Key Market Highlights

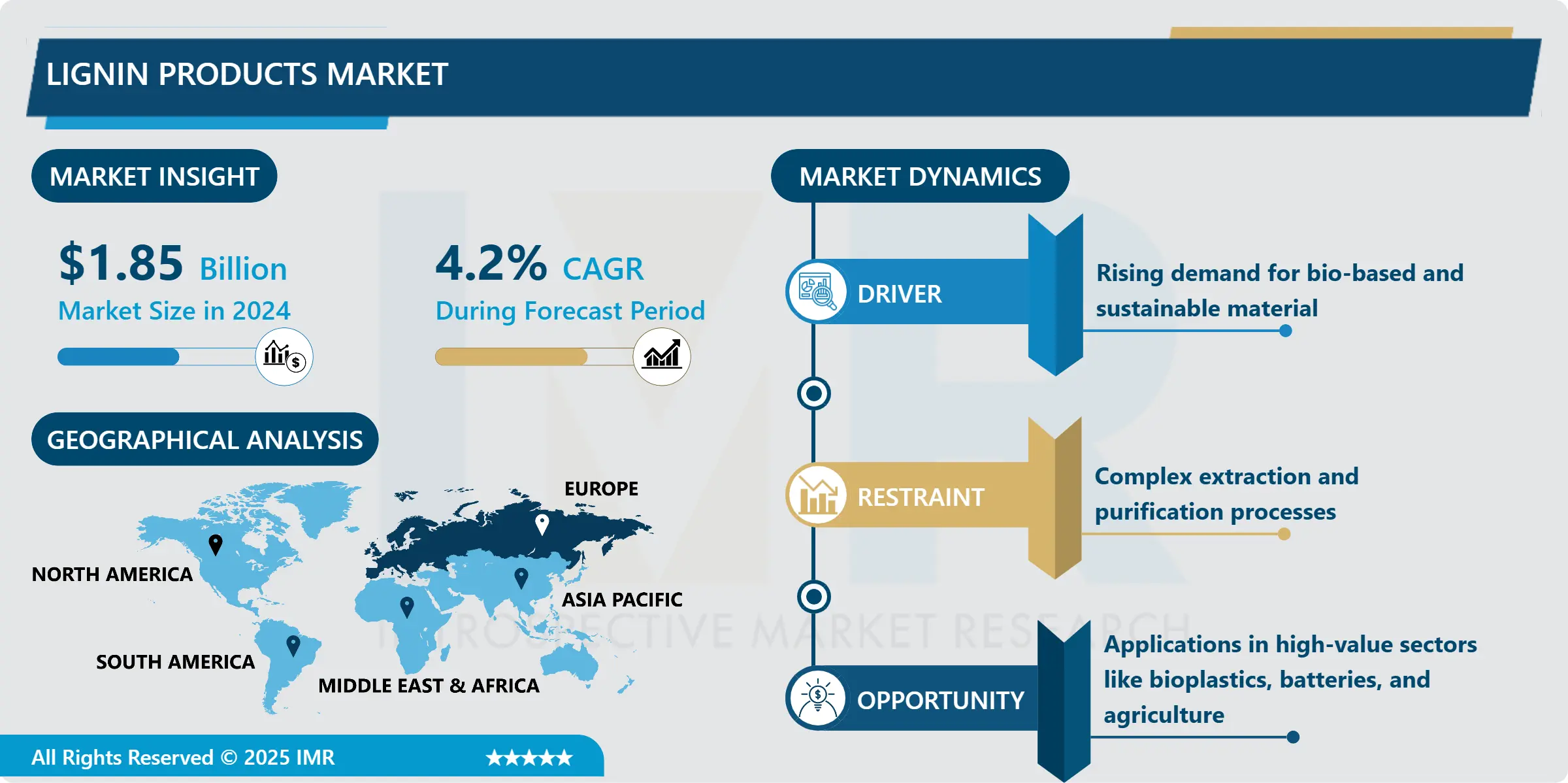

Lignin Products Market Size Was Valued at USD 1.85 billion in 2024, and is Projected to Reach USD 2.91 billion by 2035, Growing at a CAGR of 4.2% from 2025-2035.

