Key Market Highlights

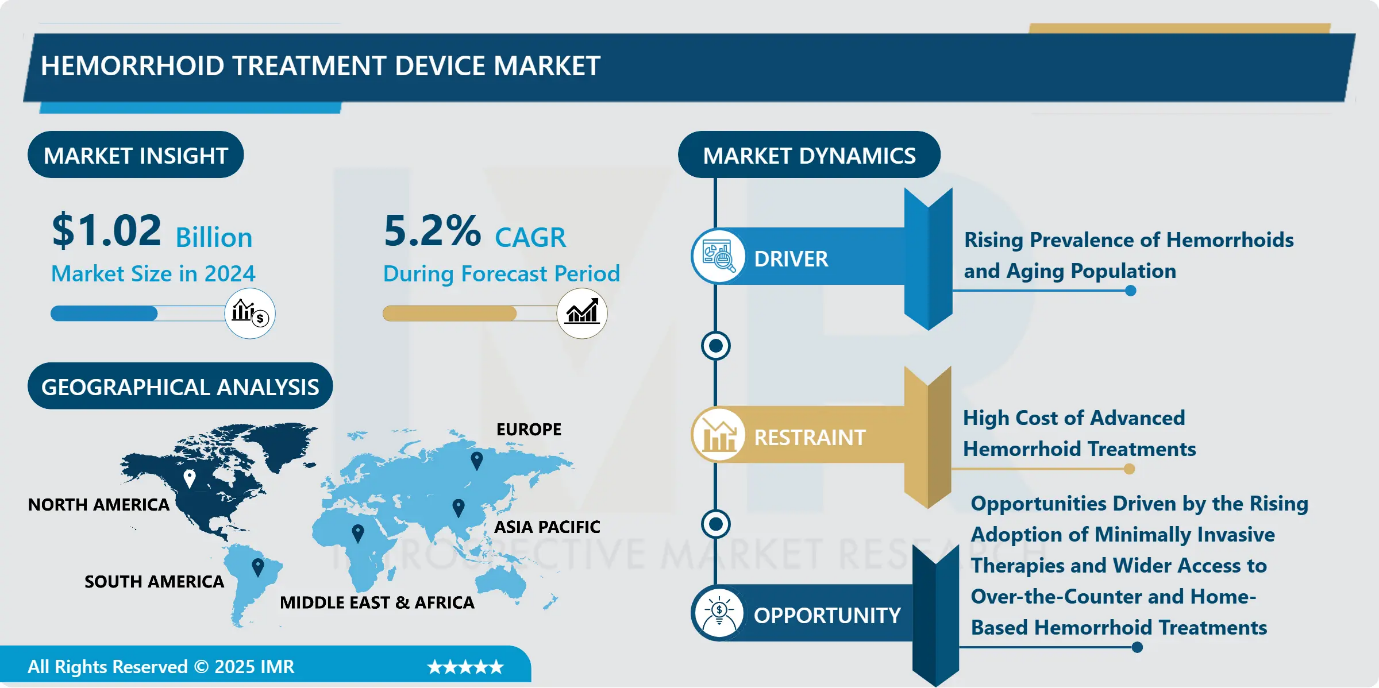

Hemorrhoid Treatment Device Market Size Was Valued at USD 1.02 Billion in 2024, and is Projected to Reach USD 1.78 Billion by 2035, Growing at a CAGR of 5.2% from 2025-2035.

- Market Size in 2024: USD 1.02 Billion

- Projected Market Size by 2035: USD 1.78 Billion

- CAGR (2025–2035): 5.2%

- Leading Market in 2024: North America

- Fastest-Growing Market: Asia-Pacific

- By Drug Class: The Corticosteroids segment is anticipated to lead the market by accounting for 33.70% of the market share throughout the forecast period.

- By Treatment Type: The Medication segment is expected to capture 34% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: North America region is projected to hold 24.35% of the market share during the forecast period.

