET, BY COUNTRY (2016-2028)

TABLE 031. EUROPE SURGICAL SITE INFECTION MARKET, BY PRODUCT (2016-2028)

TABLE 032. EUROPE SURGICAL SITE INFECTION MARKET, BY TYPE (2016-2028)

TABLE 033. EUROPE SURGICAL SITE INFECTION MARKET, BY PHASE (2016-2028)

TABLE 034. EUROPE SURGICAL SITE INFECTION MARKET, BY END-USERS (2016-2028)

TABLE 035. SURGICAL SITE INFECTION MARKET, BY COUNTRY (2016-2028)

TABLE 036. ASIA PACIFIC SURGICAL SITE INFECTION MARKET, BY PRODUCT (2016-2028)

TABLE 037. ASIA PACIFIC SURGICAL SITE INFECTION MARKET, BY TYPE (2016-2028)

TABLE 038. ASIA PACIFIC SURGICAL SITE INFECTION MARKET, BY PHASE (2016-2028)

TABLE 039. ASIA PACIFIC SURGICAL SITE INFECTION MARKET, BY END-USERS (2016-2028)

TABLE 040. SURGICAL SITE INFECTION MARKET, BY COUNTRY (2016-2028)

TABLE 041. MIDDLE EAST & AFRICA SURGICAL SITE INFECTION MARKET, BY PRODUCT (2016-2028)

TABLE 042. MIDDLE EAST & AFRICA SURGICAL SITE INFECTION MARKET, BY TYPE (2016-2028)

TABLE 043. MIDDLE EAST & AFRICA SURGICAL SITE INFECTION MARKET, BY PHASE (2016-2028)

TABLE 044. MIDDLE EAST & AFRICA SURGICAL SITE INFECTION MARKET, BY END-USERS (2016-2028)

TABLE 045. SURGICAL SITE INFECTION MARKET, BY COUNTRY (2016-2028)

TABLE 046. SOUTH AMERICA SURGICAL SITE INFECTION MARKET, BY PRODUCT (2016-2028)

TABLE 047. SOUTH AMERICA SURGICAL SITE INFECTION MARKET, BY TYPE (2016-2028)

TABLE 048. SOUTH AMERICA SURGICAL SITE INFECTION MARKET, BY PHASE (2016-2028)

TABLE 049. SOUTH AMERICA SURGICAL SITE INFECTION MARKET, BY END-USERS (2016-2028)

TABLE 050. SURGICAL SITE INFECTION MARKET, BY COUNTRY (2016-2028)

TABLE 051. 3M COMPANY: SNAPSHOT

TABLE 052. 3M COMPANY: BUSINESS PERFORMANCE

TABLE 053. 3M COMPANY: PRODUCT PORTFOLIO

TABLE 054. 3M COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. STERIS PLC: SNAPSHOT

TABLE 055. STERIS PLC: BUSINESS PERFORMANCE

TABLE 056. STERIS PLC: PRODUCT PORTFOLIO

TABLE 057. STERIS PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. STRYKER CORPORATION: SNAPSHOT

TABLE 058. STRYKER CORPORATION: BUSINESS PERFORMANCE

TABLE 059. STRYKER CORPORATION: PRODUCT PORTFOLIO

TABLE 060. STRYKER CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. MEDTRONIC PLC: SNAPSHOT

TABLE 061. MEDTRONIC PLC: BUSINESS PERFORMANCE

TABLE 062. MEDTRONIC PLC: PRODUCT PORTFOLIO

TABLE 063. MEDTRONIC PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. PRESCIENT SURGICAL INC.: SNAPSHOT

TABLE 064. PRESCIENT SURGICAL INC.: BUSINESS PERFORMANCE

TABLE 065. PRESCIENT SURGICAL INC.: PRODUCT PORTFOLIO

TABLE 066. PRESCIENT SURGICAL INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. COVALON TECHNOLOGIES LTD.: SNAPSHOT

TABLE 067. COVALON TECHNOLOGIES LTD.: BUSINESS PERFORMANCE

TABLE 068. COVALON TECHNOLOGIES LTD.: PRODUCT PORTFOLIO

TABLE 069. COVALON TECHNOLOGIES LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. SURGICAL SITE INFECTION PREVENTION LLC: SNAPSHOT

TABLE 070. SURGICAL SITE INFECTION PREVENTION LLC: BUSINESS PERFORMANCE

TABLE 071. SURGICAL SITE INFECTION PREVENTION LLC: PRODUCT PORTFOLIO

TABLE 072. SURGICAL SITE INFECTION PREVENTION LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. HARTMANN GROUP: SNAPSHOT

