Global Polymeric Sand Market Overview

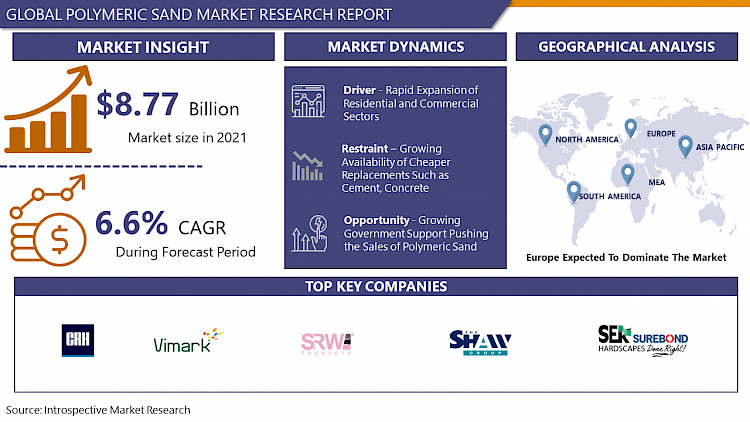

Global Polymeric Sand Market was valued at USD 8.77 billion in 2021 and is expected to reach USD 13.72 billion by the year 2028, at a CAGR of 6.6%.

Techniseal launched polymeric sand in 1999, and it has transformed the construction of interlocking concrete pavers. It is sand that hardens after being activated and dried but stays flexible when wet. Polymeric sand is a substance that is used to fill paver joints, which are the empty areas between each paver, tile, or natural stone. It is also known as jointing sand, paver sand, or hardscape sand. Jointing sand is composed of tiny grains to which manufacturers add a specific additive particle composition. When this chemical comes into contact with water, it becomes an extremely potent bonding agent that tightly bonds concrete elements together. Polymeric sand is popular among paver installers because it produces seams that are both durable and even. This prevents the possibility of weed development and ant infestation, which might have an impact on the overall aesthetics and longevity of paver projects. Recognizing the popularity of Techniseal's polymeric sand technology among hardscape specialists, numerous firms have attempted, with varying degrees of success, to mimic their recipe.

Polymeric sand is frequently utilized in residential, municipal, industrial, and other building operations for compacting and locking pavers. Rapid growth in the global building and construction industry, as well as increased construction activities in developing regions such as Asia-Pacific, the Middle East, and Africa, and Latin America, as well as reconstruction activities in the United States, are expected to drive demand for polymeric sand during the forecast period. Furthermore, the product's significant physical features, such as great resistance to water and budging, superior spreading, and durability, are projected to raise demand in the coming years.

Market Dynamics and Factors for the Polymeric Sand Market:

Drivers:

The combination of sand grains and addition particles creates a strong binding agent that securely keeps concrete pavers and other hardscape installation materials together. Polymeric sand, which is more robust and resistant to erosion than traditional jointing solutions, greatly extends the life of any project. Furthermore, the joints formed by the usage of this substance do not collapse or degrade. This implies that for the first time in a long time, and will remain in the paver joints rather than in the home or at the bottom of a pool. Polymeric sand is an extremely hostile environment for weeds and insect infestations because it keeps installations together more homogeneously than traditional jointing materials (such as ants). Paver joints that are free of parasites are less prone to age or crumble prematurely. Aside from delivering unrivaled jointing performances, the application process of polymeric sand is fast and easy.

The growing inclination for premium homes with vast outside areas will drive the expansion of the polymeric sand market. Huge capital expenditures in the real estate and infrastructure sectors to develop exceptional transportation infrastructure are expected to significantly contribute to industry growth. The expansion of product offers through e-commerce operations has resulted in huge product penetration in previously unexplored regions, hence raising market demand. Furthermore, factors such as increasing demand for housing and increased financing for public infrastructure operations will be significant drivers of the polymeric sand sector in the approaching years.

