Mobile Phone Insurance Market Overview

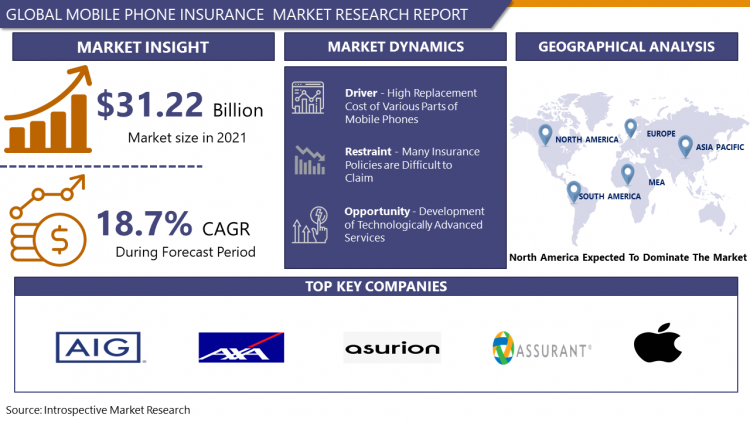

Global Mobile Phone Insurance Market was valued at USD 31.22 Billion in 2021 and is expected to reach USD 103.65 Billion by the year 2028, at a CAGR of 18.7%.

mobile phone insurance can be used for education, entertainment, and conducting digital transactions. The increased use of smartphones for storing personal information and conducting digital transactions has necessitated the need for mobile device security. This pattern is expected to accelerate business growth during the prediction period. Because of the fierce competition in mobile phone insurance market, mobile insurance saves time in a variety of ways, including by quick claim procedures. By buying an insurance package with a low premium, one may avoid significant harm incurred by rising mobile device prices. The cost of replacing the screen alone accounts for around a quarter of the total phone cost. Given the rising costs of new mobile models and the vulnerability involved in servicing, opting for a full cover insurance package will save a significant amount of money.

Mobile Phone Insurance: Key Market Dynamics

In the present situation, the global mobile phone insurance industry is undergoing rapid growth due to mobile phone insurance market participants' advancements and upgrades to plans and schemes, as well as the acquisition of potential insurance policies. There are some well-known competitors in the cell phone insurance industry, and small businesses that offer a single coverage form. Mobile network carriers, dealers, system OEMs, and others dominate the mobile phone insurance industry. The mobile phone insurance industry players improve their schemes in response to consumer demands. Furthermore, the mobile phone insurance is expanding rapidly across geographies, both in terms of new and refurbished models.

Rising Number of Smartphone Users Contributing to Growth of the Market

Both socially and economically, the world is becoming more intertwined. The global population's technological adoption pattern has been a key defining factor. To that end, over the last few years, mobile phone insurance world has seen a remarkable increase in mobile usage. With the rise of smartphone adoption, the telecommunications industry is seeing a significant increase in the number of mobile phone insurance plans sold by numerous smartphone makers, insurance providers, network carriers, and retailers around the world. Insurance providers assist mobile owners by providing burglary or loss insurance, as well as unintentional coverage and other services.

Ease of the Claiming Process Increasing Mobile Phone Insurance Demand

The mobile phone insurance market's terms and conditions are very stringent many times, causing consumers to forget about claiming practices entirely. Any sellers have a pre-defined coverage schedule with a pre-determined price independent of the handset model. On the other hand, some sellers charge various premiums/amounts for different types of coverage that consumers need. The coverage and premium/amount can vary depending on the user, such as iOS or Android-based phones.

Market Segmentation

mobile phone insurance market is categorized into various segments such as phone type, channel, protection, end user, and geographical region.

The widespread use of smartphones in the area, high cell phone prices, technologically advanced smartphones, and the rising practice of buying mobile phone insurance contracts, coupled with an increase in the number of cases of mobile phone robberies and injury, have all fuelled consumer growth in this region.

