Palletizer Market Overview

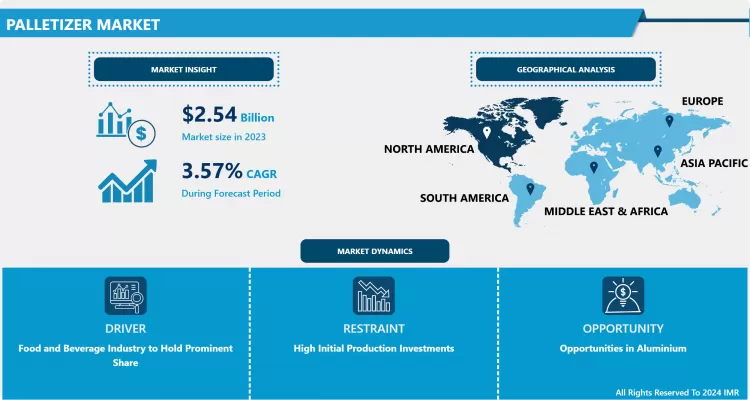

Global Palletizer Market was valued at USD 2.54 Billion in 2023 and is expected to reach USD 3.48 Billion by the year 2032, at a CAGR of 3.57%.

Pallets have been utilized since the early 1920s. Earlier, manufacturers packed goods in barrels, crates, boxes, and others. Before palletizers, workers stacked cases and other packages by hand. This worked for countless years, but with industrialization and World War II, production rates raised, and eventually, workers simply couldn't keep up. In addition, pallets were too large to move safely by hand. To solve this, Lamson Corp (now ARPAC) developed and built the first mobilized palletizer in 1948.

Palletizers referred to as case pickers, are machines specifically developed to load and unload pallets before and after shipping and during storage. Palletizers are technically Mast-Equipped Automated Vehicles (AVGs). Manual palletizers also remain, but more often than not, supply and production plants use automated and robotic palletizers for loading and unloading, not manual ones. Palletizers are utilized to repeatedly lift, rotate and wrench wood pallets and plastic pallets on their own. Nevertheless, of the type palletizers can operate an extensive variety of tasks, ranging from metering products to placing the incoming load, to put loads in rows and layers, to transporting them forward or onto pallet racks. Furthermore, palletizers are utilized widely in mass shipping centers, supply chain lines, distribution centers, and warehouses of all kinds. They are also used in greenhouses to place flats. Owing to their universal significance in material handle applications, palletizers can be used in any industry that uses pallets of goods, such as agriculture, food, and beverage, consumer products, packaging, aerospace, military and defense, marine shipping, automotive is helps to growth of the palletizer market over the forecast period. Global Palletizer Market was valued at USD 2.54 Billion in 2023 and is expected to reach USD 3.48 Billion by the year 2032, at a CAGR of 3.57%.

Market Dynamics And Factors For The Palletizer Market

Drivers:

Food and Beverage Industry to Hold Prominent Share

The massive demand for palletizers from the food and beverage industry is the key industry to improving the market revenue. The retailer competition continues in the market and the government regulation is becoming stricter with passing time so the requirements of automation and palletizing robots are also rising significantly. Moreover, in current times people are very much aware regarding eco-friendly packaging so it is also improving the opportunity of automatic machinery. In the view of all the trends and innovations that are taking place globally related to the food processing industry with the execution of selective compliance assembly robot arm (SCARA) as well as in the manufacturing industry, contributing to the decline in energy costs, it can be concluded that it is braced for developments in the packaging machinery as well as palletizer sector shortly. Moreover, with the outbreak of the COVID-19 crisis, different production facilities in the FMCG sector have been observing increased pressure for speeding up production. Therefore, the market is probably to increase during the forecast period.

Restraints:

High Initial Production Investments

The initial capital investment required for R&D and production processes is primarily hampering the market growth. Manufacturers are expected to make significant expenditures in the development of technologically advanced palletizer machinery. It also constrains regular maintenance for optimum functioning, resulting in substantial after-sale costs for the producers. Small and medium-sized businesses find it difficult to factor in unnecessary maintenance costs. As a result, the market expansion is hampered.

Opportunities:

Opportunities in Aluminum

According to the research study, E-Commerce is not the only expansion opportunity for palletizers and depalletizers. As per TopTier's Snelson, the company has been facing demand from companies that are shifting their products from glass bottles to aluminum cans as well as companies that are launching new products in cans. Even though beer in cans is nothing new, more craft beers and wines are shifting into cans, according to Nielsen, New York. Canned craft beer sales have nearly doubled in dollar sales in recent years.

