HIV Diagnostics Test Market Synopsis:

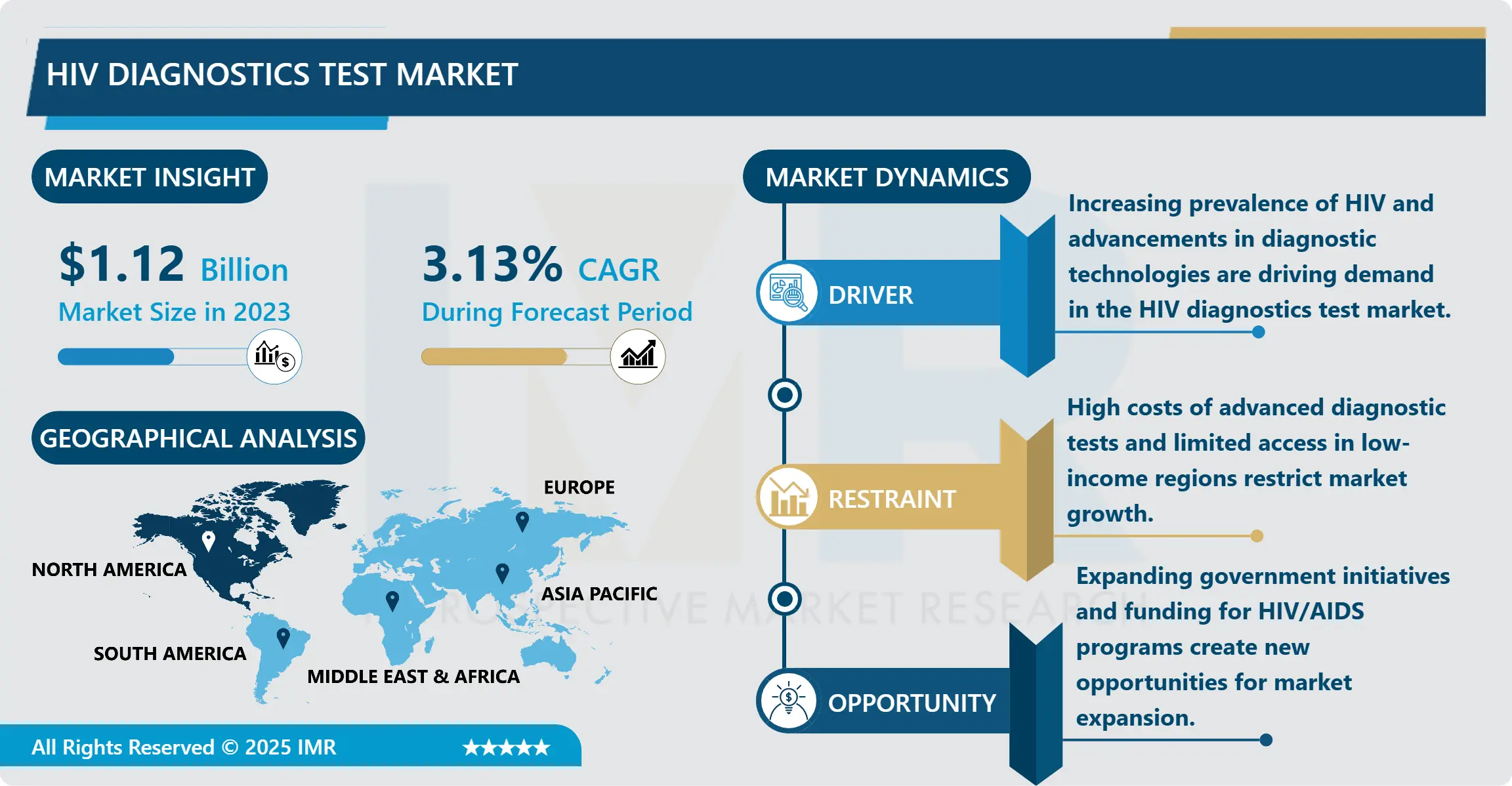

HIV Diagnostics Test Market Size Was Valued at USD 1.12 Billion in 2023, and is Projected to Reach USD 1.48 Billion by 2032, Growing at a CAGR of 3.13% From 2024-2032.

