Plastics Modifiers Market Synopsis:

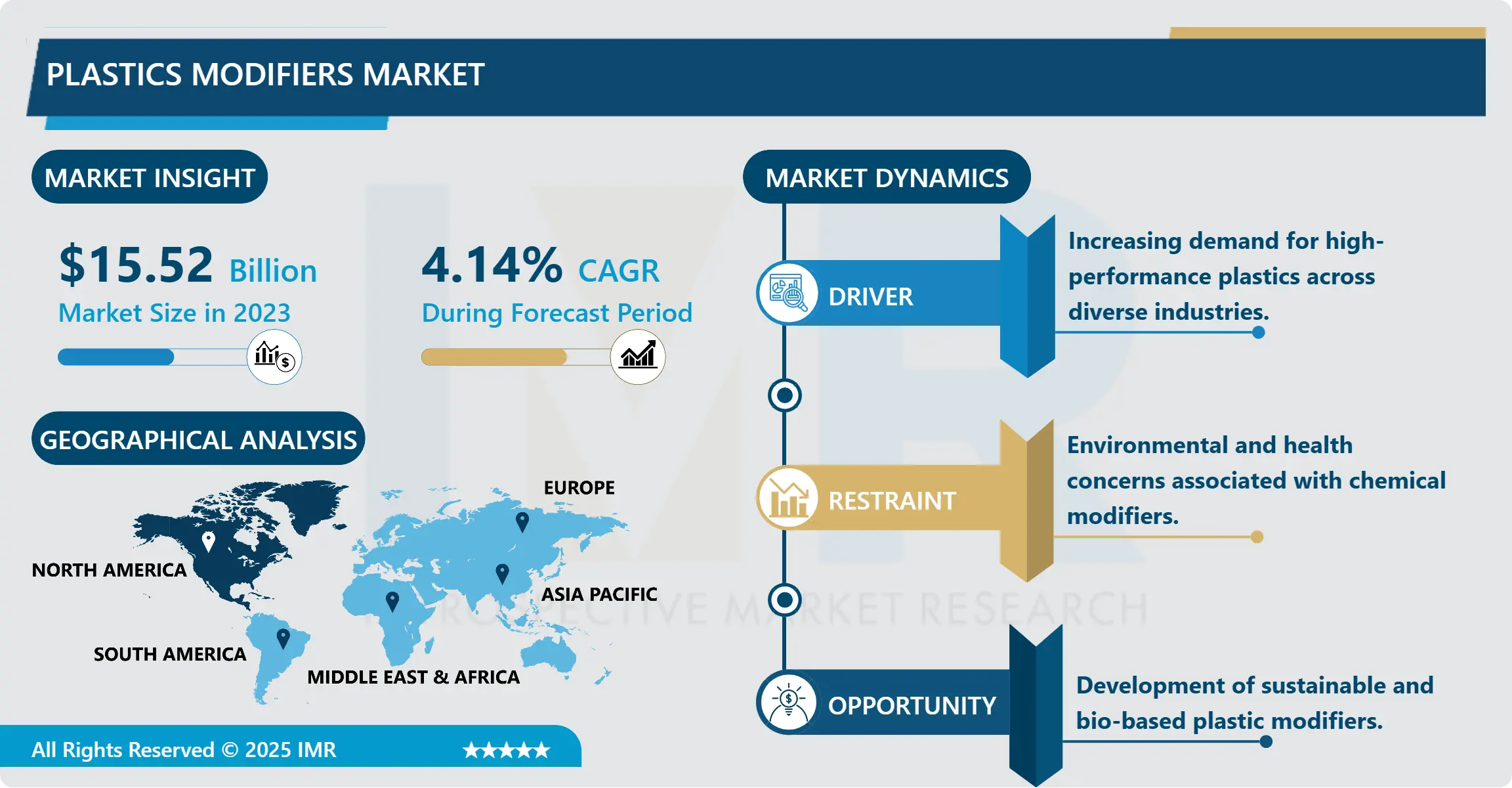

Plastics Modifiers Market Size Was Valued at USD 15.52 Billion in 2023, and is Projected to Reach USD 22.36 Billion by 2032, Growing at a CAGR of 4.14 % From 2024-2032.

The Plastics Modifiers Market can be defined as the industry for materials used in plastics which are intended to improve their performance characteristics including strength, elasticity, resistance to shock, and heat respectively. These modifiers are useful in enhancing properties and enhancing uses of plastics within car making, architecture, food preservation, and manufacture of household products among others. Plastic modifiers impact physical and chemical properties allowing producers to satisfy the needs of various industries and guidelines.