- Market Size in 2024: USD 1.85 billion

- Projected Market Size by 2035: USD 2.91 billion

- CAGR (2025–2035): 4.2%

- Leading Market in 2024: Europe

- Fastest-Growing Market: Asia?Pacific

- By Type: The Agricultural Residue Lignin segment is anticipated to lead the market by accounting for 90% of the market share throughout the forecast period.

- By Application: The Plastics and Polymers segment is expected to capture 39.6% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: Europe region is projected to hold 35% of the market share during the forecast period.

- Active Players: Aditya Birla Chemicals (India), Asia Lignin Manufacturing Pvt. Ltd. (India), Borregaard LignoTech (Norway), Burgo Group S.p.A. (Italy), Changzhou Shanfeng Chemical Industry Co. Ltd. (China), Other Active Players

Lignin Products Market Synopsis:

The Lignin Products Market is gaining momentum as industries worldwide shift toward sustainable and bio-based alternatives. Lignin, a natural polymer derived mainly as a byproduct of the pulp and paper industry, is being increasingly utilized in applications such as binders, dispersants, adhesives, bioplastics, and carbon fibre composites. This growth is largely driven by rising environmental awareness, stricter emission regulations, and the global push for carbon-neutral manufacturing.

Lignin Products Market Dynamics and Trend Analysis:

Lignin Products Market Growth Driver - Rising demand for bio-based and sustainable materials

-

In recent years, there has been a strong global shift toward using eco-friendly and sustainable materials. This change is driven by growing concerns about climate change, pollution, and the need to reduce our dependence on fossil fuels. As a result, many industries are now looking for renewable alternatives that are better for the environment.

- Lignin, a natural substance found in plants and a byproduct of the paper and pulp industry, is gaining attention as a valuable material in this green transition. Instead of being discarded as waste, lignin can be processed and used in a variety of applications. These include making binders (used in construction and adhesives), dispersants (used in chemicals and cleaning products), and bio-based polymers (used to create plastics and coatings that are biodegradable or recyclable).

- One of the main reasons for this growing demand is the increasing pressure from governments and international organizations to reduce carbon emissions. Regulations are encouraging companies to switch to materials that are less harmful to the environment. Lignin fits this need perfectly, as it is abundant, renewable, and biodegradable.

- As technology improves and awareness grows, lignin is expected to play an even bigger role in the future of sustainable manufacturing, helping industries move toward cleaner and greener production processes.

Lignin Products Market Limiting Factor - Complex extraction and purification processes

-

While lignin has great potential as a sustainable material, one of the biggest challenges in using it effectively is the difficulty in extracting and purifying it. Lignin is usually obtained as a byproduct from the paper and pulp industry, but turning it into a high-quality, usable product is not easy.

- The extraction process is complicated and expensive, especially when high purity is required for advanced uses. Unlike materials that have a consistent structure, lignin's composition can vary greatly, depending on the type of wood used and the method of extraction. This variability makes it hard to produce lignin that performs the same way every time, which is a big problem for industries that need reliable and uniform materials, such as those producing carbon fibres, adhesives, or high-grade plastics.

- Because of these technical and cost-related issues, many companies are hesitant to invest in lignin-based products for more demanding applications. The lack of standardized processes and quality levels adds to the uncertainty, making it harder to scale up production or enter mainstream markets.

- To overcome this barrier, more research and innovation are needed to improve the efficiency, consistency, and affordability of lignin processing. Until then, these technical difficulties will continue to limit the full potential of lignin in high-performance industries.

Lignin Products Market Expansion Opportunity - Applications in high-value sectors like bioplastics, batteries, and agriculture

-

Lignin is no longer seen just as a waste product from the paper industry. Today, it is being explored for its potential in many high-value industries, opening up new business opportunities and markets. Thanks to ongoing research and innovation, lignin is now finding applications in areas such as bioplastics, batteries, and agriculture.

- In the field of energy storage, scientists are developing lignin-based anodes for batteries. These anodes could be a more sustainable and cost-effective alternative to traditional materials like graphite, helping make batteries cheaper and greener. This is especially promising for electric vehicles and renewable energy systems, where clean and efficient energy storage is essential.

