LiDAR Services Market Synopsis:

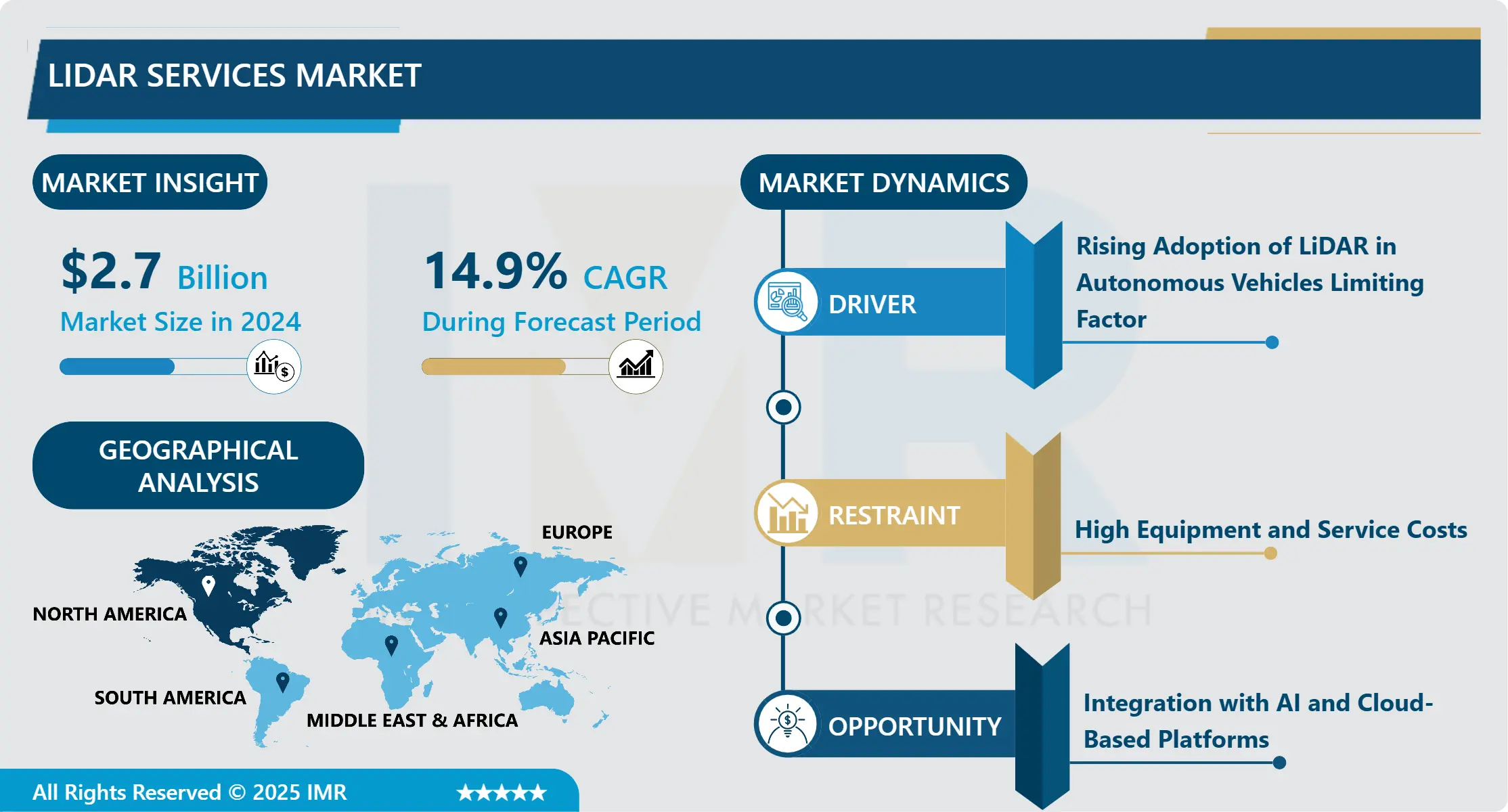

Market Size Was Valued at USD 2.7 Billion in 2024, and is Projected to Reach USD 8.20 Billion by 2032, Growing at a CAGR of 14.9% from 2025–2032.

