Powered Surgical Instruments Market Synopsis:

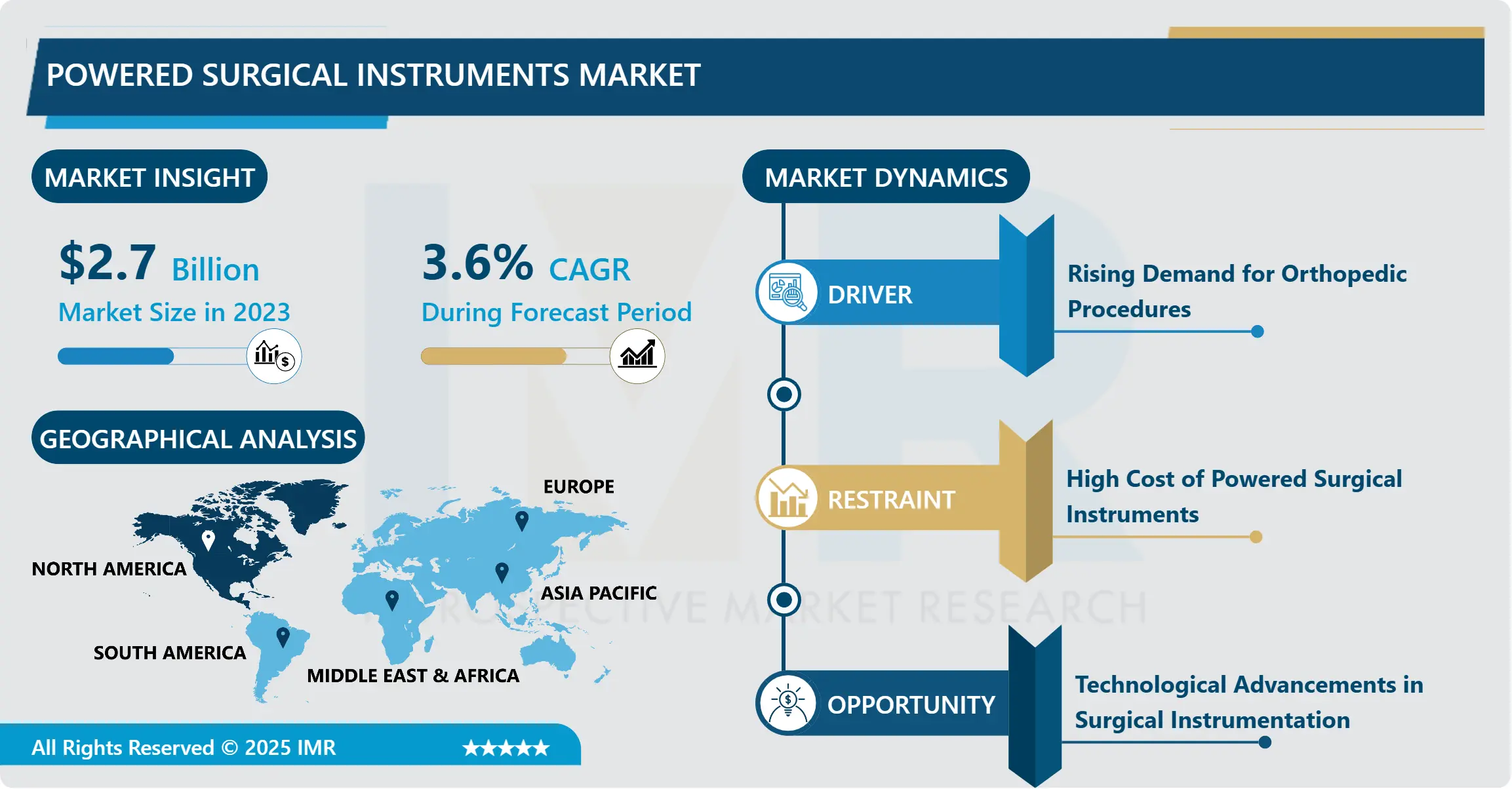

Powered Surgical Instruments Market Size Was Valued at USD 2.70 Billion in 2023, and is Projected to Reach USD 3.71 Billion by 2032, Growing at a CAGR of 3.6% From 2024-2032.