Restraints:

One downside of utilizing polymeric sand is the chemicals used in its production. Polymeric sand is hardened in the joints between your paving stones by a chemical process. It becomes permanent once it hardens. Furthermore, due to a lack of understanding, the product is challenging to establish traction in several underdeveloped countries. Another issue that is projected to limit growth in the polymeric sand market is the increased availability of cheaper replacements such as cement, concrete, and other low-cost sands.

Challenges:

Availability of alternative products in the inexpensive range than the polymeric sand such as builders' sand, cement, plain sand, stone dust is expected to challenge the polymeric sand industry over the forecasts period.

Opportunities:

Polymeric sand producers across the globe are likely to witness significant growth and expansion opportunities in the upcoming years. In addition, Companies are targeting bringing advancements in the polymeric sand market to increase their reach and address the needs of end-users. For example, Ash Grove Packaging, a part of the CRH Company, provides products online on platforms such as Amazon. Retail outlets are a major sales channel for polymeric sand.

Market Segmentation for Polymeric Sand

Based on the product, polymeric sand is expected to dominate the polymeric sand market over the forecast period. The fundamental advantage of utilizing polymeric sand over polymeric dust is that it hardens. It offers an extra layer of strength to keep the stones together and helps prevent movement by hardening and attaching to the surrounding pavers. When it joins, it seals up the paver joints, preventing weed growth and burrowing insects from the top. It even helps to overcome water damage from severe storms by preventing much of the rainwater from seeping under the pavers and harming the foundation beneath.

Based on the application, the market is segmented into Footpaths, Patios, Pool Deck, Pavements & Auxiliary Spaces, Parking Spaces. The pavements segment registered for the highest market share and is expected to hold the highest CAGR on account of high demand in almost all the construction applications such as residential, municipal, and commercial. The patio and auxiliary building spaces are also important segments which are gaining popularity in commercial construction utilizations such as restaurant, residential clubs, and sports complexes.

Based on the end-use, the residential sector is expected to hold the maximum polymeric market share over the forecast period. The growing demand for polymeric sand will be fueled by the housing industry's rapid expansion, as well as homeowner investments in rehabilitation projects. Due to an increase in disposable money, homeowners' attention on adorning their houses with gardens, patios, and so on will contribute to product market growth. For example, in the United States, 86 percent of household owners have outdoor living areas, and a similar trend can be found in several European nations such as the United Kingdom, Poland, France, and others.

Players Covered in Polymeric Sand market are :

- CRH Plc

- Shaw Group Limited

- Vimark Srl

- Unilock

- SRW Products

- SEK-Surebond

- Sakrete

- Alliance Designer Products

- Sable Marco and other major players.

Regional Analysis for the Polymeric Sand Market:

Europe region is expected to dominate the polymeric sand market over the forecast period. The region has a mature construction industry, but as governments seek to close investment gaps and upgrade aging infrastructure, product demand will rise. As it is used to build walkways, covered patios, and kitchens in gardens and backyards, this will drive product demand. With gardening and landscape activities flourishing in various European countries, it is more likely that product demand will gain traction across the region. This will also aid in the widespread use of the product in kitchens, backyards, walkaway structures, gardens, and covered patios.

The North American market registered for the second-largest share of the global market and is estimated to observe vigorous growth during the forecast period. The surging demand for sustainable construction materials along with growing reconstruction activities all over the US and Canada are anticipated to be the primary factors tuning the growth of the regional market. Additionally, the presence of major key players such as CEMEX and LafargeHolcim who are based out of this region, and high-level infrastructural development coupled with heavy investments by these companies is expected to drive the market in North America.

Significantly growing economies of countries, such as China & Australia, in the eastern half of the globe, will generate lucrative opportunities for the growth of the global polymeric sand market. China is turning out to be a significant country for the global polymeric sand market owing to its attractive foreign policies.

