Key Market Highlights

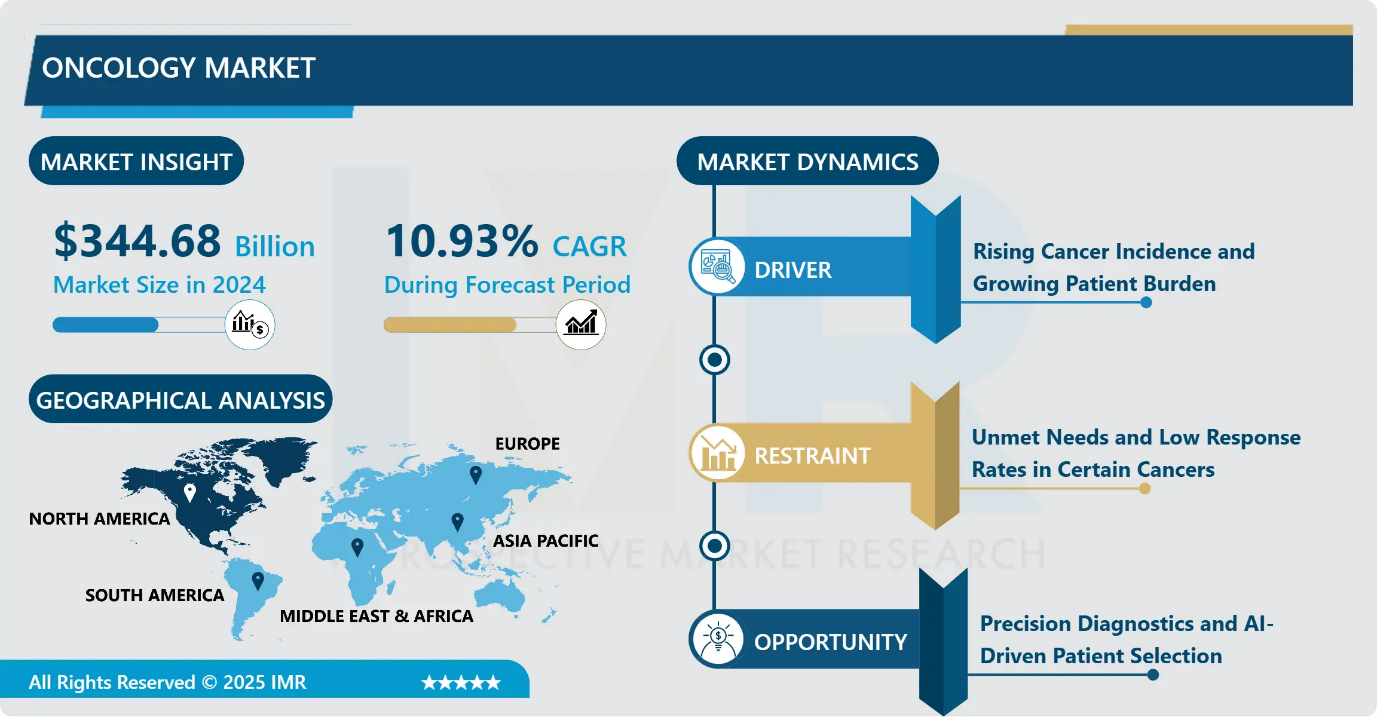

Oncology Market Size Was Valued at USD 344.68 Billion in 2024, and is Projected to Reach USD 978.24 Billion by 2035, Growing at a CAGR of 10.93% from 2025-2035.

- Market Size in 2024: USD 344.68 Billion

- Projected Market Size by 2035: USD 978.24 Billion

- CAGR (2025–2035): 10.93%

- Leading Market in 2024: North America

- Fastest-Growing Market: Asia-Pacific

- By Cancer Diagnostics: The Imaging segment is anticipated to lead the market by accounting for 27.34% of the market share throughout the forecast period.

- By Cancer Treatment: The Chemotherapy segment is expected to capture 25.76% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: North America region is projected to hold 30.71% of the market share during the forecast period.

