Pharmaceutical Packaging Machinery Market Synopsis:

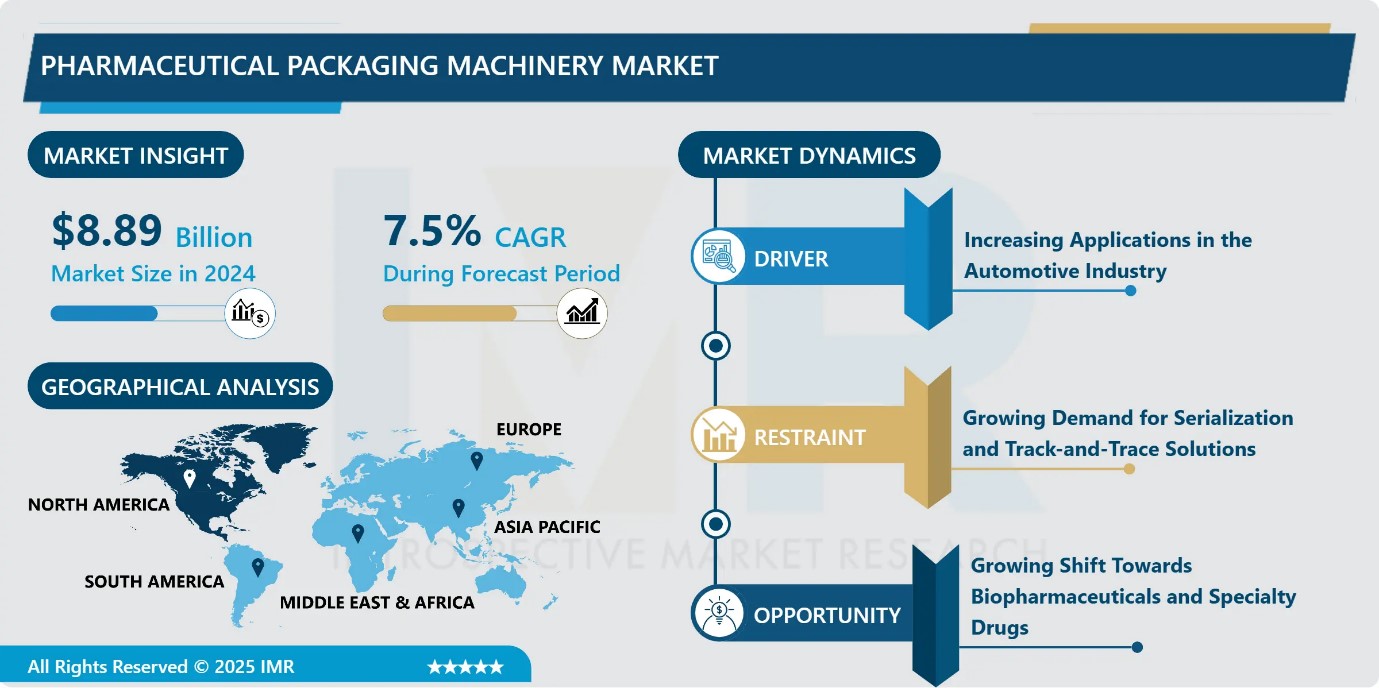

Pharmaceutical Packaging Machinery Market Size Was Valued at USD 8.89 Billion in 2024, and is Projected to Reach USD 19.70 Billion by 2035, Growing at a CAGR of 7.5% From 2025–2035.

Pharmaceutical packaging machinery includes machines used to pack medicines and healthcare products. These machines help in packing tablets, capsules, powders, liquids, creams, and ointments. The goal of using this machinery is to make sure that the medicines stay safe, effective, and clean until they reach the patient. Packaging also protects the drugs from damage, moisture, and contamination during storage and transport.

These machines can pack medicines in many forms, such as blister packs (used for tablets), bottles (used for liquids or pills), vials and ampoules (used for injections), sachets (small packets for powders), and syringes. Each type of packaging helps ensure that the medicine is delivered in the right way and in the right dose.

