Self-Testing Market Synopsis

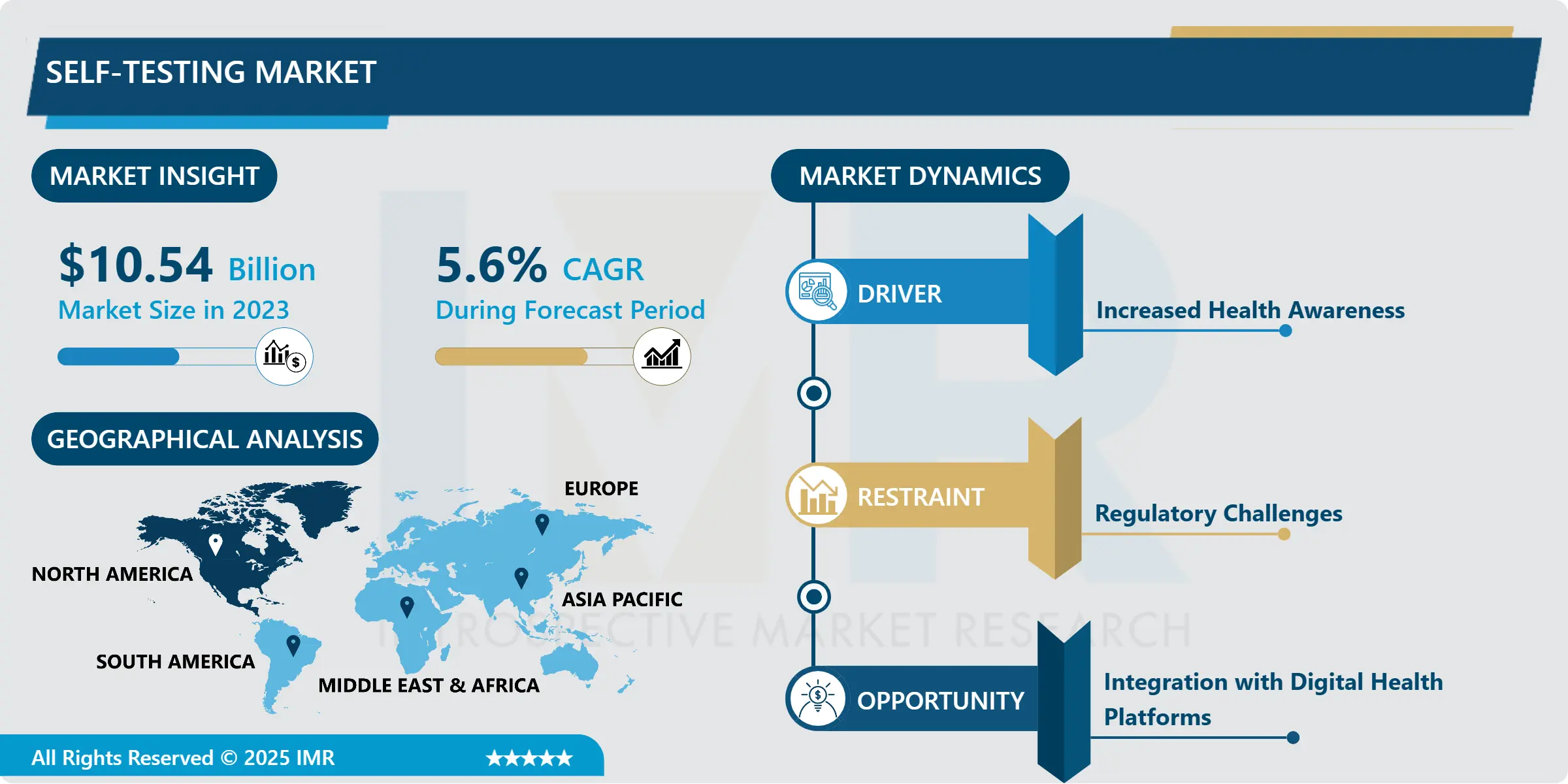

Self-Testing Market Size Was Valued at USD 10.54 Billion in 2023, and is Projected to Reach USD 17.21 Billion by 2032, Growing at a CAGR of 5.60% From 2024-2032.