The expansion in this packaging category has even brought new entrants to the palletizing and depalletizing industry. Ska Fabricating launched in 2012 in Durango, Colo., with a focus to become a world leader in small-footprint depalletizes.

Market Segmentation

Segmentation Analysis of Palletizer Market:

Based on the Technology, robotic palletizers are expected to dominate the market during the forecast period. Robotic palletizers have many qualities that raise them above manual palletizers, such as load stability, operation speed precision, and fewer related worker injuries. They make replacing packaged units much easier, safer, and less labor-intensive. In addition, they make it possible to move more loads at once. Furthermore, the purchase of a palletizer is a large initial investment, its many significances compensate for the cost many times over which leads to growth of the segment.

Based on the Application, the Food & Beverages segment is anticipated to hold the maximum market share during the forecast period. The food and beverage industry has always been a major contributor to improving the market revenue of palletizers. Among all of the machinery products in packaging, a palletizer is the most opted and significant for packaging food and beverage items owing to its cheap cost, small footprint, and high throughput rate. Moreover, palletizing systems are beneficial elements at the end of a packaging line, a vital task for every industry, such as chemical, pharmaceutical, personal care, and cosmetics.

Regional Analysis of Palletizer Market:

North America region is expected to dominate the market during the forecast period. The United States has been observing demand for automation and robots, such as robotic palletizers in industrial settings. The country has seen a few products introduced due to this. The United States is one of the highest and most emerged markets for adopting the latest and innovative palletizing solutions. The healthy economy, with notable port traffic, raised e-commerce activity, and major manufacturing indices, results in significant growth in manufacturing and is impassive to turn the demand for palletizing solutions in the country. Furthermore, North America has strong economic development and the presence of major key players such as A-B-C Packaging Machine Corporation, BW Packaging Systems, KHS Group, Krones AG, and others. This is accelerating regional market growth.

The Asia Pacific is expected to hold a significant market share palletizers market over the forecast period due to the adoption of robotic palletizing machines in the manufacturing sectors. Moreover, leading players of the market are setting up their producers' plants across India, China, and some south-east Asian countries where the cost of production is low.

In the European region, Germany is leading the market as they adopted automation technologies in manufacturing facilities to enhance productivity. This initiative focuses to offer funding and resources towards building developed and smart factory. A massive proportion of German production is sold globally to more than 100 countries. Thus, it is expected to continue the growth of the market in the region during the projected period.

Players Covered in Palletizer Market are:

- Mollers North America

- JR Automation

- Applied Manufacturing Technologies

- American Newlong Inc.

- Chantland MHS

- TopTiers Palletizers

- Eriez

- Bastian Solutions

- Brillopak Ltd.

- Columbia Machine Inc.

- Dematic Corporation

- Guangzhou Tech-Long Packaging Machinery Co. Ltd.

- Intelligrated Inc.

- Murata Machinery Ltd.

- Premier Tech Chronos

- Statec Binder GmbH

- TMG Impianti S.p.A

- Kawasaki Heavy Industries Ltd.

- KUKA AG

- A-B-C Packaging Machine Corporation

- ABB

- BW Packaging Systems

- KHS Group

- BEUMER GROUP

- Krones AG

- Fuji Yusoki Kogyo Co.Ltd.and Others major players.

Key Industry Developments In Palletizer Market

- In September 2021, At PACK EXPO 2021 in Las Vegas, MHS, a single-source supplier of material handling automation and software, exhibit a robotic palletizing solution designed in collaboration with Mujin, a specialist in developed motion planning for industrial robot arms. The palletizer, tailored for a U.S.-based packaging producer, is displayed at the Mujin booth #SU7233 in the South Upper Hall of the Las Vegas Convention Center.

- In October 2020 - Robotiq Inc. launched the latest robotic palletizing solution, especially for lower throughput applications requiring frequent task and box or pallet size changes. This application-concentrated technology consists of fully connected, plug-and-play software and hardware with pre-selected functions.

