Key Market Highlights

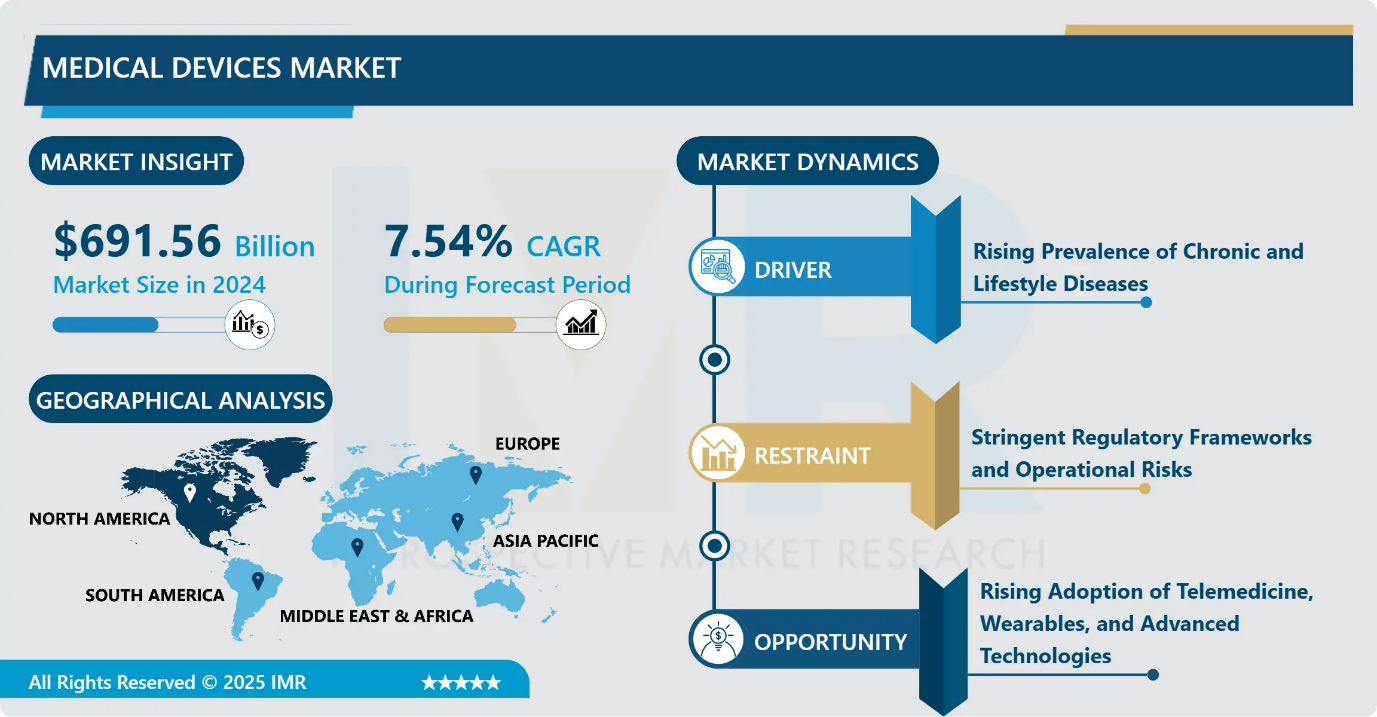

Medical Devices Market Size Was Valued at USD 691.56 Billion in 2024, and is Projected to Reach USD 978.43 Billion by 2035, Growing at a CAGR of 7.54% from 2025-2035.

- Market Size in 2024: USD 691.56 Billion

- Projected Market Size by 2035: USD 978.43 Billion

- CAGR (2025–2035): 7.54%

- Leading Market in 2024: North America

- Fastest-Growing Market: Asia-Pacific

- By Technology Platform: The Wearable & Remote Monitoring segment is anticipated to lead the market by accounting for 33.78% of the market share throughout the forecast period.

- By Therapeutic Application: The Cardiology segment is expected to capture 32.53% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: North America region is projected to hold 29.67% of the market share during the forecast period.

