Medical Grade Oxygen Market Synopsis

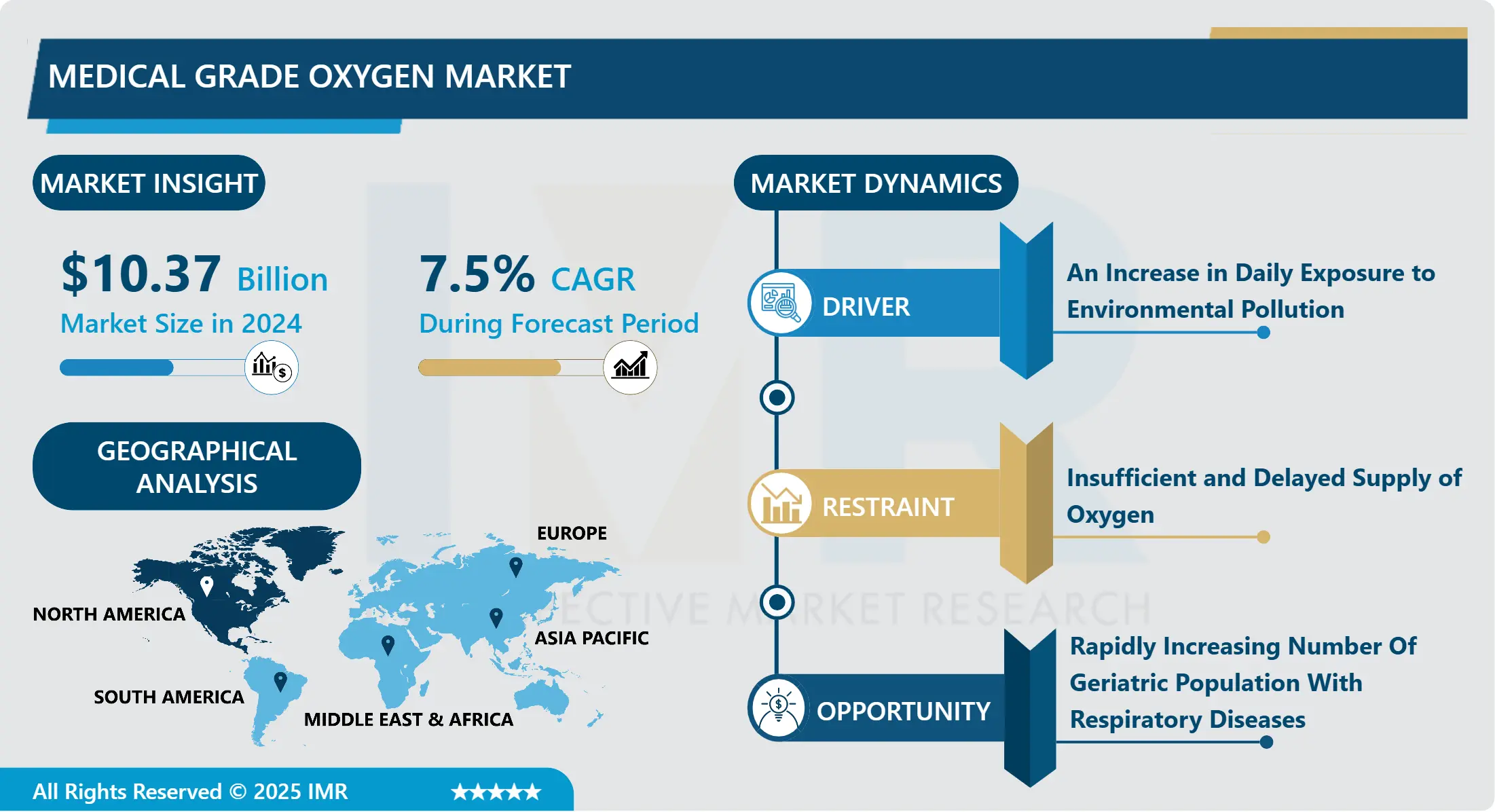

Medical Grade Oxygen Market Size Was Valued at USD 10.37 Billion in 2024, and is Projected to Reach USD 18.49 Billion by 2032, Growing at a CAGR of 7.5% From 2025-2032.