- In November 2019, EndFlex's launched its latest Z.ZAG Palletizer. EndFlex's new Z.ZAG Palletizer automatically uses vacuum generators to lift cases one at a time and place them on a pallet from above. Its suction capacity is enabled to lift 40-pound boxes at speeds up to 360 boxes per hour.

|

Palletizer Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.54 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.57% |

Market Size in 2032: |

USD 2.99 Bn. |

|

Segments Covered: |

By Technology |

|

|

|

By Equipment Components |

|

||

|

By Product |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Palletizer Market by Technology (2018-2032)

4.1 Palletizer Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Robotic Palletizers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Low Level Palletizer

4.5 High-Level Palletizers

Chapter 5: Palletizer Market by Equipment Components (2018-2032)

5.1 Palletizer Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Pallet Dispenser

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Pallet Station

5.5 Infeed

5.6 Row-Former

5.7 Layer Forming Area

5.8 Others

Chapter 6: Palletizer Market by Product (2018-2032)

6.1 Palletizer Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Boxes & Cases

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Bundles

6.5 Bags & Sacks

6.6 Others

Chapter 7: Palletizer Market by Application (2018-2032)

7.1 Palletizer Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Food & Beverages

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Pharmaceuticals

7.5 Personal Care & Cosmetics

7.6 Chemicals

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Palletizer Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 SMARTBOX ECOMMERCE SOLUTIONS PVT. LTD. (INDIA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 TZ LIMITED (AUSTRALIA)

8.4 CLEVERBOX CO. (U.K.)

8.5 QUADIENT (FRANCE)

8.6 ABELL INTERNATIONAL PTE. LTD. (SINGAPORE)

8.7 CLEVERON (ESTONIA)

8.8 PACKAGE NEXUS (U.S.)

8.9 DEBOURGH MANUFACTURING CO. (U.S.)

8.10 MOBIIKEY TECHNOLOGIES PVT. LTD. (INDIA)

8.11 KEBA AG (AUSTRIA) OTHERS MAJOR PLAYERS.

Chapter 9: Global Palletizer Market By Region

9.1 Overview

9.2. North America Palletizer Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Technology

9.2.4.1 Robotic Palletizers

9.2.4.2 Low Level Palletizer

9.2.4.3 High-Level Palletizers

9.2.5 Historic and Forecasted Market Size by Equipment Components

9.2.5.1 Pallet Dispenser

9.2.5.2 Pallet Station

9.2.5.3 Infeed

9.2.5.4 Row-Former

9.2.5.5 Layer Forming Area

9.2.5.6 Others

9.2.6 Historic and Forecasted Market Size by Product

9.2.6.1 Boxes & Cases

9.2.6.2 Bundles

9.2.6.3 Bags & Sacks

9.2.6.4 Others

9.2.7 Historic and Forecasted Market Size by Application

9.2.7.1 Food & Beverages

9.2.7.2 Pharmaceuticals

9.2.7.3 Personal Care & Cosmetics

9.2.7.4 Chemicals

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Palletizer Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Technology

9.3.4.1 Robotic Palletizers

9.3.4.2 Low Level Palletizer

9.3.4.3 High-Level Palletizers

9.3.5 Historic and Forecasted Market Size by Equipment Components

9.3.5.1 Pallet Dispenser

9.3.5.2 Pallet Station

9.3.5.3 Infeed

9.3.5.4 Row-Former

9.3.5.5 Layer Forming Area

9.3.5.6 Others

9.3.6 Historic and Forecasted Market Size by Product

9.3.6.1 Boxes & Cases

9.3.6.2 Bundles

9.3.6.3 Bags & Sacks

9.3.6.4 Others

9.3.7 Historic and Forecasted Market Size by Application

9.3.7.1 Food & Beverages

9.3.7.2 Pharmaceuticals

9.3.7.3 Personal Care & Cosmetics

9.3.7.4 Chemicals

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Palletizer Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Technology

9.4.4.1 Robotic Palletizers

9.4.4.2 Low Level Palletizer

9.4.4.3 High-Level Palletizers

9.4.5 Historic and Forecasted Market Size by Equipment Components

9.4.5.1 Pallet Dispenser

9.4.5.2 Pallet Station

9.4.5.3 Infeed

9.4.5.4 Row-Former

9.4.5.5 Layer Forming Area

9.4.5.6 Others

9.4.6 Historic and Forecasted Market Size by Product

9.4.6.1 Boxes & Cases

9.4.6.2 Bundles

9.4.6.3 Bags & Sacks

9.4.6.4 Others

9.4.7 Historic and Forecasted Market Size by Application

9.4.7.1 Food & Beverages

9.4.7.2 Pharmaceuticals

9.4.7.3 Personal Care & Cosmetics

9.4.7.4 Chemicals

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Palletizer Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Technology