Players Covered in Mobile Phone Insurance market are :

The industry is fiercely competitive, with key companies concentrating their efforts on raising awareness about smartphone insurance. The key players in the mobile insurance industry hold exhibitions and conferences to demonstrate and advertise the advantages of mobile phone insurance to smartphone consumers. The requirement of mobile phone insurance in the industry would cover cellular carriers.

- AIG

- Apple

- AXA

- Asurion

- Assurant

- Hollard Group

- Chubb (ACE)

- SoftBank

- Allianz Insurance

- AmTrust

- Aviva

Key Developments Observed in the Market

- In 2018, Trōv, Inc. introduced re-engineered on-demand insurance policy in the United Sates

- In 2018, Polkomtel launches display insurance for Plus Mix consumers

- In 2018, TIM Brasil introduces annual mobile phone trade-up scheme

- 2018: BlackBerry Limited signed a licensing contract with the Bullitt Group (UK based rugged smartphone producer)

Key Deliverables of the Global Market:

- The mobile phone insurance report covers recent competitive development and the forecast trend and profiles of leading vendors comprising emerging players and market leaders.

- The study provides a thorough evaluation of mobile phone insurance market by highlighting data on different aspects such as drivers, restraints, threats and opportunities.

|

Global Mobile Phone Insurance Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 31.22 Bn. |

|

Forecast Period 2022-28 CAGR: |

18.7% |

Market Size in 2028: |

USD 103.65 Bn. |

|

Segments Covered: |

By Phone Type |

|

|

|

By Coverage Type |

|

||

|

By Sales Channel |

|

||

|

By End users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Coverage Type

3.3 By Sales Channel

3.4 By End users

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Mobile Phone Insurance Market by Type

5.1 Mobile Phone Insurance Market Overview Snapshot and Growth Engine

5.2 Mobile Phone Insurance Market Overview

5.3 Budget Phones

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Budget Phones: Grographic Segmentation

5.4 Mid & High-End Phones

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Mid & High-End Phones: Grographic Segmentation

5.5 Premium Smartphones

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Premium Smartphones: Grographic Segmentation

Chapter 6: Mobile Phone Insurance Market by Coverage Type

6.1 Mobile Phone Insurance Market Overview Snapshot and Growth Engine

6.2 Mobile Phone Insurance Market Overview

6.3 Physical Damage

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Physical Damage: Grographic Segmentation

6.4 Internal Component Failure

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Internal Component Failure: Grographic Segmentation

6.5 Theft & Loss Protection

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Theft & Loss Protection: Grographic Segmentation

Chapter 7: Mobile Phone Insurance Market by Sales Channel

7.1 Mobile Phone Insurance Market Overview Snapshot and Growth Engine

7.2 Mobile Phone Insurance Market Overview

7.3 Retail

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Retail: Grographic Segmentation

7.4 Online

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Online: Grographic Segmentation

Chapter 8: Mobile Phone Insurance Market by End users

8.1 Mobile Phone Insurance Market Overview Snapshot and Growth Engine

8.2 Mobile Phone Insurance Market Overview

8.3 Business

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size (2016-2028F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Business: Grographic Segmentation

8.4 Individual

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size (2016-2028F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Individual: Grographic Segmentation

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Positioning

9.1.2 Mobile Phone Insurance Sales and Market Share By Players

9.1.3 Industry BCG Matrix

9.1.4 Ansoff Matrix

9.1.5 Mobile Phone Insurance Industry Concentration Ratio (CR5 and HHI)

9.1.6 Top 5 Mobile Phone Insurance Players Market Share

9.1.7 Mergers and Acquisitions

9.1.8 Business Strategies By Top Players

9.2 AIG

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Operating Business Segments

9.2.5 Product Portfolio

9.2.6 Business Performance

9.2.7 Key Strategic Moves and Recent Developments

9.2.8 SWOT Analysis

9.3 APPLE

9.4 AXA

9.5 ASURION

9.6 ASSURANT

9.7 HOLLARD GROUP

9.8 CHUBB (ACE)

9.9 SOFTBANK

9.10 ALLIANZ INSURANCE

9.11 AMTRUST

9.12 AVIVA

9.13 OTHER MAJOR PLAYERS

Chapter 10: Global Mobile Phone Insurance Market Analysis, Insights and Forecast, 2016-2028

