Key Market Highlights

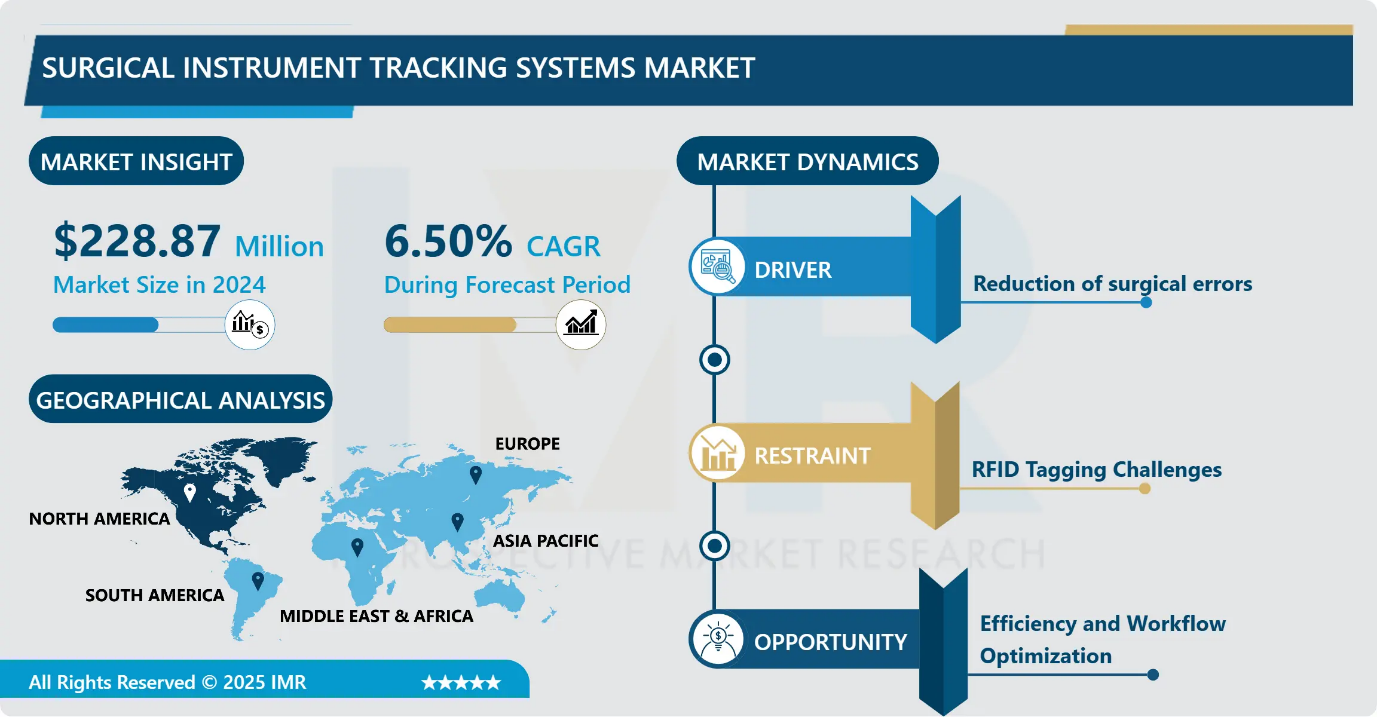

Surgical Instrument Tracking Systems Market Size Was Valued at USD 228.87 Million in 2024, and is Projected to Reach USD 429.62 Million by 2035, Growing at a CAGR of 6.50% from 2025-2035.

- Market Size in 2024: USD 228.87 Million

- Projected Market Size by 2035: USD 429.62 Million

- CAGR (2025–2035): 6.50%

- Leading Market in 2024: North America

- Fastest-Growing Market: Asia-Pacific

- By Component: The Software Component segment is anticipated to lead the market by accounting for 37.67% of the market share throughout the forecast period.

- By Technology: The Barcodes segment is expected to capture 55.4% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: North America region is projected to hold 29.5% of the market share during the forecast period.

- Active Players: Applied Logic (US), Becton, Dickinson and Company (BD) (US), B. Braun Melsungen AG (Germany), Censis Technologies (US), Fortive Corporation (US), and Other Active Players.

Surgical Instrument Tracking Systems Market Synopsis:

Surgical Instrument Tracking System is a digital solution used in healthcare facilities to monitor and manage the usage, location, and sterilization status of surgical instruments throughout their lifecycle. These systems typically utilize RFID (Radio Frequency Identification) or barcoding technology to track instruments, improve inventory management, enhance patient safety, and streamline surgical workflows. They help hospitals ensure that instruments are properly sterilized, readily available when needed, and efficiently utilized, ultimately contributing to better patient outcomes and operational efficiency.