The plastics modifiers market has shown immense growth over the previous years globally because of the rising market for better plastics in numerous sectors. Of the various end-use industries, construction and automotive industries are the largest buyers of modified plastics with the product being used for lightweight, durable, and sustainable applications. As awareness of efforts to limit environmental harm increases, industries are turning to novel modifiers for recyclability and adherence to increasingly binding codes. Also, the rise of infrastructure projects around the globe is creating more markets for plastic materials with enhanced mechanical and thermal characteristics.

There has been increased demand for high-quality packaging materials from consumers hence boosting the market. Improved plastics that have better impact strength and elasticity are gradually finding their way into the food packaging, medical, and consumer industries. Together with the development of polymer technologies, the market is expected to expand resulting from a growing use of modifiers to enhance the characteristics of plastics and address new demands of industries.

Plastics Modifiers Market Trend Analysis:

Shift Toward Sustainable Modifiers

-

An emerging trend defining the Plastics Modifiers Market is the trend of increased usage of environment-friendly and biodegradable modifiers. As the international market pushes for lesser emissions of carbon, producers are looking at organic replacements for chemical additives for plastics. These green modifiers are bio based and, in their formulation, they aim at improving the plastic properties while at the same time addressing the environmental concerns.

- Legal requirements for the usage of environmentally sound materials and the demand for environmental protection together with safe goods are driving the tendency to innovate and use advanced solutions in the processes of construction and deconstruction. This trend is beneficial for supporting environmental objectives while at the same time creating opportunities for manufacturers to generate new sales revenues through investment in sustainable product development.

Expansion in Emerging Markets

-

Emerging industries particularly in the manufacturing sectors offers a great prospective for the Plastics Modifiers Market. The Asia-Pacific, Latin America and the Middle Eastern countries are urbanizing, industrializing and investing hugely on infrastructure requiring high performance Plastic products in construction, automotive and packaging industries.

- Also these regions are transforming themselves to use more innovative technology in their manufacturing lines thus creating a very big market for plastic modifiers. In this way, by offering specific solutions and forming partnerships mostly in these identified faster-growing regions, manufacturers will be able to leverage opportunities and achieve great market growth.

Plastics Modifiers Market Segment Analysis:

Plastics Modifiers Market is Segmented on the basis of Type, Application, End User, and Region.

By Type, Phthalates segment is expected to dominate the market during the forecast period

-

The phthalates segment is expected to be the largest Segment in the Plastics Modifiers Market in the forecast timeline. Phthalates that are used in plastics find application as flexibility, durability and most importantly prolong the life of plastics. However, regulation has increased its scrutiny in some areas because of its negative impacts on the environment and health, phthalates are nonetheless used in construction materials, consumer products, and automotive parts.

- Industry improvements in formulation and production technologies are solving environmental issues that could have dwarfed the phthalates market. As they enhance the functionality of PVC and other resins, phthalates remain the key player in the plastic modification market.

By Application, the PVC segment is expected to hold the largest share

-

Among the segmentation of plastics modifiers, the PVC segment is expected to capture the largest Market share due to its use in construction, automotive, and healthcare applications. This shows that PVC is preferred for modified plastics since it is flexible and very cheap to use. The incorporation of modifiers contributes appreciably to the improvement of PVC’s performance characteristics such as weatherability, toughness and resistance to chemicals.

- Over the years, there is an increasing trend of infrastructural projects and the provision of housing around the world, and more so in the developing nations; this has fuelled the need for modified PVC material which is expected to dominate this market.

Plastics Modifiers Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America is expected to be the largest market in the Plastics Modifiers Market during the forecast period due to its high share contribution to the overall global revenue generation. This dominance is explained by a developed industrial background, a high level of research and development, and the use of composite materials in the analyzed region. Builders and automakers in the U.S. and a particularly in Canada remain the largest customers of modified plastics thus the need to come up with new modifiers. Also, high environmental standards and increasing social concern towards the conservation of the environment is encouraging the creation of greener/plant-based modifiers for plastic, thus driving the market.

- The region also thus has a well-developed packaging industry and the widely adopted modified plastics are used in the region for packing and industrial requirements. Continued evolution in polymer technologies and auspicious presence of several key market players sustain the North America to maintain an impressive pedestal in world’s usage of latest plastic modification solutions. The long-term trend towards decarbonisation and the transition towards the circular economy is anticipated to underpin the region’s leadership in the market further.