- Active Players: Abbott Laboratories (United States), AstraZeneca (United Kingdom), Bayer AG (Germany), Boston Scientific (United States), Church & Dwight Co., Inc. (United States), and Other Active Players.

Hemorrhoid Treatment Device Market Synopsis:

The hemorrhoids treatment market encompasses a wide range of products, devices, and procedures designed to manage and treat hemorrhoids, which are swollen and inflamed veins in the rectum and anus. The market includes conservative approaches such as lifestyle modifications, topical creams, and over-the-counter medications, as well as minimally invasive procedures like rubber band ligation, laser therapy, and sclerotherapy, up to surgical interventions for severe cases. Growth is driven by rising global prevalence due to sedentary lifestyles, obesity, low-fiber diets, and an aging population. Technological advancements, increased awareness, reduced stigma, and greater access to outpatient and home-based treatments are enhancing adoption, improving patient outcomes, and expanding market potential worldwide.

Hemorrhoid Treatment Device Market Dynamics and Trend Analysis:

Hemorrhoid Treatment Device Market Growth Driver - Rising Prevalence of Hemorrhoids and Aging Population

-

The rising global prevalence of hemorrhoids is a key driver of growth in the hemorrhoids treatment market. Modern lifestyle patterns, including sedentary behavior, low-fiber diets, obesity, and prolonged sitting, have significantly increased risk factors such as chronic constipation and venous pressure in the anal and rectal region. Hemorrhoids are particularly common among older adults due to weakening connective tissues, reduced mobility, and age-related gastrointestinal issues, with the highest incidence observed in individuals aged 45–65 years.

- Additionally, higher prevalence among pregnant women further expands the patient pool. According to clinical sources, a substantial proportion of adults experience hemorrhoids during their lifetime, highlighting the widespread nature of the condition. This growing and diverse patient base is driving sustained demand for effective, minimally invasive, and cost-efficient treatment options worldwide.

Hemorrhoid Treatment Device Market Limiting Factor - High Cost of Advanced Hemorrhoid Treatments

-

The high cost associated with advanced hemorrhoid treatment options remains a key restraint on market growth. Minimally invasive procedures such as laser therapy, infrared coagulation, and rubber band ligation require specialized equipment, advanced technology, and skilled medical professionals, resulting in significantly higher treatment costs compared to over-the-counter or conservative therapies. In regions with limited healthcare infrastructure or low insurance coverage, these expenses can be prohibitive, leading patients to delay treatment or rely on short-term, less effective solutions. This cost burden is particularly pronounced in emerging economies, where affordability remains a major concern, thereby restricting widespread adoption of innovative and clinically effective treatment modalities.

Hemorrhoid Treatment Device Market Expansion Opportunity - Opportunities Driven by the Rising Adoption of Minimally Invasive Therapies and Wider Access to Over-the-Counter and Home-Based Hemorrhoid Treatments

-

The growing adoption of minimally invasive and non-prescription treatment options presents a significant opportunity in the hemorrhoids treatment market. Procedures such as laser therapy, rubber band ligation, and cryotherapy are increasingly preferred due to their reduced pain, faster recovery times, and lower risk of complications compared to conventional surgery. In parallel, the rising availability of over-the-counter (OTC) medications and home-based treatment devices is improving patient access, convenience, and privacy, encouraging early intervention and self-management.

- These solutions are widely accessible through retail pharmacies and online platforms, supporting broader market penetration. Additionally, strategic initiatives by key pharmaceutical companies to expand branded OTC portfolios are strengthening product visibility and consumer trust. The convergence of minimally invasive clinical procedures with accessible OTC and home-care solutions is expected to accelerate market growth and create new revenue opportunities globally.