The powered surgical instruments market refers to the sophisticated equipment operated by electrical, pneumatic, or battery energy sources used by surgeons to perform surgery including cutting, drilling, reaming, and other operations. These instruments improve accuracy during the operations, shorten the needed time, and often make surgery less invasive within many medical specializations. Pneumatically activated instruments find application in orthopedic, cardiovascular, ENT, plastic, and reconstructive operations.

Surgical tools enhanced with power are essential components of contemporary OTs and enable surgeons during intricate, delicate, and risky procedures. These tools apart from helping to increase accuracy in surgical operations play a major role in improving patients’ outcomes since complications of non motorized tools are reduced significantly. As technology advances, the powered instruments have entered the market with proper ergonomical designs, higher accuracy and longer power sources hence favoring most any surgical specialty. Over the past few years it has been identified that there is a trend toward less invasive surgical procedures due to a comparatively faster recovery and less trauma to the patient. The shift has created a necessity for powered instruments due to the ability to harmoniously connect with images and robotics employed in minimally invasive surgeries.

Furthermore, advanced surgical technologies like powered surgical instruments again gain popularity because more and more elderly patients are suffering from chronic diseases that need surgeries. Out of all, the orthopedic part has grown immensely because of change in demographics and growing demand for joint replacement primarily due to arthritis and other bone disorders. Be that as it may, the market does have its challenges. The constraints include high cost of equipment, and the need for specialized personnel, particularly in the resource limited setting and stringently regulated markets affects market entry of new devices. However, the future is bright as ongoing innovations and increased concentration on increasing healthcare solutions across the world keeps on pushing the market forward.

Powered Surgical Instruments Market Trend Analysis:

Increasing Demand for Minimally Invasive Surgery

- One of the major driving forces described in powered surgical instruments market is minimally invasive surgery (MIS). MIS techniques are less invasive on the human body than the traditional open surgery and therefore results to shorter hospital stay, minimum post-operative pain and smaller scar. The use of these techniques involves powered surgical instruments as these facilitate compatibility with robotic systems and endoscopic instruments that are common in the minimally invasive technique.

- This is through getting increased awareness and also the desire by the patient to go for treatments that do not involve admission in the hospitals and speeds up recovery. Healthcare practitioners also see MIS-compatible tools as a way to improve patient satisfaction and raise outcomes, setting powered surgical instruments as a key factor of this change. Given the ongoing shift toward increased use of MIS procedures, powered surgical instrument manufacturers have taken it upon themselves to produce instruments that conform to MIS requirements and advance the company’s position in this lucrative market.

Technological Advancements in Surgical Instrumentation

- The powered surgical instruments have a large ongoing technology innovation as a primary driving force. Advances in battery, the instruments used, and changes in size are opening up opportunities for new use and better results in delicate surgeries. More recent laparoscopic instruments are developed with recognition for ergonomics to minimize surgeon fatigue, and with modularity design including unique components and structures fitting specific surgical needs.

- Also, the growth of the robotic technique and computer assisting surgery has broadened the potential uses of power tools. The operating instruments with elements of artificial intelligence can have feedback and help make decisions during operations, increasing the accuracy of their work. Such a degree of innovation is especially appreciated in surgical operations that require tremendous accuracy, for example, neurosurgical and cardiovascular operations. While the advancement of the underlying technology carries on, so too does the potential for product penetration and application in the fields of medicine and associated disciplines.

Powered Surgical Instruments Market Segment Analysis:

Powered Surgical Instruments Market is Segmented on the basis of product type, power source, application, end user, and Region.

By Product Type, Drill Systems segment is expected to dominate the market during the forecast period

- The powered surgical instruments market is segmented with products available depending on the need during surgery. Orthopedic procedures require the force and precision that comes with drill systems and saw systems. Drill systems are also important in neurosurgery for example for accurate severing of the skull while saw systems are very essential in joint replacement surgeries for cutting of the bones. Reamers are also used in orthopedic surgeries where powerful control in designing the bone form implantation is essential for orthopedic surgeons.

- Staplers and shavers, in contrast, are used widely in soft tissue procedures. The two common tools used are shavers which are frequently used during arthroscopic surgeries since they are efficient in removing unhealthy portion of a tissue; the staplers used in cardiovascular and gastrointestinal surgeries. The nature of products in the powered surgical instruments market caters to the versatility of its needs that ranges across all surgical fields.

