Biometrics Technology Market Synopsis:

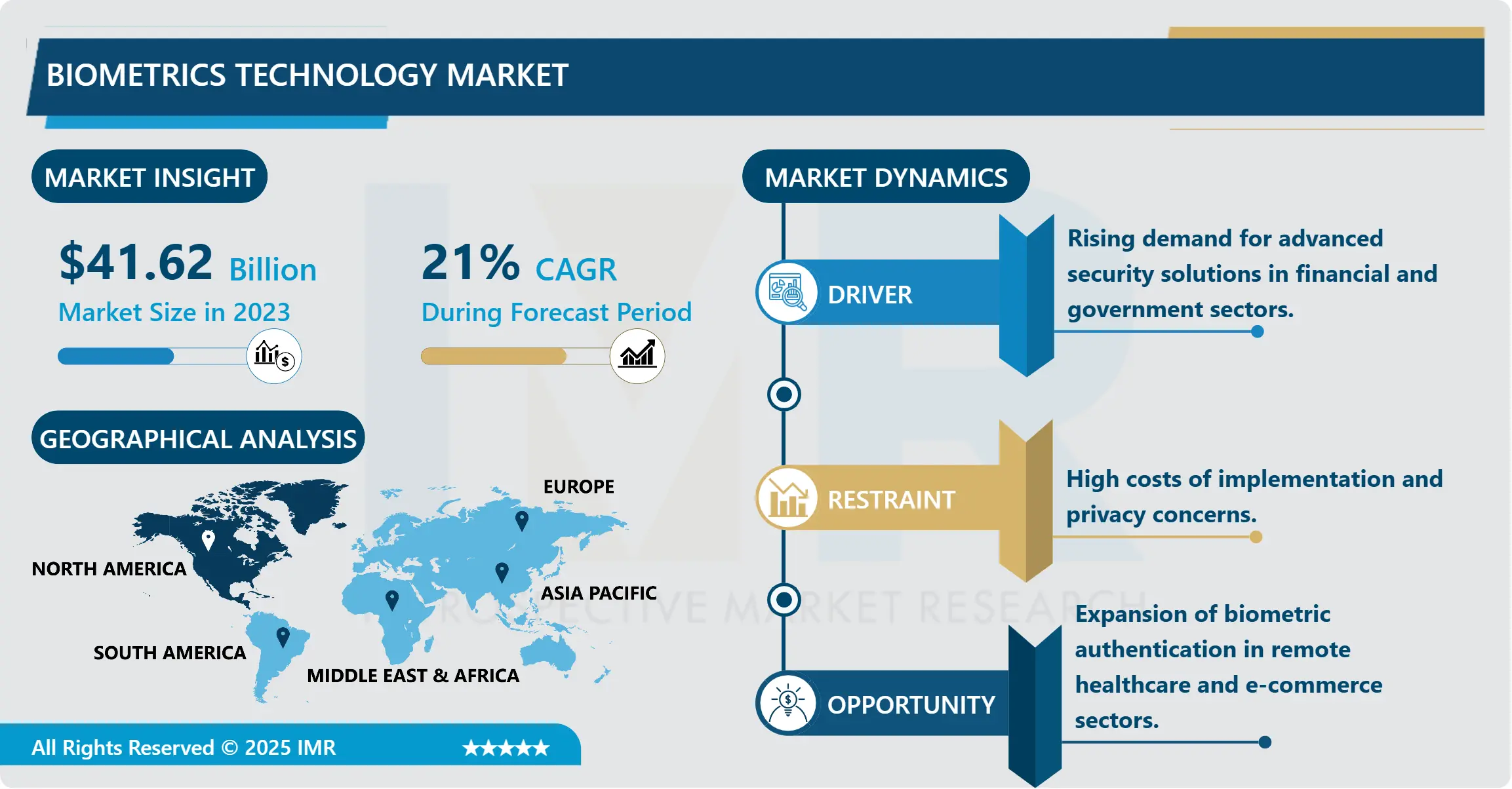

Biometrics Technology Market Size Was Valued at USD 41.62 Billion in 2023, and is Projected to Reach USD 231.40 Billion by 2032, Growing at a CAGR of 21% From 2024-2032.

Biometrics technology refers to the use of unique physical or behavioral characteristics, such as fingerprints, facial recognition, iris patterns, and voice recognition, for identifying and verifying individuals. It is widely used in security systems, authentication processes, and identity management across various industries including banking, healthcare, and law enforcement.