- Active Players: Johnson & Johnson, Abbott Laboratories. Medtronic plc, Siemens Healthineers AG, GE Healthcare Technologies Inc., Stryker Corporation, Boston Scientific Corporation, Philips Healthcare, Becton, Dickinson and Company, Cardinal Health Inc., Zimmer Biomet Holdings Inc, Smith & Nephew plc, Edwards Lifesciences and Other Active Players

Medical Devices Market Synopsis:

The medical devices market encompasses a wide range of instruments, equipment, diagnostic systems, and wearable or software-enabled solutions used to prevent, diagnose, monitor, and treat medical conditions. The market is expanding due to rising chronic diseases, aging populations, technological advancements such as AI and minimally invasive devices, and increasing demand for home-based and remote patient care across global healthcare systems.

Medical Devices Market Dynamics and Trend Analysis:

Medical Devices Market Growth Driver - Rising Prevalence of Chronic and Lifestyle Diseases

-

The medical devices market is driven by the rising prevalence of chronic and lifestyle diseases, increasing surgical volumes, and a rapidly growing elderly population requiring continuous care and advanced treatment options. Technological progress in AI, robotics, and digital health is accelerating the adoption of smart, connected, and minimally invasive devices. Expansion of home-based monitoring and telehealth is boosting demand for portable and wearable solutions.

- Strengthening healthcare infrastructure, favourable reimbursement policies, and increased government and private investments further support market expansion. Additionally, heightened patient awareness, improved diagnostic capabilities, and faster regulatory approvals are enhancing accessibility and accelerating global market growth. ?

Medical Devices Market Limiting Factor - Economic Barriers Slowing Medical Device Market Advancement

-

The medical devices market faces limitations due to stringent and complex regulatory approval processes that significantly extend product development timelines and increase compliance costs. Variations in approval standards across regions delay global commercialization and restrict smaller manufacturers from entering the market.

- Additionally, cybersecurity risks in connected devices, high capital investment for advanced technologies, and limited reimbursement coverage in emerging economies further constrain adoption and slow market expansion.

Medical Devices Market Expansion Opportunity - Rising Adoption of Telemedicine, Wearables, and Advanced Technologies

-

The medical devices market presents significant growth opportunities through the rising adoption of telemedicine, wearable devices, and remote patient monitoring solutions, enabling home-based care and continuous health tracking. Expansion in emerging economies with improving healthcare infrastructure and increasing government investments provides avenues for market penetration.

- Innovations in minimally invasive surgical tools, AI-enabled diagnostics, and robotic-assisted procedures offer potential for high-value device deployment. Additionally, unmet clinical needs in chronic disease management, rising medical tourism, and strategic partnerships between technology providers and healthcare institutions create avenues for scalable product introduction, enhancing global market reach and revenue generation.

Medical Devices Market Challenge and Risk - Stringent Regulatory Frameworks and Operational Risks

-

The medical devices market faces challenges including stringent regulatory frameworks, lengthy approval timelines, and high compliance costs that can delay product launches. Cybersecurity vulnerabilities in connected devices, high capital requirements for advanced technologies, and variability in reimbursement policies across regions further limit adoption.

- Additionally, intense competition, rapid technological changes, and operational complexities in manufacturing and distribution pose risks to profitability and market expansion, requiring strategic planning, robust quality control, and continuous innovation to mitigate potential setbacks.

Medical Devices Market Trend - Shift Towards Home-Based Care and Data-Driven Healthcare Solutions

-

The medical devices market is witnessing trends such as the rapid adoption of wearable and remote patient monitoring devices, integration of AI and IoT for diagnostics and personalized care, and growing preference for minimally invasive and robotic-assisted surgical procedures. Telemedicine and home-based healthcare solutions are expanding rapidly, especially in emerging markets.

- Additionally, sustainability initiatives, digital health platforms, and data-driven decision-making are shaping product development and service delivery, driving innovation, improving patient outcomes, and influencing strategic investments across the global medical devices landscape.

Medical Devices Market Segment Analysis:

Medical Devices Market is segmented based on Technology Platform Type, Therapeutic Application, End-Users, and Region

By Technology Platform Type, wearable and remote patient monitoring devices segment is expected to dominate the market with around 33.78% share during the forecast period.

-

Among technology platforms, wearable and remote patient monitoring devices are expected to dominate the medical devices market. Rising prevalence of chronic diseases, growing geriatric populations, and increasing demand for home-based care are driving adoption. These devices enable continuous health monitoring, early detection of medical conditions, and personalized treatment, reducing hospital visits and healthcare costs.

