Oil and Gas Separation Equipment Market Synopsis:

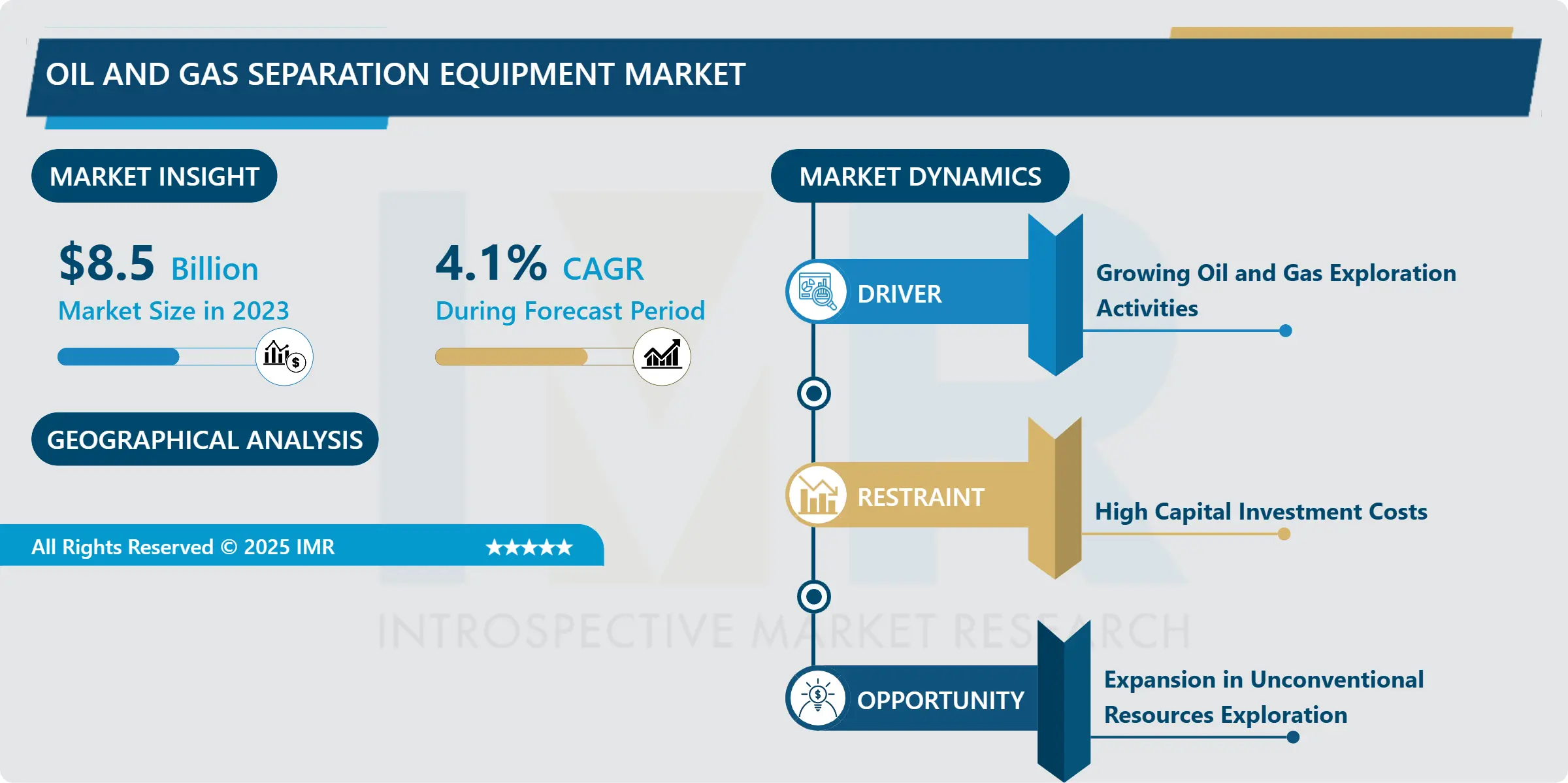

Oil and Gas Separation Equipment Market Size Was Valued at USD 8.5 Billion in 2023, and is Projected to Reach USD 12.2 Billion by 2032, Growing at a CAGR of 4.1% From 2024-2032.

