Ovulation Test Kit Market Synopsis:

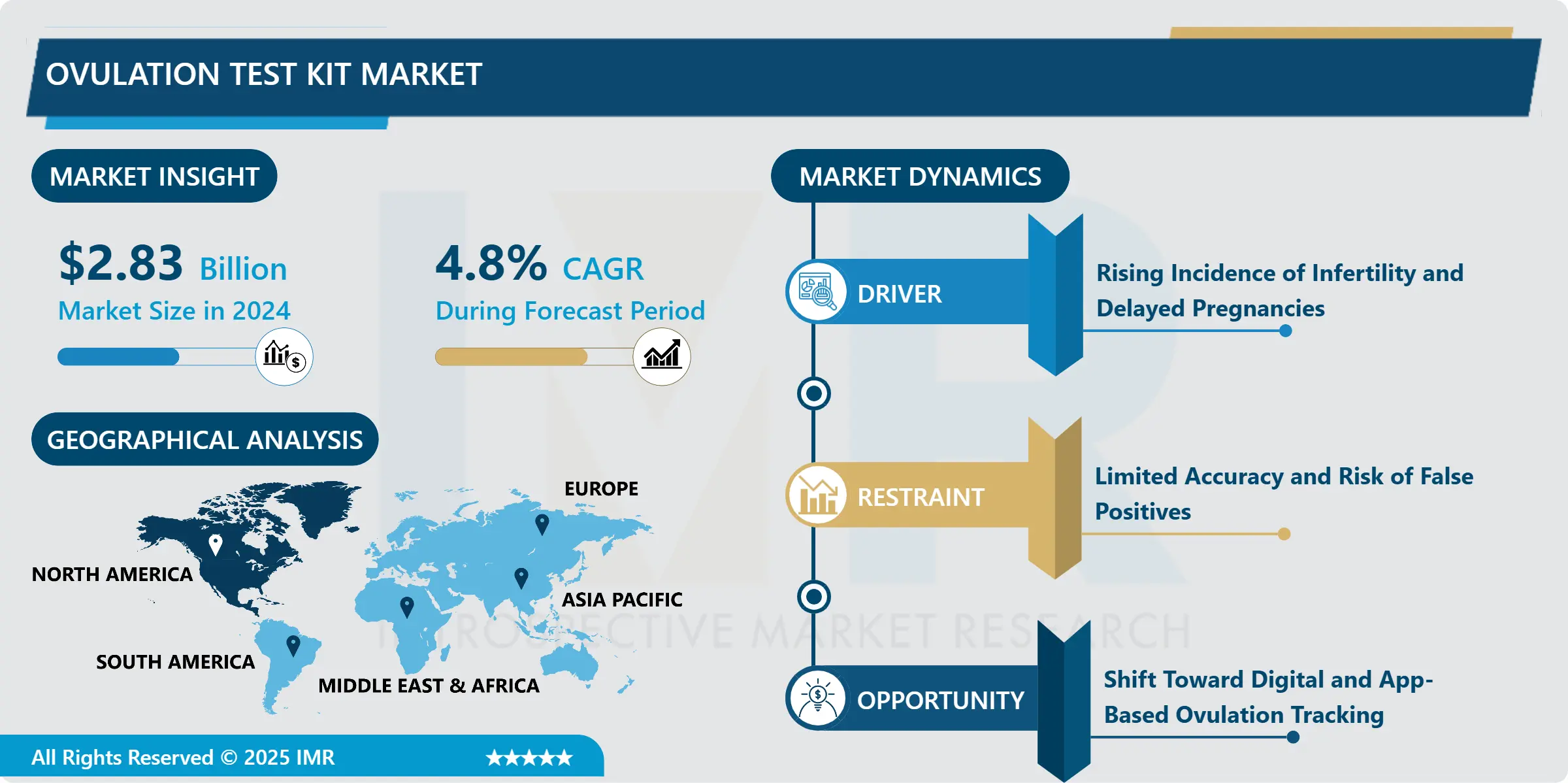

Ovulation Test Kit Market Size Was Valued at USD 2.83 Billion in 2024, and is Projected to Reach USD 4.74 Billion by 2035, Growing at a CAGR of 4.8% From 2025-2035.

