Global Smart Home Installation Service Market Overview

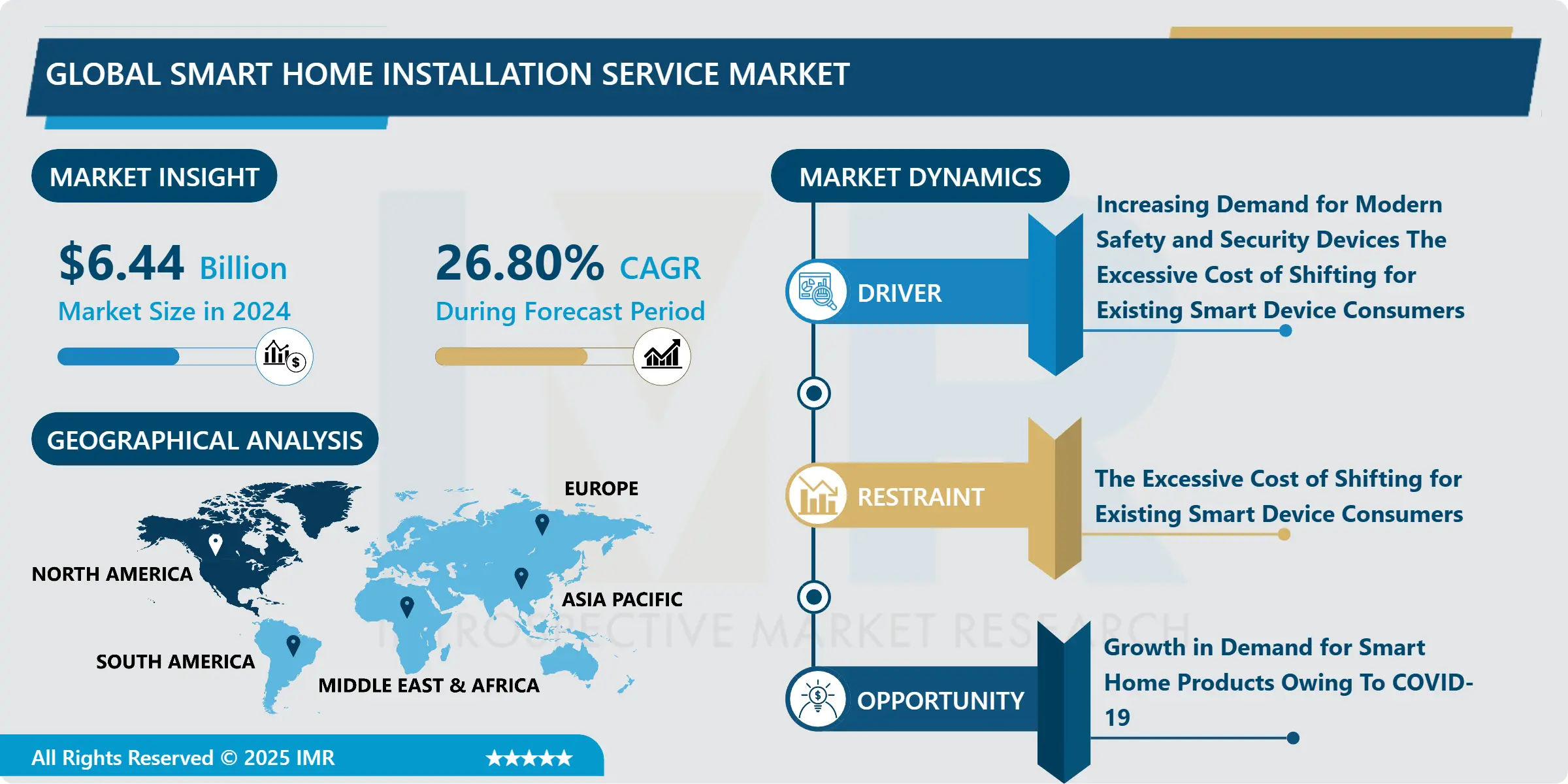

Global Smart Home Installation Service Market size was valued at USD 6.44 billion in 2024 and is projected to reach 43.05 billion in 2032, growing at a CAGR of 26.80% from 2025 to 2032.