The global medical-grade oxygen market encompasses the production, distribution, and utilization of oxygen specifically designed for medical applications. This market is integral to healthcare systems worldwide, supporting various medical procedures, treatments, and life-saving interventions.

Medical grade oxygen, typically defined as at least 99.0% pure oxygen, plays a critical role in addressing respiratory disorders, surgical procedures, emergency care, and other medical needs where supplemental oxygen is necessary.

The growth of the medical-grade oxygen market is the rising prevalence of respiratory diseases. Conditions such as chronic obstructive pulmonary disease (COPD), asthma, and pneumonia contribute significantly to the demand for medical oxygen. With an aging global population and lifestyle factors impacting respiratory health, the need for oxygen therapy continues to increase, driving market expansion.

Advancements in medical technology and healthcare infrastructure contribute to the market's growth. Innovations such as portable oxygen concentrators, improved oxygen delivery systems, and enhanced monitoring devices have enhanced patient care and accessibility to oxygen therapy. These technological advancements not only improve treatment outcomes but also broaden the market reach by making oxygen therapy more convenient and effective.

Medical Grade Oxygen Market Trend Analysis

Increase in Daily Exposure to Environmental Pollution

- As air quality deteriorates, particularly in urban areas, there's a growing need for supplemental oxygen therapy. Pollutants like particulate matter (PM2.5) and ozone irritate and damage lung tissue, reducing the body's ability to absorb oxygen from the ambient air. This can lead to respiratory problems like asthma, chronic obstructive pulmonary disease (COPD), and even heart disease.

- For individuals suffering from these pollution-induced conditions, medical-grade oxygen becomes a vital treatment. Hospitals and clinics witness a surge in demand for oxygen concentrators and tanks, especially during periods of high pollution. Additionally, home healthcare is seeing an increase in patients requiring long-term oxygen therapy due to environmental factors. This trend is expected to continue as stricter regulations and public awareness fail to keep pace with the rapid increase in pollution levels.

Rapidly Increasing Number of Geriatric Population With Respiratory Diseases

- As people age, their lung capacity naturally decreases, making them more susceptible to respiratory illnesses. This, coupled with a higher prevalence of chronic conditions like COPD and pneumonia in the elderly, creates a rising demand for supplemental oxygen therapy.

- This trend is evident worldwide. The World Health Organization projects that by 2050, the proportion of the global population aged 60 or over will nearly double. This surge in the elderly population translates to a greater number of individuals requiring oxygen support, both in hospitals and at home. Manufacturers of oxygen concentrators, portable oxygen tanks, and respiratory masks are well-positioned to cater to this growing need.

- For instance, In the United States, the National Heart, Lung, and Blood Institute report that COPD is a leading cause of hospitalization among adults aged 65 and older. This highlights the increasing dependence of the elderly population on medical-grade oxygen for managing chronic respiratory conditions. By developing user-friendly and portable oxygen delivery systems, companies can tap into this expanding market segment.

Medical Grade Oxygen Market Segment Analysis:

Medical Grade Oxygen Market is segmented on the basis of Product Type, Delivery Type, Indication, End-users and Region.

By Product Type, Compressed Gas Systems segment is expected to dominate the market during the forecast period

- Compressed gas systems are integral to the medical grade oxygen market due to their reliability and efficiency in storing and delivering oxygen to patients. These systems encompass tanks or cylinders filled with compressed oxygen gas, managed through regulators and administered via specialized delivery devices like oxygen masks, nasal cannulas, or ventilators. For instance, a portable oxygen tank used by patients with respiratory conditions like chronic obstructive pulmonary disease (COPD) exemplifies this segment. These tanks store oxygen under pressure, allowing individuals to carry them for supplemental oxygen therapy, enhancing their mobility and quality of life.