The market for pharmaceutical packaging machinery is growing steadily around the world. This growth is mainly because more medicines are being produced due to an increase in diseases and a growing global population. As the need for medicines rises, pharmaceutical companies need faster, safer, and more reliable ways to pack their products.

There is also a rising demand for automated machines that can do the job quickly and accurately. These machines help companies reduce mistakes, save time, and meet strict rules set by governments. Rules and standards in many countries require pharmaceutical companies to clearly label and track their products to prevent fake medicines and ensure patient safety. In addition, newer technologies like smart sensors and tracking systems are being added to packaging machines. These advancements help improve quality and efficiency. Countries like the United States, Germany, China, and India are key players in this market, with many companies investing in advanced machinery. Overall, pharmaceutical packaging machinery plays a crucial role in the global healthcare system by ensuring safe and effective medicine delivery.

Pharmaceutical Packaging Machinery Market Growth and Trend Analysis:

Pharmaceutical Packaging Machinery Market Growth Driver- Increasing Applications in the Automotive Industry

- 3d printing materials are extensively used in the automotive industry to manufacture scaled models for testing. They are also used for components, such as bellows, front bumper, air conditioning ducting, suspension wishbone, dashboard interface, alternator mounting bracket, battery cover, etc. Automotive OEM manufacturers are using 3d printing materials for rapid prototyping. ?

- Owing to the advantages of the 3D printing process, such as low cost, less manufacturing time, reduced material wastage, etc., automotive manufacturers are moving toward the usage of this process. Some of the largest automotive manufacturers in the world, such as AUDI, Rolls Royce, Porsche, Hack rod, and many others, are using these materials for manufacturing spare parts and metal prototypes. ?

- The current slowdown in global automotive production has affected the market for polyester staple fibre because of the decreased demand for automotive fibres. Additionally, the current slowdown in automotive sales in countries such as China is further expected to hinder the demand for 3D printing materials. ?

- The pandemic has severely impacted the automotive sector globally; according to OICA (International Organization of Motor Vehicle Manufacturers), global production of vehicles in the third quarter of 2020 was around 50 million, a significant decrease compared to the production in the third quarter of 2019, which was around 65 million.

Pharmaceutical Packaging Machinery Market Limiting Factor - Growing Demand for Serialization and Track-and-Trace Solutions

- The pharmaceutical industry is facing stronger rules from governments worldwide to make sure medicines are safe and real. This is causing a big increase in the use of serialization and track-and-trace technologies in pharmaceutical packaging. Serialization means giving each medicine package a unique code, like a barcode or QR code, so it can be identified and tracked through the entire supply chain from the factory to the pharmacy.

- Governments have introduced strict regulations to stop fake medicines from entering the market and to protect patients. For example, the Drug Supply Chain Security Act (DSCSA) in the United States and the Falsified Medicines Directive (FMD) in Europe require pharmaceutical companies to use these tracking systems. Because of this, companies need advanced packaging machines that can print unique codes on every package and help monitor the medicine as it moves through production, shipping, and sales.

- In short, the growing demand for serialization and track-and-trace solutions is changing how medicines are packaged and tracked. It pushes the industry to develop smarter, safer, and more connected packaging systems to meet new rules and keep patients safe.

Pharmaceutical Packaging Machinery Market Expansion Opportunity- Growing Shift Towards Biopharmaceuticals and Specialty Drugs

- The pharmaceutical industry is changing. More and more companies are now focusing on biopharmaceuticals and specialty drugs. These are advanced types of medicines that are often used to treat serious or rare diseases, such as cancer, autoimmune disorders, and genetic conditions.

- Unlike traditional drugs, biopharmaceuticals are made from living cells and are often very sensitive. They can be affected by temperature, light, and movement. Because of this, they need special packaging that can keep them safe and effective until they reach the patient. This is where pharmaceutical packaging machines play a very important role.

