Knowledge Management Software Market Synopsis

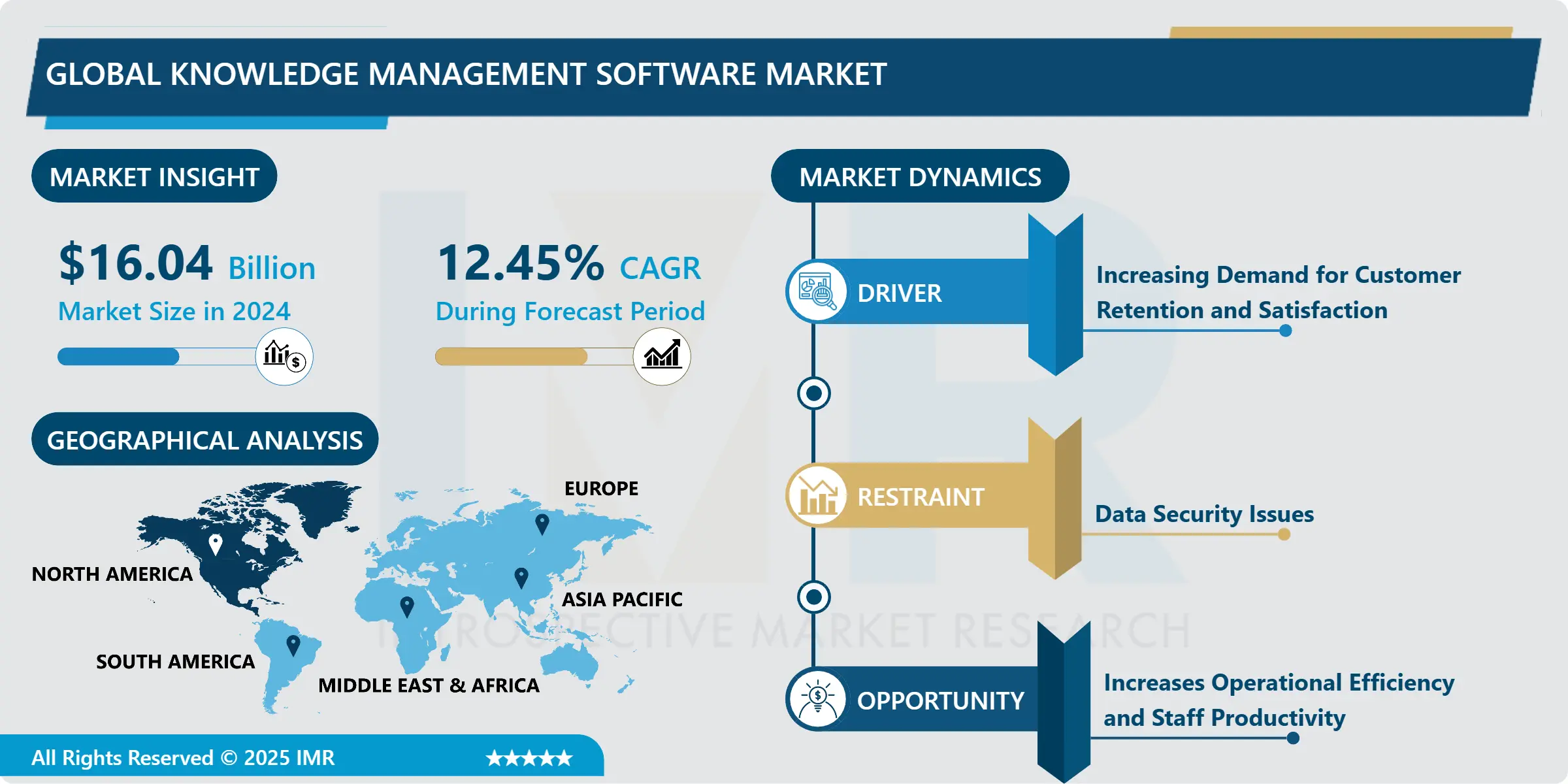

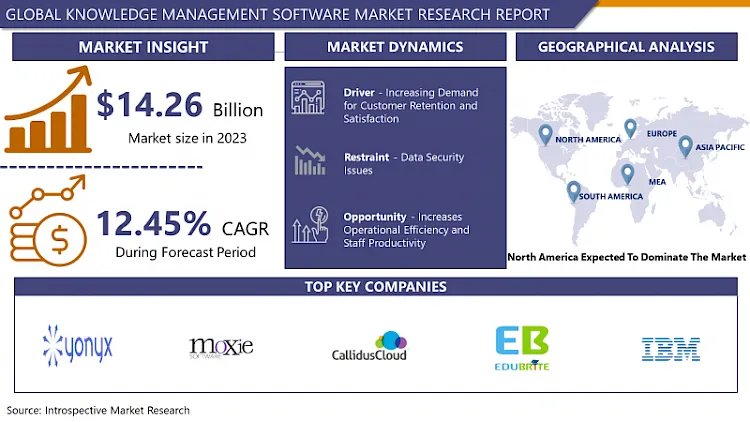

The knowledge Management Software Market Size Was Valued at USD 16.04 Billion in 2024 and is Projected to Reach USD 41.01 Billion by 2032, Growing at a CAGR of 12.45% From 2025-2032.

Knowledge Management Software (KMS) refers to digital platforms designed to organize, share, and leverage organizational knowledge effectively. These systems facilitate the creation, storage, retrieval, and dissemination of information, fostering collaboration and innovation within businesses. KMS typically features functionalities like document management, search capabilities, social networking tools, and analytics to enhance decision-making. By centralizing knowledge resources, KMS streamlines workflows, improves productivity, and ensures continuous learning and improvement across an organization. The Knowledge Management Software Market is experiencing rapid growth, driven by the increasing need for efficient knowledge sharing and collaboration across various industries. With organizations recognizing the importance of leveraging their intellectual capital, the market is witnessing a surge in demand for advanced knowledge management solutions.

Cloud-based deployment offers scalability, flexibility, and cost-effectiveness, making it attractive for businesses of all sizes. On-premises solutions continue to exist, particularly in industries with stringent security and compliance requirements, but cloud-based options are gaining traction due to their accessibility and ease of implementation. Large businesses have traditionally been among the initial to adopt new technologies, although small and medium-sized businesses (SMEs) are starting to realize how valuable these solutions are for improving efficiency and promoting creativity. Vendors have modified their products as an outcome of satisfying the particular requirements and financial constraints of SMEs. Industries, such as manufacturing, BFSI (banking, financial services, and insurance), IT & telecom, retail, healthcare, and logistics make up the end-user ecosystem for knowledge management software. The industry faces various knowledge management challenges to deal with, such as supply chain optimization in logistics and regulatory compliance in healthcare. Vendors have customized their offerings to target certain issues and provide observable commercial results.