The oil and gas separation equipment mean an industry that deals with the equipment used in the process of separation of Barrels of oil equivalent in crude oil and natural gas production. This involves the production of different streams of oil, gas, water and solids to facilitate their treatment, transportation and production of hydrocarbon. Upstream oil and several strategies contextual use of these separators in production, equipment durability, and several environmental requirements. As the energy demand increases around the planet and the technologies of extraction improves, the market has seen improvements in the efficiency, reliability and design aspect of separation equipments adapted to various production platforms including on-shore, off-shore and deep-water levels.

Indeed, the oil and gas separation equipment market has continued to expand over the years because of rising exploration and production worldwide. This has been driven by increase energy and industrial development that sees emerging markets demand for hydrocarbons also rises, making it possible for companies to invest in advanced separation technologies. As has been observed the equipment is applied mainly in the upstream activities particularly in the production of the SHR resources such as shale gas and tight oil whereby complex separation of the fluid streams is required. In addition, the focus on environmental responsibility and CO 2 emissions has increased the need for energy saving in the unit operation too and thus the need for efficient and environmentally friendly separation.

Furthermore, the increased exploration and production of oil and gas offshore, especially in the deeper waters of the Gulf of Mexico, North Sea, and South East Asia is fueling growth in the globally offshore oil and gas production market. These operations call for effective separation technologies that can effectively perform under extreme marine conditions. The industry is also experiencing an increasing trend of investments that places the digital monitoring and automation at the center for optimizing separation processes as well as making continuous production operations.

Oil and Gas Separation Equipment Market Trend Analysis:

Increasing Adoption of Compact Separation Equipment

- An emerging market trend for the oil and gas separation equipment is the inclination towards compact and modular separation systems. Knowing the daily practicing of additional production activities offshore, and the growth of limited space on platforms, the need for compact, but efficient equipment is valued. These systems are intended to consolidate more than one separation stage within a unit area of facility thus quickly picking focus among operators with space and cost-cutting ambitions. In addition, improved material corrosion resistance and new developments in the form of three-phase compact separators are contributing to improved performance. The combination of IoT and AI in these systems in relation to real-time monitoring of the systems has extended operational efficiency in this area further enhancing this trend.

Rising Investments in Unconventional Resource Development

- The increasing trend of developing the unconventional resource possession provides greater prospects in the oil and gas separation equipment market. As countries like the United States, China, and Argentina are increasing shale oil and gas production, the demand for the superior separation technology. These resources present difficult fluid characteristics, and the operating environment can be high pressure and high temperature. Moreover, rising expenditure on deepwater and ultra-deepwater project is the other factor driving the demand for those separators which are used in different difficult extraction procedures. While the governments of the world and other private players are focusing on energy security and considering the diversification of energy sources, then the market is expected to have a continuation of steady growth systemically in the development of unconventional resources.

Oil and Gas Separation Equipment Market Segment Analysis:

Oil and Gas Separation Equipment Market is Segmented on the basis of Product, Technology End User, and Region.

By Product, Two-phase separators segment is expected to dominate the market during the forecast period

- equipment market over the course of the forecast period because of their extensive application for separating liquid and gaseous products in production processes. These separators are useful in the first stages of crude oil treatment where elimination of gases facilitates proper and safe operation of liquid. Given their simplicity in design and moderate cost, two-phase separators are much more correctly used in onshore and offshore applications. The use of these separators is further driven by the growth of production tasks in mature and marginal fields that forms the basis for utilization of these separators.