- Companies that make medicines are now looking for advanced packaging equipment that can handle these delicate drugs. These machines must ensure that the medicines stay sterile, are sealed properly, and are kept at the right temperature. In many cases, the drugs are made in small batches, so the packaging systems also need to be flexible and precise.

- In summary, the rise of biopharmaceuticals and specialty drugs is driving growth in the packaging equipment market. As these treatments become more common, innovative and specialized packaging will be essential to protect the medicines and ensure they work as intended.

Pharmaceutical Packaging Machinery Market Challenge and Risk- Lack of Skilled Workforce

- One of the big challenges facing the pharmaceutical packaging equipment market is the shortage of skilled workers. Modern packaging machines are very advanced and need trained professionals to operate them correctly. Without skilled workers, it becomes difficult to use these machines efficiently and safely.

- The pharmaceutical industry is constantly changing. New technologies like automation, serialization (tracking products), and smart packaging are being added to packaging machines. These technologies make packaging faster and safer, but they also require workers who understand how to use and maintain them. This means companies need employees with special skills and training.

- The problem of a skilled workforce shortage is especially strong in emerging markets countries where industries are still growing. In these regions, there are fewer training programs and less access to technical education. Because of this, many companies struggle to find workers who can handle the new, complex packaging machines.

- In summary, the lack of skilled workers slows down the adoption of new packaging technologies in the pharmaceutical industry. Addressing this issue is important to help companies improve packaging quality and efficiency while keeping up with industry demands.

Pharmaceutical Packaging Machinery Market Segment Analysis:

Pharmaceutical Packaging Machinery Market is segmented based on Type, Application, End-Users, and Region

By Type, Pharmaceutical Packaging Machinery segment is expected to dominate the market during the forecast period

- Blister packaging machines are one of the most commonly used machines in the pharmaceutical industry. They are mainly used to pack tablets and capsules, which are among the most widely used forms of medicine around the world. These machines create small pockets, or "blisters," made from plastic and seal them with a layer of foil. Each pocket holds a single tablet or capsule, keeping it safe and easy to handle.

- One of the biggest advantages of blister packaging is protection. Medicines are sensitive to moisture, air, and light, which can reduce their effectiveness. Blister packs protect each pill by sealing it tightly, which helps to keep the medicine fresh and safe until it is used.

- Another important benefit is convenience. Blister packs are easy for patients to open and use. Many blister packs also have printed labels or markings to help patients remember when to take their medicine, which is helpful for people who take multiple pills each day.

- Blister packaging is also important for safety and quality control. Each pill is placed in its own sealed pocket, reducing the risk of contamination. If one pill is damaged, it doesn’t affect the rest. This makes blister packs a clean and safe choice for packaging.

- From a manufacturing point of view, blister packaging machines are fast and efficient. They can produce thousands of sealed packs in a short time, helping companies meet high demand.

- Blister packaging is also tamper-evident, which means it's easy to see if someone has tried to open the package. This helps prevent misuse and ensures that the medicine inside has not been altered. Overall, blister packaging machines play a key role in delivering safe, secure, and user-friendly

By Application, Pharmaceutical Packaging Machinery segment held the largest share in 2024

- This market includes machinery used to package different types of medicines such as tablets, capsules, liquid medicines, injectables, and semisolids like creams and gels. Among these, tablets and capsules are the most common types of medicines. Because they are produced in large amounts, they need fast and accurate packaging systems. The machines used must follow strict safety and quality rules to protect the medicines and make sure they are delivered correctly to patients.

- Liquid medicines, like syrups or oral drops, need special machines that can measure the exact dose and make sure the liquid stays stable and uncontaminated. These machines must also handle bottles and other containers carefully to prevent leaks or spills.

- Injectables, such as vaccines or insulin, are especially sensitive. They must be packaged in very clean and sterile conditions to protect patients from infections. The machines used for this type of medicine need to be very advanced to meet high safety standards.