Knowledge Management Software Market Trend Analysis

Increasing Demand for Customer Retention and Satisfaction

- Customer-oriented strategies are recognized as essential in fostering customer-centric environments, empowering businesses to forge stronger relationships with influential customers through effective knowledge management. This, in turn, cultivates loyalty and confers a competitive edge. Leveraging knowledge management alongside customer relationship management (CRM) yields manifold benefits, including ideation and delivery of superior services. Customer knowledge, a linchpin in this synergy, enables tailored offerings and enhanced customer satisfaction, bolstering economic viability.

- The knowledge management systems play an essential role in customer service enhancement, fostering positive connections and boosting return on investment. By deciphering consumer search patterns and preferences, these systems equip businesses to support and stimulate long-term client relationships. The escalating demand for customer retention and satisfaction acts as a catalyst for market growth, underscoring the importance of knowledge management software. Businesses prioritize customer-centricity, and the imperative for robust knowledge management solutions intensifies, propelling market expansion.

Increases Operational Efficiency and Staff Productivity

- Businesses have to optimize worker productivity and staff utilization in light of the growing competition. This requirement is fulfilled by knowledge management software, that improves productivity in general by optimizing workflows, cutting down on mistakes, and promoting smooth communication and teamwork.

- Knowledge management software helps businesses stay ahead in competitive marketplaces by directing product development efforts and encouraging innovation through the use of both internal and external input. Organizations may obtain a competitive advantage by using knowledge management systems to expedite business decisions by providing timely and pertinent information.

- The integration of management strategies such as strategic decision-making and technical implementations into knowledge management systems enables companies to effectively detect, develop, and utilize the skills and abilities of their workforce. It helps in retaining valuable expertise but also accelerates the onboarding process for new employees, leading to increased employee performance and shortened adaptation periods.