- Fabrication of more advanced materials and manufacturing methods have enhanced the repeatability, durability and competency of the two-phase separators. Self-cleaning systems and new generation mist eliminators are helping these separators to work under severe conditions with least maintenance. Since this industry is characterized by efforts to maximize product production, the use of two-phase separators is expected to remain high in the future years.

By Technology, Gravitational Separation segment expected to held the largest share

- The gravitational separation segment is expected to dominate the oil and gas separation equipment market as it does not require complex equipment, and is also highly stable and effective in separating the oil, water and gas components. This technology operates at density difference and is used widely throughout both the initial and prolonged separation stages. It is cost efficient and requires little energy input to operate thus it is ideal for use by operators searching for energy efficient solutions. Moreover, based on the operational conditions, gravitational separators are amenable to onshore and offshore applications.

- The last few years witnessed development in utilizing material science within Computational fluid dynamics or simply the CFD to improve the design and performance of the gravitational separation systems. These innovations enabled producers of separators to design new equipment that has greater flow characteristics and elevated levels of separation in conditions of high pressure. Given that energy producers pay much attention to cost control as well as operational dependability, the gravitational separation segment is prepared to stay for the top.

Oil and Gas Separation Equipment Market Regional Insights:

Middle East & Africa is Expected to Dominate the Market Over the Forecast period

- Our data showed that the Middle East & Africa has grown to be a leading region in the oil and gas separation equipment market capturing in 2023. The region’s leadership is due to some of the largest global proven crude oil and natural gas reserves together with sizeable investments in both the upstream and downstream sectors. Globally leading oil production countries, including Saudi Arabia, UAE, and Qatar have been more proactive in the development and incorporation of high efficiency separation techniques into their production and processing processes. Furthermore, new project investment for the oil and gas industry and constant capacity enhancements in refining have contributed toward the increased use of separation equipment in this region. The focus on improving the element of structure and increasing operating efficiency remains central to market development in the Middle East & Africa region.

Active Key Players in the Oil and Gas Separation Equipment Market

- Alfa Laval (Sweden)

- Andritz Group (Austria)

- Burgess-Manning (USA)

- Cepsa (Spain)

- Doosan Mecatec (South Korea)

- Eaton Corporation (USA)

- Frames Group (Netherlands)

- GEA Group (Germany)

- Halliburton (USA)

- Honeywell International (USA)

- Schlumberger (USA)

- Siemens Energy (Germany)

- SPX FLOW (USA)

- Technip Energies (France)

- Velan Inc. (Canada)

- Other Active Players.

|

Oil and Gas Separation Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.5 Billion |

|

Forecast Period 2024-32 CAGR: |

4.1% |

Market Size in 2032: |

USD 12.2 Billion |

|

Segments Covered: |

By Product |

|

|

|

By Technology |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Oil and Gas Separation Equipment Market by Product

4.1 Oil and Gas Separation Equipment Market Snapshot and Growth Engine

4.2 Oil and Gas Separation Equipment Market Overview

4.3 Two-phase separators

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Two-phase separators: Geographic Segmentation Analysis

4.4 Three-phase separators

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Three-phase separators: Geographic Segmentation Analysis

4.5 Scrubber

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Scrubber: Geographic Segmentation Analysis

4.6 Others

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Others: Geographic Segmentation Analysis

Chapter 5: Oil and Gas Separation Equipment Market by Technology

5.1 Oil and Gas Separation Equipment Market Snapshot and Growth Engine

5.2 Oil and Gas Separation Equipment Market Overview

5.3 Gravitational Separation

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Gravitational Separation: Geographic Segmentation Analysis

5.4 Centrifugal Separation

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Centrifugal Separation: Geographic Segmentation Analysis

Chapter 6: Oil and Gas Separation Equipment Market by End User

6.1 Oil and Gas Separation Equipment Market Snapshot and Growth Engine

6.2 Oil and Gas Separation Equipment Market Overview

6.3 Onshore

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Onshore: Geographic Segmentation Analysis

6.4 Offshore

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Offshore: Geographic Segmentation Analysis