- In healthcare facilities, compressed gas systems are crucial for emergency care and respiratory support. For example, during surgeries or critical care scenarios, medical professionals rely on compressed oxygen tanks connected to ventilators to ensure patients receive adequate oxygenation. These systems provide precise oxygen concentrations, essential for therapeutic applications ranging from treating acute respiratory distress to maintaining oxygen levels during anesthesia. Their versatility and ability to deliver oxygen effectively make compressed gas systems indispensable tools across various medical settings, safeguarding patient well-being and enabling optimal care delivery.

By Delivery Type, Oxygen Delivery In Oxygen Concentrators segment held the largest share in 2024

- Oxygen delivery in oxygen concentrators has become increasingly popular due to its convenience and cost-effectiveness. Unlike traditional oxygen tanks that require refilling and maintenance, oxygen concentrators extract oxygen from the ambient air, making them a more sustainable option. For example, a patient with chronic obstructive pulmonary disease (COPD) can use an oxygen concentrator at home to receive a continuous flow of medical-grade oxygen without the hassle of replacing tanks.

- Advancements in technology have improved the efficiency and portability of oxygen concentrators, further contributing to their dominance in the medical-grade oxygen market. Modern oxygen concentrators are designed to deliver precise oxygen levels, making them suitable for various medical conditions that require supplemental oxygen therapy. For instance, a portable oxygen concentrator allows patients to maintain an active lifestyle while ensuring they receive the necessary oxygen levels, such as during travel or outdoor activities. These factors combined have propelled the oxygen delivery in the oxygen concentrators segment to hold the largest share in the medical-grade oxygen market.

Medical Grade Oxygen Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America's significant market share in the medical-grade oxygen market can be attributed to its advanced healthcare infrastructure. The region boasts state-of-the-art medical facilities, including hospitals, clinics, and research centers, equipped with the latest technologies for diagnosing and treating various health conditions.

- This infrastructure enables efficient distribution and utilization of medical-grade oxygen, ensuring timely access for patients in need. For instance, hospitals in the US have well-established oxygen delivery systems that cater to a large patient population, especially those with chronic respiratory diseases like COPD, asthma, and pneumonia.

- The high prevalence of chronic respiratory diseases in North America contributes to the region's dominance in the medical-grade oxygen market. Factors such as air pollution, smoking habits, and an aging population contribute to the increased incidence of respiratory ailments, necessitating the use of medical-grade oxygen for therapeutic purposes.

- The US, in particular, stands out as the dominant player in this region due to its robust healthcare ecosystem, substantial healthcare expenditure, and strong focus on technological advancements. These factors create a conducive environment for the growth of the medical-grade oxygen market, making North America a key market player globally.

Active Key Players in the Medical Grade Oxygen Market

- Invacare Corporation (U.S.)

- Inogen Inc. (U.S.)

- CAIRE Inc. (U.S.)

- O2 CONCEPTS LLC (U.S.)

- OxyGo, LLC (U.S.)

- Precision Medical, Inc. (U.S.)

- Drive DeVilbiss Healthcare (U.S.)

- Airgas Inc (U.S.)

- Medical Depot, Inc. (Canada)

- Koninklijke Philips N.V. (Netherlands)

- Linde plc (Ireland)

- Chart Industries (U.S.)