- The knowledge management software market presents an opportunity for businesses to drive market growth by improving operational efficiency, enhancing staff productivity, fostering innovation, and gaining a competitive advantage through effective knowledge utilization.

Knowledge Management Software Market Segment Analysis:

Knowledge Management Software Market is Segmented based on Deployment Type, Organization Size, and End-User.

By Type, On-Premises segment is expected to dominate the market during the forecast period

- The Knowledge Management Software Market is dominated by the On-Premises segment for numerous significant causes. Sensitive information and exclusive knowledge are best kept inside the physical infrastructure of many major organizations for security and compliance concerns, particularly those in highly regulated areas like banking and healthcare. Concerns regarding data security and privacy are addressed by on-premises solutions, that enable these businesses more control over their infrastructure and data.

- The on-premises deployments offer better flexibility and customization possibilities over cloud-based solutions, some companies might have special customization needs or legacy systems which render them more suitable. While cloud-based solutions might prove practical or compliant in certain circumstances, on-premises solutions tend to be more desirable to enterprises with limited internet access or those operating in locations with stringent data residency regulations. These elements support the On-Premises segment's predicted dominance in the market for knowledge management software.

By End-User, IT & Telecom segment held the largest share in 2024

- The IT and telecom sectors depend significantly on the effective administration of huge amounts of data and information, proving knowledge management crucial for their business operations. Within IT and telecom firms, knowledge management software provides ways to properly organize, store, and access this data, improving productivity and decision-making processes.

- The IT and telecom industries are experiencing rapid advances in technology, offering knowledge management an essential tool for keeping up with changing client expectations, laws, and trends. Strong knowledge management systems are increasingly needed as these sectors grow on a worldwide scale.

- Cloud-based knowledge management software solutions are becoming increasingly popular, which is in line with the IT and telecom industries' preference for flexible and scalable technology. The growth of the knowledge management software market depends on how the end-user, IT, and telecom segment is positioned as an outcome of the convergence of technology and information management.

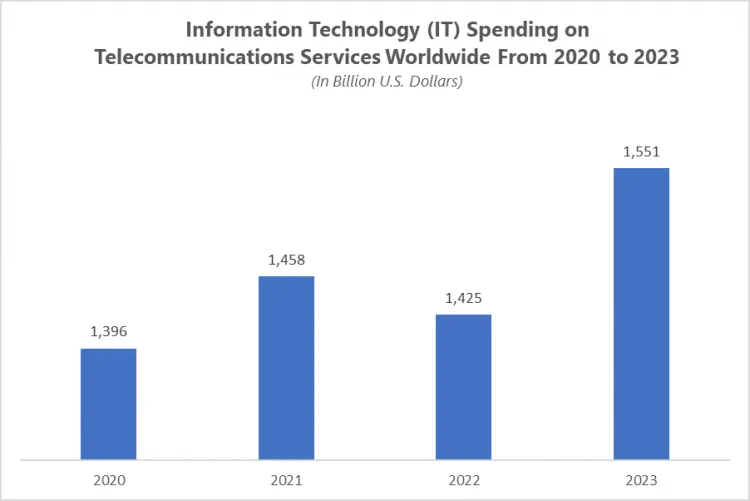

- Global IT spending on telecommunications services fluctuated between 2020 and 2023, increasing to $1,551 billion from $1,396 billion. The market for knowledge management software possibly expanded as a result of companies looking for effective data management solutions amid their digital transformation.

Knowledge Management Software Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America leads the global market for knowledge management software, composed to growing increasingly at a Compound Annual Growth Rate (CAGR) of 10.3%. Its dominance stems from robust infrastructure, early tech adoption, and a diverse range of sectors driving demand. Moreover, North America's growth in integrating new technologies into its systems and substantial R&D investments bolster its position. The US, being the largest country, benefits from extensive corporate involvement across various sectors, necessitating substantial knowledge management efforts.

- The growth of SMEs and startups supports North America's market expansion, particularly in the US, which is embracing new technology quickly. Companies like Philips highlight the shifting dynamics of the industry by utilizing knowledge management with efficiency and creative solutions.