- In bioplastics, lignin is being used to create eco-friendly alternatives to traditional petroleum-based plastics. These bio-based plastics are biodegradable and have a lower environmental impact, making them attractive in packaging, consumer goods, and more.

- In agriculture, lignin is being tested for use in controlled-release fertilizers, which release nutrients slowly over time. This helps crops grow more efficiently while reducing the risk of over-fertilization and environmental harm. Further innovations in nanolignin and lignin composites are also expanding its use in high-tech applications like coatings, foams, and even biomedical products. These developments show strong promise for lignin as a key material in future green technologies.

Lignin Products Market Challenge and Risk - Market fragmentation and lack of standardization

-

One of the major challenges facing the lignin products market is its fragmented structure. Currently, there are many different companies producing lignin across various regions, often focusing on specific applications like construction, agriculture, or chemicals. While this creates diversity, it also makes the market disorganized and inconsistent.

- A key issue is the lack of global standards for lignin production. There is no universally accepted method for processing lignin or measuring its quality. As a result, the purity, composition, and performance of lignin can vary greatly between suppliers. This inconsistency makes it difficult for manufacturers and end-users to rely on lignin products for large-scale or high-performance uses.

- For companies looking to adopt lignin in their production processes, this uncertainty can be a major barrier. Many prefer to stick with materials they know will deliver the same results every time, which puts lignin at a disadvantage despite its environmental benefits.

- Another concern is the dependence on the pulp and paper industry as the primary source of lignin. Any disruptions in that sector such as declining paper demand or supply chain issues can lead to shortages or price spikes in lignin availability.

- To truly unlock lignin's market potential, there needs to be greater standardization, collaboration, and investment in supply chain stability and quality control.

Lignin Products Market Segment Analysis:

Lignin Products Market is segmented based on Type, Application, End-Users, and Region

By Type, Lignin Products Segment is Expected to Dominate the Market During the Forecast Period

-

Lignin doesn’t only come from wood it can also be made from agricultural waste, which includes the leftover parts of crops like wheat straw, corn stalks, rice husks, and sugarcane bagasse. This type of lignin is known as agricultural residues lignin.

- Farmers often have a large amount of leftover plant material after harvesting. Instead of burning it or letting it go to waste, this crop residue can be turned into lignin through special processing. This is helpful for the environment because it reduces agricultural waste and creates useful, eco-friendly products from materials that would otherwise be discarded.

- Agricultural residues lignin is now being used in many green applications. One common use is in the production of biofuels, such as bioethanol and bio-pellets, which serve as cleaner alternatives to fossil fuels. It is also added to fertilizers to help slowly release nutrients to crops, improving efficiency in farming. Another growing use is in biodegradable plastics, which break down more easily in nature and help reduce plastic pollution.

- Because it is renewable, widely available, and sustainable, agricultural lignin is becoming a valuable resource. It not only supports the development of greener products but also offers farmers and industries a way to reduce waste and add value to agricultural byproducts.

By Application, Lignin Products Segment Held the Largest Share in 2024

-

Lignin has a high energy value, which makes it a great option for producing clean and renewable energy. Instead of being thrown away as waste from the paper or farming industries, lignin can be turned into useful energy products. For example, it can be used to make bioethanol, a fuel that can power vehicles and machines while causing less pollution than regular gasoline. It can also be made into pellets or briquettes, which are burned to produce heat or electricity in a cleaner and more sustainable way than coal or oil. Because lignin is natural and renewable, it’s an important part of the shift toward green energy solutions.

- Lignin is also being used to create eco-friendly plastics. Unlike regular plastics, which are made from oil and take hundreds of years to break down, lignin-based plastics are more biodegradable and better for the environment. These sustainable plastics are used in many everyday products, such as packaging materials, building parts, and car components. Since lignin is widely available and plant-based, using it in plastics helps reduce plastic pollution and fossil fuel use.Bottom of Form

Lignin Products Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast Period

-

Europe is currently one of the top regions in the world for the production and use of lignin-based products. One of the main reasons for this is Europe’s strong pulp and paper industry, which produces large amounts of lignin as a byproduct. Instead of letting it go to waste, many companies in Europe are turning this lignin into useful and eco-friendly products.

