Smart Gas Meter Market Synopsis:

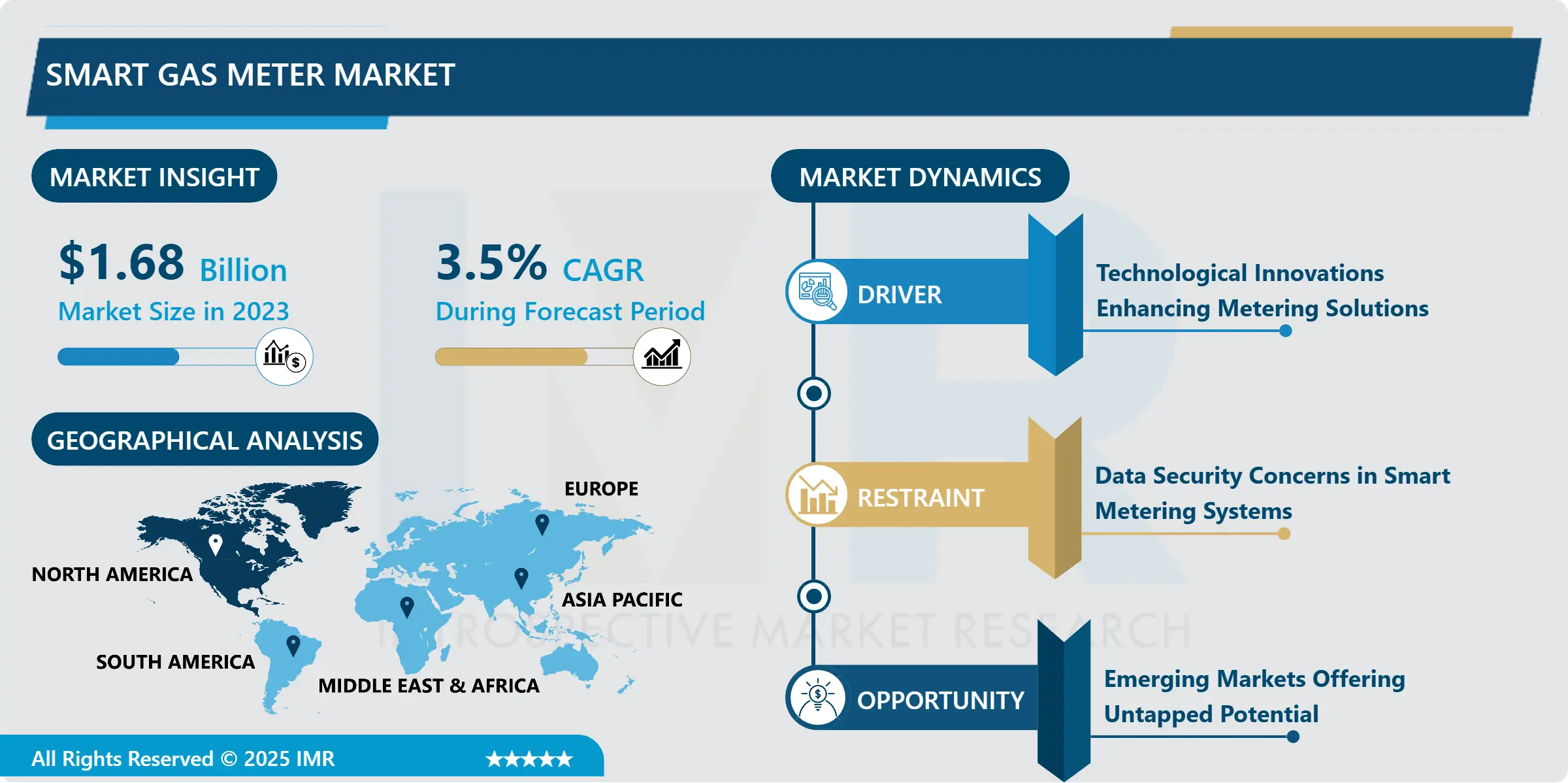

Smart Gas Meter Market Size Was Valued at USD 1.68 Billion in 2023, and is Projected to Reach USD 2.28 Billion by 2032, Growing at a CAGR of 3.50% From 2024-2032.

Smart gas meter market is defined as the industry associated with the product that is employed for measuring and tracking the gas consumption through institute technologies such as wireless connections and data transfer. such meters help in accurate billing, make operations more efficient and offer utilities useful information for effective organization of gas distribution networks.

The situation in the world is focused on the preservation of energy and the rational use of resources; thus, smart gas meters are becoming more and more popular. These devices assist the customers to control wastages resulting from utilization of the gas and also gives data on the utilization. Global governments and regulating agencies are now requiring utilities to install smart meters for energy conservation, and thereby strengthening the market.