- The compound annual growth rate is around 14.6% the Asia-Pacific area is expected to develop rapidly, led by nations like China, India, and Japan. Despite the epidemic, factors including growing IT investment and the number of SMEs are driving this increase, pushing firms toward cloud adoption and digital transformation.

- Cloud-based knowledge management systems and the expansion of unstructured information, especially from Internet of Things devices, are projected to drive substantial development in Europe as well. Market players are trying to drive growth through mergers and acquisitions new product introductions, and technology developments; Germany is concentrating on shifting to knowledge-based industries to achieve long-term economic viability.

Active Key Players in the Knowledge Management Software Market

- Bloomfire (US)

- Callidus Software Inc. (US)

- EduBrite Systems (US)

- IBM Global Services (US)

- Moxie Software (US)

- Igloo (US)

- ComAround (Sweden)

- EGain Ernst Young (UK)

- KMS Lighthouse (Israel)

- Knosys (Australia)

- Open Text Corporation (Canada)

- ProProfs (Mexico)

- Transversal (Spain)

- Yonyx (Japan)

- Other Active players.

Key Industry Developments in the Knowledge Management Software Market:

- In February 2024, Lexsoft Systems unveiled the introduction of Lexsoft T3 GenAI, an innovative knowledge management (KM) solution as part of its T3 product suite. Leveraging Microsoft OpenAI technology, the platform aimed to emulate Copilot-like features, enhancing KM functionalities for law firms. This comprehensive solution promised streamlined processes and advanced data analytics, signaling a significant advancement in KM capabilities within the legal sector.

- In May 2024, ServiceNow unveiled a collaboration with IBM aimed at enhancing enterprise productivity. The integration merged the Now Platform with IBM Watson, augmenting workflow efficiency. ServiceNow integrated watsonx.ai and IBM Granite large language models into its Now Assist GenAI experience, empowering customers. This move enabled users to leverage both platforms seamlessly, fostering rapid workflow acceleration and connectivity through ServiceNow’s Integration Hub.

|

Global Knowledge Management Software Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 16.04 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.45% |

Market Size in 2032: |

USD 41.01 Bn. |

|

Segments Covered: |

By Deployment Type |

|

|

|

By Organization Size |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Knowledge Management Software Market by Deployment Type (2018-2032)

4.1 Knowledge Management Software Market Snapshot and Growth Engine

4.2 Market Overview

4.3 On-Premises

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Cloud-Based

4.5 Hybrid

Chapter 5: Knowledge Management Software Market by Organization Size (2018-2032)

5.1 Knowledge Management Software Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Small and Medium-Sized Enterprises (SMEs)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Large Enterprises

Chapter 6: Knowledge Management Software Market by End-User (2018-2032)

6.1 Knowledge Management Software Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Manufacturing

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 BFSIIT & Telecom

6.5 Retail

6.6 Healthcare

6.7 Logistics

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Knowledge Management Software Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ACTIVISION BLIZZARD INC. (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ELECTRONIC ARTS INC. (UNITED STATES)

