Sterile Filtration Market Synopsis:

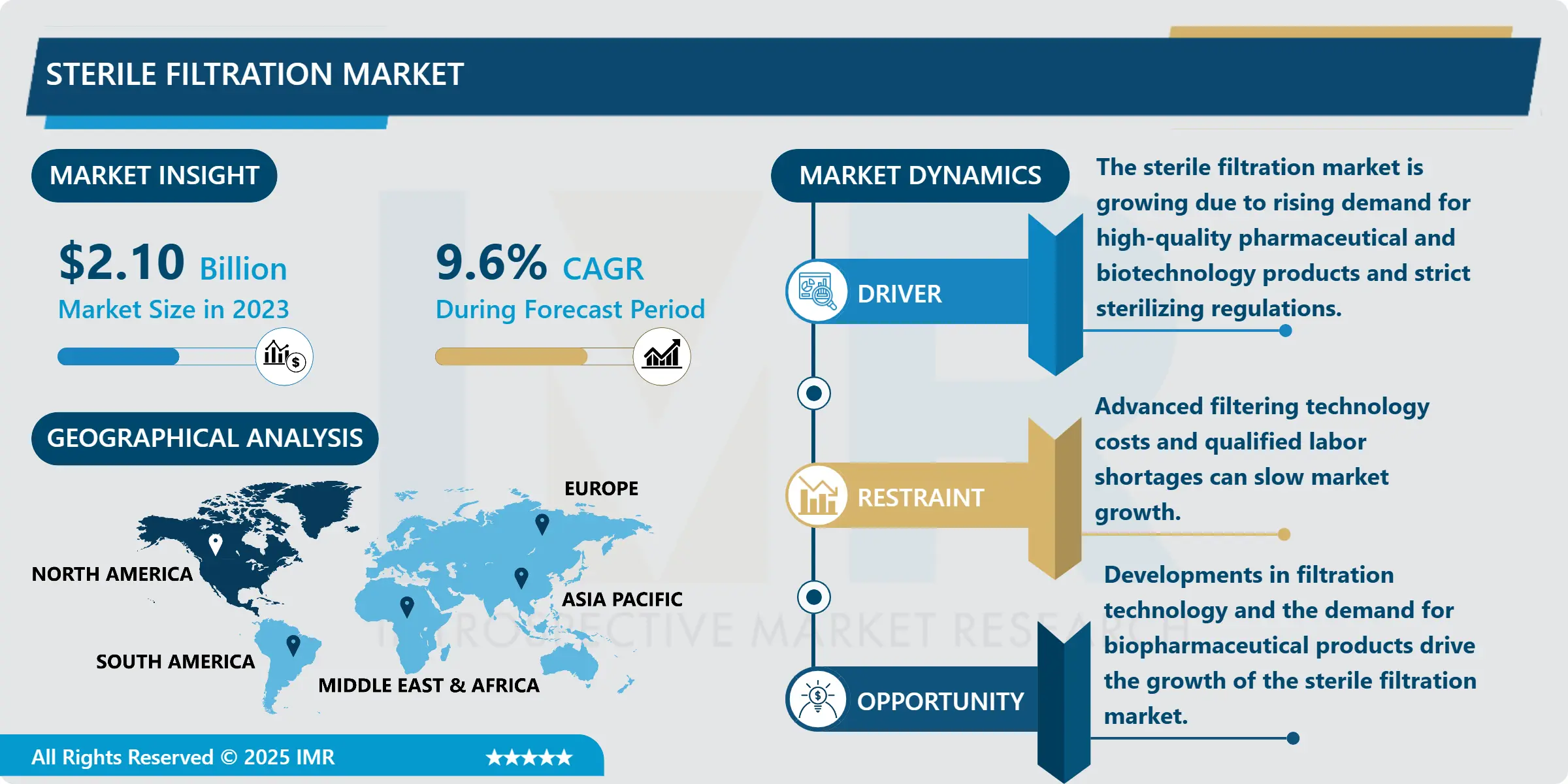

Sterile Filtration Market Size Was Valued at USD 2.10 Billion in 2023, and is Projected to Reach USD 4.79 Billion by 2032, Growing at a CAGR of 9.6% From 2024-2032.