Biometrics technology is a thriving sector that has grown from strength to strength in the past 10 years due to increasing insecurity and theft of identity around the world and in all sectors. INTS 6720 Database Paper Governments around the world are gradually incorporating biometric systems for national identification projects, mass control, and policing services since these systems are highly accurate and cannot be imitated., private entities in banking, retail and health facilities have also adopted biometric authentication in the facilitation of transaction, protection of privileged information as well ushering in new types of customer experience. Biometrics has become popular due to advancement in mobile technology where the technology is readily available in mobile phones.

Artificial intelligence and machine learning have improved biometric recognition systems and given the market added depth beyond its conventional applications. People are embracing new technologies for authentication such as multimodal biometrics that is fingerprint and iris scans and many others that are more accurate. Additionally, legal requirements regarding the protection of user information with the objectives of GDPR and CCPA stimulate the application of biometrics as a more effective and safer alternative to text logins, as well as PINs.

Biometrics Technology Market Trend Analysis:

Rise of Multimodal Biometrics for Enhanced Security

- Multimodal biometric systems has been identified as one of the most pervasive factors that is driving the biometrics technology market. In contrast to unimodal systems which use one biometric trait, say fingerprint or voice as a mode of identification, multimodal systems use two or more traits to provide high reliability. Due to using the multiple biometric inputs, such systems minimize on errors and have improved security, which makes them ideal for important functions such as immigration, ID, and managing accesses to important facilities such as national security and more. Multimodal biometrics also eliminate the downside of unimodal systems such as harsh environmental factors or physical assault that might interfere with decision making.

- In addition, with trends in artificial intelligence and machine learning, real-time processing and learning to recognize are factors that will also help the growth of multimodal biometric systems. As a result, these systems can easily process complicated formats or cases of authentication along with identification of a real user and possible frauds. Since security requirements are still on the rise, particularly in law enforcement, healthcare, and finance industries, multimodal biometrics is seen as a promising solution that helps overcome challenging security threats or hacks with highly comfortable user experiences.

Integration with Blockchain for Data Security

- The biometrics technology is the creation of technologically secure storage systems based on blockchain technology for biometric data. Biometrics is integrated into sensitive applications including, financial applications, medical record security. The centralised and distributed platform of blockchain offers an excellent remedy to the hacking worry by securely protecting biometric data from hackers and intruders. This ensures that biometric identifiers are secure while at the same time building an understanding into the system to ensure user confidence in systems that heavily rely on individual data.

- Biometric innovation when integrated with blockchain is already opening up new horizons through decentralization of identity and flawless cross-border transactions. In the case of blockchain application, everyone would be in control of their biometric solutions at any given time of access. This synergy is going to make new waves across sectors of e business, health care, and financial service among others and by doing so it is likely to redefine the digital identity ecosystems. Moreover, it responds to growing concerns of data privacy and protection and establishes sound fundamentals of reliable and large-scale biometrics.

Biometrics Technology Market Segment Analysis:

Biometrics Technology Market is Segmented on the basis of type, application, Industry Vertical, and region

By Type, physiological biometrics segment is expected to dominate the market during the forecast period

- This industry is usually divided with reference to physiology and behaviour/Physiological Biometrics and Behavioural Biometrics. Physiological biometrics, those that depend in features that may be unique to a particular person, remain popular across sectors to dominate the market. Among such, fingerprint recognition is the most conventional one and is employed in government ID schemes, in smartphones, and security systems. Face recognition is steadily growing popular, they are extensively used in security systems, shops, and in law enforcement due to the development of artificial intelligence and machine learning. Iris recognition and palm vein recognition though special kinds of biometric systems are preferred for very high security applications like healthcare records protection and critical infrastructures’ security. Other physiological means such as DNA and Ear recognition etc are other developing means but are not fully developed for most uses.

- It is applied to call centre security, smart home, and banking applications and allows the user a new level of comfort. As less frequent as this may be, the acquisition of signature recognition is especially useful in legal documents and in financial settlements of bills and other obligations. Other developing behavioural coupled methodologies including keystroke dynamics and gait analysis are extending into Information Security and Fraud Detection

By Application, Access control segment expected to held the largest share

- Access control is one of the main applications of the biometrics technology market that is used across several fields. Biometric access control systems are used in numbers of organizations for increasing security and eradicating risks of simple password or card systems. These systems utilize fingerprints, face or iris to allow only right of entry to prescribed personnel, making them relevant in government building, organization offices, and other sensitive institutions. Actually, with the constant development of mobile technologies, biometric access control does not only concern mobile gadgets like smartphones used for access control and recognition but also every person’s individual and personal devices.