Surgical Instrument Tracking Systems (SITS) are software solutions that track and manage surgical instruments throughout their lifecycle within a healthcare facility. They enable efficient inventory management by tracking location, usage history, and maintenance status in real-time, preventing loss or misplacement. SITS also optimizes instrument utilization by monitoring usage patterns, reducing unnecessary purchases and minimizing equipment redundancy. It also tracks sterilization history, ensuring instruments are properly sterilized before each use, reducing the risk of surgical site infections and patient safety.

Surgical Instrument Tracking Systems Market Dynamics and Trend Analysis:

Surgical Instrument Tracking Systems Market Growth Driver - Reduction of Surgical Errors

-

Surgical errors, including retained instruments, wrong-site surgery, and incorrect instrument usage, pose significant risks to patient safety. Implementing surgical instrument tracking systems can mitigate these risks by ensuring proper inventory management and tracking of instruments before, during, and after surgery. These systems also streamline surgical workflow by providing real-time visibility into the location and status of instruments, reducing time spent searching for equipment and minimizing disruptions during procedures.

- Accurate tracking of surgical instruments can prevent complications like post-operative infections and injuries caused by inadvertently leaving instruments inside patients' bodies. Regulatory compliance is also a key benefit of surgical instrument tracking systems, as they help healthcare facilities comply with regulatory requirements and accreditation standards related to surgical instrument management.

Surgical Instrument Tracking Systems Market Limiting Factor - Lack of standardized protocols and industry-wide interoperability standards

-

Standardized protocols in surgical instrument tracking systems can lead to interoperability issues, limited data exchange, fragmented solutions, vendor lock-in, complex integration challenges, and compliance concerns. The lack of standardized protocols can cause proprietary technologies or data formats to be incompatible, limiting data-sharing efficiency and potentially requiring manual entry. Healthcare facilities may invest in proprietary tracking solutions that are not interoperable, resulting in higher costs and redundant infrastructure.

- Vendor lock-in can limit flexibility in future system upgrades. Complex integration challenges may arise in healthcare IT departments, requiring interface configuration, data security, and system reliability. Compliance concerns related to data privacy, security, and traceability may also impact the adoption of surgical instrument tracking systems in regulated healthcare environments.

Surgical Instrument Tracking Systems Market Expansion Opportunity - Efficiency and Workflow Optimization

-

Surgical instrument tracking systems are a crucial tool in healthcare, providing real-time monitoring of instrument usage and location, reducing manual inventory management time and effort. These systems streamline sterilization processes by providing visibility into instrument usage history and sterilization status, ensuring instruments are properly sterilized and ready for use.

- Surgical instrument tracking systems also help prevent instrument loss and theft by assigning unique identifiers to each instrument and tracking their movement throughout the facility. These systems also enable healthcare facilities to analyse instrument usage data and identify opportunities for optimization, allowing for informed decisions to optimize resource allocation and operational efficiency.

Surgical Instrument Tracking Systems Market Challenge and Risk - RFID Tagging Challenges

-

RFID tagging in the Surgical Instrument Tracking System market faces several challenges, including interference and signal loss due to metallic and electronic equipment in surgical environments, sterilization compatibility with common sterilization processes, tag durability and reliability, and tag size and placement. These issues can lead to signal loss or inaccuracies in instrument tracking.

- Sterilization compatibility is crucial for RFID tags to withstand high temperatures, moisture, and chemical exposure without degradation or malfunction. Tag durability is essential for long-term tracking accuracy. Tag size and placement can pose challenges, especially for smaller or intricate instruments. Integration with existing systems, such as EHR or HIS, can be complex and require compatibility with diverse hardware and software platforms.

Surgical Instrument Tracking Systems Market Trend - Integration of AI-Enabled Predictive Analytics Across Software Platforms

-

Advanced software modules embedded with AI-driven predictive analytics are emerging as a critical trend across surgical instrument tracking systems. Hospitals increasingly rely on intelligent algorithms to forecast instrument utilization patterns, automate tray optimization, and prevent operational bottlenecks in Central Sterile Services Departments (CSSDs). These platforms analyse historical procedure data, turnaround times, and sterilization loads to identify inefficiencies and reduce instrument downtime.

- The shift toward data-centric decision making is pushing vendors to enhance software interoperability with electronic health records and OR management systems, enabling hospitals and ambulatory surgical centres to achieve higher productivity, reduced surgical instrument loss, and improved patient safety.