By Application, Orthopedic Surgery segment expected to held the largest share

- The powered surgical instruments are used in many specialties, and every specialty can require different tools. The largest application is orthopedic surgery, where powered tools are essentials because most surgical operations require manipulation with bones such as joint replacements and fracture operations. The shaking and impact motion which these instruments produce are required for cutting and carving the hard dental tissue.

- Robotic surgery is also widely used in neurosurgery and cardiovascular surgery but with more stringent accuracy because the specialty is more sensitive. ENT surgery and plastic surgery adoption some small and sharp instruments such as shaver and drill in order to manipulate the soft tissue. Such uses of distributed items are well expressed in the multi-specialty applications of these instruments and inspire demand in the sphere of surgery.

Powered Surgical Instruments Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America has the largest share in the powered surgical instruments market due to factors such as sound healthcare systems in the region, rising investment on surgery equipments and products, and recognized market players. The medical sector in the region ensures it uses the latest equipment in surgeries, these are mainly the minimally invasive and those performed with the use of a robot. Also, there is positive reimbursement policy for surgeries which put a push in the adaptation of high end powered instruments in the health facilities.

- United States market, in particular, has features such as highest R & D investment, technological enhancements, and high surgical rate in North America market. Having a solid base on accurate outcomes of a surgical procedure and more precise detailing on patients, North America is expected to stick as the most dominant region in the global market of powered surgical instruments.

Active Key Players in the Powered Surgical Instruments Market:

- Stryker Corporation (US)

- Medtronic (Ireland)

- Zimmer Biomet (US)

- DePuy Synthes (US)

- CONMED Corporation (US)

- B. Braun Melsungen AG (Germany)

- Smith & Nephew (UK)

- Arthrex, Inc. (US)

- Aesculap (Germany)

- MicroAire Surgical Instruments (US)

- Peter Brasseler Holdings (US)

- Adeor Medical AG (Germany)

- Other Active Players

Key Industry Developments in the Powered Surgical Instruments Market:

- In June 2024, Zimmer Biomet announced a collaboration with THINK Surgical to offer the TMINI, a miniature handheld robotic system for total knee arthroplasty. The TMINI complements Zimmer Biomet's existing ROSA Robotics portfolio, providing surgeons with a wireless, ergonomic option for knee replacements. This partnership aims to expand the use of robotic assistance in orthopedic surgeries, particularly in walk-in surgery centers.

- April 2024: MOLLI Surgical launched the OncoPen, a minimally invasive surgical pen that empowers surgeons for better outcomes in breast cancer surgery.

- February 2024: Dentsply Sirona launched its Midwest Energo portfolio of electric handpieces in North America.

- On April 2024, Proprio, a leader in Al-powered surgical technology, announced a significant multi-phase partnership with the Biedermann Group, a company known for its cutting-edge spinal implant systems and procedural solutions. The initial phase of partnership will focus on integrating Biedermann's advanced spinal implants with Proprio's Paradigm system. This system utilizes Al, computer vision, and augmented reality to offer surgeons real-time visualization and guidance during surgical procedures.

|

Powered Surgical Instruments Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.70 Billion |

|

Forecast Period 2024-32 CAGR: |

3.6% |

Market Size in 2032: |

USD 3.71 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Power Source |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Powered Surgical Instruments Market by Product Type

4.1 Powered Surgical Instruments Market Snapshot and Growth Engine

4.2 Powered Surgical Instruments Market Overview

4.3 Drill Systems

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Drill Systems: Geographic Segmentation Analysis

4.4 Saw Systems

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Saw Systems: Geographic Segmentation Analysis

4.5 Reamers

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Reamers: Geographic Segmentation Analysis

4.6 Staplers

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Staplers: Geographic Segmentation Analysis

4.7 Shavers

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Shavers: Geographic Segmentation Analysis

4.8 Others

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Others: Geographic Segmentation Analysis

Chapter 5: Powered Surgical Instruments Market by Power Source

5.1 Powered Surgical Instruments Market Snapshot and Growth Engine

5.2 Powered Surgical Instruments Market Overview

5.3 Electric Instruments

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Electric Instruments: Geographic Segmentation Analysis