- This is important in Ensuring that fraud in transactions, during on; -boarding processes or even at the check-point boarders is unlikely to happen since biometrics provides an accurate means for establishing identities. Workforce management is another emerging area where biometric time and attendance applications guarantee correct compensation calculations and minimum cases of temp fraud. Finally, biometrics is widely used in surveillance particularly in security, law enforcement and protecting people’s lives. Cameras used in Closed-Circuit Television systems are augmented with facial recognition applications that immediately monitor identified targets and quickly identify persons of interest, improving safety and deterrence against crimes.

Biometrics Technology Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is anticipated to dominate the biometrics technology market over the forecast period, driven by advanced infrastructure, high adoption rates across key industries, and strong investments in research and development. The region is home to several leading biometric solution providers, including multinational tech firms and specialized security companies, which continue to innovate in areas such as facial recognition, fingerprint scanning, and behavioral biometrics. Government initiatives, including large-scale biometric programs for border control, law enforcement, and digital identity management, further bolster the demand for secure and reliable authentication technologies across the United States and Canada.

- The growing integration of biometrics in consumer electronics, financial services, and healthcare in North America reflects a broader shift toward enhanced user experience and fraud prevention. Enterprises in the region are prioritizing biometric-based access control and identity verification as part of their digital transformation strategies, particularly in response to rising cybersecurity threats and regulatory compliance requirements. This dynamic ecosystem of technological advancement, supportive policy frameworks, and a mature end-user base positions North America as the leading contributor to global biometrics market growth throughout the forecast period.

Active Key Players in the Biometrics Technology Market

- Aware Inc. (USA)

- Cognitec Systems (Germany)

- Daon Inc. (USA)

- Dermalog Identification Systems GmbH (Germany)

- Fujitsu Limited (Japan)

- Gemalto (Thales Group) (France)

- HID Global Corporation (USA)

- IDEMIA (France)

- M2SYS Technology (USA)

- NEC Corporation (Japan)

- Nuance Communications (USA)

- Precise Biometrics (Sweden)

- Suprema Inc. (South Korea)

- Synaptics Inc. (USA)

- ZKTeco (China)

- Other Active Players

|

Biometrics Technology Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 41.62 Billion |

|

Forecast Period 2024-32 CAGR: |

21% |

Market Size in 2032: |

USD 231.40 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Industry Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Biometrics Technology Market by Type

4.1 Biometrics Technology Market Snapshot and Growth Engine

4.2 Biometrics Technology Market Overview

4.3 Physiological Biometrics

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Physiological Biometrics: Geographic Segmentation Analysis

4.4 Behavioural Biometrics

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Behavioural Biometrics: Geographic Segmentation Analysis

Chapter 5: Biometrics Technology Market by Application

5.1 Biometrics Technology Market Snapshot and Growth Engine

5.2 Biometrics Technology Market Overview

5.3 Access Control

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Access Control: Geographic Segmentation Analysis

5.4 Identity Verification

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Identity Verification: Geographic Segmentation Analysis

5.5 Workforce Management

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Workforce Management: Geographic Segmentation Analysis

5.6 Surveillance

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Surveillance: Geographic Segmentation Analysis

Chapter 6: Biometrics Technology Market by Industry Vertical

6.1 Biometrics Technology Market Snapshot and Growth Engine

6.2 Biometrics Technology Market Overview

6.3 Government

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Government: Geographic Segmentation Analysis

6.4 Banking

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Banking: Geographic Segmentation Analysis

6.5 Financial Services

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Financial Services: Geographic Segmentation Analysis

6.6 and Insurance (BFS)

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 and Insurance (BFS): Geographic Segmentation Analysis

6.7 Healthcare

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Healthcare: Geographic Segmentation Analysis

6.8 Retail and E-commerce

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Retail and E-commerce: Geographic Segmentation Analysis

6.9 IT and Telecommunication

6.9.1 Introduction and Market Overview

6.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.9.3 Key Market Trends, Growth Factors and Opportunities

6.9.4 IT and Telecommunication: Geographic Segmentation Analysis

6.10 Education

6.10.1 Introduction and Market Overview

6.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.10.3 Key Market Trends, Growth Factors and Opportunities

6.10.4 Education: Geographic Segmentation Analysis

6.11 Transportation and Logistics

6.11.1 Introduction and Market Overview

6.11.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.11.3 Key Market Trends, Growth Factors and Opportunities

6.11.4 Transportation and Logistics: Geographic Segmentation Analysis

6.12 Others

6.12.1 Introduction and Market Overview

6.12.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.12.3 Key Market Trends, Growth Factors and Opportunities

