Polyethylene Low Density (LDPE) Market Synopsis

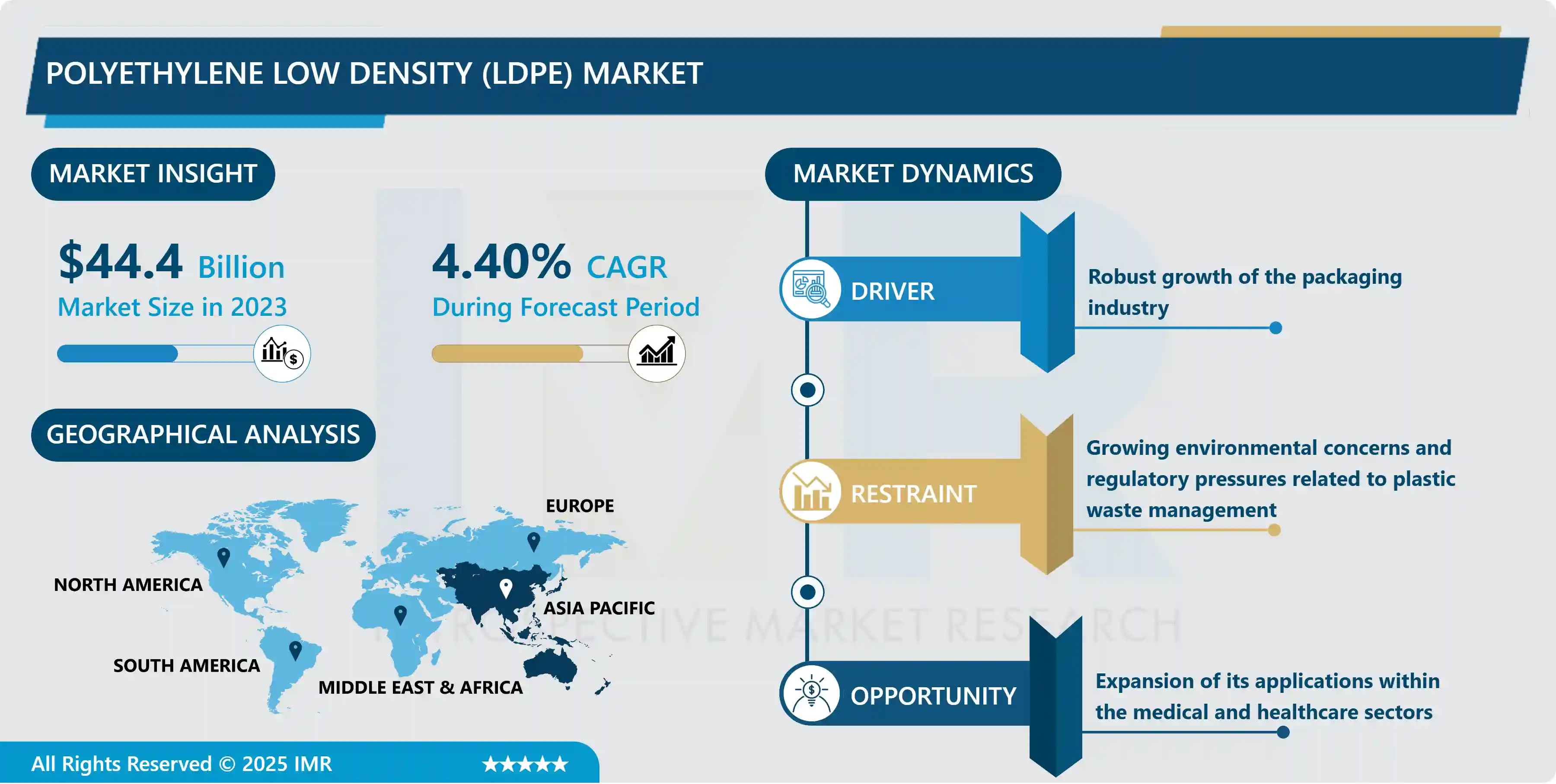

Polyethylene Low Density (LDPE) Market Size Was Valued at USD 44.4 Billion in 2023 and is Projected to Reach USD 65.4 Billion by 2032, Growing at a CAGR of 4.40% From 2024-2032.

Polyethylene Low Density (LDPE) is a kind of thermoplastic polymer having ethylene as its homologous monomer. LDPE has high flexibility and transparency as well as impact resistance; the density of the product is low, varying from 0. 91 to 0. 94 g/cm³, that has been attributed to the highly branched structure of the molecule. Such branching inhibits the closer packing of polymer chains, and thereby contributes to the characteristics of LDPE. LDPE is widely used in production of plastic bags, film wrap, containers and numerous other household items. Due to its resistant to chemical and easy to process its widely used in many consumer and even industrial purposes.