TABLE 073. HARTMANN GROUP: BUSINESS PERFORMANCE

TABLE 074. HARTMANN GROUP: PRODUCT PORTFOLIO

TABLE 075. HARTMANN GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. MÖLNLYCKE HEALTH CARE AB: SNAPSHOT

TABLE 076. MÖLNLYCKE HEALTH CARE AB: BUSINESS PERFORMANCE

TABLE 077. MÖLNLYCKE HEALTH CARE AB: PRODUCT PORTFOLIO

TABLE 078. MÖLNLYCKE HEALTH CARE AB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. BECTON: SNAPSHOT

TABLE 079. BECTON: BUSINESS PERFORMANCE

TABLE 080. BECTON: PRODUCT PORTFOLIO

TABLE 081. BECTON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. DICKINSON AND COMPANY: SNAPSHOT

TABLE 082. DICKINSON AND COMPANY: BUSINESS PERFORMANCE

TABLE 083. DICKINSON AND COMPANY: PRODUCT PORTFOLIO

TABLE 084. DICKINSON AND COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 085. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 086. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 087. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. SURGICAL SITE INFECTION MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. SURGICAL SITE INFECTION MARKET OVERVIEW BY PRODUCT

FIGURE 012. WOUND CARE DRESSING MARKET OVERVIEW (2016-2028)

FIGURE 013. ANTIBIOTIC PROPHYLAXIS PRODUCTS MARKET OVERVIEW (2016-2028)

FIGURE 014. ANTISEPTICS AND DISINFECTANTS MARKET OVERVIEW (2016-2028)

FIGURE 015. SURGICAL DRAPERS MARKET OVERVIEW (2016-2028)

FIGURE 016. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 017. SURGICAL SITE INFECTION MARKET OVERVIEW BY TYPE

FIGURE 018. SUPERFICIAL INCISIONAL INFECTION MARKET OVERVIEW (2016-2028)

FIGURE 019. DEEP INCISIONAL INFECTION MARKET OVERVIEW (2016-2028)

FIGURE 020. SPACE INFECTION MARKET OVERVIEW (2016-2028)

FIGURE 021. SURGICAL SITE INFECTION MARKET OVERVIEW BY PHASE

FIGURE 022. PREOPERATIVE PHASE MARKET OVERVIEW (2016-2028)

FIGURE 023. INTRAOPERATIVE PHASE MARKET OVERVIEW (2016-2028)

FIGURE 024. POSTOPERATIVE PHASE MARKET OVERVIEW (2016-2028)

FIGURE 025. SURGICAL SITE INFECTION MARKET OVERVIEW BY END-USERS

FIGURE 026. HOSPITALS MARKET OVERVIEW (2016-2028)

FIGURE 027. CLINICS MARKET OVERVIEW (2016-2028)

FIGURE 028. AMBULATORY SURGERY CENTERS MARKET OVERVIEW (2016-2028)

FIGURE 029. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 030. NORTH AMERICA SURGICAL SITE INFECTION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. EUROPE SURGICAL SITE INFECTION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. ASIA PACIFIC SURGICAL SITE INFECTION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 033. MIDDLE EAST & AFRICA SURGICAL SITE INFECTION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 034. SOUTH AMERICA SURGICAL SITE INFECTION MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Surgical Site Infection Market research report is 2022-2028.

3M Company, STERIS plc, Stryker Corporation, Medtronic plc, Prescient Surgical Inc., Covalon Technologies Ltd., Surgical Site Infection Prevention LLC, HARTMANN GROUP, Mölnlycke Health Care AB, Becton, Dickinson, and Company, and Other major players.

The Surgical Site Infection Market is segmented into Product, Type, End-Users, Phase, and region. By Product, the market is categorized into Wound Care Dressing, Antibiotic Prophylaxis products, Antiseptics and Disinfectants, Surgical Drapers, and Others. By End-Users, the market is categorized into Hospitals, Ambulatory Surgical Centers, Clinics, and Others. By Type, the market is categorized into Superficial Incisional Infection, Deep Incisional Infection, and Space Infection. By Phase, the market is categorized into Preoperative Phase, Intraoperative Phase, and Postoperative Phase. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

When an infection develops in the area of the body where surgery was performed, it is called a surgical site infection. Sometimes infections at surgical sites are only skin deep. Infections at other surgical sites can be much more dangerous because they can spread to deeper layers of tissue, organs, or implanted materials.

The Surgical Site Infection Market size is expected to grow from USD 4.59 Billion in 2022 to USD 6.38 Billion by 2030, at a CAGR of 4.2% during the forecast period.