Meal Kit Market Synopsis

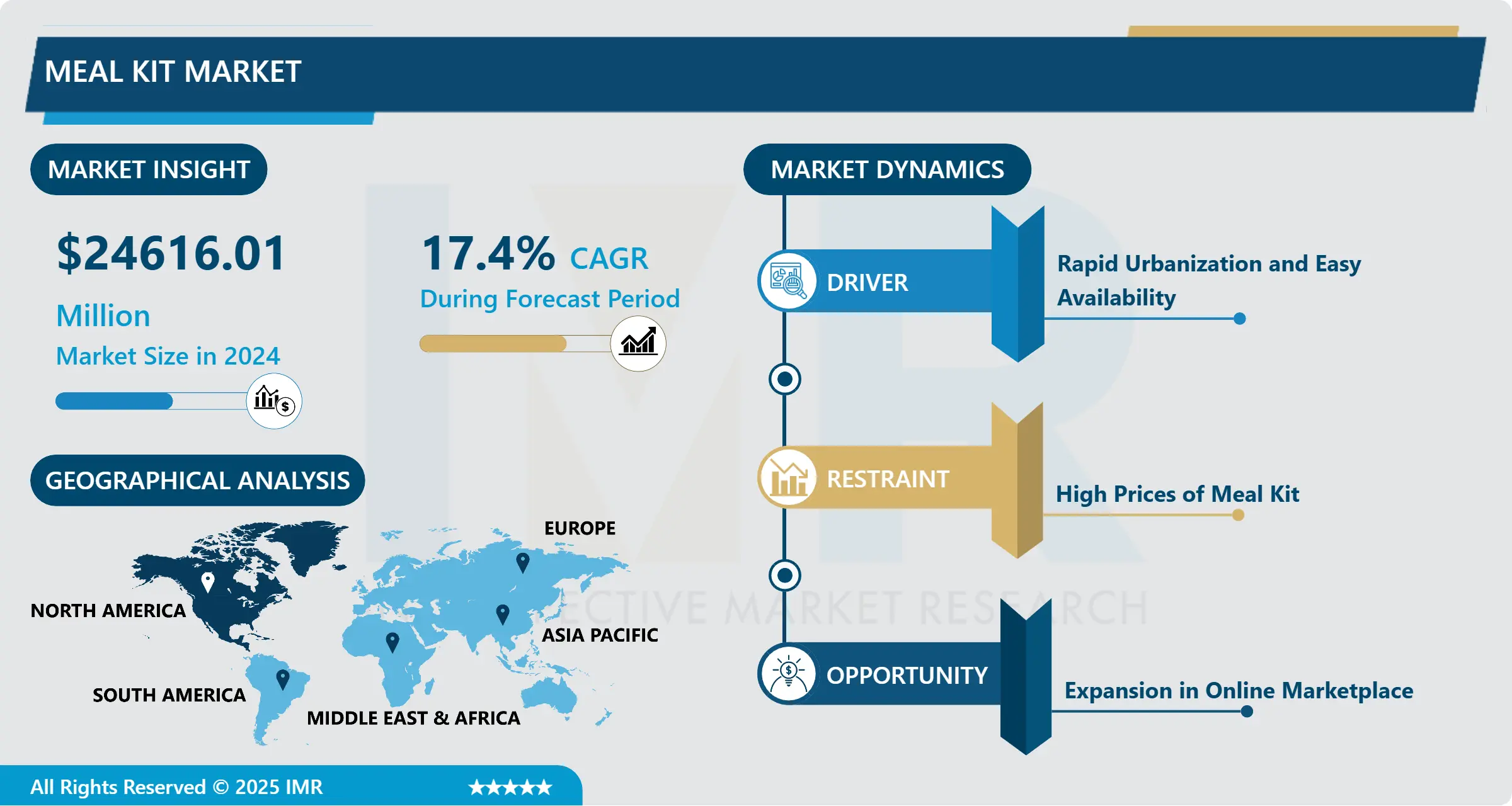

Meal Kit Market Size Was Valued at USD 24616.01 Million in 2024 and is Projected to Reach USD 88830.56 Million by 2032, Growing at a CAGR of 17.4% From 2025-2032.

Meal kit is a newly introduced concept in the food and beverages sector, where a customer gets half cooked or fully cooked meal at his doorstep. These services are designed to reduce the troubles of grocery shopping and meal planning, and to recreate the restaurant eating experience at one’s own desired place or home.

Meal kits also offer customers with customized food ingredients as per their choice for their family or for the individual use. As the meal kit service helps the customer to select healthy ingredients for their healthy life the whole year, this turns out to be a key factor for the market development of meal kit.

Growing preferences for homemade meals among young generation or millennials is expected to be a key element contributing to the market growth of meal kit. The meal kit delivery services are also popular among working couples, busy parents, those juggling with multiple jobs, and people with special diet needs who choose consuming pre-planned ingredients or meals so that they can prepare meals easily.

Such busy parents or individuals fuel the market growth as they believe that the price they pay for the services are justified as it provides numerous benefits, and are further expected to increase the market growth of meal kit in the forthcoming years.