Smart Home Installation Service is referred to as a service provided by the home installation companies such as easy control and management of smart home devices through the support of smartphones. Moreover, they also offer comfort, security, and convenience to keep the house connected and functioning as a whole. It also enables owners to manage different systems such as lights, video entertainment, thermostats, doors, and smart speakers from a central control hub or a device. The smart home system needs a smartphone application or web portal as a user interface, to interconnect with an automated system. The scope of this study includes an analysis of the devices that can be managed by sensors, switches, remote controllers, and timers apart from other control devices. Globally, the rising importance associated with the requirement to counter security issues is expected to accelerate the demand growth for smart and connected homes during the projected period. Furthermore, the launch of modern wireless technologies, including HVAC controllers, security and access regulators, and entertainment controls, is anticipated to fuel market growth. Additionally, the recent advancements in the Internet of Things (IoT) that resulted in price drops of sensors and processors are anticipated to encourage producers to promote automation in the household industry.

Market Dynamics and Factors of Smart Home Installation Service Market:

Drivers:

Demand for Modern Safety and Security Devices:

The penetration of advanced safety and security features with active monitoring technology is a key trend in improving the smart home installation services market. Smart home systems contain inbuilt encoding systems that facilitate the device to operate and function securely and safely, thereby defending the deal of sensitive data in these devices.

Growing Adoption of Smartphones:

The smartphone application allows the smartphone to use a device remotely concerning the operate locks, and switches for lights, heating, security cameras, and alarms. Smartphone connectivity permits users not only to customize and manage the operation of connected or individual devices but also to collect real-time information and alerts from sensors in the home, such as hasty temperature changes that can alert a sound or fire, and movement that could inform an intrusion.

Furthermore, owing to the growing adoption of personal assistants in smart homes, it is anticipated to produce a lucrative opportunity for smart home installation service suppliers in the next few years. This is especially due to the consumers are acquiring technologically advanced devices, including artificial intelligence implanted devices such as smart speakers, smart TVs, and gaming devices. Therefore, these drivers have raised the adoption of smart home devices, which, in turn, is accelerating the smart home installation services market during the forecast period.

Restraints:

The excessive cost of shifting for existing smart device consumers

The shipments of smart home products depend on the usage and needs of homeowners. Consumers usually opted products that provide convenience and energy efficiency. The cost of smart home products is excessive and involves other in advance costs such as installation and maintenance costs as well. The high-cost restraints the adoption and installation of smart devices by the customers including many organizations. Furthermore, increasing concern about data privacy and security is another important factor hampering the growth of the smart home installation service market

Opportunities:

Growth in demand for smart home products owing to COVID-19

After the outbreak of novel coronavirus, people have started staying at home. Therefore, the dependency on the internet and digital gadgets has raised in the past year. As people are not reaching out, the major day-to-day expenses have been declined significantly. Owing to this, the disposable income of people has also increased. Furthermore, as people are staying at home, they are using smart devices and products more than they used to before the pandemic. In the wake of COVID-19, home security solutions such as smart locks and cameras are enabling contactless deliveries. Home healthcare solutions for the elderly to live a safe and unconventional lifestyle, such as remote persistent health monitoring, are gaining momentum. Work-from-home solutions are being used to high productivity such as smart speakers/hubs to restore track of meetings and tasks. More entertainment needs to be centered around health, spirituality, and personal needs are developing due to which there is increased adoption of smart TVs, home theaters, and entertainment systems. This gives massive opportunities to the producers and suppliers working in the smart home market to come up with more innovative and user-friendly features in the appliances to attract users.