- Advances in connectivity, IoT, and AI have enhanced device accuracy and usability. Additionally, patient preference for convenient, non-invasive solutions and supportive government initiatives in digital health are accelerating market penetration, making wearables and remote monitoring the leading technology segment globally.

By Therapeutic Application, Cardiology Segment is expected to dominate with close to 32.53% market share during the forecast period.

-

The cardiology segment is expected to dominate the medical devices market due to the increasing prevalence of cardiovascular diseases worldwide, driven by aging populations, sedentary lifestyles, and rising risk factors such as hypertension and obesity. High demand for cardiac implants, stents, pacemakers, and advanced diagnostic and monitoring devices supports market growth.

- Continuous technological advancements, including minimally invasive procedures, wearable cardiac monitors, and AI-enabled diagnostics, enhance patient outcomes and treatment efficiency. Furthermore, government initiatives for cardiovascular health awareness and reimbursement coverage encourage adoption, positioning cardiology as the leading therapeutic segment in the global medical devices market.

Medical Devices Market Regional Insights:

North America region is estimated to lead the market with around 29.67% share during the forecast period.

-

North America, led by the United States, is the largest medical devices market due to high healthcare spending, advanced infrastructure, and widespread adoption of new technologies. According to the U.S. Centres for Medicare & Medicaid Services (CMS), healthcare expenditure exceeded $4 trillion in 2022, supporting strong demand for medical devices.

- The FDA’s clear regulatory framework encourages innovation while ensuring safety. High prevalence of chronic diseases like heart disease, diabetes, and cancer increases the need for diagnostic, monitoring, and therapeutic devices. Additionally, the region’s focus on research, technology development, and home-based care solutions drives market growth.

Medical Devices Market Active Players:

- Abbott Laboratories, (USA)

- Becton, Dickinson and Company, (USA)

- Boston Scientific Corporation (USA)

- Cardinal Health Inc, (USA)

- Edwards Lifesciences Corporation (USA)

- GE HealthCare Technologies, (USA)

- Johnson & Johnson, (USA)

- Medtronic plc, (USA)

- Other Active Players

- Philips Healthcare, (Netherlands)

- Siemens Healthineers AG, (Germany)

- Smith & Nephew plc (UK)

- Stryker Corporation, (USA)

- Zimmer Biomet Holdings Inc (USA), and Other Active Players

Key Industry Developments in the Medical Devices Market:

-

In July 2025, GE HealthCare launched the new floor?mounted digital X?ray system Definium Pace Select ET designed for high?throughput environments, improving imaging efficiency and workflow for radiology departments.

- In September 2024, Medtronic unveiled expansions to its Aibel spine surgery ecosystem including the new software?driven imaging/navigation tool O?arm 4.3, an updated Mazor robotic guidance system (5.1 software), and the next?generation ModuLeX Spinal System implant. These advances are aimed at improving spine?surgery planning, imaging, and surgical precision.

Transforming Healthcare Through Advanced Medical Device Technologies

- Medical devices are advanced healthcare technologies designed to diagnose, monitor, prevent, or treat medical conditions with precision and safety. These devices range from simple tools such as syringes and bandages to highly sophisticated systems including robotic surgical equipment

- AI-enabled diagnostic imaging, implantable devices like pacemakers, and wearable remote monitoring sensors. Modern medical devices leverage cutting-edge technologies such as artificial intelligence, machine learning, Internet of Things (IoT), and robotics to deliver accurate clinical outcomes while reducing procedure time and improving patient recovery.

- Rapid growth in digital healthcare is transforming the medical device landscape. Remote patient monitoring devices allow continuous health tracking outside hospital settings and support early detection of complications.

- Minimally invasive surgical devices and robotic-assisted systems reduce hospital stays, lower surgical risks, and improve precision during complex procedures such as joint replacement and neuro-spine surgeries. Additionally, 3D printing enables custom implants and prosthetics tailored to individual patient needs.