Active Key Players in the Plastics Modifiers Market:

- ADEKA Corporation (Japan)

- Arkema S.A. (France)

- BASF SE (Germany)

- BYK Additives (Germany)

- Clariant AG (Switzerland)

- Dow Inc. (United States)

- Eastman Chemical Company (United States)

- Evonik Industries AG (Germany)

- ExxonMobil Chemical Company (United States)

- Kaneka Corporation (Japan)

- Lanxess AG (Germany)

- LG Chem Ltd. (South Korea)

- Mitsubishi Chemical Corporation (Japan)

- Solvay S.A. (Belgium)

- Teknor Apex Company (United States), and Other Active Players

|

Global Plastics Modifiers Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 15.52 Billion |

|

Forecast Period 2024-32 CAGR: |

4.14 % |

Market Size in 2032: |

USD 22.36 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Plastics Modifiers Market by Type

4.1 Plastics Modifiers Market Snapshot and Growth Engine

4.2 Plastics Modifiers Market Overview

4.3 Application PaaS (aPaaS) Integration PaaS (iPaaS) Database PaaS (dbPaaS) Other

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Application PaaS (aPaaS) Integration PaaS (iPaaS) Database PaaS (dbPaaS) Other: Geographic Segmentation Analysis

Chapter 5: Plastics Modifiers Market by Deployment

5.1 Plastics Modifiers Market Snapshot and Growth Engine

5.2 Plastics Modifiers Market Overview

5.3 Public Cloud Private Cloud

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Public Cloud Private Cloud: Geographic Segmentation Analysis

Chapter 6: Plastics Modifiers Market by End User

6.1 Plastics Modifiers Market Snapshot and Growth Engine

6.2 Plastics Modifiers Market Overview

6.3 BFSI IT and Telecommunication Manufacturing Healthcare and life sciences Energy and utility Others

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 BFSI IT and Telecommunication Manufacturing Healthcare and life sciences Energy and utility Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Plastics Modifiers Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ADEKA CORPORATION (JAPAN)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ARKEMA S.A. (FRANCE)

7.4 BASF SE (GERMANY)

7.5 BYK ADDITIVES (GERMANY)

7.6 CLARIANT AG (SWITZERLAND)

7.7 DOW INC. (UNITED STATES)

7.8 EASTMAN CHEMICAL COMPANY (UNITED STATES)

7.9 EVONIK INDUSTRIES AG (GERMANY)

7.10 EXXONMOBIL CHEMICAL COMPANY (UNITED STATES)

7.11 KANEKA CORPORATION (JAPAN)

7.12 LANXESS AG (GERMANY)

7.13 LG CHEM LTD. (SOUTH KOREA)

7.14 MITSUBISHI CHEMICAL CORPORATION (JAPAN)

7.15 SOLVAY S.A. (BELGIUM)

7.16 TEKNOR APEX COMPANY (UNITED STATES)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Plastics Modifiers Market By Region

8.1 Overview

8.2. North America Plastics Modifiers Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Application PaaS (aPaaS) Integration PaaS (iPaaS) Database PaaS (dbPaaS) Other

8.2.5 Historic and Forecasted Market Size By Deployment

8.2.5.1 Public Cloud Private Cloud

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 BFSI IT and Telecommunication Manufacturing Healthcare and life sciences Energy and utility Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Plastics Modifiers Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Application PaaS (aPaaS) Integration PaaS (iPaaS) Database PaaS (dbPaaS) Other

8.3.5 Historic and Forecasted Market Size By Deployment

8.3.5.1 Public Cloud Private Cloud

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 BFSI IT and Telecommunication Manufacturing Healthcare and life sciences Energy and utility Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Plastics Modifiers Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Application PaaS (aPaaS) Integration PaaS (iPaaS) Database PaaS (dbPaaS) Other

8.4.5 Historic and Forecasted Market Size By Deployment

8.4.5.1 Public Cloud Private Cloud

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 BFSI IT and Telecommunication Manufacturing Healthcare and life sciences Energy and utility Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Plastics Modifiers Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Application PaaS (aPaaS) Integration PaaS (iPaaS) Database PaaS (dbPaaS) Other

8.5.5 Historic and Forecasted Market Size By Deployment

8.5.5.1 Public Cloud Private Cloud

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 BFSI IT and Telecommunication Manufacturing Healthcare and life sciences Energy and utility Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Plastics Modifiers Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Application PaaS (aPaaS) Integration PaaS (iPaaS) Database PaaS (dbPaaS) Other

8.6.5 Historic and Forecasted Market Size By Deployment

8.6.5.1 Public Cloud Private Cloud

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 BFSI IT and Telecommunication Manufacturing Healthcare and life sciences Energy and utility Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Plastics Modifiers Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Application PaaS (aPaaS) Integration PaaS (iPaaS) Database PaaS (dbPaaS) Other

8.7.5 Historic and Forecasted Market Size By Deployment

8.7.5.1 Public Cloud Private Cloud

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 BFSI IT and Telecommunication Manufacturing Healthcare and life sciences Energy and utility Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Plastics Modifiers Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 15.52 Billion |

|

Forecast Period 2024-32 CAGR: |

4.14 % |

Market Size in 2032: |

USD 22.36 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||