10.1 Market Overview

10.2 Historic and Forecasted Market Size By Type

10.2.1 Budget Phones

10.2.2 Mid & High-End Phones

10.2.3 Premium Smartphones

10.3 Historic and Forecasted Market Size By Coverage Type

10.3.1 Physical Damage

10.3.2 Internal Component Failure

10.3.3 Theft & Loss Protection

10.4 Historic and Forecasted Market Size By Sales Channel

10.4.1 Retail

10.4.2 Online

10.5 Historic and Forecasted Market Size By End users

10.5.1 Business

10.5.2 Individual

Chapter 11: North America Mobile Phone Insurance Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Budget Phones

11.4.2 Mid & High-End Phones

11.4.3 Premium Smartphones

11.5 Historic and Forecasted Market Size By Coverage Type

11.5.1 Physical Damage

11.5.2 Internal Component Failure

11.5.3 Theft & Loss Protection

11.6 Historic and Forecasted Market Size By Sales Channel

11.6.1 Retail

11.6.2 Online

11.7 Historic and Forecasted Market Size By End users

11.7.1 Business

11.7.2 Individual

11.8 Historic and Forecast Market Size by Country

11.8.1 U.S.

11.8.2 Canada

11.8.3 Mexico

Chapter 12: Europe Mobile Phone Insurance Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Budget Phones

12.4.2 Mid & High-End Phones

12.4.3 Premium Smartphones

12.5 Historic and Forecasted Market Size By Coverage Type

12.5.1 Physical Damage

12.5.2 Internal Component Failure

12.5.3 Theft & Loss Protection

12.6 Historic and Forecasted Market Size By Sales Channel

12.6.1 Retail

12.6.2 Online

12.7 Historic and Forecasted Market Size By End users

12.7.1 Business

12.7.2 Individual

12.8 Historic and Forecast Market Size by Country

12.8.1 Germany

12.8.2 U.K.

12.8.3 France

12.8.4 Italy

12.8.5 Russia

12.8.6 Spain

12.8.7 Rest of Europe

Chapter 13: Asia-Pacific Mobile Phone Insurance Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Budget Phones

13.4.2 Mid & High-End Phones

13.4.3 Premium Smartphones

13.5 Historic and Forecasted Market Size By Coverage Type

13.5.1 Physical Damage

13.5.2 Internal Component Failure

13.5.3 Theft & Loss Protection

13.6 Historic and Forecasted Market Size By Sales Channel

13.6.1 Retail

13.6.2 Online

13.7 Historic and Forecasted Market Size By End users

13.7.1 Business

13.7.2 Individual

13.8 Historic and Forecast Market Size by Country

13.8.1 China

13.8.2 India

13.8.3 Japan

13.8.4 Singapore

13.8.5 Australia

13.8.6 New Zealand

13.8.7 Rest of APAC

Chapter 14: Middle East & Africa Mobile Phone Insurance Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Budget Phones

14.4.2 Mid & High-End Phones

14.4.3 Premium Smartphones

14.5 Historic and Forecasted Market Size By Coverage Type

14.5.1 Physical Damage

14.5.2 Internal Component Failure

14.5.3 Theft & Loss Protection

14.6 Historic and Forecasted Market Size By Sales Channel

14.6.1 Retail

14.6.2 Online

14.7 Historic and Forecasted Market Size By End users

14.7.1 Business

14.7.2 Individual

14.8 Historic and Forecast Market Size by Country

14.8.1 Turkey

14.8.2 Saudi Arabia

14.8.3 Iran

14.8.4 UAE

14.8.5 Africa

14.8.6 Rest of MEA

Chapter 15: South America Mobile Phone Insurance Market Analysis, Insights and Forecast, 2016-2028