The sterile filtration market is highly significant in the application of manufacturing pharmaceutical, biotechnological, and food and drink production because purity is highly valued in these industries. Sterile filtration is used for filtering out microorganisms and particulate matter out of liquids and gases so that the final product may be used suitably for consumption or utilization in medicine. The main reason for growth in this market is the need for sterile product and hence the drugs, biopharmaceuticals and the medical devices to be manufactured in a specific way to meet this requirement. Development in Filtration technologies has also played a key role in the growth of filtration market where new material and enhanced designs of the filters make the filtration tasks easier, faster and economical.

The market is dominated mainly by the increasing requirement of biopharmaceuticals since the production of biologics and vaccines call for higher levels of sterility. Due to the continuously increasing demand for healthcare and the growth of diseases, along with adoption of personalized medicine, the demand for sterile filtration also increases remarkably. However, the growing application of Sterile Filtration in food and beverages industry as a means of enhancing the safety and the shelf life of the food products have also played the market growth. Legal and regulatory forces, including FDA and EMA, also contribute enormously to the continuous implementation of sterile filtration in production.

As the market continues to evolve, key trends include advancements in membrane technology, which enhance the efficiency of filtration processes while reducing the risk of product contamination. Also, there is increasing market for single-use sterile filtration systems as it economical and convenient for researching companies and pharmaceuticals companies in the biotechnology industries. The refinement of stand-alone automated and integrated filtration systems is also now progressing fast thus delivering better performance and higher conformance to specific quality requirements to manufacturers.

Sterile Filtration Market Trend Analysis:

Advancements in Membrane Technology

- The growing with the sterile filtration market membrane technology is continuously improving. Contemporary membranes are developed to increase the effectiveness of filters, limit attachment of contaminants to the membrane surface and optimise the functionality of filtration processes. These new generation membranes have the potential to filter microorganisms, particles and endotoxins better than the existing membranes which is very important in the preparation of high purity pharmaceutical and biopharmaceutical products. Furthermore, advancements in the membrane strength and filter selectivity are greatly assisting manufacturers to minimize cost of operation, increase production efficiency while ensuring product purity. The increasing demand of these latest membrane technologies is expected to strengthen the market further.

Growing Demand for Single-Use Filtration Systems

- An increasing preference of consumers for single use systems. They have several advantages such as: prospects of avoiding cross contamination, low Capital intensity and high flexibility to manufacturers. Single-use technologies are especially used in the biopharmaceutical sector because of the variability of the batch size and the need for rapid switch from one production to the next. They are made of single use filtration systems, their application in manufacturing adds efficient cost effective and scalable processes which is why the manufacturing industries wide prefer use of microfiber filtration systems. This is a tendency that should continue to spur further development of the offers within the market segment, which will also lead to a higher level of operational utilization and contribute to the growing global need for biopharmaceuticals and vaccines.

Sterile Filtration Market Segment Analysis:

Sterile Filtration Market Segmented on the basis of By Product, Membrane Pore Size, Membrane Type, Application, End User and region.

By Product, Cartridge Filters segment is expected to dominate the market during the forecast period

- Cartridge filters are commonly used for extra capacity filtration because of high dust hold of particles and microorganisms. Capsule filters are a more compact and less expensive than traditional filters but are used mostly in applications requiring only 1-2 filter cartridges Each year, membranes are used in pharmaceutical and biochemical manufacturing processes requiring tight filtration. Syringe filters’ small design makes them suitable for small volume use and in laboratory where results will be quick and accurate. Portable and point-of-use filters such as the bottle-top and table-top are suitable for laboratory and mini scale production. As for any filtration equipment, the accessories ranging from filtration holders, connectors to regulators need special attention as they are the major components for system integrity and functionality. In different production steps, these products respond to the need for sterile filtration and create the market for sterile filters in various industries.