5.4 Battery-Powered Instruments

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Battery-Powered Instruments: Geographic Segmentation Analysis

5.5 Pneumatic Instruments

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Pneumatic Instruments: Geographic Segmentation Analysis

Chapter 6: Powered Surgical Instruments Market by Application

6.1 Powered Surgical Instruments Market Snapshot and Growth Engine

6.2 Powered Surgical Instruments Market Overview

6.3 Orthopedic Surgery

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Orthopedic Surgery: Geographic Segmentation Analysis

6.4 Neurosurgery

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Neurosurgery: Geographic Segmentation Analysis

6.5 Cardiovascular Surgery

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Cardiovascular Surgery: Geographic Segmentation Analysis

6.6 ENT Surgery

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 ENT Surgery: Geographic Segmentation Analysis

6.7 Plastic and Reconstructive Surgery

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Plastic and Reconstructive Surgery: Geographic Segmentation Analysis

6.8 Others

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Others: Geographic Segmentation Analysis

Chapter 7: Powered Surgical Instruments Market by End User

7.1 Powered Surgical Instruments Market Snapshot and Growth Engine

7.2 Powered Surgical Instruments Market Overview

7.3 Hospitals

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Hospitals: Geographic Segmentation Analysis

7.4 Ambulatory Surgical Centers (ASCs)

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Ambulatory Surgical Centers (ASCs): Geographic Segmentation Analysis

7.5 Clinics

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Clinics: Geographic Segmentation Analysis

7.6 Others

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Others: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Powered Surgical Instruments Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 STRYKER CORPORATION (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 MEDTRONIC (IRELAND)

8.4 ZIMMER BIOMET (US)

8.5 DEPUY SYNTHES (US)

8.6 CONMED CORPORATION (US)

8.7 B. BRAUN MELSUNGEN AG (GERMANY)

8.8 SMITH & NEPHEW (UK)

8.9 ARTHREX INC. (US)

8.10 AESCULAP (GERMANY)

8.11 MICROAIRE SURGICAL INSTRUMENTS (US)

8.12 PETER BRASSELER HOLDINGS (US)

8.13 ADEOR MEDICAL AG (GERMANY)

8.14 OTHER ACTIVE PLAYERS

Chapter 9: Global Powered Surgical Instruments Market By Region

9.1 Overview

9.2. North America Powered Surgical Instruments Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Product Type

9.2.4.1 Drill Systems

9.2.4.2 Saw Systems

9.2.4.3 Reamers

9.2.4.4 Staplers

9.2.4.5 Shavers

9.2.4.6 Others

9.2.5 Historic and Forecasted Market Size By Power Source

9.2.5.1 Electric Instruments

9.2.5.2 Battery-Powered Instruments

9.2.5.3 Pneumatic Instruments

9.2.6 Historic and Forecasted Market Size By Application

9.2.6.1 Orthopedic Surgery

9.2.6.2 Neurosurgery

9.2.6.3 Cardiovascular Surgery

9.2.6.4 ENT Surgery

9.2.6.5 Plastic and Reconstructive Surgery

9.2.6.6 Others

9.2.7 Historic and Forecasted Market Size By End User

9.2.7.1 Hospitals

9.2.7.2 Ambulatory Surgical Centers (ASCs)

9.2.7.3 Clinics

9.2.7.4 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Powered Surgical Instruments Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Product Type

9.3.4.1 Drill Systems

9.3.4.2 Saw Systems

9.3.4.3 Reamers

9.3.4.4 Staplers

9.3.4.5 Shavers

9.3.4.6 Others

9.3.5 Historic and Forecasted Market Size By Power Source

9.3.5.1 Electric Instruments

9.3.5.2 Battery-Powered Instruments

9.3.5.3 Pneumatic Instruments

9.3.6 Historic and Forecasted Market Size By Application

9.3.6.1 Orthopedic Surgery

9.3.6.2 Neurosurgery

9.3.6.3 Cardiovascular Surgery

9.3.6.4 ENT Surgery

9.3.6.5 Plastic and Reconstructive Surgery

9.3.6.6 Others

9.3.7 Historic and Forecasted Market Size By End User

9.3.7.1 Hospitals

9.3.7.2 Ambulatory Surgical Centers (ASCs)

9.3.7.3 Clinics

9.3.7.4 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Powered Surgical Instruments Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Product Type