Hemorrhoid Treatment Device Market Challenge and Risk - Social Stigma and Low Awareness Limiting Treatment Uptake

-

Social stigma and limited awareness surrounding hemorrhoids continue to pose a major challenge to market growth. The condition is often perceived as embarrassing, discouraging patients from discussing symptoms or seeking timely medical care. This reluctance results in delayed diagnosis and reliance on self-treatment rather than professional intervention. Many individuals remain unaware of modern, minimally invasive treatment options, further restricting adoption. Studies indicate that embarrassment is a leading reason for avoiding physician visits, particularly in conservative societies. This hesitation reduces demand for both pharmaceutical and device-based treatments, thereby constraining overall market expansion despite the availability of effective solutions.

Hemorrhoid Treatment Device Market Trend - Advancements in Treatment Technologies

-

Technological advancements are transforming the hemorrhoids treatment market by shifting preference toward minimally invasive and precision-based therapies. Traditional surgical procedures are increasingly being complemented or replaced by options such as rubber band ligation, infrared coagulation, laser hemorrhoidoplasty, and Doppler-guided hemorrhoidal artery ligation.

- These techniques offer significant benefits, including reduced postoperative pain, shorter recovery times, and lower complication and recurrence rates, improving overall patient acceptance. In parallel, the integration of advanced technologies such as real-time imaging, high-sensitivity Doppler systems, embedded sensors, and artificial intelligence is enhancing procedural accuracy and clinical outcomes. The convergence of diagnostic and therapeutic capabilities on single platforms simplifies physician training and accelerates adoption across healthcare settings. Additionally, ongoing innovations in pharmacological and combination therapies are further improving treatment effectiveness, supporting sustained market growth through 2035.

Hemorrhoid Treatment Device Market Segment Analysis:

Hemorrhoid Treatment Device Market is segmented based on Product, Drug Class, Treatment Type, Route of Administration, Distribution channel and Region.

By Drug Type, corticosteroids segment is expected to dominate the market with around 33.70% share during the forecast period.

-

The corticosteroids segment dominates the hemorrhoids treatment market due to its high clinical effectiveness and widespread availability. Corticosteroids such as hydrocortisone are extensively used to reduce inflammation, swelling, redness, and itching associated with hemorrhoids, providing rapid symptom relief and improved patient comfort. These drugs are available in multiple formulations, including creams, ointments, and suppositories, allowing flexible and targeted treatment across different severity levels.

- Corticosteroids are commonly recommended as first-line therapy for moderate to severe cases, supported by their well-established safety and efficacy profile. In addition, easy accessibility through retail pharmacies and healthcare facilities, along with continuous improvements in formulations to enhance potency while minimizing side effects, has reinforced the strong market position of corticosteroid-based treatments.

By Treatment, Medication is expected to dominate with close to 34% market share during the forecast period.

-

The medication segment dominates the hemorrhoids treatment market due to its wide accessibility, cost effectiveness, and strong patient preference for non-invasive care. Over-the-counter and prescription drugs, including topical creams, suppositories, and oral medications, are extensively used for symptom management and early-stage treatment. These therapies provide convenient and effective relief from pain, itching, and inflammation, making them the first choice for most patients.

- The dominance of this segment is further supported by high self-medication rates in regions such as North America and Europe, where well-established pharmacy and online distribution networks ensure easy product availability. Additionally, the rising prevalence of hemorrhoids driven by sedentary lifestyles, poor dietary habits, and aging populations continues to sustain strong demand for medication-based treatment options.

Hemorrhoid Treatment Device Market Regional Insights:

North America region is estimated to lead the market with around 24.35% share during the forecast period.

-

North America dominated the hemorrhoids Treatment Device market in 2024, accounting for over 24.35% of global revenue, driven by a high prevalence of the condition among adults and strong awareness of available treatment options. The region benefits from advanced healthcare infrastructure, favorable reimbursement policies, and widespread adoption of minimally invasive procedures such as rubber band ligation and laser therapy.

- The U.S. plays a key role due to extensive clinical research activity, rapid regulatory approvals, and the strong presence of leading pharmaceutical and medical device companies. This regional dominance is important as it accelerates innovation, improves access to effective treatments, supports outpatient care models, and sets clinical and technological benchmarks that influence treatment standards globally.