Currently, the world Polyethylene Low Density (LDPE) market has been expanding due to its versatility of uses as well as satisfying material characteristics. It’s predominant used for packaging, more specifically in the formation of plastic bags, films, and containers the best and most important properties of LDPE be noted are flexibility, clarity, and moisture resistance. The packaging industry has developed progressively along with the escalating demand for convenient and lightweight LDPE for packaging. Besides, the applications of the material in other industries like the agricultural industry in greenhouse films and the construction industry for protective covers and insulation elongate its demand even further.

Yet, this type of plastic has many customers; there are some issues, concerning the LDPE market, for example, with the ecological aspects and the problem of recycling. Different governments and organizations are employing policies and advocacy for responsible production and use of the LDPE and this may lead to changes in policies. But there are also threats which include; The good news is that there are two trends that may offset the above challenges They include; Recycling technologies Inventions of Bio-based LDPE. This is also a strong factor because the market is sensitive to the changes in the price of raw materials and the general economic trends hence affecting the cost of production and the prices that are set in the market. In general, the LDPE market is predicted to have a positive trend in the future, although the primary emphasis will therefore be on sustainability and the expansion of new types of products.

Polyethylene Low Density (LDPE) Market Trend Analysis

Increasing emphasis on sustainability and the development of eco-friendly alternatives

- As for the trends, the one that can be mentioned as significant for Polyethylene Low Density (LDPE) market is the constantly rising focus on the sustainability and the attempts to create more environmentally friendly products. Due to increasing awareness of the negative impact of plastics particularly when it comes to environmental issues, organizations are now calling for change when it comes to plastics in the market. This include finding of new technologies that enhance the ability of LDPE products to be recycled and finding of bio-degradable LDPE from natural resources. There is research and development activity to develop LDPE types that retain the good characteristics of the polymer but at lower impact on the environment. This trend is due to rigid regulation, as well as the interest in environmentally friendly products that put sustainability as a main prospective development of the LDPE market.

Expansion of its applications within the medical and healthcare sectors

- Yet, an opportunity that is developing in the Polyethylene Low Density (LDPE) market area is the growth of the product’s uses in the medical and healthcare industries. LDPE’s characteristics, including flexibility, chemical immunity and clarity, make it appropriate for many uses in the medical field for such as in pharmaceuticals’ packaging and medical instrumentations and other disposable health care accessories like gloves and tubes. LDPE manufacturers have a strong potential growth area as the development of medical technologies continue and demand for safe, sterile, and reliable medical products including LDPE continues to rise. Also, greater emphasis on the healthcare building construction coupled with increasing requirement of medical facilities owing to various health crises across the world adds to this prospect. Therefore, improving the range of the specialised LDPE grades, meeting the necessary medical requirements and demands of the legislation, the companies will be able to enter the promising and developing market segment.

Polyethylene Low Density (LDPE) Market Segment Analysis:

Polyethylene Low Density (LDPE) Market Segmented on the basis of technology and application.

By Technology, Autoclave segment is expected to dominate the market during the forecast period

- The technology segment that has tremendously transformed the fabrication of automobiles is expected to remain the most popular in the Polyethylene Low Density (LDPE) market within the forecast period due to its excellent efficiency in producing quality LDPE with uniform characteristics. The new system creates a more uniform LDPE with better clarity, strength and uniformity due to the fact that compared to tubular reactors, it enables more precise control of polymerization. The particular benefit derived from this technology is that it helps in the manufacturing of hi-end / specialty LDPE grades which find application in high performance films & oriented films, medical packaging and hi-tech consumer goods.

- The autoclave process also complies with the requirements for quality and performance of high-value and high-performance LDPE products needed in today’s LDPE markets, which is the reason for its growth. Also, the constant technological improvements with regards to the autoclave and the increasing use of the same from prominent players in the LDPE market can only affirm the technology’s supremacy in the market moving forward.

By Application, Film & Sheets segment expected to held the largest share

- From the forecasted demand_ALLOCATIONS of Polyethylene Low Density (LDPE), it is expected that Film & Sheets segment will command the largest percentage of share due to its application in the packaging the protection industry. Because LDPE is very flexible, robust, and transparent, it is used in the creation of films and sheets for various items such as plastic bags, covered in agriculture, shrink, and packaging. Agricultural films used in the food & beverage industries for easy packaging and to protect from environmental factors and also, demand for lightweight packaging materials to pack food & beverages also drive this segment.

- Also, owing to requirements of the construction industry, such as protective coverings and moisture barriers, the LDPE films and sheets have greater market demand. Currently, due to consistent advancements and consumers’ shift towards environment-friendly packaging, the Film & Sheets segment has been predicted to retain its dominance of the LDPE market.

Polyethylene Low Density (LDPE) Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Polyethylene Low Density (LDPE) market is expected to be majorly driven by Asia Pacific over the next few years due to higher rate of industrialization, urbanization and economic growth in countries like China, India, and several nations of South East Asia. A primary reason for this dominance is the region’s growing packaging industry owing to increasing consumer consumption and growing e-commerce in operation.