The self-testing market encompasses a range of diagnostic and monitoring tools that individuals can use independently, without direct healthcare provider intervention, to assess their health status. These include at-home test kits and portable devices for detecting or monitoring various conditions, such as infectious diseases, chronic illnesses, pregnancy, fertility, and genetic predispositions. By enabling individuals to obtain real-time health data, the self-testing market promotes early diagnosis, personalized health management, and reduced reliance on traditional healthcare settings, driven by advancements in diagnostic technology, increasing health awareness, and the demand for convenience and privacy.

The self-testing market has emerged as a transformative segment within the broader diagnostics industry, driven by a growing emphasis on personalized healthcare, convenience, and preventive measures. Self-testing products, including at-home diagnostic kits for glucose monitoring, pregnancy testing, and infectious diseases, have seen remarkable adoption due to their ease of use and ability to deliver rapid results. The COVID-19 pandemic significantly accelerated the demand for self-testing solutions, highlighting their role in decentralizing healthcare and reducing the burden on traditional healthcare settings. Technological advancements, such as integration with digital health platforms and smartphone applications, have further bolstered their utility, enabling users to track, store, and share health data seamlessly with healthcare providers. This convergence of technology and healthcare has elevated consumer awareness and fostered a preference for accessible, on-demand testing solutions.

Regionally, the self-testing market showcases varying degrees of maturity and growth potential. North America leads the market, driven by robust healthcare infrastructure, high disposable income, and early adoption of innovative diagnostic tools. Europe closely follows, benefiting from favorable regulatory frameworks and rising health consciousness among its population. Meanwhile, the Asia-Pacific region is witnessing exponential growth due to an expanding middle-class population, increasing prevalence of chronic diseases, and improving access to healthcare services. Market players are strategically focusing on these emerging markets, launching affordable and culturally tailored solutions to cater to diverse consumer needs. As regulatory bodies continue to endorse self-testing devices for home use, the market is poised for sustained expansion, with significant opportunities in telemedicine integration and disease-specific diagnostic solutions.

Key challenges in the market include concerns about the accuracy and reliability of self-testing devices and the potential for misinterpretation of results by untrained users. However, ongoing efforts by manufacturers to enhance product quality, coupled with educational initiatives, are mitigating these barriers. The industry is also addressing data privacy concerns associated with digital health integrations, ensuring compliance with stringent data protection regulations. As awareness grows and innovation progresses, the self-testing market is expected to redefine the healthcare landscape, empowering individuals to take proactive control of their health and contributing to broader public health outcomes.

Self-Testing Market Trend Analysis:

Rising Popularity and Advancements in At-Home Diagnostic Kits

- The self-testing market is witnessing remarkable growth, with the rising popularity of at-home diagnostic kits at its core. These kits have gained traction due to advancements in technology, including AI integration and smartphone-based diagnostics, which enhance their accuracy and ease of use. Offering results that rival traditional laboratory tests, self-testing has expanded to cover a variety of health conditions such as diabetes, cholesterol levels, and infectious diseases. Additionally, genetic predisposition and wellness monitoring kits are becoming increasingly common, empowering individuals to take a proactive role in managing their health. This trend aligns with a broader shift toward personalized healthcare, where consumers are prioritizing convenience and control.

- The COVID-19 pandemic acted as a significant catalyst for the adoption of self-testing kits, as lockdowns and overwhelmed healthcare systems made home-based solutions more appealing and necessary. This period normalized the use of such kits, fostering widespread consumer trust in their reliability. Moreover, heightened health awareness during the pandemic encouraged individuals to regularly monitor their health, further boosting market demand. As self-testing becomes more embedded in daily life, it underscores a larger movement toward accessible and technology-driven healthcare solutions that cater to the needs of an increasingly health-conscious population.

Digital Health Integration and OTC Expansion

- The integration of digital health tools, such as mobile apps and connected devices, with self-testing kits represents a transformative opportunity in the self-testing market. These technologies enhance the user experience by providing real-time feedback, enabling individuals to monitor and track their health metrics over time. This capability not only empowers users to take proactive control of their health but also bridges the gap between self-testing and professional healthcare. By facilitating direct communication with healthcare providers, these digital solutions create a seamless continuum of care, improving diagnosis accuracy and treatment outcomes. Additionally, the incorporation of artificial intelligence (AI) and machine learning (ML) into self-testing devices further elevates the potential for personalized healthcare. These technologies analyze vast amounts of data to deliver tailored insights and recommendations, fostering greater consumer trust and engagement.

