Smart Ports Market Synopsis:

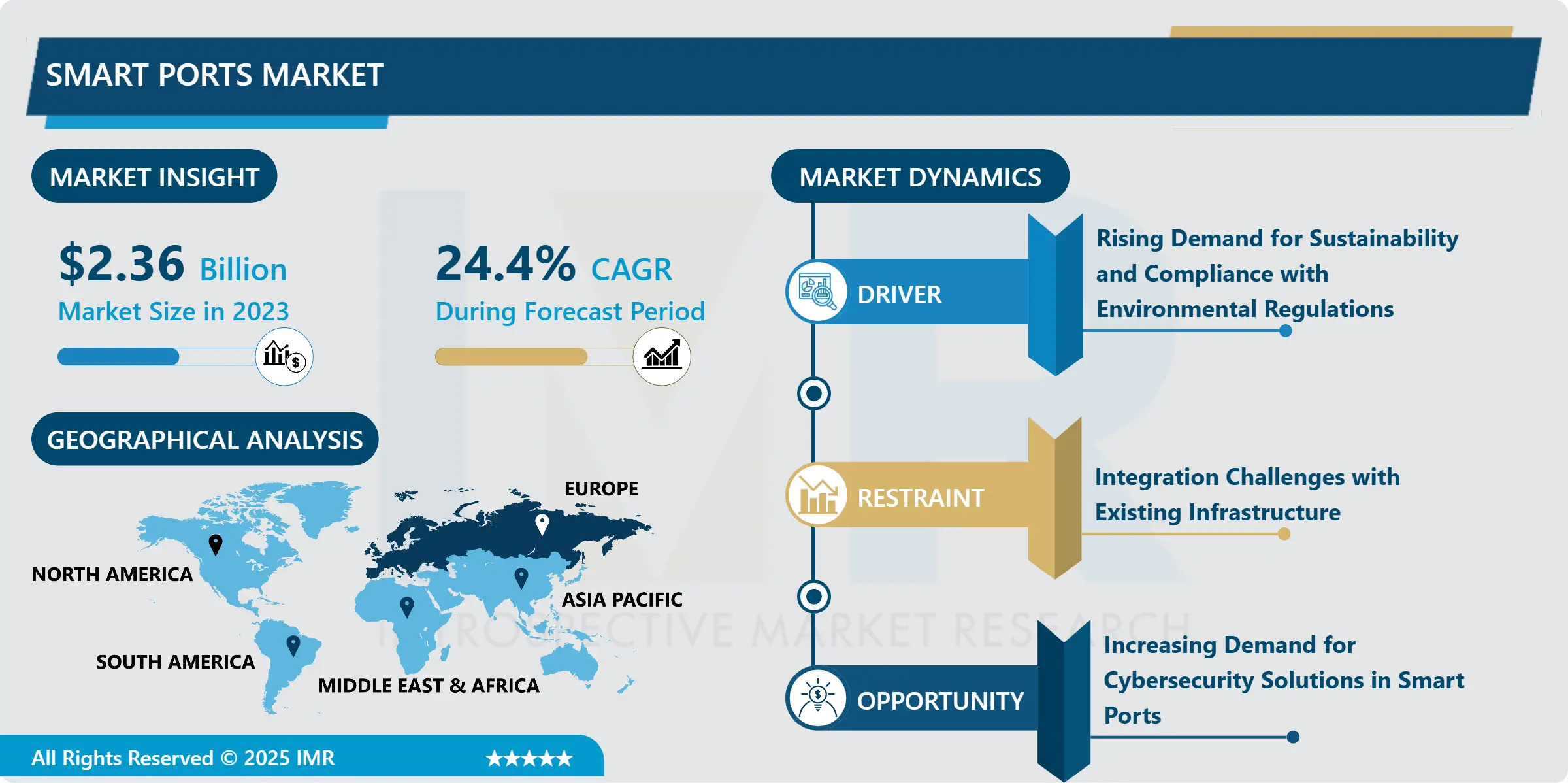

Smart Ports Market Size Was Valued at USD 2.36 Billion in 2023, and is Projected to Reach USD 16.86 Billion by 2032, Growing at a CAGR of 24.40% From 2024-2032.

Smart ports market aims at the application of internet of things, artificial intelligence, blockchain, big data analytics and automated systems in improving on port activities, its gained effectiveness and efficiency in handling cargoes, security and logistics. These technologies foster better decision making, cost efficiencies, and goods processing at the ports’ hence improvement of port infrastructure and services.

Some other factors that fuel the growth of the Smart Ports Market are increasing demand of better operational efficiency and reduction of the cost in ports functions. As the volumes of the traded goods increase, conventional port logistics face challenges, which in response prompt the implementation of innovative digital technologies for optimization of operations, improvement of the efficiency of cargo handling, and increase of the coming through rate. Growth in automation and IoT systems decreases the human intervention, lower infrastructural cost, and minimize time delay which in turn fuels the need for smart port technologies.