The Latin American region is estimated to be the fastest-growing industry and is anticipated to grow at a significant rate throughout the forecast period, mainly because of its advantages such as availability of raw materials, lower transportation costs, which are used for production (especially construction sand) and cheaper labor costs.

Key Industry Developments in the Polymeric Sand Market:

In April 2019, Wynnchurch Capital, LLC has declared that it has acquired Alliance Designer Products, Inc. Alliance is the leading producer of polymeric sand and is associated with the installation products utilized in residential and commercial hardscaping projects. Established in 2003, Alliance leads the industry with its all-encompassing suite of products, product innovation, and dedication to unmatched customer service and product support. Alliance currently caters to the U.S., Canadian, and European markets from its headquarters in Mirabel, Québec.

COVID-19 Impact on the Polymeric Sand Market:

Over the previous months, almost every industry in the world has suffered a setback. This is due to major interruptions in their separate production and supply-chain activities as a result of numerous precautionary lockdowns and other limitations imposed by governing bodies throughout the world. The same may be said for the global Polymeric Sand Market. Furthermore, consumer demand has subsequently decreased as people are now more focused on minimizing non-essential costs from their separate budgets since the overall economic condition of the majority of people has been badly impacted by this outbreak. These factors are projected to weigh on the revenue trajectory of the worldwide Polymeric Sand Market throughout the forecast period. However, when regional regulatory bodies begin to relax these imposed lockdowns, the global Polymeric Sand Market is likely to rebound.

|

Global Polymeric Sand Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 8.77 Bn. |

|

Forecast Period 2022-28 CAGR: |

6.6% |

Market Size in 2028: |

USD 13.72 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Color |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Product Type

3.2 By Color

3.3 By Application

3.4 By End-User

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Polymeric Sand Market by Product Type

5.1 Polymeric Sand Market Overview Snapshot and Growth Engine

5.2 Polymeric Sand Market Overview

5.3 Polymeric Sand

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Polymeric Sand: Grographic Segmentation

5.4 Polymeric Dust

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Polymeric Dust: Grographic Segmentation

Chapter 6: Polymeric Sand Market by Color

6.1 Polymeric Sand Market Overview Snapshot and Growth Engine

6.2 Polymeric Sand Market Overview

6.3 Beige

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Beige: Grographic Segmentation

6.4 Gray

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Gray: Grographic Segmentation

6.5 Black

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Black: Grographic Segmentation

6.6 Others

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Others: Grographic Segmentation

Chapter 7: Polymeric Sand Market by Application

7.1 Polymeric Sand Market Overview Snapshot and Growth Engine

7.2 Polymeric Sand Market Overview

7.3 Footpaths

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Footpaths: Grographic Segmentation

7.4 Patios

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Patios: Grographic Segmentation

7.5 Pool Deck

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Pool Deck: Grographic Segmentation

7.6 Pavements & Auxiliary Spaces

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2016-2028F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Pavements & Auxiliary Spaces: Grographic Segmentation

7.7 Parking Spaces

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size (2016-2028F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Parking Spaces: Grographic Segmentation

Chapter 8: Polymeric Sand Market by End-User

8.1 Polymeric Sand Market Overview Snapshot and Growth Engine

8.2 Polymeric Sand Market Overview

8.3 Residential

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size (2016-2028F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Residential: Grographic Segmentation

8.4 Commercial

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size (2016-2028F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Commercial: Grographic Segmentation

8.5 Infrastructural

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size (2016-2028F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Infrastructural: Grographic Segmentation

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Positioning

9.1.2 Polymeric Sand Sales and Market Share By Players

9.1.3 Industry BCG Matrix

9.1.4 Ansoff Matrix

9.1.5 Polymeric Sand Industry Concentration Ratio (CR5 and HHI)

9.1.6 Top 5 Polymeric Sand Players Market Share

9.1.7 Mergers and Acquisitions

9.1.8 Business Strategies By Top Players

9.2 CRH PLC

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Operating Business Segments

9.2.5 Product Portfolio

9.2.6 Business Performance

9.2.7 Key Strategic Moves and Recent Developments

9.2.8 SWOT Analysis

9.3 HAW GROUP LIMITED

9.4 VIMARK SRL

9.5 UNILOCK

9.6 SRW PRODUCTS

9.7 SEK-SUREBOND

9.8 SAKRETE

9.9 ALLIANCE DESIGNER PRODUCTS

9.10 SABLE MARCO

9.11 OTHER MAJOR PLAYERS

Chapter 10: Global Polymeric Sand Market Analysis, Insights and Forecast, 2016-2028