- The growing availability of over-the-counter (OTC) self-testing kits for chronic conditions such as diabetes, cholesterol management, and blood pressure monitoring further bolsters market opportunities. Consumers increasingly prefer these solutions due to their affordability, convenience, and the privacy they offer compared to traditional diagnostic settings. This shift aligns with the broader trend toward preventive healthcare, as individuals seek to manage their health proactively and mitigate potential complications. The demand for these kits is expected to grow as more advanced, user-friendly options become available, catering to the needs of tech-savvy and health-conscious consumers alike. This convergence of digital health and OTC solutions not only expands market reach but also reshapes the way diagnostics are approached, creating a new era of accessible and efficient healthcare.

Self-Testing Market Segment Analysis:

Self-Testing Market is Segmented on the basis of Product Type, Sample Type, Application, Distribution Channel, and Region.

By Product Type, Kits segment is expected to dominate the market during the forecast period

- The kits segment in the diagnostic testing market refers to comprehensive, pre-packaged testing solutions that include all the necessary components for conducting a test. These kits typically contain reagents, test strips, and step-by-step instructions, making them easy to use for individuals without specialized medical knowledge. They are widely utilized in home healthcare settings, offering consumers the convenience of performing tests such as pregnancy, glucose, and cholesterol monitoring independently. The appeal of these kits lies in their simplicity and the ability to provide quick results, which helps users monitor their health more proactively without needing to visit a healthcare provider.

- Additionally, diagnostic kits are gaining popularity in clinical environments due to their cost-effectiveness and time-saving advantages. Medical professionals often use these kits for routine testing or to quickly gather diagnostic information. They offer a convenient alternative to more complex and time-consuming laboratory procedures, which is especially beneficial in urgent care settings or remote locations where advanced medical equipment may not be readily available. As the demand for home-based healthcare grows, the kits segment continues to expand, driven by technological advancements that improve the accuracy and reliability of test results.

By Application, Blood Pressure Test segment expected to held the largest share

- The blood pressure test segment is a significant part of the diagnostic testing market, encompassing devices and kits specifically designed to measure blood pressure levels. These tests are primarily used to monitor hypertension, a common and potentially dangerous condition that can lead to heart disease, stroke, and other health complications. The most popular devices in this segment are sphygmomanometers (manual or digital), which provide an accurate and reliable method for measuring systolic and diastolic pressure. In addition, at-home blood pressure monitoring kits are widely available, allowing individuals to track their health regularly without visiting a healthcare professional. These kits often include a cuff, a digital monitor, and easy-to-follow instructions, making them user-friendly and suitable for both home and clinical settings.

- The rising prevalence of hypertension globally has driven the growth of the blood pressure test segment. As awareness of the risks associated with high blood pressure increases, more consumers are opting for personal monitoring to better manage their health. Digital blood pressure monitors, in particular, have seen significant adoption due to their convenience, ease of use, and ability to store readings for long-term tracking. Many of these devices also come equipped with additional features, such as irregular heartbeat detection and smartphone connectivity, allowing users to sync their results for further analysis and share them with healthcare providers. This growth in demand is expected to continue as consumers become more proactive in managing chronic conditions like hypertension.

Self-Testing Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America stands as the dominant market for self-testing products, driven by robust healthcare infrastructure and high disposable income. The region's advanced medical technologies and healthcare systems have paved the way for the widespread adoption of self-testing devices, particularly among the aging population. As individuals seek more convenient and accessible healthcare solutions, the demand for products like glucose meters, blood pressure monitors, and pregnancy tests has surged. Additionally, the growing preference for home healthcare, supported by consumers’ desire for privacy and convenience, has significantly bolstered the market. The presence of major health technology companies in the region further supports the availability and innovation of self-testing products.

- Regulatory support plays a crucial role in the market’s growth in North America, with agencies such as the FDA actively approving a range of at-home diagnostic kits. The approval of COVID-19 rapid tests during the pandemic is a notable example, which not only accelerated the adoption of self-testing but also demonstrated the region's ability to quickly integrate such technologies into everyday life. These regulatory frameworks ensure that the products meet safety standards while providing consumers with the confidence to adopt self-testing solutions. As telehealth and digital health technologies continue to grow, North America is poised to maintain its leadership in the self-testing market, with ongoing advancements in diagnostics and increasing consumer awareness.