The HIV diagnostics test market is progressing as the global incidence of HIV infections rises and there is the development of new technologies in diagnostics. This testing is critical to identifying the virus early and in turn, starting on the required treatment and avoiding spread. There are government supports, increasing the number of people being educated regarding HIV/AIDS prevention, and expanding healthcare spending on diagnostics. Technological developments in HIV testing such as the use of rapid tests, point –of -care testing and molecular testing has enhanced HIV testing in the global world especially in developing nations.

Another factor which determine the market includes the increasing of home-based HIV testing kit that help people have more privacy and is more comfortable for them.. This trend is especially pin-pointed at the developed markets where patients are eager to get access to easier tests. At the same time, the use of a combined HIV diagnostic system, which makes it possible to diagnose several infections at once, is beginning to spread, which adds value for both the health care provider and the patient. Such a development is expected to push the market further as it provides faster and more detailed diagnoses. But even as the market was noted to be growing, problems like the test technologies cost, health infrastructures especially in the rural areas for the growth of the disease, HIV test stigma continues to be a concern.ts, where patients seek more accessible testing options. Additionally, the introduction of integrated HIV diagnostic tests, which can detect multiple infectious diseases simultaneously, is gaining momentum, providing enhanced value for both healthcare providers and patients. This innovation is expected to drive the market further by offering quicker, more comprehensive diagnostics.

However, despite the market's positive growth, challenges such as the cost of testing technologies, the need for healthcare infrastructure in remote areas, and stigma surrounding HIV testing persist. Measures that directly target these barriers, such as public education measures and collaborations between state and non-state actors, will very much cut across to promote HIV diagnostics globally and improve success rates. Owing to sustained innovation coupled with commitment towards global efforts to eliminate the HIV epidemic, the HIV diagnostics test market is expected to present significant growth in the future years.

HIV Diagnostics Test Market Trend Analysis:

Rise in Home-based HIV Testing Kits

-

Home based HIV testing kits are another observable trend involving the HIV diagnostics test market. These kits avail to individuals an easy and confidential means of testing for HIV from comfort of their own home. These kits can give fast and accurate results that have made them more popular with people all over the world and more so in developed countries since better testing technologies are used today. The need for such tests has also been as a result of increased awareness in HIV prevention and the need for more easy to perform tests that offer privacy. Therefore, home-based HIV testing kits are believed to be performing significant roles in increasing the rate of testing and better early identification, especially among high-risk clients.

Integration of Molecular Diagnostics for Faster Results

-

The other main trend that defines the characteristics of the HIV diagnostics test market is the molecular diagnostics to increase its speed and accuracy.. Previously used HIV testing techniques are time consuming; for instance enzyme-linked immunosorbent assay (ELISA) could take up to several hours to produce results. On the contrary, Molecular diagnostics test such as nucleic acid tests (NATs) have increased accurate virus detection with short turnaround time. However, the major reason driving this trend is the growing demand for quicker, more accurate diagnostic tools especially where a timely diagnosis is likely to make a huge difference. The use of molecular diagnostics is believed to improve the HIV testing outcomes thus improving disease management and control in the world.

HIV Diagnostics Test Market Segment Analysis:

HIV Diagnostics Test Market is Segmented on the basis of Product, End User, and Region

By Product, Assay Kit segment is expected to dominate the market during the forecast period

-

In the HIV diagnostics test market, the product segment can be primarily classified as assay kits and consumables.. Test kits in clinical HIV are termed assay kits which are comprising of all reagents and other material … for identifying HIV virus or the antibodies from blood or other body fluids. These kits are useful for analyzing samples both in clinical laboratory and near patient locations. Where consumables, these are items such as strips, pipettes, vials and any other part of an assay kit which is disposed after use in the diagnostic process. The need for assay kits is dependent on the number of HIV tests done worldwide, while consumables are crucial to the running of tests processes. Altogether these products are an important component of the comprehensive HIV diagnostic process, which facilitates the enhancement of the testing process.