- Active Players: AbbVie (USA), Amgen (USA), AstraZeneca (UK), Bristol-Myers Squibb Company (USA), Eli Lilly and Company (USA), GE HealthCare Technologies (USA), Gilead Sciences (USA), Johnson & Johnson (USA), Merck & Co (USA), Novartis (Switzerland), Pfizer (USA), and Other Active Players

Oncology Market Synopsis:

-

Oncology is the branch of medicine focused on the study, diagnosis, treatment, and prevention of cancer, which involves abnormal cells growing uncontrollably. It covers various aspects like screening, research, surgery, chemotherapy, radiation, immunotherapy, and managing patient well-being through supportive and palliative care, with specialists called oncologists

- The Oncology market remains the fastest-expanding segment in global pharmaceuticals, driven by the rising global cancer burden and breakthrough therapeutic innovation across precision medicine and cell-and-gene therapies

Oncology Market Dynamics and Trend Analysis:

Oncology Market Growth Driver - Rising Cancer Incidence and Growing Patient Burden

-

The continuous rise in global cancer cases remains the primary factor accelerating market growth. In India alone, more than 1.6 million new cancer diagnoses and around 870,000 deaths were reported in 2024, reflecting a 6.8% annual increase in incidence. As healthcare access improves and diagnostic capabilities expand, more patients are being identified earlier, creating higher demand for oncology drugs, diagnostic services, and hospital infrastructure.

- Additionally, demographic shifts particularly increasing life expectancy are contributing to a greater prevalence of age-related cancers. This trend is driving significant investment across pharmaceutical R&D, hospital expansion, and technology adoption within the oncology ecosystem.

Oncology Market Limiting Factor - Unmet Needs and Low Response Rates in Certain Cancers

-

Although oncology has seen remarkable scientific progress, several cancers still have limited treatment success. Tumours such as pancreatic cancer and glioblastoma continue to show poor survival outcomes, and many immunotherapies including PD-(L)1 inhibitors demonstrate response rates below 50% in solid tumours.

- Furthermore, the high cost and complexity of research, combined with high clinical trial failure rates, restrict commercial potential for many therapies. These limitations highlight the need for continued innovation and reinforce the importance of targeting underserved disease segments.

Oncology Market Expansion Opportunity - Precision Diagnostics and AI-Driven Patient Selection

-

Precision diagnostics present a major commercial opportunity by improving patient selection and enhancing treatment success rates. Over 90% of current oncology clinical trials target molecular pathways, making biomarker testing critical for therapy adoption and reimbursement.

- Investments in next-generation sequencing (NGS), companion diagnostics, and AI-based predictive tools are expected to accelerate patient identification, optimize clinical outcomes, and support the growth of high-value therapies. Companies that integrate advanced diagnostics into care pathways stand to benefit significantly.

Oncology Market Challenge and Risk - Intense Competition and Pipeline Crowding

-

Oncology is the most competitive therapeutic category, with nearly 80% of emerging drug candidates targeting areas already served by approved therapies or multiple assets under development.

- Companies must demonstrate clear clinical superiority or pursue high-risk research targeting new biological mechanisms to differentiate products. This competitive environment raises development risk while placing significant pressure on innovation speed and trial design.

Oncology Market Trend - Growing Dominance of Immunotherapies & Cell/Gene Therapies

-

The global market is shifting rapidly away from conventional chemotherapy toward immunotherapies and CGT approaches. More than 550 cell and gene therapy candidates are currently in clinical development, including multiple CAR-T programs.

- These highly targeted treatments harness the immune system to fight cancer and are supported by accelerated regulatory approvals and strong R&D investment. This transformation is expected to reshape long-term treatment standards and market leadership.

Oncology Market Segment Analysis:

Oncology Market is segmented based on Treatment Type, Cancer Type, Diagnosis Type, End-Users, and Region

By Cancer Diagnosis Type, Imaging segment is expected to dominate the market with around 27.34% share during the forecast period.

-

Imaging techniques such as CT scans, MRI, PET scans, and ultrasound are widely used as the first step to detect and locate tumors. They are preferred because they are non-invasive, quick, easily available in hospitals, and help doctors understand the size, stage, and spread of cancer.

- Imaging is also essential for treatment planning and monitoring response during chemotherapy or radiation. Due to its broad applications and frequent use across all cancer types, imaging holds the largest market share in cancer diagnostics.

By Cancer treatment type, Chemotherapy is expected to dominate with close to 25.76% market share during the forecast period.

-

Chemotherapy has been used for many decades as one of the primary and most accessible cancer treatment options worldwide. It is widely available across hospitals and cancer care centres, making it a standard approach for treating various types and stages of cancer. Chemotherapy is also comparatively cost-effective compared to some of the newer therapies, which makes it more affordable, particularly in developing and low-income regions.