9.4.4.1 Drill Systems

9.4.4.2 Saw Systems

9.4.4.3 Reamers

9.4.4.4 Staplers

9.4.4.5 Shavers

9.4.4.6 Others

9.4.5 Historic and Forecasted Market Size By Power Source

9.4.5.1 Electric Instruments

9.4.5.2 Battery-Powered Instruments

9.4.5.3 Pneumatic Instruments

9.4.6 Historic and Forecasted Market Size By Application

9.4.6.1 Orthopedic Surgery

9.4.6.2 Neurosurgery

9.4.6.3 Cardiovascular Surgery

9.4.6.4 ENT Surgery

9.4.6.5 Plastic and Reconstructive Surgery

9.4.6.6 Others

9.4.7 Historic and Forecasted Market Size By End User

9.4.7.1 Hospitals

9.4.7.2 Ambulatory Surgical Centers (ASCs)

9.4.7.3 Clinics

9.4.7.4 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Powered Surgical Instruments Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Product Type

9.5.4.1 Drill Systems

9.5.4.2 Saw Systems

9.5.4.3 Reamers

9.5.4.4 Staplers

9.5.4.5 Shavers

9.5.4.6 Others

9.5.5 Historic and Forecasted Market Size By Power Source

9.5.5.1 Electric Instruments

9.5.5.2 Battery-Powered Instruments

9.5.5.3 Pneumatic Instruments

9.5.6 Historic and Forecasted Market Size By Application

9.5.6.1 Orthopedic Surgery

9.5.6.2 Neurosurgery

9.5.6.3 Cardiovascular Surgery

9.5.6.4 ENT Surgery

9.5.6.5 Plastic and Reconstructive Surgery

9.5.6.6 Others

9.5.7 Historic and Forecasted Market Size By End User

9.5.7.1 Hospitals

9.5.7.2 Ambulatory Surgical Centers (ASCs)

9.5.7.3 Clinics

9.5.7.4 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Powered Surgical Instruments Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Product Type

9.6.4.1 Drill Systems

9.6.4.2 Saw Systems

9.6.4.3 Reamers

9.6.4.4 Staplers

9.6.4.5 Shavers

9.6.4.6 Others

9.6.5 Historic and Forecasted Market Size By Power Source

9.6.5.1 Electric Instruments

9.6.5.2 Battery-Powered Instruments

9.6.5.3 Pneumatic Instruments

9.6.6 Historic and Forecasted Market Size By Application

9.6.6.1 Orthopedic Surgery

9.6.6.2 Neurosurgery

9.6.6.3 Cardiovascular Surgery

9.6.6.4 ENT Surgery

9.6.6.5 Plastic and Reconstructive Surgery

9.6.6.6 Others

9.6.7 Historic and Forecasted Market Size By End User

9.6.7.1 Hospitals

9.6.7.2 Ambulatory Surgical Centers (ASCs)

9.6.7.3 Clinics

9.6.7.4 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Powered Surgical Instruments Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Product Type

9.7.4.1 Drill Systems

9.7.4.2 Saw Systems

9.7.4.3 Reamers

9.7.4.4 Staplers

9.7.4.5 Shavers

9.7.4.6 Others

9.7.5 Historic and Forecasted Market Size By Power Source

9.7.5.1 Electric Instruments

9.7.5.2 Battery-Powered Instruments

9.7.5.3 Pneumatic Instruments

9.7.6 Historic and Forecasted Market Size By Application

9.7.6.1 Orthopedic Surgery

9.7.6.2 Neurosurgery

9.7.6.3 Cardiovascular Surgery

9.7.6.4 ENT Surgery

9.7.6.5 Plastic and Reconstructive Surgery

9.7.6.6 Others

9.7.7 Historic and Forecasted Market Size By End User

9.7.7.1 Hospitals

9.7.7.2 Ambulatory Surgical Centers (ASCs)

9.7.7.3 Clinics

9.7.7.4 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Powered Surgical Instruments Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.70 Billion |

|

Forecast Period 2024-32 CAGR: |

3.6% |

Market Size in 2032: |

USD 3.71 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Power Source |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||