- Countries like Germany, Sweden, and France are leading the way in using lignin for making green materials, bio-based chemicals, and sustainable composites. Among these, Germany stands out, accounting for about 28% of global lignin product consumption, according to reports from Econ Market Research and Market Growth Reports. This shows how seriously the country is investing in bio-based solutions.

- Another important factor is that the European Union has strong rules and policies that support the use of renewable resources. These regulations encourage companies to invest in sustainable technologies and find alternatives to fossil-based materials. As a result, Europe is seeing increased research and development (R&D) focused on lignin-based innovations.

- Overall, Europe’s combination of industrial strength, environmental responsibility, and policy support makes it a global leader in the lignin products market

Lignin Products Market Active Players:

- Aditya Birla Chemicals (India)

- Asia Lignin Manufacturing Pvt. Ltd. (India)

- Borregaard LignoTech (Norway)

- Burgo Group S.p.A. (Italy)

- Changzhou Shanfeng Chemical Industry Co. Ltd. (China)

- Domsjö Fabriker (Aditya Birla Group) (Sweden / India)

- Domtar Corporation (Canada)

- Green Agrochem Pvt. Ltd. (India)

- Green Value SA (United States)

- Ingevity Corporation (United States)

- KMT Polymers (India)

- Lignin Industries AB (Sweden)

- Liquid Lignin Company LLC (United States)

- MetGen Oy (Finland)

- Metsä Group (Finland)

- MWV (MeadWestvaco/WestRock) (United States)

- Nippon Paper Industries Co., Ltd. (Japan)

- Northway Lignin Chemical (United States)

- Rayonier Advanced Materials (Tembec) (United States / Canada)

- Sappi Lanxess (South Africa / Germany)

- Schweighofer Fiber (Austria)

- Shenyang Xingzhenghe Chemical (China)

- Stora Enso Oyj (Finland / Sweden)

- Sweetwater Energy (United States)

- The Dallas Group of America, Inc. (United States)

- UPM Biochemicals (UPM-Kymmene) (Finland)

- Valmet Corporation (Finland)

- Weili Group (China)

- West Fraser (Canada)

- Xinyi Feihuang Chemical (China)

- Other Active Players

|

Lignin Products Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 1.85 billion |

|

Forecast Period 2025-35 CAGR: |

4.2 % |

Market Size in 2035: |

USD 2.91 billion |

|

Segments Covered: |

By Source Type |

|

|

|

By Application |

|

||

|

By Process |

|

||

|

By Form |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Lignin Products Market by Source (2018-2035)

4.1 Lignin Products Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Wood-based Lignin

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Agricultural Residues Lignin

Chapter 5: Lignin Products Market by Application (2018-2035)

5.1 Lignin Products Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Biofuels and Bioenergy

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Plastics and Polymers

Chapter 6: Lignin Products Market by Form (2018-2035)

6.1 Lignin Products Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Powdered Lignin

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Liquid Lignin

Chapter 7: Lignin Products Market by End-Use Industry (2018-2035)

7.1 Lignin Products Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Automotive

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Construction

Chapter 8: Lignin Products Market by Process (2018-2035)

8.1 Lignin Products Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Organosolv Lignin

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Kraft Lignin

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Lignin Products Market Share by Manufacturer/Service Provider(2024)