15.1 Key Market Trends, Growth Factors and Opportunities

15.2 Impact of Covid-19

15.3 Key Players

15.4 Key Market Trends, Growth Factors and Opportunities

15.4 Historic and Forecasted Market Size By Type

15.4.1 Budget Phones

15.4.2 Mid & High-End Phones

15.4.3 Premium Smartphones

15.5 Historic and Forecasted Market Size By Coverage Type

15.5.1 Physical Damage

15.5.2 Internal Component Failure

15.5.3 Theft & Loss Protection

15.6 Historic and Forecasted Market Size By Sales Channel

15.6.1 Retail

15.6.2 Online

15.7 Historic and Forecasted Market Size By End users

15.7.1 Business

15.7.2 Individual

15.8 Historic and Forecast Market Size by Country

15.8.1 Brazil

15.8.2 Argentina

15.8.3 Rest of SA

Chapter 16 Investment Analysis

Chapter 17 Analyst Viewpoint and Conclusion

|

Global Mobile Phone Insurance Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 31.22 Bn. |

|

Forecast Period 2022-28 CAGR: |

18.7% |

Market Size in 2028: |

USD 103.65 Bn. |

|

Segments Covered: |

By Phone Type |

|

|

|

By Coverage Type |

|

||

|

By Sales Channel |

|

||

|

By End users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. MOBILE PHONE INSURANCE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. MOBILE PHONE INSURANCE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. MOBILE PHONE INSURANCE MARKET COMPETITIVE RIVALRY

TABLE 005. MOBILE PHONE INSURANCE MARKET THREAT OF NEW ENTRANTS

TABLE 006. MOBILE PHONE INSURANCE MARKET THREAT OF SUBSTITUTES

TABLE 007. MOBILE PHONE INSURANCE MARKET BY TYPE

TABLE 008. BUDGET PHONES MARKET OVERVIEW (2016-2028)

TABLE 009. MID & HIGH-END PHONES MARKET OVERVIEW (2016-2028)

TABLE 010. PREMIUM SMARTPHONES MARKET OVERVIEW (2016-2028)

TABLE 011. MOBILE PHONE INSURANCE MARKET BY COVERAGE TYPE

TABLE 012. PHYSICAL DAMAGE MARKET OVERVIEW (2016-2028)

TABLE 013. INTERNAL COMPONENT FAILURE MARKET OVERVIEW (2016-2028)

TABLE 014. THEFT & LOSS PROTECTION MARKET OVERVIEW (2016-2028)

TABLE 015. MOBILE PHONE INSURANCE MARKET BY SALES CHANNEL

TABLE 016. RETAIL MARKET OVERVIEW (2016-2028)

TABLE 017. ONLINE MARKET OVERVIEW (2016-2028)

TABLE 018. MOBILE PHONE INSURANCE MARKET BY END USERS

TABLE 019. BUSINESS MARKET OVERVIEW (2016-2028)

TABLE 020. INDIVIDUAL MARKET OVERVIEW (2016-2028)

TABLE 021. NORTH AMERICA MOBILE PHONE INSURANCE MARKET, BY TYPE (2016-2028)

TABLE 022. NORTH AMERICA MOBILE PHONE INSURANCE MARKET, BY COVERAGE TYPE (2016-2028)

TABLE 023. NORTH AMERICA MOBILE PHONE INSURANCE MARKET, BY SALES CHANNEL (2016-2028)

TABLE 024. NORTH AMERICA MOBILE PHONE INSURANCE MARKET, BY END USERS (2016-2028)

TABLE 025. N MOBILE PHONE INSURANCE MARKET, BY COUNTRY (2016-2028)