- In clinical practice, it is frequently used in combination with surgery, radiation therapy, targeted therapy, or immunotherapy to improve overall treatment outcomes. Due to its broad clinical applications, strong medical acceptance, and wide availability, chemotherapy continues to hold the largest and most dominant segment in the global cancer treatment market.

Oncology Market Regional Insights:

North America region is estimated to lead the market with around 30.71% share during the forecast period.

-

North America is leading the oncology market due to its strong healthcare infrastructure, advanced diagnostic and treatment technologies, and high investment in cancer research and drug development. The region has a large presence of global pharmaceutical and biotech companies actively developing innovative therapies like immunotherapy and targeted drugs.

- Government support, funding programs, early adoption of new technologies, and well-established cancer care centers also contribute significantly. Additionally, higher cancer prevalence, strong awareness, and widespread access to screening and treatment services drive demand. Reimbursement policies and higher healthcare spending further position North America as the dominant region in the global oncology market.

Oncology Market Active Players:

- AbbVie (USA)

- Amgen (USA)

- AstraZeneca (UK)

- Bristol-Myers Squibb Company (USA)

- Eli Lilly and Company (USA)

- GE HealthCare Technologies (USA)

- Gilead Sciences (USA)

- Johnson & Johnson (USA)

- Merck & Co (USA)

- Novartis (Switzerland)

- Pfizer (USA)

- Other Active Players

Key Industry Developments in the Oncology Market:

-

In May 2024, Novartis announced that it had agreed to acquire Mariana Oncology, a preclinical-stage biotechnology company based in Watertown, Massachusetts. The company specializes in developing novel radioligand therapies (RLTs) aimed at treating cancers with significant unmet medical needs. This acquisition strengthened Novartis' RLT pipeline and expanded its research infrastructure and clinical supply capabilities, aligning with the company's strategic priorities in oncology and furthering innovation within its RLT platform.

- In March 2024, AstraZeneca entered into a definitive agreement to acquire Fusion Pharmaceuticals Inc., a clinical-stage biopharmaceutical company focused on developing next-generation radio conjugates (RCs). This acquisition represented a significant advancement in AstraZeneca’s efforts to transform cancer treatment by replacing traditional therapies, such as chemotherapy and radiotherapy, with more targeted treatments aimed at improving patient outcomes.

Oncology Treatment & Innovation

Oncology treatment is undergoing a major evolution, shifting from broad cytotoxic therapies toward precision-based and immune-driven approaches designed to maximize cancer cell destruction while preserving healthy tissue. Treatments are commonly delivered as part of neoadjuvant, adjuvant, or palliative regimens depending on disease stage and intent.

How Treatments Work

Chemotherapy (Cytotoxic Drugs)

Chemotherapy targets rapidly dividing cells, disrupting the cancer cell replication cycle and triggering cell death. Although effective for rapid tumour shrinkage, the lack of selectivity leads to damage of healthy tissue and significant physical side effects.

Targeted Therapy

Targeted therapies focus on molecular pathways essential for tumour growth, such as growth factor receptors or intracellular signalling proteins. Examples include angiogenesis inhibitors, which block blood supply to tumours, and hormone therapies used for cancers influenced by hormonal signals, such as breast and prostate tumours.

Immunotherapy

These treatments activate the patient’s immune system to identify and eliminate cancer cells. Immune checkpoint inhibitors such as PD-(L)1 blockers remove immune suppression signals created by tumours, enabling T-cells to mount an attack. Cell-based treatments like CAR T-cell therapy involve modifying a patient’s immune cells outside the body so they can selectively target cancer cells when reinfused.

Risks and Side Effects of Oncology Therapies

- Chemotherapy: hair loss, fatigue, nausea, infection risk, cardiotoxicity, neuropathy

- Targeted therapy: rashes, hypertension, digestive complications, clotting disorders

- Immunotherapy: immune-related inflammation (lungs, liver, colon), cytokine release syndrome, neurotoxicity (especially with CAR-T)

Current innovation efforts aim to improve precision, durability of responses, and ease of delivery:

- Combination therapies that pair chemotherapy or radiation with immunotherapy for synergistic benefits

- Advanced radiation techniques, including proton therapy, improving tumour targeting while protecting healthy tissue

- Next-generation cell therapies, such as TIL-based treatments and CAR-NK programs, offering broader applicability and potential off-the-shelf manufacturing