Light Detection and Ranging (LiDAR) is a remote sensing technology that utilises pulsed laser waves to measure variable distances to the Earth’s surface. The increasing adoption of LiDAR services in autonomous vehicles, smart city infrastructure, agriculture, mining, and environmental monitoring is fueling market growth globally.

The technology offers enhanced precision, real-time data processing, and 3D mapping capabilities, enabling faster and more accurate decision-making across various industries. Growing investments in infrastructure development, increasing demand for high-resolution spatial data, and supportive government initiatives are expected to boost the market.

Globally, LiDAR adoption is surging across sectors such as autonomous vehicles, smart cities, agriculture, mining, and environmental monitoring. In autonomous driving, for example, LiDAR enables vehicles to detect obstacles and navigate safely. Smart city infrastructure supports urban planning and asset management through detailed mapping. In agriculture, LiDAR helps assess soil quality and optimize irrigation, while in mining, it enhances site analysis and operational safety.

This growth is further propelled by rising investments in infrastructure, the demand for accurate geospatial data, and government-backed innovation initiatives. As a result, LiDAR is emerging as a cornerstone technology for modern industry and urban development.

LiDAR Services Market Market Growth and Trend Analysis:

LiDAR Services Market Growth Driver- Rising Adoption of LiDAR in Autonomous Vehicles Limiting Factor

- LiDAR (Light Detection and Ranging) technology is becoming a cornerstone in the development of autonomous vehicles due to its precision in detecting objects and mapping terrain in real-time. Unlike traditional cameras or radar systems, LiDAR provides high-resolution 3D imagery that enables vehicles to see their environment with exceptional clarity, even in low-light conditions.

- Major automotive and tech companies such as Tesla, Waymo, and Ford are investing heavily in integrating LiDAR systems into self-driving prototypes. This push is driven by the need for robust safety systems capable of accurately identifying pedestrians, road edges, and obstacles. As autonomous driving technology progresses toward commercialization, LiDAR’s role becomes increasingly critical in meeting stringent safety standards and navigating complex traffic environments.

- Consequently, this trend is a major growth driver for the LiDAR market, fueling innovation, partnerships, and increased demand across the automotive and mobility sectors.

LiDAR Services Market Limiting Factor- High Equipment and Service Costs

- Despite its advantages, the widespread adoption of LiDAR technology faces a significant hurdle due to its high costs. LiDAR systems can range from several thousand to tens of thousands of dollars, depending on the resolution, range, and scanning capability. Additionally, the operational cost of LiDAR services including data acquisition, processing, and interpretation can be substantial, especially for small businesses, local governments, or organizations in developing countries.

- This price barrier often discourages adoption in applications where cost sensitivity is paramount. For instance, while LiDAR can greatly benefit infrastructure planning or environmental monitoring, limited budgets often restrict its use to pilot projects or high-priority zones. Although technological advancements and economies of scale are gradually reducing hardware costs, affordability remains a key concern. Without significant price drops or funding support, the high cost continues to limit LiDAR's scalability, particularly in low-resource environments or small-scale commercial use cases.

LiDAR Services Market Expansion Opportunity- Integration with AI and Cloud-Based Platforms

- The integration of LiDAR with artificial intelligence (AI) and cloud computing represents a transformative opportunity for the market. By combining real-time LiDAR data with AI algorithms, organizations can derive actionable insights such as identifying infrastructure wear, forecasting environmental changes, or automating traffic management. Cloud platforms enable the storage, sharing, and processing of massive LiDAR datasets, overcoming traditional limitations of local hardware and facilitating collaboration across geographic locations. This fusion supports advanced use cases like predictive maintenance in smart cities or real-time hazard detection in autonomous navigation.

- Cloud-based platforms improve access to LiDAR analytics by offering software as service (SaaS) models, allowing smaller firms to tap into powerful computational resources without major capital investment. As digital ecosystems evolve, this synergy enhances scalability, accuracy, and accessibility broadening the market reach of LiDAR technology and enabling sophisticated applications across sectors such as logistics, agriculture, and disaster response.

LiDAR Services Market Challenge Barrier- Data Processing and Management Complexity

- One of the major challenges facing the LiDAR industry is the complexity of data processing and management. A single LiDAR scan can generate millions of data points, forming dense 3D point clouds that require specialized software and high-performance computing for interpretation. This volume of data demands robust infrastructure for storage, real-time processing, and analysis.