Active Key Players in the Self-Testing Market:

- Johnson & Johnson Services, Inc.

- Geratherm Medical AG

- B. Braun Holding GmbH

- Piramal Enterprises

- Cardinal Health

- OraSure Technologies, Inc.

- bioLytical Laboratories Inc.

- PRIMA Lab SA.

- BD

- F. Hoffmann-La Roche Ltd.

- Bionime Corporation

- Other Active Players

|

Self-Testing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.54 Billion |

|

Forecast Period 2024-32 CAGR: |

5.60% |

Market Size in 2032: |

USD 17.21 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Sample Type |

|

||

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Self-Testing Market by Product Type

4.1 Self-Testing Market Snapshot and Growth Engine

4.2 Self-Testing Market Overview

4.3 Kits

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Kits: Geographic Segmentation Analysis

4.4 Devices and Strips) Sample Type

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Devices and Strips) Sample Type: Geographic Segmentation Analysis

Chapter 5: Self-Testing Market by Application

5.1 Self-Testing Market Snapshot and Growth Engine

5.2 Self-Testing Market Overview

5.3 Blood Pressure Test

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Blood Pressure Test: Geographic Segmentation Analysis

5.4 Diabetes and Glucose Tests

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Diabetes and Glucose Tests: Geographic Segmentation Analysis

5.5 Cholesterol and Triglycerides Tests

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Cholesterol and Triglycerides Tests: Geographic Segmentation Analysis

5.6 Pregnancy Test

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Pregnancy Test: Geographic Segmentation Analysis

5.7 STD /STI Test

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 STD /STI Test: Geographic Segmentation Analysis

5.8 Urinary Tract Infection Test

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Urinary Tract Infection Test: Geographic Segmentation Analysis

5.9 Cancer Test

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 Cancer Test: Geographic Segmentation Analysis

5.10 Celiac disease Test

5.10.1 Introduction and Market Overview

5.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.10.3 Key Market Trends, Growth Factors and Opportunities

5.10.4 Celiac disease Test: Geographic Segmentation Analysis

5.11 Thyroid Test

5.11.1 Introduction and Market Overview

5.11.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.11.3 Key Market Trends, Growth Factors and Opportunities

5.11.4 Thyroid Test: Geographic Segmentation Analysis

5.12 Transaminase Test

5.12.1 Introduction and Market Overview

5.12.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.12.3 Key Market Trends, Growth Factors and Opportunities

5.12.4 Transaminase Test: Geographic Segmentation Analysis

5.13 Anaemia Test

5.13.1 Introduction and Market Overview

5.13.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.13.3 Key Market Trends, Growth Factors and Opportunities

5.13.4 Anaemia Test: Geographic Segmentation Analysis

5.14 Allergy Test and Others

5.14.1 Introduction and Market Overview

5.14.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.14.3 Key Market Trends, Growth Factors and Opportunities

5.14.4 Allergy Test and Others: Geographic Segmentation Analysis

Chapter 6: Self-Testing Market by Distribution Channel

6.1 Self-Testing Market Snapshot and Growth Engine

6.2 Self-Testing Market Overview

6.3 Online and Offline)

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Online and Offline) : Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Self-Testing Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 JOHNSON & JOHNSON SERVICES INC.

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 GERATHERM MEDICAL AG

7.4 B. BRAUN HOLDING GMBH

7.5 PIRAMAL ENTERPRISES

7.6 CARDINAL HEALTH

7.7 ORASURE TECHNOLOGIES INC.

7.8 BIOLYTICAL LABORATORIES INC.

7.9 PRIMA LAB SA

7.10 BD

7.11 F. HOFFMANN-LA ROCHE LTD.

7.12 BIONIME CORPORATION

7.13 OTHER ACTIVE PLAYERS

Chapter 8: Global Self-Testing Market By Region

8.1 Overview

8.2. North America Self-Testing Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Product Type

8.2.4.1 Kits

8.2.4.2 Devices and Strips) Sample Type

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Blood Pressure Test

8.2.5.2 Diabetes and Glucose Tests

8.2.5.3 Cholesterol and Triglycerides Tests

8.2.5.4 Pregnancy Test

8.2.5.5 STD /STI Test

8.2.5.6 Urinary Tract Infection Test

8.2.5.7 Cancer Test

8.2.5.8 Celiac disease Test

8.2.5.9 Thyroid Test

8.2.5.10 Transaminase Test

8.2.5.11 Anaemia Test

8.2.5.12 Allergy Test and Others

8.2.6 Historic and Forecasted Market Size By Distribution Channel

8.2.6.1 Online and Offline)

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Self-Testing Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Product Type