The second factor is that, with the rising concerns regarding sustainability and environmental compliance. Ports have been faced with historical environmental laws and an ever-growing impetus to incorporate greener measures in terms of carbon footprint. Smart ports, therefore ensure efficient use of energy, better ways of handling waste and control over emission which are essential for a sustainable future of the maritime business.

Smart Ports Market Trend Analysis:

Use of AI and big data analytics

-

The Smart Ports Market is experiencing a notable transition to the increased application of artificial intelligence and big data solution. Ports are integrating AI algorithms and predictive analytics tools as a way of planning traffic density, achieving logistics and more efficiently utilizing their resources. These technologies improve capacity management of the port and also reduces delay thus improving customer satisfaction and returns on equity.

- Also, concepts like drone, AGVs and robotics are gradually assuming precedence for operating the warehouses and supply chain. These are being used in moving the cargo, transporting the cargo and monitoring the cargo with minimal human interventions thus increasing safety and efficiency.

Growth of port automation and the increasing investments in digital infrastructure

-

Pursuant to Kornet, one of the important trends in the Smart Ports Market remains the development of the ports’ automation and investments into digitalization. Today’s ports are upgrading their facilities to handle increasing traffic levels and ever-shrinking delivery turnaround expectations. This, in turn, poses a great potential for technology suppliers to provide products that could improve ports’ automation, management of its supply chain as well as its efficiency.

- Another chance in the Smart Ports Market is the demand for cybersecurity solutions is growing at a faster rate. The problem is that cyber threats tend to increase when a port implements more digital technologies. Hence, the demand rises for improving cybersecurity that would protect the essential infrastructure and data, creating a favorable chance for cybersecurity firms to penetrate the market.

Smart Ports Market Segment Analysis:

Smart Ports Market is Segmented on the Component, Port Type, Technology, Application, and Region.

By Component, Services segment is expected to dominate the market during the forecast period

-

The Smart Ports Market can be divided into three primary components: Computer Hardware, Computer Software, and Computer & Related Services. Software comprises of physical assets at the ports including the instruments used in handling operations such as sensors, cameras, and other automations. It means AI application and supporting programs, systems, tools, and platforms, including hardware infrastructure, like data centres, smart sensors, big data analytics systems, software frameworks and applications, or management software that run smart ports. Services include guidance, help, continuous assistance in supporting smart port technologies’ integration into current structures.

By Application, Port Automation segment expected to held the largest share

-

In the light of applications, Smart Ports Market is categorised as follows: Port Automation, Cargo management, Fleet management, Security & surveillance, and Other. Port Automation refers to processes or services that are managed and performed with minimal human intervention especially in the aspects of loading, running and storing services. Cargo flow means the development and usage of other tools and technologies used for tracking or sorting as well as for managing the flows of cargo in the ports to help increase the flow rate. Fleet Management enhances the use of transportation vehicles which major include; trucks, ships and cranes among others. Security & Surveillance applications are majorly centered on security through surveillance and access control and threats. Other application areas include; Monitoring, energy usage, and logistics.

Smart Ports Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast period

-

Europe is holding the largest market share in Smart Ports Market at present due to increased automation and progressive number of technologies integrated ports. There is increasing uptake of smart technologies in major European ports of Rotterdam, Hamburg, and Antwerp to improve operation. Another factor favourable for this market is the well-developed legislation assistance to integration of environmental technologies where Europe has many opportunities to act as a market leader.

- Also, Europe receives significant investments on a digital port environment with good port conditions in terms of business environment and cooperation with the port private sector and many other ports in the EU countries. The European Union has further backed smart port plans and continues the focus on the environmental concern, which cements Europe’s position as a frontrunner in smart port projects.

Active Key Players in the Smart Ports Market

- A.P. Moller - Maersk (Denmark)

- Cisco Systems (USA)

- DP World (UAE)

- IBM (USA)

- Konecranes (Finland)

- Port of Rotterdam (Netherlands)

- Siemens AG (Germany)

- Sovcomflot (Russia)

- Tideworks Technology (USA)

- Wärtsilä Corporation (Finland)

- Other Active Players.

|

Global Smart Ports Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.36 Billion |

|

Forecast Period 2024-32 CAGR: |

24.40% |

Market Size in 2032: |

USD 16.86 Billion |

|

Segments Covered: |

By Component |

|

|

|

By Port Type |

|

||

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Smart Ports Market by Component

4.1 Smart Ports Market Snapshot and Growth Engine

4.2 Smart Ports Market Overview

4.3 Hardware

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Hardware: Geographic Segmentation Analysis

4.4 Software

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Software: Geographic Segmentation Analysis