Surgical Instrument Tracking Systems Market Segment Analysis:

Surgical Instrument Tracking System Market Segmented based on Component, Technology, End-Users, and Region

By Component, Software segment is expected to dominate close to the market during the forecast period

-

Surgical instrument tracking software is a vital tool for healthcare facilities, enabling real-time tracking of instrument usage, location, maintenance history, and sterilization status. It streamlines manual processes, enhancing operational efficiency and minimizing the risk of misplaced or misused instruments.

- The software offers real-time visibility and analytics, enabling data-driven decision-making and performance monitoring. It is customizable and scalable, allowing for the configuration of tracking parameters, alerts, and reports tailored to specific departments or regulatory requirements. It integrates seamlessly with existing systems, enabling data sharing and synchronization.

By Technology, Barcodes segment held the largest share of 55.4% during the forecast period

-

Barcoding technology is a cost-effective and easy-to-implement tracking method that is particularly beneficial for healthcare facilities, especially those with limited budgets. It is familiar and standardized, making it suitable for various industries, including inventory management and patient identification. Barcode technology offers scalability, allowing facilities to expand their tracking capabilities as needed.

- It provides accurate and reliable identification of surgical instruments through unique barcode labels, ensuring proper inventory management and traceability. Barcoding technology also complies with regulatory requirements for tracking medical devices, such as surgical instruments.

Surgical Instrument Tracking Systems Market Regional Insights:

North America is expected to dominate the 29.5% market share over the Forecast period

-

North America's advanced healthcare infrastructure, coupled with stringent regulatory standards, encourages the adoption of surgical instrument tracking systems to enhance patient safety, streamline operations, and improve efficiency. The high incidence of healthcare-associated infections (HAIs) in the region necessitates the use of these systems to monitor sterilization processes, track usage, and identify potential contamination sources.

- Healthcare providers in North America prioritize patient safety and quality improvement, leading to the demand for innovative technologies like surgical instrument tracking systems. The region is a hub for technological innovation, with healthcare providers adopting advanced technologies like RFID, barcoding, and real-time tracking systems to optimize workflow efficiency, reduce costs, and improve patient care.

Surgical Instrument Tracking Systems Market Active Players:

-

Applied Logic (US)

- Becton, Dickinson and Company (BD) (US)

- B. Braun Melsungen AG (Germany)

- Censis Technologies (US)

- Fortive Corporation (US)

- Getinge Group (Sweden)

- Haldor (US)

- Haldor Advanced Technologies (Israel)

- Infor (US)

- Intelligent InSites (US)

- Integra LifeSciences Corporation (US)

- Keir Surgical (Canada)

- Microsystems (US)

- SynMed (Canada)

- STERIS plc (UK)

- SPAtrack Medical Limited (Ireland)

- STANLEY Healthcare (US)

- STERIS Corporation (US)

- Scanlan International (US)

- Terso Solutions (US)

- TGX Medical Systems (US) and Other Active Players

Key Industry Developments in the Surgical Instrument Tracking Systems Market:

-

In January 2024, Censis Technologies has introduced CensisAI2 Instrument Recovery, the newest module of the CensisAI2 interactive data platform, helps sterile processing departments (SPDs) significantly reduce instrumentation costs, improving interdepartmental collaboration and surgical efficiency.

- In August 2023, STERIS plc. announced that it had completed the previously announced acquisition of the surgical instrumentation, laparoscopic instrumentation, and sterilization container assets from Becton, Dickinson, and Company.

How Surgical Instrument Tracking Transforms Hospital Efficiency and Safety

-

Hospitals relied heavily on manual record-keeping, handwritten logbooks, and staff memory to track instruments. Sterile Processing Departments (SPDs) had limited visibility into where instruments were, how often they were used, or whether they had completed proper sterilization cycles. This lack of transparency not only increased costs but also created higher risk of human error and inconsistent sterilization documentation.

- Each surgical instrument is marked with either a barcode or an RFID tag. As the instrument moves through washing, sterilization, packing, storage, and into the operating room, staff scan it, or RFID readers automatically detect it. All this information is captured in a central software system that shows where each instrument is, how many cycles it has been used, and whether it is ready for the next surgery. This ensures complete traceability and eliminates guesswork.