TABLE 026. EUROPE MOBILE PHONE INSURANCE MARKET, BY TYPE (2016-2028)

TABLE 027. EUROPE MOBILE PHONE INSURANCE MARKET, BY COVERAGE TYPE (2016-2028)

TABLE 028. EUROPE MOBILE PHONE INSURANCE MARKET, BY SALES CHANNEL (2016-2028)

TABLE 029. EUROPE MOBILE PHONE INSURANCE MARKET, BY END USERS (2016-2028)

TABLE 030. MOBILE PHONE INSURANCE MARKET, BY COUNTRY (2016-2028)

TABLE 031. ASIA PACIFIC MOBILE PHONE INSURANCE MARKET, BY TYPE (2016-2028)

TABLE 032. ASIA PACIFIC MOBILE PHONE INSURANCE MARKET, BY COVERAGE TYPE (2016-2028)

TABLE 033. ASIA PACIFIC MOBILE PHONE INSURANCE MARKET, BY SALES CHANNEL (2016-2028)

TABLE 034. ASIA PACIFIC MOBILE PHONE INSURANCE MARKET, BY END USERS (2016-2028)

TABLE 035. MOBILE PHONE INSURANCE MARKET, BY COUNTRY (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA MOBILE PHONE INSURANCE MARKET, BY TYPE (2016-2028)

TABLE 037. MIDDLE EAST & AFRICA MOBILE PHONE INSURANCE MARKET, BY COVERAGE TYPE (2016-2028)

TABLE 038. MIDDLE EAST & AFRICA MOBILE PHONE INSURANCE MARKET, BY SALES CHANNEL (2016-2028)

TABLE 039. MIDDLE EAST & AFRICA MOBILE PHONE INSURANCE MARKET, BY END USERS (2016-2028)

TABLE 040. MOBILE PHONE INSURANCE MARKET, BY COUNTRY (2016-2028)

TABLE 041. SOUTH AMERICA MOBILE PHONE INSURANCE MARKET, BY TYPE (2016-2028)

TABLE 042. SOUTH AMERICA MOBILE PHONE INSURANCE MARKET, BY COVERAGE TYPE (2016-2028)

TABLE 043. SOUTH AMERICA MOBILE PHONE INSURANCE MARKET, BY SALES CHANNEL (2016-2028)

TABLE 044. SOUTH AMERICA MOBILE PHONE INSURANCE MARKET, BY END USERS (2016-2028)

TABLE 045. MOBILE PHONE INSURANCE MARKET, BY COUNTRY (2016-2028)

TABLE 046. AIG: SNAPSHOT

TABLE 047. AIG: BUSINESS PERFORMANCE

TABLE 048. AIG: PRODUCT PORTFOLIO

TABLE 049. AIG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. APPLE: SNAPSHOT

TABLE 050. APPLE: BUSINESS PERFORMANCE

TABLE 051. APPLE: PRODUCT PORTFOLIO

TABLE 052. APPLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. AXA: SNAPSHOT

TABLE 053. AXA: BUSINESS PERFORMANCE

TABLE 054. AXA: PRODUCT PORTFOLIO

TABLE 055. AXA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. ASURION: SNAPSHOT

TABLE 056. ASURION: BUSINESS PERFORMANCE

TABLE 057. ASURION: PRODUCT PORTFOLIO

TABLE 058. ASURION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. ASSURANT: SNAPSHOT

TABLE 059. ASSURANT: BUSINESS PERFORMANCE

TABLE 060. ASSURANT: PRODUCT PORTFOLIO

TABLE 061. ASSURANT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. HOLLARD GROUP: SNAPSHOT

TABLE 062. HOLLARD GROUP: BUSINESS PERFORMANCE

TABLE 063. HOLLARD GROUP: PRODUCT PORTFOLIO

TABLE 064. HOLLARD GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. CHUBB (ACE): SNAPSHOT