Market Segmentation

Based on the system, the lighting controls segment is expected to dominates the market of the smart home installation services during the forecast period. The growing demand for declining power utilization and carbon emissions, majorly in emerging countries such as India and China, have accelerated the demand for the installation of lighting control systems in houses.

Based on the channel, the OEMs segment held a dominant position in the smart home installation services market and is anticipated to retain its eminence during the forecast period. OEMs offer both, installation and aftersales service to customers.

Players Covered in Smart Home Installation Service market are :

- Vivint Inc.

- Datalogic S.p.A.

- Meyer Electrical Services Inc.

- Red River Electric Inc.

- HelloTech Inc.

- Calix Inc.

- Finite Solutions LLC

- Handy Inc.

- Miami Electric Masters Inc.

- Insteon Inc and other active players.

Regional Analysis for Smart Home Installation Service Market:

North America held a dominant position in the global smart home installation services market and is anticipated to retain its importance during the projected period. The U.S. and Canada are the key economies that drive the smart home installation services market in the region. The rising acceptance of network-connected devices in North America is a major factor in turning the smart home installation services market in the region. The course of early adoption of technology and significant presence of market leaders such as Red River Electric, Miami Electric Masters, and Vivint, Inc., in the region, is responsible for the prominent position of North America in the global smart home installation services market. Growing crime rates and awareness about residential security have stimulated the demand for advanced security systems, which, in turn, are accelerating the smart home installation services market in North America.

COVID-19 Impact on the Smart Home Installation Service Market:

A smart home is a residence that uses Internet-connected devices to allow the management and remote monitoring of systems and appliances, including heating, video entertainment, and lighting. In other words, smart homes are combined with the latest designed automated systems that manage security, thermostats, lighting, temperature, door, multi-media, window operations, and entertainment systems, which are controlled by the consumers via computers and smartphones. The home appliances are connected by the Internet connection. Here, IoT act as a beneficial role. The use of IoT in smart homes has forced producers to promote automation in the household sector. The outbreak of COVID-19 across the world has influenced major countries across the globe. The pandemic has also affected the purchasing behavior and buying habits of consumers. Even though people are spending a significant amount of time at home, they are more targeted at purchasing essential goods rather than IoT devices. The declining interest in buying consumer IoT devices is anticipated to restraint the growth of the market during the COVID-19 outbreak. The key players in the market have invested massively in the development of products such as electrical installation systems and security systems. Nevertheless, the COVID-19 outbreak has influenced producing operations over the globe. The detain in the production of smart systems owing to the lockdowns imposed by different governments is also hampering the growth of the market.

Key Industry

- In Oct 2024, Apple, Google, and Amazon have teamed up to create Matter, a groundbreaking smart home protocol designed to enhance cross-platform compatibility for smart devices and accessories. The collaboration aims to offer users seamless integration across multiple platforms, making it easier to control devices such as lights, thermostats, and security systems. Matter will simplify the smart home experience by ensuring that devices from different brands work together smoothly, boosting overall user convenience.

- In August 2023, Yale Assure Smart Deadbolts come in different options to suit your needs. They usually feature keyless entry, touchscreen controls, and integration with smart home systems like Amazon Alexa, Google Assistant, or Apple HomeKit. Yale provides several models with distinct features, including the Yale Assure Lock SL and Yale Assure Lock Touchscreen Deadbolt.

|

Global Smart Home Installation Service Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 6.44 Bn. |

|

Forecast Period 2024-32 CAGR: |

26.80% |

Market Size in 2032: |

USD 43.05 Bn. |

|

Segments Covered: |

By System |

|

|

|

By Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Smart Home Installation Service Market by System (2018-2032)

4.1 Smart Home Installation Service Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Lighting Control

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Home Monitoring/Security

4.5 Thermostat

4.6 Video Entertainment

4.7 Smart Appliances

4.8 Other

Chapter 5: Smart Home Installation Service Market by Channel (2018-2032)