4.5 Services

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Services: Geographic Segmentation Analysis

Chapter 5: Smart Ports Market by Application

5.1 Smart Ports Market Snapshot and Growth Engine

5.2 Smart Ports Market Overview

5.3 Passenger Information System

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Passenger Information System: Geographic Segmentation Analysis

5.4 Ticketing & Reservation

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Ticketing & Reservation: Geographic Segmentation Analysis

5.5 Train Management

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Train Management: Geographic Segmentation Analysis

5.6 Fleet Management

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Fleet Management: Geographic Segmentation Analysis

5.7 Security & Surveillance

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Security & Surveillance: Geographic Segmentation Analysis

Chapter 6: Smart Ports Market by End User

6.1 Smart Ports Market Snapshot and Growth Engine

6.2 Smart Ports Market Overview

6.3 Rail Operators

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Rail Operators: Geographic Segmentation Analysis

6.4 Government Bodies

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Government Bodies: Geographic Segmentation Analysis

6.5 Infrastructure Providers

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Infrastructure Providers: Geographic Segmentation Analysis

6.6 Railway Operators (Private & Public)

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Railway Operators (Private & Public): Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Smart Ports Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 DP WORLD (UAE)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 SOVCOMFLOT (RUSSIA)

7.4 KONECRANES (FINLAND)

7.5 IBM (USA)

7.6 SIEMENS AG (GERMANY)

7.7 CISCO SYSTEMS (USA)

7.8 A.P. MOLLER - MAERSK (DENMARK)

7.9 TIDEWORKS TECHNOLOGY (USA)

7.10 PORT OF ROTTERDAM (NETHERLANDS)

7.11 WÄRTSILÄ CORPORATION (FINLAND)

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global Smart Ports Market By Region

8.1 Overview

8.2. North America Smart Ports Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Component

8.2.4.1 Hardware

8.2.4.2 Software

8.2.4.3 Services

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Passenger Information System

8.2.5.2 Ticketing & Reservation

8.2.5.3 Train Management

8.2.5.4 Fleet Management

8.2.5.5 Security & Surveillance

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Rail Operators

8.2.6.2 Government Bodies

8.2.6.3 Infrastructure Providers

8.2.6.4 Railway Operators (Private & Public)

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Smart Ports Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Component

8.3.4.1 Hardware

8.3.4.2 Software

8.3.4.3 Services

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Passenger Information System

8.3.5.2 Ticketing & Reservation

8.3.5.3 Train Management

8.3.5.4 Fleet Management

8.3.5.5 Security & Surveillance

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Rail Operators

8.3.6.2 Government Bodies

8.3.6.3 Infrastructure Providers

8.3.6.4 Railway Operators (Private & Public)

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Smart Ports Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Component

8.4.4.1 Hardware

8.4.4.2 Software

8.4.4.3 Services

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Passenger Information System

8.4.5.2 Ticketing & Reservation

8.4.5.3 Train Management

8.4.5.4 Fleet Management

8.4.5.5 Security & Surveillance

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Rail Operators

8.4.6.2 Government Bodies

8.4.6.3 Infrastructure Providers

8.4.6.4 Railway Operators (Private & Public)

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Smart Ports Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Component

8.5.4.1 Hardware

8.5.4.2 Software

8.5.4.3 Services

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Passenger Information System

8.5.5.2 Ticketing & Reservation

8.5.5.3 Train Management

8.5.5.4 Fleet Management

8.5.5.5 Security & Surveillance

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Rail Operators

8.5.6.2 Government Bodies

8.5.6.3 Infrastructure Providers

8.5.6.4 Railway Operators (Private & Public)

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Smart Ports Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Component

8.6.4.1 Hardware

8.6.4.2 Software

8.6.4.3 Services

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Passenger Information System

8.6.5.2 Ticketing & Reservation

8.6.5.3 Train Management

8.6.5.4 Fleet Management

8.6.5.5 Security & Surveillance

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Rail Operators

8.6.6.2 Government Bodies

8.6.6.3 Infrastructure Providers

8.6.6.4 Railway Operators (Private & Public)

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Smart Ports Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Component

8.7.4.1 Hardware

8.7.4.2 Software

8.7.4.3 Services

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Passenger Information System

8.7.5.2 Ticketing & Reservation

8.7.5.3 Train Management

8.7.5.4 Fleet Management

8.7.5.5 Security & Surveillance

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Rail Operators

8.7.6.2 Government Bodies

8.7.6.3 Infrastructure Providers

8.7.6.4 Railway Operators (Private & Public)

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Smart Ports Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.36 Billion |

|

Forecast Period 2024-32 CAGR: |

24.40% |

Market Size in 2032: |

USD 16.86 Billion |

|

Segments Covered: |

By Component |

|

|

|

By Port Type |

|

||

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||