10.1 Market Overview

10.2 Historic and Forecasted Market Size By Product Type

10.2.1 Polymeric Sand

10.2.2 Polymeric Dust

10.3 Historic and Forecasted Market Size By Color

10.3.1 Beige

10.3.2 Gray

10.3.3 Black

10.3.4 Others

10.4 Historic and Forecasted Market Size By Application

10.4.1 Footpaths

10.4.2 Patios

10.4.3 Pool Deck

10.4.4 Pavements & Auxiliary Spaces

10.4.5 Parking Spaces

10.5 Historic and Forecasted Market Size By End-User

10.5.1 Residential

10.5.2 Commercial

10.5.3 Infrastructural

Chapter 11: North America Polymeric Sand Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Product Type

11.4.1 Polymeric Sand

11.4.2 Polymeric Dust

11.5 Historic and Forecasted Market Size By Color

11.5.1 Beige

11.5.2 Gray

11.5.3 Black

11.5.4 Others

11.6 Historic and Forecasted Market Size By Application

11.6.1 Footpaths

11.6.2 Patios

11.6.3 Pool Deck

11.6.4 Pavements & Auxiliary Spaces

11.6.5 Parking Spaces

11.7 Historic and Forecasted Market Size By End-User

11.7.1 Residential

11.7.2 Commercial

11.7.3 Infrastructural

11.8 Historic and Forecast Market Size by Country

11.8.1 U.S.

11.8.2 Canada

11.8.3 Mexico

Chapter 12: Europe Polymeric Sand Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Product Type

12.4.1 Polymeric Sand

12.4.2 Polymeric Dust

12.5 Historic and Forecasted Market Size By Color

12.5.1 Beige

12.5.2 Gray

12.5.3 Black

12.5.4 Others

12.6 Historic and Forecasted Market Size By Application

12.6.1 Footpaths

12.6.2 Patios

12.6.3 Pool Deck

12.6.4 Pavements & Auxiliary Spaces

12.6.5 Parking Spaces

12.7 Historic and Forecasted Market Size By End-User

12.7.1 Residential

12.7.2 Commercial

12.7.3 Infrastructural

12.8 Historic and Forecast Market Size by Country

12.8.1 Germany

12.8.2 U.K.

12.8.3 France

12.8.4 Italy

12.8.5 Russia

12.8.6 Spain

12.8.7 Rest of Europe

Chapter 13: Asia-Pacific Polymeric Sand Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Product Type

13.4.1 Polymeric Sand

13.4.2 Polymeric Dust

13.5 Historic and Forecasted Market Size By Color

13.5.1 Beige

13.5.2 Gray

13.5.3 Black

13.5.4 Others

13.6 Historic and Forecasted Market Size By Application

13.6.1 Footpaths

13.6.2 Patios

13.6.3 Pool Deck

13.6.4 Pavements & Auxiliary Spaces

13.6.5 Parking Spaces

13.7 Historic and Forecasted Market Size By End-User

13.7.1 Residential

13.7.2 Commercial

13.7.3 Infrastructural

13.8 Historic and Forecast Market Size by Country

13.8.1 China

13.8.2 India

13.8.3 Japan

13.8.4 Singapore

13.8.5 Australia

13.8.6 New Zealand

13.8.7 Rest of APAC

Chapter 14: Middle East & Africa Polymeric Sand Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Product Type