The developments in the Internet of Things, and wireless technologies have greatly improved the performance of smart gas meters. Things like remote monitoring, ability to predict the need for a maintenance and compatibility with smart grid make these meters crucial for utility companies. Also, the current development of smart technologies for demand forecasting and leak detection through the use of advanced analytics and AI professions are changing the metering environment.

Smart Gas Meter Market Trend Analysis:

Shift Toward Sustainability

- Another development observed in the market is the bringing together of smart gas meters with smart grids. This integration provides a way through which utilities can enhance the distribution of energy since data collected will be harmonized across the various forms of energy hence making it easier to strengthen the energy grid. Also, smart grids improve the integration of gas meters with other smart devices, connecting all the fragments of a smart energy system.

- Increasing concerns about the environment have made the utility providers utilize smart gas meters to improve sustainable operation. They make it easier to adopt cleaner energy alternatives by recognizing use and encouraging the appropriate usage. Furthermore, governments are advancing adoption of these meters in relations to other decarbonisation agendas.

Expansion in Emerging Markets

- The increased interest in smart city solutions worldwide is one of the biggest opportunities for the smart gas meter market. Development and modernisation of digital initiatives and structures, the use of technologies such as smart gas meters for the improvement of urban energy. Smart cities at a particularly high rate in Asia-Pacific, and such investments represent significant business opportunities for key market participants.

- New opportunities for market players could be availed in the emerging economies Latin America, Asia-Pacific and the African continent. The rise in the general population and specifically the uptick of people residing in cities alike results in the need for improved measuring systems. These regions also enjoy such government policies as well as international funding for enhancement of the utilities.

Smart Gas Meter Market Segment Analysis:

Smart Gas Meter Market is Segmented on the basis of Type, Component, Technology, End User, and Region.

By Type, Automatic Meter Reading (AMR) segment is expected to dominate the market during the forecast period

- Smart gas meters can be split into two broad groups: Automatic Meter Reading (AMR) and Advanced Metering Infrastructure (AMI). AMR automates the collection of information reducing billing mistakes hence the need for AMR. While AMI brings only basic features including power management, two-way communication, and true real time scalar data, it provides for much better monitoring and predictive maintenance.

By Component, Hardware segment expected to held the largest share

- The market comprises three primary components Again, we have the three categories of: Hardware, Software and Services. Hardware consists of metering devices having sensing and transmission functionality fabricated into the physical metering units. Software solutions allow for scenarios analysis, visualization techniques, as well as integration of utility systems. Some of them include installation, maintenance and technical support to make the services reach their intended consumers to the maximum.

Smart Gas Meter Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America reportedly forms the largest market for smart gas meters global market. The leadership of the region stems from the widespread use of intelligent metering and sound legal requirements in efficiency promotion. The smart meter system is highly developed across the U.S. The Smart Grid Investment Grant Program has supported smart meters extensively.

- North America has emerged as a technology hub of the world, backed up by key technologically advanced utility companies, leading energy market players and conducive market conditions. Greater emphasis placed on the upgrading of infrastructure, coupled with increased consumer attention devoted to energy control systems, reinforces the regional leadership position.

Active Key Players in the Smart Gas Meter Market

- Aichi Tokei Denki Co., Ltd. (Japan)

- Apator S.A. (Poland)

- Diehl Metering (Germany)

- EDMI Limited (Singapore)

- Elster Group GmbH (Germany)

- Honeywell International Inc. (USA)

- Itron Inc. (USA)

- Landis+Gyr (Switzerland)

- Sensus (USA)

- Zenner International GmbH & Co. KG (Germany)

- Other Active Players.

|

Global Smart Gas Meter Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.68 Billion |

|

Forecast Period 2024-32 CAGR: |

3.50% |

Market Size in 2032: |

USD 2.28 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Component |

|

||

|

By Technology |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Smart Gas Meter Market by Component

4.1 Smart Gas Meter Market Snapshot and Growth Engine

4.2 Smart Gas Meter Market Overview

4.3 Hardware

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Hardware: Geographic Segmentation Analysis

4.4 Software

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Software: Geographic Segmentation Analysis

4.5 Services

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Services: Geographic Segmentation Analysis

Chapter 5: Smart Gas Meter Market by Technology

5.1 Smart Gas Meter Market Snapshot and Growth Engine

5.2 Smart Gas Meter Market Overview

5.3 Wired

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Wired: Geographic Segmentation Analysis

5.4 Wireless

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Wireless: Geographic Segmentation Analysis