- GCE Group (Sweden)

- Messer SE & Co. KGaA (Germany)

- Philips Healthcare (Netherlands)

- TECNO-GAZ SpA (Italy)

- Terumo Medical Corporation (Japan)

- NIDEK MEDICAL INDIA (India)

- OrientMEd International (UAE)

- Gulf Cryo Saudi for Industrial & Medical Gases (UAE)

- Jacko Gases Company (Saudi Arabia)

- Other Active Players

Key Industry Developments in the Medical Grade Oxygen Market:

- In February 2023, React Health, a company specializing in the development, manufacturing, and distribution of medical devices for treating sleep-disordered breathing and providing oxygen therapy, successfully acquired Invacare's Respiratory line. This strategic acquisition will enable React Health to enhance its position in the market further and expand its product portfolio to cater to a broader range of customers

- In January 2023, CAIRE Inc., a global manufacturer of oxygen therapy and on-site generation systems, acquired MGC Diagnostics Holdings, Inc., headquartered in St. Paul, Minnesota. The acquisition strengthened CAIRE's presence and commitment to diagnostic technologies, further enhancing its proficiency in catering to patients at all stages of pulmonary disease progression

|

Global Medical Grade Oxygen Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 10.37 Bn. |

|

Forecast Period 2025-32 CAGR: |

7.5% |

Market Size in 2032: |

USD 18.49 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Delivery type |

|

||

|

By Indication |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Medical Grade Oxygen Market by Product Type (2018-2032)

4.1 Medical Grade Oxygen Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Compressed gas systems

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Portable oxygen concentrator systems (POCs)

4.5 Liquid oxygen systems

Chapter 5: Medical Grade Oxygen Market by Delivery type (2018-2032)

5.1 Medical Grade Oxygen Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Oxygen Delivery In Oxygen Concentrators

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Continuous Flow Dose Deliver

5.5 Pulse Mode Delivery

Chapter 6: Medical Grade Oxygen Market by Indication (2018-2032)

6.1 Medical Grade Oxygen Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Stationary Oxygen Concentrators

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Portable Oxygen Concentrators

Chapter 7: Medical Grade Oxygen Market by End User (2018-2032)

7.1 Medical Grade Oxygen Market Snapshot and Growth Engine

7.2 Market Overview

7.3 General and Specialized Hospitals

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Emergency Transports

7.5 Outpatient Units

7.6 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Medical Grade Oxygen Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 BORGES INTERNATIONAL GROUP(SPAIN)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 DEOLEO S.A. (SPAIN)

8.4 EU OLIVE OIL (U.K.)

8.5 ARTAJO OIL(SPAIN)

8.6 SALOV GROUP (ITALY)

8.7 ACEITES SANDÚA (SPAIN)

8.8 TUCAN OLIVE OIL COMPANY (U.S.)

8.9 DOMENICO MANCA S.P.A (ITALY)

8.10 MINERVA FOODS(GREECE)

8.11 OLINEXO S.L. (SPAIN)

8.12 NUTRINVESTE SGPS (PORTUGAL)

8.13 CURATION FOODS (U.S.)

8.14

Chapter 9: Global Medical Grade Oxygen Market By Region

9.1 Overview

9.2. North America Medical Grade Oxygen Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Product Type

9.2.4.1 Compressed gas systems

9.2.4.2 Portable oxygen concentrator systems (POCs)

9.2.4.3 Liquid oxygen systems

9.2.5 Historic and Forecasted Market Size by Delivery type

9.2.5.1 Oxygen Delivery In Oxygen Concentrators

9.2.5.2 Continuous Flow Dose Deliver

9.2.5.3 Pulse Mode Delivery

9.2.6 Historic and Forecasted Market Size by Indication

9.2.6.1 Stationary Oxygen Concentrators

9.2.6.2 Portable Oxygen Concentrators

9.2.7 Historic and Forecasted Market Size by End User

9.2.7.1 General and Specialized Hospitals

9.2.7.2 Emergency Transports

9.2.7.3 Outpatient Units

9.2.7.4 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Medical Grade Oxygen Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Product Type

9.3.4.1 Compressed gas systems

9.3.4.2 Portable oxygen concentrator systems (POCs)

9.3.4.3 Liquid oxygen systems

9.3.5 Historic and Forecasted Market Size by Delivery type

9.3.5.1 Oxygen Delivery In Oxygen Concentrators

9.3.5.2 Continuous Flow Dose Deliver

9.3.5.3 Pulse Mode Delivery

9.3.6 Historic and Forecasted Market Size by Indication

9.3.6.1 Stationary Oxygen Concentrators

9.3.6.2 Portable Oxygen Concentrators

9.3.7 Historic and Forecasted Market Size by End User

9.3.7.1 General and Specialized Hospitals

9.3.7.2 Emergency Transports

9.3.7.3 Outpatient Units

9.3.7.4 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Medical Grade Oxygen Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Product Type