14.4.1 Polymeric Sand

14.4.2 Polymeric Dust

14.5 Historic and Forecasted Market Size By Color

14.5.1 Beige

14.5.2 Gray

14.5.3 Black

14.5.4 Others

14.6 Historic and Forecasted Market Size By Application

14.6.1 Footpaths

14.6.2 Patios

14.6.3 Pool Deck

14.6.4 Pavements & Auxiliary Spaces

14.6.5 Parking Spaces

14.7 Historic and Forecasted Market Size By End-User

14.7.1 Residential

14.7.2 Commercial

14.7.3 Infrastructural

14.8 Historic and Forecast Market Size by Country

14.8.1 Turkey

14.8.2 Saudi Arabia

14.8.3 Iran

14.8.4 UAE

14.8.5 Africa

14.8.6 Rest of MEA

Chapter 15: South America Polymeric Sand Market Analysis, Insights and Forecast, 2016-2028

15.1 Key Market Trends, Growth Factors and Opportunities

15.2 Impact of Covid-19

15.3 Key Players

15.4 Key Market Trends, Growth Factors and Opportunities

15.4 Historic and Forecasted Market Size By Product Type

15.4.1 Polymeric Sand

15.4.2 Polymeric Dust

15.5 Historic and Forecasted Market Size By Color

15.5.1 Beige

15.5.2 Gray

15.5.3 Black

15.5.4 Others

15.6 Historic and Forecasted Market Size By Application

15.6.1 Footpaths

15.6.2 Patios

15.6.3 Pool Deck

15.6.4 Pavements & Auxiliary Spaces

15.6.5 Parking Spaces

15.7 Historic and Forecasted Market Size By End-User

15.7.1 Residential

15.7.2 Commercial

15.7.3 Infrastructural

15.8 Historic and Forecast Market Size by Country

15.8.1 Brazil

15.8.2 Argentina

15.8.3 Rest of SA

Chapter 16 Investment Analysis

Chapter 17 Analyst Viewpoint and Conclusion

|

Global Polymeric Sand Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 8.77 Bn. |

|

Forecast Period 2022-28 CAGR: |

6.6% |

Market Size in 2028: |

USD 13.72 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Color |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. POLYMERIC SAND MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. POLYMERIC SAND MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. POLYMERIC SAND MARKET COMPETITIVE RIVALRY

TABLE 005. POLYMERIC SAND MARKET THREAT OF NEW ENTRANTS

TABLE 006. POLYMERIC SAND MARKET THREAT OF SUBSTITUTES

TABLE 007. POLYMERIC SAND MARKET BY PRODUCT TYPE

TABLE 008. POLYMERIC SAND MARKET OVERVIEW (2016-2028)

TABLE 009. POLYMERIC DUST MARKET OVERVIEW (2016-2028)

TABLE 010. POLYMERIC SAND MARKET BY COLOR

TABLE 011. BEIGE MARKET OVERVIEW (2016-2028)

TABLE 012. GRAY MARKET OVERVIEW (2016-2028)

TABLE 013. BLACK MARKET OVERVIEW (2016-2028)

TABLE 014. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 015. POLYMERIC SAND MARKET BY APPLICATION

TABLE 016. FOOTPATHS MARKET OVERVIEW (2016-2028)

TABLE 017. PATIOS MARKET OVERVIEW (2016-2028)

TABLE 018. POOL DECK MARKET OVERVIEW (2016-2028)

TABLE 019. PAVEMENTS & AUXILIARY SPACES MARKET OVERVIEW (2016-2028)

TABLE 020. PARKING SPACES MARKET OVERVIEW (2016-2028)

TABLE 021. POLYMERIC SAND MARKET BY END-USER

TABLE 022. RESIDENTIAL MARKET OVERVIEW (2016-2028)

TABLE 023. COMMERCIAL MARKET OVERVIEW (2016-2028)

TABLE 024. INFRASTRUCTURAL MARKET OVERVIEW (2016-2028)