- As the market grows, there are more chronic diseases like diabetes and heart problems, which increase the need for medicines. At the same time, new packaging technologies are helping companies work faster and more efficiently. However, challenges like following complex regulations and using eco-friendly materials also affect the market. In summary, the different medicine types lead to different packaging needs, pushing the market to keep evolving and improving.

Pharmaceutical Packaging Machinery Market Regional Insights:

- In Asia-Pacific, the Pharmaceutical Packaging Machinery Market is experiencing rapid growth, driven by increasing pharmaceutical production and rising demand for advanced packaging solutions. Countries like China, India, Japan, and South Korea are leading the market expansion, benefiting from strong healthcare infrastructure and government support for pharmaceutical manufacturing.

- The region's large population and growing healthcare needs are pushing companies to invest in automation and digitalization to improve efficiency and meet regulatory standards. Additionally, the demand for track-and-trace systems and serialization is increasing due to stricter regulations on drug safety and supply chain transparency. Sustainability is also becoming a key focus, with manufacturers exploring eco-friendly packaging materials to reduce environmental impact. Overall, Asia-Pacific is expected to continue its strong growth trajectory, making it a crucial market for pharmaceutical packaging machinery

Pharmaceutical Packaging Machinery Market Active Players:

- Accutek Packaging Equipment (United States)

- ACG Pampac (India)

- ACIC Machinery (Canada)

- Aesus Packaging Systems (Canada)

- Bausch + Ströbel (Germany)

- Coesia Group (Italy)

- GEA Group (Germany)

- Glatt Group (Germany)

- IMA Group (Italy)

- Ishida Co., Ltd. (Japan)

- Körber Pharma (Germany)

- Marchesini Group (Italy)

- Multivac Group (Germany)

- Nichrome Packaging Solutions (India)

- Optima Packaging Group (Germany)

- PAC Machinery (United States)

- PMR System Group (Italy)

- Premier Tech (Canada)

- ProMach (United States)

- Romaco Group (Germany)

- Sealed Air (United States)

- Serac Group (France)

- Shemesh Automation (Israel)

- Sidel Group (Italy)

- Tetra Pak (Switzerland)

- Uhlmann Group (Germany)

- United Pharmatek (United States)

- Wilco AG (Switzerland)

- Wulftec International (Canada)

- yntegon Technology (Germany)

- other active players

|

Pharmaceutical Packaging Machinery Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 8.89 Billion

|

|

Forecast Period 2025-35 CAGR: |

7.5% |

Market Size in 2035: |

USD 19.70 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Pharmaceutical Packaging Machinery Market by Type (2018-2035)

4.1 Pharmaceutical Packaging Machinery Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Blister Packaging Machines

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Aseptic Packaging Machines

4.5 Labelling Machines

4.6 Filling Machines

4.7 Sealing Machines

Chapter 5: Pharmaceutical Packaging Machinery Market by End User (2018-2035)

5.1 Pharmaceutical Packaging Machinery Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Pharmaceutical Manufacturers

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Contract Packaging Organizations

5.5 Research and Development Laboratories

Chapter 6: Pharmaceutical Packaging Machinery Market by Application (2018-2035)

6.1 Pharmaceutical Packaging Machinery Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Tablets

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Capsules

6.5 Liquid Medicines

6.6 Injectables

6.7 Semisolids

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Pharmaceutical Packaging Machinery Market Share by Manufacturer/Service Provider(2024)