7.4 ZYNGA INC. (UNITED STATES)

7.5 TAKE-TWO INTERACTIVE SOFTWARE INC. (UNITED STATES)

7.6 NIANTIC INC. (UNITED STATES)

7.7 KING DIGITAL ENTERTAINMENT (UNITED STATES)

7.8 GLU MOBILE INC. (UNITED STATES)

7.9 KABAM INC. (UNITED STATES)

7.10 GAMELOFT SE (FRANCE)

7.11 ROVIO ENTERTAINMENT CORPORATION (FINLAND)

7.12 MINICLIP SA (SWITZERLAND)

7.13 SUPERCELL OY (FINLAND)

7.14 TENCENT HOLDINGS LIMITED (CHINA)

7.15 NETEASE INC. (CHINA)

7.16 SONY CORPORATION (JAPAN)

7.17 NINTENDO COLTD. (JAPAN)

7.18 BANDAI NAMCO ENTERTAINMENT INC. (JAPAN)

7.19 GUNGHO ONLINE ENTERTAINMENT INC. (JAPAN)

7.20 LINE CORPORATION (JAPAN)

7.21 SQUARE ENIX HOLDINGS COLTD. (JAPAN)

7.22 DENA COLTD. (JAPAN)

7.23 MIXI INC. (JAPAN)

7.24 GREE INC. (JAPAN)

7.25 SCOPELY INC. (UNITED STATES)

7.26 MACHINE ZONE INC. (UNITED STATES)

7.27 PLAYRIX (RUSSIA)

7.28 KAKAO GAMES CORP. (SOUTH KOREA)

7.29 COM2US CORP. (SOUTH KOREA)

7.30 NETMARBLE CORPORATION (SOUTH KOREA)

7.31 NEXON COLTD. (SOUTH KOREA)

7.32

Chapter 8: Global Knowledge Management Software Market By Region

8.1 Overview

8.2. North America Knowledge Management Software Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Deployment Type

8.2.4.1 On-Premises

8.2.4.2 Cloud-Based

8.2.4.3 Hybrid

8.2.5 Historic and Forecasted Market Size by Organization Size

8.2.5.1 Small and Medium-Sized Enterprises (SMEs)

8.2.5.2 Large Enterprises

8.2.6 Historic and Forecasted Market Size by End-User

8.2.6.1 Manufacturing

8.2.6.2 BFSIIT & Telecom

8.2.6.3 Retail

8.2.6.4 Healthcare

8.2.6.5 Logistics

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Knowledge Management Software Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Deployment Type

8.3.4.1 On-Premises

8.3.4.2 Cloud-Based

8.3.4.3 Hybrid

8.3.5 Historic and Forecasted Market Size by Organization Size

8.3.5.1 Small and Medium-Sized Enterprises (SMEs)

8.3.5.2 Large Enterprises

8.3.6 Historic and Forecasted Market Size by End-User

8.3.6.1 Manufacturing

8.3.6.2 BFSIIT & Telecom

8.3.6.3 Retail

8.3.6.4 Healthcare

8.3.6.5 Logistics

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Knowledge Management Software Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Deployment Type

8.4.4.1 On-Premises

8.4.4.2 Cloud-Based

8.4.4.3 Hybrid

8.4.5 Historic and Forecasted Market Size by Organization Size

8.4.5.1 Small and Medium-Sized Enterprises (SMEs)

8.4.5.2 Large Enterprises

8.4.6 Historic and Forecasted Market Size by End-User

8.4.6.1 Manufacturing

8.4.6.2 BFSIIT & Telecom

8.4.6.3 Retail

8.4.6.4 Healthcare

8.4.6.5 Logistics

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Knowledge Management Software Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Deployment Type

8.5.4.1 On-Premises

8.5.4.2 Cloud-Based

8.5.4.3 Hybrid

8.5.5 Historic and Forecasted Market Size by Organization Size

8.5.5.1 Small and Medium-Sized Enterprises (SMEs)

8.5.5.2 Large Enterprises

8.5.6 Historic and Forecasted Market Size by End-User

8.5.6.1 Manufacturing

8.5.6.2 BFSIIT & Telecom

8.5.6.3 Retail

8.5.6.4 Healthcare

8.5.6.5 Logistics

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Knowledge Management Software Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Deployment Type

8.6.4.1 On-Premises

8.6.4.2 Cloud-Based

8.6.4.3 Hybrid

8.6.5 Historic and Forecasted Market Size by Organization Size

8.6.5.1 Small and Medium-Sized Enterprises (SMEs)

8.6.5.2 Large Enterprises

8.6.6 Historic and Forecasted Market Size by End-User

8.6.6.1 Manufacturing

8.6.6.2 BFSIIT & Telecom

8.6.6.3 Retail

8.6.6.4 Healthcare

8.6.6.5 Logistics

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Knowledge Management Software Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Deployment Type

8.7.4.1 On-Premises

8.7.4.2 Cloud-Based

8.7.4.3 Hybrid

8.7.5 Historic and Forecasted Market Size by Organization Size

8.7.5.1 Small and Medium-Sized Enterprises (SMEs)

8.7.5.2 Large Enterprises

8.7.6 Historic and Forecasted Market Size by End-User

8.7.6.1 Manufacturing

8.7.6.2 BFSIIT & Telecom

8.7.6.3 Retail

8.7.6.4 Healthcare

8.7.6.5 Logistics

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Knowledge Management Software Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 16.04 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.45% |

Market Size in 2032: |

USD 41.01 Bn. |

|

Segments Covered: |

By Deployment Type |

|

|

|

By Organization Size |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||