5.1 Smart Home Installation Service Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Retailers

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 OEM

5.5 E-commerce

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Smart Home Installation Service Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 IBM CORPORATION

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 ALPHABET INCMICROSOFT CORPORATION

6.4 ACCENTURE

6.5 PURE MODERATION

6.6 APPEN LIMITED

6.7 WEBHELP

6.8 BASEDO

6.9 ALEGION

6.10 CLARIFAI INC

6.11 COGITO TECH LLC

6.12 COMPUTYNE BUSINESS PROCESS SERVICES

6.13 CONECTYS

6.14 WEBFURTHER LLC

6.15 TWO HAT SECURITY

6.16 EUROPE IT OUTSOURCING COMPANY

6.17 ICUC.SOCIAL

6.18 LIONBRIDGE TECHNOLOGIES INCONESPACE.COM

6.19 LIVEWORLD INCMD SOFTWARE

6.20 OPEN ACCESS BPO AND OTHER MAJOR KEY PLAYERS

Chapter 7: Global Smart Home Installation Service Market By Region

7.1 Overview

7.2. North America Smart Home Installation Service Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by System

7.2.4.1 Lighting Control

7.2.4.2 Home Monitoring/Security

7.2.4.3 Thermostat

7.2.4.4 Video Entertainment

7.2.4.5 Smart Appliances

7.2.4.6 Other

7.2.5 Historic and Forecasted Market Size by Channel

7.2.5.1 Retailers

7.2.5.2 OEM

7.2.5.3 E-commerce

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Smart Home Installation Service Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by System

7.3.4.1 Lighting Control

7.3.4.2 Home Monitoring/Security

7.3.4.3 Thermostat

7.3.4.4 Video Entertainment

7.3.4.5 Smart Appliances

7.3.4.6 Other

7.3.5 Historic and Forecasted Market Size by Channel

7.3.5.1 Retailers

7.3.5.2 OEM

7.3.5.3 E-commerce

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Smart Home Installation Service Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by System

7.4.4.1 Lighting Control

7.4.4.2 Home Monitoring/Security

7.4.4.3 Thermostat

7.4.4.4 Video Entertainment

7.4.4.5 Smart Appliances

7.4.4.6 Other

7.4.5 Historic and Forecasted Market Size by Channel

7.4.5.1 Retailers

7.4.5.2 OEM

7.4.5.3 E-commerce

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Smart Home Installation Service Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by System

7.5.4.1 Lighting Control

7.5.4.2 Home Monitoring/Security

7.5.4.3 Thermostat

7.5.4.4 Video Entertainment

7.5.4.5 Smart Appliances

7.5.4.6 Other

7.5.5 Historic and Forecasted Market Size by Channel

7.5.5.1 Retailers

7.5.5.2 OEM

7.5.5.3 E-commerce

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Smart Home Installation Service Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by System

7.6.4.1 Lighting Control

7.6.4.2 Home Monitoring/Security

7.6.4.3 Thermostat

7.6.4.4 Video Entertainment

7.6.4.5 Smart Appliances

7.6.4.6 Other

7.6.5 Historic and Forecasted Market Size by Channel

7.6.5.1 Retailers

7.6.5.2 OEM

7.6.5.3 E-commerce

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Smart Home Installation Service Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by System

7.7.4.1 Lighting Control

7.7.4.2 Home Monitoring/Security

7.7.4.3 Thermostat

7.7.4.4 Video Entertainment

7.7.4.5 Smart Appliances

7.7.4.6 Other

7.7.5 Historic and Forecasted Market Size by Channel

7.7.5.1 Retailers

7.7.5.2 OEM

7.7.5.3 E-commerce

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Smart Home Installation Service Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 6.44 Bn. |

|

Forecast Period 2024-32 CAGR: |

26.80% |

Market Size in 2032: |

USD 43.05 Bn. |

|

Segments Covered: |

By System |

|

|

|

By Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||