By End User, Hospitals & Clinics segment expected to held the largest share

-

Among the end users, the global HIV diagnostics test market has been divided into hospitals and clinic, diagnostic laboratories, homecare, and others.. Hospitals and clinics are the largest consuming segment due to the need to test, diagnose, treat and monitor patients suspected to have the HIV virus. Diagnostic laboratories also have a significant position since they offer varied testing services and are involved in organization of vast screening on HIV. The homecare settings segment is rapidly evolving because people prefer HIV at-home testing kits to get the result in privacy, convenience, or ease of use. Other types of users are also involved in increasing access to HIV testing in populations with limited health care needs and those at high risk of contracting the virus; this involves clients such as public health facilities and mobile testing-services units. In the case of HIV, end users contribute greatly to the rate at which testing is done worldwide, and thus must embrace the testing process.

HIV Diagnostics Test Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

Due to structural development, high awareness level, and government funding in the North America region the HIV diagnostics test market have contributed tremendously and therefore the HIV diagnostics shall stay dominant in the destined period.. In particular, the United States is health-care rich and provides access to HIV testing that features home self-testing and point-of-care testing. Also, there are several key players operating in the diagnostic industry and persistent growth in HIV testing technologies are therefore contributing to market growth of this region. As there are constant activities regarding the HIV epidemic and early detection, North America is ready to dominate the HIV diagnostics market in the global level.

Active Key Players in the HIV Diagnostics Test Market:

- Abbott (USA)

- Bio-Rad Laboratories Inc. (USA)

- Hologic Inc. (USA)

- Siemens Healthineers (Germany)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Beckman Coulter Inc. (USA)

- OraSure Technologies Inc. (USA)

- Becton Dickinson and Company (USA)

- Merck KGaA (Germany)

- Biosynex SA (France)

- Zyomyx Incorporation (USA)

- Bristol–Myers Squibb (USA)

- Janssen Pharmaceutica NV (Belgium)

- QIAGEN N.V. (Germany)

- ViiV Healthcare Ltd. (UK)

- Other Active Players

| HIV Diagnostics Test Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.12 Billion |

|

Forecast Period 2024-32 CAGR: |

3.13% |

Market Size in 2032: |

USD 1.48 Billion |

|

Segments Covered: |

By Product |

|

|

|

By Test Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: HIV Diagnostics Test Market by Product

4.1 HIV Diagnostics Test Market Snapshot and Growth Engine

4.2 HIV Diagnostics Test Market Overview

4.3 Assay Kit

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Assay Kit: Geographic Segmentation Analysis

4.4 Consumables

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Consumables: Geographic Segmentation Analysis

Chapter 5: HIV Diagnostics Test Market by Test Type

5.1 HIV Diagnostics Test Market Snapshot and Growth Engine

5.2 HIV Diagnostics Test Market Overview

5.3 Antibody Test

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Antibody Test: Geographic Segmentation Analysis

5.4 Antigen/antibody tests

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Antigen/antibody tests: Geographic Segmentation Analysis

5.5 Nucleic Acid Test

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Nucleic Acid Test: Geographic Segmentation Analysis

Chapter 6: HIV Diagnostics Test Market by End User

6.1 HIV Diagnostics Test Market Snapshot and Growth Engine

6.2 HIV Diagnostics Test Market Overview

6.3 Hospitals & Clinics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospitals & Clinics: Geographic Segmentation Analysis

6.4 Diagnostic Laboratories

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Diagnostic Laboratories: Geographic Segmentation Analysis

6.5 Homecare Settings

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Homecare Settings: Geographic Segmentation Analysis