The ovulation test kit market refers to the industry focused on the development, production, and distribution of diagnostic tools used to detect a woman’s most fertile days by identifying the surge in luteinizing hormone (LH) or changes in saliva composition, indicating impending ovulation. These kits help individuals and couples track fertility cycles for conception or natural family planning.

The growing awareness about fertility and the increasing prevalence of infertility issues are major drivers boosting the demand for ovulation test kits globally. With a rise in women planning pregnancies later in life and the growing acceptance of home-based diagnostic tools, the market has seen considerable growth over recent years. Urine-based and saliva-based kits continue to be popular due to their accuracy, ease of use, and affordability.

Technological advancements have led to the emergence of digital ovulation test kits that provide more precise and user-friendly results. In addition, the increasing availability of these products through online platforms and pharmacies is further expanding consumer access.

Geographically, North America holds a significant market share due to high healthcare awareness, while Asia Pacific is expected to witness rapid growth due to rising fertility concerns and increasing healthcare expenditure. Overall, the market is expected to grow steadily, driven by innovations and growing demand for reproductive health monitoring solutions.

Ovulation Test Kit Market Trend Analysis:

Rising Incidence of Infertility and Delayed Pregnancies

-

The increasing global incidence of infertility among both men and women is a major driver fueling demand for ovulation test kits. According to WHO, infertility affects around 17.5% of the adult population, making fertility monitoring tools a necessity for couples trying to conceive. Furthermore, lifestyle factors such as stress, obesity, and changing dietary habits have contributed to declining reproductive health, leading to a higher demand for tools that aid in ovulation tracking and family planning.

- Additionally, societal and economic shifts have led to delayed pregnancies, especially in urban areas, where many women choose to focus on careers and education before starting families. As fertility tends to decline with age, there is an increasing reliance on diagnostic solutions like ovulation test kits to optimize conception chances. This behavioral shift is positively impacting the market growth, particularly among women aged 30–40.

Shift Toward Digital and App-Based Ovulation Tracking

-

One prominent trend in the ovulation test kit market is the transition from traditional testing methods to digital and app-integrated solutions. These digital kits offer greater accuracy, clarity of results, and ease of tracking ovulation cycles over time. They often come with Bluetooth connectivity and smartphone applications that store data, send reminders, and offer fertility insights, which appeals to tech-savvy consumers.

- Moreover, app-based ovulation trackers are gaining popularity among women seeking non-invasive, real-time monitoring options. These apps often integrate data from wearable health devices, enabling a holistic view of a user’s menstrual health. As digital health solutions become more widespread, this trend is expected to further transform the ovulation test kit market by enhancing user engagement and expanding market reach.

Ovulation Test Kit Market Segment Analysis:

Ovulation Test Kit Market Segmented based on Product Type, Form, End User, Distribution Channel, and Region.

By Product Type, the Urine-based Ovulation Test Kits segment is expected to dominate the market during the forecast period

-

Urine-based ovulation test kits dominate the ovulation test kit market and hold the largest market share. This dominance is primarily due to their higher accuracy in detecting the surge in luteinizing hormone (LH), which is a reliable indicator of ovulation. These kits are widely recommended by healthcare professionals and are preferred by consumers for their simplicity, quick results, and affordability. Moreover, they are easily available across pharmacies, supermarkets, and online platforms, making them more accessible to the general public.

- Urine-based kits have a longer track record of clinical validation and consumer trust compared to saliva-based alternatives. While saliva-based kits offer a reusable option, they often require more interpretation and are perceived as less accurate. Continuous product innovation in urine-based kits, including the introduction of digital formats with clearer results, has further reinforced their market dominance. As a result, urine-based ovulation test kits remain the first choice for most women tracking their fertility cycles.

By Form, the Strip-based Ovulation Test Kits segment is expected to hold the largest share

-

Strip-based ovulation test kits currently dominate the market in the "Form" segment. Their popularity stems from being the most cost-effective and widely available option, making them highly accessible to a broad consumer base, especially in developing regions. These kits are simple to use, disposable, and provide quick results, which makes them suitable for regular, at-home fertility monitoring. Their affordability also allows users to test frequently without a significant financial burden, making them a preferred choice among price-sensitive consumers.

- Moreover, strip-based kits are commonly sold through both online and offline retail channels, boosting their market penetration. Although cassette and digital devices offer benefits such as enhanced hygiene or digital result displays, they are generally priced higher and cater to niche segments. As a result, strip-based kits continue to lead due to their practicality, reliability, and ease of use, particularly among first-time users and in low- to middle-income markets.