TABLE 025. NORTH AMERICA POLYMERIC SAND MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 026. NORTH AMERICA POLYMERIC SAND MARKET, BY COLOR (2016-2028)

TABLE 027. NORTH AMERICA POLYMERIC SAND MARKET, BY APPLICATION (2016-2028)

TABLE 028. NORTH AMERICA POLYMERIC SAND MARKET, BY END-USER (2016-2028)

TABLE 029. N POLYMERIC SAND MARKET, BY COUNTRY (2016-2028)

TABLE 030. EUROPE POLYMERIC SAND MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 031. EUROPE POLYMERIC SAND MARKET, BY COLOR (2016-2028)

TABLE 032. EUROPE POLYMERIC SAND MARKET, BY APPLICATION (2016-2028)

TABLE 033. EUROPE POLYMERIC SAND MARKET, BY END-USER (2016-2028)

TABLE 034. POLYMERIC SAND MARKET, BY COUNTRY (2016-2028)

TABLE 035. ASIA PACIFIC POLYMERIC SAND MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 036. ASIA PACIFIC POLYMERIC SAND MARKET, BY COLOR (2016-2028)

TABLE 037. ASIA PACIFIC POLYMERIC SAND MARKET, BY APPLICATION (2016-2028)

TABLE 038. ASIA PACIFIC POLYMERIC SAND MARKET, BY END-USER (2016-2028)

TABLE 039. POLYMERIC SAND MARKET, BY COUNTRY (2016-2028)

TABLE 040. MIDDLE EAST & AFRICA POLYMERIC SAND MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 041. MIDDLE EAST & AFRICA POLYMERIC SAND MARKET, BY COLOR (2016-2028)

TABLE 042. MIDDLE EAST & AFRICA POLYMERIC SAND MARKET, BY APPLICATION (2016-2028)

TABLE 043. MIDDLE EAST & AFRICA POLYMERIC SAND MARKET, BY END-USER (2016-2028)

TABLE 044. POLYMERIC SAND MARKET, BY COUNTRY (2016-2028)

TABLE 045. SOUTH AMERICA POLYMERIC SAND MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 046. SOUTH AMERICA POLYMERIC SAND MARKET, BY COLOR (2016-2028)

TABLE 047. SOUTH AMERICA POLYMERIC SAND MARKET, BY APPLICATION (2016-2028)

TABLE 048. SOUTH AMERICA POLYMERIC SAND MARKET, BY END-USER (2016-2028)

TABLE 049. POLYMERIC SAND MARKET, BY COUNTRY (2016-2028)

TABLE 050. CRH PLC: SNAPSHOT

TABLE 051. CRH PLC: BUSINESS PERFORMANCE

TABLE 052. CRH PLC: PRODUCT PORTFOLIO

TABLE 053. CRH PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. HAW GROUP LIMITED: SNAPSHOT

TABLE 054. HAW GROUP LIMITED: BUSINESS PERFORMANCE

TABLE 055. HAW GROUP LIMITED: PRODUCT PORTFOLIO

TABLE 056. HAW GROUP LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. VIMARK SRL: SNAPSHOT

TABLE 057. VIMARK SRL: BUSINESS PERFORMANCE

TABLE 058. VIMARK SRL: PRODUCT PORTFOLIO

TABLE 059. VIMARK SRL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. UNILOCK: SNAPSHOT

TABLE 060. UNILOCK: BUSINESS PERFORMANCE

TABLE 061. UNILOCK: PRODUCT PORTFOLIO

TABLE 062. UNILOCK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. SRW PRODUCTS: SNAPSHOT

TABLE 063. SRW PRODUCTS: BUSINESS PERFORMANCE

TABLE 064. SRW PRODUCTS: PRODUCT PORTFOLIO

TABLE 065. SRW PRODUCTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. SEK-SUREBOND: SNAPSHOT