6.12.4 Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Biometrics Technology Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 FUJITSU LIMITED

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 IDEMIA

7.4 NEC CORPORATION

7.5 ZKTECO

7.6 SUPREMA INC

7.7 OTHER ACTIVE PLAYERS

Chapter 8: Global Biometrics Technology Market By Region

8.1 Overview

8.2. North America Biometrics Technology Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Physiological Biometrics

8.2.4.2 Behavioural Biometrics

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Access Control

8.2.5.2 Identity Verification

8.2.5.3 Workforce Management

8.2.5.4 Surveillance

8.2.6 Historic and Forecasted Market Size By Industry Vertical

8.2.6.1 Government

8.2.6.2 Banking

8.2.6.3 Financial Services

8.2.6.4 and Insurance (BFS)

8.2.6.5 Healthcare

8.2.6.6 Retail and E-commerce

8.2.6.7 IT and Telecommunication

8.2.6.8 Education

8.2.6.9 Transportation and Logistics

8.2.6.10 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Biometrics Technology Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Physiological Biometrics

8.3.4.2 Behavioural Biometrics

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Access Control

8.3.5.2 Identity Verification

8.3.5.3 Workforce Management

8.3.5.4 Surveillance

8.3.6 Historic and Forecasted Market Size By Industry Vertical

8.3.6.1 Government

8.3.6.2 Banking

8.3.6.3 Financial Services

8.3.6.4 and Insurance (BFS)

8.3.6.5 Healthcare

8.3.6.6 Retail and E-commerce

8.3.6.7 IT and Telecommunication

8.3.6.8 Education

8.3.6.9 Transportation and Logistics

8.3.6.10 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Biometrics Technology Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Physiological Biometrics

8.4.4.2 Behavioural Biometrics

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Access Control

8.4.5.2 Identity Verification

8.4.5.3 Workforce Management

8.4.5.4 Surveillance

8.4.6 Historic and Forecasted Market Size By Industry Vertical

8.4.6.1 Government

8.4.6.2 Banking

8.4.6.3 Financial Services

8.4.6.4 and Insurance (BFS)

8.4.6.5 Healthcare

8.4.6.6 Retail and E-commerce

8.4.6.7 IT and Telecommunication

8.4.6.8 Education

8.4.6.9 Transportation and Logistics

8.4.6.10 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Biometrics Technology Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Physiological Biometrics

8.5.4.2 Behavioural Biometrics

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Access Control

8.5.5.2 Identity Verification

8.5.5.3 Workforce Management

8.5.5.4 Surveillance

8.5.6 Historic and Forecasted Market Size By Industry Vertical

8.5.6.1 Government

8.5.6.2 Banking

8.5.6.3 Financial Services

8.5.6.4 and Insurance (BFS)

8.5.6.5 Healthcare

8.5.6.6 Retail and E-commerce

8.5.6.7 IT and Telecommunication

8.5.6.8 Education

8.5.6.9 Transportation and Logistics

8.5.6.10 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Biometrics Technology Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Physiological Biometrics

8.6.4.2 Behavioural Biometrics

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Access Control

8.6.5.2 Identity Verification

8.6.5.3 Workforce Management

8.6.5.4 Surveillance

8.6.6 Historic and Forecasted Market Size By Industry Vertical

8.6.6.1 Government

8.6.6.2 Banking

8.6.6.3 Financial Services

8.6.6.4 and Insurance (BFS)

8.6.6.5 Healthcare

8.6.6.6 Retail and E-commerce

8.6.6.7 IT and Telecommunication

8.6.6.8 Education

8.6.6.9 Transportation and Logistics

8.6.6.10 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Biometrics Technology Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Physiological Biometrics

8.7.4.2 Behavioural Biometrics

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Access Control

8.7.5.2 Identity Verification

8.7.5.3 Workforce Management

8.7.5.4 Surveillance

8.7.6 Historic and Forecasted Market Size By Industry Vertical

8.7.6.1 Government

8.7.6.2 Banking

8.7.6.3 Financial Services

8.7.6.4 and Insurance (BFS)

8.7.6.5 Healthcare

8.7.6.6 Retail and E-commerce

8.7.6.7 IT and Telecommunication

8.7.6.8 Education

8.7.6.9 Transportation and Logistics

8.7.6.10 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Biometrics Technology Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 41.62 Billion |

|

Forecast Period 2024-32 CAGR: |

21% |

Market Size in 2032: |

USD 231.40 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Industry Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||