By Application, Fill-Finish Process segment expected to held the largest share

- In bioprocesses the main function of sterile filtration is to remove bacterial and viral endotoxins from the biopharmaceutical products thereby enhancing its purity. In the fill-finish, process it guarantees the inviolability of drugs and vaccines as they are sealed into vials or syringes. Uses and applications of utilities filtration include filtration of water and gases used in pharmaceutical manufacturing; pre-filtration is useful for the filtering out of larger particles before the final filtering process. Since biologics are biological products, used indirect way of viruses’ elimination is crucial in producing high-quality biologics. All in all, the concept of sterile filtration is indispensably significant to sustaining the quality and safety of products in these various fields, hence a strong market push towards innovation of filtration processes in the health care and pharmaceutical sectors.

Sterile Filtration Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America will remain the largest consumer of sterile filtration over the upcoming years because of the highly developed healthcare sector, continuously growing need for biopharmaceuticals, and increasing concerns over the quality and safety of the medicines to be produced. The mobile pharmaceutical and biotechnology sectors in the United States and Canada, as well as high R & D investment, promote the application of high-tech filtration. In addition, regulatory guidelines regarding sterilisation procedures in North America remain high, in so doing enhancing efficiency and reliability of filtration methods. The demand for vaccines, biologics as well as monoclonal antibodies that is getting high due to the ongoing emphasis on pandemic preparedness also supports the regional market growth.

Active Key Players in the Sterile Filtration Market:

- Merck KGaA (Germany)

- Danaher (U.S.)

- Sartorius AG (Germany)

- General Electric (U.S.)

- 3M (U.S.)

- Parker Hannifin Corp (U.S.)

- Sterlitech Corporation (U.S.)

- ALFA LAVAL (Sweden)

- Thermo Fisher Scientific Inc. (U.S.)

- Porvair Filtration Group (U.K.)

- Medtronic (U.S.)

- Meissner Filtration Products, Inc. (U.S.)

- Donaldson Company, Inc. (U.S.)

- Corning Incorporated (U.S.)

- Eaton (Ireland)

- Cole-Parmer Instrument Company, LLC. (U.S.)

- Other Active Players

|

Sterile Filtration Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.10 Billion |

|

Forecast Period 2024-32 CAGR: |

9.6% |

Market Size in 2032: |

USD 4.79 Billion |

|

Segments Covered: |

By Product |

|

|

|

Membrane Pore Size |

|

||

|

Membrane Type |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Industry Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Strategic Pestle Overview

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Mapping

3.6 Regulatory Framework

3.7 Princing Trend Analysis

3.8 Patent Analysis

3.9 Technology Evolution

3.10 Investment Pockets

3.11 Import-Export Analysis

Chapter 4: Sterile Filtration Market by Product

4.1 Sterile Filtration Market Snapshot and Growth Engine

4.2 Sterile Filtration Market Overview

4.3 Cartridge Filters

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Cartridge Filters: Geographic Segmentation Analysis

4.4 Capsule Filters

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Capsule Filters: Geographic Segmentation Analysis

4.5 Membranes

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Membranes: Geographic Segmentation Analysis

4.6 Syringe Filters

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Syringe Filters: Geographic Segmentation Analysis

4.7 Bottle-Top and Table-Top Filtration Systems

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Bottle-Top and Table-Top Filtration Systems: Geographic Segmentation Analysis

4.8 and Accessories

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 and Accessories: Geographic Segmentation Analysis

Chapter 5: Sterile Filtration Market by Membrane Pore Size

5.1 Sterile Filtration Market Snapshot and Growth Engine

5.2 Sterile Filtration Market Overview

5.3 0.2–0.22 µm

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 0.2–0.22 µm: Geographic Segmentation Analysis

5.4 0.45 µm

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 0.45 µm: Geographic Segmentation Analysis

5.5 and 0.1 µm

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 and 0.1 µm: Geographic Segmentation Analysis

Chapter 6: Sterile Filtration Market by Membrane Type

6.1 Sterile Filtration Market Snapshot and Growth Engine

6.2 Sterile Filtration Market Overview

6.3 Polyethersulfone

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Polyethersulfone: Geographic Segmentation Analysis