8.3.4.1 Kits

8.3.4.2 Devices and Strips) Sample Type

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Blood Pressure Test

8.3.5.2 Diabetes and Glucose Tests

8.3.5.3 Cholesterol and Triglycerides Tests

8.3.5.4 Pregnancy Test

8.3.5.5 STD /STI Test

8.3.5.6 Urinary Tract Infection Test

8.3.5.7 Cancer Test

8.3.5.8 Celiac disease Test

8.3.5.9 Thyroid Test

8.3.5.10 Transaminase Test

8.3.5.11 Anaemia Test

8.3.5.12 Allergy Test and Others

8.3.6 Historic and Forecasted Market Size By Distribution Channel

8.3.6.1 Online and Offline)

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Self-Testing Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Product Type

8.4.4.1 Kits

8.4.4.2 Devices and Strips) Sample Type

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Blood Pressure Test

8.4.5.2 Diabetes and Glucose Tests

8.4.5.3 Cholesterol and Triglycerides Tests

8.4.5.4 Pregnancy Test

8.4.5.5 STD /STI Test

8.4.5.6 Urinary Tract Infection Test

8.4.5.7 Cancer Test

8.4.5.8 Celiac disease Test

8.4.5.9 Thyroid Test

8.4.5.10 Transaminase Test

8.4.5.11 Anaemia Test

8.4.5.12 Allergy Test and Others

8.4.6 Historic and Forecasted Market Size By Distribution Channel

8.4.6.1 Online and Offline)

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Self-Testing Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Product Type

8.5.4.1 Kits

8.5.4.2 Devices and Strips) Sample Type

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Blood Pressure Test

8.5.5.2 Diabetes and Glucose Tests

8.5.5.3 Cholesterol and Triglycerides Tests

8.5.5.4 Pregnancy Test

8.5.5.5 STD /STI Test

8.5.5.6 Urinary Tract Infection Test

8.5.5.7 Cancer Test

8.5.5.8 Celiac disease Test

8.5.5.9 Thyroid Test

8.5.5.10 Transaminase Test

8.5.5.11 Anaemia Test

8.5.5.12 Allergy Test and Others

8.5.6 Historic and Forecasted Market Size By Distribution Channel

8.5.6.1 Online and Offline)

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Self-Testing Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Product Type

8.6.4.1 Kits

8.6.4.2 Devices and Strips) Sample Type

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Blood Pressure Test

8.6.5.2 Diabetes and Glucose Tests

8.6.5.3 Cholesterol and Triglycerides Tests

8.6.5.4 Pregnancy Test

8.6.5.5 STD /STI Test

8.6.5.6 Urinary Tract Infection Test

8.6.5.7 Cancer Test

8.6.5.8 Celiac disease Test

8.6.5.9 Thyroid Test

8.6.5.10 Transaminase Test

8.6.5.11 Anaemia Test

8.6.5.12 Allergy Test and Others

8.6.6 Historic and Forecasted Market Size By Distribution Channel

8.6.6.1 Online and Offline)

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Self-Testing Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Product Type

8.7.4.1 Kits

8.7.4.2 Devices and Strips) Sample Type

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Blood Pressure Test

8.7.5.2 Diabetes and Glucose Tests

8.7.5.3 Cholesterol and Triglycerides Tests

8.7.5.4 Pregnancy Test

8.7.5.5 STD /STI Test

8.7.5.6 Urinary Tract Infection Test

8.7.5.7 Cancer Test

8.7.5.8 Celiac disease Test

8.7.5.9 Thyroid Test

8.7.5.10 Transaminase Test

8.7.5.11 Anaemia Test

8.7.5.12 Allergy Test and Others

8.7.6 Historic and Forecasted Market Size By Distribution Channel

8.7.6.1 Online and Offline)

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Self-Testing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.54 Billion |

|

Forecast Period 2024-32 CAGR: |

5.60% |

Market Size in 2032: |

USD 17.21 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Sample Type |

|

||

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||