Ovulation Test Kit Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America dominates the global ovulation test kit market, with the United States being the major contributor to this leadership. The region’s dominance is driven by high awareness of reproductive health, widespread availability of home diagnostic tools, and greater healthcare spending per capita. Women in North America are more likely to use fertility tracking tools, especially given the growing trend of family planning and delayed pregnancies. In addition, the region has a robust retail and e-commerce infrastructure, enabling easy access to both over-the-counter and online fertility products.

- Another key factor supporting North America’s lead is the strong presence of major market players and continuous product innovation. Companies in the region invest heavily in R&D to introduce advanced digital ovulation test kits with smartphone connectivity and higher accuracy. Moreover, favorable reimbursement policies for fertility treatments and increased adoption of home healthcare devices further contribute to the region’s market dominance.

- The growing prevalence of infertility, coupled with proactive health management behavior, continues to make North America the most lucrative market for ovulation test kits. With ongoing consumer education campaigns and technological integration, the region is expected to maintain its leading position in the coming years.

Active Key Players in the Ovulation Test Kit Market:

- AccuMed Medical Devices Co., Ltd. (China)

- ACON Laboratories, Inc. (USA)

- Aide Health Care Pvt. Ltd. (India)

- BioniCare Medical Technologies, Inc. (USA)

- Clearblue (USA/Switzerland)

- Diao Medical Co., Ltd. (China)

- Eva Women’s Health (USA)

- FertilAid (USA)

- First Response (USA)

- Flowflex (USA)

- Guangzhou Wondfo Biotech Co., Ltd. (China)

- i-Health, Inc. (USA)

- Ivita Biotech (China)

- Lepu Medical Technology (China)

- LifeSign (USA)

- Medline Industries, Inc. (USA)

- Microlife Corporation (Switzerland)

- Mylab Discovery Solutions Pvt Ltd (India)

- Mylan N.V. (USA)

- Onestep Medical Co., Ltd. (China)

- Prega News (India)

- Roche Diagnostics (Switzerland)

- SPD Swiss Precision Diagnostics GmbH (Switzerland)

- Wondfo Biotech Co., Ltd. (China), and Other Active Players.

Key Industry Developments in the Ovulation Test Kit Market:

- In June 2024, Wisp expanded into the fertility market by launching at-home fertility tests and insemination kits through partnerships with Proov and PherDal. This move aimed to offer affordable, accessible pre-IVF solutions and support women struggling to conceive via telehealth services and quick medication delivery.

- In August 2023, Clearblue®, a leader in home fertility products, expanded its portfolio with the launch of the Menopause Stage Indicator, building on its strong presence in the ovulation test kits market. Known for accurate and easy-to-use ovulation tests, Clearblue leveraged its expertise to enter the menopause category, offering women tools to better understand their reproductive stages. This move reinforced Clearblue’s commitment to supporting women throughout their reproductive health journey.

|

Global Ovulation Test Kit Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.83 Billion |

|

Forecast Period 2025-35 CAGR: |

4.8% |

Market Size in 2035: |

USD 4.74 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Form |

|

||

|

By End User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Ovulation Test Kit Market by Device Type

4.1 Ovulation Test Kit Market Snapshot and Growth Engine

4.2 Ovulation Test Kit Market Overview

4.3 Line Indicator Devices

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2018-2035F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Line Indicator Devices: Geographic Segmentation Analysis

4.4 Digital Devices

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2018-2035F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Digital Devices: Geographic Segmentation Analysis

4.5 Microscopic Devices

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2018-2035F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Microscopic Devices: Geographic Segmentation Analysis

Chapter 5: Ovulation Test Kit Market by Sample Type

5.1 Ovulation Test Kit Market Snapshot and Growth Engine

5.2 Ovulation Test Kit Market Overview

5.3 Urine

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2018-2035F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Urine: Geographic Segmentation Analysis

5.4 Blood

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2018-2035F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Blood: Geographic Segmentation Analysis

5.5 Saliva

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2018-2035F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Saliva: Geographic Segmentation Analysis

Chapter 6: Ovulation Test Kit Market by End-User

6.1 Ovulation Test Kit Market Snapshot and Growth Engine

6.2 Ovulation Test Kit Market Overview

6.3 Hospitals & Clinics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2018-2035F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospitals & Clinics: Geographic Segmentation Analysis