Meal Kit Market Trend Analysis

Meal Kit Market Growth Drivers- Rapid Urbanization and Easy Availability

- The concept of meal kit offers customers cooked food meal as well as half cooked food meal which reduces their hassles of grocery shopping as well as planning for everyday meals. With rapidly growing urbanization in many developed and developing countries, customers get an exciting experience of recreating eating food in restaurants or hotels. Meal kits are growing rapidly owing to their easy availability and convenient nature across the world.

- Meal kits also offer customers to customize their meals according to their diet and fitness plans, which thereby drives the market growth. Moreover, the vendors provide easy recipes for the cook and eat option of meal kits so as to ensure that the customer is satisfied and retention rate is increased. In the busy and hectic schedule, meal kits play a significant role in providing timely and healthy food at an individual’s home or desired place with ease, which further is estimated to boost the market growth of meal kit in the projected years.

Meal Kit Market Opportunities- Expansion in Online Marketplace creates an Opportunity

- With providing excellent services of food meals and deliveries at doorstep, the meal kit market has an immense opportunity to expand through online platforms. In addition to this, some major players like Hello Fresh and Blue Apron have grabbed this opportunity and further created online marketplaces for subscribers to add required ingredients and grocery items to their meal purchases, such as proteins, produce, and pantry staples which can boost their healthy diet.

- Furthermore, the market has an opportunity to transform completely from subscription services into online marketplaces that can offer more than just meal kits. For instance, HelloFresh gained huge profit from its global customer base up from 2.5 to 4.2 million in just a few months which helped them to build loyalty and retain customers as well. Henceforth, with subscription plans, meal kit markets have a fast-growing opportunity to expand in online marketplace in the upcoming years.

Meal Kit Market Segment Analysis:

Meal Kit Market Segmented on the basis of offering, service, platform, meal type.

By Offering, cook and eat segment is expected to dominate the market during the forecast period

- The cook and eat segment dominate the global meat kit market and holds the largest revenue share. Growing demand for healthy food ingredients and the trend of cooking food at home worldwide is expected to expand the market of cook and eat meal delivery services over the projected period.

- Additionally, cooking is a great pastime and effective exercise for any individual that is suffering from anxiety, depression, or have a desire to maintain brain health. Henceforth, the cook and eat meal kit segment is expected to continue its dominance over the forecast among the masses.

By Meal Type, non-vegetarian segment held the largest share in 2024

- Non-vegetarian meal kit delivery service segment held the largest revenue share and dominated the meal kit market, and is estimated to continue its dominance in the upcoming years. This can be attributed to the popularity of non-vegetarian meal kits worldwide as well as the nutritional value associated with this segment.

- The growth of non-vegetarian segment can be attributed to the presence vitamins and proteins as well as minerals such as B12, A, B6, thiamine and niacin in meat, which make it appealing to consumers who desire to introduce lean protein in their diets.

Meal Kit Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The meal kit industry, characterized by the delivery of pre-portioned ingredients and recipes to consumers, has seen significant growth in North America. Factors contributing to this dominance include the busy lifestyles of consumers, a growing interest in home-cooked meals, and the convenience offered by meal kit services.

- The United States and Canada, in particular, have witnessed a surge in demand for meal kits, with numerous companies competing in the market. Major metropolitan areas have become hubs for meal kit delivery services, catering to the preferences of consumers seeking convenient, time-saving, and varied meal options.

- The region's well-established e-commerce infrastructure, coupled with a culture of embracing food innovations, has further fueled the meal kit market's growth. With consumers increasingly valuing the convenience of having fresh ingredients delivered to their doorsteps, North America is expected to continue dominating the meal kit market in the foreseeable future.

Meal Kit Market Top Key Players:

- Blue Apron (USA)

- Home Chef (USA)

- Sunbasket (USA)

- Purple Carrot (USA)

- Gobble (USA)

- Daily Harvest (USA)

- Freshly (USA)

- Factor75 (USA)

- Green Chef (USA)

- PlateJoy (USA)

- Misfits Market (USA)

- Preply (USA)

- Hello Bello (USA)

- Freshly Fit (USA)

- Quockery (USA)

- Every Plate (Germany)

- HelloFresh (Germany)

- Dinnerly (UK)

- Marley Spoon (Australia)

- Hello Chef Australia (Australia)

- Other Active Players

Key Industry Developments in the Meal Kit Market:

- In May 2024, Squeaky Bean, a leading UK brand in vegan alternatives, expanded its offerings with a meal kit and alt-meat snacks, enhancing the plant-based category in the UK. The launch includes the Hoisin Duck Style Pancakes Meal Kit and snack options like Southern Fried Straws, Duck and Hoisin Style Bites, and BBQ Pork Style Rolls

- In March 2024, Emily Mariko, a popular content creator known for showcasing easy and delicious recipes has partnered with Green Chef to create a new meal kit featuring eight farm-fresh dishes. The kit includes dishes like maple cauliflower bowls with seared tofu, sockeye salmon with sweet heat pan sauce, and ricotta pancakes with cherry maple syrup.