- Advanced imaging equipment including MRI, CT, ultrasound, and PET systems enhances real-time visualization and supports predictive diagnostics. Integration with electronic health records (EHRs) ensures seamless clinical decision-making. With rising demand for personalized treatment, aging populations, and chronic disease management, medical devices are becoming indispensable to modern healthcare delivery and future innovation.

|

Medical Devices Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 691.56 Bn. |

|

Forecast Period 2025-35 CAGR: |

7.54% |

Market Size in 2035: |

USD 978.43 Bn. |

|

Segments Covered: |

By Technology Platform Type |

|

|

|

By Therapeutic Application |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Medical Devices Market by Technology Platform (2018-2032)

4.1 Medical Devices Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Conventional Electro-Mechanical & Disposable Devices

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Wearable & Remote Monitoring

4.5 and More

Chapter 5: Medical Devices Market by Therapeutic Application (2018-2032)

5.1 Medical Devices Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Cardiology

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Orthopaedics

5.5 Neurology

5.6 and More

Chapter 6: Medical Devices Market by End User (2018-2032)

6.1 Medical Devices Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Clinics

6.5 Ambulatory Surgical Centres

6.6 and More

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Medical Devices Market Share by Manufacturer/Service Provider(2024)

7.1.3 Industry BCG Matrix

7.1.4 PArtnerships, Mergers & Acquisitions

7.2 ABBOTT LABORATORIES

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Recent News & Developments

7.2.10 SWOT Analysis

7.3 (USA)

7.4 BECTON

7.5 DICKINSON AND COMPANY

7.6 (USA)

7.7 BOSTON SCIENTIFIC CORPORATION (USA)

7.8 CARDINAL HEALTH INC

7.9 (USA)

7.10 EDWARDS LIFESCIENCES CORPORATION (USA)

7.11 GE HEALTHCARE TECHNOLOGIES

7.12 (USA)

7.13 JOHNSON & JOHNSON

7.14 (USA)

7.15 MEDTRONIC PLC

7.16 (USA)

7.17 OTHER ACTIVE PLAYERS

7.18 PHILIPS HEALTHCARE

7.19 (NETHERLANDS)

7.20 SIEMENS HEALTHINEERS AG

7.21 (GERMANY)

7.22 SMITH & NEPHEW PLC (UK)

7.23 STRYKER CORPORATION

7.24 (USA)

7.25 ZIMMER BIOMET HOLDINGS INC (USA)

7.26 OTHER ACTIVE PLAYERS

Chapter 8: Global Medical Devices Market By Region

8.1 Overview

8.2. North America Medical Devices Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecast Market Size by Country

8.2.4.1 US

8.2.4.2 Canada

8.2.4.3 Mexico

8.3. Eastern Europe Medical Devices Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecast Market Size by Country

8.3.4.1 Russia

8.3.4.2 Bulgaria

8.3.4.3 The Czech Republic

8.3.4.4 Hungary

8.3.4.5 Poland

8.3.4.6 Romania

8.3.4.7 Rest of Eastern Europe

8.4. Western Europe Medical Devices Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecast Market Size by Country

8.4.4.1 Germany

8.4.4.2 UK

8.4.4.3 France

8.4.4.4 The Netherlands

8.4.4.5 Italy

8.4.4.6 Spain

8.4.4.7 Rest of Western Europe

8.5. Asia Pacific Medical Devices Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecast Market Size by Country

8.5.4.1 China

8.5.4.2 India

8.5.4.3 Japan

8.5.4.4 South Korea

8.5.4.5 Malaysia

8.5.4.6 Thailand

8.5.4.7 Vietnam

8.5.4.8 The Philippines

8.5.4.9 Australia

8.5.4.10 New Zealand

8.5.4.11 Rest of APAC

8.6. Middle East & Africa Medical Devices Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecast Market Size by Country

8.6.4.1 Turkiye

8.6.4.2 Bahrain

8.6.4.3 Kuwait

8.6.4.4 Saudi Arabia

8.6.4.5 Qatar

8.6.4.6 UAE

8.6.4.7 Israel

8.6.4.8 South Africa

8.7. South America Medical Devices Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecast Market Size by Country

8.7.4.1 Brazil

8.7.4.2 Argentina

8.7.4.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

Chapter 10 Our Thematic Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Chapter 11 Case Study

Chapter 12 Appendix

12.1 Sources

12.2 List of Tables and figures

12.3 Short Forms and Citations

12.4 Assumption and Conversion

12.5 Disclaimer

|

Medical Devices Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 691.56 Bn. |

|

Forecast Period 2025-35 CAGR: |

7.54% |

Market Size in 2035: |

USD 978.43 Bn. |

|

Segments Covered: |

By Technology Platform Type |

|

|

|

By Therapeutic Application |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||