6.4 Fertility Centers

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2018-2035F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Fertility Centers: Geographic Segmentation Analysis

6.5 Others

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2018-2035F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Ovulation Test Kit Market Share by Manufacturer (2025)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 SWISS PRECISION DIAGNOSTICS (SWITZERLAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 PROCTER & GAMBLE (USA)

7.4 CHURCH & DWIGHT CO. INC. (USA)

7.5 FAIRHAVEN HEALTH (USA)

7.6 PIRAMAL ENTERPRISES LTD. (INDIA)

7.7 ACCUQUIK (USA)

7.8 GERATHERM MEDICAL AG (GERMANY)

7.9 MANKIND PHARMA (INDIA)

7.10 SUGENTECH INC. (SOUTH KOREA)

7.11 IXENSOR CO. LTD. (TAIWAN)

7.12 HILIN LIFE PRODUCTS INC. (USA)

7.13 BIOMERIEUX SA (FRANCE)

7.14 OTHER ACTIVE PLAYERS

Chapter 8: Global Ovulation Test Kit Market By Region

8.1 Overview

8.2. North America Ovulation Test Kit Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Device Type

8.2.4.1 Line Indicator Devices

8.2.4.2 Digital Devices

8.2.4.3 Microscopic Devices

8.2.5 Historic and Forecasted Market Size By Sample Type

8.2.5.1 Urine

8.2.5.2 Blood

8.2.5.3 Saliva

8.2.6 Historic and Forecasted Market Size By End-User

8.2.6.1 Hospitals & Clinics

8.2.6.2 Fertility Centers

8.2.6.3 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Ovulation Test Kit Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Device Type

8.3.4.1 Line Indicator Devices

8.3.4.2 Digital Devices

8.3.4.3 Microscopic Devices

8.3.5 Historic and Forecasted Market Size By Sample Type

8.3.5.1 Urine

8.3.5.2 Blood

8.3.5.3 Saliva

8.3.6 Historic and Forecasted Market Size By End-User

8.3.6.1 Hospitals & Clinics

8.3.6.2 Fertility Centers

8.3.6.3 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Ovulation Test Kit Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Device Type

8.4.4.1 Line Indicator Devices

8.4.4.2 Digital Devices

8.4.4.3 Microscopic Devices

8.4.5 Historic and Forecasted Market Size By Sample Type

8.4.5.1 Urine

8.4.5.2 Blood

8.4.5.3 Saliva

8.4.6 Historic and Forecasted Market Size By End-User

8.4.6.1 Hospitals & Clinics

8.4.6.2 Fertility Centers

8.4.6.3 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Ovulation Test Kit Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Device Type

8.5.4.1 Line Indicator Devices

8.5.4.2 Digital Devices

8.5.4.3 Microscopic Devices

8.5.5 Historic and Forecasted Market Size By Sample Type

8.5.5.1 Urine

8.5.5.2 Blood

8.5.5.3 Saliva

8.5.6 Historic and Forecasted Market Size By End-User

8.5.6.1 Hospitals & Clinics

8.5.6.2 Fertility Centers

8.5.6.3 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Ovulation Test Kit Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Device Type

8.6.4.1 Line Indicator Devices

8.6.4.2 Digital Devices

8.6.4.3 Microscopic Devices

8.6.5 Historic and Forecasted Market Size By Sample Type

8.6.5.1 Urine

8.6.5.2 Blood

8.6.5.3 Saliva

8.6.6 Historic and Forecasted Market Size By End-User

8.6.6.1 Hospitals & Clinics

8.6.6.2 Fertility Centers

8.6.6.3 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Ovulation Test Kit Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Device Type

8.7.4.1 Line Indicator Devices

8.7.4.2 Digital Devices

8.7.4.3 Microscopic Devices

8.7.5 Historic and Forecasted Market Size By Sample Type

8.7.5.1 Urine

8.7.5.2 Blood

8.7.5.3 Saliva

8.7.6 Historic and Forecasted Market Size By End-User

8.7.6.1 Hospitals & Clinics

8.7.6.2 Fertility Centers

8.7.6.3 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Ovulation Test Kit Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.83 Billion |

|

Forecast Period 2025-35 CAGR: |

4.8% |

Market Size in 2035: |

USD 4.74 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Form |

|

||

|

By End User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||