TABLE 065. CHUBB (ACE): BUSINESS PERFORMANCE

TABLE 066. CHUBB (ACE): PRODUCT PORTFOLIO

TABLE 067. CHUBB (ACE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. SOFTBANK: SNAPSHOT

TABLE 068. SOFTBANK: BUSINESS PERFORMANCE

TABLE 069. SOFTBANK: PRODUCT PORTFOLIO

TABLE 070. SOFTBANK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. ALLIANZ INSURANCE: SNAPSHOT

TABLE 071. ALLIANZ INSURANCE: BUSINESS PERFORMANCE

TABLE 072. ALLIANZ INSURANCE: PRODUCT PORTFOLIO

TABLE 073. ALLIANZ INSURANCE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. AMTRUST: SNAPSHOT

TABLE 074. AMTRUST: BUSINESS PERFORMANCE

TABLE 075. AMTRUST: PRODUCT PORTFOLIO

TABLE 076. AMTRUST: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. AVIVA: SNAPSHOT

TABLE 077. AVIVA: BUSINESS PERFORMANCE

TABLE 078. AVIVA: PRODUCT PORTFOLIO

TABLE 079. AVIVA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 080. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 081. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 082. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. MOBILE PHONE INSURANCE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. MOBILE PHONE INSURANCE MARKET OVERVIEW BY TYPE

FIGURE 012. BUDGET PHONES MARKET OVERVIEW (2016-2028)

FIGURE 013. MID & HIGH-END PHONES MARKET OVERVIEW (2016-2028)

FIGURE 014. PREMIUM SMARTPHONES MARKET OVERVIEW (2016-2028)

FIGURE 015. MOBILE PHONE INSURANCE MARKET OVERVIEW BY COVERAGE TYPE

FIGURE 016. PHYSICAL DAMAGE MARKET OVERVIEW (2016-2028)

FIGURE 017. INTERNAL COMPONENT FAILURE MARKET OVERVIEW (2016-2028)

FIGURE 018. THEFT & LOSS PROTECTION MARKET OVERVIEW (2016-2028)

FIGURE 019. MOBILE PHONE INSURANCE MARKET OVERVIEW BY SALES CHANNEL

FIGURE 020. RETAIL MARKET OVERVIEW (2016-2028)

FIGURE 021. ONLINE MARKET OVERVIEW (2016-2028)

FIGURE 022. MOBILE PHONE INSURANCE MARKET OVERVIEW BY END USERS

FIGURE 023. BUSINESS MARKET OVERVIEW (2016-2028)

FIGURE 024. INDIVIDUAL MARKET OVERVIEW (2016-2028)

FIGURE 025. NORTH AMERICA MOBILE PHONE INSURANCE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. EUROPE MOBILE PHONE INSURANCE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. ASIA PACIFIC MOBILE PHONE INSURANCE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. MIDDLE EAST & AFRICA MOBILE PHONE INSURANCE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. SOUTH AMERICA MOBILE PHONE INSURANCE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Mobile Phone Insurance Market research report is 2022-2028.

AIG, Apple, AXA, Asurion, Assurant, Hollard Group, and Other Major Players.

Mobile Phone Insurance Market is segmented into Phone Type, Coverage Type, Sales Channel, End users and region. By Phone Type, the market is categorized into Budget Phones, Mid & High-End Phones, and Premium Smartphones. By Coverage Type, the market is categorized into Physical Damage, Internal Component Failure, and Theft & Loss Protection. By Sales Channel the market is categorized into Retail, Online. By End users the market is categorized into Business, Individual. By region, it is analysed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Mobile phone insurance is nothing but the service contract, which offers component fix repairing for mobile phones that are sold by retailer or service providers. Mobile phone insurances provide additional coverage of phones like malicious damage, the unauthorized usage, e-wallet payments, or theft.

Global Mobile Phone Insurance Market was valued at USD 31.22 Billion in 2021 and is expected to reach USD 103.65 Billion by the year 2028, at a CAGR of 18.7%.