6.5 Refineries

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Refineries: Geographic Segmentation Analysis

6.6 Other

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Other: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Oil and Gas Separation Equipment Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ALFA LAVAL (SWEDEN)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ANDRITZ GROUP (AUSTRIA)

7.4 BURGESS-MANNING (USA)

7.5 CEPSA (SPAIN)

7.6 DOOSAN MECATEC (SOUTH KOREA)

7.7 EATON CORPORATION (USA)

7.8 FRAMES GROUP (NETHERLANDS)

7.9 GEA GROUP (GERMANY)

7.10 HALLIBURTON (USA)

7.11 HONEYWELL INTERNATIONAL (USA)

7.12 SCHLUMBERGER (USA)

7.13 SIEMENS ENERGY (GERMANY)

7.14 SPX FLOW (USA)

7.15 TECHNIP ENERGIES (FRANCE)

7.16 VELAN INC. (CANADA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Oil and Gas Separation Equipment Market By Region

8.1 Overview

8.2. North America Oil and Gas Separation Equipment Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Product

8.2.4.1 Two-phase separators

8.2.4.2 Three-phase separators

8.2.4.3 Scrubber

8.2.4.4 Others

8.2.5 Historic and Forecasted Market Size By Technology

8.2.5.1 Gravitational Separation

8.2.5.2 Centrifugal Separation

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Onshore

8.2.6.2 Offshore

8.2.6.3 Refineries

8.2.6.4 Other

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Oil and Gas Separation Equipment Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Product

8.3.4.1 Two-phase separators

8.3.4.2 Three-phase separators

8.3.4.3 Scrubber

8.3.4.4 Others

8.3.5 Historic and Forecasted Market Size By Technology

8.3.5.1 Gravitational Separation

8.3.5.2 Centrifugal Separation

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Onshore

8.3.6.2 Offshore

8.3.6.3 Refineries

8.3.6.4 Other

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Oil and Gas Separation Equipment Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Product

8.4.4.1 Two-phase separators

8.4.4.2 Three-phase separators

8.4.4.3 Scrubber

8.4.4.4 Others

8.4.5 Historic and Forecasted Market Size By Technology

8.4.5.1 Gravitational Separation

8.4.5.2 Centrifugal Separation

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Onshore

8.4.6.2 Offshore

8.4.6.3 Refineries

8.4.6.4 Other

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Oil and Gas Separation Equipment Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Product

8.5.4.1 Two-phase separators

8.5.4.2 Three-phase separators

8.5.4.3 Scrubber

8.5.4.4 Others

8.5.5 Historic and Forecasted Market Size By Technology

8.5.5.1 Gravitational Separation

8.5.5.2 Centrifugal Separation

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Onshore

8.5.6.2 Offshore

8.5.6.3 Refineries

8.5.6.4 Other

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Oil and Gas Separation Equipment Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Product

8.6.4.1 Two-phase separators

8.6.4.2 Three-phase separators

8.6.4.3 Scrubber

8.6.4.4 Others

8.6.5 Historic and Forecasted Market Size By Technology

8.6.5.1 Gravitational Separation

8.6.5.2 Centrifugal Separation

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Onshore

8.6.6.2 Offshore

8.6.6.3 Refineries

8.6.6.4 Other

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Oil and Gas Separation Equipment Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Product

8.7.4.1 Two-phase separators

8.7.4.2 Three-phase separators

8.7.4.3 Scrubber

8.7.4.4 Others

8.7.5 Historic and Forecasted Market Size By Technology

8.7.5.1 Gravitational Separation

8.7.5.2 Centrifugal Separation

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Onshore

8.7.6.2 Offshore

8.7.6.3 Refineries

8.7.6.4 Other

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Oil and Gas Separation Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.5 Billion |

|

Forecast Period 2024-32 CAGR: |

4.1% |

Market Size in 2032: |

USD 12.2 Billion |

|

Segments Covered: |

By Product |

|

|

|

By Technology |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||