Hemorrhoid Treatment Device Market Active Players:

- Abbott Laboratories (United States)

- Bayer AG (Germany)

- Boston Scientific Corporation (United States)

- Church & Dwight Co., Inc. (United States)

- Cipla Ltd. (India)

- Cook Medical (United States)

- Haleon Group of Companies (United Kingdom)

- Lupin Ltd. (India)

- Medtronic plc (United States)

- Olympus Corporation (Japan)

- Sanofi S.A. (France)

- Sebela Pharmaceuticals (United States)

- Sun Pharmaceutical Industries, Inc. (India)

- Takeda Pharmaceutical Company Limited (Japan)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Other Active Players

Key Industry Developments in the Hemorrhoid Treatment Device Market:

-

In June 2025, Haleon plc finalized the acquisition of the remaining 12% stake in its China-based OTC joint venture, Tianjin TSKF Pharmaceutical Co. Ltd., for approximately USD 225 million, strengthening its presence in the Chinese consumer healthcare market.

- In January 2025, Medtronic launched its minimally invasive hemorrhoid treatment system in the European Union following CE Mark approval. The system utilizes advanced radiofrequency technology to reduce patient discomfort, shorten recovery time, and lower complication risks compared to conventional hemorrhoid surgery.

Technological Innovations and Advancements Driving the Hemorrhoids Treatment Device Market: Minimally Invasive Solutions, Precision Therapeutics, and Device Optimization

-

The technical landscape of the Hemorrhoids Treatment Device Market is characterized by innovations in both surgical and non-surgical interventions aimed at effectively managing hemorrhoidal conditions. Devices such as rubber band ligators, infrared coagulation systems, cryotherapy units, and staplers leverage precision technology to target hemorrhoidal tissue while minimizing patient discomfort and recovery time. Advanced imaging and endoscopic guidance enhance procedural accuracy, reducing complications and recurrence rates.

- Minimally invasive techniques, including Doppler-guided hemorrhoidal artery ligation, rely on ultrasonic or infrared sensors to identify feeding arteries, improving treatment outcomes. Material innovations, such as biocompatible polymers and disposable components, enhance device safety and sterility. Integration with digital monitoring tools and data analytics enables clinicians to track procedural efficacy and patient progress. Overall, the market’s technical evolution focuses on efficiency, reduced invasiveness, and patient-centric design, aligning with global trends in ambulatory care and precision therapeutics, thereby driving adoption across hospitals and outpatient centers.

|

Hemorrhoid Treatment Device Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 1.02 Bn. |

|

Forecast Period 2025-35 CAGR: |

5.2% |

Market Size in 2035: |

USD 1.78 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Drug Class

|

|

||

|

By Treatment Type |

|

||

|

By Route of Administration |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Hemorrhoid Treatment Device Market by Product (2018-2035)

4.1 Hemorrhoid Treatment Device Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Suppositories

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Creams & Ointments

4.5 Sprays

4.6 Others

Chapter 5: Hemorrhoid Treatment Device Market by Drug Class (2018-2035)

5.1 Hemorrhoid Treatment Device Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Non-Steroidal Anti-Inflammatory Drugs (NSAIDs)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Local Anesthetics

5.5 Corticosteroids

Chapter 6: Hemorrhoid Treatment Device Market by Treatment Type (2018-2035)

6.1 Hemorrhoid Treatment Device Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Medication

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Non-Surgical Procedures

6.5 Surgical Procedures

Chapter 7: Hemorrhoid Treatment Device Market by Route of Administration (2018-2035)

7.1 Hemorrhoid Treatment Device Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Oral

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Topical

Chapter 8: Hemorrhoid Treatment Device Market by Distribution Channel (2018-2035)