- Furthermore, the agricultural sector has also been gradually using LDPE for green house films and irrigation systems, which accelerates the market growth was well. Infrastructural related construction activities, the solid progression in the construction industry in general also contribute to the higher demands in LDPE products. The region is well positioned due to the encouraging government polices, upgrade manufacturing facilities and availability of some of the major LDPE manufacturers. Therefore, it is expected that Asia Pacific would emerge as the biggest consumer and producer for LDPE based on the different uses and strong economical activities.

Active Key Players in the Polyethylene Low Density (LDPE) Market

- BASF SE (Germany)

- Borealis AG (Austria)

- Braskem (Brazil)

- Dow Chemical Company (USA)

- ExxonMobil Chemical (USA)

- Formosa Plastics Group (Taiwan)

- INEOS Group (UK)

- LG Chem (South Korea)

- LyondellBasell Industries (Netherlands)

- Mitsui Chemicals (Japan)

- Reliance Industries Limited (India)

- SABIC (Saudi Arabia)

- Sinopec (China)

- TotalEnergies (France)

- Westlake Chemical Corporation (USA), Other key Players.

Key Industry Developments in the Polyethylene Low Density (LDPE) Market:

- In July 2023, Siegwerk Druckfarben AG & Co. KGaA, a German-based manufacturer of inks and varnishes, collaborated with Wildplastic GmbH and Hamburg University of Technology (TU-Hamburg) to improve the recyclability and sustainability of plastic.

|

Global Polyethylene Low Density (LDPE) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 44.4 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.4 % |

Market Size in 2032: |

USD 65.4 Bn. |

|

Segments Covered: |

By Technology |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Polyethylene Low Density (LDPE) Market by Technology (2018-2032)

4.1 Polyethylene Low Density (LDPE) Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Autoclave

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Roving

4.5 Tubular

Chapter 5: Polyethylene Low Density (LDPE) Market by Application (2018-2032)

5.1 Polyethylene Low Density (LDPE) Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Film & Sheets

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Extrusion Coating

5.5 Injection Moulding

5.6 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Polyethylene Low Density (LDPE) Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 DAIFUKU (JAPAN)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 DEMATIC (US)

6.4 EGEMIN AUTOMATION (US)

6.5 JBT (US)

6.6 MEIDENSHA (JAPAN)

6.7 CORECON (US)

6.8 SEEGRID (US)

6.9 AETHON (US)

6.10 DOERFER (US)

6.11 SAVANT AUTOMATION (US)

6.12 BASTIAN SOLUTIONS (US)

6.13 MURATA (JAPAN)

6.14 SCOTT (SWITZERLAND)

6.15 WOLTER GROUP LLC (US) OTHERS MAJOR PLAYERS

Chapter 7: Global Polyethylene Low Density (LDPE) Market By Region

7.1 Overview

7.2. North America Polyethylene Low Density (LDPE) Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Technology

7.2.4.1 Autoclave

7.2.4.2 Roving

7.2.4.3 Tubular

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Film & Sheets

7.2.5.2 Extrusion Coating

7.2.5.3 Injection Moulding

7.2.5.4 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Polyethylene Low Density (LDPE) Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Technology

7.3.4.1 Autoclave

7.3.4.2 Roving

7.3.4.3 Tubular

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Film & Sheets

7.3.5.2 Extrusion Coating

7.3.5.3 Injection Moulding

7.3.5.4 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Polyethylene Low Density (LDPE) Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Technology

7.4.4.1 Autoclave

7.4.4.2 Roving

7.4.4.3 Tubular

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Film & Sheets

7.4.5.2 Extrusion Coating

7.4.5.3 Injection Moulding

7.4.5.4 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Polyethylene Low Density (LDPE) Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Technology

7.5.4.1 Autoclave

7.5.4.2 Roving

7.5.4.3 Tubular

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Film & Sheets

7.5.5.2 Extrusion Coating

7.5.5.3 Injection Moulding

7.5.5.4 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Polyethylene Low Density (LDPE) Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Technology

7.6.4.1 Autoclave

7.6.4.2 Roving

7.6.4.3 Tubular

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Film & Sheets

7.6.5.2 Extrusion Coating

7.6.5.3 Injection Moulding

7.6.5.4 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Polyethylene Low Density (LDPE) Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Technology

7.7.4.1 Autoclave

7.7.4.2 Roving

7.7.4.3 Tubular

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Film & Sheets

7.7.5.2 Extrusion Coating

7.7.5.3 Injection Moulding

7.7.5.4 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Polyethylene Low Density (LDPE) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 44.4 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.4 % |

Market Size in 2032: |

USD 65.4 Bn. |

|

Segments Covered: |

By Technology |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||