|

Global Meal Kit Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 24616.01 Mn. |

|

Forecast Period 2024-32 CAGR: |

17.4% |

Market Size in 2032: |

USD 88830.56 Mn. |

|

Segments Covered: |

By Offering |

|

|

|

By Serving |

|

||

|

By Platform |

|

||

|

By Meal Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Meal Kit Market by Offering (2018-2032)

4.1 Meal Kit Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Heat & Eat

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Cook & Eat

Chapter 5: Meal Kit Market by Serving (2018-2032)

5.1 Meal Kit Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Single

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Multiple

Chapter 6: Meal Kit Market by Platform (2018-2032)

6.1 Meal Kit Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Online

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Offline

Chapter 7: Meal Kit Market by Meal Type (2018-2032)

7.1 Meal Kit Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Vegetarian

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Non-Vegetarian

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Meal Kit Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 AGJUNCTION INC. (CANADA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 RAVEN INDUSTRIES INC. (U.S)

8.4 CNH INDUSTRIAL N.V. (U.K)

8.5 DEERE & COMPANY (U.S)

8.6 TRIMBLE INC. (U.S)

8.7 ITERIS INC. (U.S)

8.8 TOPCON CORPORATION (JAPAN)

8.9 PRECISIONHAWK (U.S)

8.10 SENSEFLY (CHESEAUX-SUR-LAUSANNE)

8.11 DICKEY-JOHN (AUBURN)

8.12 SST DEVELOPMENT GROUP INC. (U.S)

8.13 AGRIBOTIX LLC (U.S)

8.14

Chapter 9: Global Meal Kit Market By Region

9.1 Overview

9.2. North America Meal Kit Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Offering

9.2.4.1 Heat & Eat

9.2.4.2 Cook & Eat

9.2.5 Historic and Forecasted Market Size by Serving

9.2.5.1 Single

9.2.5.2 Multiple

9.2.6 Historic and Forecasted Market Size by Platform

9.2.6.1 Online

9.2.6.2 Offline

9.2.7 Historic and Forecasted Market Size by Meal Type

9.2.7.1 Vegetarian

9.2.7.2 Non-Vegetarian

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Meal Kit Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Offering

9.3.4.1 Heat & Eat

9.3.4.2 Cook & Eat

9.3.5 Historic and Forecasted Market Size by Serving

9.3.5.1 Single

9.3.5.2 Multiple

9.3.6 Historic and Forecasted Market Size by Platform

9.3.6.1 Online

9.3.6.2 Offline

9.3.7 Historic and Forecasted Market Size by Meal Type

9.3.7.1 Vegetarian

9.3.7.2 Non-Vegetarian

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Meal Kit Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Offering

9.4.4.1 Heat & Eat

9.4.4.2 Cook & Eat

9.4.5 Historic and Forecasted Market Size by Serving

9.4.5.1 Single

9.4.5.2 Multiple

9.4.6 Historic and Forecasted Market Size by Platform

9.4.6.1 Online

9.4.6.2 Offline

9.4.7 Historic and Forecasted Market Size by Meal Type

9.4.7.1 Vegetarian

9.4.7.2 Non-Vegetarian

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Meal Kit Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Offering

9.5.4.1 Heat & Eat

9.5.4.2 Cook & Eat

9.5.5 Historic and Forecasted Market Size by Serving

9.5.5.1 Single

9.5.5.2 Multiple

9.5.6 Historic and Forecasted Market Size by Platform

9.5.6.1 Online

9.5.6.2 Offline

9.5.7 Historic and Forecasted Market Size by Meal Type

9.5.7.1 Vegetarian

9.5.7.2 Non-Vegetarian

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Meal Kit Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Offering

9.6.4.1 Heat & Eat

9.6.4.2 Cook & Eat

9.6.5 Historic and Forecasted Market Size by Serving

9.6.5.1 Single

9.6.5.2 Multiple

9.6.6 Historic and Forecasted Market Size by Platform

9.6.6.1 Online

9.6.6.2 Offline

9.6.7 Historic and Forecasted Market Size by Meal Type

9.6.7.1 Vegetarian

9.6.7.2 Non-Vegetarian

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Meal Kit Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Offering

9.7.4.1 Heat & Eat

9.7.4.2 Cook & Eat

9.7.5 Historic and Forecasted Market Size by Serving

9.7.5.1 Single

9.7.5.2 Multiple

9.7.6 Historic and Forecasted Market Size by Platform

9.7.6.1 Online

9.7.6.2 Offline

9.7.7 Historic and Forecasted Market Size by Meal Type

9.7.7.1 Vegetarian

9.7.7.2 Non-Vegetarian

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Meal Kit Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 24616.01 Mn. |

|

Forecast Period 2024-32 CAGR: |

17.4% |

Market Size in 2032: |

USD 88830.56 Mn. |

|

Segments Covered: |

By Offering |

|

|

|

By Serving |

|

||

|

By Platform |

|

||

|

By Meal Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||