8.1 Hemorrhoid Treatment Device Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Hospital Pharmacies

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Retail Pharmacies

8.5 Online Pharmacies

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Hemorrhoid Treatment Device Market Share by Manufacturer/Service Provider(2024)

9.1.3 Industry BCG Matrix

9.1.4 PArtnerships, Mergers & Acquisitions

9.2 ABBOTT LABORATORIES (UNITED STATES)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Recent News & Developments

9.2.10 SWOT Analysis

9.3 ASTRAZENECA (UNITED KINGDOM)

9.4 BAYER AG (GERMANY)

9.5 BOSTON SCIENTIFIC (UNITED STATES)

9.6 CHURCH & DWIGHT CO.

9.7 INC. (UNITED STATES)

9.8 CIPLA LTD. (INDIA)

9.9 COOK MEDICAL (UNITED STATES)

9.10 HALEON GROUP OF COMPANIES (UNITED KINGDOM)

9.11 LUPIN LTD. (INDIA)

9.12 MEDTRONIC PLC (UNITED STATES)

9.13 OLYMPUS CORPORATION (JAPAN)

9.14 SANOFI S.A. (FRANCE)

9.15 SEBELA PHARMACEUTICALS (UNITED STATES)

9.16 SUN PHARMACEUTICAL INDUSTRIES

9.17 INC. (INDIA)

9.18 TAKEDA PHARMACEUTICAL COMPANY LIMITED (JAPAN) AND OTHER ACTIVE PLAYERS

Chapter 10: Global Hemorrhoid Treatment Device Market By Region

10.1 Overview

10.2. North America Hemorrhoid Treatment Device Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecast Market Size by Country

10.2.4.1 US

10.2.4.2 Canada

10.2.4.3 Mexico

10.3. Eastern Europe Hemorrhoid Treatment Device Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecast Market Size by Country

10.3.4.1 Russia

10.3.4.2 Bulgaria

10.3.4.3 The Czech Republic

10.3.4.4 Hungary

10.3.4.5 Poland

10.3.4.6 Romania

10.3.4.7 Rest of Eastern Europe

10.4. Western Europe Hemorrhoid Treatment Device Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecast Market Size by Country

10.4.4.1 Germany

10.4.4.2 UK

10.4.4.3 France

10.4.4.4 The Netherlands

10.4.4.5 Italy

10.4.4.6 Spain

10.4.4.7 Rest of Western Europe

10.5. Asia Pacific Hemorrhoid Treatment Device Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecast Market Size by Country

10.5.4.1 China

10.5.4.2 India

10.5.4.3 Japan

10.5.4.4 South Korea

10.5.4.5 Malaysia

10.5.4.6 Thailand

10.5.4.7 Vietnam

10.5.4.8 The Philippines

10.5.4.9 Australia

10.5.4.10 New Zealand

10.5.4.11 Rest of APAC

10.6. Middle East & Africa Hemorrhoid Treatment Device Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecast Market Size by Country

10.6.4.1 Turkiye

10.6.4.2 Bahrain

10.6.4.3 Kuwait

10.6.4.4 Saudi Arabia

10.6.4.5 Qatar

10.6.4.6 UAE

10.6.4.7 Israel

10.6.4.8 South Africa

10.7. South America Hemorrhoid Treatment Device Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecast Market Size by Country

10.7.4.1 Brazil

10.7.4.2 Argentina

10.7.4.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

Chapter 12 Our Thematic Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Chapter 13 Analyst Viewpoint and Conclusion

Chapter 14 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Chapter 15 Case Study

Chapter 16 Appendix

12.1 Sources

12.2 List of Tables and figures

12.3 Short Forms and Citations

12.4 Assumption and Conversion

12.5 Disclaimer

|

Hemorrhoid Treatment Device Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 1.02 Bn. |

|

Forecast Period 2025-35 CAGR: |

5.2% |

Market Size in 2035: |

USD 1.78 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Drug Class

|

|

||

|

By Treatment Type |

|

||

|

By Route of Administration |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||