- AI-assisted prediction and drug discovery, accelerating target identification and personalized treatment selection

|

Oncology Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 344.68 Bn. |

|

Forecast Period 2025-35 CAGR: |

10.93 % |

Market Size in 2035: |

USD 978.24 Bn. |

|

Segments Covered: |

By Cancer Type |

|

|

|

By Cancer Treatment |

|

||

|

By Cancer Diagnosis |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Oncology Market by Type (2018-2032)

4.1 Oncology Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Lung cancer

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Prostate cancer

4.5 Colon and rectal cancer

4.6 Gastric cancer

4.7 Oesophageal cancer

4.8 Liver cancer

4.9 Breast cancer

4.10 other cancer types

Chapter 5: Oncology Market by Diagnosis (2018-2032)

5.1 Oncology Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Tumour biomarkers test

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Imaging

5.5 Biopsy

5.6 Liquid biopsy

5.7 Immunohistochemistry

5.8 In situ hybridization

Chapter 6: Oncology Market by Treatment (2018-2032)

6.1 Oncology Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Chemotherapy

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Targeted therapy

6.5 Immunotherapy

6.6 Hormonal therapy

6.7 other cancer treatments

Chapter 7: Oncology Market by End-use (2018-2032)

7.1 Oncology Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Hospitals

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Diagnostic laboratories

7.5 Diagnostic imaging centers

7.6 Academia

7.7 Specialty clinics

7.8 other end use

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Oncology Market Share by Manufacturer/Service Provider(2024)

8.1.3 Industry BCG Matrix

8.1.4 PArtnerships, Mergers & Acquisitions

8.2 ABBVIE (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Recent News & Developments

8.2.10 SWOT Analysis

8.3 AMGEN (USA)

8.4 ASTRAZENECA (UK)

8.5 BRISTOL-MYERS SQUIBB COMPANY (USA)

8.6 ELI LILLY AND COMPANY (USA)

8.7 GE HEALTHCARE TECHNOLOGIES (USA)

8.8 GILEAD SCIENCES (USA)

8.9 JOHNSON & JOHNSON (USA)

8.10 MERCK & CO (USA)

8.11 NOVARTIS (SWITZERLAND)

8.12 PFIZER (USA)

8.13 OTHER ACTIVE PLAYERS

Chapter 9: Global Oncology Market By Region

9.1 Overview

9.2. North America Oncology Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecast Market Size by Country

9.2.4.1 US

9.2.4.2 Canada

9.2.4.3 Mexico

9.3. Eastern Europe Oncology Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecast Market Size by Country

9.3.4.1 Russia

9.3.4.2 Bulgaria

9.3.4.3 The Czech Republic

9.3.4.4 Hungary

9.3.4.5 Poland

9.3.4.6 Romania

9.3.4.7 Rest of Eastern Europe

9.4. Western Europe Oncology Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecast Market Size by Country

9.4.4.1 Germany

9.4.4.2 UK

9.4.4.3 France

9.4.4.4 The Netherlands

9.4.4.5 Italy

9.4.4.6 Spain

9.4.4.7 Rest of Western Europe

9.5. Asia Pacific Oncology Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecast Market Size by Country

9.5.4.1 China

9.5.4.2 India

9.5.4.3 Japan

9.5.4.4 South Korea

9.5.4.5 Malaysia

9.5.4.6 Thailand

9.5.4.7 Vietnam

9.5.4.8 The Philippines

9.5.4.9 Australia

9.5.4.10 New Zealand

9.5.4.11 Rest of APAC

9.6. Middle East & Africa Oncology Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecast Market Size by Country

9.6.4.1 Turkiye

9.6.4.2 Bahrain

9.6.4.3 Kuwait

9.6.4.4 Saudi Arabia

9.6.4.5 Qatar

9.6.4.6 UAE

9.6.4.7 Israel

9.6.4.8 South Africa

9.7. South America Oncology Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecast Market Size by Country

9.7.4.1 Brazil

9.7.4.2 Argentina

9.7.4.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

Chapter 11 Our Thematic Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Chapter 12 Case Study

Chapter 13 Appendix

13.1 Sources

13.2 List of Tables and figures

13.3 Short Forms and Citations

13.4 Assumption and Conversion

13.5 Disclaimer

|

Oncology Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 344.68 Bn. |

|

Forecast Period 2025-35 CAGR: |

10.93 % |

Market Size in 2035: |

USD 978.24 Bn. |

|

Segments Covered: |

By Cancer Type |

|

|

|

By Cancer Treatment |

|

||

|

By Cancer Diagnosis |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||