9.4.4.1 Compressed gas systems

9.4.4.2 Portable oxygen concentrator systems (POCs)

9.4.4.3 Liquid oxygen systems

9.4.5 Historic and Forecasted Market Size by Delivery type

9.4.5.1 Oxygen Delivery In Oxygen Concentrators

9.4.5.2 Continuous Flow Dose Deliver

9.4.5.3 Pulse Mode Delivery

9.4.6 Historic and Forecasted Market Size by Indication

9.4.6.1 Stationary Oxygen Concentrators

9.4.6.2 Portable Oxygen Concentrators

9.4.7 Historic and Forecasted Market Size by End User

9.4.7.1 General and Specialized Hospitals

9.4.7.2 Emergency Transports

9.4.7.3 Outpatient Units

9.4.7.4 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Medical Grade Oxygen Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Product Type

9.5.4.1 Compressed gas systems

9.5.4.2 Portable oxygen concentrator systems (POCs)

9.5.4.3 Liquid oxygen systems

9.5.5 Historic and Forecasted Market Size by Delivery type

9.5.5.1 Oxygen Delivery In Oxygen Concentrators

9.5.5.2 Continuous Flow Dose Deliver

9.5.5.3 Pulse Mode Delivery

9.5.6 Historic and Forecasted Market Size by Indication

9.5.6.1 Stationary Oxygen Concentrators

9.5.6.2 Portable Oxygen Concentrators

9.5.7 Historic and Forecasted Market Size by End User

9.5.7.1 General and Specialized Hospitals

9.5.7.2 Emergency Transports

9.5.7.3 Outpatient Units

9.5.7.4 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Medical Grade Oxygen Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Product Type

9.6.4.1 Compressed gas systems

9.6.4.2 Portable oxygen concentrator systems (POCs)

9.6.4.3 Liquid oxygen systems

9.6.5 Historic and Forecasted Market Size by Delivery type

9.6.5.1 Oxygen Delivery In Oxygen Concentrators

9.6.5.2 Continuous Flow Dose Deliver

9.6.5.3 Pulse Mode Delivery

9.6.6 Historic and Forecasted Market Size by Indication

9.6.6.1 Stationary Oxygen Concentrators

9.6.6.2 Portable Oxygen Concentrators

9.6.7 Historic and Forecasted Market Size by End User

9.6.7.1 General and Specialized Hospitals

9.6.7.2 Emergency Transports

9.6.7.3 Outpatient Units

9.6.7.4 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Medical Grade Oxygen Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Product Type

9.7.4.1 Compressed gas systems

9.7.4.2 Portable oxygen concentrator systems (POCs)

9.7.4.3 Liquid oxygen systems

9.7.5 Historic and Forecasted Market Size by Delivery type

9.7.5.1 Oxygen Delivery In Oxygen Concentrators

9.7.5.2 Continuous Flow Dose Deliver

9.7.5.3 Pulse Mode Delivery

9.7.6 Historic and Forecasted Market Size by Indication

9.7.6.1 Stationary Oxygen Concentrators

9.7.6.2 Portable Oxygen Concentrators

9.7.7 Historic and Forecasted Market Size by End User

9.7.7.1 General and Specialized Hospitals

9.7.7.2 Emergency Transports

9.7.7.3 Outpatient Units

9.7.7.4 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Medical Grade Oxygen Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 10.37 Bn. |

|

Forecast Period 2025-32 CAGR: |

7.5% |

Market Size in 2032: |

USD 18.49 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Delivery type |

|

||

|

By Indication |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||