6.4 Polyvinylidene Difluoride

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Polyvinylidene Difluoride: Geographic Segmentation Analysis

6.5 Nylon

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Nylon: Geographic Segmentation Analysis

6.6 Polytetrafluoroethylene

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Polytetrafluoroethylene: Geographic Segmentation Analysis

6.7 Mixed Cellulose Ester and Cellulose Acetate

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Mixed Cellulose Ester and Cellulose Acetate: Geographic Segmentation Analysis

6.8 and Other Materials

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.8.3 and Other Materials: Geographic Segmentation Analysis

Chapter 7: Sterile Filtration Market by Application

7.1 Sterile Filtration Market Snapshot and Growth Engine

7.2 Sterile Filtration Market Overview

7.3 Bioprocesses

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Bioprocesses: Geographic Segmentation Analysis

7.4 Fill-Finish Process

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Fill-Finish Process: Geographic Segmentation Analysis

7.5 Utilities Filtration

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Utilities Filtration: Geographic Segmentation Analysis

7.6 Pre-Filtration

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Pre-Filtration: Geographic Segmentation Analysis

7.7 Virus Filtration

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.7.3 Virus Filtration: Geographic Segmentation Analysis

7.8 and Other Applications

7.8.1 Introduction and Market Overview

7.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.8.3 and Other Applications: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Sterile Filtration Market Share by Manufacturer (2023)

8.1.3 Concentration Ratio(CR5)

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 MERCK KGAA (GERMANY)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.3 DANAHER (U.S.)

8.4 SARTORIUS AG (GERMANY)

8.5 GENERAL ELECTRIC (U.S.)

8.6 3M (U.S.)