9.1.3 Industry BCG Matrix

9.1.4 PArtnerships, Mergers & Acquisitions

9.2 ADITYA BIRLA CHEMICALS (INDIA)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Recent News & Developments

9.2.10 SWOT Analysis

9.3 ASIA LIGNIN MANUFACTURING PVT. LTD. (INDIA)

9.4 BORREGAARD LIGNOTECH (NORWAY)

9.5 BURGO GROUP S.P.A. (ITALY)

9.6 CHANGZHOU SHANFENG CHEMICAL INDUSTRY CO. LTD. (CHINA)

9.7 DOMSJÖ FABRIKER (ADITYA BIRLA GROUP) (SWEDEN / INDIA)

9.8 DOMTAR CORPORATION (CANADA)

9.9 GREEN AGROCHEM PVT. LTD. (INDIA)

9.10 GREEN VALUE SA (UNITED STATES)

9.11 INGEVITY CORPORATION (UNITED STATES)

9.12 KMT POLYMERS (INDIA)

9.13 LIGNIN INDUSTRIES AB (SWEDEN)

9.14 LIQUID LIGNIN COMPANY LLC (UNITED STATES)

9.15 METGEN OY (FINLAND)

9.16 METSÄ GROUP (FINLAND)

9.17 MWV (MEADWESTVACO/WESTROCK) (UNITED STATES)

9.18 NIPPON PAPER INDUSTRIES CO.

9.19 LTD. (JAPAN)

9.20 NORTHWAY LIGNIN CHEMICAL (UNITED STATES)

9.21 RAYONIER ADVANCED MATERIALS (TEMBEC) (UNITED STATES / CANADA)

9.22 SAPPI LANXESS (SOUTH AFRICA / GERMANY)

9.23 SCHWEIGHOFER FIBER (AUSTRIA)

9.24 SHENYANG XINGZHENGHE CHEMICAL (CHINA)

9.25 STORA ENSO OYJ (FINLAND / SWEDEN)

9.26 SWEETWATER ENERGY (UNITED STATES)

9.27 THE DALLAS GROUP OF AMERICA

9.28 INC. (UNITED STATES)

9.29 UPM BIOCHEMICALS (UPM-KYMMENE) (FINLAND)

9.30 VALMET CORPORATION (FINLAND)

9.31 WEILI GROUP (CHINA)

9.32 WEST FRASER (CANADA)

9.33 XINYI FEIHUANG CHEMICAL (CHINA)

9.34 AND OTHER ACTIVE PLAYERS.

Chapter 10: Global Lignin Products Market By Region

10.1 Overview

10.2. North America Lignin Products Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecast Market Size by Country

10.2.4.1 US

10.2.4.2 Canada

10.2.4.3 Mexico

10.3. Eastern Europe Lignin Products Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecast Market Size by Country

10.3.4.1 Russia

10.3.4.2 Bulgaria

10.3.4.3 The Czech Republic

10.3.4.4 Hungary

10.3.4.5 Poland

10.3.4.6 Romania

10.3.4.7 Rest of Eastern Europe

10.4. Western Europe Lignin Products Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecast Market Size by Country

10.4.4.1 Germany

10.4.4.2 UK

10.4.4.3 France

10.4.4.4 The Netherlands

10.4.4.5 Italy

10.4.4.6 Spain

10.4.4.7 Rest of Western Europe

10.5. Asia Pacific Lignin Products Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecast Market Size by Country

10.5.4.1 China

10.5.4.2 India

10.5.4.3 Japan

10.5.4.4 South Korea

10.5.4.5 Malaysia

10.5.4.6 Thailand

10.5.4.7 Vietnam

10.5.4.8 The Philippines

10.5.4.9 Australia

10.5.4.10 New Zealand

10.5.4.11 Rest of APAC

10.6. Middle East & Africa Lignin Products Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecast Market Size by Country

10.6.4.1 Turkiye

10.6.4.2 Bahrain

10.6.4.3 Kuwait

10.6.4.4 Saudi Arabia

10.6.4.5 Qatar

10.6.4.6 UAE

10.6.4.7 Israel

10.6.4.8 South Africa

10.7. South America Lignin Products Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecast Market Size by Country

10.7.4.1 Brazil

10.7.4.2 Argentina

10.7.4.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

Chapter 12 Our Thematic Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Chapter 13 Case Study

Chapter 14 Appendix

14.1 Sources

14.2 List of Tables and figures

14.3 Short Forms and Citations

14.4 Assumption and Conversion

14.5 Disclaimer

|

Lignin Products Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 1.85 billion |

|

Forecast Period 2025-35 CAGR: |

4.2 % |

Market Size in 2035: |

USD 2.91 billion |

|

Segments Covered: |

By Source Type |

|

|

|

By Application |

|

||

|

By Process |

|

||

|

By Form |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||