7.1.3 Industry BCG Matrix

7.1.4 PArtnerships, Mergers & Acquisitions

7.2 ACCUTEK PACKAGING EQUIPMENT (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Recent News & Developments

7.2.10 SWOT Analysis

7.3 ACG PAMPAC (INDIA)

7.4 ACIC MACHINERY (CANADA)

7.5 AESUS PACKAGING SYSTEMS (CANADA)

7.6 BAUSCH + STRÖBEL (GERMANY)

7.7 COESIA GROUP (ITALY)

7.8 GEA GROUP (GERMANY)

7.9 GLATT GROUP (GERMANY)

7.10 IMA GROUP (ITALY)

7.11 ISHIDA CO.

7.12 LTD. (JAPAN)

7.13 KÖRBER PHARMA (GERMANY)

7.14 MARCHESINI GROUP (ITALY)

7.15 MULTIVAC GROUP (GERMANY)

7.16 NICHROME PACKAGING SOLUTIONS (INDIA)

7.17 OPTIMA PACKAGING GROUP (GERMANY)

7.18 PAC MACHINERY (UNITED STATES)

7.19 PMR SYSTEM GROUP (ITALY)

7.20 PREMIER TECH (CANADA)

7.21 PROMACH (UNITED STATES)

7.22 ROMACO GROUP (GERMANY)

7.23 SEALED AIR (UNITED STATES)

7.24 SERAC GROUP (FRANCE)

7.25 SHEMESH AUTOMATION (ISRAEL)

7.26 SIDEL GROUP (ITALY)

7.27 TETRA PAK (SWITZERLAND)

7.28 UHLMANN GROUP (GERMANY)

7.29 UNITED PHARMATEK (UNITED STATES)

7.30 WILCO AG (SWITZERLAND)

7.31 WULFTEC INTERNATIONAL (CANADA)

7.32 SYNTEGON TECHNOLOGY (GERMANY)

7.33 AND OTHER ACTIVE PLAYERS

Chapter 8: Global Pharmaceutical Packaging Machinery Market By Region

8.1 Overview

8.2. North America Pharmaceutical Packaging Machinery Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecast Market Size by Country

8.2.4.1 US

8.2.4.2 Canada

8.2.4.3 Mexico

8.3. Eastern Europe Pharmaceutical Packaging Machinery Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecast Market Size by Country

8.3.4.1 Russia

8.3.4.2 Bulgaria

8.3.4.3 The Czech Republic

8.3.4.4 Hungary

8.3.4.5 Poland

8.3.4.6 Romania

8.3.4.7 Rest of Eastern Europe

8.4. Western Europe Pharmaceutical Packaging Machinery Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecast Market Size by Country

8.4.4.1 Germany

8.4.4.2 UK

8.4.4.3 France

8.4.4.4 The Netherlands

8.4.4.5 Italy

8.4.4.6 Spain

8.4.4.7 Rest of Western Europe

8.5. Asia Pacific Pharmaceutical Packaging Machinery Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecast Market Size by Country

8.5.4.1 China

8.5.4.2 India

8.5.4.3 Japan

8.5.4.4 South Korea

8.5.4.5 Malaysia

8.5.4.6 Thailand

8.5.4.7 Vietnam

8.5.4.8 The Philippines

8.5.4.9 Australia

8.5.4.10 New Zealand

8.5.4.11 Rest of APAC

8.6. Middle East & Africa Pharmaceutical Packaging Machinery Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecast Market Size by Country

8.6.4.1 Turkiye

8.6.4.2 Bahrain

8.6.4.3 Kuwait

8.6.4.4 Saudi Arabia

8.6.4.5 Qatar

8.6.4.6 UAE

8.6.4.7 Israel

8.6.4.8 South Africa

8.7. South America Pharmaceutical Packaging Machinery Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecast Market Size by Country

8.7.4.1 Brazil

8.7.4.2 Argentina

8.7.4.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

Chapter 10 Our Thematic Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Chapter 11 Case Study

Chapter 12 Appendix

12.1 Sources

12.2 List of Tables and figures

12.3 Short Forms and Citations

12.4 Assumption and Conversion

12.5 Disclaimer

|

Pharmaceutical Packaging Machinery Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 8.89 Billion

|

|

Forecast Period 2025-35 CAGR: |

7.5% |

Market Size in 2035: |

USD 19.70 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||