9.5.4.1 Robotic Palletizers

9.5.4.2 Low Level Palletizer

9.5.4.3 High-Level Palletizers

9.5.5 Historic and Forecasted Market Size by Equipment Components

9.5.5.1 Pallet Dispenser

9.5.5.2 Pallet Station

9.5.5.3 Infeed

9.5.5.4 Row-Former

9.5.5.5 Layer Forming Area

9.5.5.6 Others

9.5.6 Historic and Forecasted Market Size by Product

9.5.6.1 Boxes & Cases

9.5.6.2 Bundles

9.5.6.3 Bags & Sacks

9.5.6.4 Others

9.5.7 Historic and Forecasted Market Size by Application

9.5.7.1 Food & Beverages

9.5.7.2 Pharmaceuticals

9.5.7.3 Personal Care & Cosmetics

9.5.7.4 Chemicals

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Palletizer Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Technology

9.6.4.1 Robotic Palletizers

9.6.4.2 Low Level Palletizer

9.6.4.3 High-Level Palletizers

9.6.5 Historic and Forecasted Market Size by Equipment Components

9.6.5.1 Pallet Dispenser

9.6.5.2 Pallet Station

9.6.5.3 Infeed

9.6.5.4 Row-Former

9.6.5.5 Layer Forming Area

9.6.5.6 Others

9.6.6 Historic and Forecasted Market Size by Product

9.6.6.1 Boxes & Cases

9.6.6.2 Bundles

9.6.6.3 Bags & Sacks

9.6.6.4 Others

9.6.7 Historic and Forecasted Market Size by Application

9.6.7.1 Food & Beverages

9.6.7.2 Pharmaceuticals

9.6.7.3 Personal Care & Cosmetics

9.6.7.4 Chemicals

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Palletizer Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Technology

9.7.4.1 Robotic Palletizers

9.7.4.2 Low Level Palletizer

9.7.4.3 High-Level Palletizers

9.7.5 Historic and Forecasted Market Size by Equipment Components

9.7.5.1 Pallet Dispenser

9.7.5.2 Pallet Station

9.7.5.3 Infeed

9.7.5.4 Row-Former

9.7.5.5 Layer Forming Area

9.7.5.6 Others

9.7.6 Historic and Forecasted Market Size by Product

9.7.6.1 Boxes & Cases

9.7.6.2 Bundles

9.7.6.3 Bags & Sacks

9.7.6.4 Others

9.7.7 Historic and Forecasted Market Size by Application

9.7.7.1 Food & Beverages

9.7.7.2 Pharmaceuticals

9.7.7.3 Personal Care & Cosmetics

9.7.7.4 Chemicals

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Palletizer Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.54 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.57% |

Market Size in 2032: |

USD 2.99 Bn. |

|

Segments Covered: |

By Technology |

|

|

|

By Equipment Components |

|

||

|

By Product |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Palletizer Market research report is 2024-2032.

Mollers North America, JR Automation, Applied Manufacturing Technologies, American Newlong Inc., Chantland MHS, TopTiers Palletizers, Eriez, Bastian Solutions, Brillopak Ltd., Columbia Machine Inc., Dematic Corporation, Guangzhou Tech-Long Packaging Machinery Co. Ltd., Intelligrated Inc., Murata Machinery Ltd., Premier Tech Chronos, Statec Binder GmbH, TMG Impianti S.p.A, Kawasaki Heavy Industries Ltd., KUKA AG,A-B-C Packaging Machine Corporation, ABB,BW Packaging Systems, KHS Group, BEUMER GROUP, Krones AG, Fuji Yusoki Kogyo Co.Ltd.and Other Major Players.

Palletizer Market is segmented into Technology, Equipment Components, Product, Application and region. By Technology, the market is categorized into Robotic Palletizers, Low-Level Palletizer, and High-Level Palletizers. By Equipment Components, the market is categorized into Pallet Dispenser, Pallet Station, Infeed, Row-Former, Layer Forming Area, Others. By Product the market is categorized into Boxes & Cases, Bundles, Bags & Sacks, Others. By Application, the market is categorized into Food & Beverages, Pharmaceuticals, Personal Care & Cosmetics, and Chemicals. By region, it is analysed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Pallets have been utilized since the early 1920s. Earlier, manufacturers packed goods in barrels, crates, boxes, and others. Before palletizers, workers stacked cases and other packages by hand

Global Palletizer Market was valued at USD 2.54 Billion in 2023 and is expected to reach USD 3.48 Billion by the year 2032, at a CAGR of 3.57%.