6.6 Others

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 HIV Diagnostics Test Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABBOTT (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BIO-RAD LABORATORIES INC. (USA)

7.4 HOLOGIC INC. (USA)

7.5 SIEMENS HEALTHINEERS (GERMANY)

7.6 F. HOFFMANN-LA ROCHE LTD. (SWITZERLAND)

7.7 BECKMAN COULTER INC. (USA)

7.8 ORASURE TECHNOLOGIES INC. (USA)

7.9 BECTON DICKINSON AND COMPANY (USA)

7.10 MERCK KGAA (GERMANY)

7.11 BIOSYNEX SA (FRANCE)

7.12 ZYOMYX INCORPORATION (USA)

7.13 BRISTOL–MYERS SQUIBB (USA)

7.14 JANSSEN PHARMACEUTICA NV (BELGIUM)

7.15 QIAGEN N.V. (GERMANY)

7.16 VIIV HEALTHCARE LTD. (UK)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global HIV Diagnostics Test Market By Region

8.1 Overview

8.2. North America HIV Diagnostics Test Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Product

8.2.4.1 Assay Kit

8.2.4.2 Consumables

8.2.5 Historic and Forecasted Market Size By Test Type

8.2.5.1 Antibody Test

8.2.5.2 Antigen/antibody tests

8.2.5.3 Nucleic Acid Test

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Hospitals & Clinics

8.2.6.2 Diagnostic Laboratories

8.2.6.3 Homecare Settings

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe HIV Diagnostics Test Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Product

8.3.4.1 Assay Kit

8.3.4.2 Consumables

8.3.5 Historic and Forecasted Market Size By Test Type

8.3.5.1 Antibody Test

8.3.5.2 Antigen/antibody tests

8.3.5.3 Nucleic Acid Test

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Hospitals & Clinics

8.3.6.2 Diagnostic Laboratories

8.3.6.3 Homecare Settings

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe HIV Diagnostics Test Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Product

8.4.4.1 Assay Kit

8.4.4.2 Consumables

8.4.5 Historic and Forecasted Market Size By Test Type

8.4.5.1 Antibody Test

8.4.5.2 Antigen/antibody tests

8.4.5.3 Nucleic Acid Test

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Hospitals & Clinics

8.4.6.2 Diagnostic Laboratories

8.4.6.3 Homecare Settings

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific HIV Diagnostics Test Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Product

8.5.4.1 Assay Kit

8.5.4.2 Consumables

8.5.5 Historic and Forecasted Market Size By Test Type

8.5.5.1 Antibody Test

8.5.5.2 Antigen/antibody tests

8.5.5.3 Nucleic Acid Test

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Hospitals & Clinics

8.5.6.2 Diagnostic Laboratories

8.5.6.3 Homecare Settings

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa HIV Diagnostics Test Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Product

8.6.4.1 Assay Kit

8.6.4.2 Consumables

8.6.5 Historic and Forecasted Market Size By Test Type

8.6.5.1 Antibody Test

8.6.5.2 Antigen/antibody tests

8.6.5.3 Nucleic Acid Test

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Hospitals & Clinics

8.6.6.2 Diagnostic Laboratories

8.6.6.3 Homecare Settings

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America HIV Diagnostics Test Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Product

8.7.4.1 Assay Kit

8.7.4.2 Consumables

8.7.5 Historic and Forecasted Market Size By Test Type

8.7.5.1 Antibody Test

8.7.5.2 Antigen/antibody tests

8.7.5.3 Nucleic Acid Test

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Hospitals & Clinics

8.7.6.2 Diagnostic Laboratories

8.7.6.3 Homecare Settings

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

| HIV Diagnostics Test Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.12 Billion |

|

Forecast Period 2024-32 CAGR: |

3.13% |

Market Size in 2032: |

USD 1.48 Billion |

|

Segments Covered: |

By Product |

|

|

|

By Test Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||