Chapter 6: Smart Gas Meter Market by Application

6.1 Smart Gas Meter Market Snapshot and Growth Engine

6.2 Smart Gas Meter Market Overview

6.3 Indoor

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Indoor: Geographic Segmentation Analysis

6.4 Outdoor

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Outdoor: Geographic Segmentation Analysis

Chapter 7: Smart Gas Meter Market by End User

7.1 Smart Gas Meter Market Snapshot and Growth Engine

7.2 Smart Gas Meter Market Overview

7.3 Residential

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Residential: Geographic Segmentation Analysis

7.4 Commercial

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Commercial: Geographic Segmentation Analysis

7.5 Industrial

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Industrial: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Smart Gas Meter Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 HONEYWELL INTERNATIONAL INC. (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 ITRON INC. (USA)

8.4 SENSUS (USA)

8.5 LANDIS+GYR (SWITZERLAND)

8.6 DIEHL METERING (GERMANY)

8.7 ELSTER GROUP GMBH (GERMANY)

8.8 EDMI LIMITED (SINGAPORE)

8.9 AICHI TOKEI DENKI CO. LTD. (JAPAN)

8.10 APATOR S.A. (POLAND)

8.11 ZENNER INTERNATIONAL GMBH & CO. KG (GERMANY)

8.12 OTHER ACTIVE PLAYERS

Chapter 9: Global Smart Gas Meter Market By Region

9.1 Overview

9.2. North America Smart Gas Meter Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Component

9.2.4.1 Hardware

9.2.4.2 Software

9.2.4.3 Services

9.2.5 Historic and Forecasted Market Size By Technology

9.2.5.1 Wired

9.2.5.2 Wireless

9.2.6 Historic and Forecasted Market Size By Application

9.2.6.1 Indoor

9.2.6.2 Outdoor

9.2.7 Historic and Forecasted Market Size By End User

9.2.7.1 Residential

9.2.7.2 Commercial

9.2.7.3 Industrial

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Smart Gas Meter Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Component

9.3.4.1 Hardware

9.3.4.2 Software

9.3.4.3 Services

9.3.5 Historic and Forecasted Market Size By Technology

9.3.5.1 Wired

9.3.5.2 Wireless

9.3.6 Historic and Forecasted Market Size By Application

9.3.6.1 Indoor

9.3.6.2 Outdoor

9.3.7 Historic and Forecasted Market Size By End User

9.3.7.1 Residential

9.3.7.2 Commercial

9.3.7.3 Industrial

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Smart Gas Meter Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Component

9.4.4.1 Hardware

9.4.4.2 Software

9.4.4.3 Services

9.4.5 Historic and Forecasted Market Size By Technology

9.4.5.1 Wired

9.4.5.2 Wireless

9.4.6 Historic and Forecasted Market Size By Application

9.4.6.1 Indoor

9.4.6.2 Outdoor

9.4.7 Historic and Forecasted Market Size By End User

9.4.7.1 Residential

9.4.7.2 Commercial

9.4.7.3 Industrial

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Smart Gas Meter Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Component

9.5.4.1 Hardware

9.5.4.2 Software

9.5.4.3 Services

9.5.5 Historic and Forecasted Market Size By Technology

9.5.5.1 Wired

9.5.5.2 Wireless

9.5.6 Historic and Forecasted Market Size By Application

9.5.6.1 Indoor

9.5.6.2 Outdoor

9.5.7 Historic and Forecasted Market Size By End User

9.5.7.1 Residential

9.5.7.2 Commercial

9.5.7.3 Industrial

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Smart Gas Meter Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Component

9.6.4.1 Hardware

9.6.4.2 Software

9.6.4.3 Services

9.6.5 Historic and Forecasted Market Size By Technology

9.6.5.1 Wired

9.6.5.2 Wireless

9.6.6 Historic and Forecasted Market Size By Application

9.6.6.1 Indoor

9.6.6.2 Outdoor

9.6.7 Historic and Forecasted Market Size By End User

9.6.7.1 Residential

9.6.7.2 Commercial

9.6.7.3 Industrial

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Smart Gas Meter Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Component

9.7.4.1 Hardware

9.7.4.2 Software

9.7.4.3 Services

9.7.5 Historic and Forecasted Market Size By Technology

9.7.5.1 Wired

9.7.5.2 Wireless

9.7.6 Historic and Forecasted Market Size By Application

9.7.6.1 Indoor

9.7.6.2 Outdoor

9.7.7 Historic and Forecasted Market Size By End User

9.7.7.1 Residential

9.7.7.2 Commercial

9.7.7.3 Industrial

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Smart Gas Meter Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.68 Billion |

|

Forecast Period 2024-32 CAGR: |

3.50% |

Market Size in 2032: |

USD 2.28 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Component |

|

||

|

By Technology |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||