8.7 PARKER HANNIFIN CORP (U.S.)

8.8 STERLITECH CORPORATION (U.S.)

8.9 ALFA LAVAL (SWEDEN)

8.10 THERMO FISHER SCIENTIFIC INC. (U.S.)

8.11 PORVAIR FILTRATION GROUP (U.K.)

8.12 MEDTRONIC (U.S.)

8.13 MEISSNER FILTRATION PRODUCTS INC. (U.S.)

8.14 DONALDSON COMPANY INC. (U.S.)

8.15 CORNING INCORPORATED (U.S.)

8.16 EATON (IRELAND)

8.17 COLE-PARMER INSTRUMENT COMPANY LLC. (U.S.)

8.18 OTHER ACTIVE PLAYERS

Chapter 9: Global Sterile Filtration Market By Region

9.1 Overview

9.2. North America Sterile Filtration Market

9.2.1 Historic and Forecasted Market Size by Segments

9.2.2 Historic and Forecasted Market Size By Product

9.2.2.1 Cartridge Filters

9.2.2.2 Capsule Filters

9.2.2.3 Membranes

9.2.2.4 Syringe Filters

9.2.2.5 Bottle-Top and Table-Top Filtration Systems

9.2.2.6 and Accessories

9.2.3 Historic and Forecasted Market Size By Membrane Pore Size

9.2.3.1 0.2–0.22 µm

9.2.3.2 0.45 µm

9.2.3.3 and 0.1 µm

9.2.4 Historic and Forecasted Market Size By Membrane Type

9.2.4.1 Polyethersulfone

9.2.4.2 Polyvinylidene Difluoride

9.2.4.3 Nylon

9.2.4.4 Polytetrafluoroethylene

9.2.4.5 Mixed Cellulose Ester and Cellulose Acetate

9.2.4.6 and Other Materials

9.2.5 Historic and Forecasted Market Size By Application

9.2.5.1 Bioprocesses

9.2.5.2 Fill-Finish Process

9.2.5.3 Utilities Filtration

9.2.5.4 Pre-Filtration

9.2.5.5 Virus Filtration

9.2.5.6 and Other Applications

9.2.6 Historic and Forecast Market Size by Country

9.2.6.1 US

9.2.6.2 Canada

9.2.6.3 Mexico

9.3. Eastern Europe Sterile Filtration Market

9.3.1 Historic and Forecasted Market Size by Segments

9.3.2 Historic and Forecasted Market Size By Product

9.3.2.1 Cartridge Filters

9.3.2.2 Capsule Filters

9.3.2.3 Membranes

9.3.2.4 Syringe Filters

9.3.2.5 Bottle-Top and Table-Top Filtration Systems

9.3.2.6 and Accessories

9.3.3 Historic and Forecasted Market Size By Membrane Pore Size

9.3.3.1 0.2–0.22 µm

9.3.3.2 0.45 µm

9.3.3.3 and 0.1 µm

9.3.4 Historic and Forecasted Market Size By Membrane Type

9.3.4.1 Polyethersulfone

9.3.4.2 Polyvinylidene Difluoride

9.3.4.3 Nylon

9.3.4.4 Polytetrafluoroethylene

9.3.4.5 Mixed Cellulose Ester and Cellulose Acetate

9.3.4.6 and Other Materials

9.3.5 Historic and Forecasted Market Size By Application

9.3.5.1 Bioprocesses

9.3.5.2 Fill-Finish Process

9.3.5.3 Utilities Filtration

9.3.5.4 Pre-Filtration

9.3.5.5 Virus Filtration

9.3.5.6 and Other Applications

9.3.6 Historic and Forecast Market Size by Country

9.3.6.1 Bulgaria

9.3.6.2 The Czech Republic

9.3.6.3 Hungary

9.3.6.4 Poland

9.3.6.5 Romania

9.3.6.6 Rest of Eastern Europe

9.4. Western Europe Sterile Filtration Market

9.4.1 Historic and Forecasted Market Size by Segments

9.4.2 Historic and Forecasted Market Size By Product

9.4.2.1 Cartridge Filters

9.4.2.2 Capsule Filters

9.4.2.3 Membranes

9.4.2.4 Syringe Filters

9.4.2.5 Bottle-Top and Table-Top Filtration Systems

9.4.2.6 and Accessories

9.4.3 Historic and Forecasted Market Size By Membrane Pore Size

9.4.3.1 0.2–0.22 µm

9.4.3.2 0.45 µm

9.4.3.3 and 0.1 µm

9.4.4 Historic and Forecasted Market Size By Membrane Type

9.4.4.1 Polyethersulfone

9.4.4.2 Polyvinylidene Difluoride

9.4.4.3 Nylon

9.4.4.4 Polytetrafluoroethylene

9.4.4.5 Mixed Cellulose Ester and Cellulose Acetate

9.4.4.6 and Other Materials

9.4.5 Historic and Forecasted Market Size By Application

9.4.5.1 Bioprocesses

9.4.5.2 Fill-Finish Process

9.4.5.3 Utilities Filtration

9.4.5.4 Pre-Filtration

9.4.5.5 Virus Filtration

9.4.5.6 and Other Applications

9.4.6 Historic and Forecast Market Size by Country

9.4.6.1 Germany

9.4.6.2 UK

9.4.6.3 France

9.4.6.4 Netherlands

9.4.6.5 Italy

9.4.6.6 Russia

9.4.6.7 Spain

9.4.6.8 Rest of Western Europe