- Moreover, to extract meaningful insights such as object classification, topographic mapping, or vegetation analysis organizations must employ skilled technicians proficient in geospatial analysis, machine learning, and software engineering. The shortage of such expertise, coupled with the technical demands of handling unstructured LiDAR data, can delay project timelines and inflate operational costs. Additionally, interoperability challenges between different LiDAR platforms and software ecosystems can hinder workflow efficiency. Without streamlined processing solutions and user-friendly tools, the full potential of LiDAR technology remains underutilized, particularly in non-specialist industries or regions lacking advanced digital infrastructure.

Market Segment Analysis:

The Market Is Segmented Based On Type, Application, End-Users, And Region

By Type, Aerial LiDAR Segment is Expected to Dominate the Market During the Forecast Period

- Aerial LiDAR leads the LiDAR market due to its unmatched capability in large-scale and high-precision mapping. Deployed via aircraft, drones, or helicopters, Aerial LiDAR captures expansive geographic areas quickly and efficiently, making it ideal for applications such as topographic surveys, forest canopy assessments, and flood risk modeling.

- Its advantage lies in the ability to access remote or difficult terrains and provide detailed elevation models with minimal human intervention. Governments and environmental agencies extensively use aerial LiDAR for monitoring natural disasters, managing forestry resources, and planning urban development. Additionally, the increased use of unmanned aerial vehicles (UAVs) in commercial applications has made Aerial LiDAR more accessible and cost-effective. Its growing utility in diverse sectors such as agriculture, mining, and infrastructure planning ensures this segment maintains dominance.

- Continued technological advancements, such as improved sensors and real-time data processing, further reinforce aerial LiDAR’s leading market position.

By Application, Corridor Mapping Segment Held the Largest Share in 2024

- Corridor mapping emerged as the leading application segment in 2024, This technique involves the creation of detailed linear maps, crucial for planning and monitoring transportation networks such as roads, railways, and utility pipelines. LiDAR's high-resolution data supports accurate terrain modeling and obstacle detection, making it indispensable in route optimization and risk mitigation for infrastructure development. The technology reduces survey time and costs significantly compared to traditional methods while increasing safety by minimizing on-ground exposure.

- Governments and private firms rely on corridor mapping for regulatory compliance, environmental assessments, and project feasibility studies. In rapidly urbanizing areas, corridor mapping helps streamline large-scale public transportation and utility projects. Moreover, as the demand for intelligent transport systems and smart infrastructure grows, LiDAR-enabled corridor mapping is set to become even more integral to urban planning, reinforcing its dominance in the application segment.

Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America is projected to remain the dominant region in the global LiDAR market, thanks to substantial technological investments and early adoption across key industries. The U.S. and Canada are leading the charge, driven by rapid advancements in autonomous vehicles, smart infrastructure, and national defence technologies.

- The U.S. automotive sector, for example, is heavily investing in LiDAR for advanced driver assistance systems (ADAS) and autonomous vehicle testing. Simultaneously, Canadian and U.S. defence agencies are integrating LiDAR into reconnaissance, surveillance, and terrain mapping applications. Environmental agencies use LiDAR for forest management, climate monitoring, and disaster response planning.

- Additionally, industries such as construction, agriculture, and utilities are leveraging LiDAR for precision mapping and asset monitoring. Robust infrastructure, strong government funding, and a mature technology ecosystem give North America a competitive edge. Continued innovation and strategic partnerships are likely to sustain its leadership in the global LiDAR market over the forecast period.

Market Active Players:

- FARO Technologies Inc. (United States)

- Hexagon AB (Sweden)

- Innoviz Technologies Ltd. (Israel)

- Leica Geosystems AG (Switzerland)

- Luminar Technologies Inc. (United States)

- Quanergy Systems Inc. (United States)

- RIEGL Laser Measurement Systems GmbH (Austria)

- Teledyne Technologies Incorporated (United States)

- Trimble Inc. (United States)

- Velodyne Lidar Inc. (United States)

- Other Active Players

Key Industry Developments in the LiDAR Services Market:

- March 2025: Velodyne Lidar launched the latest solid-state LiDAR sensor optimized for urban mobility and autonomous vehicle platforms.

- January 2025: Trimble announced an AI-enhanced cloud processing system to streamline LiDAR data analytics for civil engineering.