- Proper tracking significantly reduces missing or misplaced instruments, lowers reprocessing errors, and shortens or preparation time. Studies show hospitals can cut instrument loss by over 30–40%, reduce unnecessary instruments in trays by 10–70%, and save thousands of dollars annually through better workflow and fewer delays. In addition, global regulations now require stronger traceability, making tracking systems essential rather than optional.

|

Surgical Instrument Tracking Systems Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 228.87 Mn. |

|

Forecast Period 2025-35 CAGR: |

6.50 % |

Market Size in 2035: |

USD 429.62 Mn. |

|

Segments Covered: |

By Component |

|

|

|

By Technology

|

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Surgical Instrument Tracking Systems Market by Component (2018-2032)

4.1 Surgical Instrument Tracking Systems Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Hardware

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Software

4.5 Services

Chapter 5: Surgical Instrument Tracking Systems Market by Technology (2018-2032)

5.1 Surgical Instrument Tracking Systems Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Barcodes

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 RFID

Chapter 6: Surgical Instrument Tracking Systems Market by End-User (2018-2032)

6.1 Surgical Instrument Tracking Systems Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Ambulatory Surgical Centres

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Surgical Instrument Tracking Systems Market Share by Manufacturer/Service Provider(2024)

7.1.3 Industry BCG Matrix

7.1.4 PArtnerships, Mergers & Acquisitions

7.2 APPLIED LOGIC (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Recent News & Developments

7.2.10 SWOT Analysis

7.3 BECTON

7.4 DICKINSON AND COMPANY (BD) (US)

7.5 B. BRAUN MELSUNGEN AG (GERMANY)

7.6 CENSIS TECHNOLOGIES (US)

7.7 FORTIVE CORPORATION (US)

7.8 GETINGE GROUP (SWEDEN)

7.9 HALDOR (US)

7.10 HALDOR ADVANCED TECHNOLOGIES (ISRAEL)

7.11 INFOR (US)

7.12 INTELLIGENT INSITES (US)

7.13 INTEGRA LIFESCIENCES CORPORATION (US)

7.14 KEIR SURGICAL (CANADA)

7.15 MICROSYSTEMS (US)

7.16 SYNMED (CANADA)

7.17 STERIS PLC (UK)

7.18 SPATRACK MEDICAL LIMITED (IRELAND)

7.19 STANLEY HEALTHCARE (US)

7.20 STERIS CORPORATION (US)

7.21 SCANLAN INTERNATIONAL (US)

7.22 TERSO SOLUTIONS (US)

7.23 TGX MEDICAL SYSTEMS (US) OTHER ACTIVE PLAYERS.

Chapter 8: Global Surgical Instrument Tracking Systems Market By Region

8.1 Overview

8.2. North America Surgical Instrument Tracking Systems Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecast Market Size by Country

8.2.4.1 US

8.2.4.2 Canada

8.2.4.3 Mexico

8.3. Eastern Europe Surgical Instrument Tracking Systems Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecast Market Size by Country

8.3.4.1 Russia

8.3.4.2 Bulgaria

8.3.4.3 The Czech Republic

8.3.4.4 Hungary

8.3.4.5 Poland

8.3.4.6 Romania

8.3.4.7 Rest of Eastern Europe

8.4. Western Europe Surgical Instrument Tracking Systems Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecast Market Size by Country

8.4.4.1 Germany

8.4.4.2 UK

8.4.4.3 France

8.4.4.4 The Netherlands

8.4.4.5 Italy

8.4.4.6 Spain

8.4.4.7 Rest of Western Europe

8.5. Asia Pacific Surgical Instrument Tracking Systems Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecast Market Size by Country

8.5.4.1 China

8.5.4.2 India

8.5.4.3 Japan

8.5.4.4 South Korea

8.5.4.5 Malaysia

8.5.4.6 Thailand

8.5.4.7 Vietnam

8.5.4.8 The Philippines

8.5.4.9 Australia

8.5.4.10 New Zealand

8.5.4.11 Rest of APAC

8.6. Middle East & Africa Surgical Instrument Tracking Systems Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecast Market Size by Country

8.6.4.1 Turkiye

8.6.4.2 Bahrain

8.6.4.3 Kuwait

8.6.4.4 Saudi Arabia

8.6.4.5 Qatar

8.6.4.6 UAE

8.6.4.7 Israel

8.6.4.8 South Africa

8.7. South America Surgical Instrument Tracking Systems Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecast Market Size by Country

8.7.4.1 Brazil

8.7.4.2 Argentina

8.7.4.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

Chapter 10 Our Thematic Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Chapter 11 Analyst Viewpoint and Conclusion

Chapter 12 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Chapter 13 Case Study

Chapter 14 Appendix

10.1 Sources

10.2 List of Tables and figures

10.3 Short Forms and Citations

10.4 Assumption and Conversion

10.5 Disclaimer

|

Surgical Instrument Tracking Systems Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 228.87 Mn. |

|

Forecast Period 2025-35 CAGR: |

6.50 % |

Market Size in 2035: |

USD 429.62 Mn. |

|

Segments Covered: |

By Component |

|

|

|

By Technology

|

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||