9.5. Asia Pacific Sterile Filtration Market

9.5.1 Historic and Forecasted Market Size by Segments

9.5.2 Historic and Forecasted Market Size By Product

9.5.2.1 Cartridge Filters

9.5.2.2 Capsule Filters

9.5.2.3 Membranes

9.5.2.4 Syringe Filters

9.5.2.5 Bottle-Top and Table-Top Filtration Systems

9.5.2.6 and Accessories

9.5.3 Historic and Forecasted Market Size By Membrane Pore Size

9.5.3.1 0.2–0.22 µm

9.5.3.2 0.45 µm

9.5.3.3 and 0.1 µm

9.5.4 Historic and Forecasted Market Size By Membrane Type

9.5.4.1 Polyethersulfone

9.5.4.2 Polyvinylidene Difluoride

9.5.4.3 Nylon

9.5.4.4 Polytetrafluoroethylene

9.5.4.5 Mixed Cellulose Ester and Cellulose Acetate

9.5.4.6 and Other Materials

9.5.5 Historic and Forecasted Market Size By Application

9.5.5.1 Bioprocesses

9.5.5.2 Fill-Finish Process

9.5.5.3 Utilities Filtration

9.5.5.4 Pre-Filtration

9.5.5.5 Virus Filtration

9.5.5.6 and Other Applications

9.5.6 Historic and Forecast Market Size by Country

9.5.6.1 China

9.5.6.2 India

9.5.6.3 Japan

9.5.6.4 South Korea

9.5.6.5 Malaysia

9.5.6.6 Thailand

9.5.6.7 Vietnam

9.5.6.8 The Philippines

9.5.6.9 Australia

9.5.6.10 New Zealand

9.5.6.11 Rest of APAC

9.6. Middle East & Africa Sterile Filtration Market

9.6.1 Historic and Forecasted Market Size by Segments

9.6.2 Historic and Forecasted Market Size By Product

9.6.2.1 Cartridge Filters

9.6.2.2 Capsule Filters

9.6.2.3 Membranes

9.6.2.4 Syringe Filters

9.6.2.5 Bottle-Top and Table-Top Filtration Systems

9.6.2.6 and Accessories

9.6.3 Historic and Forecasted Market Size By Membrane Pore Size

9.6.3.1 0.2–0.22 µm

9.6.3.2 0.45 µm

9.6.3.3 and 0.1 µm

9.6.4 Historic and Forecasted Market Size By Membrane Type

9.6.4.1 Polyethersulfone

9.6.4.2 Polyvinylidene Difluoride

9.6.4.3 Nylon

9.6.4.4 Polytetrafluoroethylene

9.6.4.5 Mixed Cellulose Ester and Cellulose Acetate

9.6.4.6 and Other Materials

9.6.5 Historic and Forecasted Market Size By Application

9.6.5.1 Bioprocesses

9.6.5.2 Fill-Finish Process

9.6.5.3 Utilities Filtration

9.6.5.4 Pre-Filtration

9.6.5.5 Virus Filtration

9.6.5.6 and Other Applications

9.6.6 Historic and Forecast Market Size by Country

9.6.6.1 Turkey

9.6.6.2 Bahrain

9.6.6.3 Kuwait

9.6.6.4 Saudi Arabia

9.6.6.5 Qatar

9.6.6.6 UAE

9.6.6.7 Israel

9.6.6.8 South Africa

9.7. South America Sterile Filtration Market

9.7.1 Historic and Forecasted Market Size by Segments

9.7.2 Historic and Forecasted Market Size By Product

9.7.2.1 Cartridge Filters

9.7.2.2 Capsule Filters

9.7.2.3 Membranes

9.7.2.4 Syringe Filters

9.7.2.5 Bottle-Top and Table-Top Filtration Systems

9.7.2.6 and Accessories

9.7.3 Historic and Forecasted Market Size By Membrane Pore Size

9.7.3.1 0.2–0.22 µm

9.7.3.2 0.45 µm

9.7.3.3 and 0.1 µm

9.7.4 Historic and Forecasted Market Size By Membrane Type

9.7.4.1 Polyethersulfone

9.7.4.2 Polyvinylidene Difluoride

9.7.4.3 Nylon

9.7.4.4 Polytetrafluoroethylene

9.7.4.5 Mixed Cellulose Ester and Cellulose Acetate

9.7.4.6 and Other Materials

9.7.5 Historic and Forecasted Market Size By Application

9.7.5.1 Bioprocesses

9.7.5.2 Fill-Finish Process

9.7.5.3 Utilities Filtration

9.7.5.4 Pre-Filtration

9.7.5.5 Virus Filtration

9.7.5.6 and Other Applications

9.7.6 Historic and Forecast Market Size by Country

9.7.6.1 Brazil

9.7.6.2 Argentina

9.7.6.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Sterile Filtration Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.10 Billion |

|

Forecast Period 2024-32 CAGR: |

9.6% |

Market Size in 2032: |

USD 4.79 Billion |

|

Segments Covered: |

By Product |

|

|

|

Membrane Pore Size |

|

||

|

Membrane Type |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||