- November 2024: Hexagon AB acquired a majority stake in a leading drone-based LiDAR survey company to expand its aerial services footprint in Asia Pacific.

|

LiDAR Service Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.7 Bn. |

|

Forecast Period 2025-32 CAGR: |

14.9% |

Market Size in 2032: |

USD 8.20 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End -User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge Barrier |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: LiDAR Service Market by By Type (2018-2032)

4.1 LiDAR Service Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Aerial LiDAR

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Terrestrial LiDAR

4.5 Mobile LiDAR

4.6 UAV LiDAR

Chapter 5: LiDAR Service Market by Application (2018-2032)

5.1 LiDAR Service Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Corridor Mapping

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Engineering

5.5 Environment

5.6 ADAS & Driverless Cars)

Chapter 6: LiDAR Service Market by End-User (2018-2032)

6.1 LiDAR Service Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Construction

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Automotive

6.5 Agriculture

6.6 Oil & Gas

6.7 Mining

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 LiDAR Service Market Share by Manufacturer/Service Provider(2024)

7.1.3 Industry BCG Matrix

7.1.4 PArtnerships, Mergers & Acquisitions

7.2 FARO TECHNOLOGIES INC. (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Recent News & Developments

7.2.10 SWOT Analysis

7.3 HEXAGON AB (SWEDEN)

7.4 INNOVIZ TECHNOLOGIES LTD. (ISRAEL)

7.5 LEICA GEOSYSTEMS AG (SWITZERLAND)

7.6 LUMINAR TECHNOLOGIES INC. (UNITED STATES)

7.7 QUANERGY SYSTEMS INC. (UNITED STATES)

7.8 RIEGL LASER MEASUREMENT SYSTEMS GMBH (AUSTRIA)

7.9 TELEDYNE TECHNOLOGIES INCORPORATED (UNITED STATES)

7.10 TRIMBLE INC. (UNITED STATES)

7.11 VELODYNE LIDAR INC. (UNITED STATES)

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global LiDAR Service Market By Region

8.1 Overview

8.2. North America LiDAR Service Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecast Market Size by Country

8.2.4.1 US

8.2.4.2 Canada

8.2.4.3 Mexico

8.3. Eastern Europe LiDAR Service Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecast Market Size by Country

8.3.4.1 Russia

8.3.4.2 Bulgaria

8.3.4.3 The Czech Republic

8.3.4.4 Hungary

8.3.4.5 Poland

8.3.4.6 Romania

8.3.4.7 Rest of Eastern Europe

8.4. Western Europe LiDAR Service Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecast Market Size by Country

8.4.4.1 Germany

8.4.4.2 UK

8.4.4.3 France

8.4.4.4 The Netherlands

8.4.4.5 Italy

8.4.4.6 Spain

8.4.4.7 Rest of Western Europe

8.5. Asia Pacific LiDAR Service Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecast Market Size by Country

8.5.4.1 China

8.5.4.2 India

8.5.4.3 Japan

8.5.4.4 South Korea

8.5.4.5 Malaysia

8.5.4.6 Thailand

8.5.4.7 Vietnam

8.5.4.8 The Philippines

8.5.4.9 Australia

8.5.4.10 New Zealand

8.5.4.11 Rest of APAC

8.6. Middle East & Africa LiDAR Service Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecast Market Size by Country

8.6.4.1 Turkiye

8.6.4.2 Bahrain

8.6.4.3 Kuwait

8.6.4.4 Saudi Arabia

8.6.4.5 Qatar

8.6.4.6 UAE

8.6.4.7 Israel

8.6.4.8 South Africa

8.7. South America LiDAR Service Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecast Market Size by Country

8.7.4.1 Brazil

8.7.4.2 Argentina

8.7.4.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

Chapter 10 Our Thematic Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Chapter 11 Analyst Viewpoint and Conclusion

Chapter 12 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Chapter 13 Case Study

Chapter 14 Appendix

10.1 Sources

10.2 List of Tables and figures

10.3 Short Forms and Citations

10.4 Assumption and Conversion

10.5 Disclaimer

|

LiDAR Service Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.7 Bn. |

|

Forecast Period 2025-32 CAGR: |

14.9% |

Market Size in 2032: |

USD 8.20 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End -User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge Barrier |

|

||

|

Companies Covered in the Report: |

|

||