TABLE 066. SEK-SUREBOND: BUSINESS PERFORMANCE

TABLE 067. SEK-SUREBOND: PRODUCT PORTFOLIO

TABLE 068. SEK-SUREBOND: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. SAKRETE: SNAPSHOT

TABLE 069. SAKRETE: BUSINESS PERFORMANCE

TABLE 070. SAKRETE: PRODUCT PORTFOLIO

TABLE 071. SAKRETE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. ALLIANCE DESIGNER PRODUCTS: SNAPSHOT

TABLE 072. ALLIANCE DESIGNER PRODUCTS: BUSINESS PERFORMANCE

TABLE 073. ALLIANCE DESIGNER PRODUCTS: PRODUCT PORTFOLIO

TABLE 074. ALLIANCE DESIGNER PRODUCTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. SABLE MARCO: SNAPSHOT

TABLE 075. SABLE MARCO: BUSINESS PERFORMANCE

TABLE 076. SABLE MARCO: PRODUCT PORTFOLIO

TABLE 077. SABLE MARCO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 078. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 079. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 080. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. POLYMERIC SAND MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. POLYMERIC SAND MARKET OVERVIEW BY PRODUCT TYPE

FIGURE 012. POLYMERIC SAND MARKET OVERVIEW (2016-2028)

FIGURE 013. POLYMERIC DUST MARKET OVERVIEW (2016-2028)

FIGURE 014. POLYMERIC SAND MARKET OVERVIEW BY COLOR

FIGURE 015. BEIGE MARKET OVERVIEW (2016-2028)

FIGURE 016. GRAY MARKET OVERVIEW (2016-2028)

FIGURE 017. BLACK MARKET OVERVIEW (2016-2028)

FIGURE 018. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 019. POLYMERIC SAND MARKET OVERVIEW BY APPLICATION

FIGURE 020. FOOTPATHS MARKET OVERVIEW (2016-2028)

FIGURE 021. PATIOS MARKET OVERVIEW (2016-2028)

FIGURE 022. POOL DECK MARKET OVERVIEW (2016-2028)

FIGURE 023. PAVEMENTS & AUXILIARY SPACES MARKET OVERVIEW (2016-2028)

FIGURE 024. PARKING SPACES MARKET OVERVIEW (2016-2028)

FIGURE 025. POLYMERIC SAND MARKET OVERVIEW BY END-USER

FIGURE 026. RESIDENTIAL MARKET OVERVIEW (2016-2028)

FIGURE 027. COMMERCIAL MARKET OVERVIEW (2016-2028)

FIGURE 028. INFRASTRUCTURAL MARKET OVERVIEW (2016-2028)

FIGURE 029. NORTH AMERICA POLYMERIC SAND MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. EUROPE POLYMERIC SAND MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. ASIA PACIFIC POLYMERIC SAND MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. MIDDLE EAST & AFRICA POLYMERIC SAND MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 033. SOUTH AMERICA POLYMERIC SAND MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Polymeric Sand Market research report is 2022-2028.

CRH Plc, Shaw Group Limited, Vimark Srl, Unilock, SRW Products, SEK-Surebond, Sakrete, Alliance Designer Products, Sable Marco., and other major players.

The Polymeric Sand Market is segmented into Product Type, Color, Application, and region. By Product Type, the market is categorized into Polymeric Sand, Polymeric Dust. By Color, the market is categorized into Beige, Gray, Black, and Others. By Application, the market is categorized into Footpaths, Patios, Pool Deck, Pavements & Auxiliary Spaces, and Parking Spaces. By End-User, the market is categorized into Residential, Commercial, and Infrastructural. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Techniseal launched polymeric sand in 1999, and it has transformed the construction of interlocking concrete pavers. It is sand that hardens after being activated and dried but stays flexible when wet. Polymeric sand is a substance that is used to fill paver joints, which are the empty areas between each paver, tile, or natural stone.

Global Polymeric Sand Market was valued at USD 8.77 billion in 2021 and is expected to reach USD 13.72 billion by the year 2028, at a CAGR of 6.6%.